Medical Reimbursement Claim In Income Tax Verkko 9 helmik 2023 nbsp 0183 32 Medical Reimbursement is tax free perquisites under Section 17 2 till INR 15000 However the employee can incur an amount higher than INR 15 000 on

Verkko 26 jouluk 2022 nbsp 0183 32 The monthly taxable amount paid by an employer as part of a worker s taxable salary is known as the Medical Allowance Medical reimbursement Verkko 1 Is medical allowance part of the salary Yes it is part of the salary Medical allowance is money that an employee receives each month in addition to his pay and

Medical Reimbursement Claim In Income Tax

Medical Reimbursement Claim In Income Tax

https://i0.wp.com/www.insurancesamadhan.com/blog/wp-content/uploads/2022/08/A-Guide-to-Health-Insurance-Reimbursement.jpg?w=1920&ssl=1

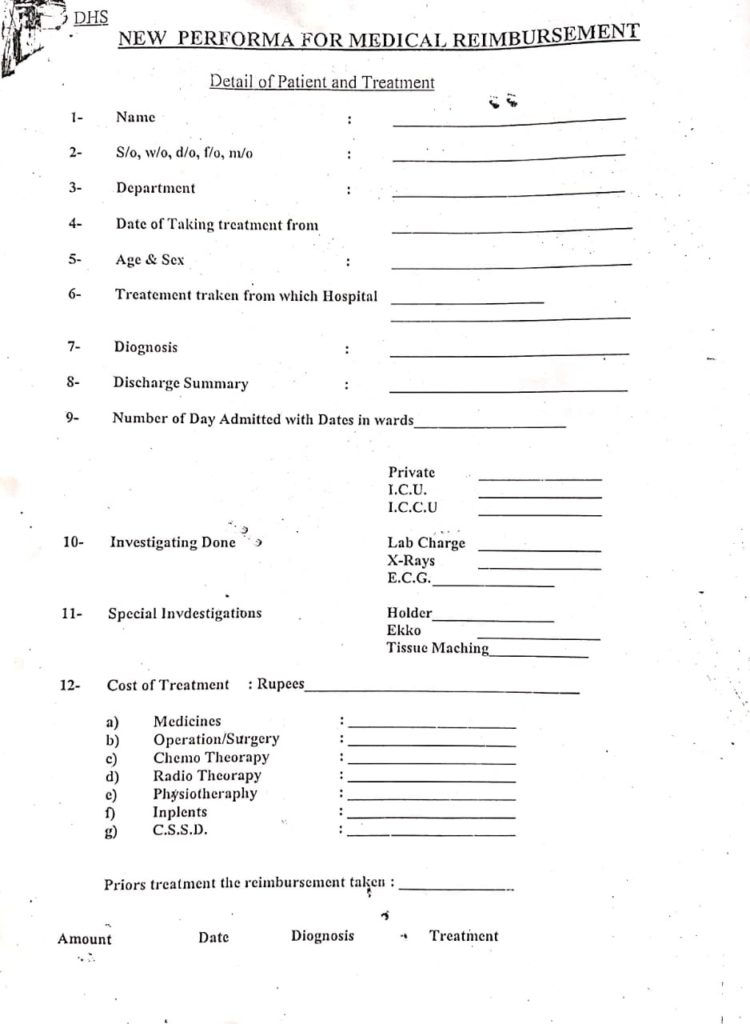

Download Medical Reimbursement Form For Punjab Govt Employees

https://1.bp.blogspot.com/-pnZQplqHfq4/YDEwddDdmKI/AAAAAAAAHB8/LY6fSdKtk7EhzFAvAaO35LuDBDW0I8SJACLcBGAsYHQ/s1024/Medical-Reimbursement-Proforma-750x1024.jpg

