Michigan Property Sale Tax Rebate Web After subtracting the school operating tax from your property tax bill you can claim 90 of the remaining property tax for the credit How to compute your homestead property tax credit if your P R E is between 1 and 99 P R E

Web 19 mai 2022 nbsp 0183 32 Gov Whitmer Proposes MI Tax Rebate Right Now 500 for Working Families As fiscal agencies project additional revenue governor proposes working across the aisle with legislature to put money in people s pockets right away as they face rising prices LANSING Mich Web Information regarding the real property tax forfeiture foreclosure and auction process in Michigan can be found here Forfeiture and Foreclosure Property Tax Exemptions Exemptions to provide eligible taxpayers with a variety of property tax savings Property Tax Exemptions Homestead Property Tax Credit

Michigan Property Sale Tax Rebate

Michigan Property Sale Tax Rebate

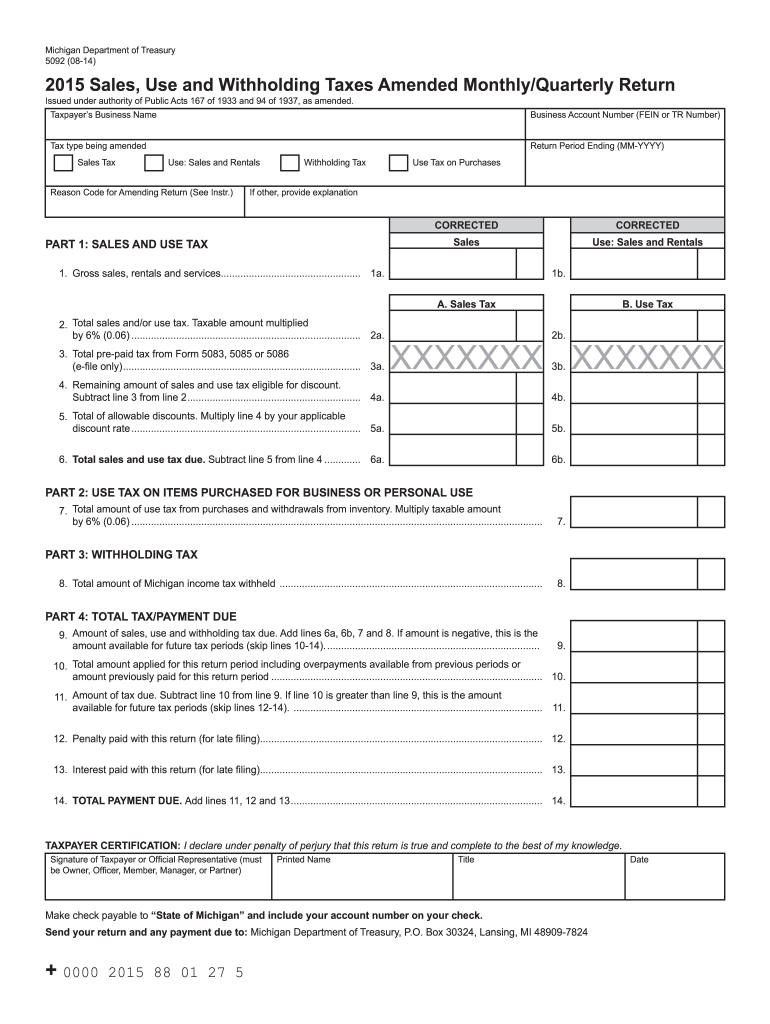

https://www.pdffiller.com/preview/100/521/100521732/large.png

2020 2022 Form Mi Dot Mi 1041 Fill Online Printable Fillable Blank

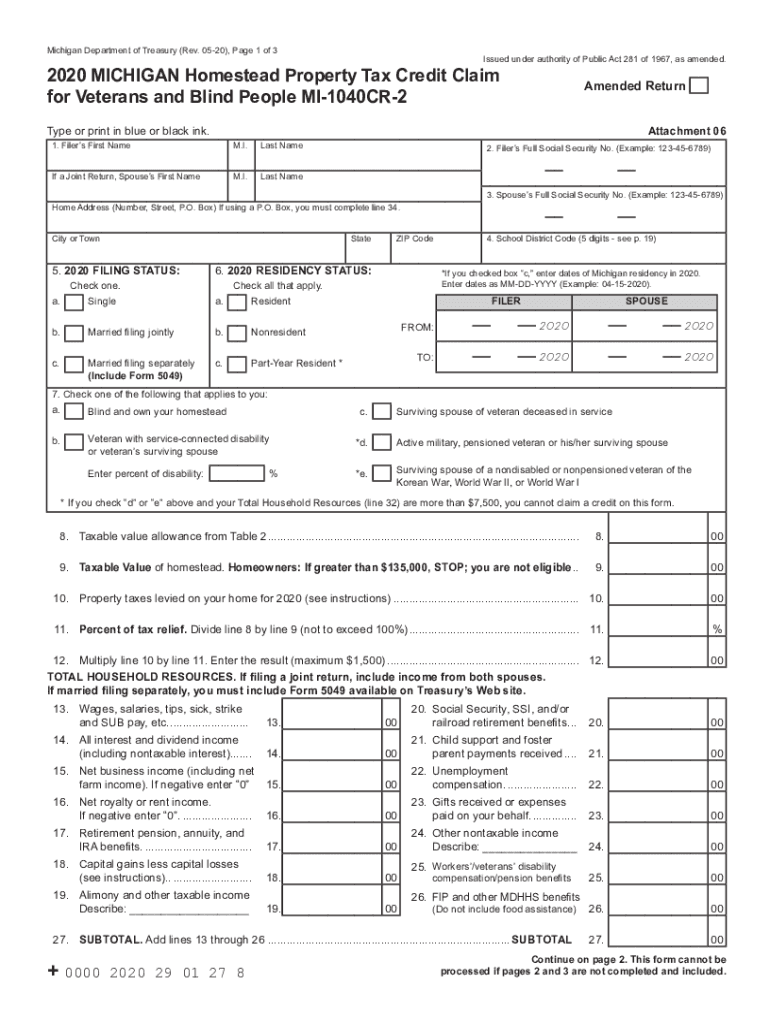

https://www.pdffiller.com/preview/540/440/540440856/large.png

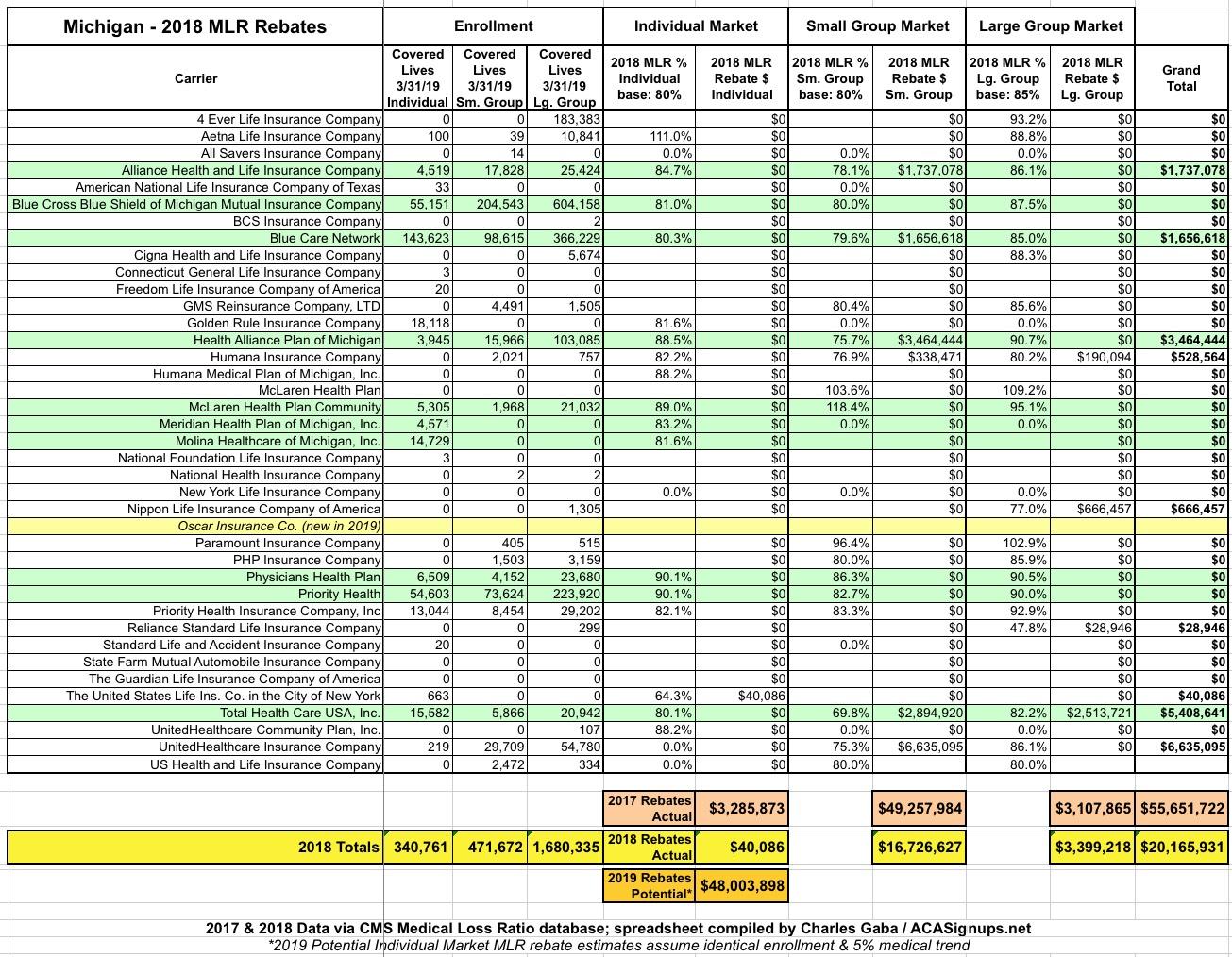

Exclusive Michigan 2018 MLR Rebate Payments Potential 2019 Rebates

http://acasignups.net/sites/default/files/styles/inline_default/public/Microsoft ExcelScreenSnapz3102.jpg?itok=yMkHT4kO

Web 28 mars 2023 nbsp 0183 32 Typically the rate for short term capital gains tax is between 10 and 37 following the seven federal tax brackets for ordinary income in the United States This primarily differs depending on income and one s filing status whether single head of household married filing jointly or married filing separately Web We auction properties located in more than 74 Michigan counties each year Take a look and find that perfect up north spot hunting camp or fixer upper

Web 5 sept 2022 nbsp 0183 32 The city has signed legislation to provide one time property tax rebates to homeowners who qualify for them These rebates are worth up to 150 and will help homeowners with low or moderate incomes lower their tax bills Some homeowners will be eligible for the rebate immediately while others will have to provide additional information Web 8 mai 2018 nbsp 0183 32 In Michigan sales and use tax law determining whether an item of tangible personal property remains tangible personal property or becomes a fixture affixed to real estate can significantly affect the taxability of the item in question This determination may impact whether the taxpayer is The post Michigan Real Estate Sales Tax

