Mileage And Travel Expenses Tax Rebates Web HMRC won t automatically give you a mileage tax rebate for your travel so you have to claim it back which can be worth 163 3 000 on average when you claim with RIFT Here s a

Web Mileage tax or Mileage Allowance Relief MAR makes it possible to claim up to 45p per mile for the first 10 000 miles travelled by car or van After 10 000 it s 25p per mile More Web 21 mars 2023 nbsp 0183 32 Getty Images Claiming a deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their

Mileage And Travel Expenses Tax Rebates

Mileage And Travel Expenses Tax Rebates

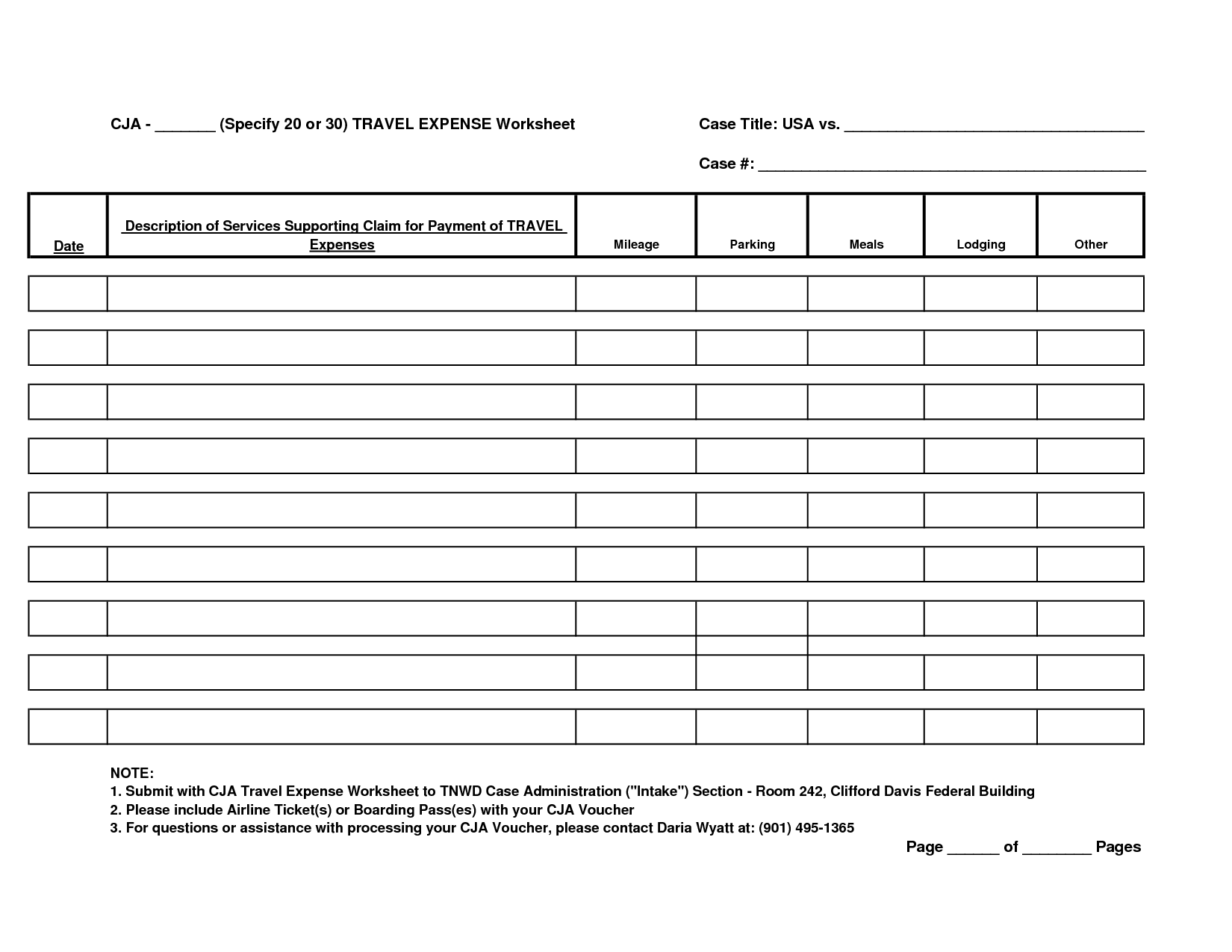

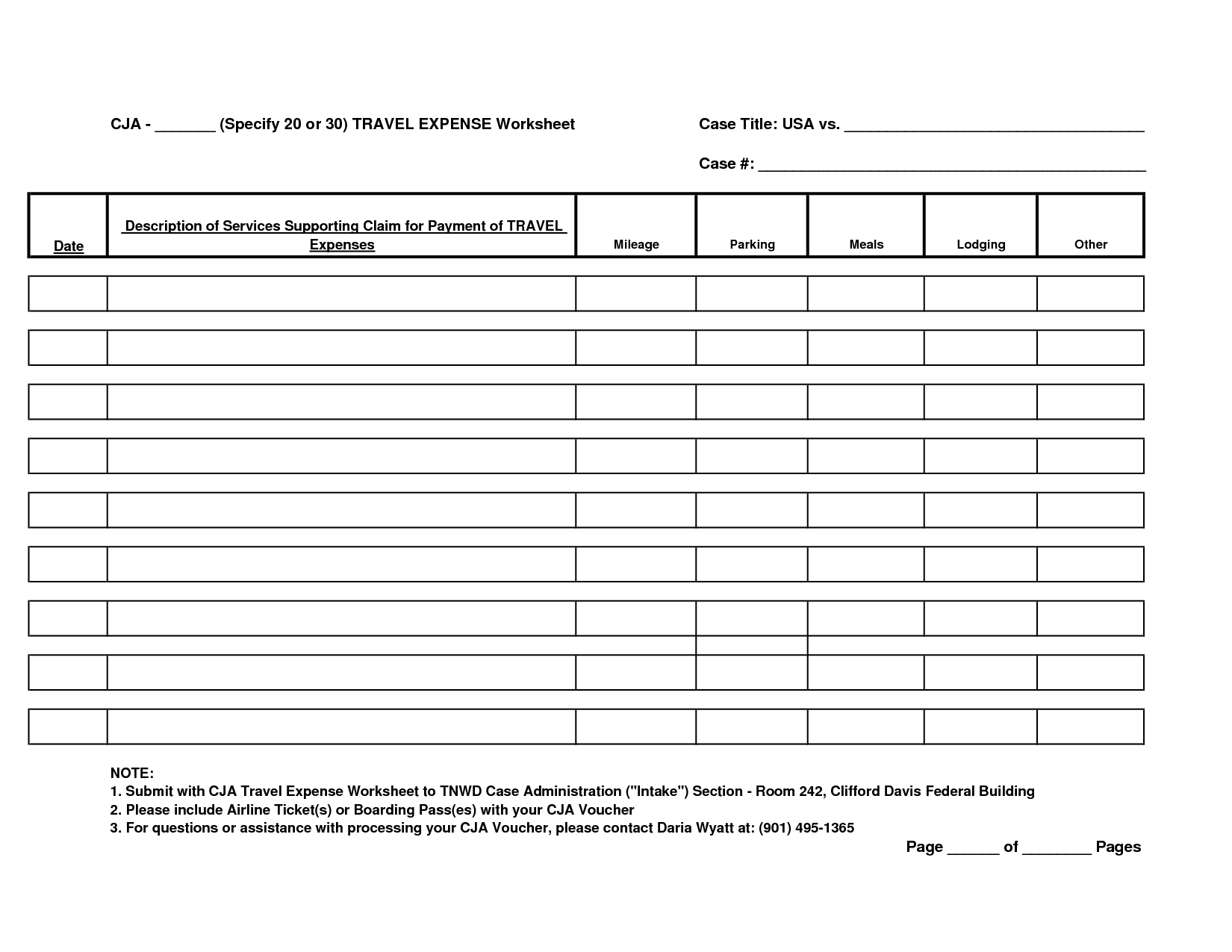

http://www.worksheeto.com/postpic/2013/05/travel-expense-worksheet_557932.png

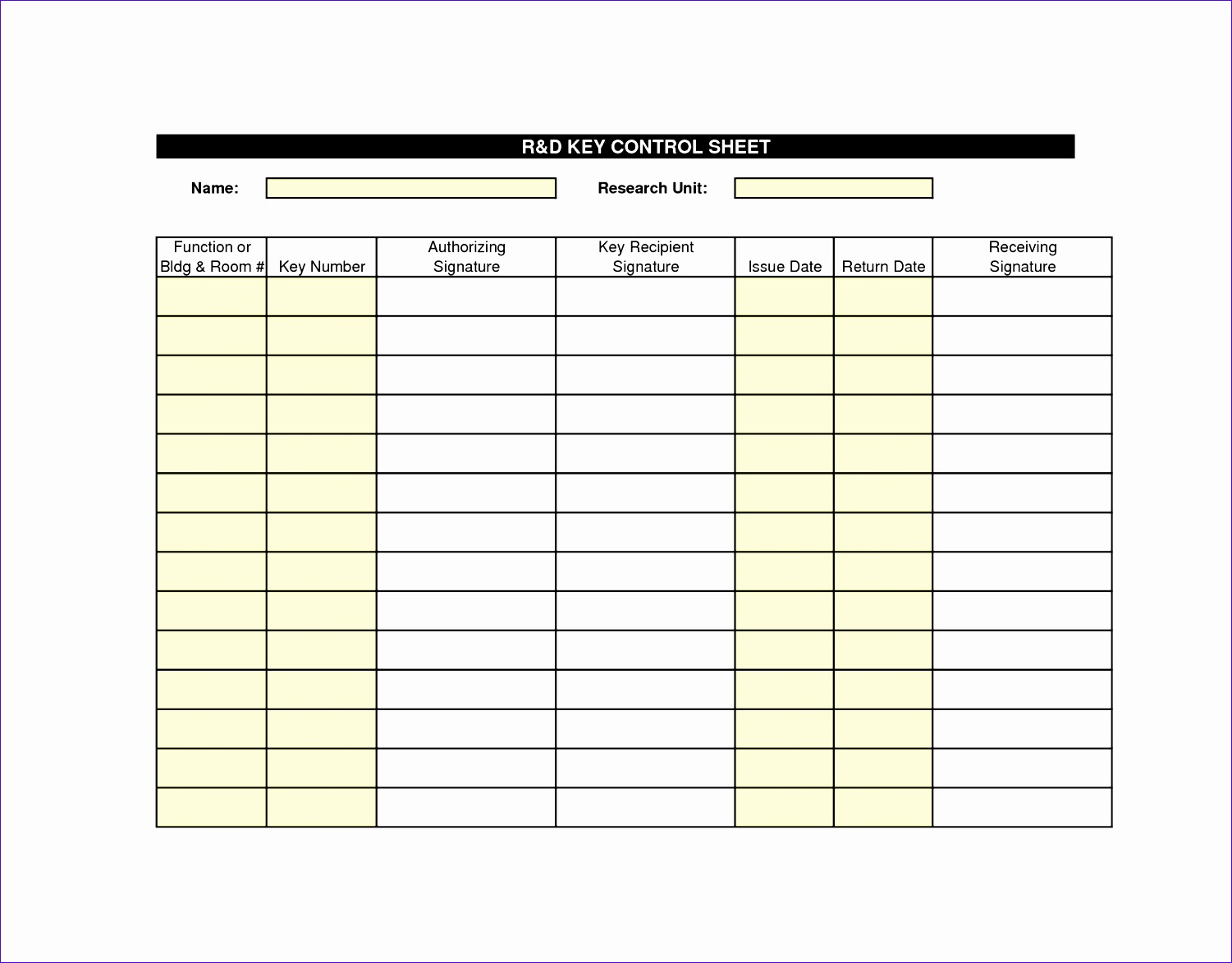

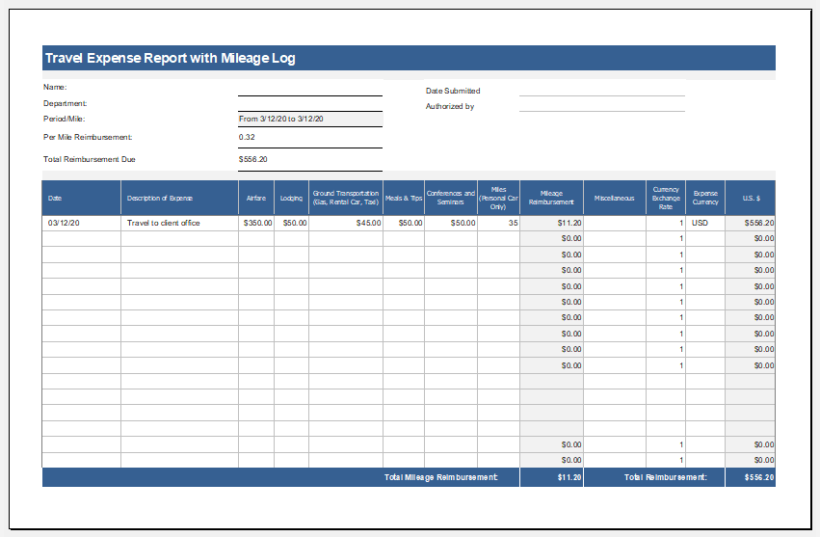

Expense Log Template Excel Excel Templates

