Mediclaim Rebate In Income Tax Web Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee

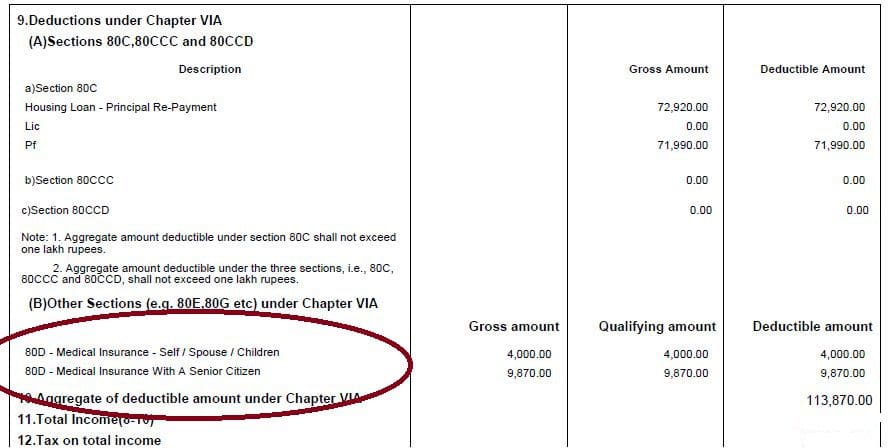

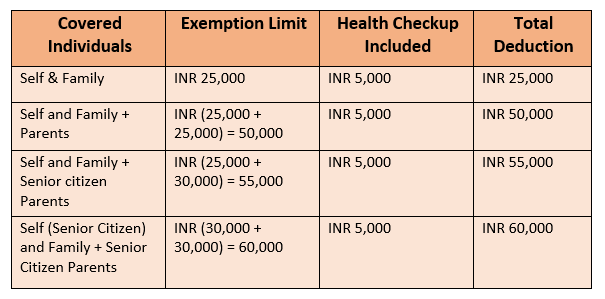

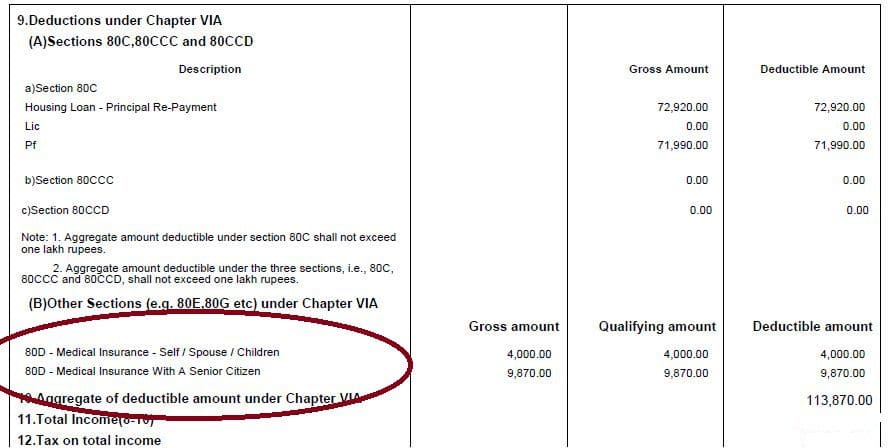

Web 26 juin 2018 nbsp 0183 32 1 Medical insurance premium on his policy of Rs 15 000 will qualify for deduction 2 Medical insurance premium on policy of his spouse of Rs 4 000 will qualify for 3 Medical insurance premium on Web 17 mai 2021 nbsp 0183 32 Section 80D deduction Mediclaim Medical Insurance Premium CA Brijmohan Lavaniya Income Tax Articles Download PDF 17 May 2021 13 104

