Mileage Tax Deduction 2022 Verkko 17 marrask 2023 nbsp 0183 32 Decision of the Tax Administration on tax exempt allowances for travel expenses in 2023 Kilometre allowance for driving a motor vehicle Reimbursement in the form of kilometre allowance is paid to employees who drive their car paying the vehicle costs personally when they go on a work trip

Verkko 9 kes 228 k 2022 nbsp 0183 32 WASHINGTON The Internal Revenue Service today announced an increase in the optional standard mileage rate for the final 6 months of 2022 Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes Verkko 25 marrask 2021 nbsp 0183 32 All terrain quadbike 104 cents Motorcycle 35 cents Moped 19 cents Other means of transport 11 cents If other persons for whose transport the employer is responsible travel in a vehicle owned or held by the employee the maximum allowance referred to in paragraph 1 is raised by 3 cents per Km and passenger

Mileage Tax Deduction 2022

Mileage Tax Deduction 2022

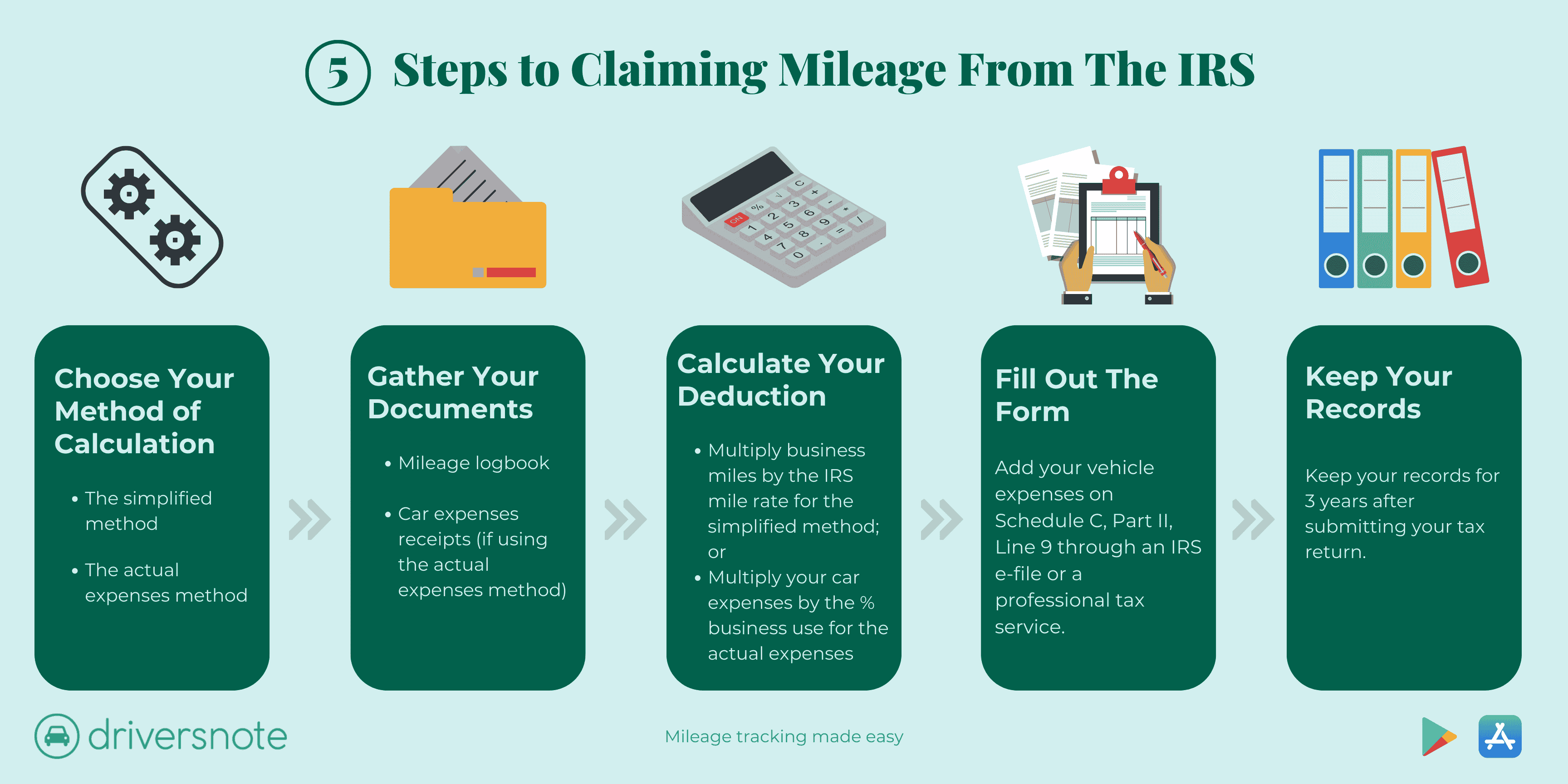

