Mileage Expense Claim Rules Here s what you need to know about mileage reimbursement to ensure you fulfill your legal obligations as an employer

No federal law requires you to reimburse your employees for using their personal vehicles for work but some state laws do California Illinois and Massachusetts require companies to reimburse their employees Learn about the mileage tax deductions business mileage reimbursement how to claim a mileage deduction and see the 2024 IRS mileage rate with help from Block

Mileage Expense Claim Rules

Mileage Expense Claim Rules

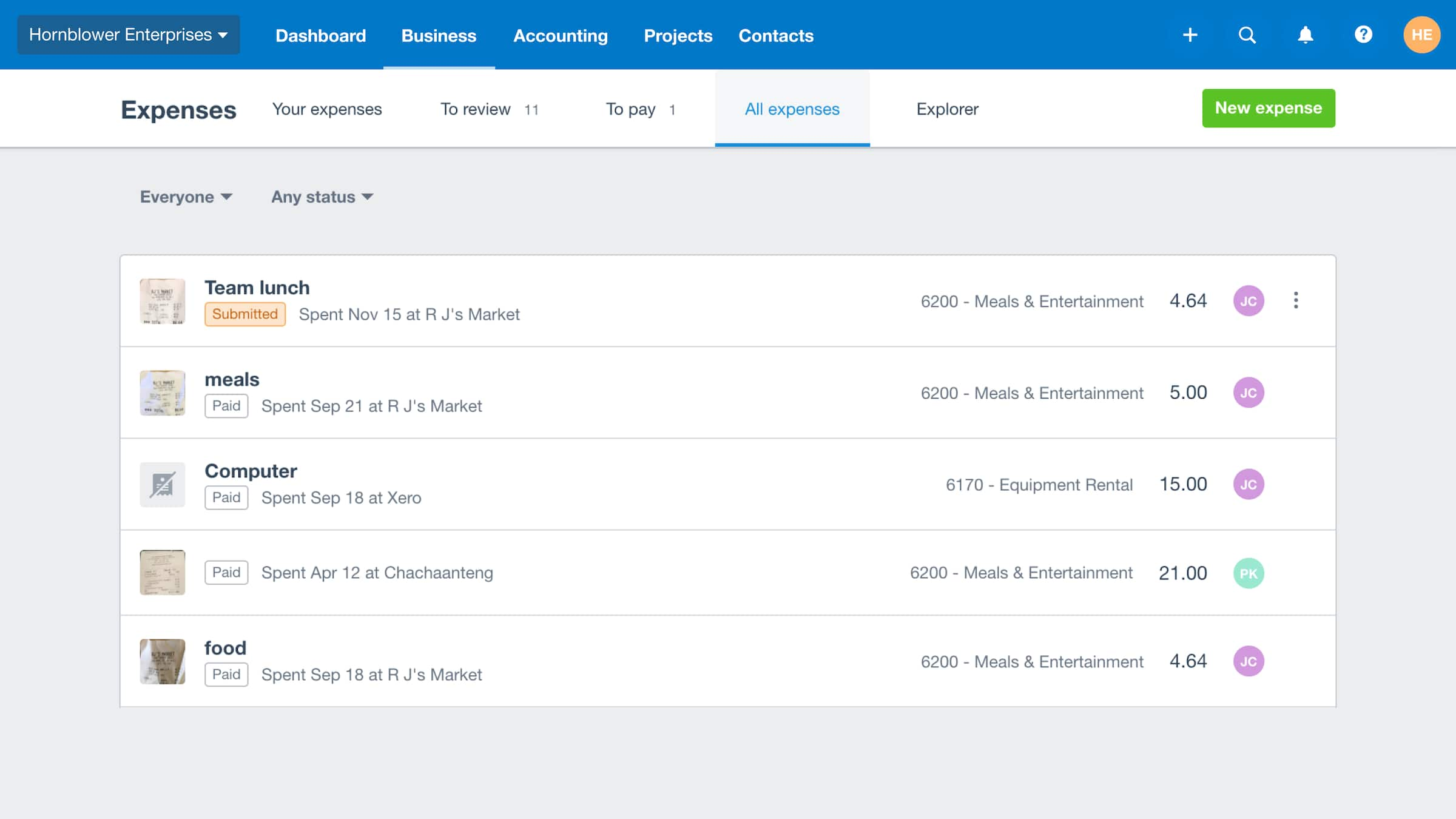

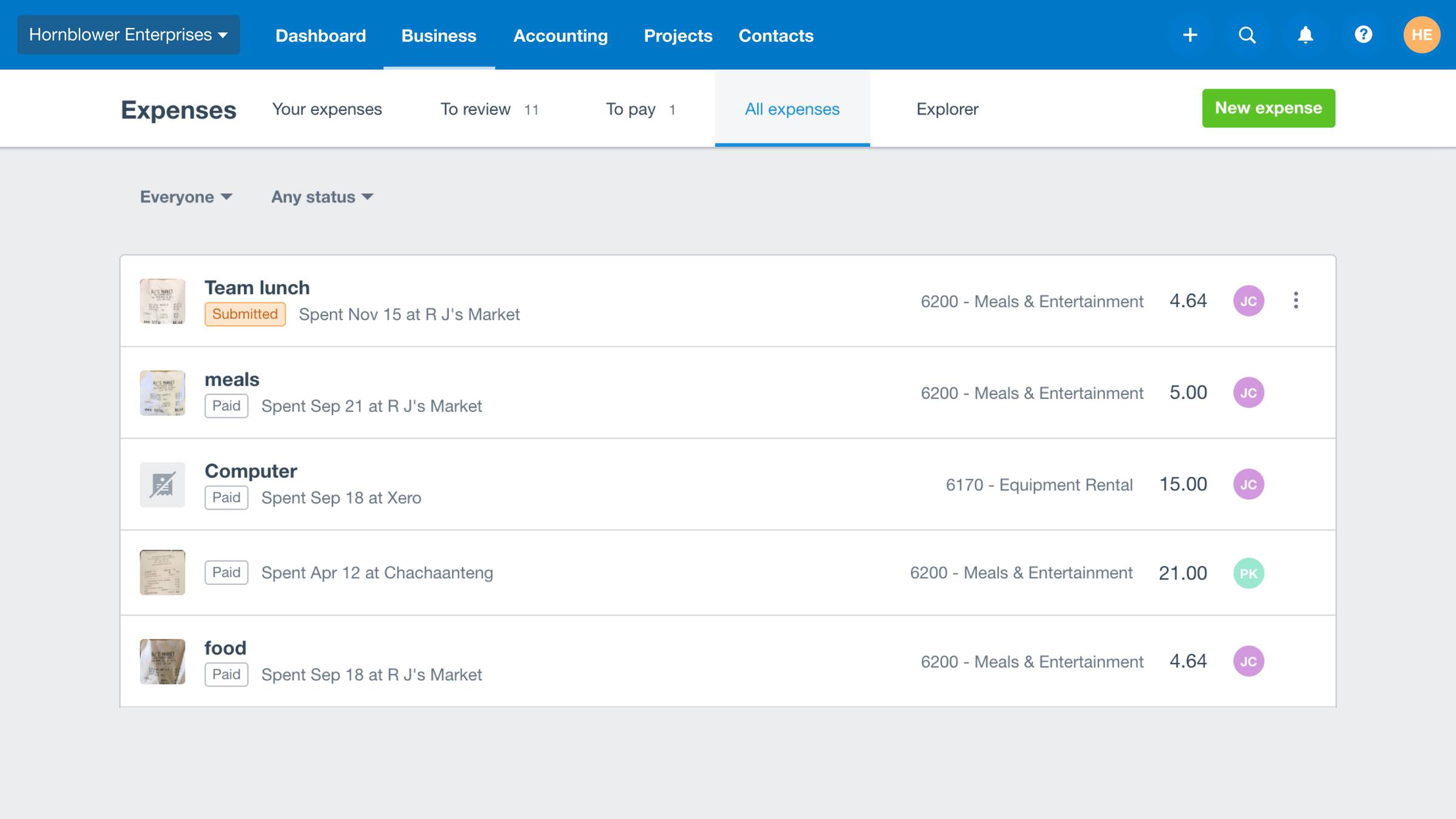

https://www.xero.com/content/dam/xero/pilot-images/features/expenses/expenses-overview.1646877462619.jpg