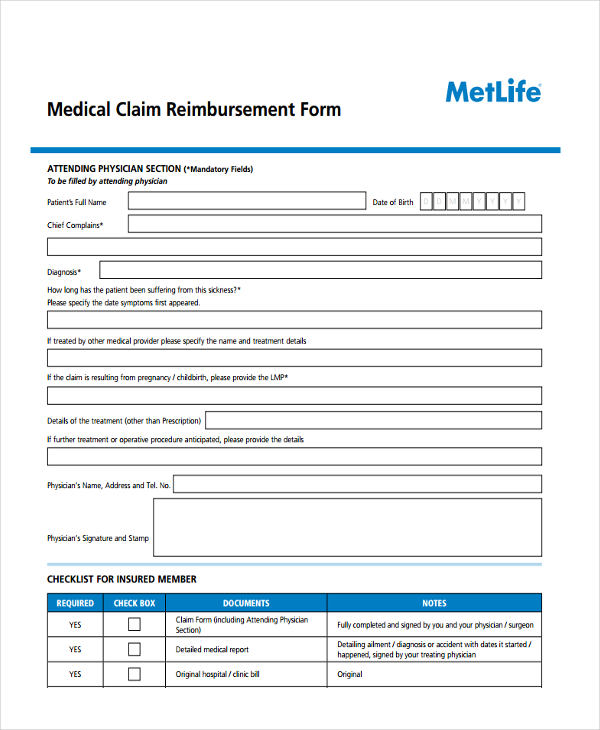

Procedure To Process Of Medical Reimbursement Claim CHECK LIST FOR

https://i.pinimg.com/originals/ff/f8/77/fff87796dc4b9991118dbf9d95a61ad1.jpg

Verkko 12 tammik 2023 nbsp 0183 32 Most taxpayers can claim medical expenses that exceed 7 5 of their adjusted gross incomes AGIs subject to certain rules Though the deduction seems simple there are a variety of rules Verkko 23 huhtik 2020 nbsp 0183 32 Under the Income Tax Act there is a tax exemption of up to Rs 15 000 on medical reimbursements Medical Reimbursement Rules The Income Tax Act

Verkko 20 lokak 2023 nbsp 0183 32 Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved Verkko 11 tammik 2023 nbsp 0183 32 Is health insurance reimbursement considered income No Unlike a healthcare stipend with a health insurance reimbursement employers don t have to pay payroll taxes and

Download Medical Reimbursement Claim In Income Tax

More picture related to Medical Reimbursement Claim In Income Tax

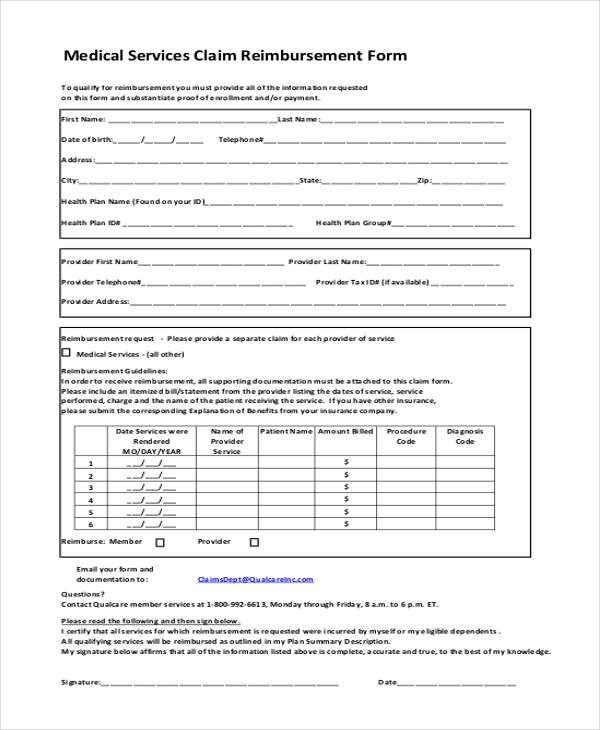

Medical Reimbursement Form 6 Free Templates In PDF Word Excel Download

https://www.formsbirds.com/formimg/medical-reimbursement-form/3811/member-reimbursement-medical-claim-form-d1.png

