Medical Treatment Tax Rebate Web Overview As an employer providing medical or dental treatment or insurance to your employees you have certain tax National Insurance and reporting obligations What s

Web 18 nov 2021 nbsp 0183 32 Section 80DDB provides a tax deduction against the medical treatment of specified diseases However you must ensure to get a prescription from the specified Web 24 oct 2022 nbsp 0183 32 Medical Tax Relief Types Amount Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner

Medical Treatment Tax Rebate

Medical Treatment Tax Rebate

https://news.leavitt.com/wp-content/uploads/2019/09/chart-mlr1-768x355.jpg

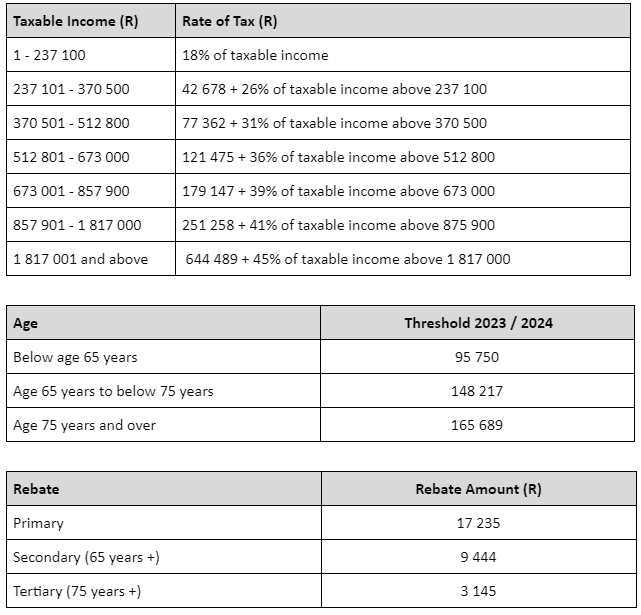

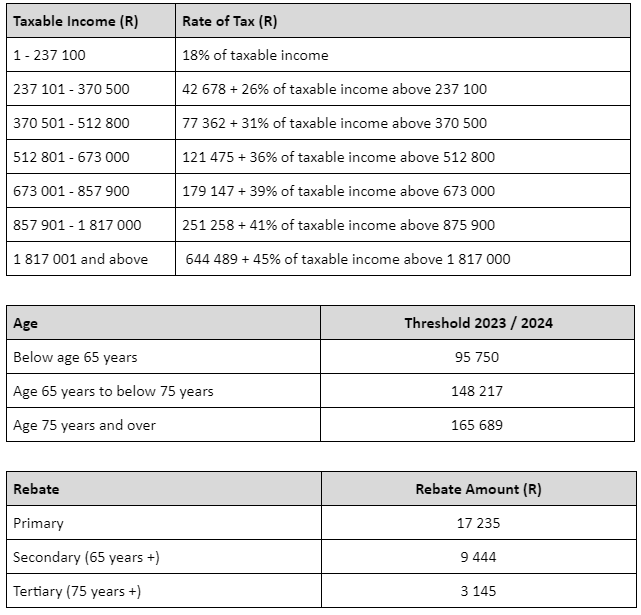

National Budget Speech 2023 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/blog-image.png

REBATES FOR MEDICAL AND ALLIED HEALTH THERAPIES

https://s3.studylib.net/store/data/008447136_1-856556770ed22f5955a5a1f85590b51e-768x994.png

Web Cette contribution est due par toute entreprise assurant l exploitation en France m 233 tropole et ou d 233 partements d Outre mer collectivit 233 s de Saint Martin et Saint Barth 233 l 233 my d une ou plusieurs sp 233 cialit 233 s pharmaceutiques inscrites sur la liste des m 233 dicaments remboursables aux assur 233 s sociaux Non inscrit Web 29 juin 2018 nbsp 0183 32 1 Medical treatment of specified ailments under section 80DDB 2 Amount of deduction under section 80DDB 3 Points to be

Web 26 nov 2020 nbsp 0183 32 Deduction for medical treatment of a dependent who is a person with disability Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a Web 24 avr 2023 nbsp 0183 32 Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal Revenue Service and you must itemize your deductions TABLE OF CONTENTS Deducting medical expenses How to claim medical expense deductions