http://www.exceltemplate123.us/wp-content/uploads/2017/11/travel-expense-report-with-mileage-log-v0ehd-elegant-mileage-log-form-template-business-of-travel-expense-report-with-mileage-logg3j285.jpg

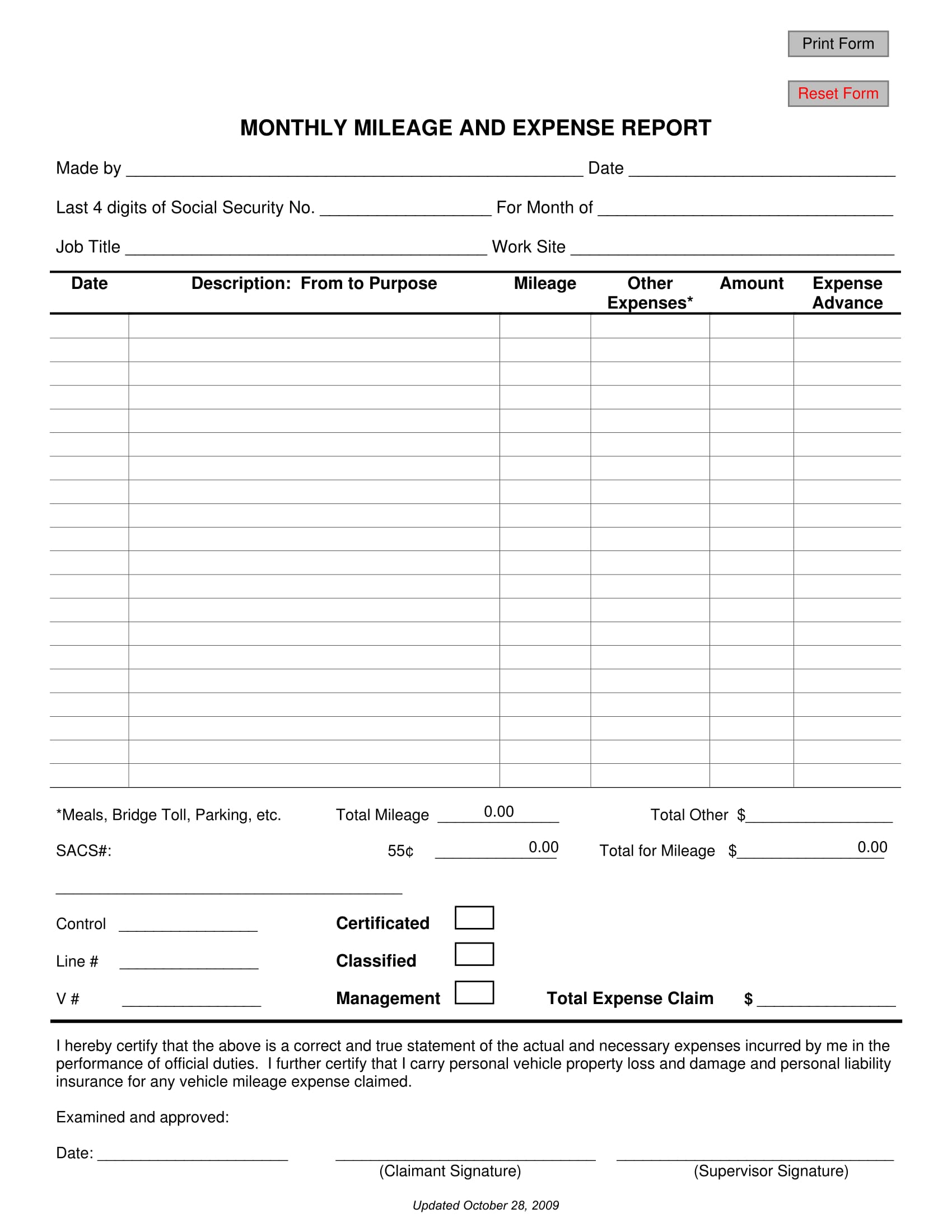

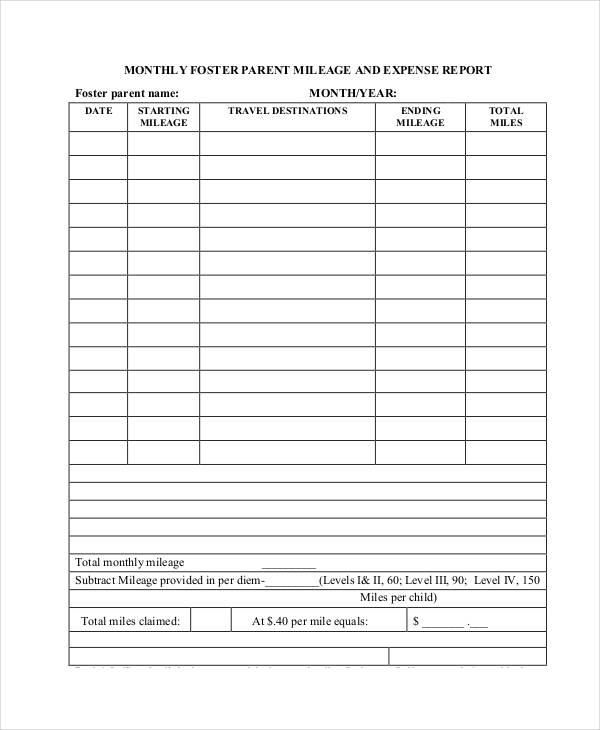

FREE 5 Mileage Report Forms In MS Word PDF Excel

https://images.sampleforms.com/wp-content/uploads/2018/01/Monthly-Mileage-and-Expense-Report-Form-1.jpg