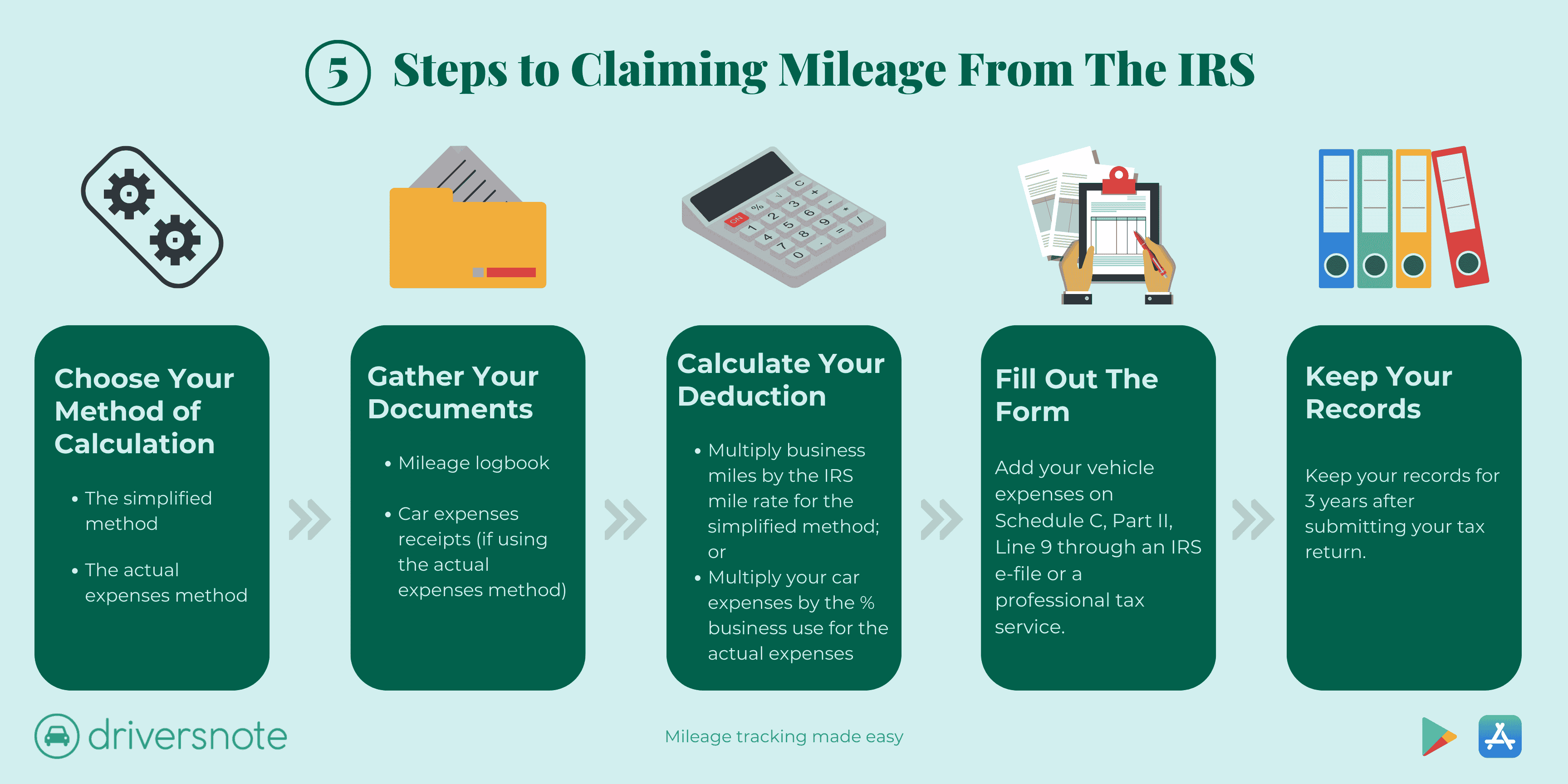

https://storage.googleapis.com/driversnote-marketing-pages/US-infographic-how-to-deduct-mileage-landscape.png

13 Proven Mileage Tax Deduction Tips The Handy Tax Guy

https://www.handytaxguy.com/wp-content/uploads/2014/04/My-way-or-Highway.jpg

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

Verkko The standard mileage tax deduction rate is set by the IRS every year and this is the deductible rate for your drives What are the standard mileage tax deduction rates after 2022 For 2023 the standard mileage rates are 65 5 cents per mile for business up 3 cents from the midyear increase of 2022 Verkko Standard mileage rate For 2022 the standard mileage rate for the cost of operating your car for business use is 58 5 cents 0 585 per mile from January 1 June 30 and 62 5 cents 0 625 per mile from July 1 December 31 Car expenses and use of the standard mileage rate are explained in chapter 4 Depreciation limits on cars trucks and vans

Verkko 17 jouluk 2021 nbsp 0183 32 Standard Optional Mileage Rates for 2022 For 2022 the business mileage rate is 58 5 cents per mile medical and moving expenses driving is 18 cents per mile and charitable driving is 14 Verkko 17 jouluk 2021 nbsp 0183 32 In Notice 22 03 the IRS lists the standard mileage rates effective January 1 2022 Business use 58 5 cents a mile in 2022 up 2 5 cents from 56 cents a mile in 2021 Medical use 18 cents

Download Mileage Tax Deduction 2022

More picture related to Mileage Tax Deduction 2022

2018 Mileage Tax Deductions Grant Management Nonprofit Fund Accounting

https://mygrantmanagement.com/wp-content/uploads/2018/09/2018-IRS-STANDARD-MILEAGE-DEDUCTION-1.png

How To Get A Business Mileage Tax Deduction Small Business Bookkeeping

https://i.pinimg.com/originals/b4/03/b6/b403b6b7cb3715acc824f79e94ddae2d.jpg

IRS Finally Boosts Mileage Deduction For Rest Of 2022 Standard Mileage

https://i.ytimg.com/vi/9l8O9elspCA/maxresdefault.jpg

Verkko Standard mileage rate The 2022 per mile rate for business use of your vehicle is 58 5 cents 0 585 from January 1 2022 to June 30 2022 and 62 5 cents 0 625 from July 1 2022 to December 31 2022 Depreciation limits on vehicles The depreciation limits apply under section 179 and section 280F Under section 179 Verkko Standard Mileage Rates The following table summarizes the optional standard mileage rates for employees self employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes Find optional standard mileage rates to calculate the

Verkko Or instead of figuring the business part of these actual expenses you may be able to use the standard mileage rate to figure your deduction For 2022 the standard mileage rate is 58 5 cents per mile before July 1 2022 and Verkko 17 jouluk 2021 nbsp 0183 32 Standard mileage rates for 2022 released December 17 The rate for computing the deductible costs of automobiles operated for a business expense purpose under tax code Section 162 is 58 5 cents up 2 5 cents per mile Because the 2017 TCJA Pub L No 115 97 suspended the deduction for miscellaneous itemized deductions

/shutterstock_315151916.driving.business.car_.cropped-5bfc4134c9e77c00519fd5d7.jpg)

This Year s Mileage Tax Deduction

https://www.investopedia.com/thmb/uhRiNpdj6XXfIhDUtNwg0LVVOc0=/680x440/filters:fill(auto,1)/shutterstock_315151916.driving.business.car_.cropped-5bfc4134c9e77c00519fd5d7.jpg

How To Calculate Mileage For Tax Deduction Storia

https://tlwastoria.com/wp-content/uploads/2022/03/mileage-for-tax-deduction.jpg

https://www.vero.fi/en/individuals/vehicles/kilometre_and_per_diem...

Verkko 17 marrask 2023 nbsp 0183 32 Decision of the Tax Administration on tax exempt allowances for travel expenses in 2023 Kilometre allowance for driving a motor vehicle Reimbursement in the form of kilometre allowance is paid to employees who drive their car paying the vehicle costs personally when they go on a work trip

https://www.irs.gov/.../irs-increases-mileage-rate-for-remainder-of-2022

Verkko 9 kes 228 k 2022 nbsp 0183 32 WASHINGTON The Internal Revenue Service today announced an increase in the optional standard mileage rate for the final 6 months of 2022 Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes

Standard Mileage Rates For 2022 New York Society Of Tax Accountants

/shutterstock_315151916.driving.business.car_.cropped-5bfc4134c9e77c00519fd5d7.jpg)

This Year s Mileage Tax Deduction

Tax Deduction Everything You Should Know About TDS And VDS

How To Get A Business Mileage Tax Deduction Small Business Sarah

Standard Deduction On Salary For AY 2022 23 New Tax Route

Mileage Tax Deduction Tracking Log 2019

Mileage Tax Deduction Tracking Log 2019

2021 Mileage Reimbursement Calculator

Mileage Tax Deduction Claim Or Take The Standard Deduction

13 Proven Mileage Tax Deduction Tips The Handy Tax Guy

Mileage Tax Deduction 2022 - Verkko Standard mileage rate For 2022 the standard mileage rate for the cost of operating your car for business use is 58 5 cents 0 585 per mile from January 1 June 30 and 62 5 cents 0 625 per mile from July 1 December 31 Car expenses and use of the standard mileage rate are explained in chapter 4 Depreciation limits on cars trucks and vans