Download Medical Treatment Tax Rebate

More picture related to Medical Treatment Tax Rebate

Health Insurance Tax Benefits u s 80D For FY 2018 19 AY 2019 20

https://www.relakhs.com/wp-content/uploads/2018/02/Medical-Insurance-Premium-Tax-Benefits-Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2018-19-AY-2019-20-Medical-treatment-expenditure-bills.jpg

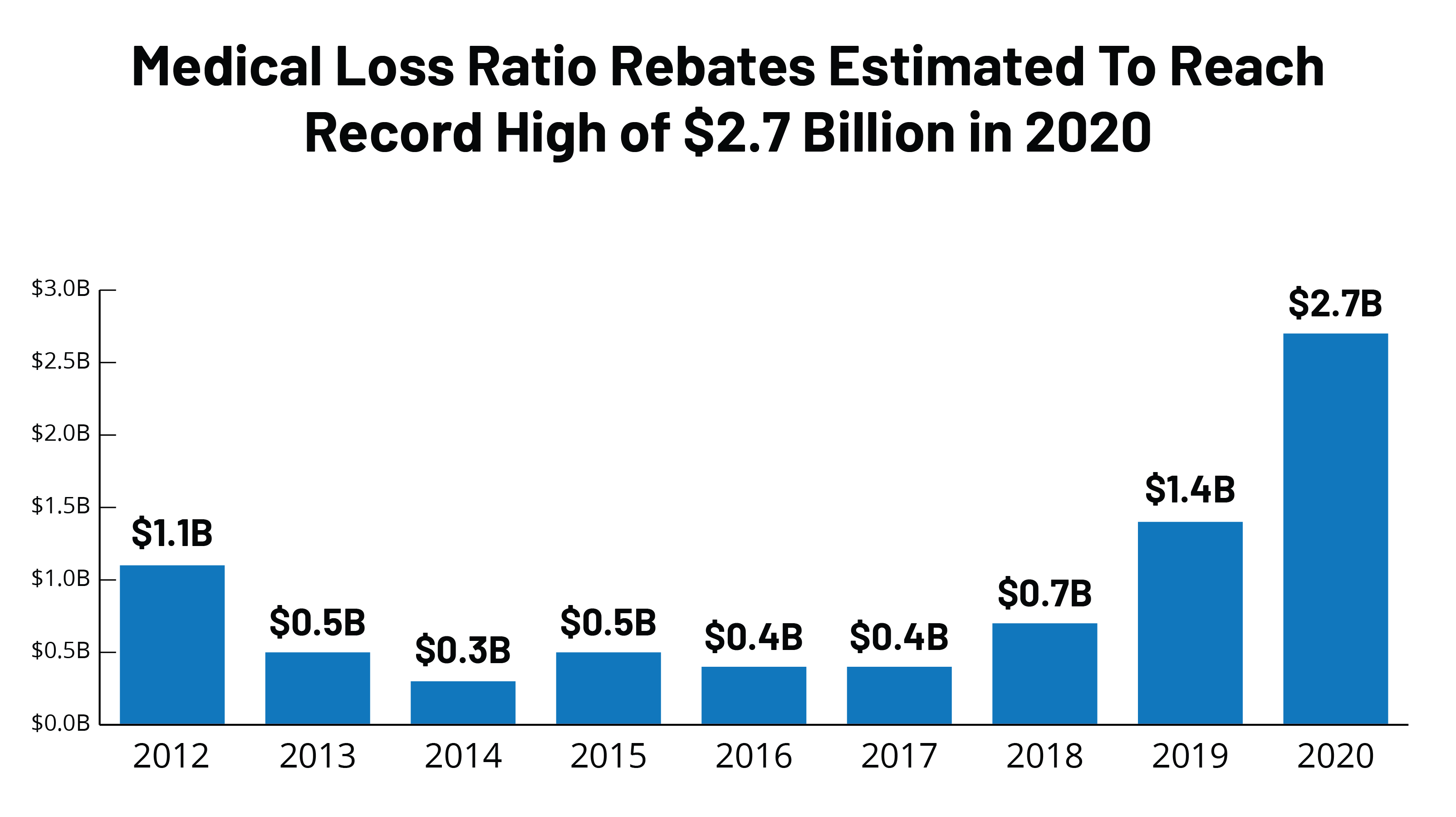

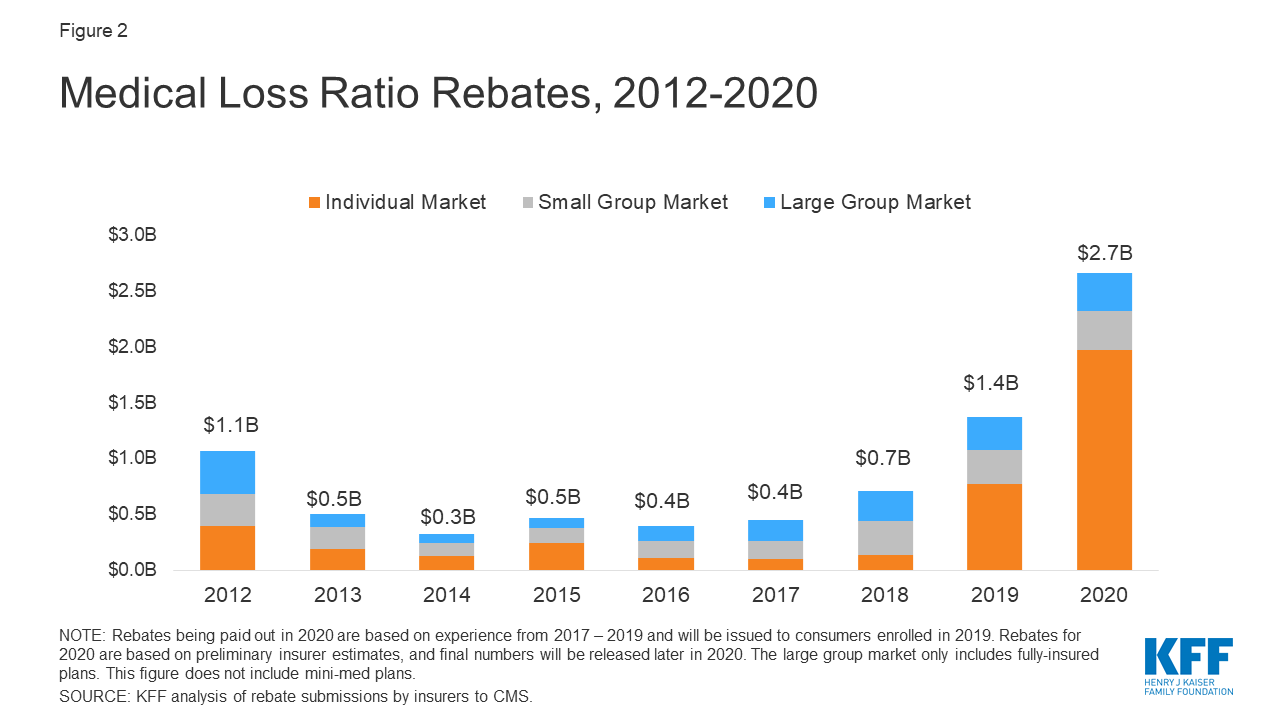

Data Note 2020 Medical Loss Ratio Rebates Methods 9346 02 KFF

https://www.kff.org/wp-content/uploads/2020/04/FEATURE-Medical-Loss-Ratio-Rebates_1.png

