Medical Policy Rebate In Income Tax Explore Section 80D of the Income Tax Act to understand deductions available for medical and health

Income Tax Rebate in Health Insurance Policy Check the Eligibility What is the Permitted Deduction Amount and the Max Limit for Deduction in Section 80D Money received through a claim under a medical policy is only a reimbursement of expenditure already incurred by the policyholder As this does not amount to profit or income for the insured person this money is not taxable

Medical Policy Rebate In Income Tax

Medical Policy Rebate In Income Tax

https://www.oecd-ilibrary.org/sites/bdfe626d-en/images/images/011_Part_I_Chapter-1/media/image3.png

Major Changes In Income Tax Income Tax Slabs Tax Rates Calculation

https://i.ytimg.com/vi/rRGs7tKMgUM/maxresdefault.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Section 80D of the Income Tax Act 1961 offers tax deductions of up to 25 000 on health insurance premiums paid in a financial year The tax deduction limit increases to 50 000 per fiscal year for senior citizens aged 60 years and above Tax deductions can be claimed on the premiums paid towards health insurance by individuals and Hindu Undivided Families HUFs Section 80D offers deductions that reduce taxpayers

Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self spouses or dependent children If you are making Section 80D of the Income Tax Act in India provides deductions on premiums paid for health insurance policies offering taxpayers an opportunity to reduce their taxable income Here s a detailed breakdown of the benefits

Download Medical Policy Rebate In Income Tax

More picture related to Medical Policy Rebate In Income Tax

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

https://i.ytimg.com/vi/IrYTqu6Hohg/maxresdefault.jpg

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

It is mandatory to recall the proof of premium payments as it might be required during the Income Tax assessment procedure You can also claim a tax deduction under Section 80D for the Health Insurance premium Section 80D of the Income Tax Act 1961 is a vital tool for reducing your tax burden while investing in your well being It allows you to claim deductions on expenses related to medical insurance and preventive healthcare

Availing tax rebates on mediclaim policies is a valuable benefit provided by the government to encourage individuals to secure their health financially You can efficiently file your tax returns How is a tax rebate calculated for a 3 year health insurance policy Under Section 80D of the Income Tax Act you can claim annual tax deductions of up to INR 25 000 or INR

How To Get Tax Rebate In Income Tax

https://lh3.googleusercontent.com/-jJ4zZZJpzu4/XkYh5zpW4bI/AAAAAAAALlw/03vDaCyfckIn2RjNTnWAHgi9ClX_V6MrACLcBGAsYHQ/s1600/Image_1.jpeg

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/white-slip-school-taxes-2023.jpg

https://tax2win.in › guide

Explore Section 80D of the Income Tax Act to understand deductions available for medical and health

https://www.bankbazaar.com › health-insurance › income...

Income Tax Rebate in Health Insurance Policy Check the Eligibility What is the Permitted Deduction Amount and the Max Limit for Deduction in Section 80D

