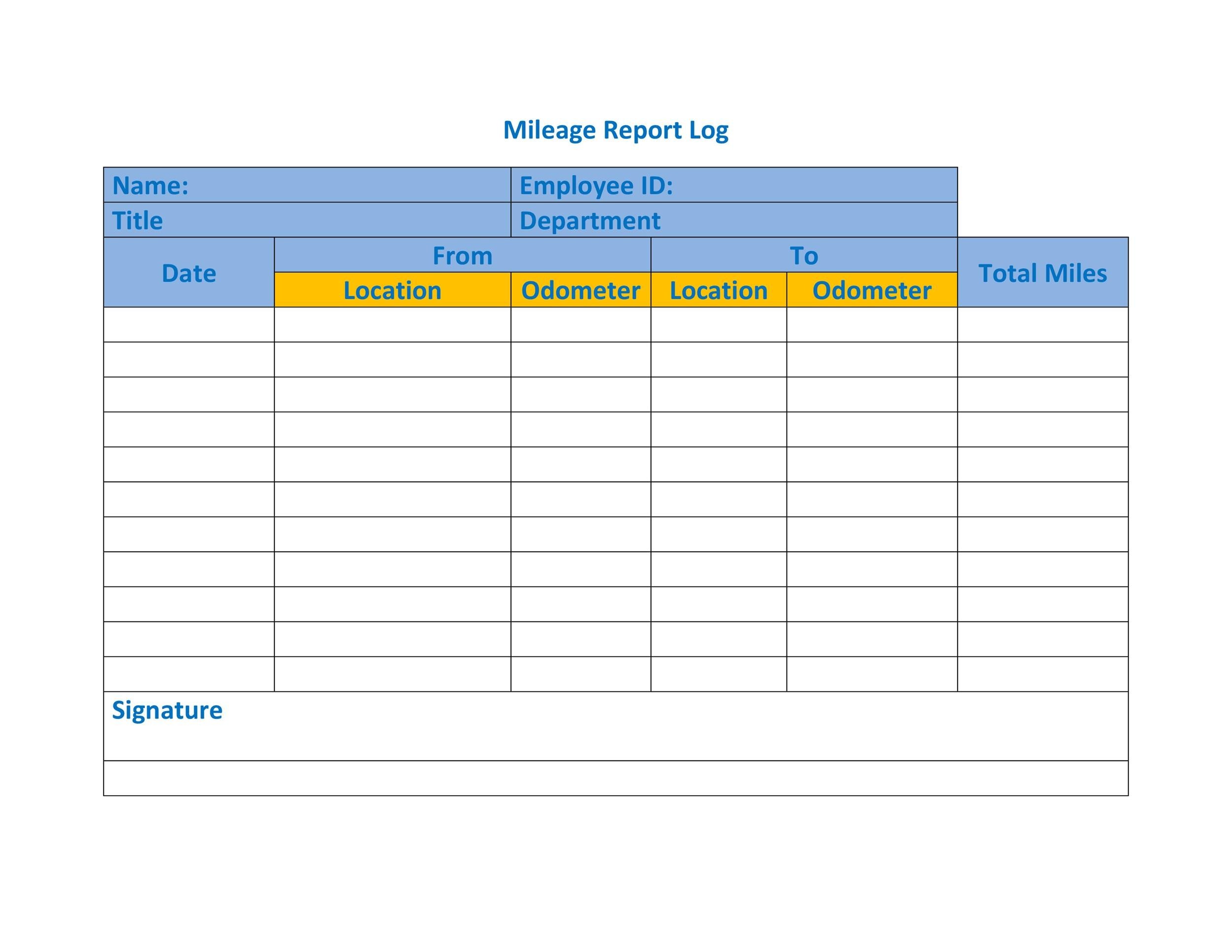

Mileage And Travel Expenses Tax Rebates For Work Web 21 mars 2023 nbsp 0183 32 Edited by Colin Hogan March 21 2023 at 12 30 p m How to Claim a Mileage Tax Deduction You need to know the rules for claiming mileage on your taxes