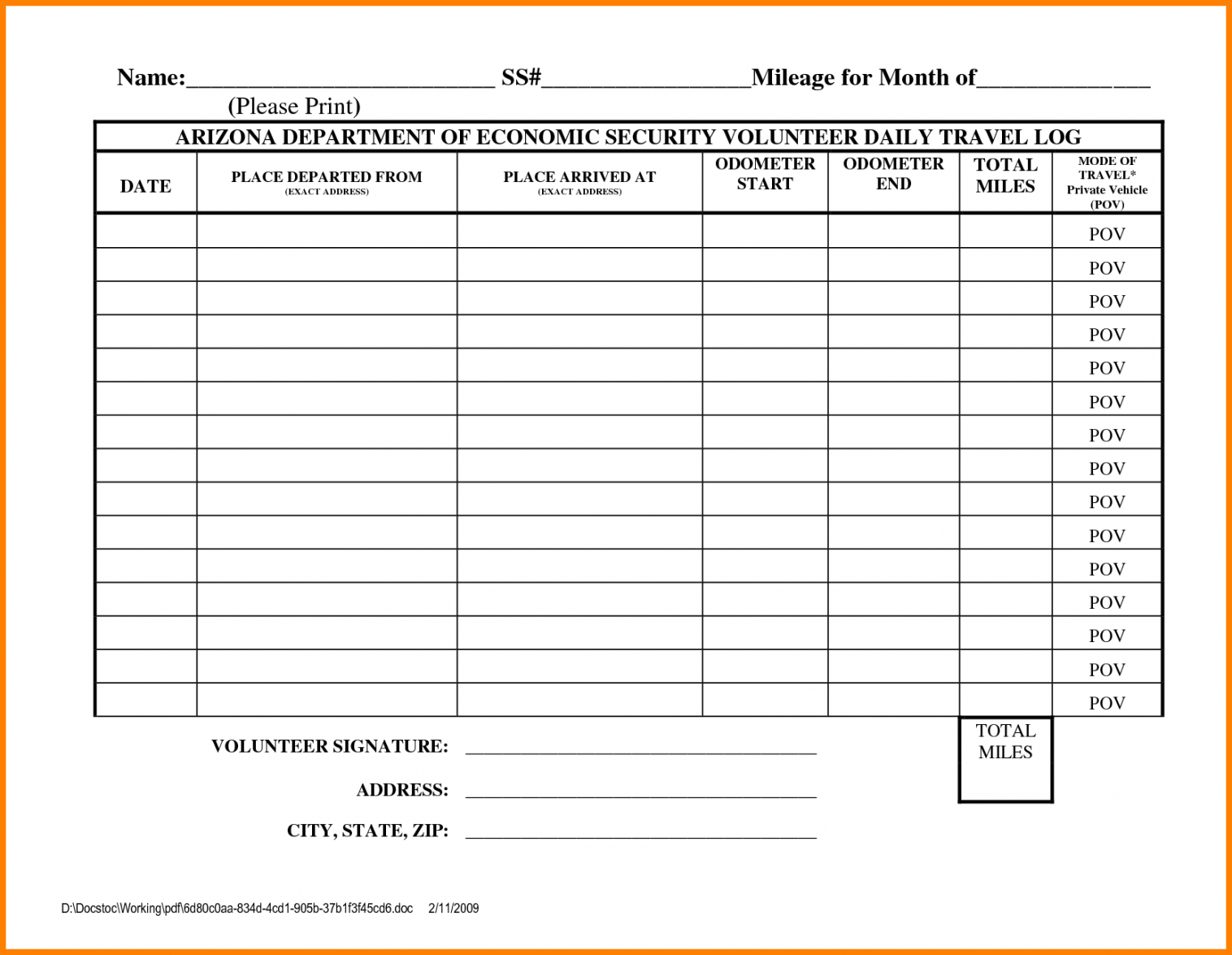

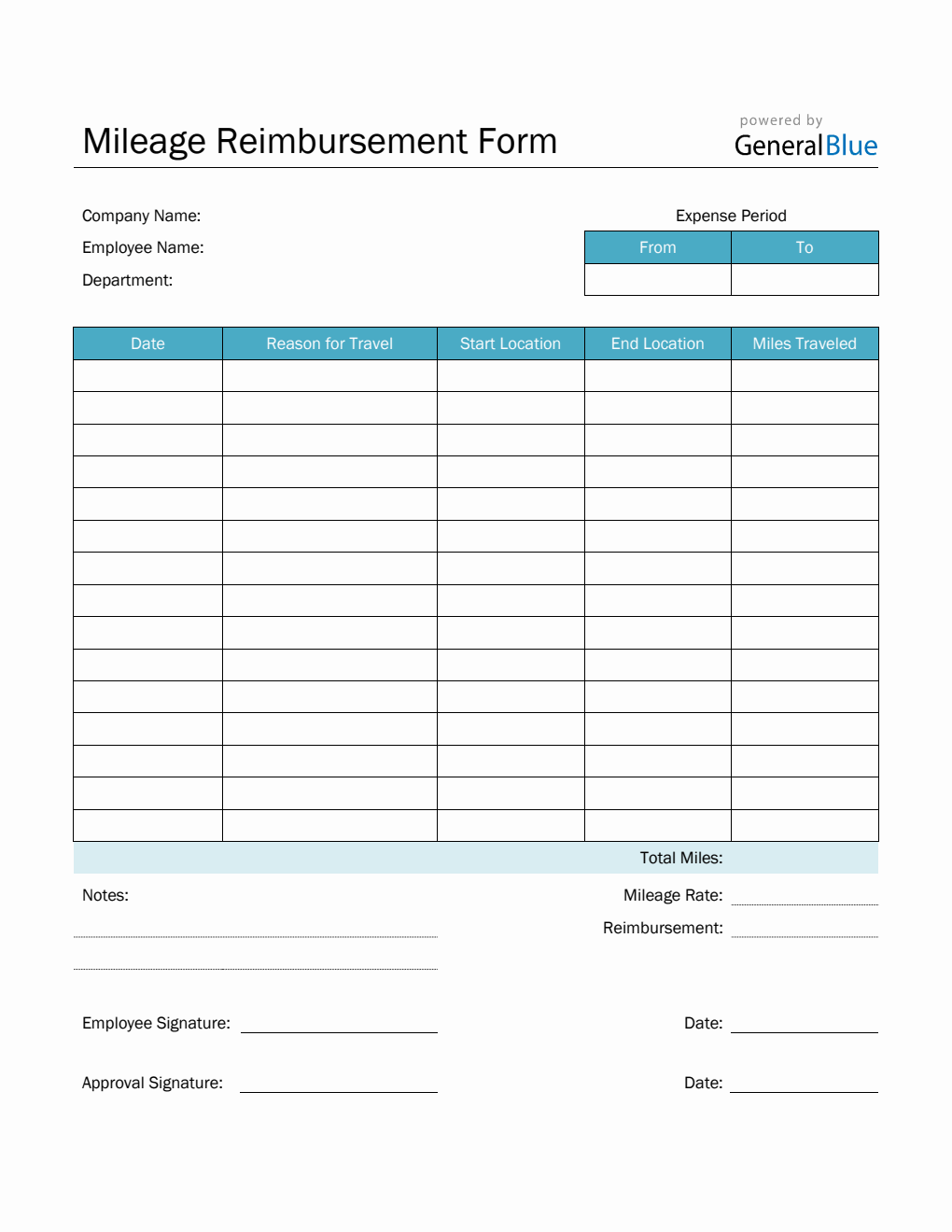

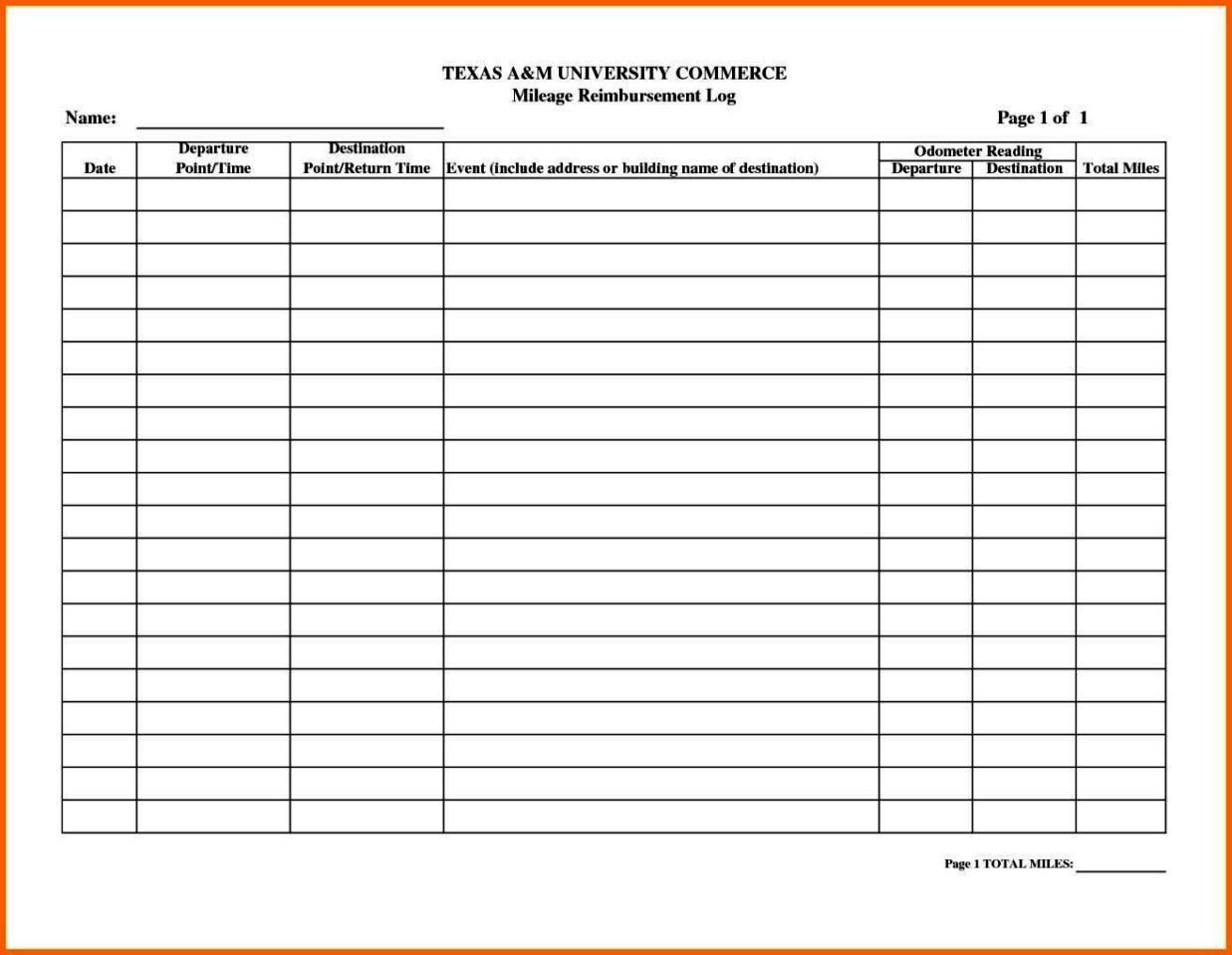

Mileage Claim Form Template

https://minasinternational.org/wp-content/uploads/2021/03/costum-mileage-claim-form-template-word-sample.png