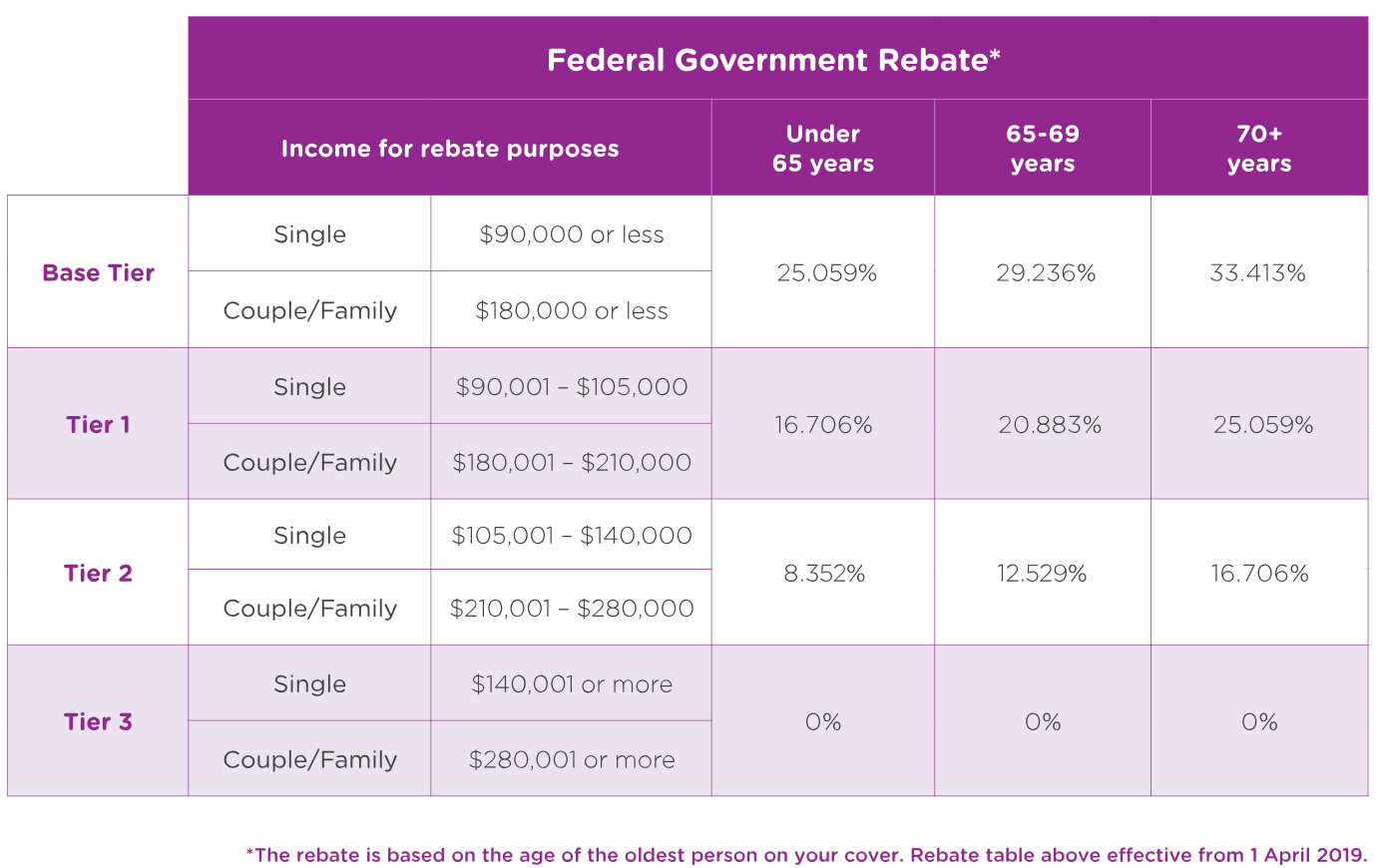

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

Web 12 janv 2023 nbsp 0183 32 The Deduction and Your AGI Threshold You can calculate the 7 5 rule by tallying up all your medical expenses for the year then subtracting the amount equal to 7 5 of your AGI For example if your AGI is 65 000 your threshold would be 4 875 or 7 5 of 65 000 You can find your AGI on Form 1040 Web 13 f 233 vr 2019 nbsp 0183 32 If the expenditure has been incurred is for a person individual or dependant who is below 60 years of age then the maximum deduction that can be claimed is Rs 40 000 in a single

Web An assessee is eligible for tax deduction of Rs 40 000 or the actual amount paid for medical treatment whichever is lower Senior citizens between the ages of 60 years Web 15 janv 2020 nbsp 0183 32 Dans le cadre d un rescrit l administration vient de r 233 pondre 224 une question relative 224 l application ou non de la TVA sur une r 233 trocession d honoraires entre m 233 decins Les patients versent dans ce cas les honoraires au m 233 decin remplac 233 et ce dernier reverse ensuite ce montant au m 233 decin rempla 231 ant 224 l exception d un