Web Government approved mileage allowance relief rates for the 2023 2024 tax year are Car van 163 0 45 per mile up to 10 000 miles 163 0 25 over 10 000 miles If you carry a Web 6 avr 2023 nbsp 0183 32 It is crucial to understand that the rules on what travel expenses qualify for tax relief are quite strict In particular there is generally no tax relief available for the costs of ordinary commuting

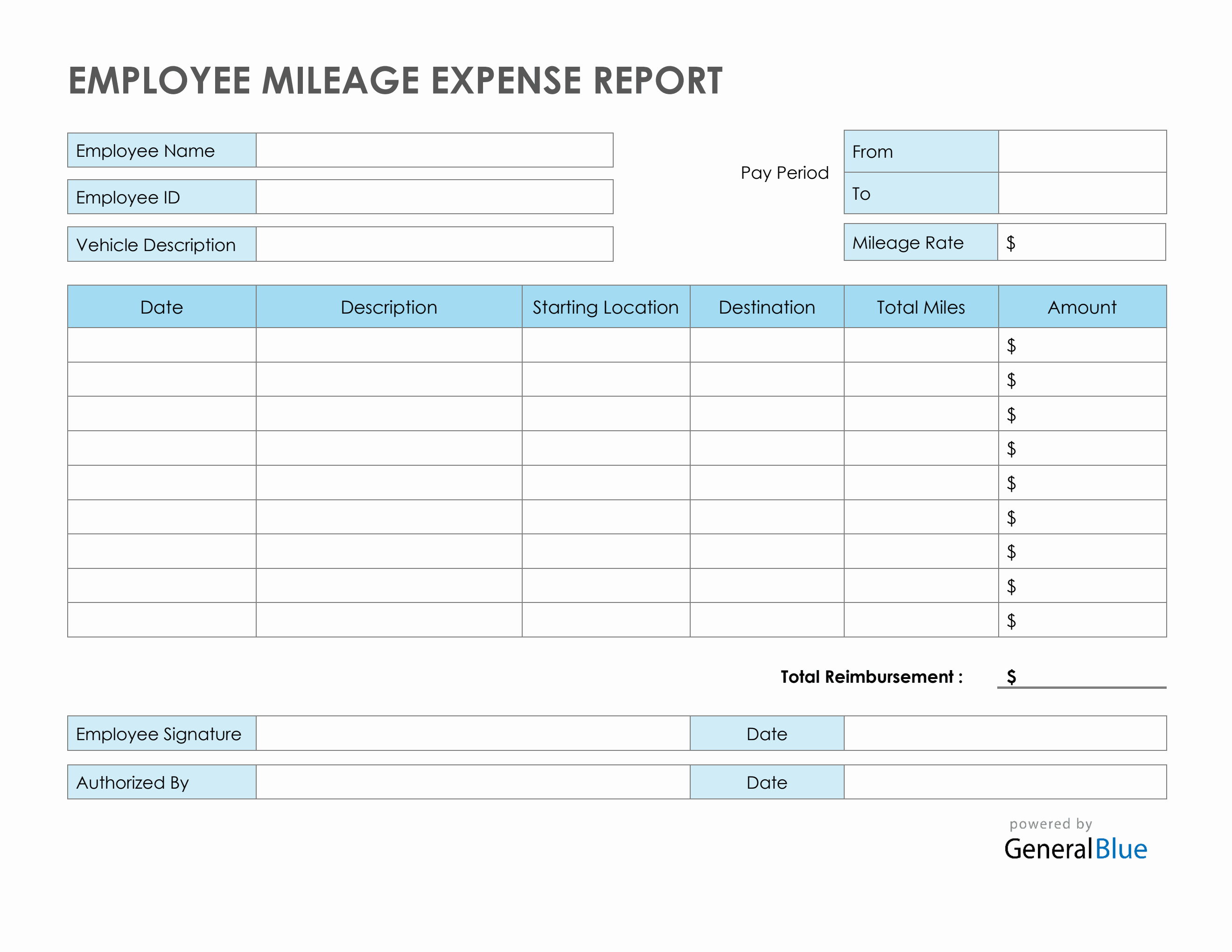

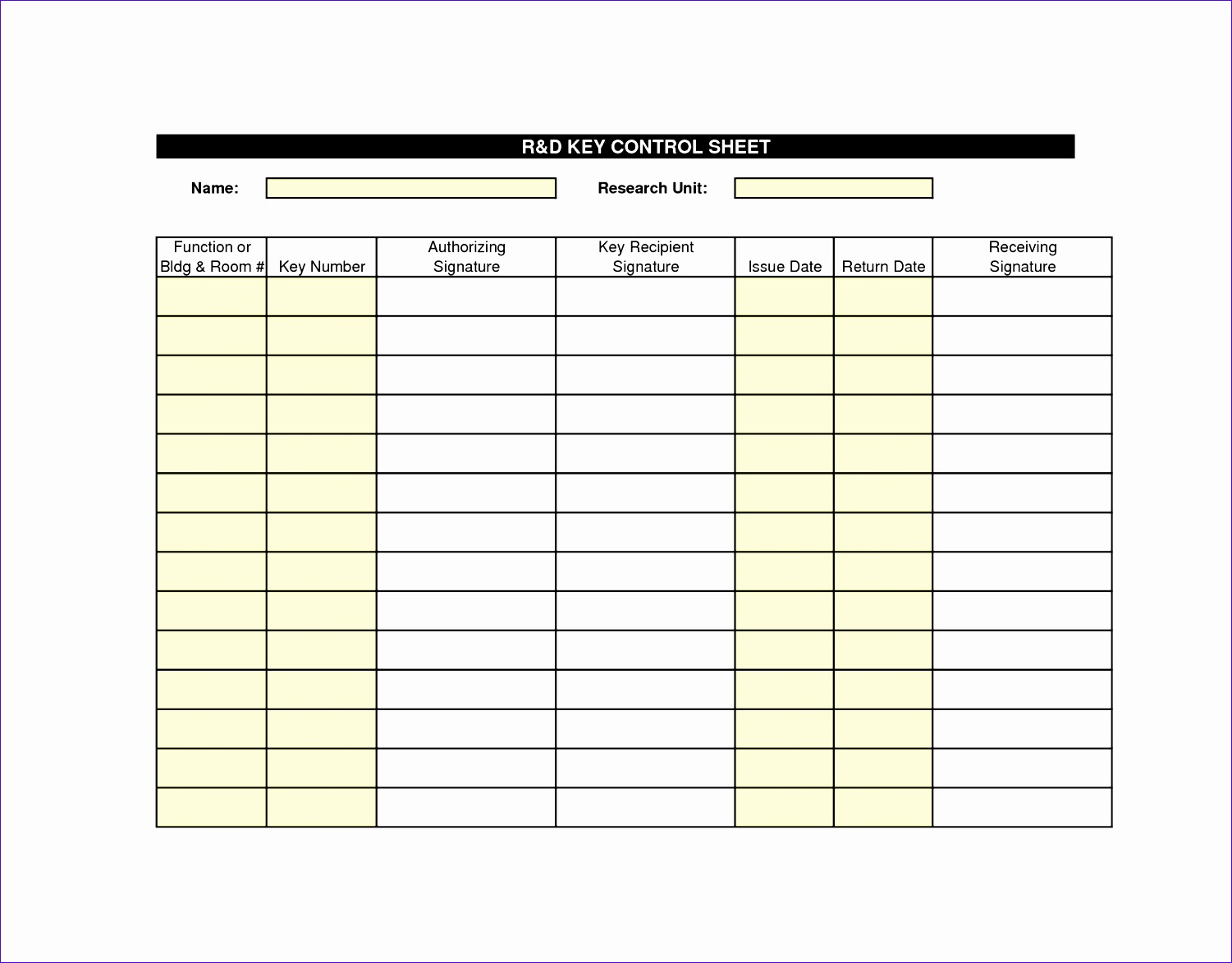

Mileage And Travel Expenses Tax Rebates For Work