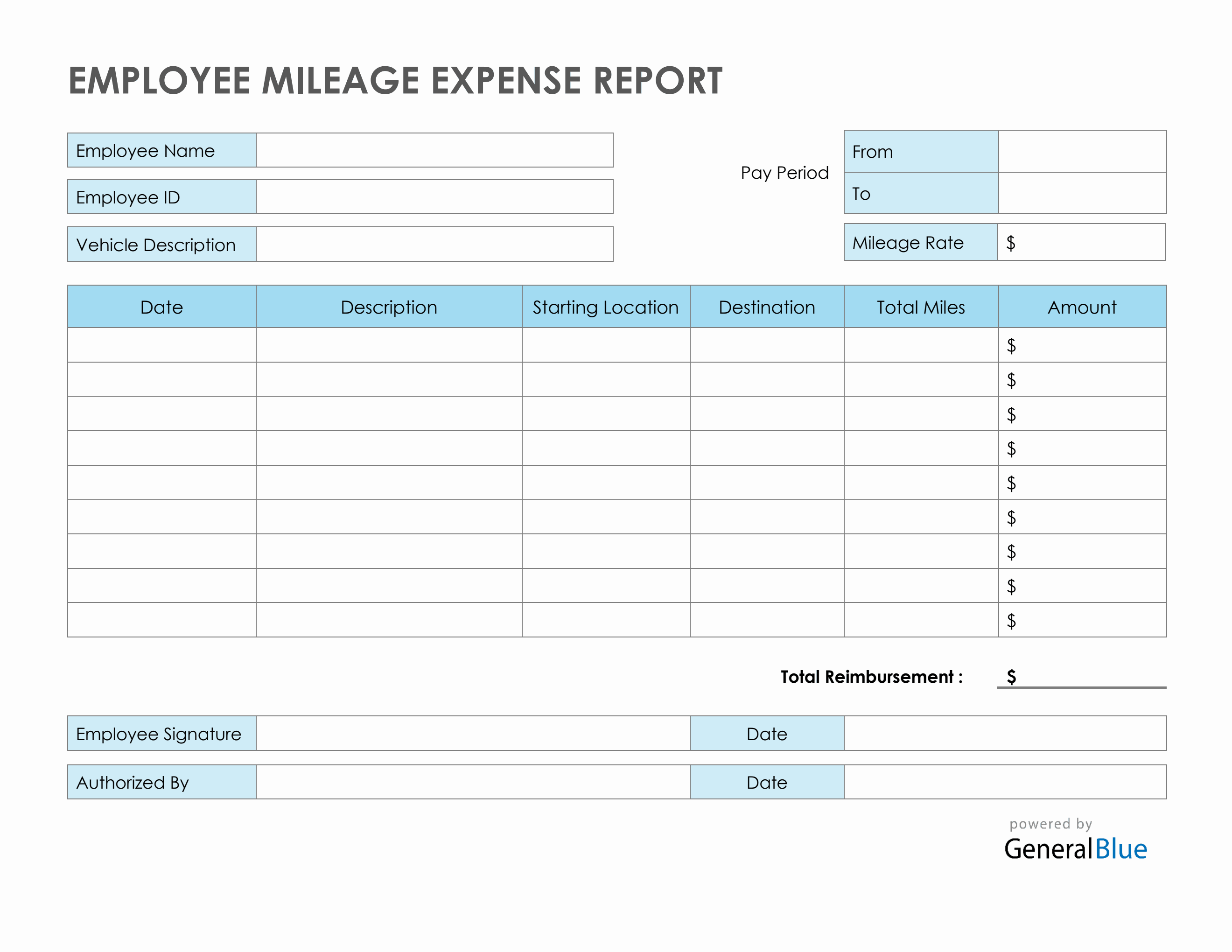

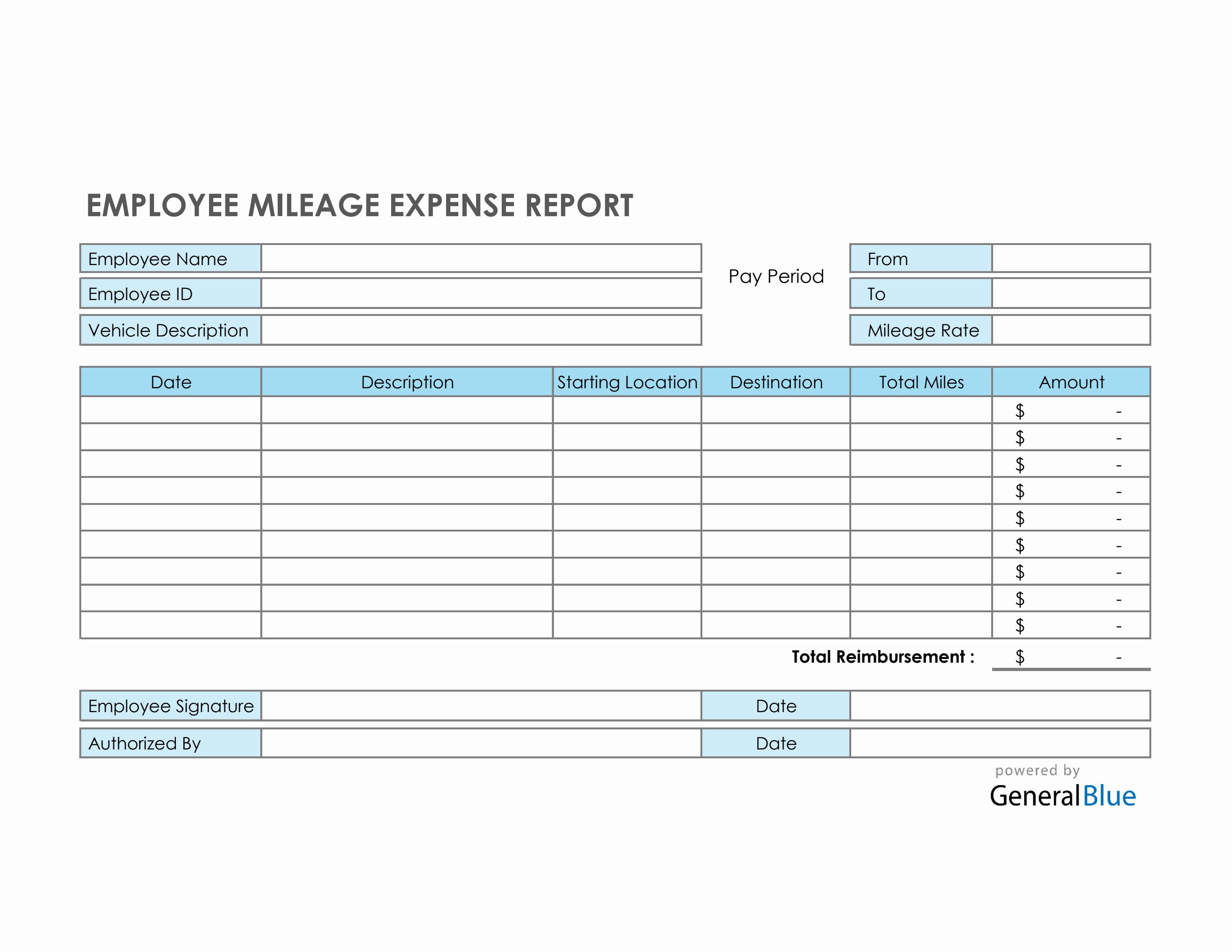

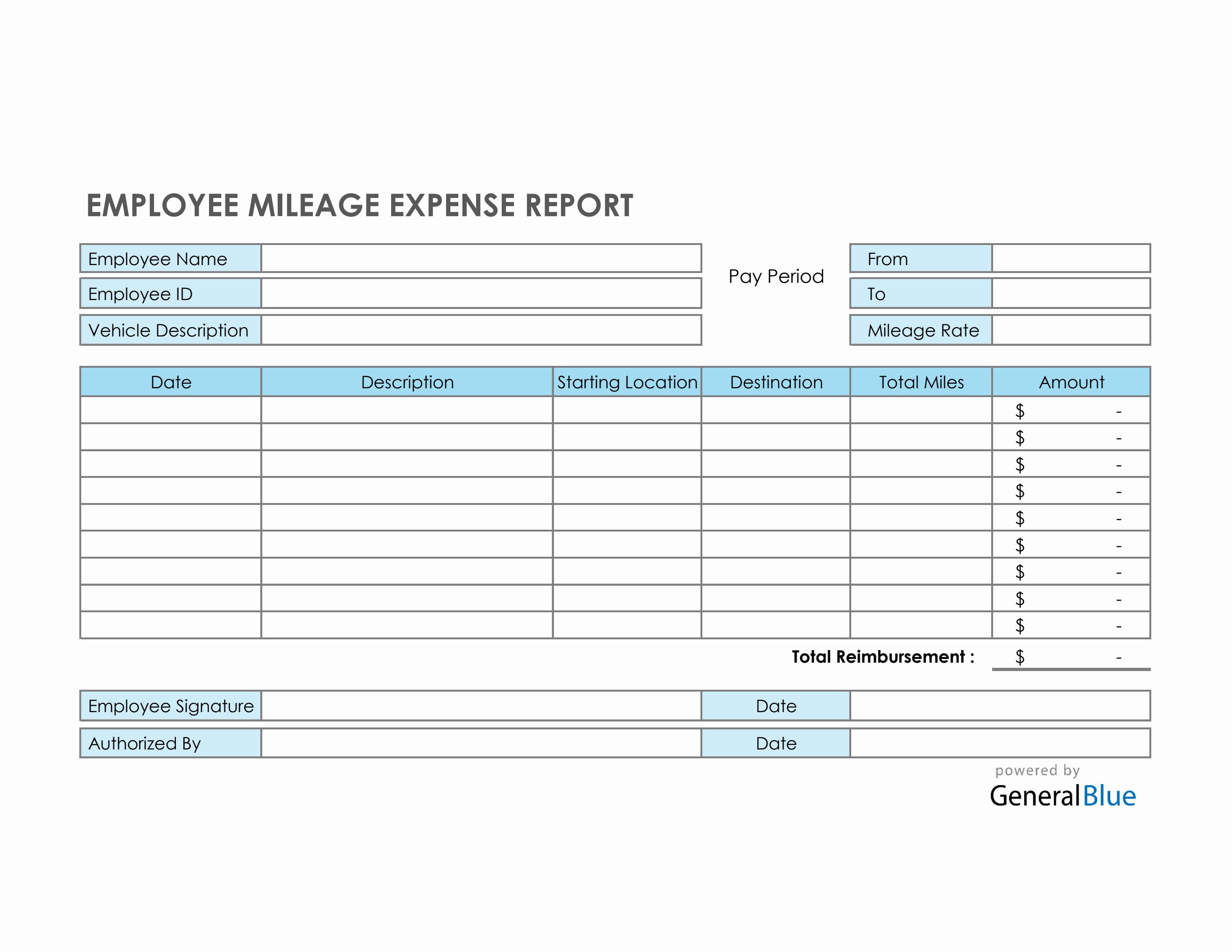

Employee Mileage Expense Report Template In Word

https://www.generalblue.com/employee-mileage-expense-report-template/p/thg4d64xv/f/employee-mileage-expense-report-template-in-word-lg.png?v=cb4277b7c9f1be7f63926ed6542bdce5

