Medical Tax Rebate Ireland Web 23 janv 2023 nbsp 0183 32 If you pay medical insurance directly to an approved insurer tax relief is available Qualifying medical insurance policies can be for health insurance dental

Web 9 mars 2023 nbsp 0183 32 You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40 Web 9 mars 2023 nbsp 0183 32 Relief for your health expenses is granted by way of a tax refund To benefit you must have paid tax in the relevant year If you have private health insurance you

Medical Tax Rebate Ireland

Medical Tax Rebate Ireland

http://blog.irishtaxrebates.ie/wp-content/uploads/2017/07/1.png

Claiming Tax Back FAQ s Irish Tax Rebates

http://blog.irishtaxrebates.ie/wp-content/uploads/2015/10/itr-infographic-faq.jpg

National Budget Speech 2023 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/blog-image.png

Web Claim 20 back on the cost of GP Doctor and Consultant fees or treatment in a hospital Example GP visits for a family of 5 throughout the year can add up to 500 resulting in Web 9 mars 2020 nbsp 0183 32 20 of 1 000 equal to a credit of 200 Claim Your Medical Insurance Relief Today Step 1 of 4 25 Save and Continue Later Per Child Relief available is equal to the lesser of 20 of the cost of

Web 9 mars 2023 nbsp 0183 32 Overview What are qualifying expenses Dental expenses Nursing home and additional nursing care expenses Additional diet expenses for coeliacs and diabetics Web Every PAYE employee in Ireland can claim up to 20 tax back on both day to day and specialist medical expenses such as doctor visits for you or your family prescriptions

Download Medical Tax Rebate Ireland

More picture related to Medical Tax Rebate Ireland

National Budget Speech 2022 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/tax-rate-tables.png

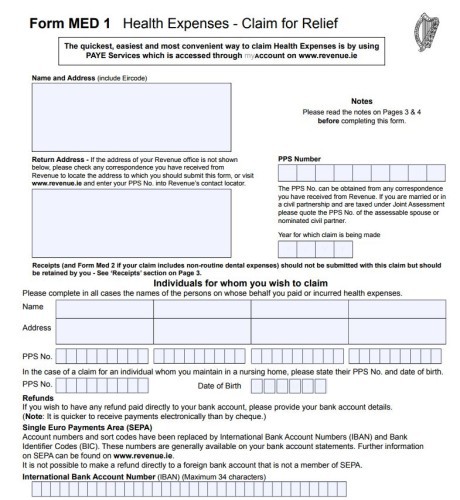

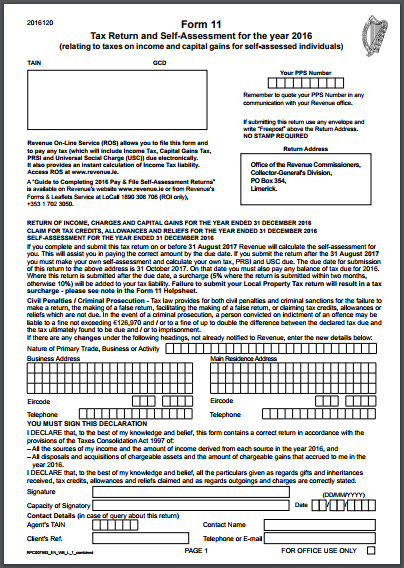

68 MEDICAL 1 FORM IRELAND MedicalForm

https://img2.thejournal.ie/inline/3477222/original/?width=460&version=3477222

Your Bullsh t Free Guide To PAYE Taxes In Ireland

https://www.taxback.com/resources/blogimages/20171114192527.1510680327563.cf95518ad556bdca230d3138df2.png

Web Housing tax credits and reliefs You can claim tax relief on some housing expenses and income Find out more Tax relief on medical expenses You can claim tax relief on Web 2 mai 2019 nbsp 0183 32 When you consider that the average PAYE tax refund is 1076 it s easy to see why applying for your tax refund makes so much sense When you quickly apply online with Taxback you re

Web 19 avr 2021 nbsp 0183 32 The cost of taking a blood test varies from 40 to 400 The cost of other tests such as X Ray MRI and Echo varies accordingly All such expenses can be used Web You can claim tax relief at the standard rate of 20 for fees relating to doctors visits seeing medical consultants or treatment in a hospital Prescription Items or Treatments The

Taxation Medical Expenses Sandycove Dental Care

http://sandycovedentalcare.ie/wp-content/uploads/2019/03/Screen-Shot-2019-03-28-at-13.20.15.jpg

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

https://www.revenue.ie/en/personal-tax-credits-reliefs-and-exemptions/...

Web 23 janv 2023 nbsp 0183 32 If you pay medical insurance directly to an approved insurer tax relief is available Qualifying medical insurance policies can be for health insurance dental

https://www.revenue.ie/en/personal-tax-credits-reliefs-and-exemptions/...

Web 9 mars 2023 nbsp 0183 32 You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40

Doctors Tax Rebate Tax Rebate Online

Taxation Medical Expenses Sandycove Dental Care

Mew Mew Cenz ra Podob Ireland Tax Calculator 2019 Dod vate Niekto Ryb r

Claim Tax Rebates Online Tax Refunds Online Tax Rebate Ireland

Why You Should Use A Tax Expert To Claim Tax Back Irish Tax Rebates

What Medical Expenses Are Tax Deductible

What Medical Expenses Are Tax Deductible

Claim Tax Rebates Online Tax Refunds Online Tax Rebate Ireland

Top Additional Tax Rebates Irish Tax Rebates

5 Important Tax Credits For Medical Professionals Irish Tax Rebates

Medical Tax Rebate Ireland - Web 9 mars 2020 nbsp 0183 32 20 of 1 000 equal to a credit of 200 Claim Your Medical Insurance Relief Today Step 1 of 4 25 Save and Continue Later Per Child Relief available is equal to the lesser of 20 of the cost of