Web 9 juin 2023 nbsp 0183 32 45p per mile is the tax free approved mileage allowance for the first 10 000 miles in the financial year it s 25p per mile thereafter If a business chooses to pay employees an amount towards the mileage Web 27 janv 2023 nbsp 0183 32 The IRS standard mileage rate is a key benchmark that s used by the federal government and many businesses to reimburse their employees for their out of pocket mileage expenses It s also key

Web Guidance Rates and allowances travel mileage and fuel allowances Rates and allowances for travel including mileage and fuel allowances From HM Revenue amp Web The cost of using your car as an employee whether measured using actual expenses or the standard mileage rate will no longer be allowed to be claimed as an unreimbursed employee travel expense as a

Download Mileage And Travel Expenses Tax Rebates

More picture related to Mileage And Travel Expenses Tax Rebates

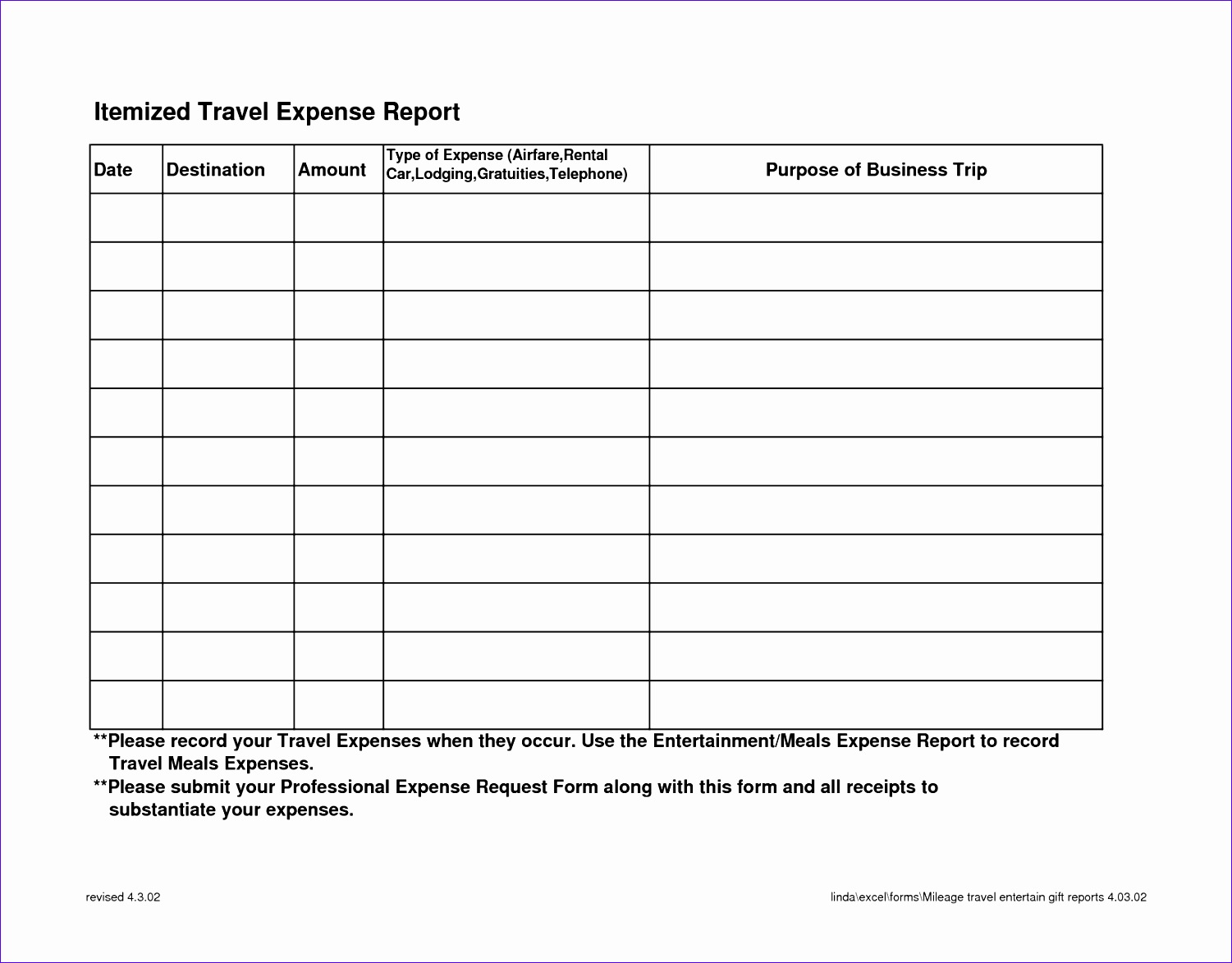

Download Travel Expense Report With Mileage Log For Free FormTemplate

https://cdn.formtemplate.org/images/600/travel-expense-report-with-mileage-log-1.png

