Medicare Part B Premium Deduction For Self Employed Yes the IRS has allowed self employed individuals to deduct all Medicare premiums including premiums for Medicare Part B and Part A for people who have to pay a

Yes You can enter the Medicare B premiums as self employed health insurance premiums It will show as a deduction on Schedule 1 of Form 1040 line 16 Self Employed Insurance Deduction Self employed individuals can deduct health insurance premiums including Medicare Part B directly from gross income under Section

Medicare Part B Premium Deduction For Self Employed

Medicare Part B Premium Deduction For Self Employed

https://www.retiremed.com/sites/default/files/2022-12/Part B IRMAA Chart_Cerkl.png

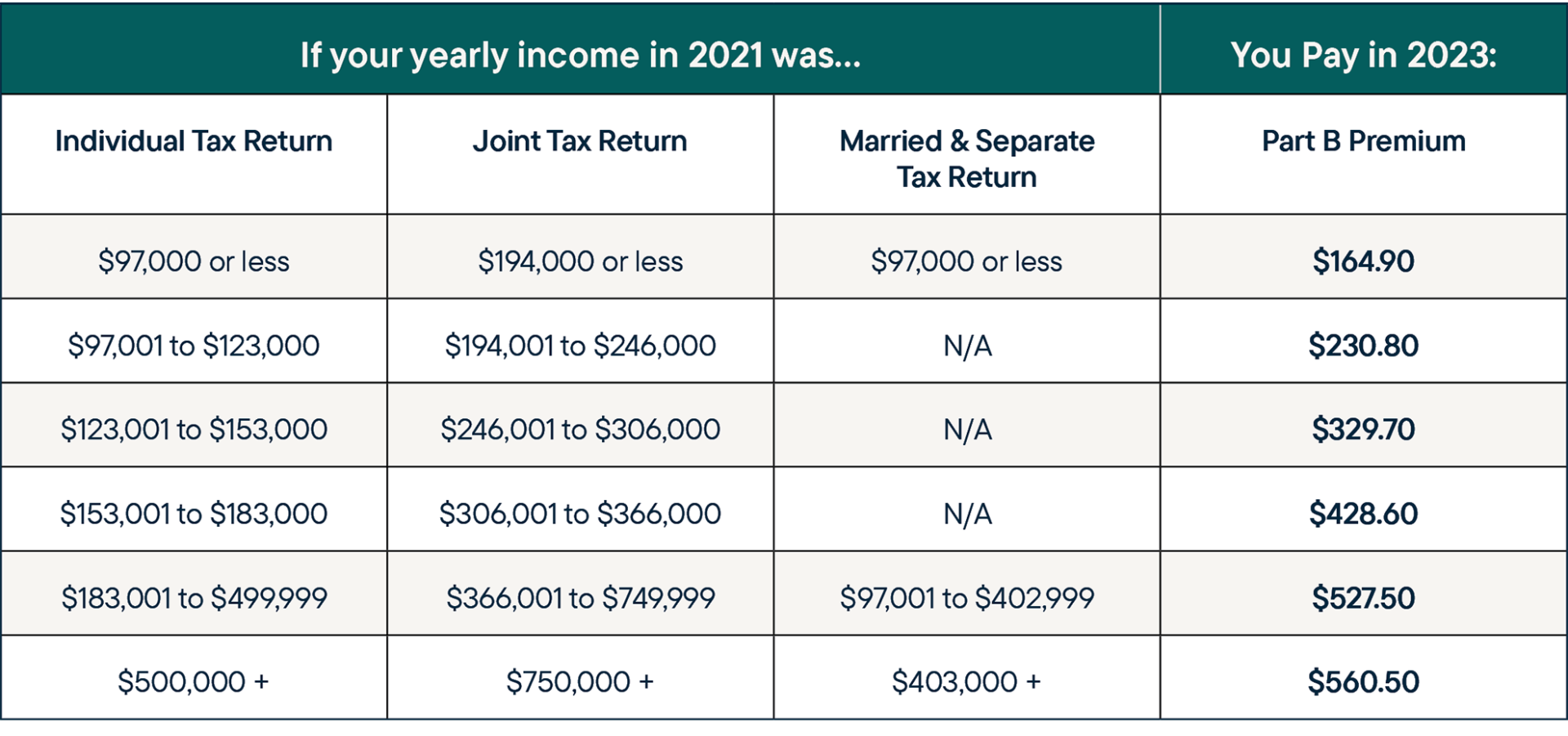

What Are The 2024 Medicare Part B Premiums And IRMAA Independent

https://help.ihealthagents.com/hc/article_attachments/16628776683415

Qualified Business Income Deduction And The Self Employed The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

If you re self employed the self employed health insurance deduction putting your Medicare premiums on Schedule 1 of your 1040 is the most direct way to reduce The IRS has ruled that Medicare recipients who have self employment income may deduct the premiums they pay for Medicare coverage the same as the premiums for any other

If you are age 65 or older and self employed I have great news you may be able to take a tax deduction for your Medicare Part A B C and D premiums as well as the On July 13 2012 the IRS Chief Counsel s Office released Chief Counsel Advice CCA 201228037 which clarified that all Medicare premiums Parts A B C and D are insurance

Download Medicare Part B Premium Deduction For Self Employed

More picture related to Medicare Part B Premium Deduction For Self Employed

Self employed Individuals Are Allowed To Take A Tax Deduction For Their

http://static1.squarespace.com/static/601c437c854ffc4d9f0aead9/6033c36413e8d937c4d9d497/636d52be324d854ed57020d6/1668797535403/Self+employed+medicare+premium+tax+deduction+.jpg?format=1500w

What Is Medigap Medicare Supplement The Medicare Coach

https://www.themedicarecoach.com/wp-content/uploads/2023/05/Wordpress-Blog-Image-2.jpg