Mileage And Travel Expenses Tax Rebates For Work

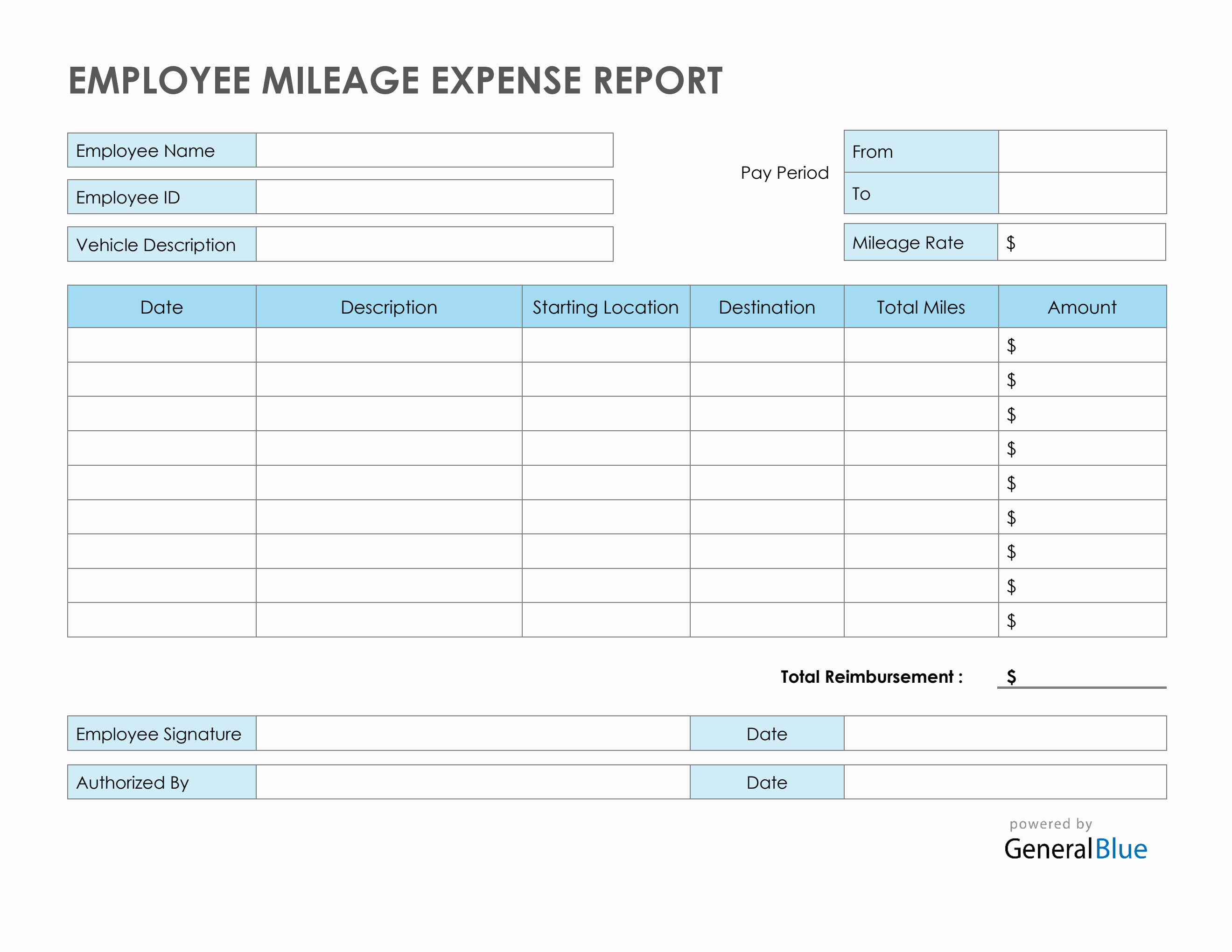

https://www.generalblue.com/employee-mileage-expense-report-template/p/t1f1dhd2b/f/employee-mileage-expense-report-template-in-pdf-lg.png?v=d61aff98332a29cfd3b706f95f054266

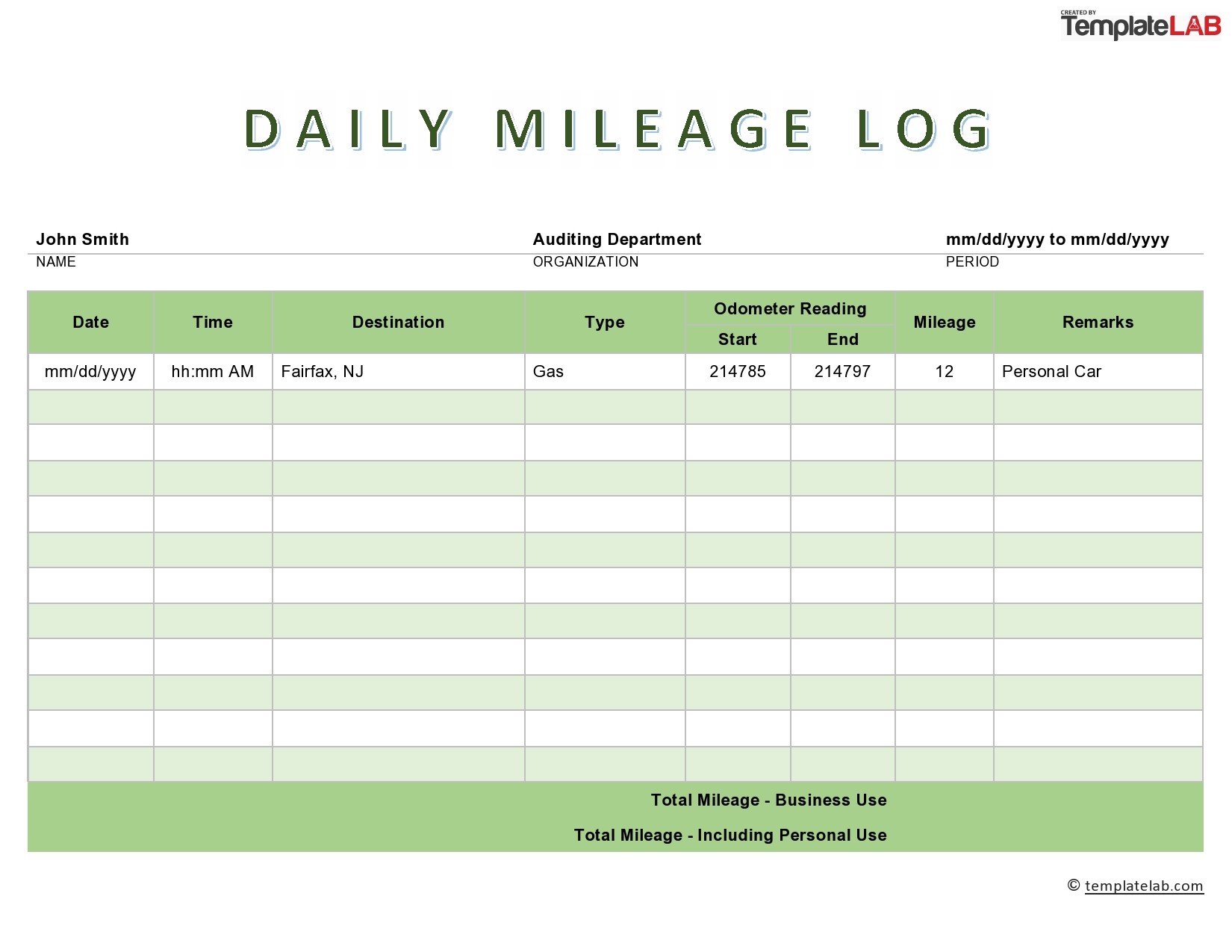

Mileage Log With Reimbursement Form MS Excel Excel Templates Excel

https://i.pinimg.com/originals/89/1b/0a/891b0ad37c9259795ebb74fa88dbb1e0.png

Mileage Log Template Google Sheets

https://templatelab.com/wp-content/uploads/2020/02/Daily-Mileage-Log-TemplateLab.com_.jpg

Web This travel must be overnight and more than 100 miles from your home Expenses must be ordinary and necessary This deduction is limited to the regular federal per diem rate for Web The cost of using your car as an employee whether measured using actual expenses or the standard mileage rate will no longer be allowed to be claimed as an unreimbursed employee travel expense as a

Web Travel and Mileage Tax Refunds with RIFT Claiming tax refunds for travel can be complicated from work mileage allowances to DVLA tax refunds Work travel Web 12 juil 2022 nbsp 0183 32 Approved mileage allowance payments cover expenses in the form of road taxes wear and tear on the vehicle insurance and fuel Employees whose employers don t pay the full approved mileage rates

Download Mileage And Travel Expenses Tax Rebates For Work

More picture related to Mileage And Travel Expenses Tax Rebates For Work

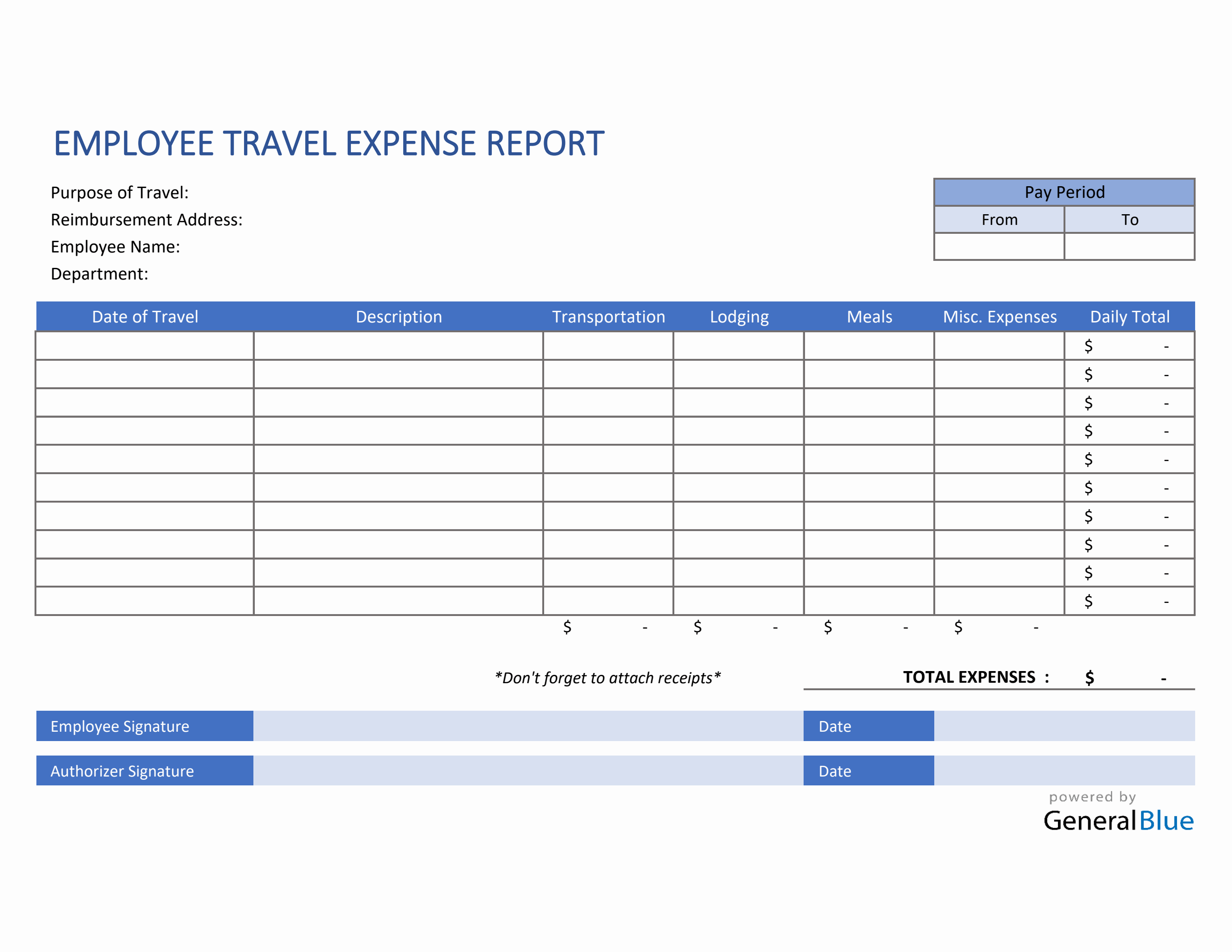

8 Travel Expense Report With Mileage Log Excel Templates Excel

http://www.exceltemplate123.us/wp-content/uploads/2017/11/travel-expense-report-with-mileage-log-w2eka-luxury-printable-mileage-log-sheet-template-projects-to-try-of-travel-expense-report-with-mileage-logb6v999.jpg

8 Travel Expense Report With Mileage Log Excel Templates Excel

http://www.exceltemplate123.us/wp-content/uploads/2017/11/travel-expense-report-with-mileage-log-kdghl-lovely-3-mileage-expense-report-of-travel-expense-report-with-mileage-logt6e349.jpg

Workers Comp Mileage Reimbursement 2022 Form Fill Online Printable

https://www.pdffiller.com/preview/17/398/17398379/large.png

Web 7 f 233 vr 2023 nbsp 0183 32 Deductible travel expenses include Travel by airplane train bus or car between your home and your business destination Fares for taxis or other types of Web The UK law means you re entitled to claim some tax back for any mileage you ve incurred as long as it is essential for your job Mileage tax or Mileage Allowance Relief MAR

Web For 2021 the standard mileage rate for the use of a car as well as vans pickups or panel trucks is 56 cents per mile a decrease of 1 5 cents from the rate for 2020 The IRS didn t explain why the reimbursement Web 27 janv 2023 nbsp 0183 32 The IRS business standard mileage rate cannot be used to claim an itemized deduction for unreimbursed employee travel expenses under the Tax Cuts and Jobs Act which remains in effect through 2025

31 Printable Mileage Log Templates Free Templatelab Throughout Gas

https://i.pinimg.com/originals/b3/1a/4f/b31a4f7c3f7581eef54476167a79924e.jpg

Mileage Log Template For Taxes Lovely Template Mileage Forms Template

https://i.pinimg.com/originals/fc/2f/4a/fc2f4adec7f9ef9a53f13e6b77ab5c35.jpg

https://money.usnews.com/money/personal-finance/taxes/articles/...

Web 21 mars 2023 nbsp 0183 32 Edited by Colin Hogan March 21 2023 at 12 30 p m How to Claim a Mileage Tax Deduction You need to know the rules for claiming mileage on your taxes

https://www.taxrebateservices.co.uk/tax-guides/mileage-allowance...

Web Government approved mileage allowance relief rates for the 2023 2024 tax year are Car van 163 0 45 per mile up to 10 000 miles 163 0 25 over 10 000 miles If you carry a

Employee Travel Expense Report Template In Excel

31 Printable Mileage Log Templates Free Templatelab Throughout Gas

Expense Log Template Excel Excel Templates

Mileage Log Template For Taxes Inspirational 2019 Mileage Log Fillable

Download Travel Expense Report With Mileage Log For Free FormTemplate

Travel Expense Sheet Template Free Of 8 Travel Expense Report With

Travel Expense Sheet Template Free Of 8 Travel Expense Report With

Tax Deductions Printable Editable Vehicle Mileage Expense Log

6 Mileage Record Template DocTemplates

The Best Free Printable Mileage Log Harper Blog

Mileage And Travel Expenses Tax Rebates For Work - Web MILLIONS OF UK WORKERS USE THEIR OWN CAR FOR WORK WITHOUT KNOWING THEY CAN GET TAX RELIEF ON MILEAGE Even if your employer does