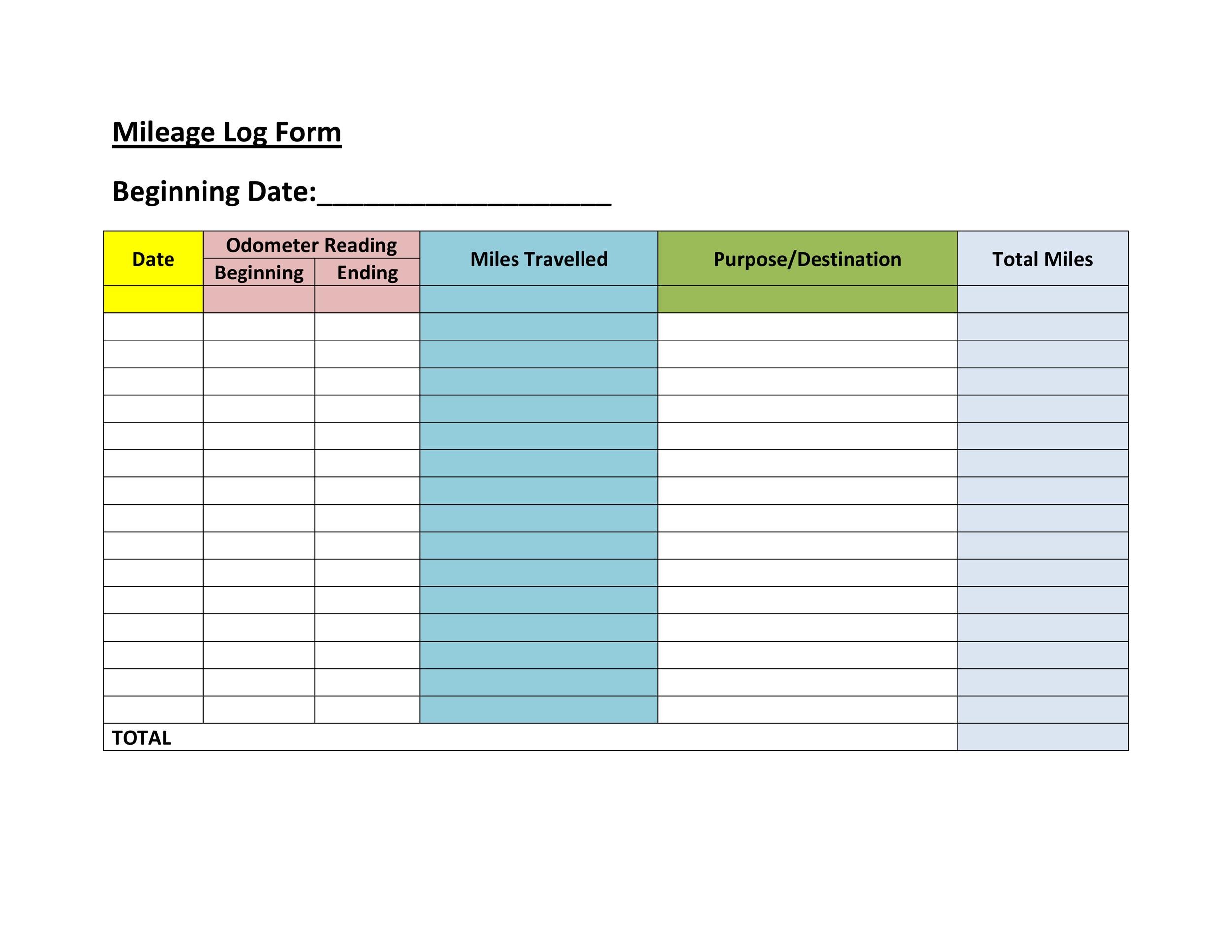

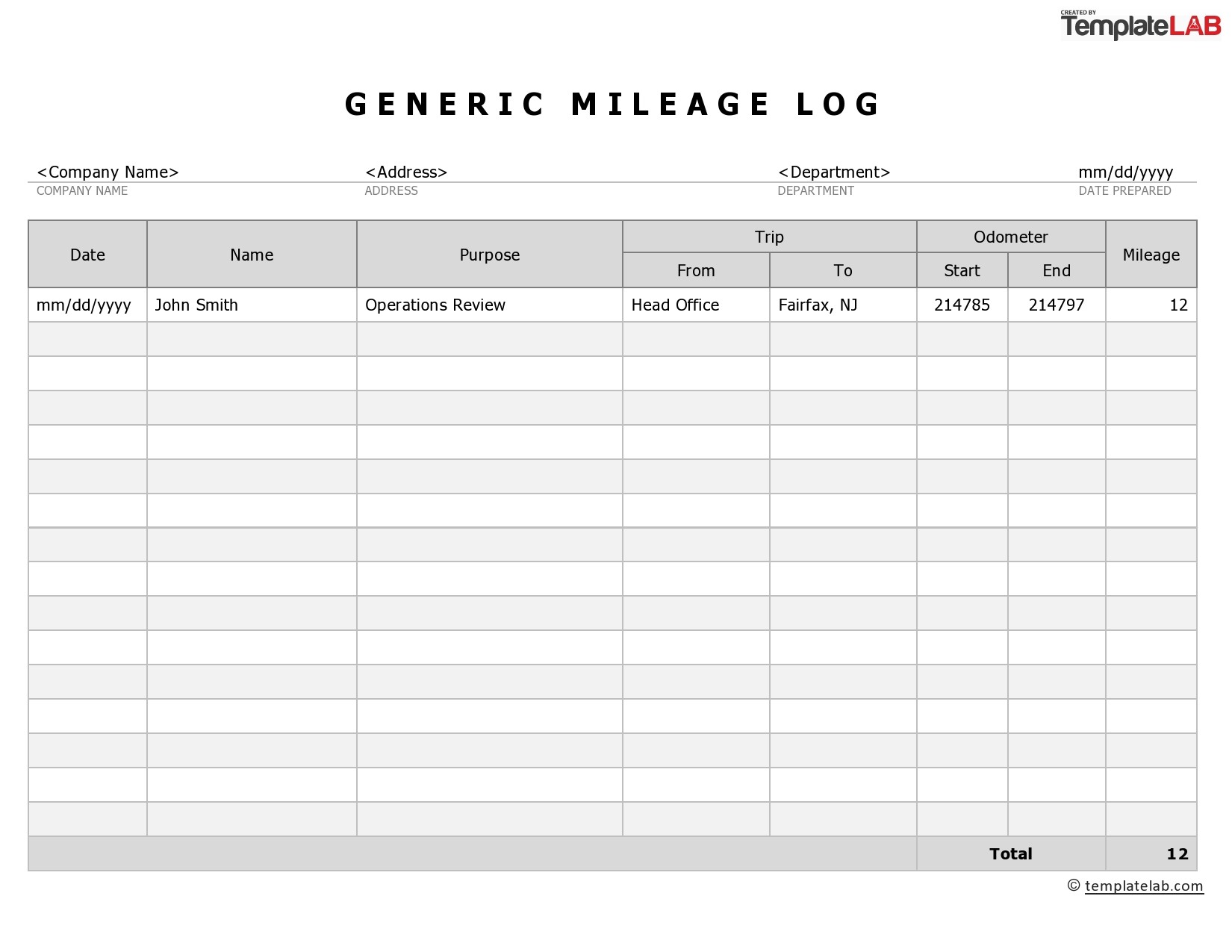

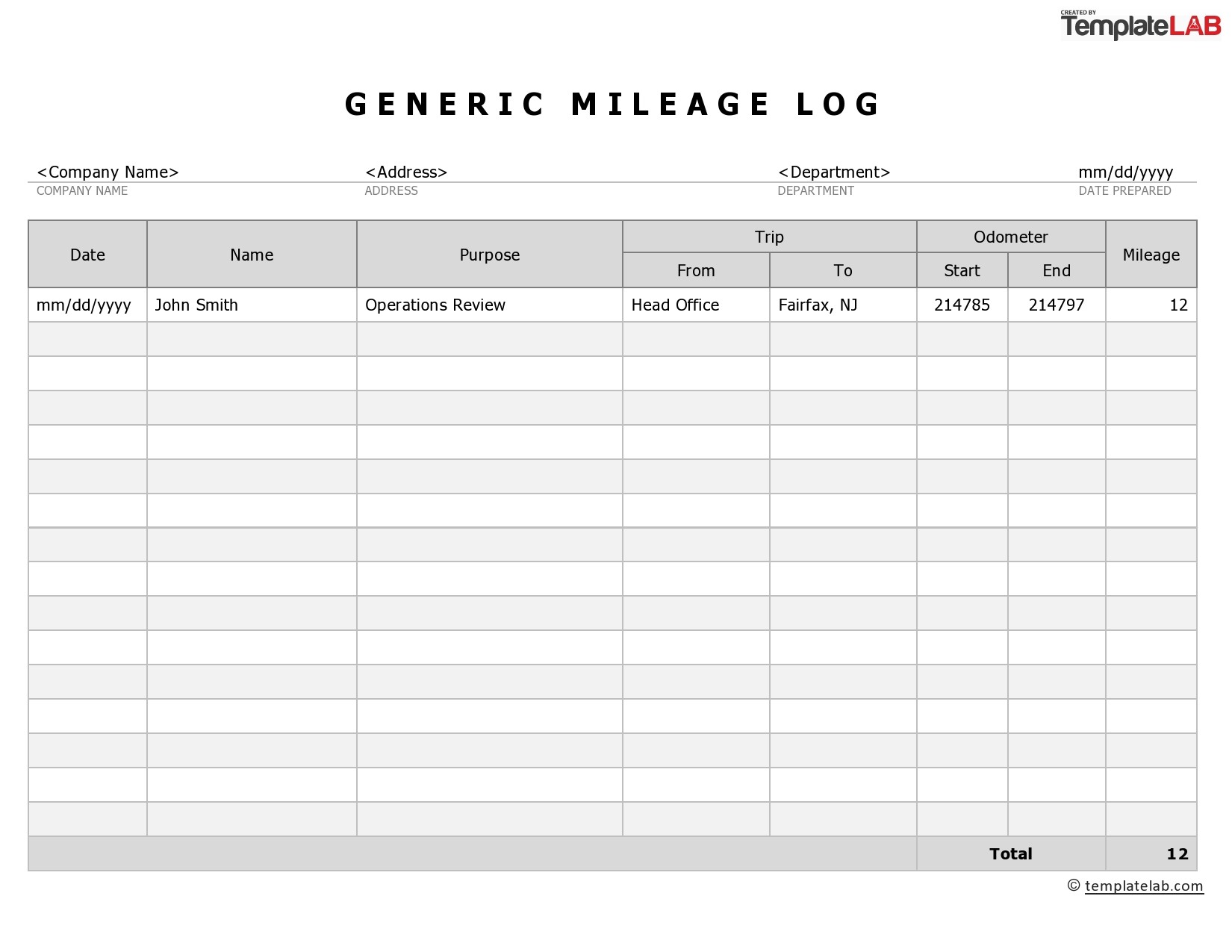

31 Printable Mileage Log Templates Free TemplateLab

http://templatelab.com/wp-content/uploads/2015/11/Mileage-Log-10.jpg?w=320

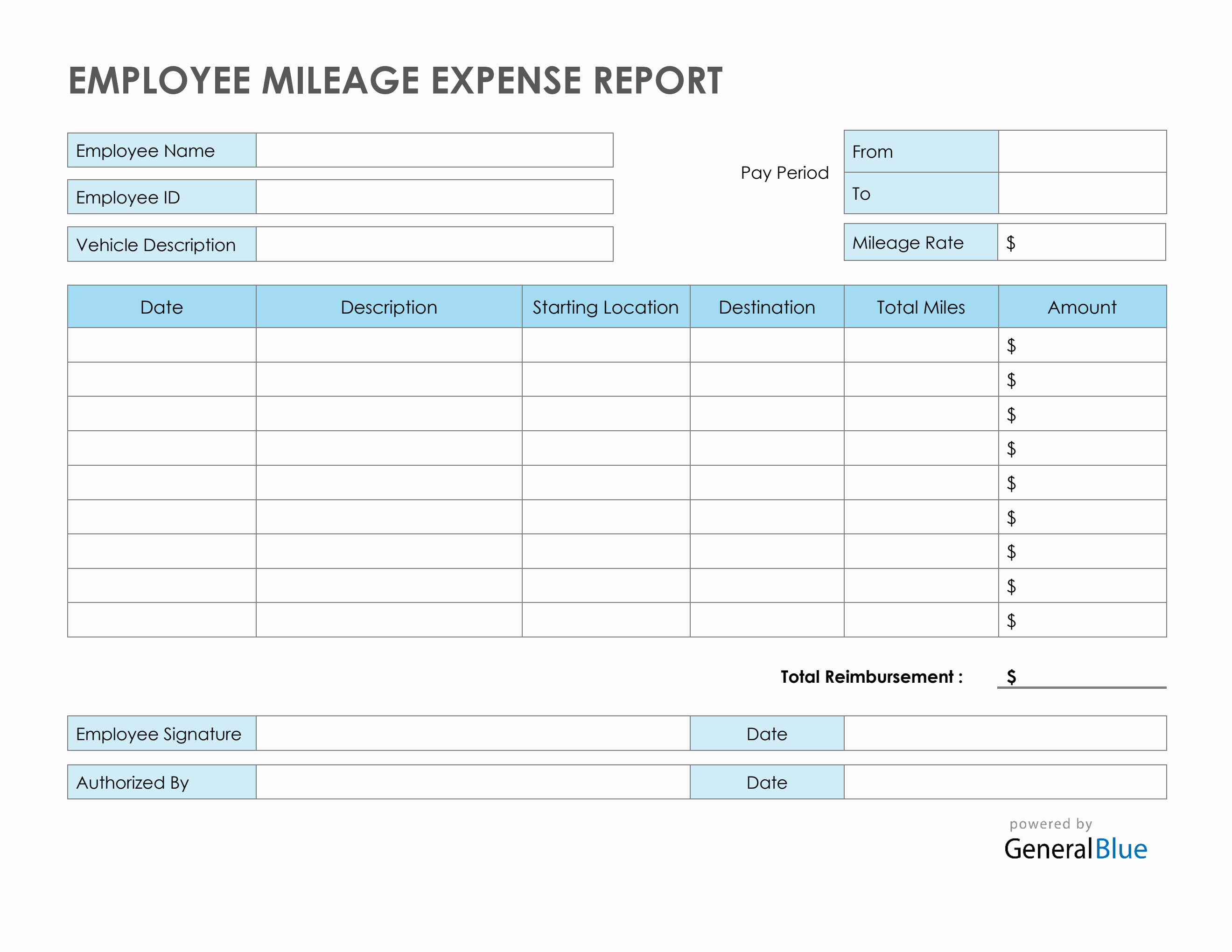

Employee Mileage Expense Report Template In PDF

https://www.generalblue.com/employee-mileage-expense-report-template/p/t1f1dhd2b/f/employee-mileage-expense-report-template-in-pdf-lg.png?v=d61aff98332a29cfd3b706f95f054266

Web You claim back tax relief for expenses of employment such as business mileage as part of a tax rebate claim It means keeping track of your mileage expenses and how far you Web Car Fuel Allowance 45p for each mile for the first 100 000 miles Motorcyclists 24p for each mile Cyclists 20p for each mile It doesn t matter how old or new your vehicle is

Web 2 avr 2013 nbsp 0183 32 Travel expenses include claiming business mileage public transport costs and sometimes subsistence and accommodation costs There are criteria as to Web Tax Refunds Travel Expenses Tax Help Home gt Tax Refund gt Travel Expenses Travel Expenses for the employed can include business mileage subsistence

31 Printable Mileage Log Templates Free TemplateLab

https://templatelab.com/wp-content/uploads/2020/02/Generic-Mileage-Log-TemplateLab.com_.jpg?w=395

15 Business Expense Log Template DocTemplates

http://www.exceltemplate123.us/wp-content/uploads/2017/11/travel-expense-report-with-mileage-log-towlq-elegant-blank-expense-report-business-reports-format-of-travel-expense-report-with-mileage-logt5a916.jpg

