Mileage Reimbursement Vs Gas Reimbursement In this guide we ll explore gas card vs mileage reimbursement covering the pros and cons of each to help you make an informed decision We will also examine how Timeero can play a pivotal role in streamlining your

How is mileage reimbursement calculated The IRS sets a standard mileage reimbursement rate of 58 5 cents per business mile driven in 2022 This rate is based on an Most businesses use the standard mileage rate as a benchmark for setting their own mileage reimbursement policies The standard mileage reimbursement rate fluctuates from year to year

Mileage Reimbursement Vs Gas Reimbursement

Mileage Reimbursement Vs Gas Reimbursement

https://companymileage.com/wp-content/uploads/2019/05/mileage-reimbursement-vs-car-allowance.jpg

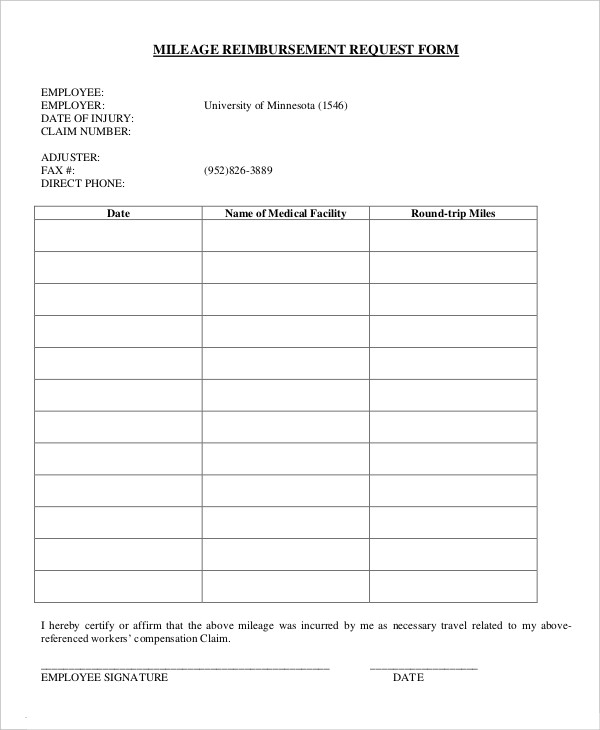

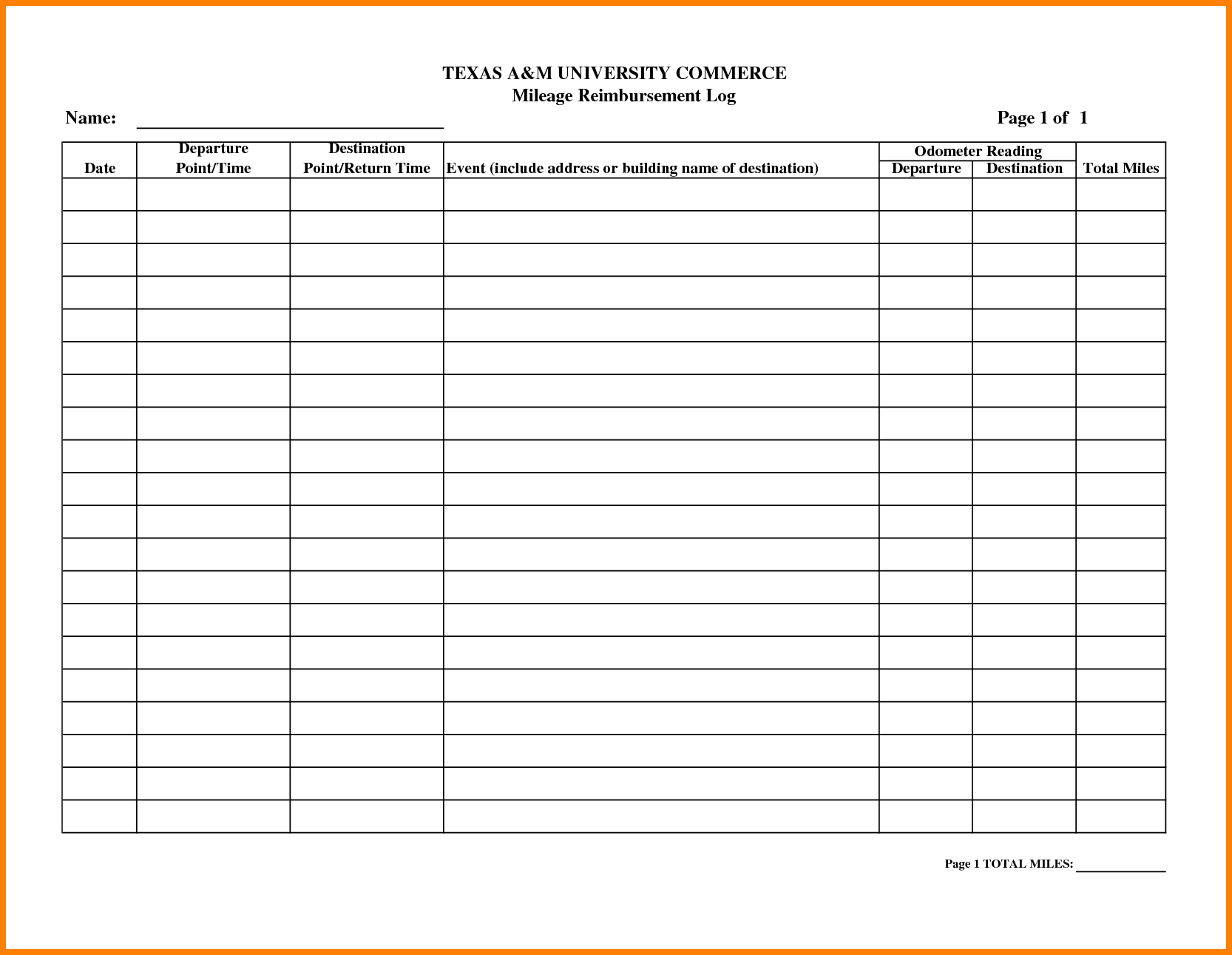

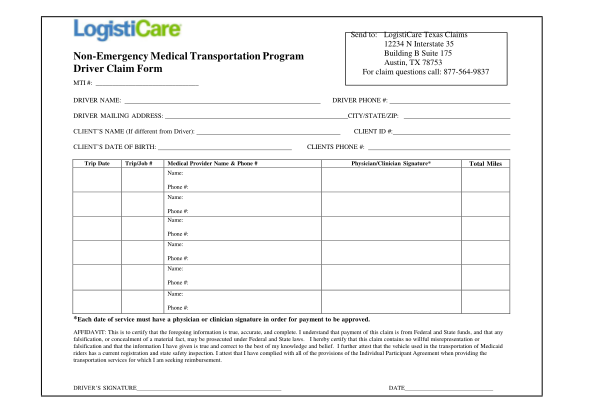

Mileage Reimbursement Form Template Charlotte Clergy Coalition

http://charlotteclergycoalition.com/wp-content/uploads/2018/08/mileage-reimbursement-form-template-mileage-reimbursement-form-template-mileage-reimbursement-form-9-free-sample-example-format-free.jpg

Mileage Reimbursement Form Template Charlotte Clergy Coalition

https://www.charlotteclergycoalition.com/wp-content/uploads/2018/08/mileage-reimbursement-form-template-mileage-reimbursement-form-1-1.jpg

Does Mileage Reimbursement Include Gas Expenses A mileage reimbursement includes reimbursement for using your car van pickup or panel truck for company business Mileage reimbursement is intended to cover all the costs associated with operating a vehicle for business purposes including wear and tear on the car as well as gas costs Employers who reimburse mileage should not also

Car allowance vs mileage reimbursement What s the difference A car allowance is a periodic stipend paid to an employee for using a vehicle It is usually taxable A mileage reimbursement is a cents per mile rate multiplied Mileage reimbursement typically covers a broader range of expenses related to using a personal vehicle for work while gas reimbursement specifically reimburses employees for fuel costs Employers can combine these