Mediclaim Rebate In Income Tax

Mediclaim Rebate In Income Tax

https://www.fincash.com/b/wp-content/uploads/2017/01/80c-deductions.png

Income Tax Deductions For FY 2018 19 And AY 2019 20 Sid Associates

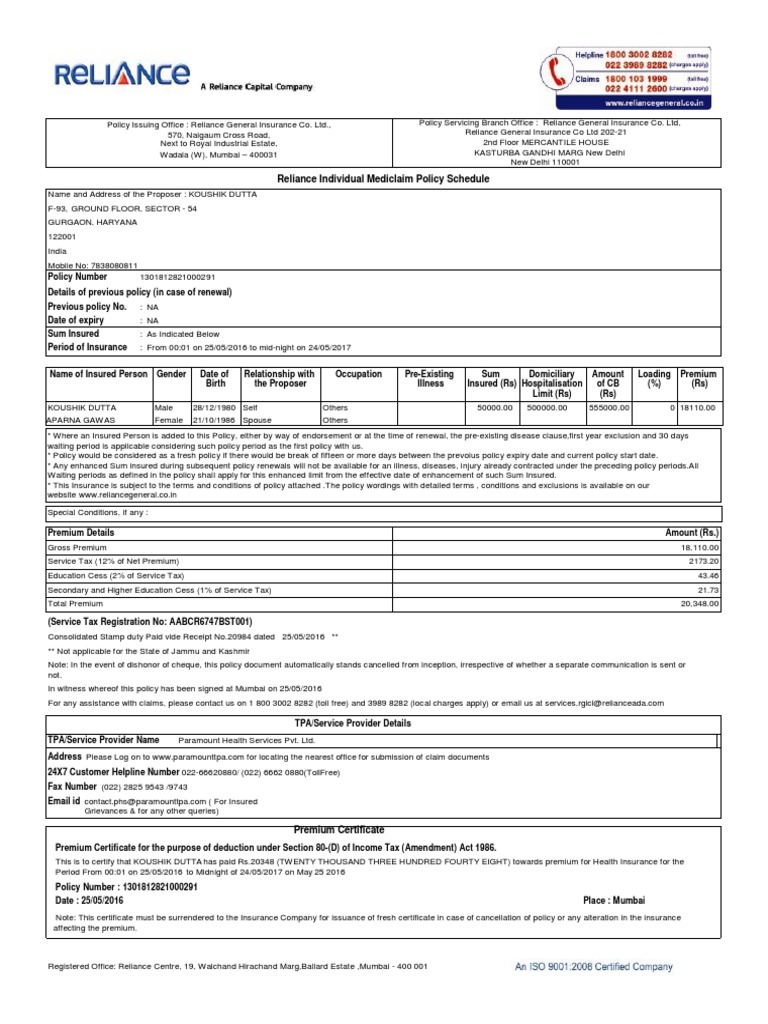

https://www.relakhs.com/wp-content/uploads/2014/11/Mediclaim-section-80d-form-16.jpg

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2014/11/Medical-allowance-form-16.jpg

Web 4 juin 2022 nbsp 0183 32 Tax benefit on Insurance Premium Mediclaim amp Medical Expenses TG Team Income Tax Articles Featured Download PDF 04 Jun 2022 107 041 Views 6 Web 27 janv 2023 nbsp 0183 32 Section 80D of Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the amount paid towards medical

Web 3 ao 251 t 2023 nbsp 0183 32 What is Section 80D of the Income Tax Act Who is eligible to claim Tax deductions under Section 80D What is the maximum deduction that can be claimed under Section 80D A Medical Insurance Web 12 juin 2020 nbsp 0183 32 3 Income Tax treatment in case of medical insurance reimbursement under mediclaim policy for both salaried as well as non salaried people Money received through a claim under a medical policy

Download Mediclaim Rebate In Income Tax

More picture related to Mediclaim Rebate In Income Tax

A Step by Step Guide To File For Tax Rebate On Mediclaim Policy

https://www.careinsurance.com/upload_master/media/posts/February2023/image20230201153943.jpg