Download Michigan Property Sale Tax Rebate

More picture related to Michigan Property Sale Tax Rebate

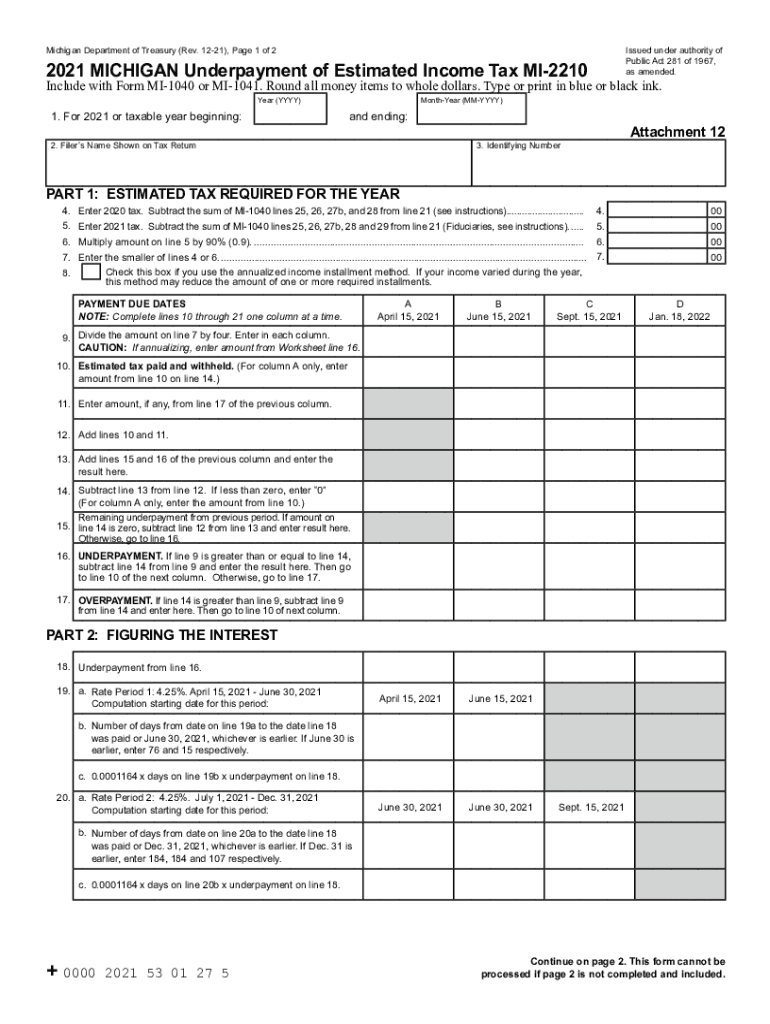

Mi 2210 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/592/293/592293693/large.png