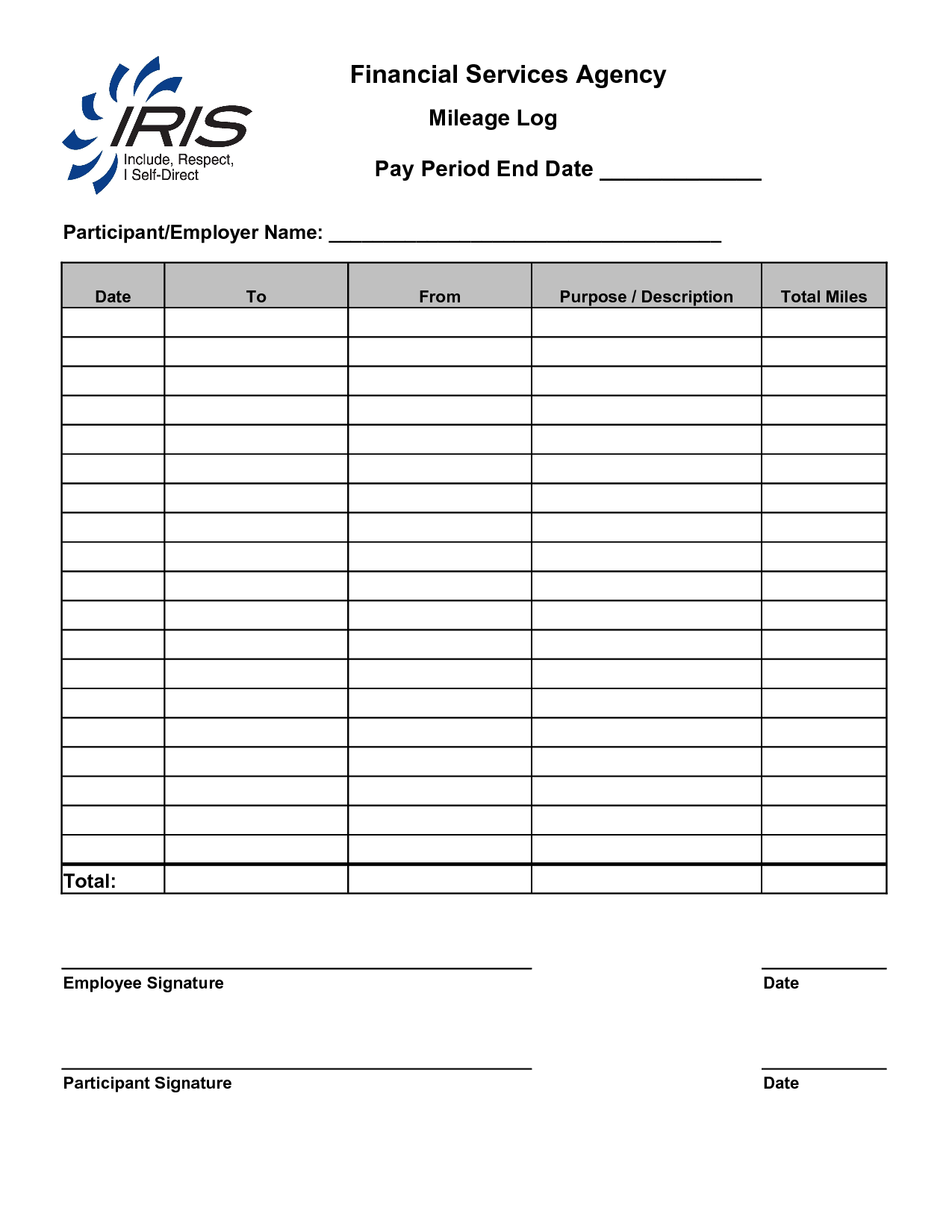

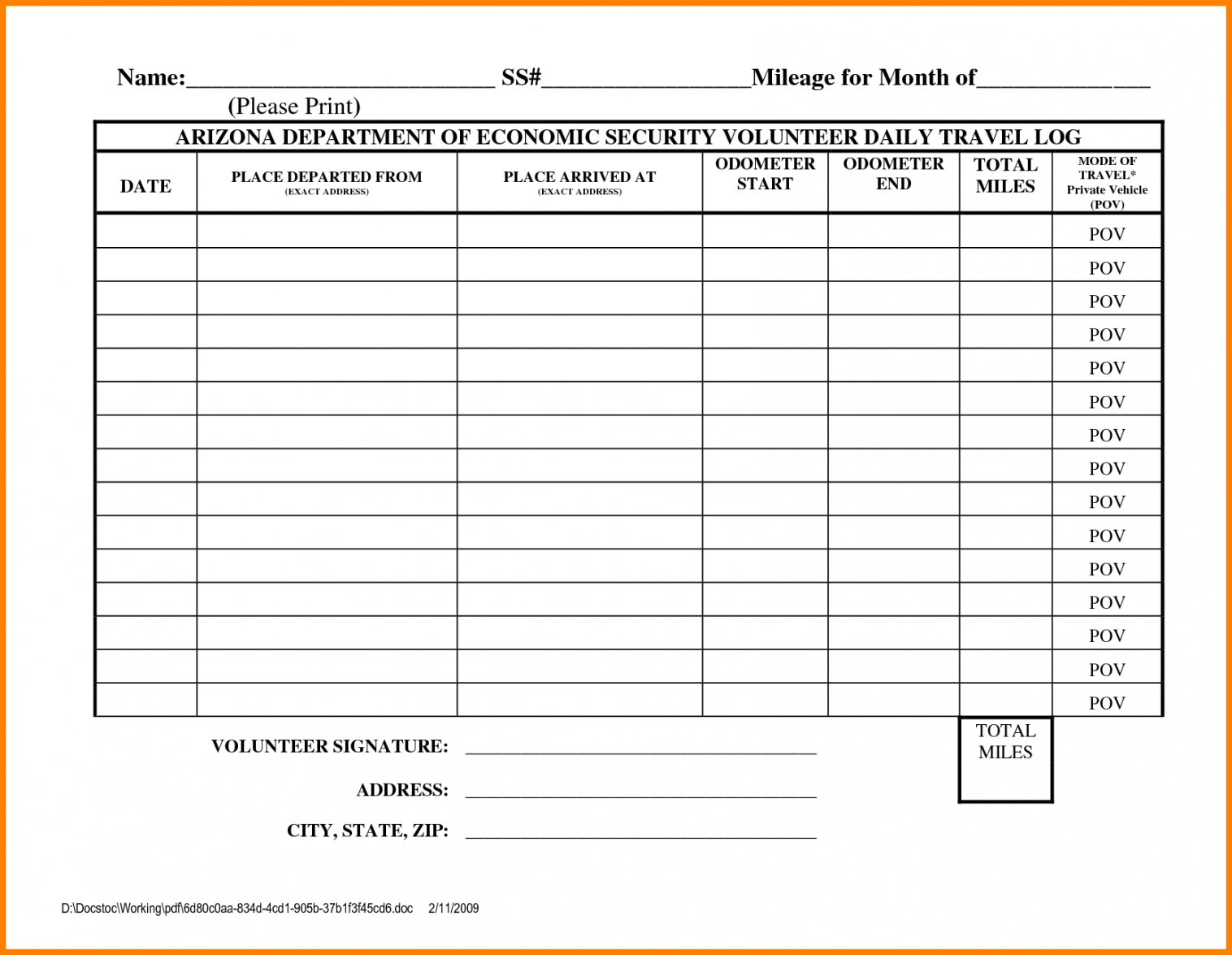

Where you provide allowances based on the number of kilometres driven calculated using a reasonable per kilometre rate your employees have to file expense claims with you on an ongoing basis starting at the beginning of the year See the business driving reimbursement rules in Canada learn what to expect from your employer how to log mileage and report to your employer for reimbursement

You must not have claimed actual expenses after 1997 for a car you lease To use the standard mileage rate for a car you own you must choose to use it in the first year the car is available for use in your business Mileage reimbursement is a compensation process through which employees are reimbursed for using their personal vehicles during work related activities such as going to client meetings training and work related shopping Notably it doesn t include travel from home to a regular workplace

Download Mileage Expense Claim Rules

More picture related to Mileage Expense Claim Rules

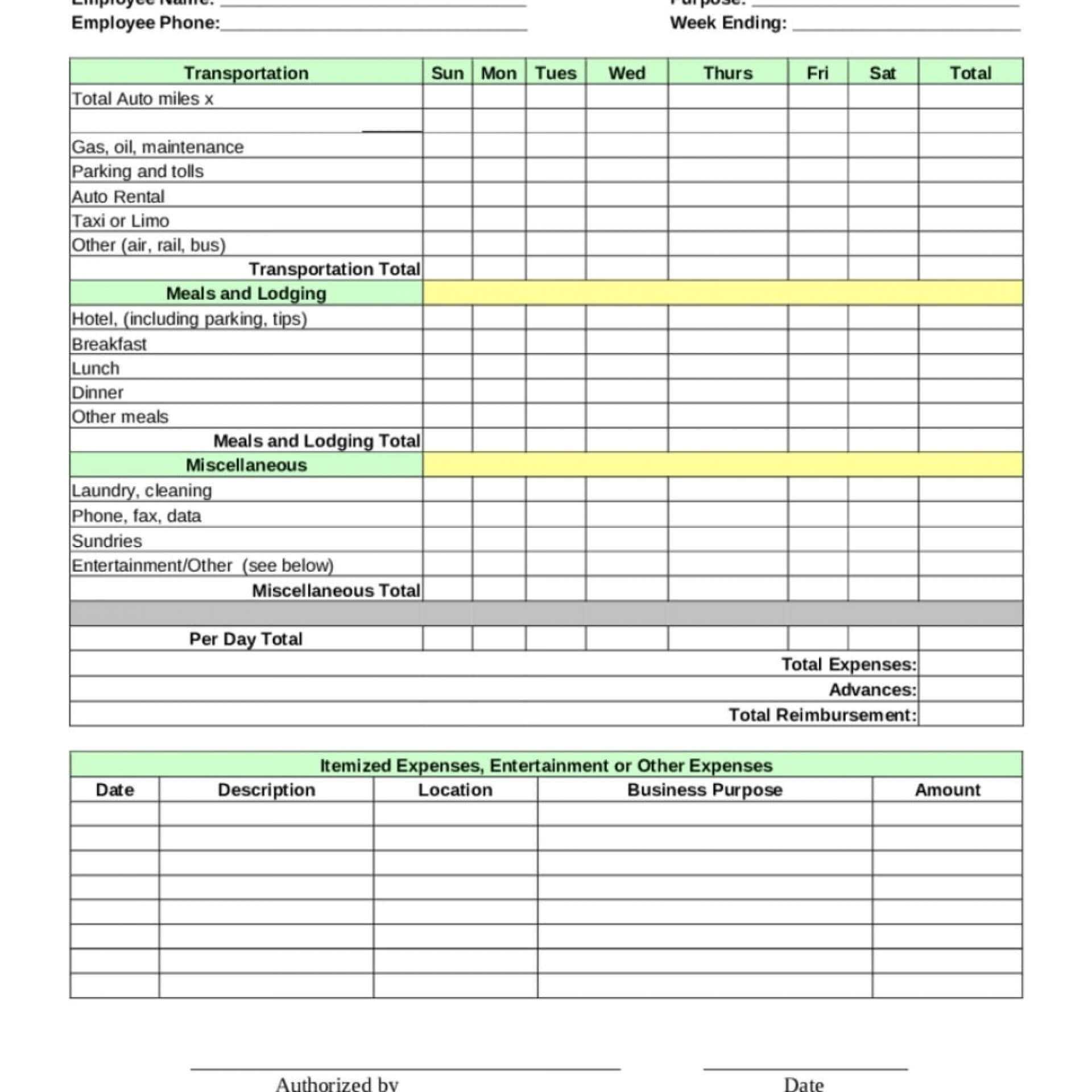

18 Mileage Expense Worksheets Worksheeto

https://www.worksheeto.com/postpic/2013/05/gas-mileage-log-sheet-printable_557927.png

Expense Account Free Of Charge Creative Commons Lever Arch File Image

https://pix4free.org/assets/library/2021-02-04/originals/expense_account.jpg

Mileage Reimbursement Form In Word Basic

https://www.generalblue.com/mileage-reimbursement-form/p/tgh4jt2v2/f/basic-mileage-reimbursement-form-in-word-md.png?v=5b4b7d0371aad301b5653aedb5b309e2

You can claim a section 179 deduction and use a depreciation method other than straight line only if you don t use the standard mileage rate to figure your business related car expenses in the year you first place a car in service This article will guide you through the main rules you should be aware of as an employer paying out mileage allowance as an employee receiving the payments and as self employed claiming deductions

The standard mileage rates for 2023 are Self employed and business 65 5 cents mile Charities 14 cents mile Medical 22 cents mile Moving military only 22 cents mile Find out when you can deduct vehicle mileage HMRC mileage claim rules allow you to claim expenses connected with driving your personal vehicle for business purposes Also known as Mileage Allowance Relief MAR HMRC mileage claims help reduce your tax obligations

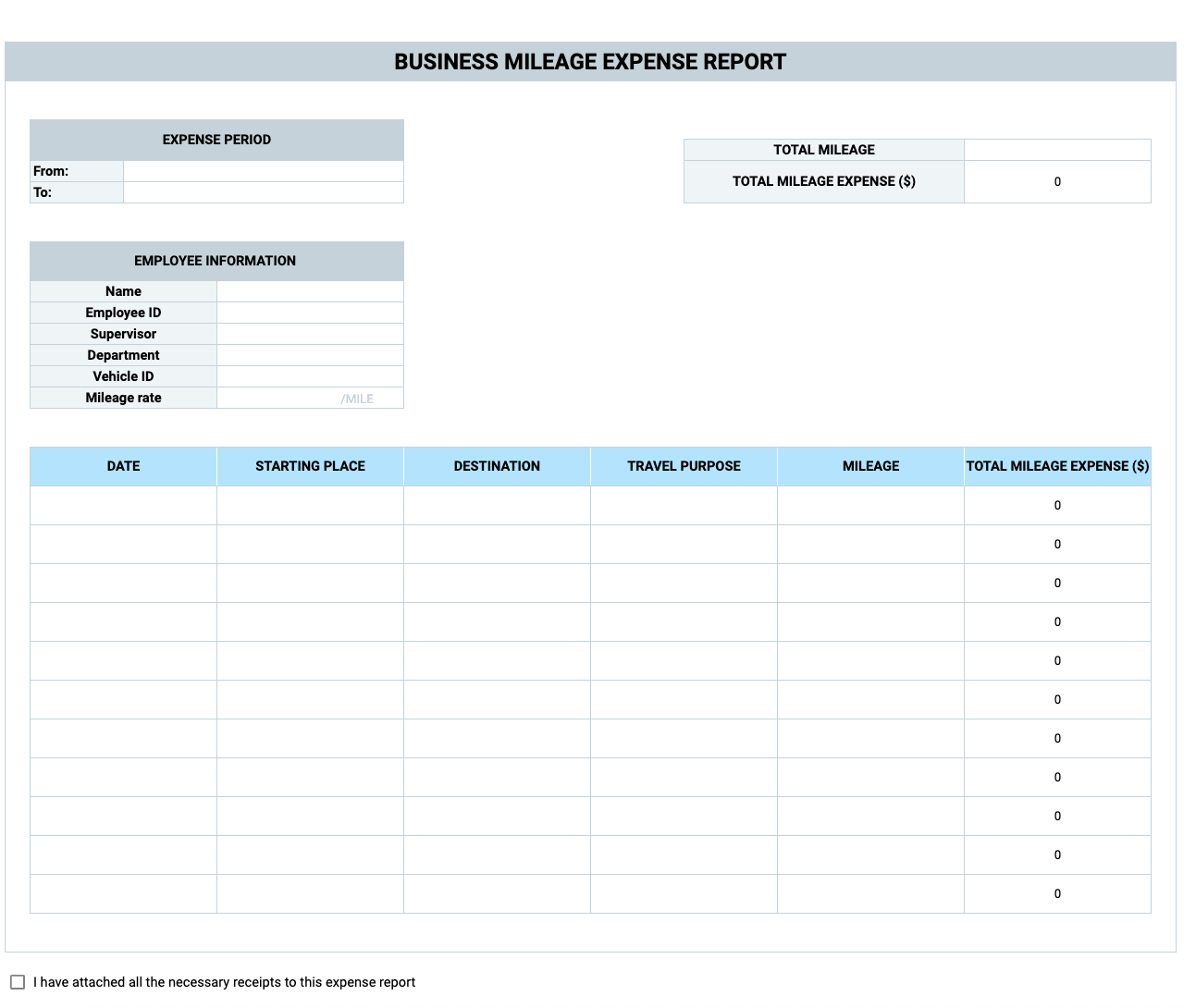

Employee Mileage Expense Report Template In Excel

https://www.generalblue.com/employee-mileage-expense-report-template/p/t5hq3xx8g/f/employee-mileage-expense-report-template-in-excel-lg.png?v=f4409e1f21d6669750bc34151b7ac46e

Expense Claim Form In Word Simple FREE 32 Claim Form Templates In

https://ops-syndicate.com/1840b13d/https/342fdf/www.generalblue.com/expense-claim-form/p/tg5d9br4p/f/simple-expense-claim-form-in-word-lg.png?v=fbf6feedb36b98a7671228fc6d06360c

https://www.businessnewsdaily.com/15891-mileage...

Here s what you need to know about mileage reimbursement to ensure you fulfill your legal obligations as an employer

https://www.uschamber.com/co/run/finance/employee...

No federal law requires you to reimburse your employees for using their personal vehicles for work but some state laws do California Illinois and Massachusetts require companies to reimburse their employees

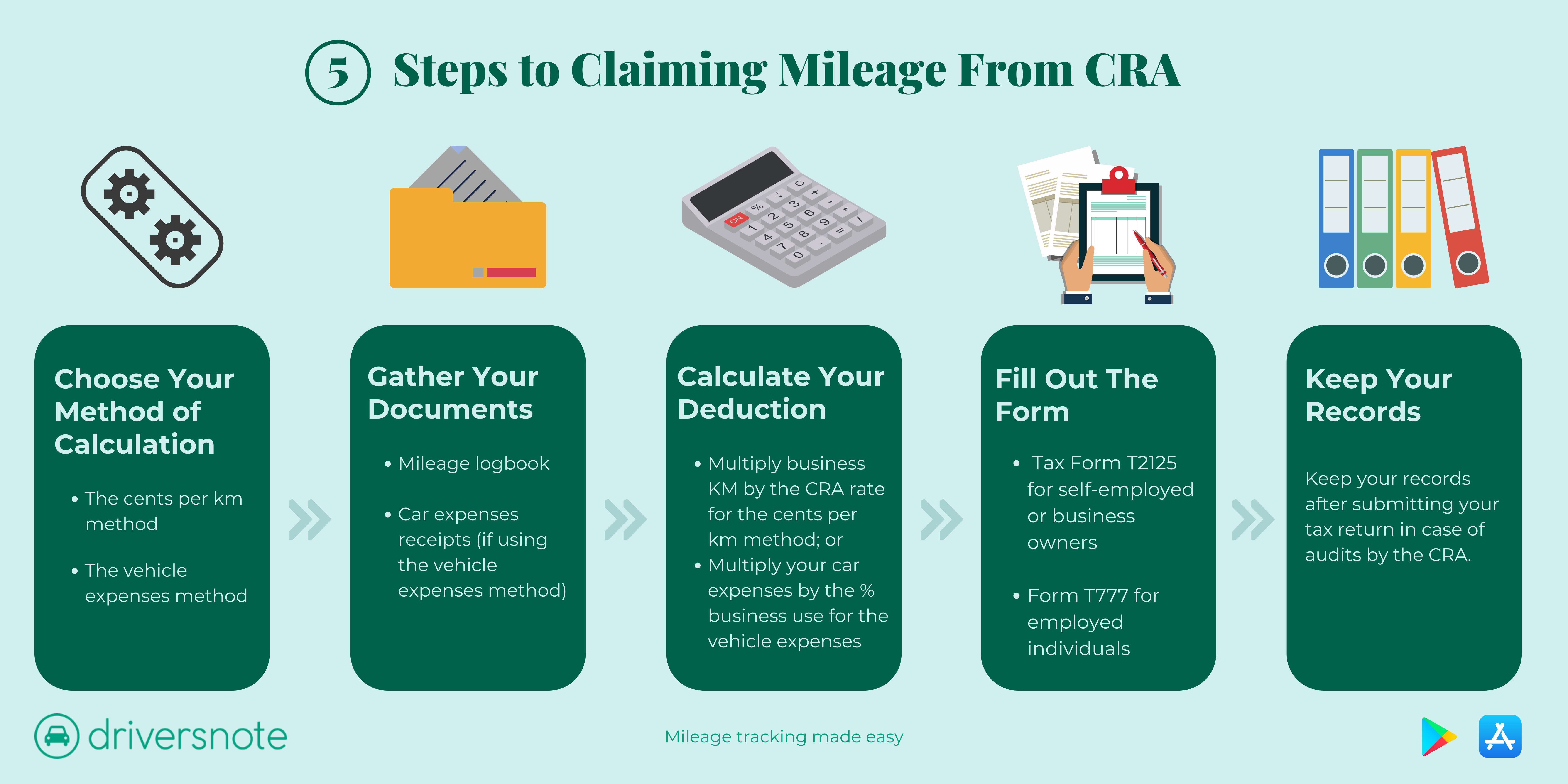

Step By Step How To Claim Motor Vehicle Expenses From The CRA

Employee Mileage Expense Report Template In Excel

Gas Mileage Expense Report Template

18 Best Images Of Mileage Expense Worksheets Free Regarding Medical

Clockify Expense Report Templates 2023

Free Expenses Claim Form Excel Template Download Excel Templates

Free Expenses Claim Form Excel Template Download Excel Templates

28 Expense Reimbursement Form Template In 2020 Invoice Template Word

Expense Claim Form Template Double Entry Bookkeeping

Mileage Expense Form Template Free SampleTemplatess SampleTemplatess

Mileage Expense Claim Rules - Mileage reimbursement is a compensation process through which employees are reimbursed for using their personal vehicles during work related activities such as going to client meetings training and work related shopping Notably it doesn t include travel from home to a regular workplace