Download Mileage Reimbursement Vs Gas Reimbursement

More picture related to Mileage Reimbursement Vs Gas Reimbursement

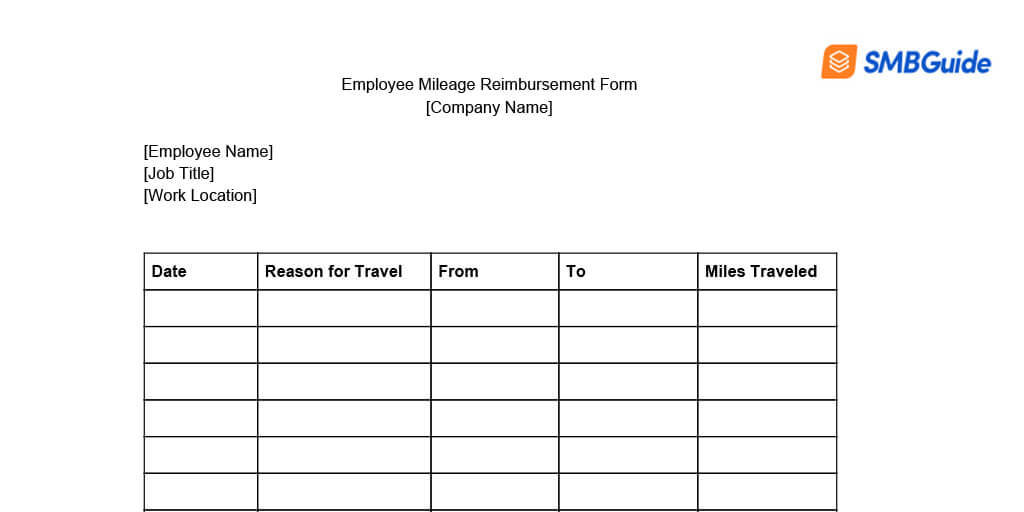

Mileage Reimbursement For Employees Info Free Download

https://www.thesmbguide.com/images/employee-mileage-reimbursement-form-1024x512-20181119.jpg

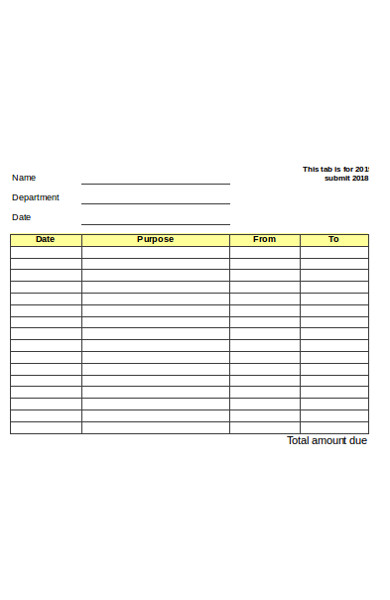

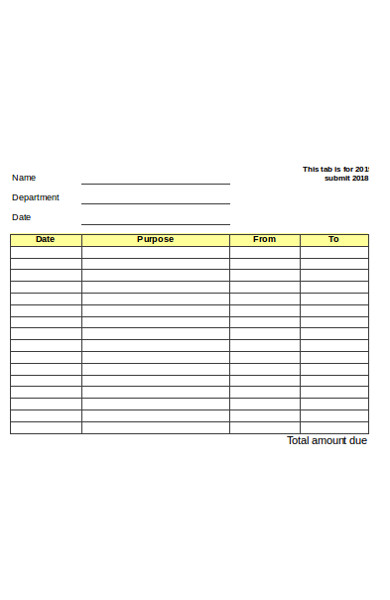

Mileage Reimbursement Form Excel Charlotte Clergy Coalition

http://www.charlotteclergycoalition.com/wp-content/uploads/2018/08/mileage-reimbursement-form-excel-template-business-mileage-reimbursement-form-request-template-sample.jpg