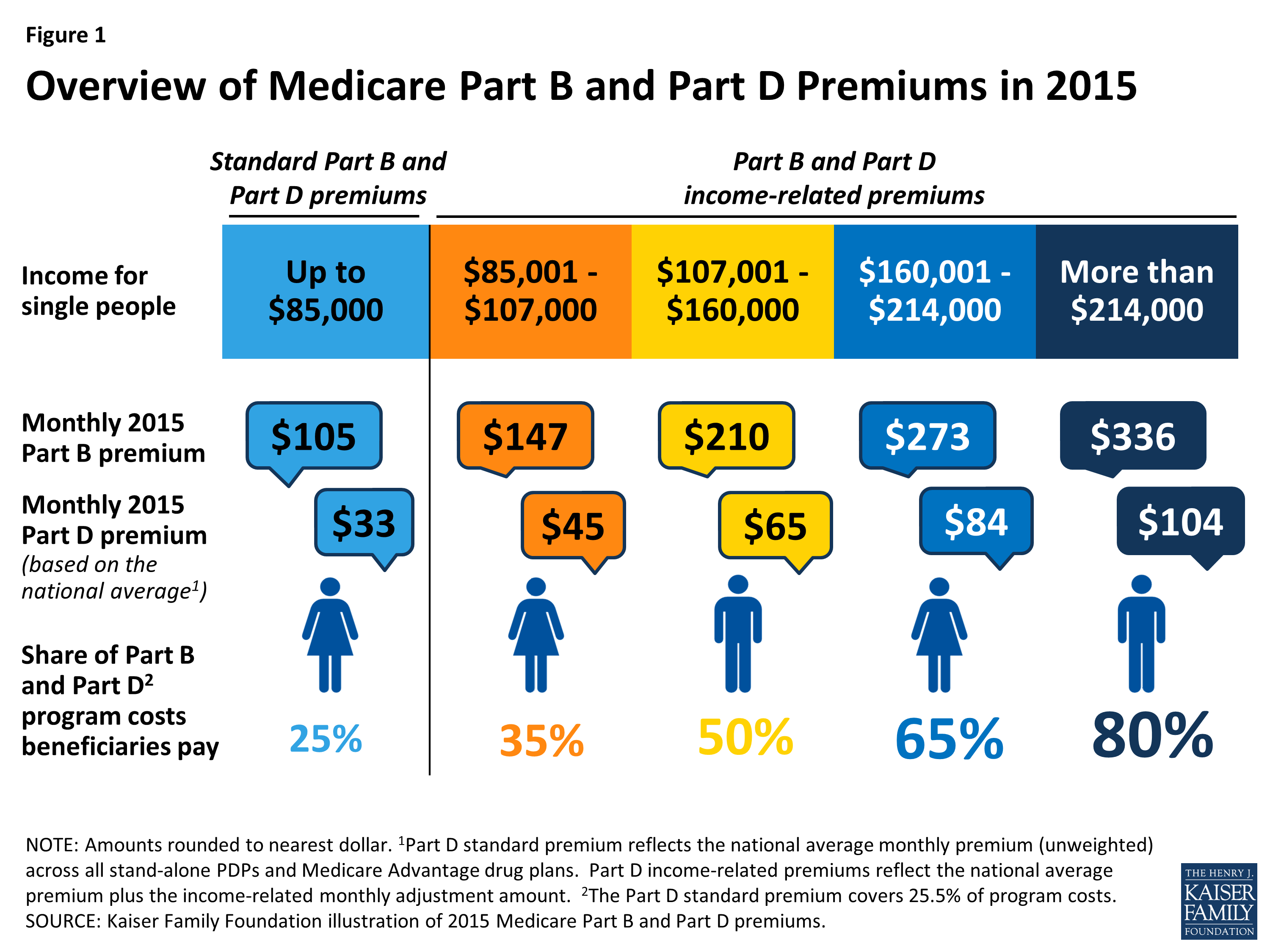

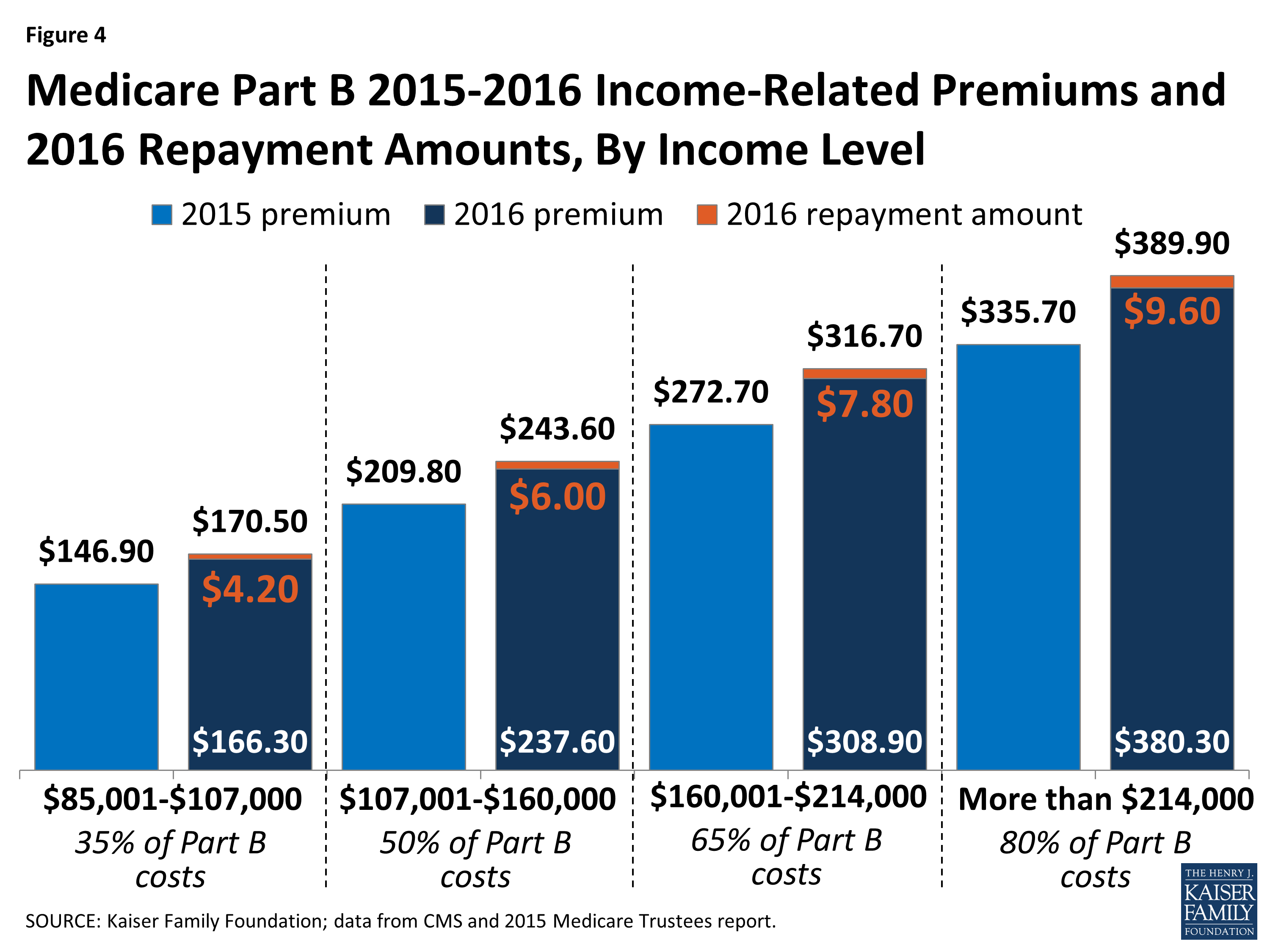

Medicare s Income Related Premiums A Data Note KFF

https://www.kff.org/wp-content/uploads/2015/05/8706-figure-1.png

In 2012 the IRS ruled that Medicare recipients who are self employed may deduct out of pocket health insurance costs that exceed 10 of your adjusted gross income AGI for Self employed individuals can rejoice they may deduct their Medicare Part B premiums from their taxes You can include all premiums paid for Medicare including Part B

If you are self employed and receive Medicare benefits you are responsible for paying the premiums for Parts B and D These premiums can be a significant expense but the You can deduct up to 100 of health insurance premiums for you your spouse and your dependents if you are self employed and have a net profit from the business for which