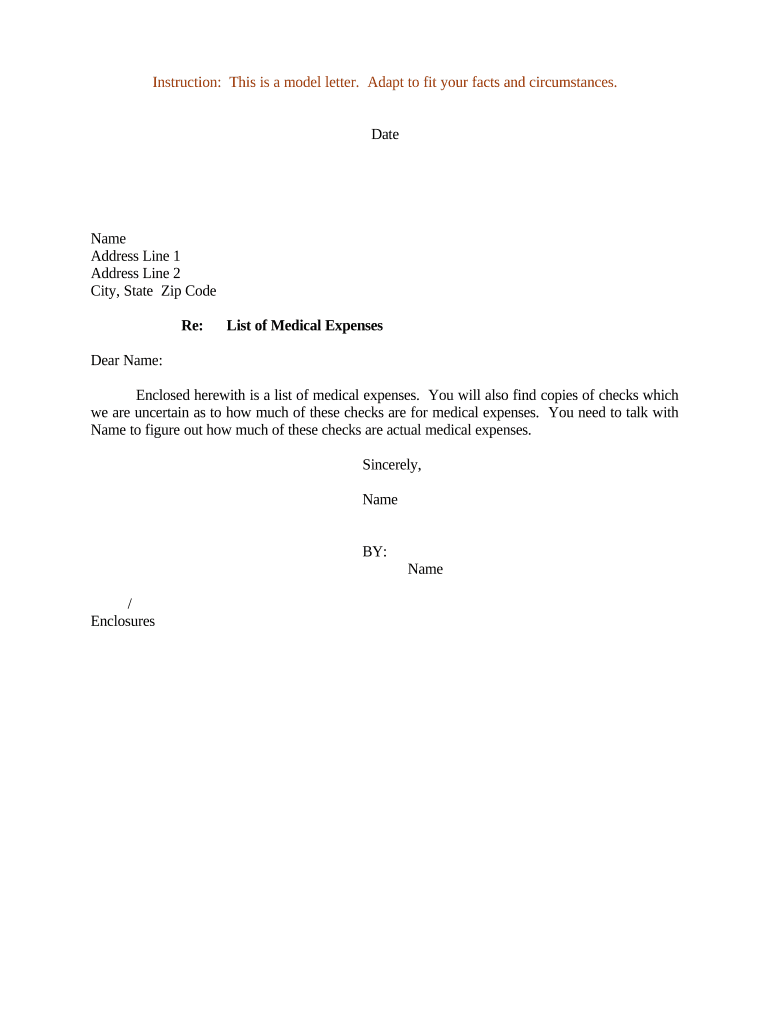

Sample Letter Requesting Reimbursement Of Expenses Fill Out Sign

https://www.pdffiller.com/preview/497/333/497333899/large.png

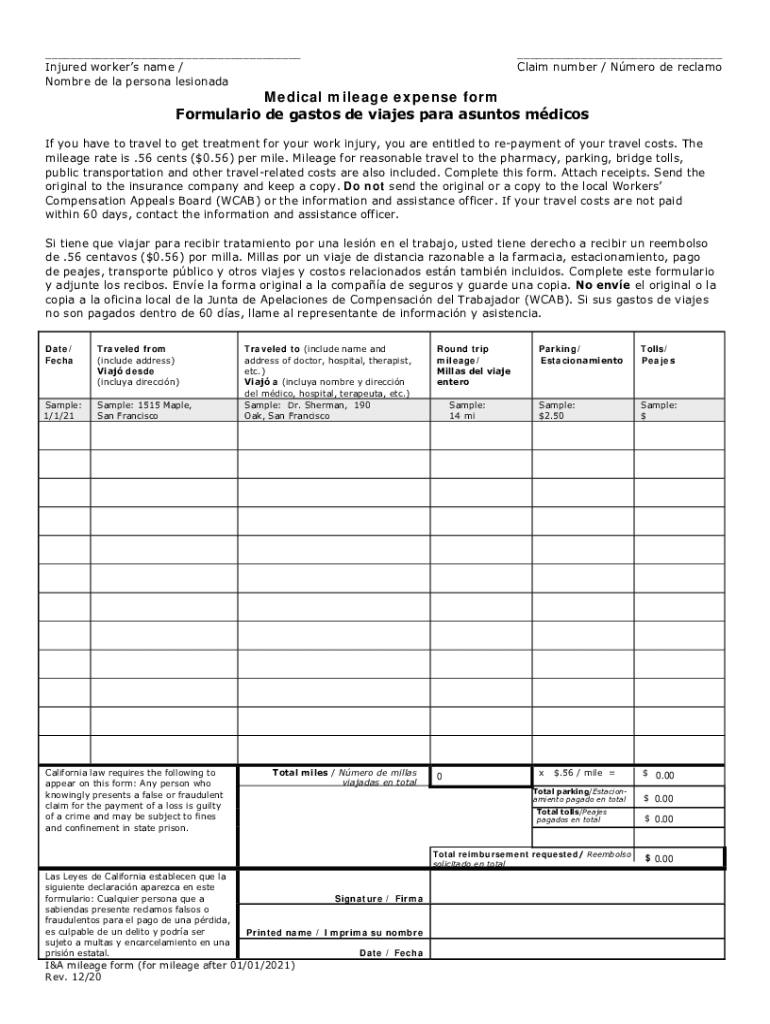

Medical Mileage Expense Form Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/17/398/17398379/large.png

