Michigan Tax Credit For Charitable Donations 2022 Charitable contribution deductions from Adjusted Gross Income AGI are 300 for 2020 single joint or the 300 single and 600 joint for 2021 Are these deductions from

The tax credit allowed Michiganders to deduct 50 of their donation or gift capped at 200 for single filers and 400 for joint filers to a Michigan community foundation homeless shelter food bank or public Michigan Department of Treasury 4572 Rev 04 21 Attachment 10 2021 MICHIGAN Business Tax Charitable Contribution Credits Issued under authority of Public Act 36

Michigan Tax Credit For Charitable Donations 2022

Michigan Tax Credit For Charitable Donations 2022

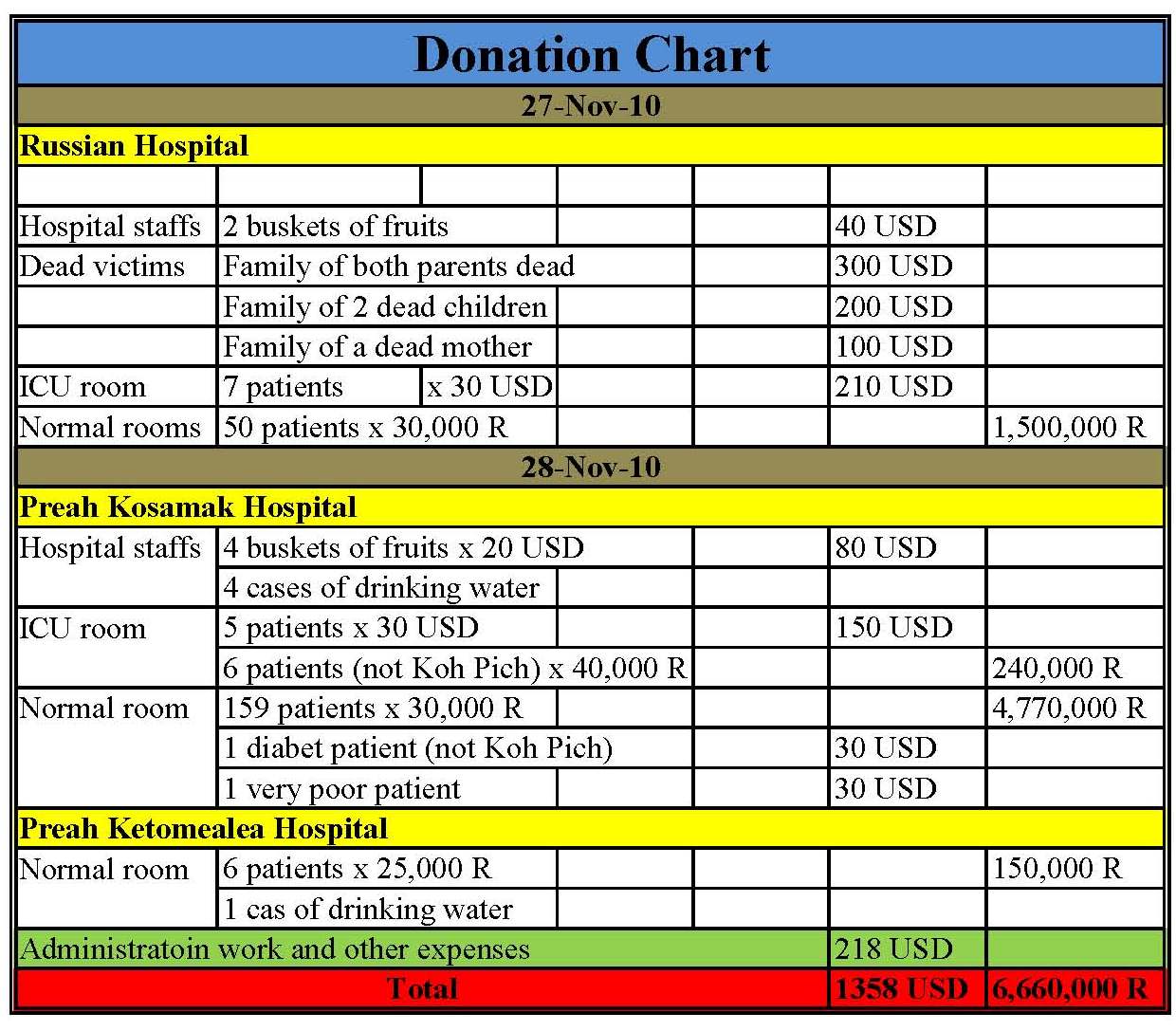

http://4.bp.blogspot.com/_n-8w21PwsUY/TPXZW9cIGCI/AAAAAAAAB08/45h_e3L8QEQ/s1600/Donation+chart1.jpg

How Does The Child Tax Credit Work Leia Aqui How Do The Child Tax

https://static01.nyt.com/images/2022/12/14/upshot/14up-child-tax-credit-promo-promo/14up-child-tax-credit-promo-promo-mediumSquareAt3X.png