What Income Is Used For Medicare Part B Premiums MedicareTalk

https://www.medicaretalk.net/wp-content/uploads/medicare-part-b-coverage-medicare-plan-finder.png

2021 Medicare Part B Overview

https://medicareworld.com/wp-content/uploads/2020/12/12-3-20_MW_INFO_2021-Part-B-Premiums.png

https://ttlc.intuit.com › community › tax-credits...

Yes the IRS has allowed self employed individuals to deduct all Medicare premiums including premiums for Medicare Part B and Part A for people who have to pay a

https://ttlc.intuit.com › community › tax-credits...

Yes You can enter the Medicare B premiums as self employed health insurance premiums It will show as a deduction on Schedule 1 of Form 1040 line 16

Medicare Part B Stoughton Hospital Health Talk IHeart

What Income Is Used For Medicare Part B Premiums MedicareTalk

How Does The Deduction For Self Employed Health Insurance Work

Medicare Part B Premium 2024 Chart

Are You On A Medicare Cliff Finding Out Can Save You Money Triage

Medicare Part B Costs 2022 Medicare Planning

Medicare Part B Costs 2022 Medicare Planning

Alternate Text

What s In Store For Medicare s Part B Premiums And Deductible In 2016

Printable Itemized Deductions Worksheet

Medicare Part B Premium Deduction For Self Employed - Now all Medicare premium parts A B C and D paid by the self employed individual for themselves their spouse and dependents are deductible as self employed health