2018 Form MI MI 1040CR 7 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/465/679/465679973/large.png

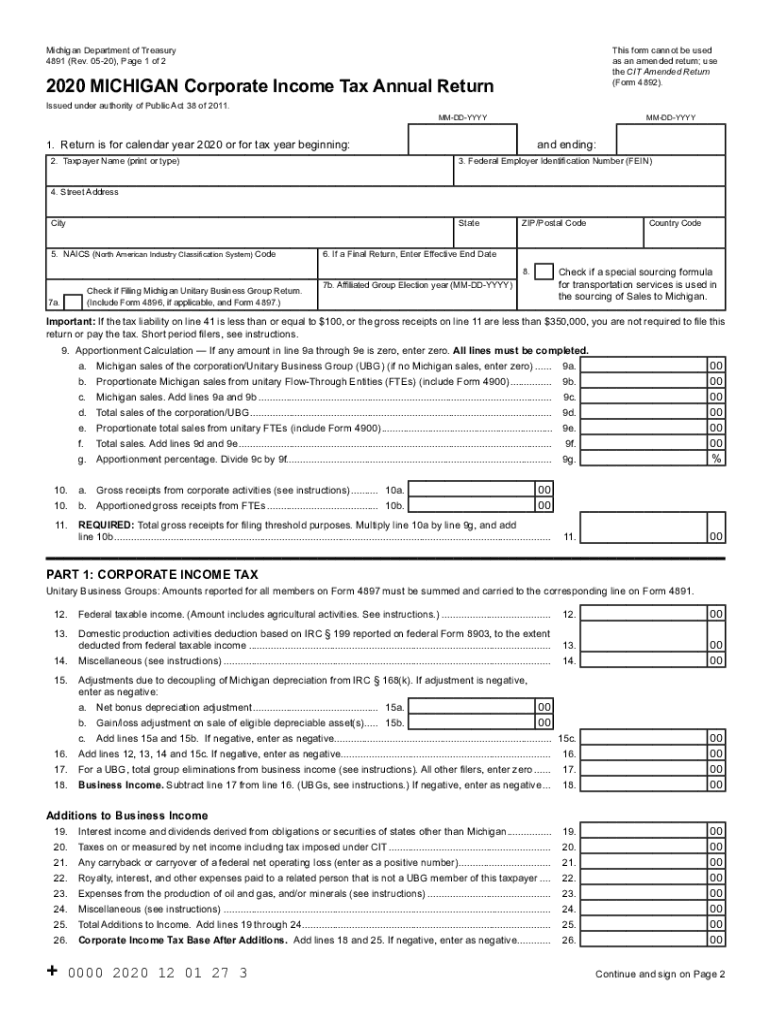

2020 Form MI DoT 4891 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/552/439/552439875/large.png

Web 31 d 233 c 2022 nbsp 0183 32 The city has signed legislation to provide one time property tax rebates to homeowners who qualify for them The rebates will be worth up to 150 and are intended to help homeowners with low and moderate incomes reduce their tax bills Some homeowners will receive the rebate automatically while others will need to submit additional Web A The local tax collecting unit must submit a completed form 4736 Payment in Lieu of Taxes for Senior Citizen amp Disabled Housing and current tax bills to Treasury by December 1 year two Treasury will pay year two taxes by December 15 year two

Web for 200 000 for example is 1 500 The Michigan Department of Treasury website provides a transfer tax refund form for filing the request for refund along with directions as to the required documentation for obtaining the refund To obtain the refund the property owner will need Proof of payment of the transfer tax Web Application for State Real Estate Transfer Tax SRETT Refund Issued under authority of Public Act 330 of 1993 When a principal residence is sold State Real Estate Transfer Tax SRETT must be paid to the County Treasurer If the Seller or the Buyer who paid SRETT on behalf of the seller under u later believes that the sale or

Michigan Property Tax Rates By Township Eden Newsletter Bildergallerie

https://lh6.googleusercontent.com/iomTSymVHXHxtlFDDsPuLRbkPYvxRS06Bqq7_6mzkZdrXMalss8cVhRbZXuiuaJbhl1WVn_q_vdYEeQlLcD6GUD8p5RoAi-5qWO89xbFPhUQOSZ3HyGpoGVx_MtBk7fgPYclFsNW

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/27/773/27773189/large.png

https://www.michigan.gov/taxes/property/homestead-property-tax-credit...

Web After subtracting the school operating tax from your property tax bill you can claim 90 of the remaining property tax for the credit How to compute your homestead property tax credit if your P R E is between 1 and 99 P R E

https://www.michigan.gov/.../19/whitmer-proposes-mi-tax-rebate-right-now

Web 19 mai 2022 nbsp 0183 32 Gov Whitmer Proposes MI Tax Rebate Right Now 500 for Working Families As fiscal agencies project additional revenue governor proposes working across the aisle with legislature to put money in people s pockets right away as they face rising prices LANSING Mich

