Mileage Tax Rebate Claim Web Government approved mileage allowance relief rates for the 2023 2024 tax year are Car van 163 0 45 per mile up to 10 000 miles 163 0 25 over 10 000 miles If you carry a

Web 9 juin 2023 nbsp 0183 32 The employee can therefore claim tax relief on 163 4 875 the maximum tax free payment available less 163 1 725 amount employer pays 163 3 150 If employees pay tax at the basic rate they can claim Web You claim back tax relief for expenses of employment such as business mileage as part of a tax rebate claim It means keeping track of your mileage expenses and how far you

Mileage Tax Rebate Claim

Mileage Tax Rebate Claim

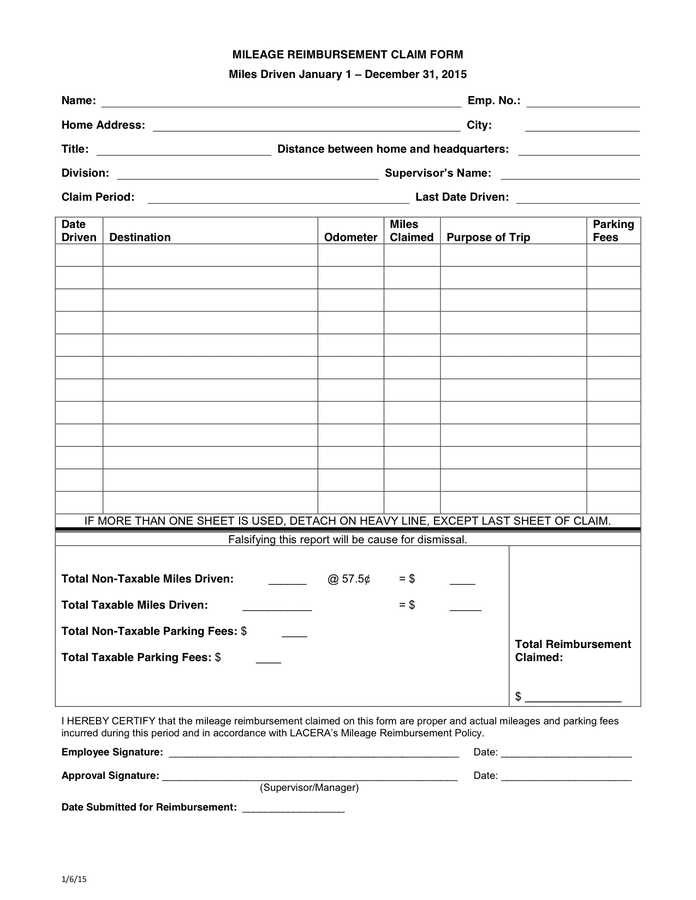

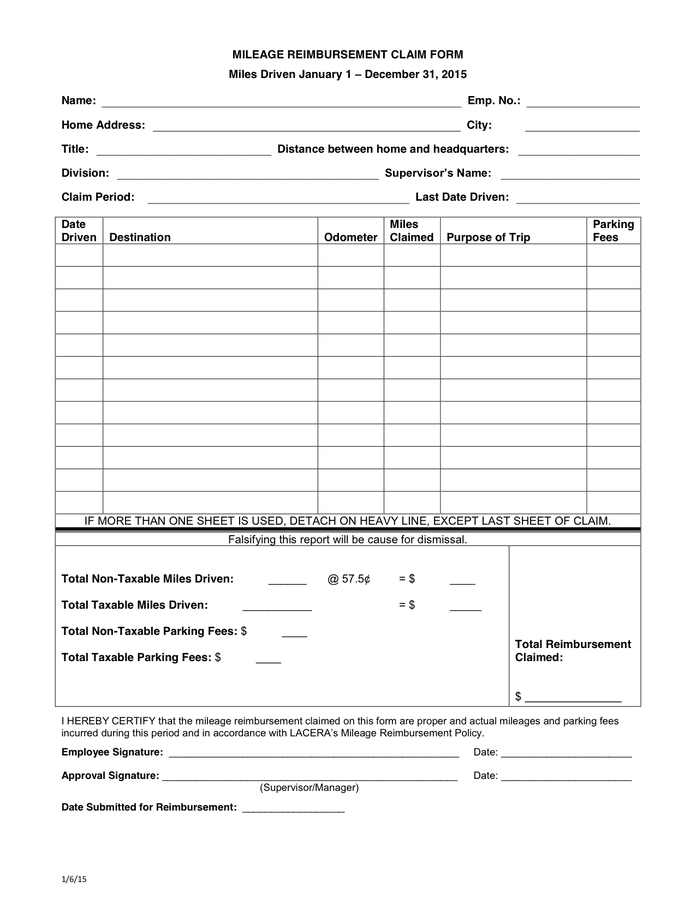

https://static.dexform.com/media/docs/1864/mileage-reimbursement-claim-form_1.png