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

How To Get Tax Rebate In Income Tax

Income Tax Slabs Budget 2021 No Changes In Income Tax Slabs In 2021 And

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

Income Tax Appellate Tribunal Recruitment Https www itat gov in

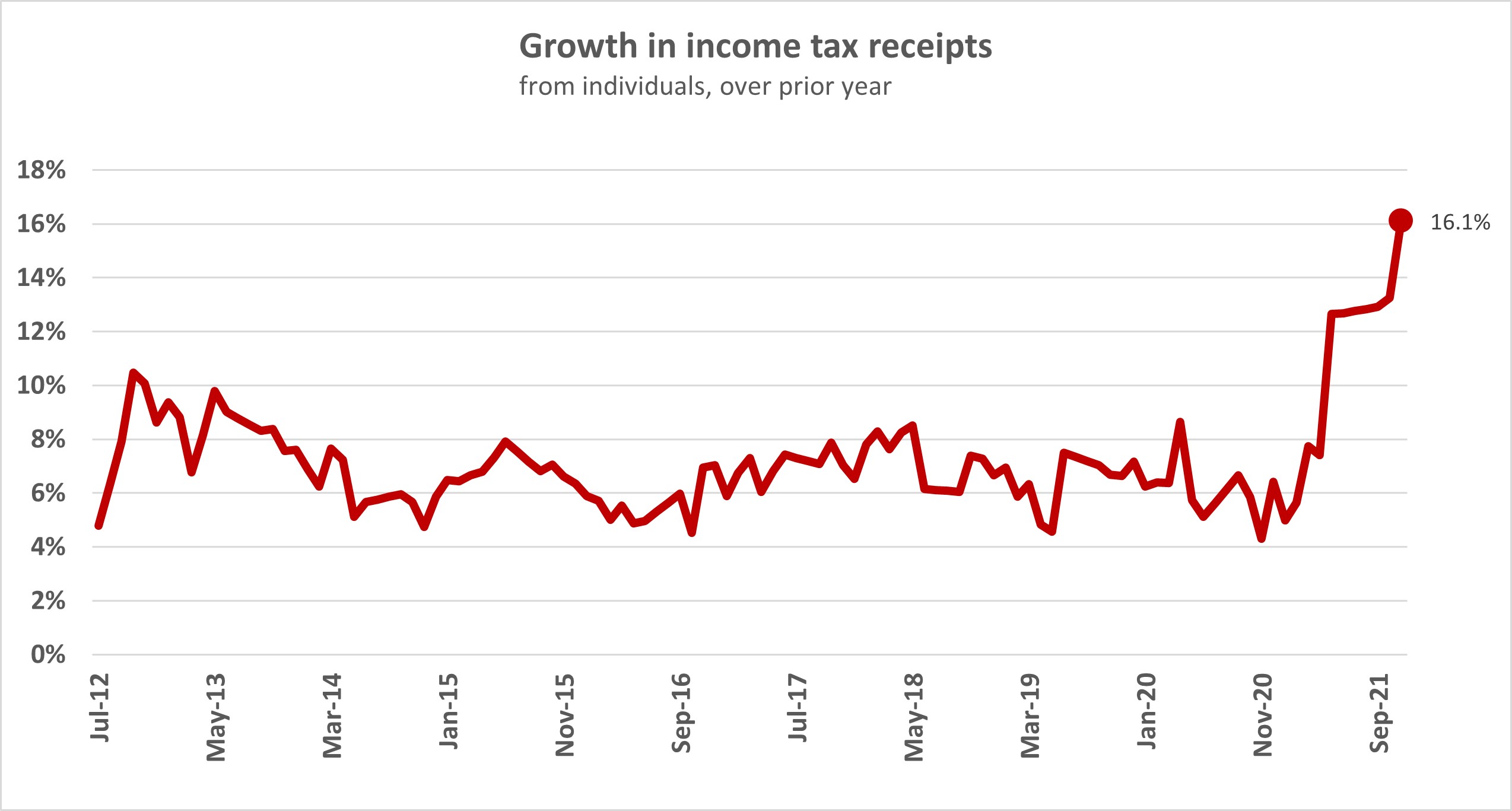

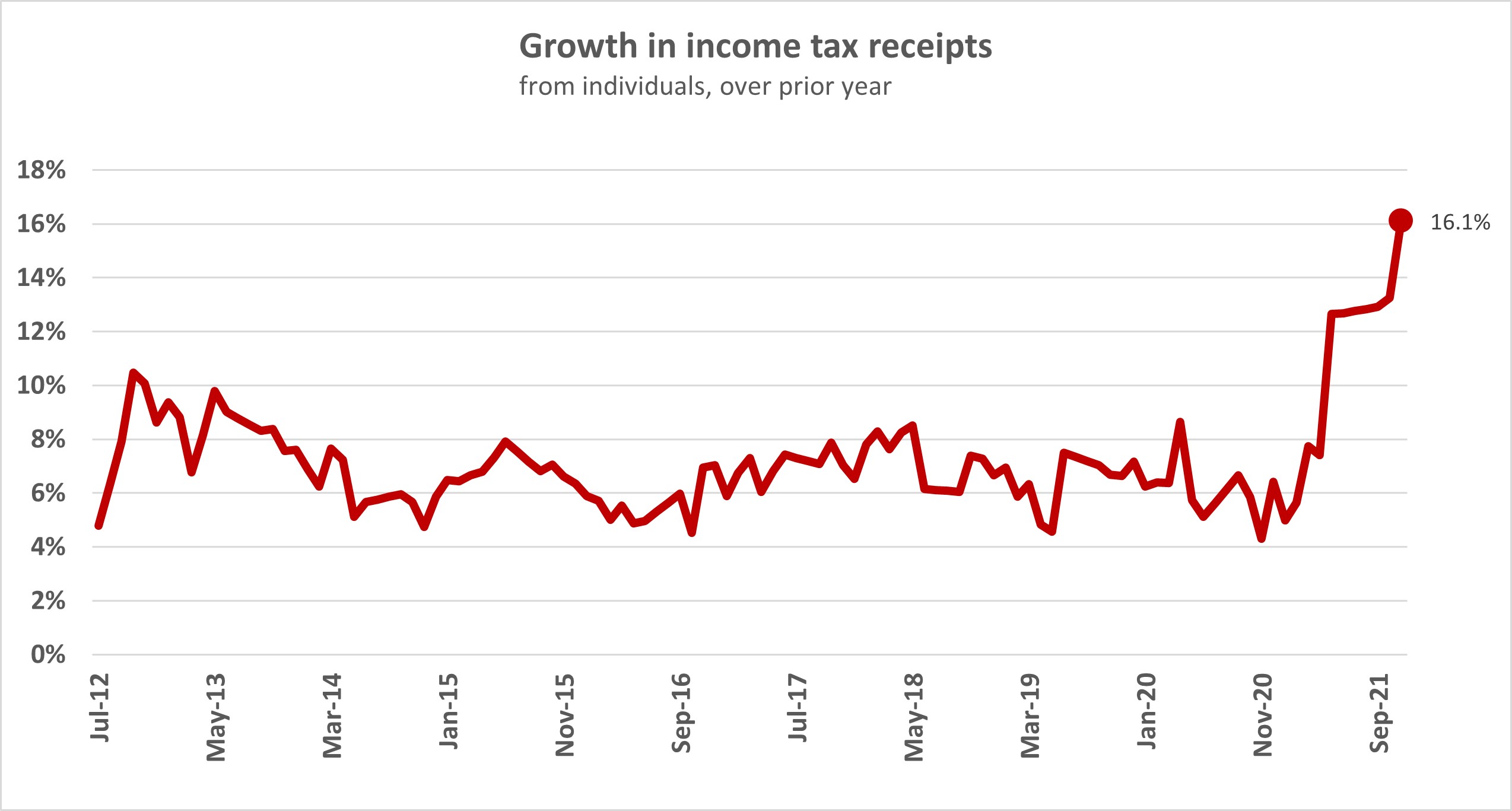

Income Taxes Paid By Individuals Eclipse Previous High Interest co nz

Income Taxes Paid By Individuals Eclipse Previous High Interest co nz

Rebate In Income Tax Ultimate Guide

How To Calculate Tax Rebate In Income Tax Of Bangladesh BDesheba Com

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

Medical Policy Rebate In Income Tax - What are the Exemptions on the Premium Paid for Medical Insurance Policies Section 80 D of the Income Tax Act of 1961 offers tax exemptions for premiums paid on medical insurance