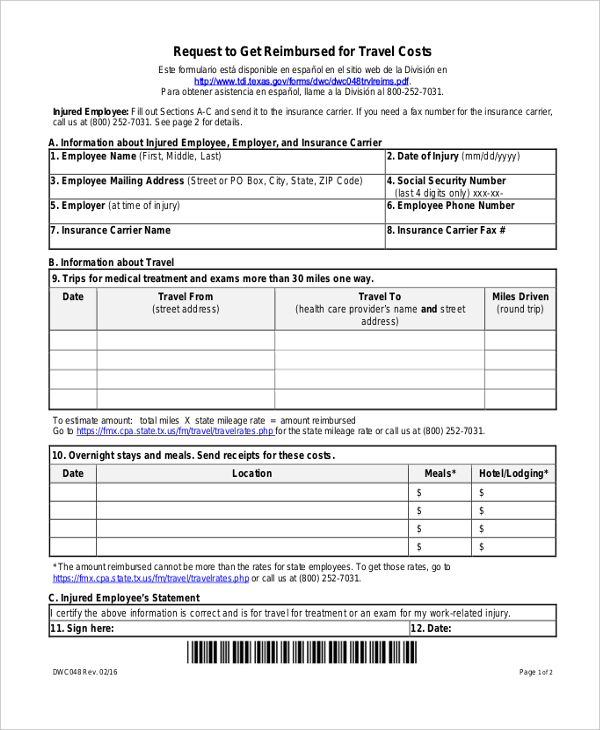

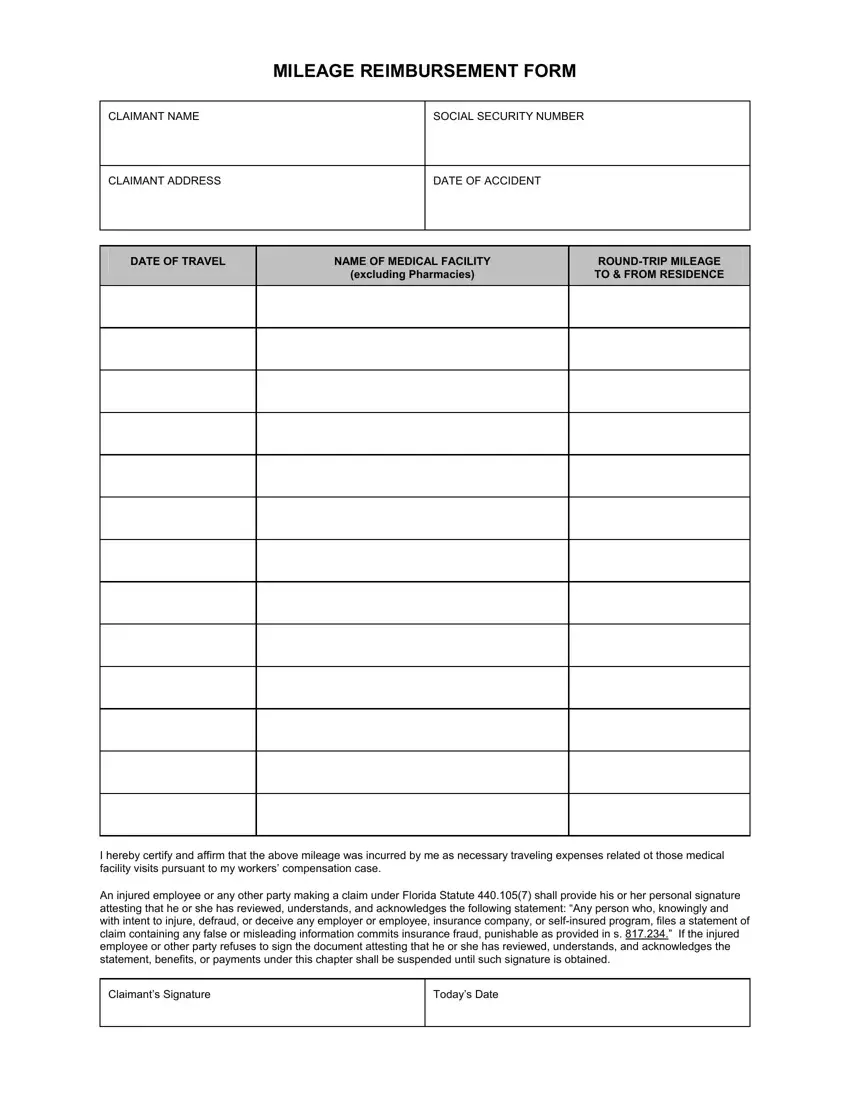

Mileage Reimbursement Form Pdf FREE DOWNLOAD Elsevier Social Sciences

https://i2.wp.com/images.sampletemplates.com/wp-content/uploads/2016/11/25163519/Workers-Compensation-Mileage-Reimbursement-Form.jpg?w=640&ssl=1