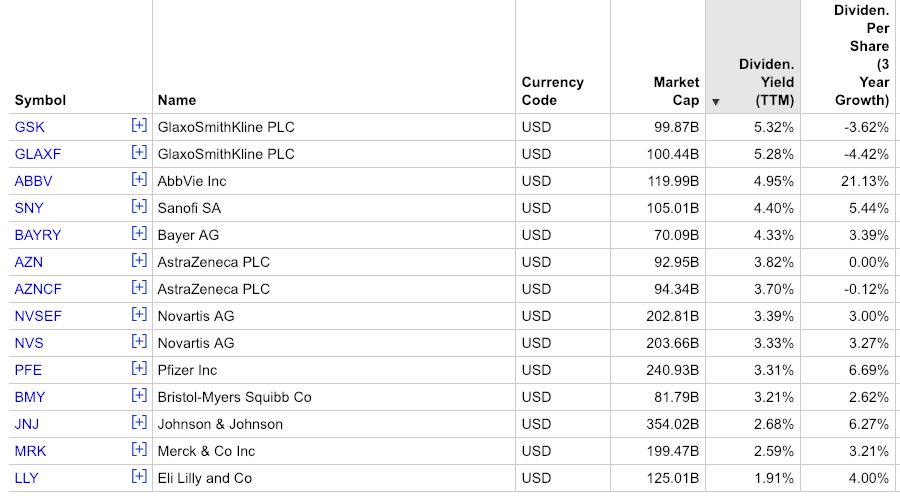

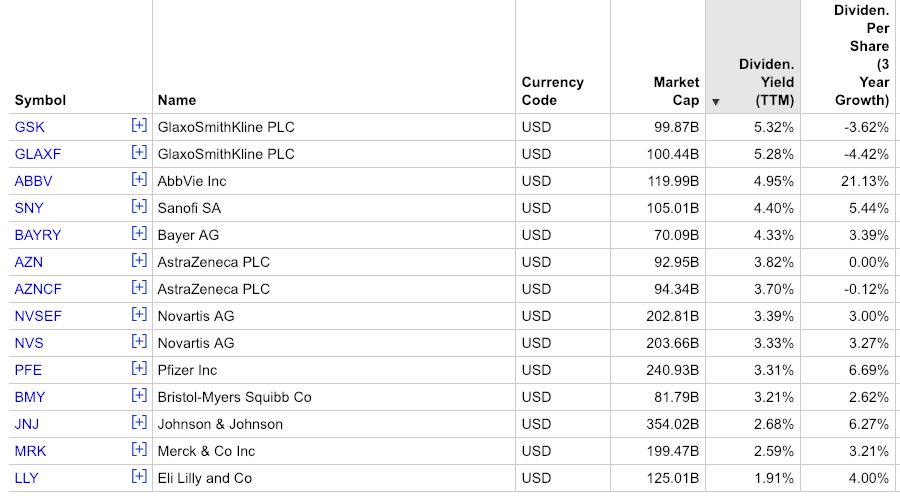

Can You Secure Your Medical Rebate Check By February 15 Stock Gumshoe

https://www.stockgumshoe.com/wp-content/uploads/2019/02/pharmadivs.jpg

Sample Of A Medical Bill Bill Template Receipt Template Invoice

https://i.pinimg.com/originals/3c/53/f7/3c53f7e40090a87f6b39f42a2cc20f0c.jpg

https://www.gov.uk/expenses-and-benefits-medical-treatment

Web Overview As an employer providing medical or dental treatment or insurance to your employees you have certain tax National Insurance and reporting obligations What s

https://scripbox.com/tax/section-80ddb

Web 18 nov 2021 nbsp 0183 32 Section 80DDB provides a tax deduction against the medical treatment of specified diseases However you must ensure to get a prescription from the specified

In SA Tax Credits For Medical Aid Contributions eBiz Money

Can You Secure Your Medical Rebate Check By February 15 Stock Gumshoe

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Data Note 2020 Medical Loss Ratio Rebates KFF