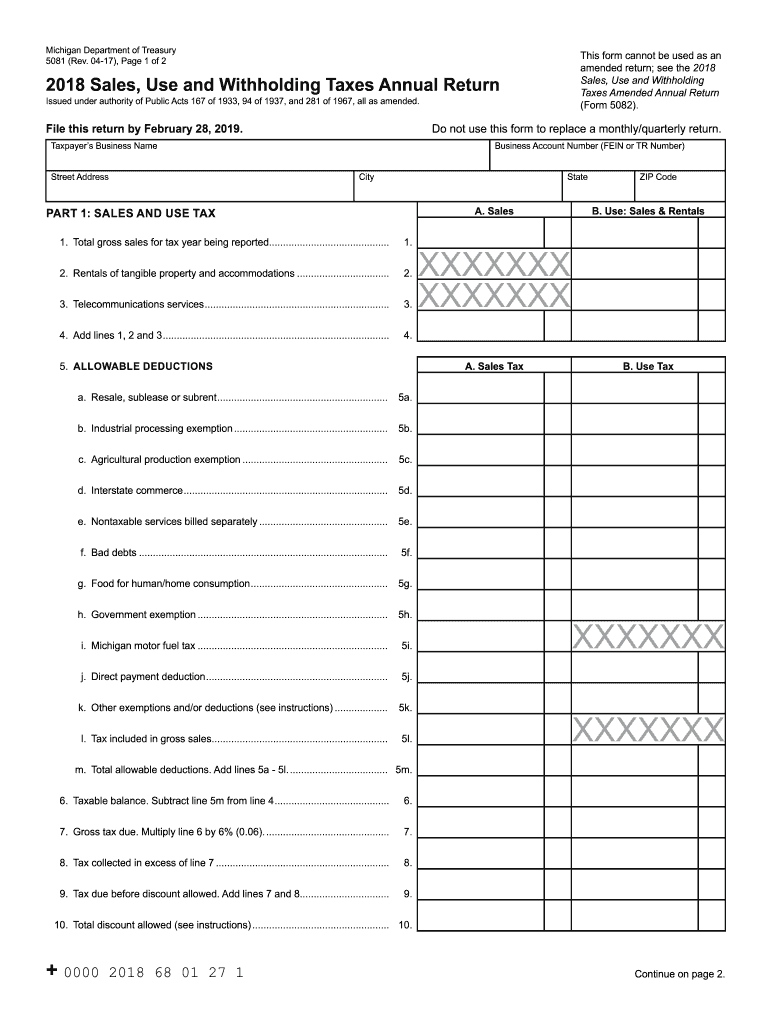

2018 Form MI 5081 Fill Online Printable Fillable Blank PdfFiller

Michigan Property Tax Rates By Township Eden Newsletter Bildergallerie

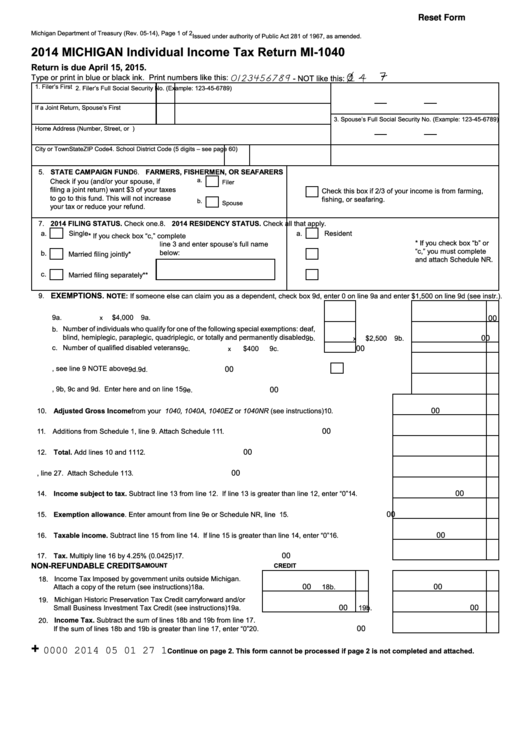

Form Mi 1040 Michigan Income Tax Return 2000 Printable Pdf Download

Michigan Tax Forms And Templates PDF Download Fill And Print For Free

Michigan Use Tax Vs Sales Tax My Tax