How To Claim The Work Mileage Tax Rebate Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2019/02/tax-rebate-work-mileage-2.png

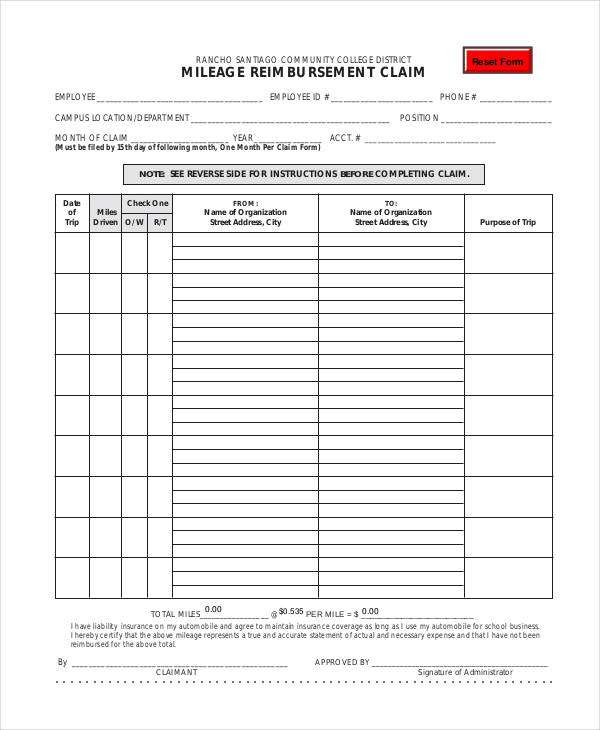

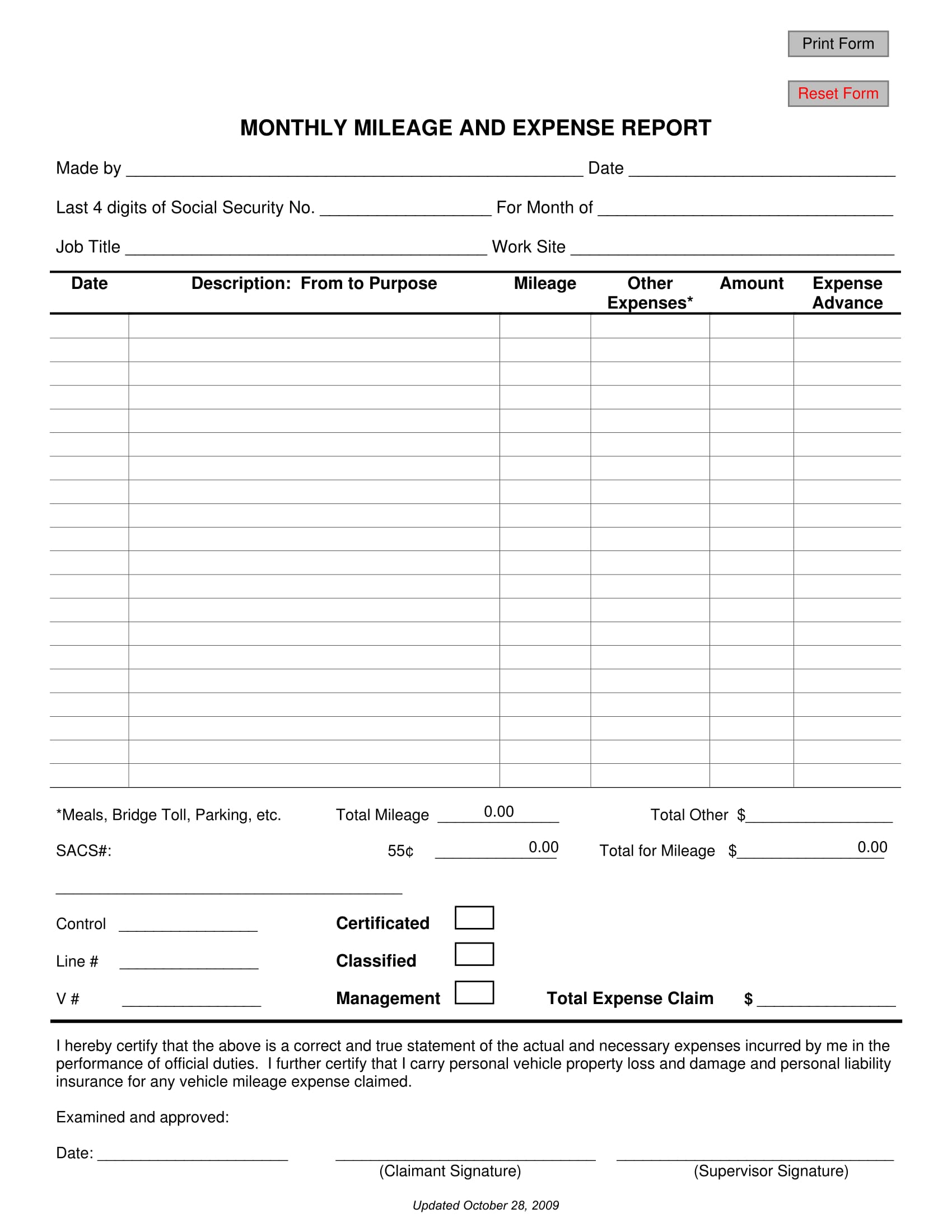

Example Mileage Reimbursement Form Printable Form Templates And Letter

https://i2.wp.com/eforms.com/images/2020/01/IRS-Mileage-Reimbursement-Form.png?fit=1600%2C2070&ssl=1

Web You can claim back 45p per mile for the first 10 000 miles you travel in a year 25p per mile after that The average mileage expenses rebate made with RIFT Tax Refunds is worth Web We provide a easy and quick way for claiming your mileage allowance rebate We only need a few details from you in order for our accountants to review your claim and

Web HMRC won t automatically give you a mileage tax rebate for your travel so you have to claim it back which can be worth 163 3 000 on average when you claim with RIFT Here s Web 30 d 233 c 2019 nbsp 0183 32 Mileage Allowance Payments MAPs Approved Mileage Allowance Payments AMAPs Mileage Allowance Relief MAR Passenger payments Record

Download Mileage Tax Rebate Claim

More picture related to Mileage Tax Rebate Claim

Mileage Reimbursement Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/58/810/58810479/large.png