Particularly when it comes to clinical trials patients will travel hundreds of miles racking up high gas costs and adding wear and tear to their vehicle A patient recently handed me five pages of gas receipts in order to obtain gas and What is the federal mileage reimbursement rate for 2024 The IRS sets a standard mileage rate each year to simplify mileage reimbursement The IRS mileage rate in 2024 is 67 cents per mile for business use This rate

Learn the ins and outs of employee mileage reimbursement IRS tax deduction rates and how an organization can adopt its own mileage policies Learn more about the differences between the IRS standard mileage rate reimbursement the FAVR method and mileage allowance and when your reimbursement may

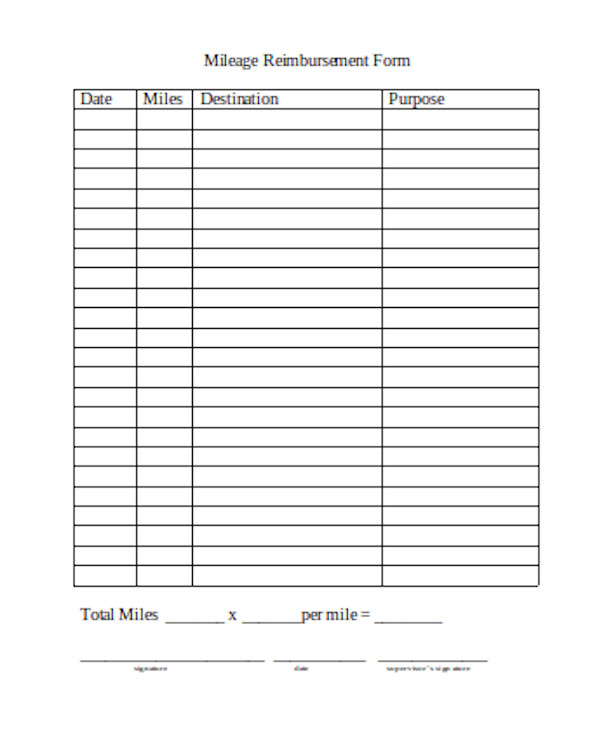

Mileage Reimbursement Form 8 Download Free Documents In PDF Word

http://images.sampletemplates.com/wp-content/uploads/2016/02/24130455/Mileage-Reimbursement-Form.jpg