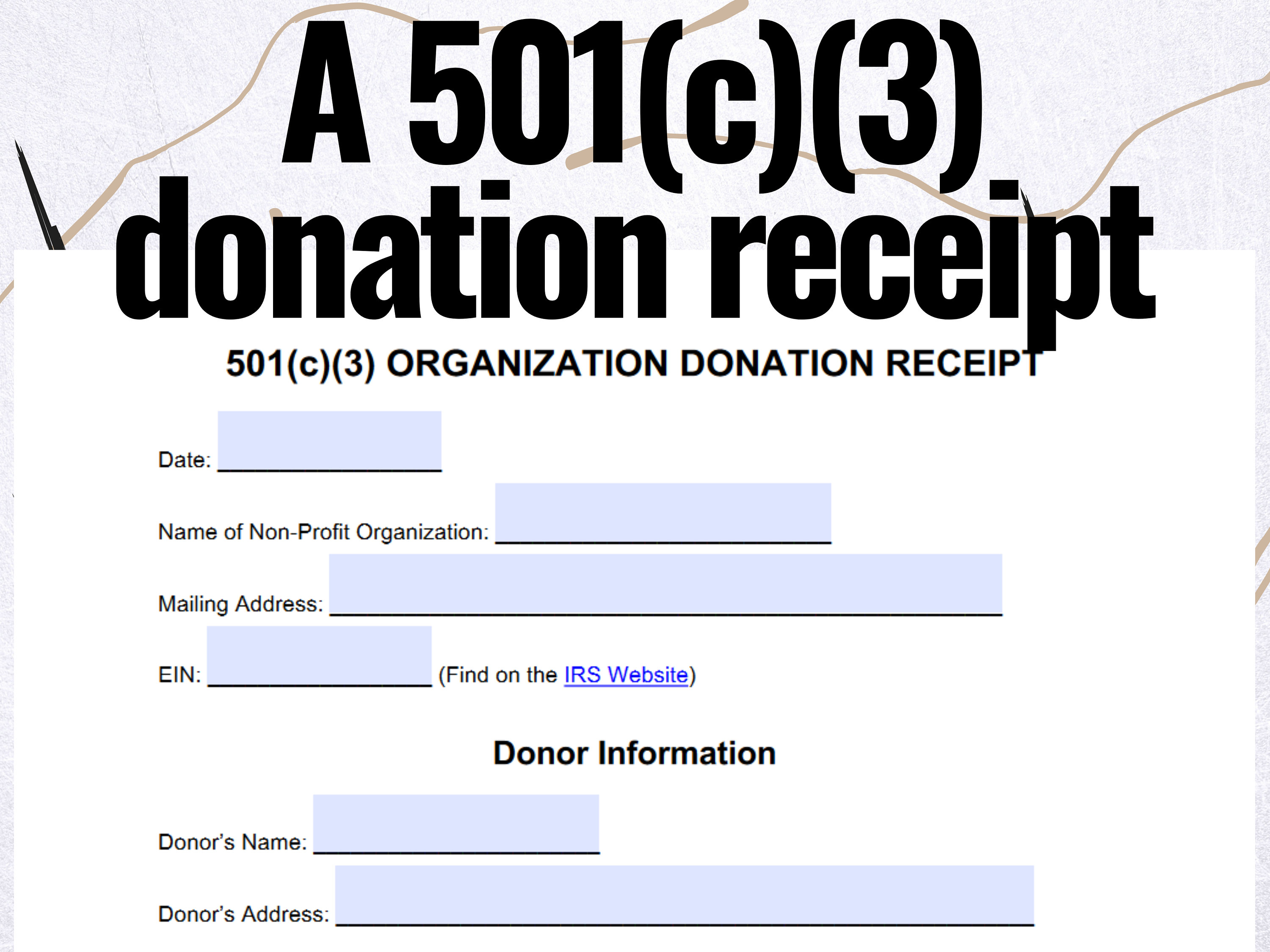

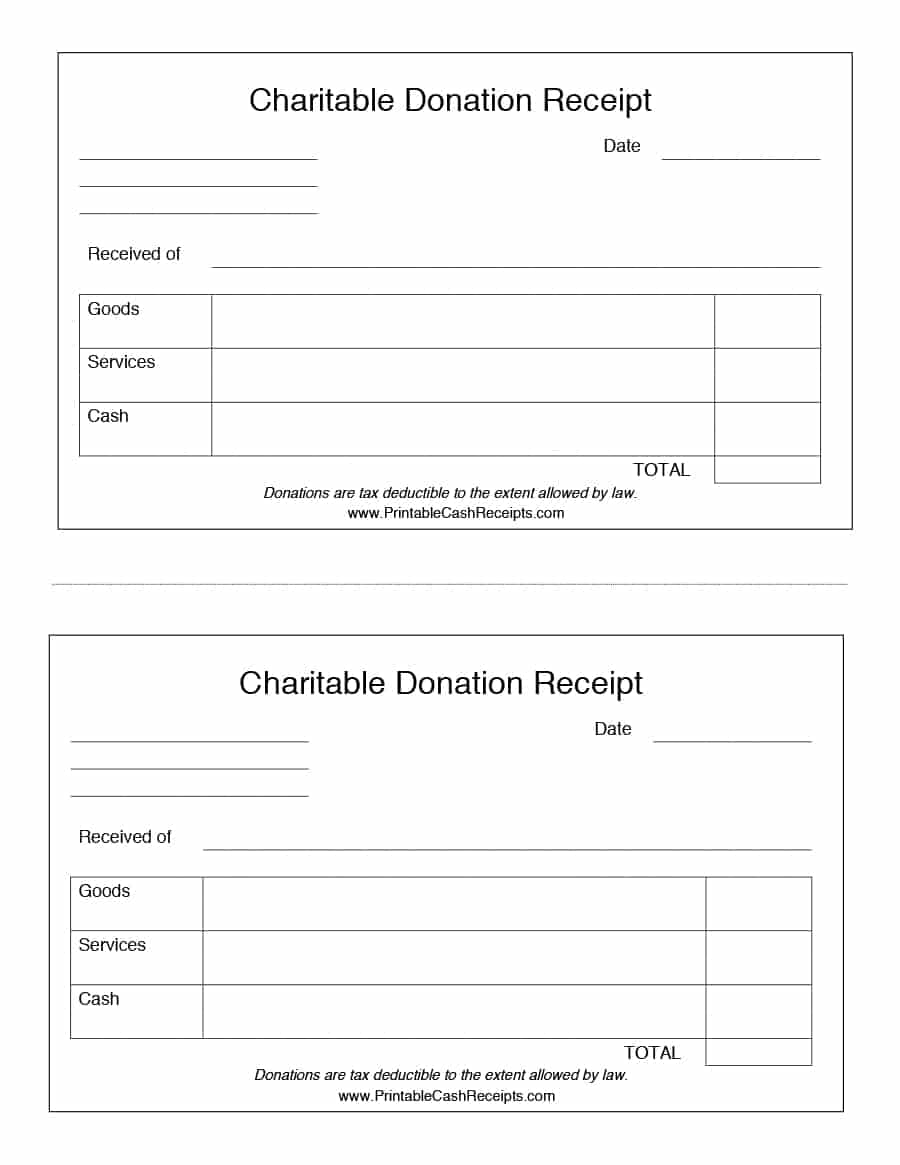

Free Sample Printable Donation Receipt Template Form

https://bestlettertemplate.com/wp-content/uploads/2020/08/Goodwill-donation-receipt-2-768x972.jpg

Michigan taxpayers can contribute 5 10 or more to any of the following funds on the 4642 Voluntary Contributions Schedule Form Contributions to these funds will How does a charitable contribution deduction claimed in 2020 or in 2021 affect Michigan taxable income For tax year 2020 a 300 charitable contribution deduction for a

The tax credit allowed Michiganders to deduct 50 of their donation or gift in the 200 to 400 range to a Michigan community foundation homeless shelter food This paper considers the effect of state charitable giving tax credits on the contribution revenues of eligible charities Using event studies paired with Form 990 data we detect