Data Note 2022 Medical Loss Ratio Rebates California Partnership For

Data Note 2022 Medical Loss Ratio Rebates California Partnership For

DEDUCTION FOR MEDICAL INSURANCE PREMIUM PREVENTIVE HEALTH CHECK UP

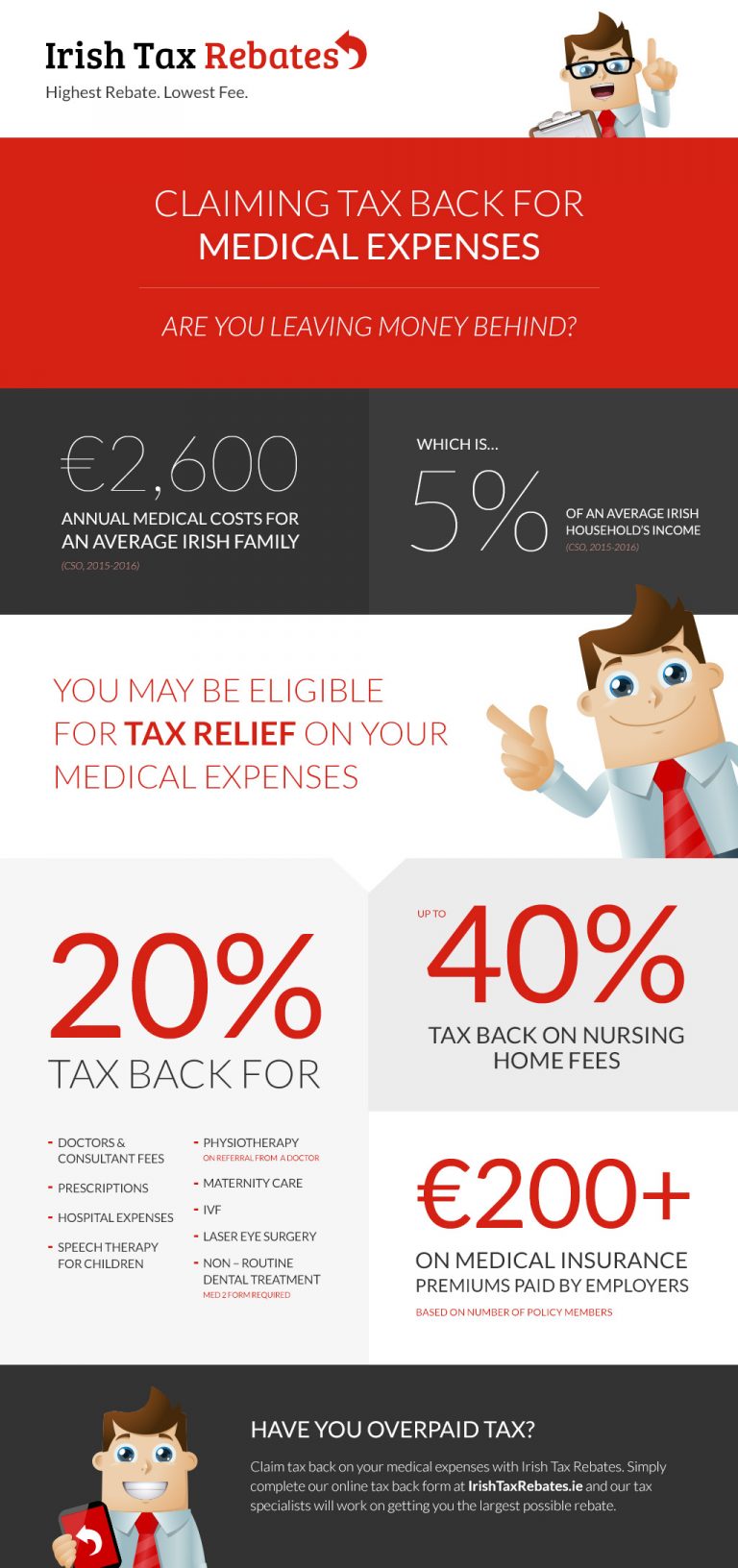

Tax Back On Medical Expenses Infographic Irish Tax Rebates

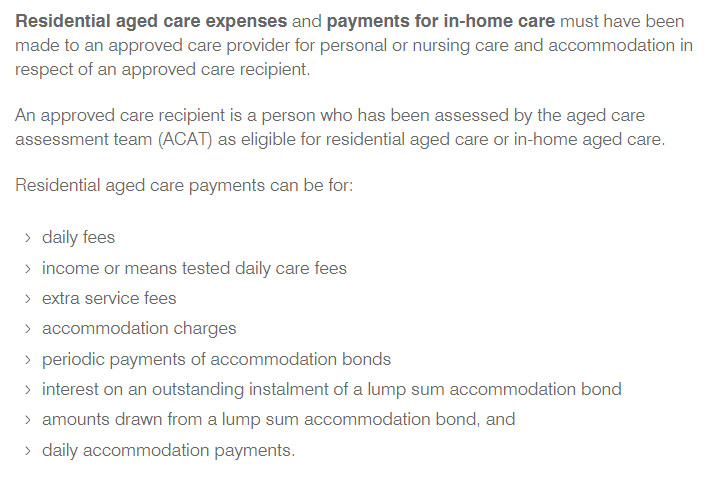

Claiming The Medical Offset Tax Rebate

Medical Treatment Tax Rebate - Web 26 nov 2020 nbsp 0183 32 Deduction for medical treatment of a dependent who is a person with disability Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a