Mediclaim Receipt Insurance Taxes

https://imgv2-2-f.scribdassets.com/img/document/368529097/original/d24413953c/1547041318?v=1

Health Insurance Tax Benefits Under Section 80D

https://www.policybazaar.com/images/IncomeTax/section-80d-income-tax-act.jpg

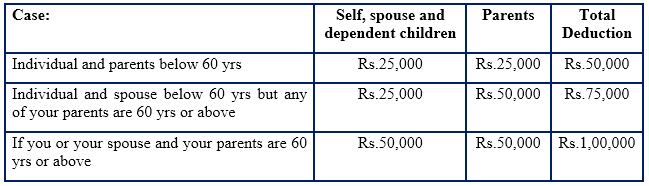

Web 29 avr 2020 nbsp 0183 32 The Income Tax Act 1961 has given tax benefits of Medical insurance as well as regular medical expenditure which are as under There are three items of medical expenditure on which deductions are Web 5 nov 2019 nbsp 0183 32 Therefore the total deduction which can be claimed is Rs 75 000 Rs 25 000 Rs 50 000 if you are below 60 years In case you are a senior citizen too then the total

Web Under Section 80DD of the Income Tax Act people can claim a tax deduction of up to Rs 75 000 per financial year on the medical expenses incurred on the treatment of a Web 1 f 233 vr 2023 nbsp 0183 32 As per the Income Tax provisions the tax assessees can claim a deduction under section 80D of the Income Tax for the premium paid towards a mediclaim

Mediclaim Deduction U s 80d Under Income Tax Act Health Insurance

https://i.ytimg.com/vi/ur_SJznr2TM/maxresdefault.jpg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.aspx

Web Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee

https://taxguru.in/income-tax/all-about-deduc…

Web 26 juin 2018 nbsp 0183 32 1 Medical insurance premium on his policy of Rs 15 000 will qualify for deduction 2 Medical insurance premium on policy of his spouse of Rs 4 000 will qualify for 3 Medical insurance premium on

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Mediclaim Deduction U s 80d Under Income Tax Act Health Insurance