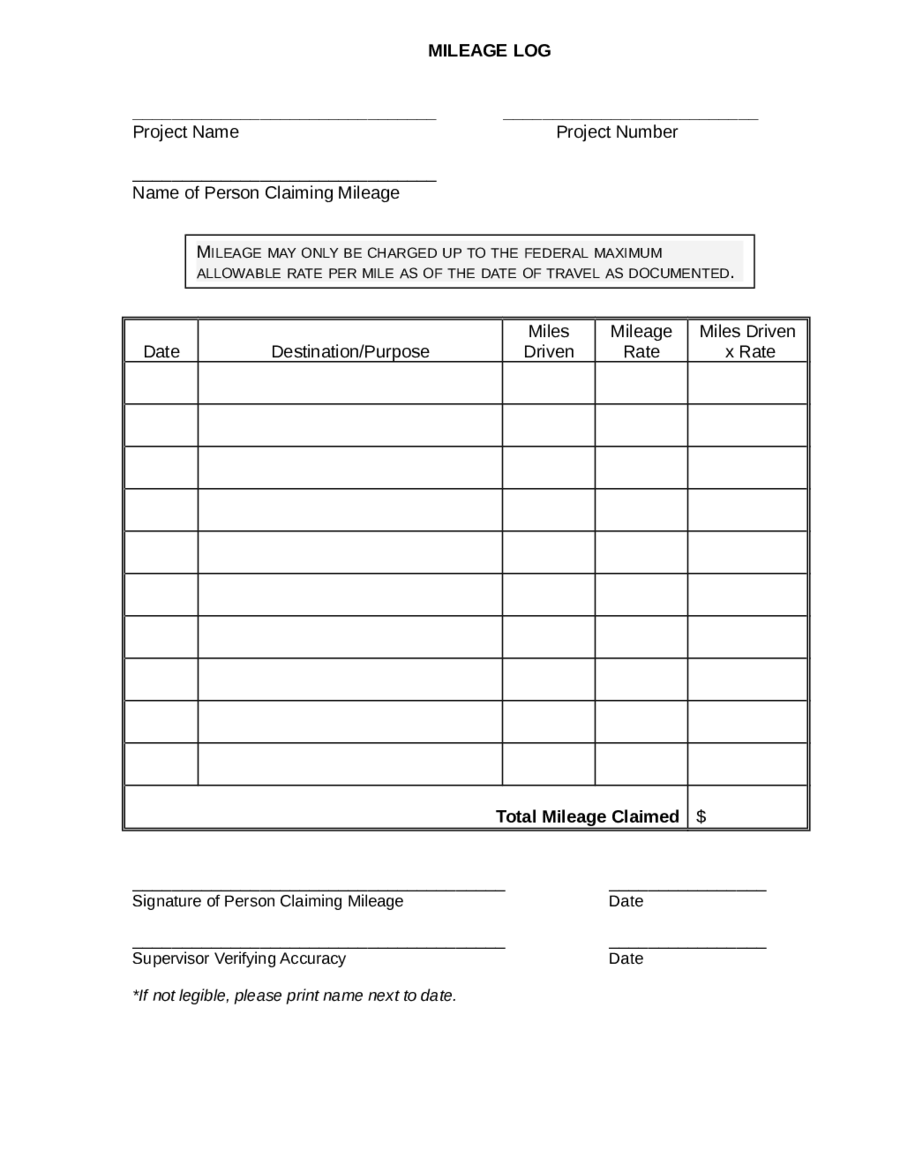

Mileage Log With Reimbursement Form MS Excel Excel Templates

https://www.xltemplates.org/wp-content/uploads/2015/11/mileage-log-with-reimbursement-log.png

How To Claim Mileage On Taxes TaxesTalk

https://www.taxestalk.net/wp-content/uploads/cincinnati-ins-co-claims-how-to-claim-mileage-on-taxes.jpeg

Web Rates and allowances for travel including mileage and fuel allowances From HM Revenue amp Customs Published 13 June 2013 Last updated 5 April 2023 See all updates Get Web 21 mars 2023 nbsp 0183 32 Claiming a deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their travel as a tax

Web 25 juin 2021 nbsp 0183 32 June 25 2021 You can usually claim mileage tax relief on cars vans motorcycles or bicycles that you use for business purposes It applies to vehicles you Web How to Claim the Work Mileage Tax Rebate Find out how to claim a work mileage tax rebate including how to check the tax refund you are eligible to receive which tax form

Mileage Log Template For Taxes Inspirational 2019 Mileage Log Fillable

https://i.pinimg.com/originals/df/61/f1/df61f192a85e1b14ab585b6f451af531.jpg

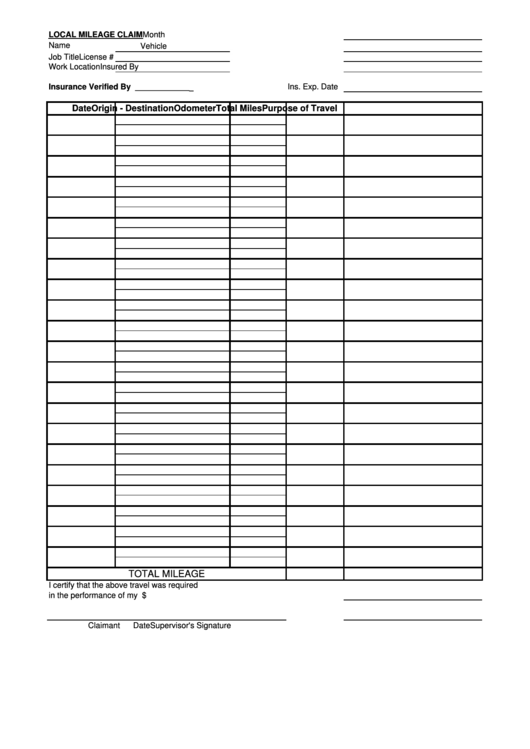

Local Mileage Claim Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/108/1086/108603/page_1_thumb_big.png