Download Michigan Tax Credit For Charitable Donations 2022

More picture related to Michigan Tax Credit For Charitable Donations 2022

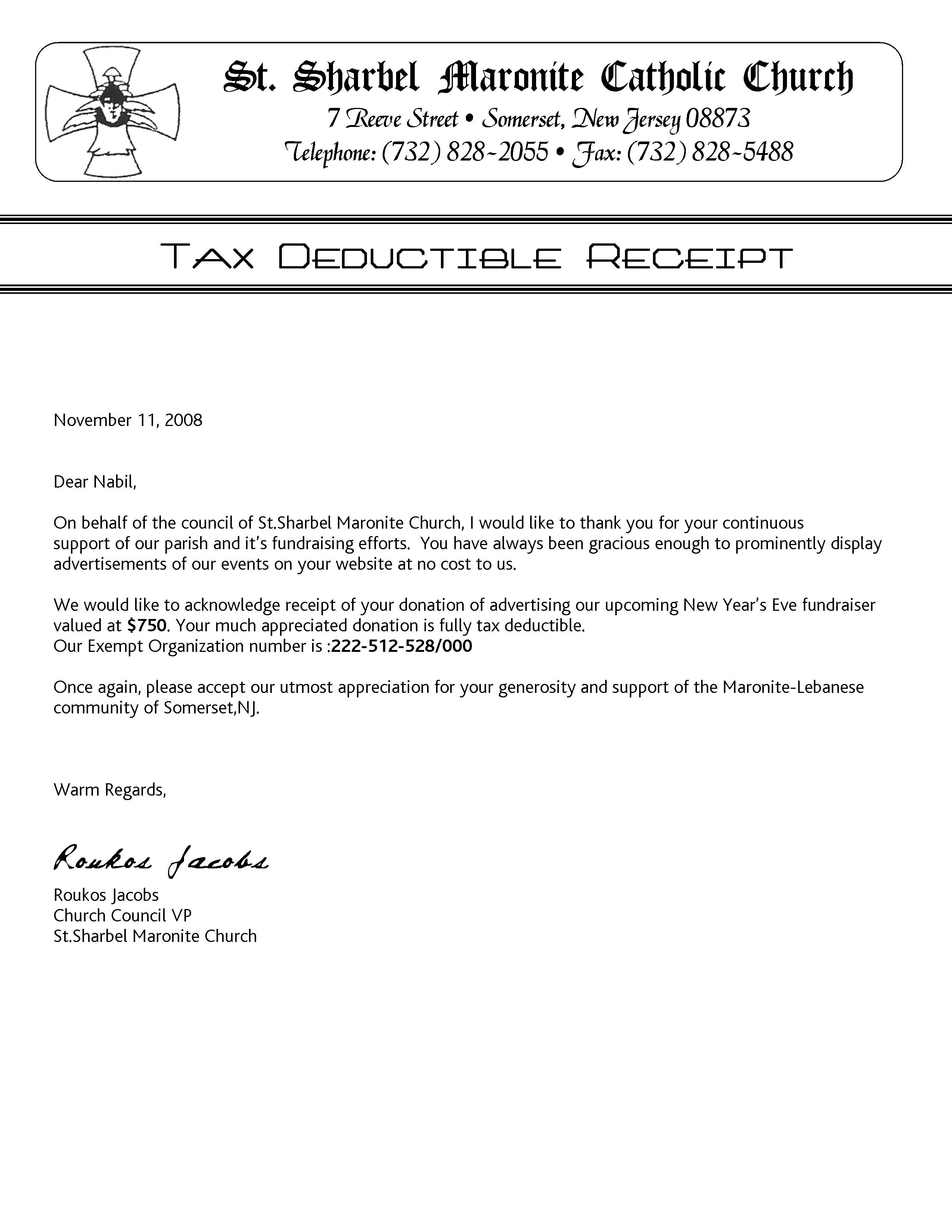

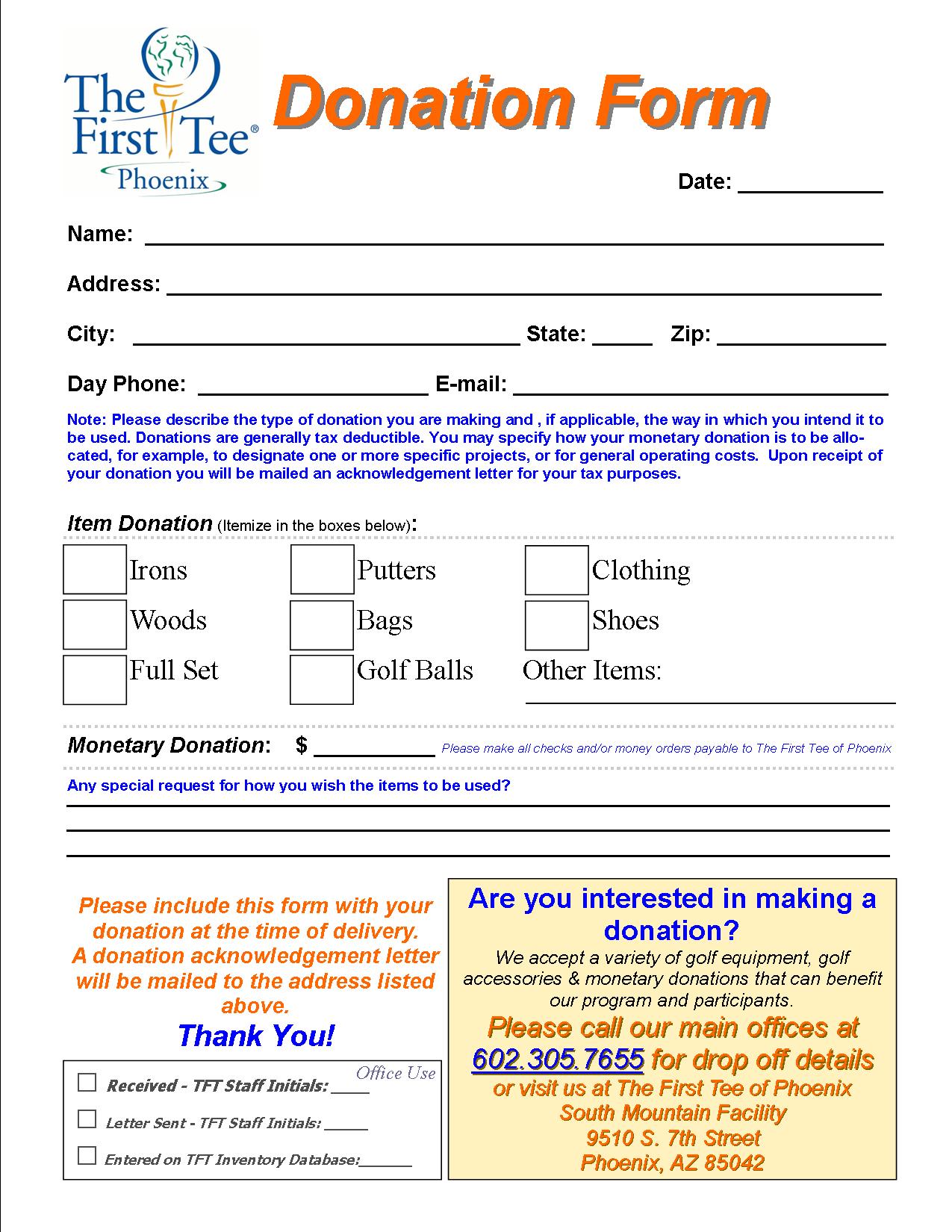

Donation Letter Template For Tax Purposes Examples Letter Template

https://simpleartifact.com/wp-content/uploads/2018/08/tax-deductible-donation-form-template-of-donation-letter-template-for-tax-purposes.jpg

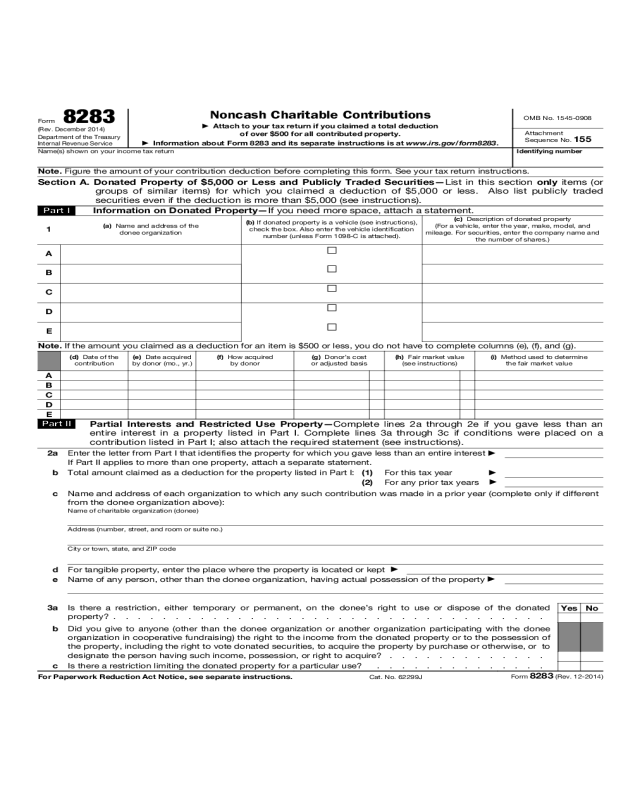

2024 IRS Donation Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/10000/noncash-charitable-contributions-page1.png

Get Our Printable Charitable Donation Receipt Template Receipt

https://i.pinimg.com/originals/9d/57/59/9d5759c726266522fb347875506a4d98.jpg

These bills would allow Michigan taxpayers to claim an income tax credit for donations made to endowed funds at community foundations and donations to food LANSING Michigan would bring back charitable tax credits for donations to community foundation endowment funds homeless shelters and food

The tax credit allowed Michiganders to deduct 50 of their donation or gift capped at 200 for single filers and 400 for joint filers to a Michigan community The bill would amend the Income Tax Act to do the following Allow a taxpayer beginning on and after January 1 2021 to claim a credit against the individual income tax in an

501c3 Donation Receipt 501c3 Donation Receipt Template 501c3

https://i.etsystatic.com/25866327/r/il/4a86ed/4070870535/il_fullxfull.4070870535_gyqf.jpg

Georgia Tax Credits For Workers And Families

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4200&ssl=1

https://www.michigan.gov/taxes/questions/iit/...

