Mileage Claim Rates Electric Cars The 2024 HMRC electric car mileage rate is 9p for company cars If you are driving a personal electric car for business purposes the mileage rates are 45p for the first 10 000 miles and 25p thereafter

Approved mileage rates from tax year 2011 to 2012 to present date Passenger payments cars and vans 5p per passenger per business mile for carrying From 1 September 2023 the advisory electric rate for fully electric company cars is 10 pence per mile The Advisory Electricity Rate AER is calculated similarly to an AFR

Mileage Claim Rates Electric Cars

Mileage Claim Rates Electric Cars

https://media.notthebee.com/articles/630f94ce607ef630f94ce607f0.jpg

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

How To Claim Mileage Allowance When You re Self employed IPSE

https://www.ipse.co.uk/static/4db9b86a-25f4-4013-8a7bb18629e14019/freelancer-driving-mileage.jpg

The attached document is classified by HMRC as guidance and contains information about rates and allowances for travel including mileage and fuel allowances The HMRC electric car mileage rate works out to be 45p per mile for the first 10 000 miles You can then claim 25p on any mileage after that Example If you ve

The HMRC the U K s tax authority has currently set this rate at 45 pence per mile for the first 10 000 miles and 25 pence per mile for any additional mileage Plus the employee What are the HMRC electric car mileage rates for the 2023 2024 tax year The rate for Personal Electric Cars AMAPs is 45 pence per mile for the first 10 000 business miles

Download Mileage Claim Rates Electric Cars

More picture related to Mileage Claim Rates Electric Cars

Mileage Rates For Electric And Hybrid Cars Mazuma

https://www.mazumamoney.co.uk/app/uploads/2021/01/mileage-rates-electric-hybrid-cars.jpg

Tesla Joins S P 500 As Electric Car Stocks Surge

https://d.newsweek.com/en/full/1670543/elon-musk.jpg

Buy 2pcs 12V 24V 20A Automatic Reset Circuit Breaker With Cover Stud

https://m.media-amazon.com/images/I/71pQQ7n40PL.jpg

Find out more about claiming mileage for electric vehicles advisory electricity rates and charging corporate electric vehicles and how Mooncard Fuel Card Yes and no The 9p figure you might have encountered refers to the Approved Mileage Rate AER set by HMRC for fully electric cars as of April 2023 This

Mileage reimbursement for electric vehicles EVs can differ from traditional gasoline powered vehicles due to the unique characteristics of EVs Here are a few key points to In September 2018 HMRC announced that the Advisory Electricity Rate AER to be used for electric company cars is 4p per mile With the current electric company car mileage

Making Sense Of The Rates Energy Usage High Energy Savings Calculator

https://i.pinimg.com/originals/d1/48/5c/d1485c30d30871dde7043fe609f8107f.png

Mileage Claim Rate Everything You Need To Know Moss

https://www.getmoss.com/guide/wp-content/uploads/2022/10/What-Is-a-Mileage-Claim-Rate-768x364.png

https://electriccarguide.co.uk/hmrc-elec…

The 2024 HMRC electric car mileage rate is 9p for company cars If you are driving a personal electric car for business purposes the mileage rates are 45p for the first 10 000 miles and 25p thereafter

https://www.gov.uk/government/publications/rates...

Approved mileage rates from tax year 2011 to 2012 to present date Passenger payments cars and vans 5p per passenger per business mile for carrying

Vorschlag Kompression Sandwich Goodyear Reifen Manager Selbst Axt Grenze

Making Sense Of The Rates Energy Usage High Energy Savings Calculator

New Energy Resources Electric Automobile EV Electric Vehicle BYD And

Ola Electric Cars In India To Debut In 2024

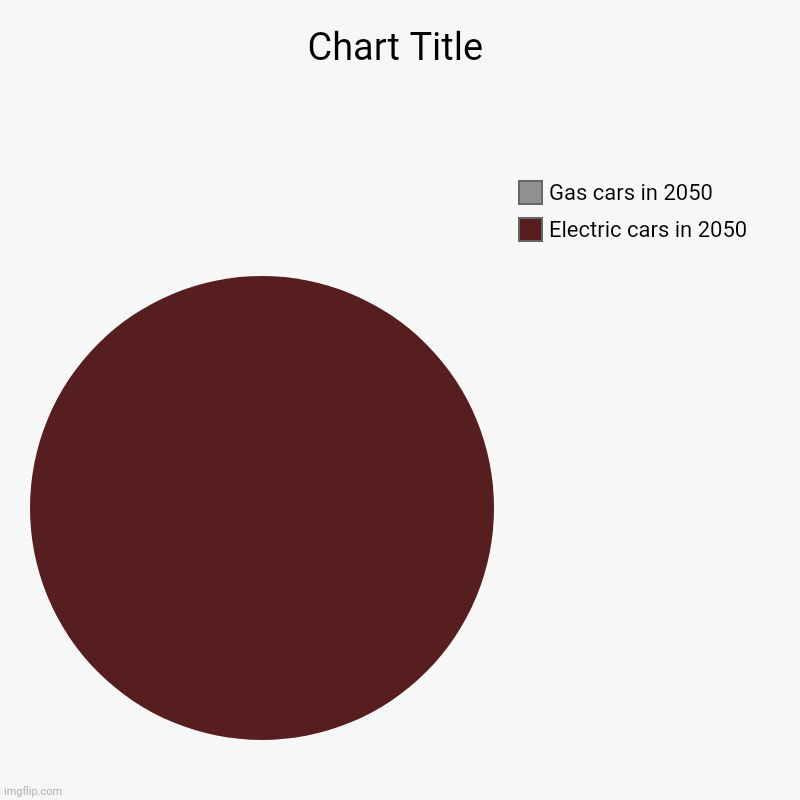

Image Tagged In Charts pie Charts Imgflip

The Mileage Rates For Petrol Diesel Hybrid And Electric Cars Autocar

The Mileage Rates For Petrol Diesel Hybrid And Electric Cars Autocar

Cars Is A Home Electric Charging Point Tax Exempt Tax Tips G T

These Electric Cars Qualify For The EV Tax Credits 15 Minute News

Updates To Company Car Mileage Rates In 2022

Mileage Claim Rates Electric Cars - If actual electric charging costs whether at home or at commercial chargers can be fully claimed regardless of whether the travel will be business or