https://www.taxrebateservices.co.uk/tax-guides/mileage-allowance...

Web Government approved mileage allowance relief rates for the 2023 2024 tax year are Car van 163 0 45 per mile up to 10 000 miles 163 0 25 over 10 000 miles If you carry a

https://www.gosimpletax.com/blog/car-allowa…

Web 9 juin 2023 nbsp 0183 32 The employee can therefore claim tax relief on 163 4 875 the maximum tax free payment available less 163 1 725 amount employer pays 163 3 150 If employees pay tax at the basic rate they can claim

Sedgwick Mileage Reimbursement Form Fill Out And Sign Printable PDF

Mileage Log Template For Taxes Inspirational 2019 Mileage Log Fillable

FREE 5 Mileage Report Forms In MS Word PDF Excel

FREE 47 Claim Forms In PDF

Mileage Log Template For Taxes New Mileage Spreadsheet For Taxes

FREE 47 Claim Forms In PDF

FREE 47 Claim Forms In PDF

2023 Mileage Log Fillable Printable PDF Forms Handypdf

FREE 50 Sample Claim Forms In PDF MS Word

Vehicle Mileage Log With Reimbursement Form Word Excel Templates

Mileage Tax Rebate Claim - Web 30 d 233 c 2019 nbsp 0183 32 Mileage Allowance Payments MAPs Approved Mileage Allowance Payments AMAPs Mileage Allowance Relief MAR Passenger payments Record