Charitable contribution deductions from Adjusted Gross Income AGI are 300 for 2020 single joint or the 300 single and 600 joint for 2021 Are these deductions from

https://www.michiganfoundations.org/n…

The tax credit allowed Michiganders to deduct 50 of their donation or gift capped at 200 for single filers and 400 for joint filers to a Michigan community foundation homeless shelter food bank or public

2021 Form MI DoT MI 1040CR 2 Fill Online Printable Fillable Blank

501c3 Donation Receipt 501c3 Donation Receipt Template 501c3

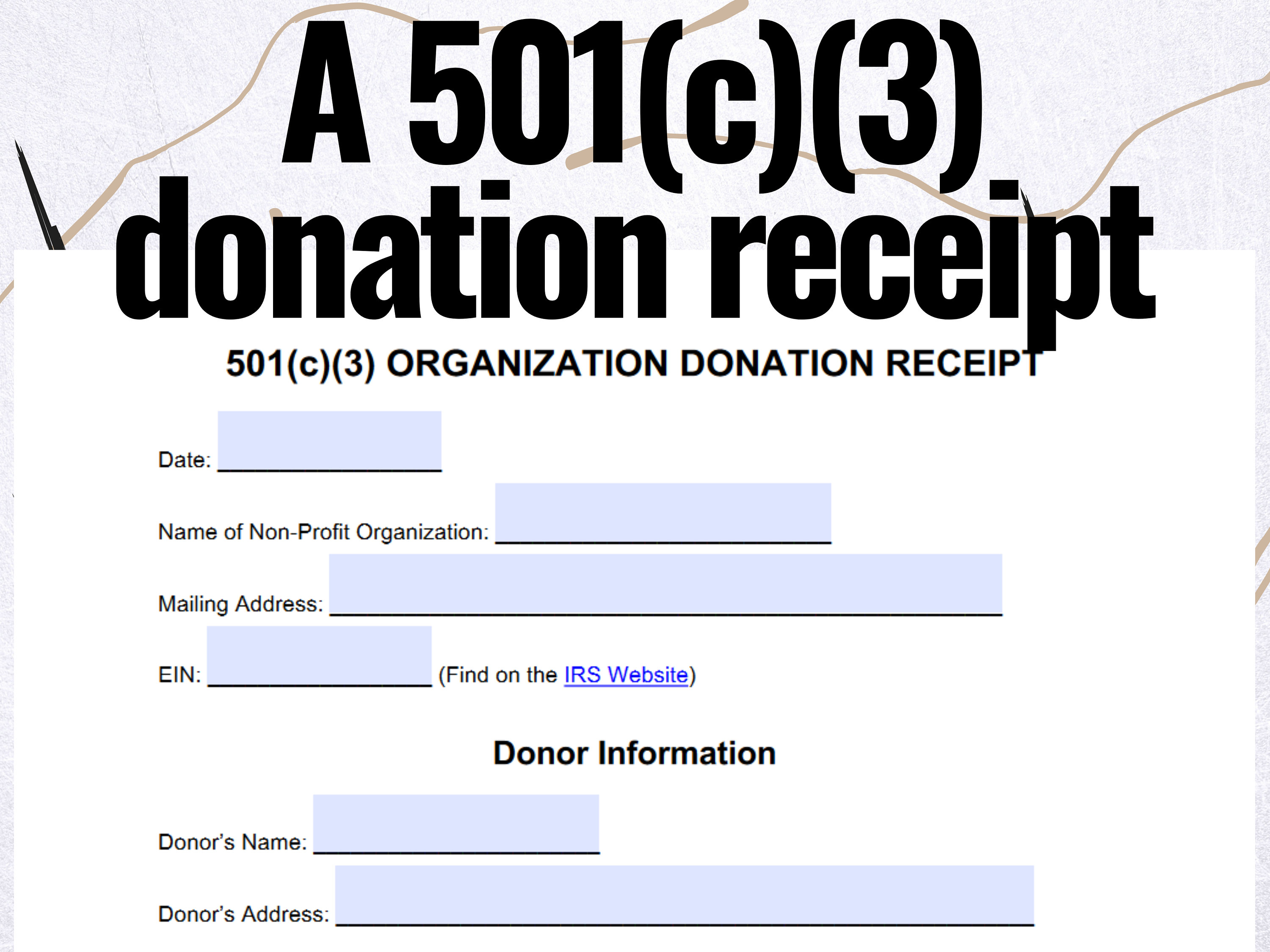

Goodwill Donation Estimate The Value Of Your Donation

Irs Donation Values Spreadsheet Printable Spreadshee Irs Donation Value

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

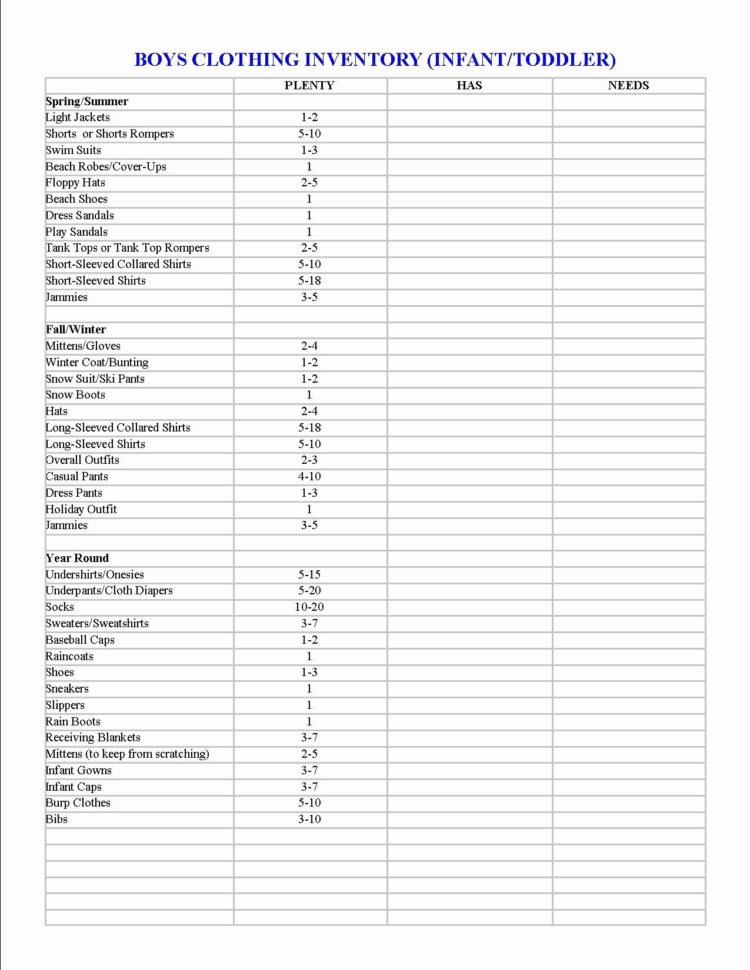

Charity Donation List Destock Track Charitable Giving Tax Deductions

Charity Donation List Destock Track Charitable Giving Tax Deductions

Tax Deductible Donation Receipt Template Charlotte Clergy Coalition

US Treasury Department Issues Guidelines Around A New Tax Credit For

Charity Donation Card Template

Michigan Tax Credit For Charitable Donations 2022 - The 2023 and 2024 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the AGI limit of 60 for cash