Verkko 28 hein 228 k 2023 nbsp 0183 32 Under the Income Tax Act medical reimbursement falls under Section 80D and the maximum amount allowed per year is Rs 15 000 It s crucial for Verkko receipt cannot be generally classified as income In this scenario any reimbursement cannot be treated as income and therefore should not be subject to Income tax

Verkko 232 22 Feb 2023 Read up about medical reimbursement policies and how to submit claims coupled with other guidelines for medical reimbursement and whether Verkko 16 marrask 2023 nbsp 0183 32 If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental

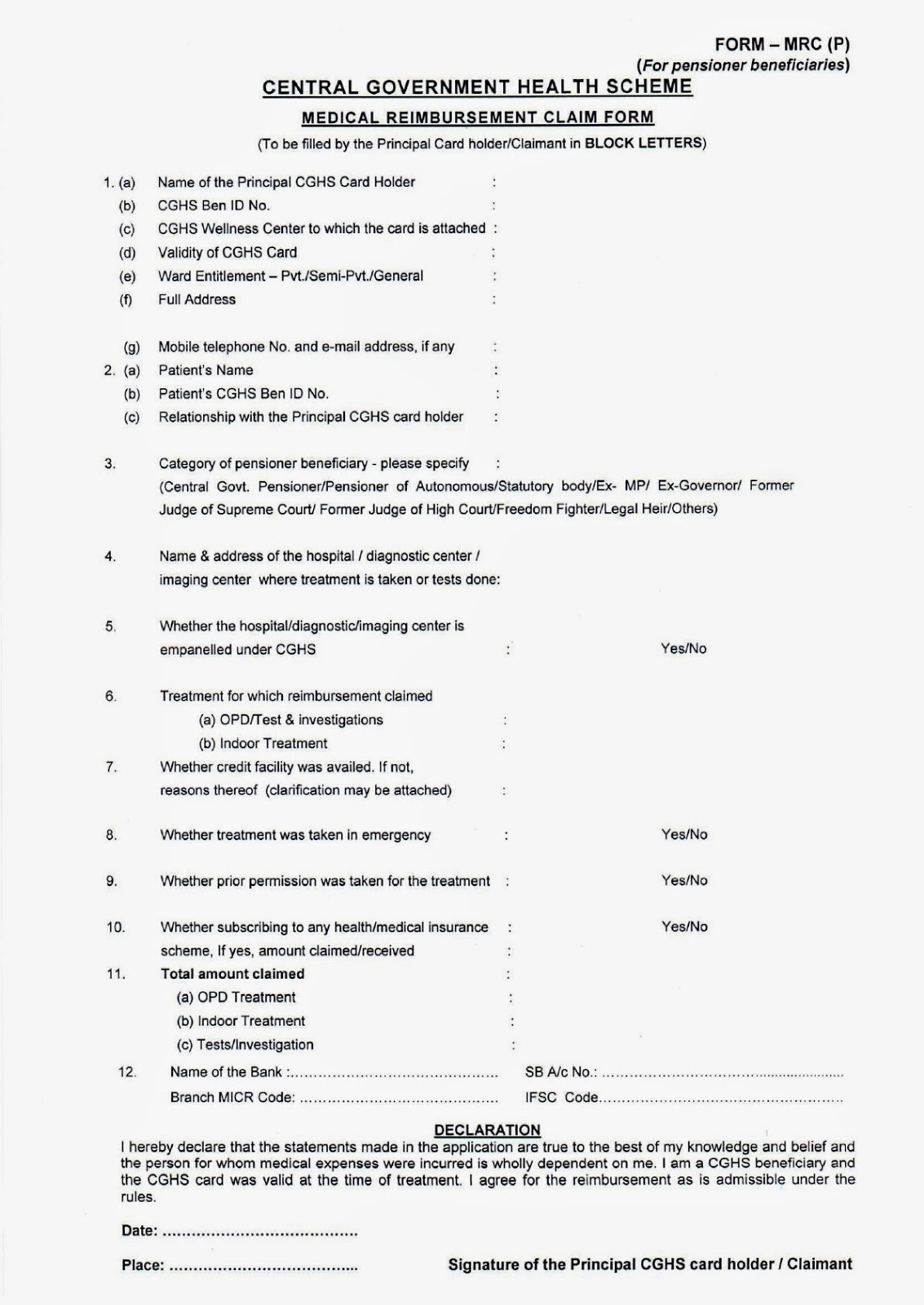

Medical Reimbursement Claim Form For Central Government Employees

https://i0.wp.com/www.claimforms.net/wp-content/uploads/2023/01/new-medical-reimbursement-claim-mrc-form-for-cghs-beneficiaries-3.jpg?resize=725%2C1024&ssl=1