Tax Planning And Wealth Management

Tax Rebate For Individual Deductions For Individuals reliefs

All You Wanted To Know About The Mediclaim Policy In India

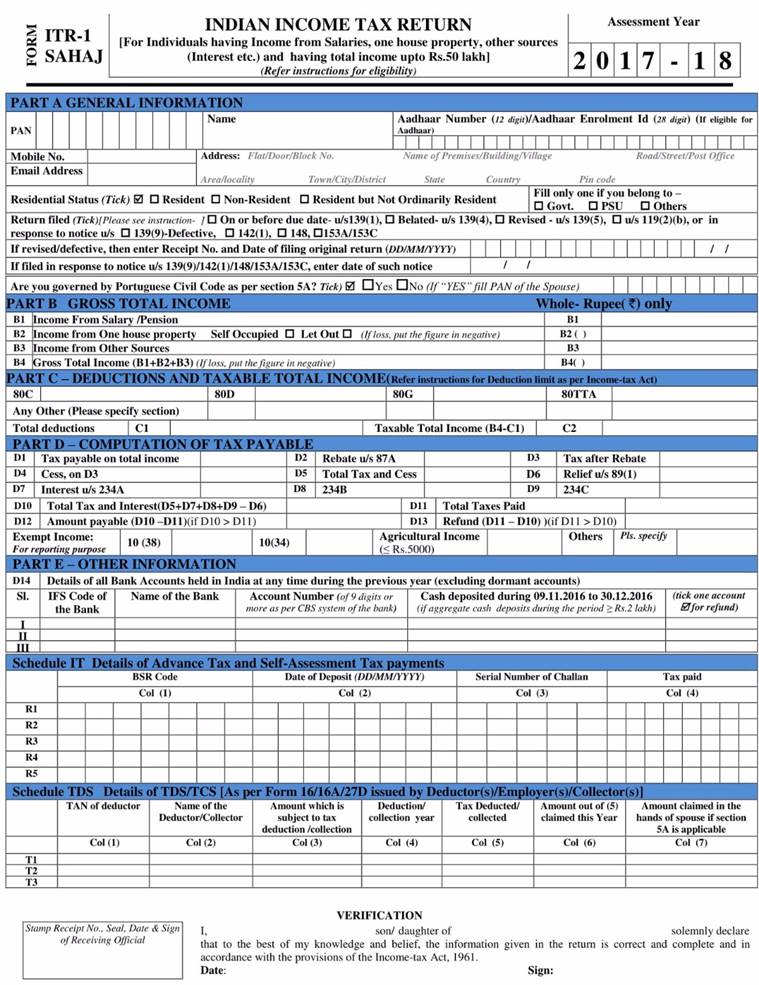

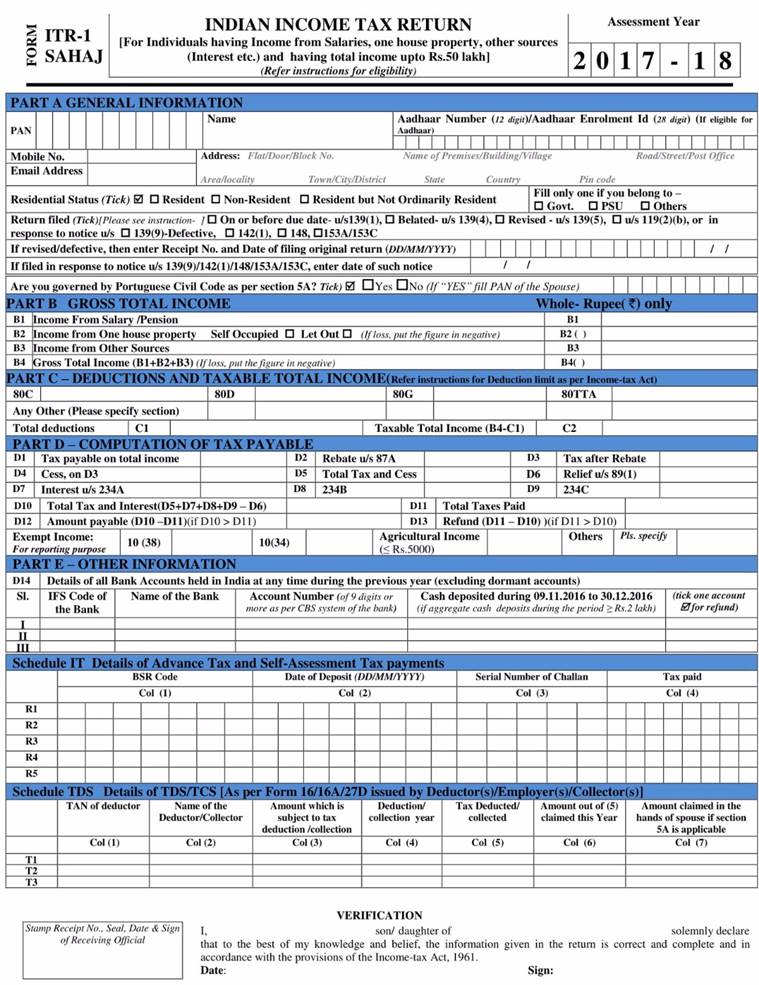

Govt Introduces New Simplified ITR Form All You Need To Know The

Govt Introduces New Simplified ITR Form All You Need To Know The

All About Tax Benefits Of Mediclaim Premium Health Expenses And Life

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Lic Star Mediclaim Income Tax Return GST

Mediclaim Rebate In Income Tax - Web 23 avr 2020 nbsp 0183 32 Under the Income Tax Act there is a tax exemption of up to Rs 15 000 on medical reimbursements Medical Reimbursement Rules The Income Tax Act