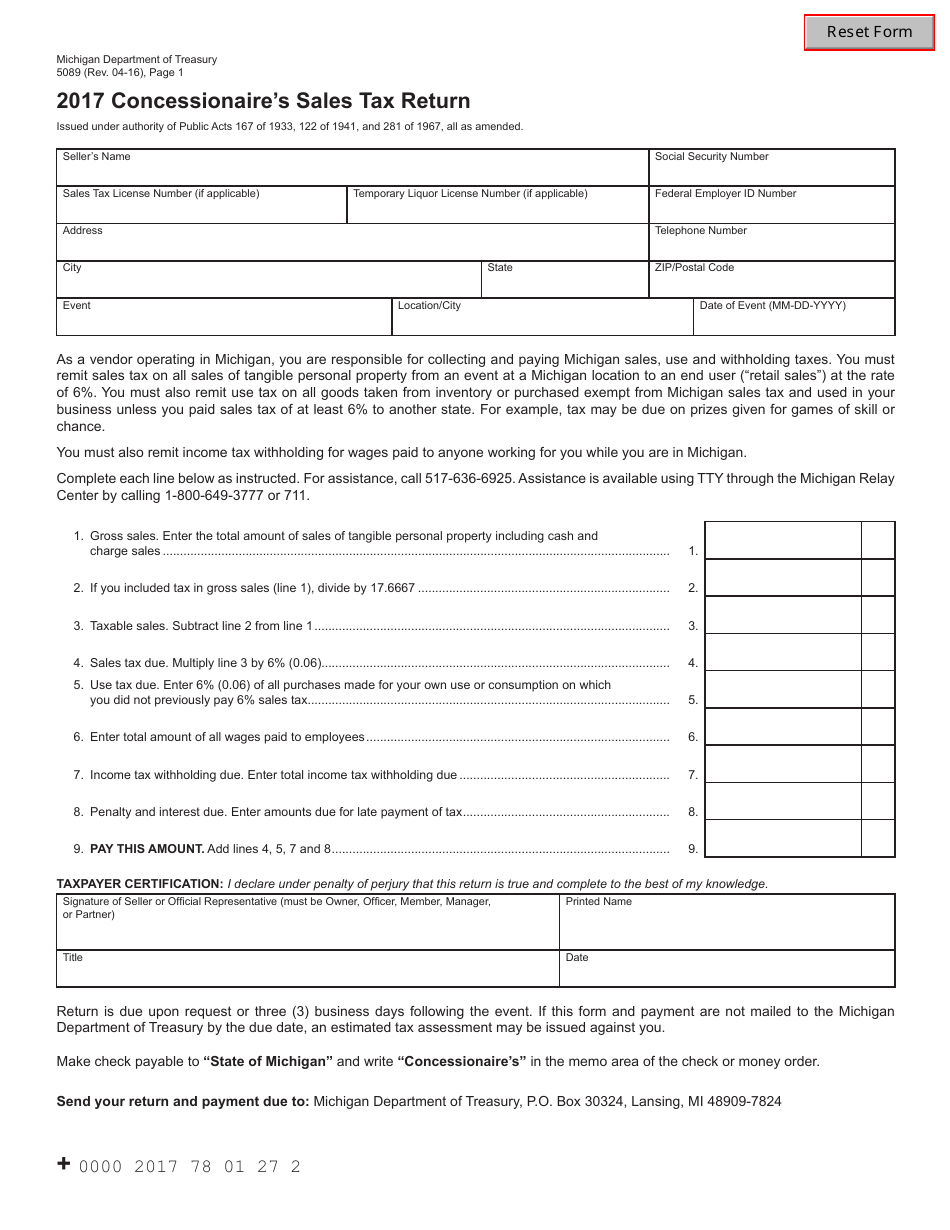

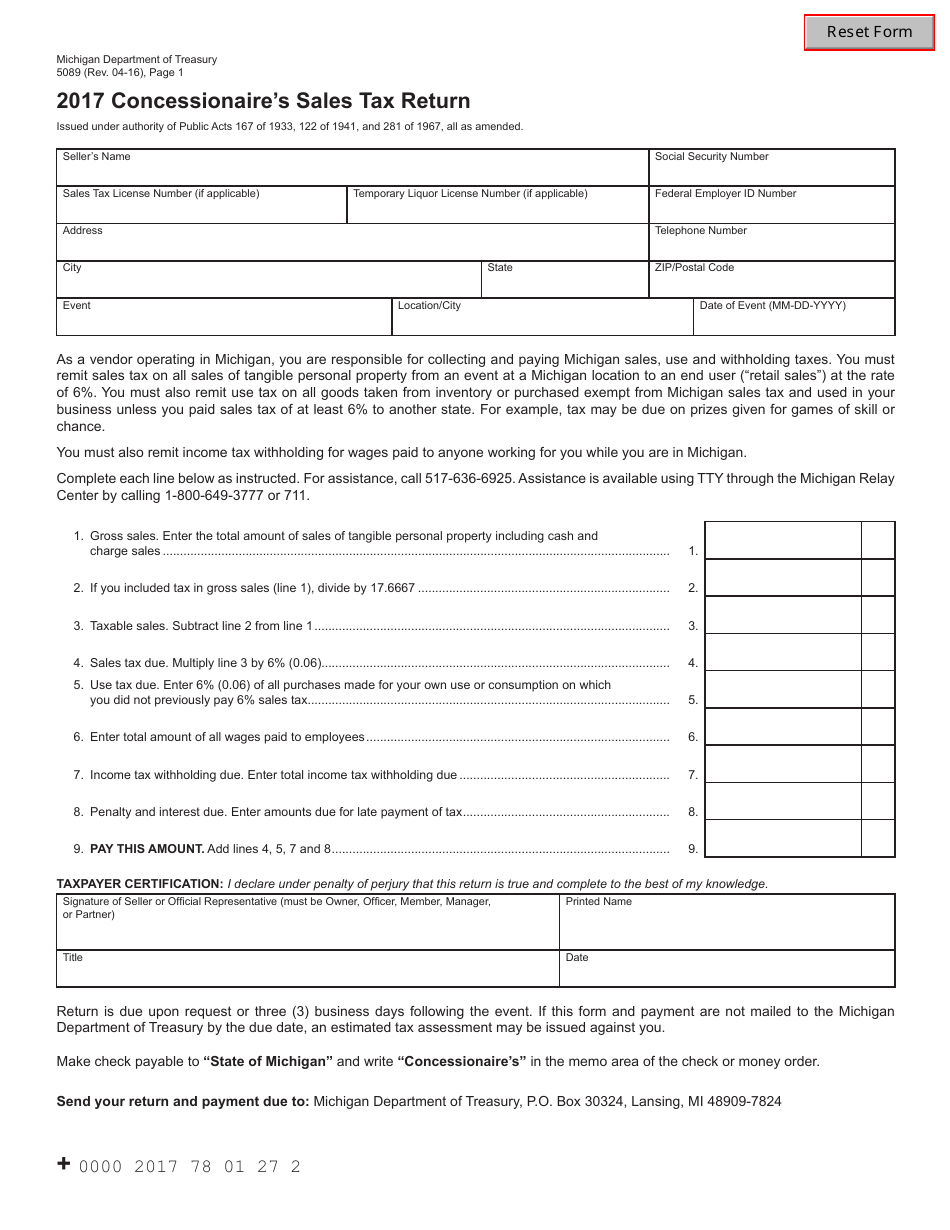

Form 5089 Download Fillable PDF Or Fill Online Concessionaire s Sales

Form 5089 Download Fillable PDF Or Fill Online Concessionaire s Sales

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim

Statewide Average Property Tax Millage Rates In Michigan 1990 2008

Michigan Form 3372 Fillable Fill Online Printable Fillable Blank

Michigan Property Sale Tax Rebate - Web 5 sept 2022 nbsp 0183 32 The city has signed legislation to provide one time property tax rebates to homeowners who qualify for them These rebates are worth up to 150 and will help homeowners with low or moderate incomes lower their tax bills Some homeowners will be eligible for the rebate immediately while others will have to provide additional information