1800 Contacts Insurance Reimbursement

https://images.sampleforms.com/wp-content/uploads/2016/08/Medical-Services-Claim-Reimbursement-Form.jpg

https://learn.quicko.com/medical-allowance-reimbursement

Verkko 9 helmik 2023 nbsp 0183 32 Medical Reimbursement is tax free perquisites under Section 17 2 till INR 15000 However the employee can incur an amount higher than INR 15 000 on

https://navi.com/blog/medical-reimbursement

Verkko 26 jouluk 2022 nbsp 0183 32 The monthly taxable amount paid by an employer as part of a worker s taxable salary is known as the Medical Allowance Medical reimbursement

California Mileage Verification Form Fill Out Sign Online DocHub

Medical Reimbursement Claim Form For Central Government Employees

New Medical Reimbursement Claim MRC Form For CGHS Beneficiaries

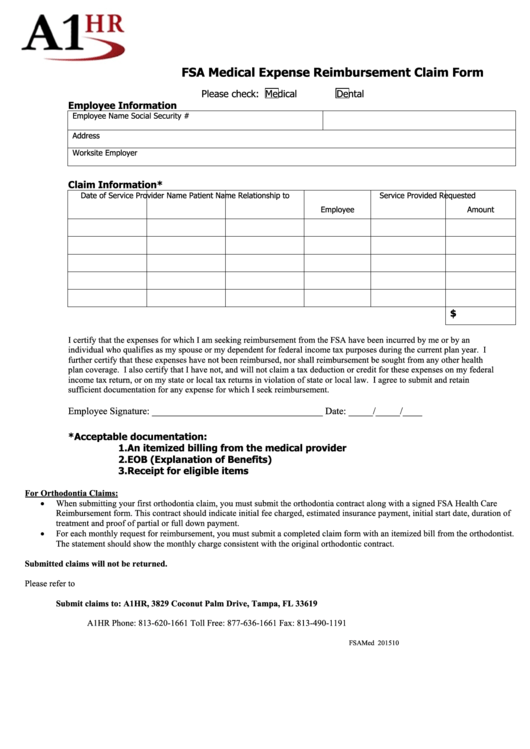

Fillable Fsa Medical Expense Reimbursement Claim Form A1hr Printable

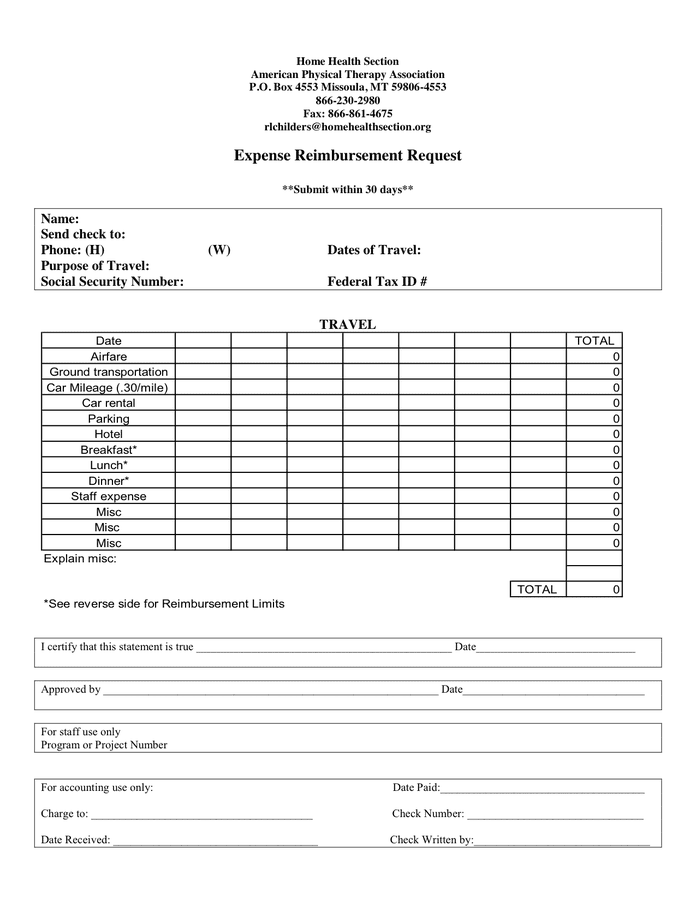

Travel Expense Reimbursement Form In Word And Pdf Formats