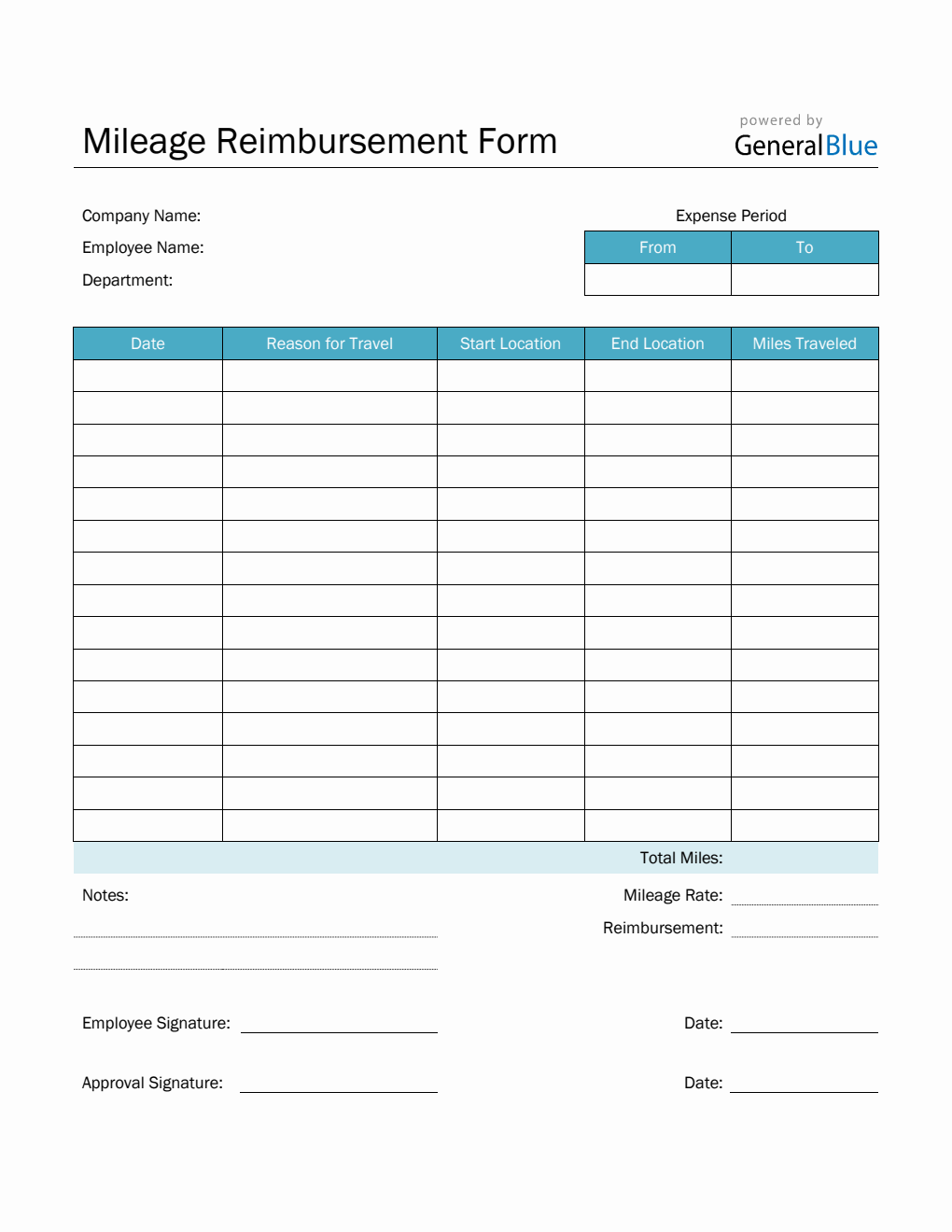

Mileage Reimbursement Form Excel Excel Templates

https://images.sampleforms.com/wp-content/uploads/2016/08/Basic-Mileage-Reimbursement-Form.jpg

https://timeero.com › post › gas-card-vs-mil…

In this guide we ll explore gas card vs mileage reimbursement covering the pros and cons of each to help you make an informed decision We will also examine how Timeero can play a pivotal role in streamlining your

https://www.uschamber.com › co › run › finance › employee...

How is mileage reimbursement calculated The IRS sets a standard mileage reimbursement rate of 58 5 cents per business mile driven in 2022 This rate is based on an

Car Allowance Vs Mileage Reimbursement

Mileage Reimbursement Form 8 Download Free Documents In PDF Word

Mileage Reimbursement 2023 Form Printable Forms Free Online

Mileage Reimbursement Forms Charlotte Clergy Coalition

FREE 9 Sample Mileage Reimbursement Forms In PDF Word Excel

FREE 12 Mileage Reimbursement Forms In PDF Ms Word Excel

FREE 12 Mileage Reimbursement Forms In PDF Ms Word Excel

27 Gas Mileage Reimbursement Form Page 2 Free To Edit Download

Mileage Reimbursement Form In Word Basic

Mileage Reimbursement Form Fill Out Printable PDF Forms Online

Mileage Reimbursement Vs Gas Reimbursement - Mileage reimbursement is intended to cover all the costs associated with operating a vehicle for business purposes including wear and tear on the car as well as gas costs Employers who reimburse mileage should not also