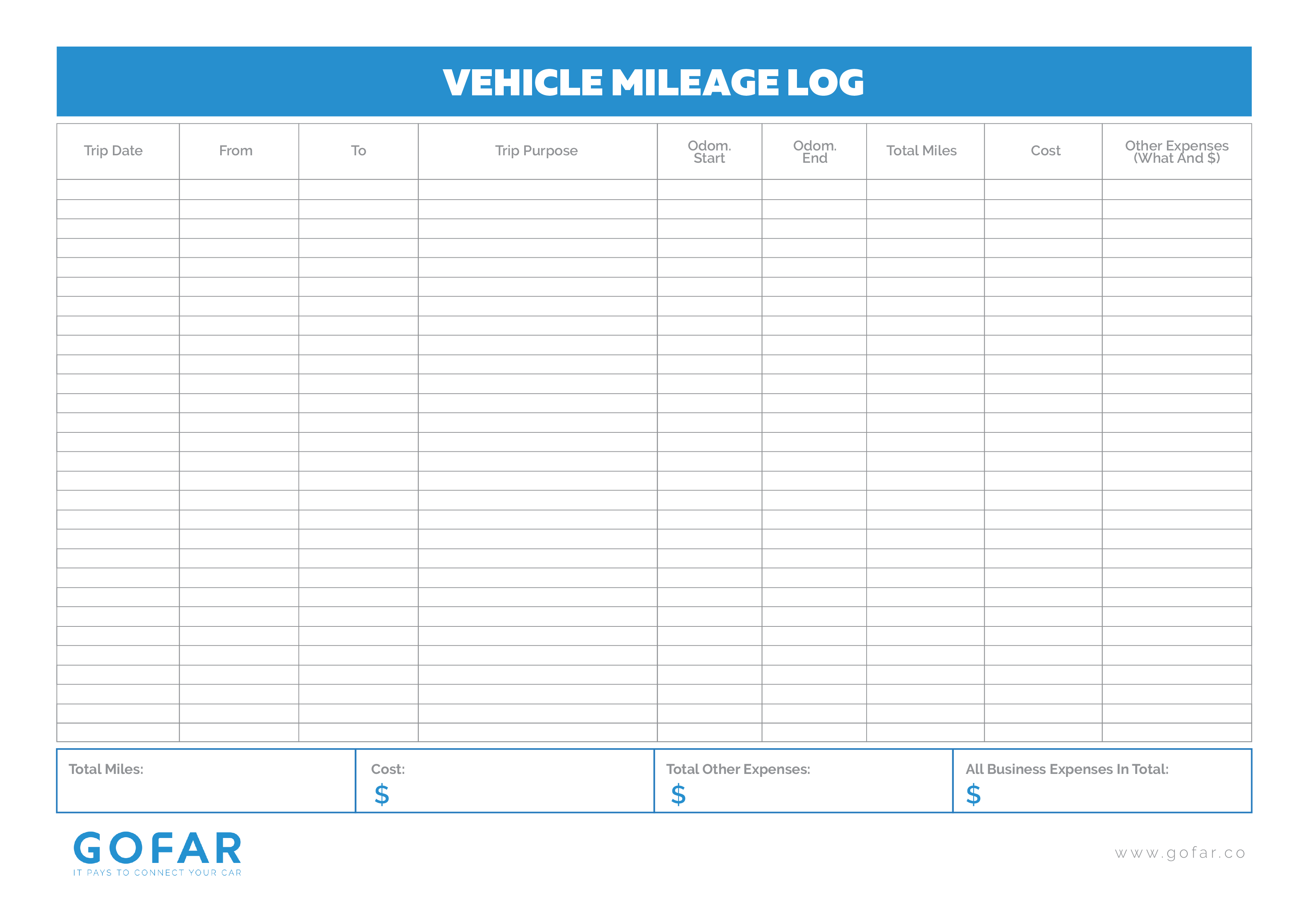

https://www.riftrefunds.co.uk/tax-rebates/travel-and-mileage

Web HMRC won t automatically give you a mileage tax rebate for your travel so you have to claim it back which can be worth 163 3 000 on average when you claim with RIFT Here s a

https://www.riftrefunds.co.uk/tax-rebates/travel-and-mileage/mileage...

Web Mileage tax or Mileage Allowance Relief MAR makes it possible to claim up to 45p per mile for the first 10 000 miles travelled by car or van After 10 000 it s 25p per mile More

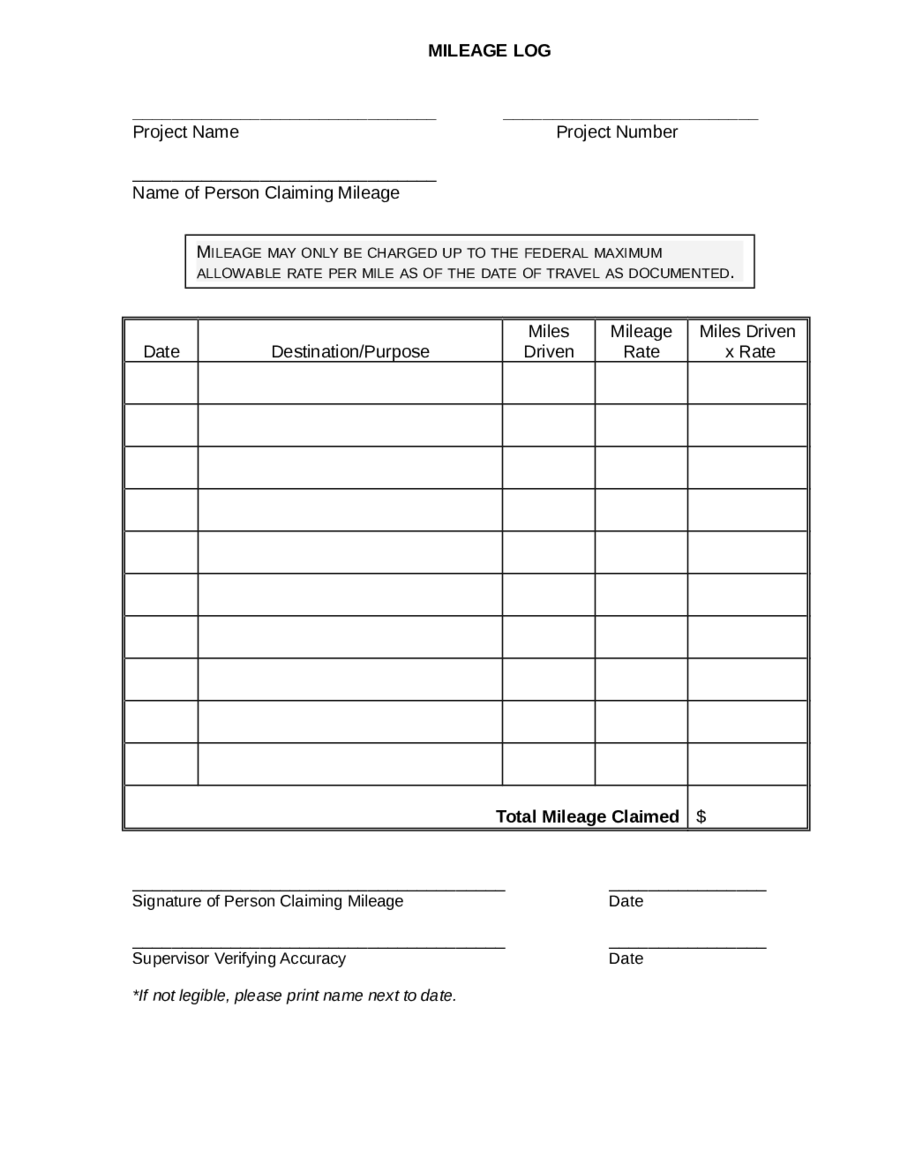

25 Printable IRS Mileage Tracking Templates GOFAR

31 Printable Mileage Log Templates Free TemplateLab

31 Printable Mileage Log Templates Free TemplateLab Mileage

Mileage Log Template Excel Excel Templates

Travel Spreadsheet Template

Mileage Reimbursement Log Excel Templates

Mileage Reimbursement Log Excel Templates

Mileage Log Template Free Excel PDF Versions IRS Compliant

Expense Report 36 Examples Samples PDF Google Docs Pages DOC

2023 Mileage Log Fillable Printable PDF Forms Handypdf

Mileage And Travel Expenses Tax Rebates - Web 7 juil 2021 nbsp 0183 32 In those 500 miles you did 5 business trips that totaled 100 miles To calculate your business share you would divide 100 by 500 100 500 0 20 Your business