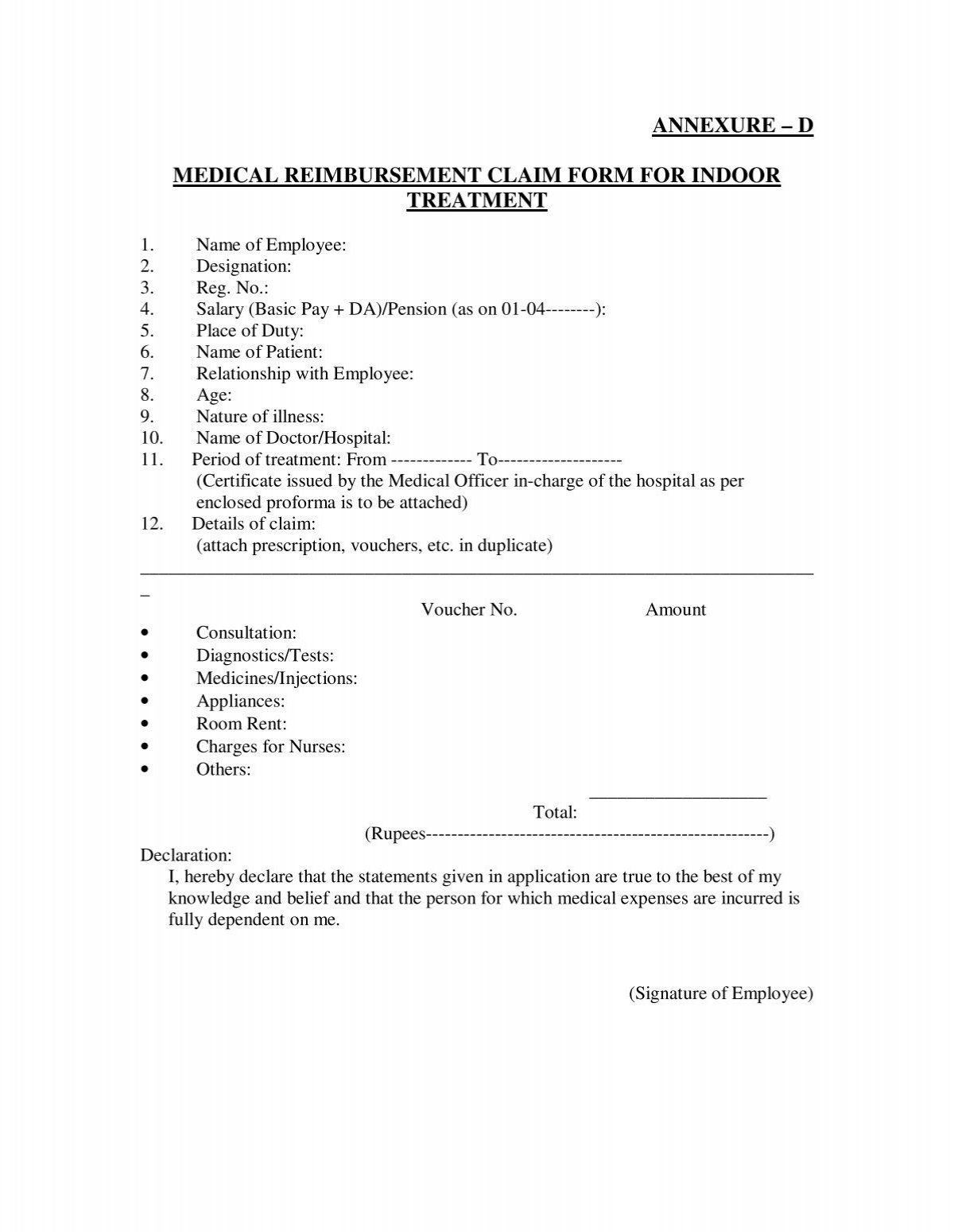

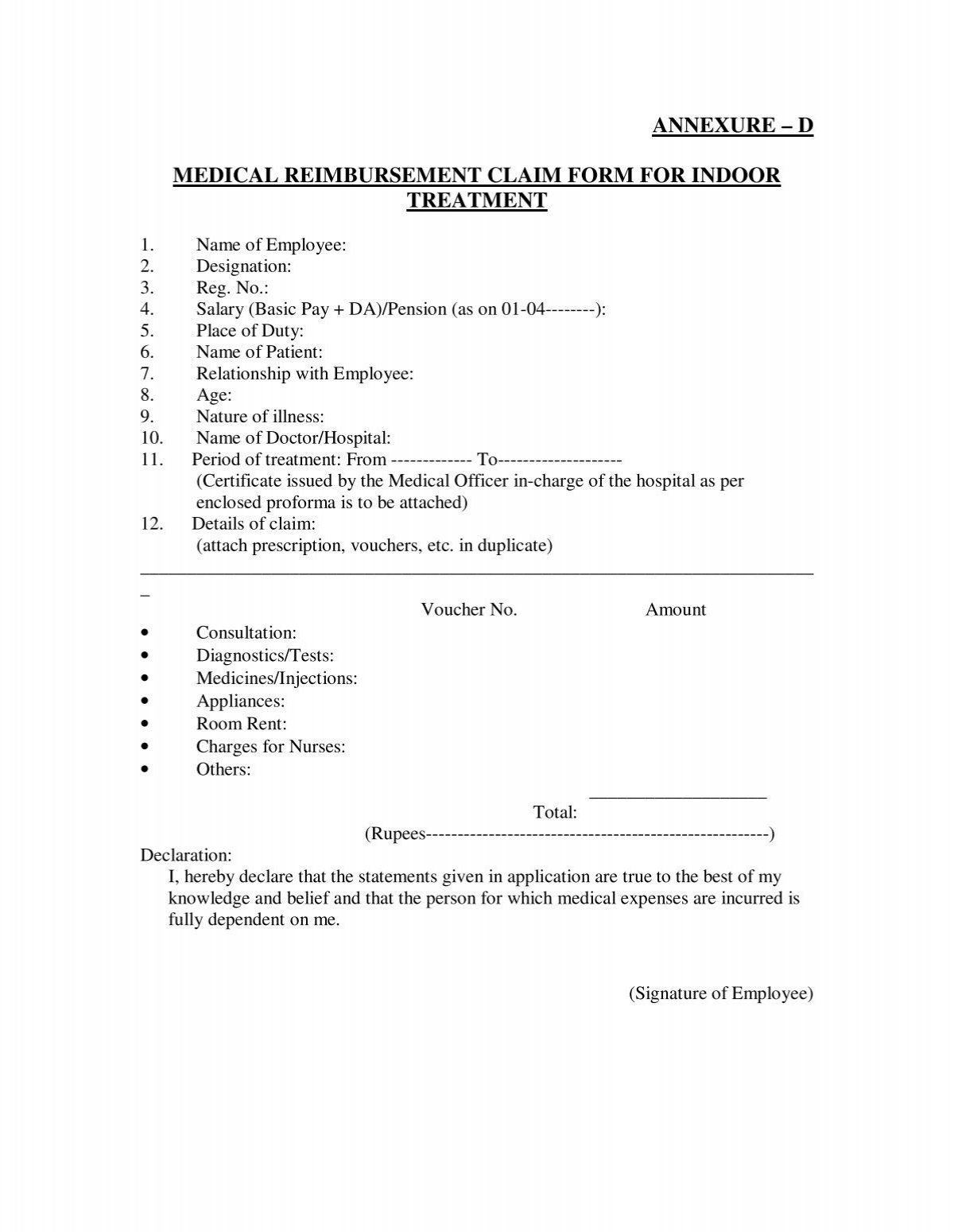

Medical Reimbursement Claim Form For Indoor Treatment SNEA I

Medical Reimbursement Claim Form For Indoor Treatment SNEA I

Sample Letter For Reimbursement Of Wife Delivery Medical Expenses

FREE 8 Medical Reimbursement Forms In PDF

Tax Free Health Reimbursement For Small Employers Payroll Management Inc

Medical Reimbursement Claim In Income Tax - Verkko 20 lokak 2023 nbsp 0183 32 Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved