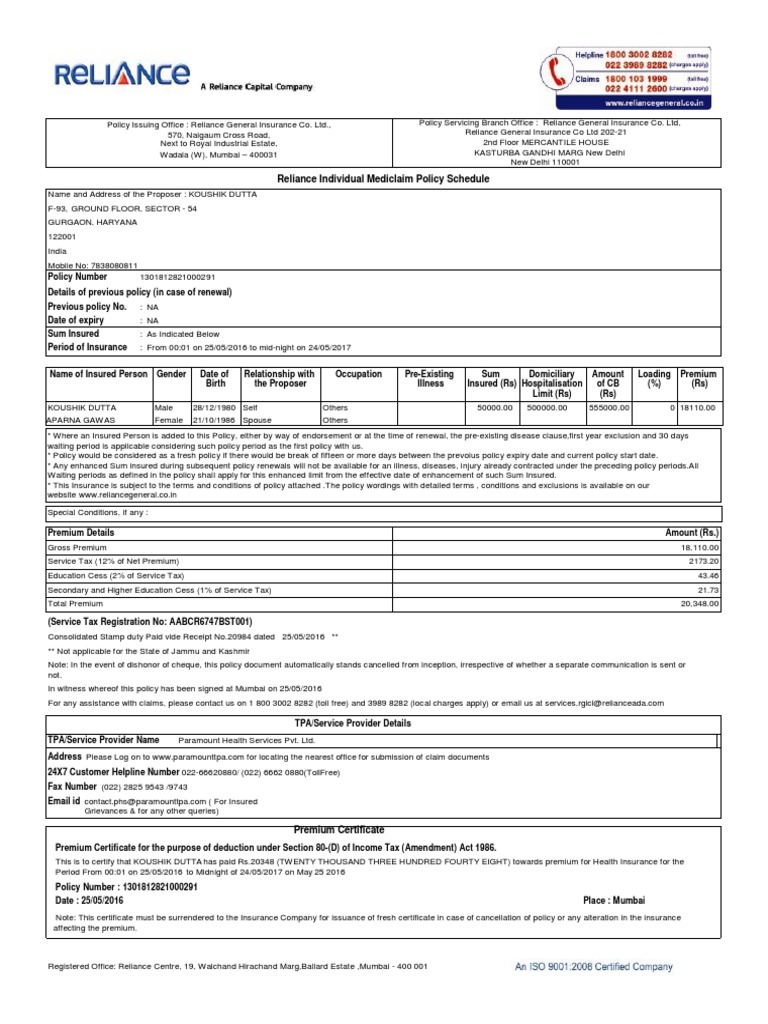

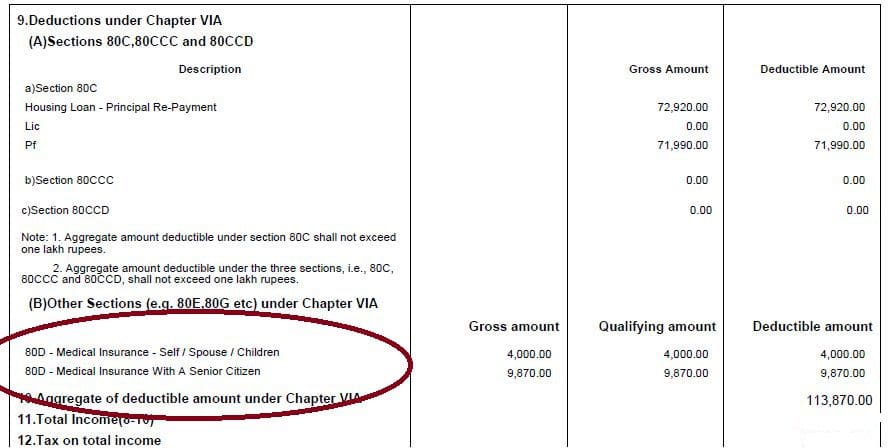

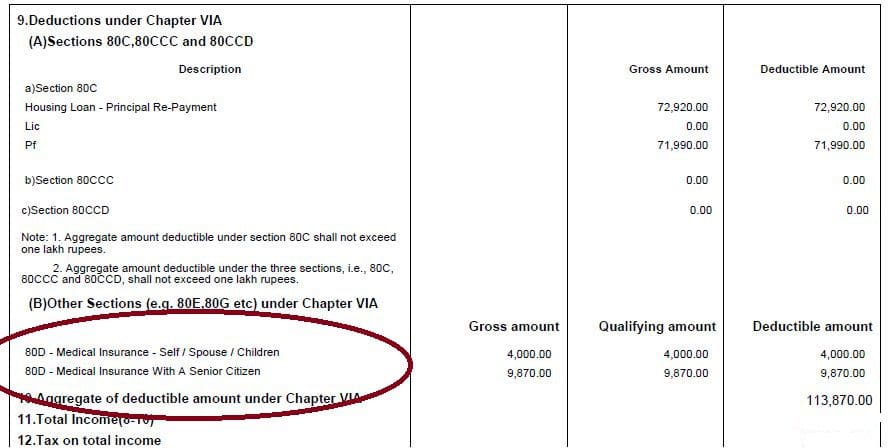

Mediclaim Insurance Tax Rebate Web 26 juin 2018 nbsp 0183 32 1 Medical insurance premium on his policy of Rs 15 000 will qualify for deduction 2 Medical insurance premium on policy of his spouse of Rs 4 000 will qualify for 3 Medical insurance premium on

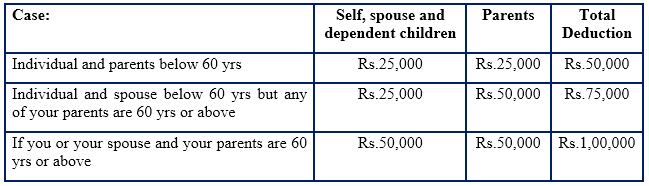

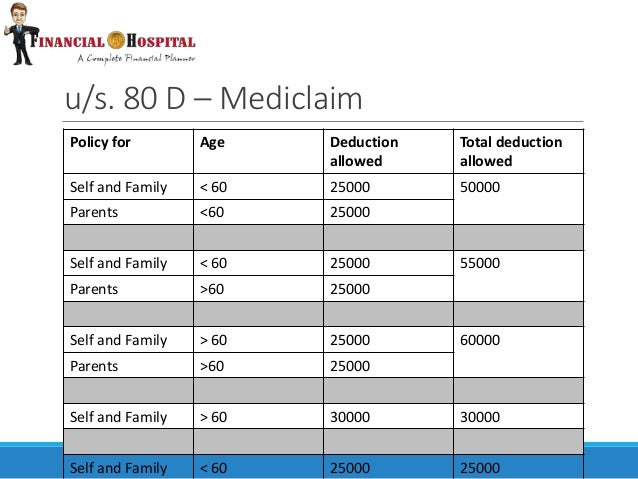

Web 14 juin 2018 nbsp 0183 32 As per section 80D a taxpayer can deduct tax on premiums paid towards medical insurance for self spouse parents and dependent children Individuals and Web As an employer providing medical or dental treatment or insurance to your employees you have certain tax National Insurance and reporting obligations What s included

Mediclaim Insurance Tax Rebate

Mediclaim Insurance Tax Rebate

https://www.careinsurance.com/upload_master/media/posts/February2023/image20230201153943.jpg

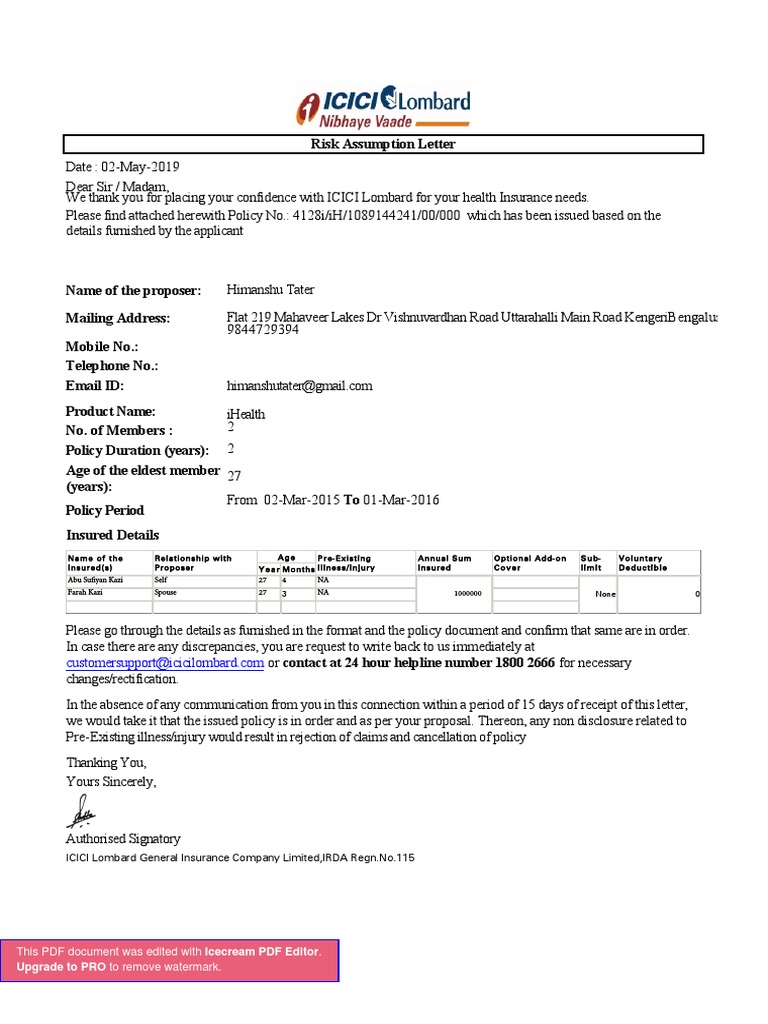

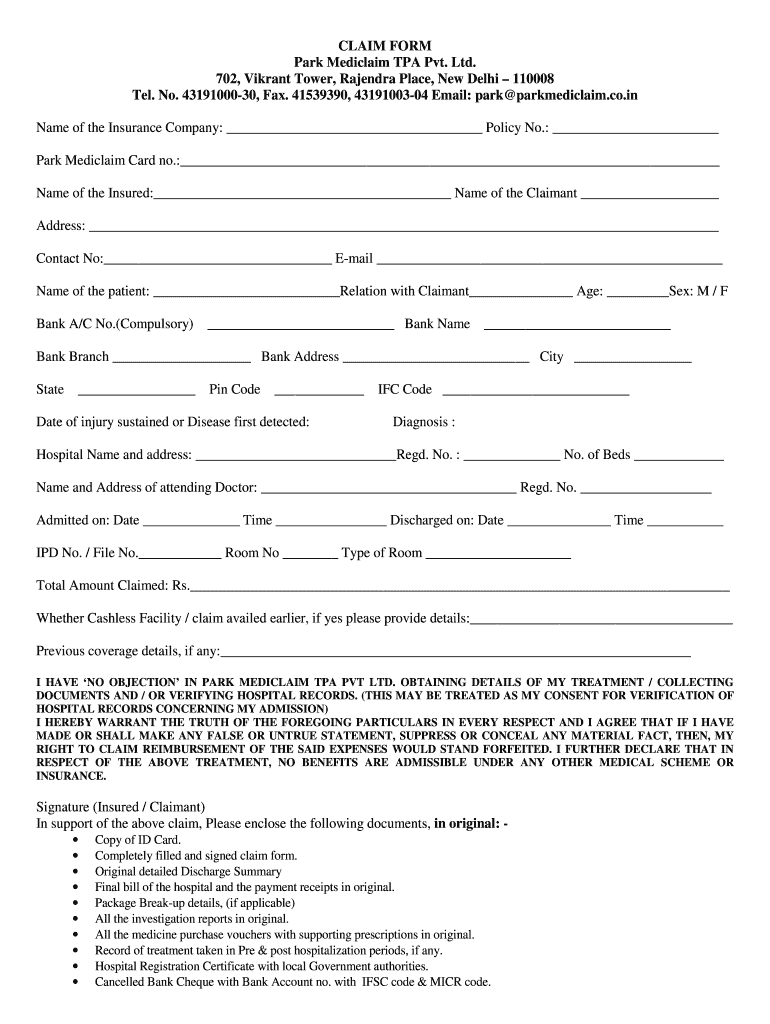

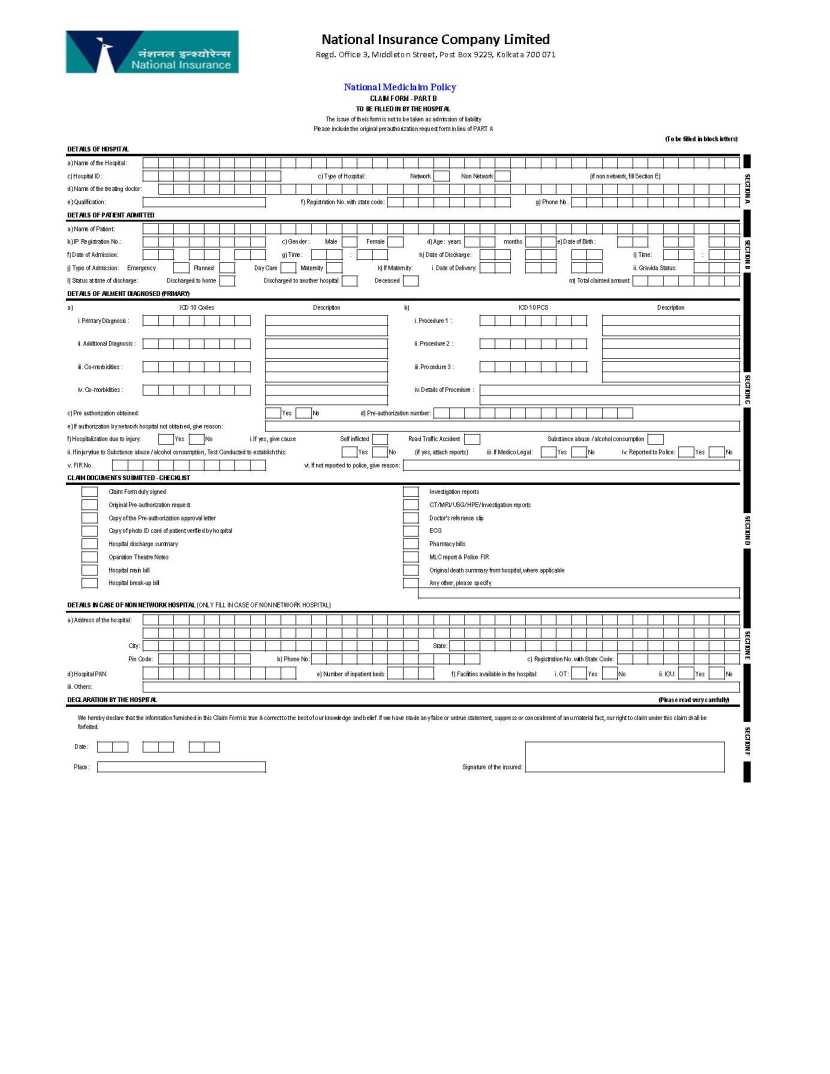

Park Mediclaim Reimbursement Claim Form Fill Online Printable

https://www.pdffiller.com/preview/326/873/326873657/large.png

Mediclaim Receipt Insurance Taxes

https://imgv2-2-f.scribdassets.com/img/document/368529097/original/d24413953c/1547041318?v=1

Web 5 nov 2019 nbsp 0183 32 7 Aug 2023 Views Method is not allowed for the requested route Tax Exemptions in Mediclaim Policy In today s times buying a mediclaim policy has more Web If any one of the persons specified is a senior citizen and Mediclaim Insurance premium is paid for such senior citizen then the deduction amount now is Rs 30 000 From Financial Year 2015 2016 this limit is

Web Section 80D allows a tax deduction of up to Rs 25 000 per financial year on medical insurance premiums Section 80D also includes a Rs 5 000 deduction for any expenses Web Health insurance plans offer tax benefits on the premium amount paid Your health insurance premium is tax deductible under Section 80D of the Indian Income Tax Act

Download Mediclaim Insurance Tax Rebate

More picture related to Mediclaim Insurance Tax Rebate

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

https://www.fincash.com/b/wp-content/uploads/2017/01/80c-deductions.png

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2014/11/Medical-allowance-form-16.jpg

Medical Insurance Premium Receipt 2019 20 PDF Deductible Insurance

https://imgv2-2-f.scribdassets.com/img/document/442594448/original/090873fdc7/1631340133?v=1

Web How You Can Save Taxes with Medical Expenses Most people lead a sedentary lifestyle that has deteriorated their health and increased their medical expenses Health Web The income thresholds used to calculate the Medicare levy surcharge and private health insurance rebate have increased from 1 July 2023 Before 1 July 2023 they remained

Web 17 avr 2021 nbsp 0183 32 Answer Under Section 80D of the Income Tax Act you are entitled to claim deduction for premium paid for health insurance policies popularly known as mediclaim There are two categories for whom Web Follow the steps below to get the health insurance tax benefits While filing your ITR under the Deductions column you need to select 80D to claim tax deductions on medical

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2014/11/Mediclaim-section-80d-form-16.jpg

80d Medical Insurance Premium Receipt Pdf Fill Online Printable

https://www.pdffiller.com/preview/470/590/470590793/large.png

https://taxguru.in/income-tax/all-about-deducti…

Web 26 juin 2018 nbsp 0183 32 1 Medical insurance premium on his policy of Rs 15 000 will qualify for deduction 2 Medical insurance premium on policy of his spouse of Rs 4 000 will qualify for 3 Medical insurance premium on

https://cleartax.in/s/medical-insurance

Web 14 juin 2018 nbsp 0183 32 As per section 80D a taxpayer can deduct tax on premiums paid towards medical insurance for self spouse parents and dependent children Individuals and

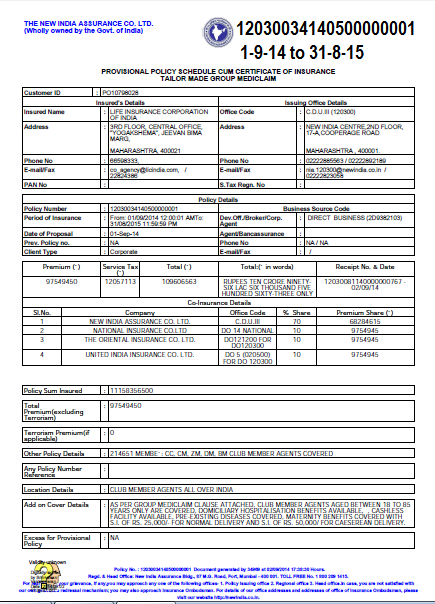

InsureRelaxInfo Agents Club Members Group Mediclaime Policy 2014 15

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Health Care Tax Rebate Calculator 2022 Carrebate

How To Claim Back National Insurance Perziedesign

All You Wanted To Know About The Mediclaim Policy In India

Systems And Services Technologies Bill Pay Service Near Me

Systems And Services Technologies Bill Pay Service Near Me

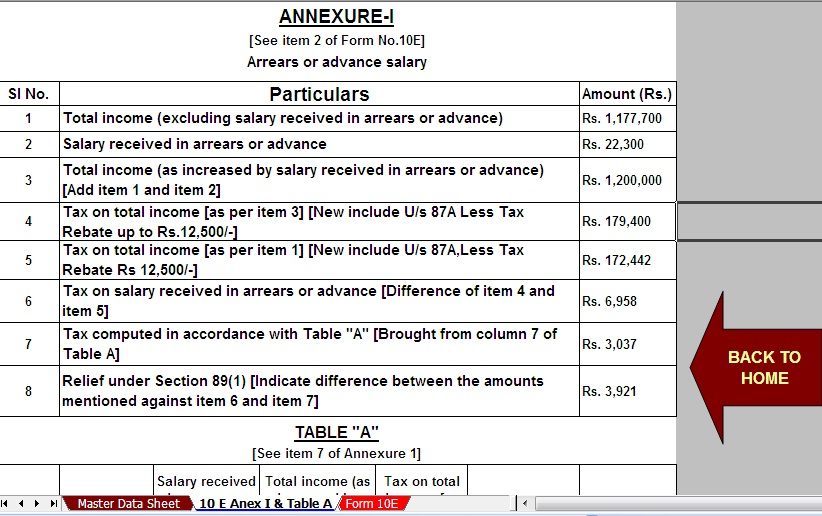

Tax Planning For Salaried Individual

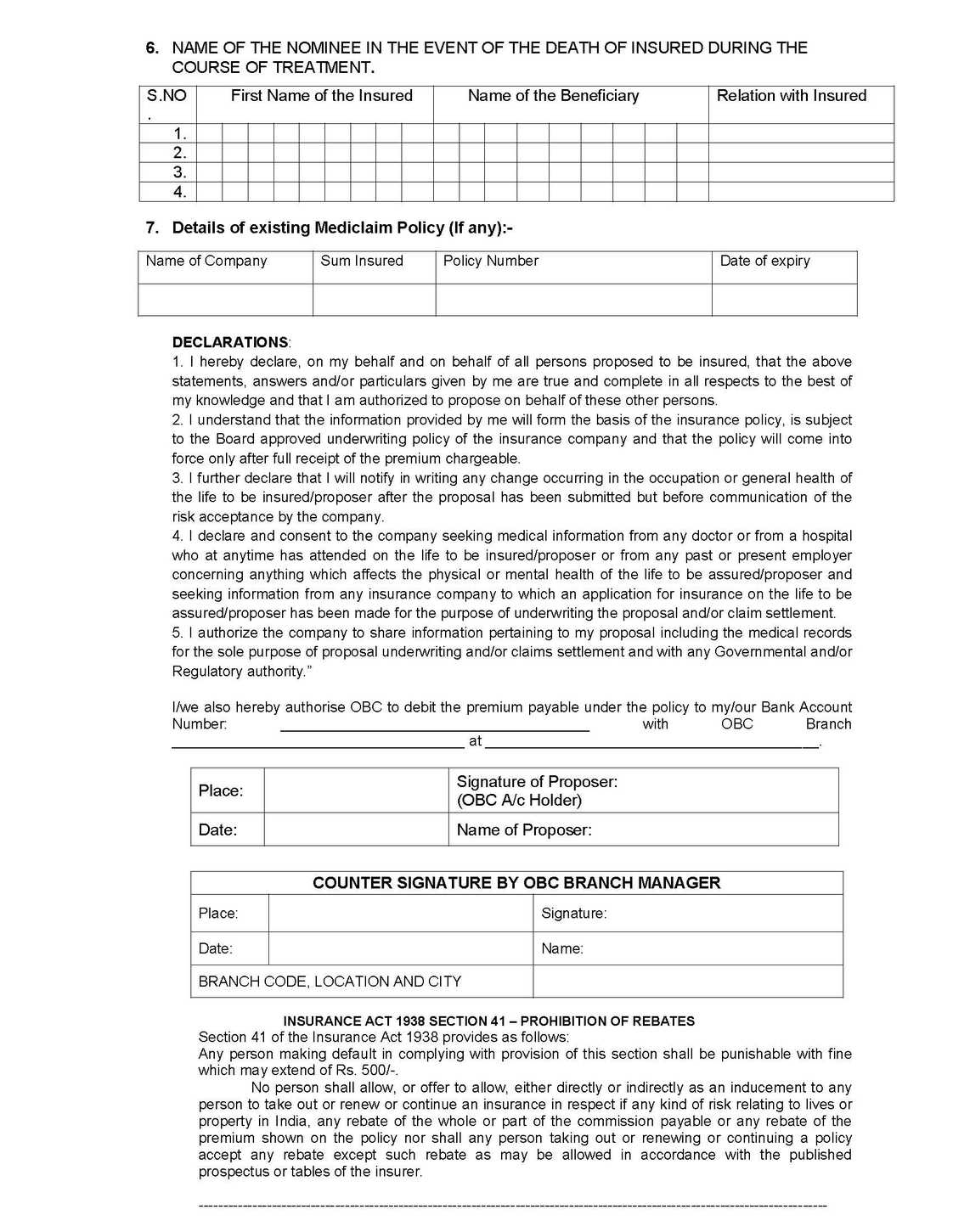

Oriental Insurance Mediclaim Policy For Oriental Bank Of Commerce

Mediclaim Insurance Policy By Syed Issuu

Mediclaim Insurance Tax Rebate - Web Health insurance plans offer tax benefits on the premium amount paid Your health insurance premium is tax deductible under Section 80D of the Indian Income Tax Act