Mileage Tax Rebate Uk Web Government approved mileage allowance relief rates for the 2023 2024 tax year are Car van 163 0 45 per mile up to 10 000 miles 163 0 25 over 10 000 miles If you carry a

Web 3 mars 2016 nbsp 0183 32 the total amount of mileage allowance payments you ve had Using a company vehicle for work You can only claim for your actual fuel costs If any amount is Web Approved mileage rates from tax year 2011 to 2012 to present date From tax year 2011 to 2012 onwards First 10 000 business miles in the tax year Each business mile over

Mileage Tax Rebate Uk

Mileage Tax Rebate Uk

https://i.pinimg.com/originals/df/61/f1/df61f192a85e1b14ab585b6f451af531.jpg

How To Claim The Work Mileage Tax Rebate Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2019/02/tax-rebate-work-mileage-2.png

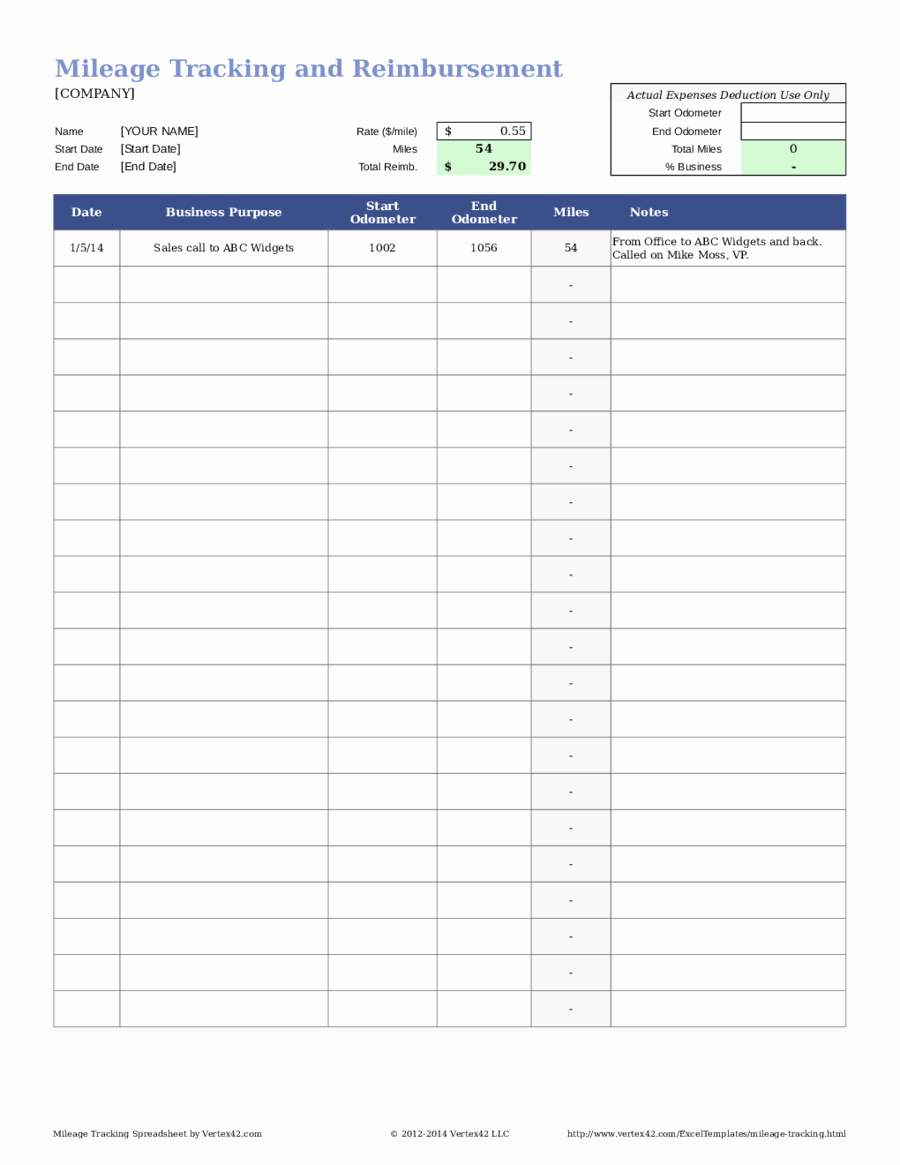

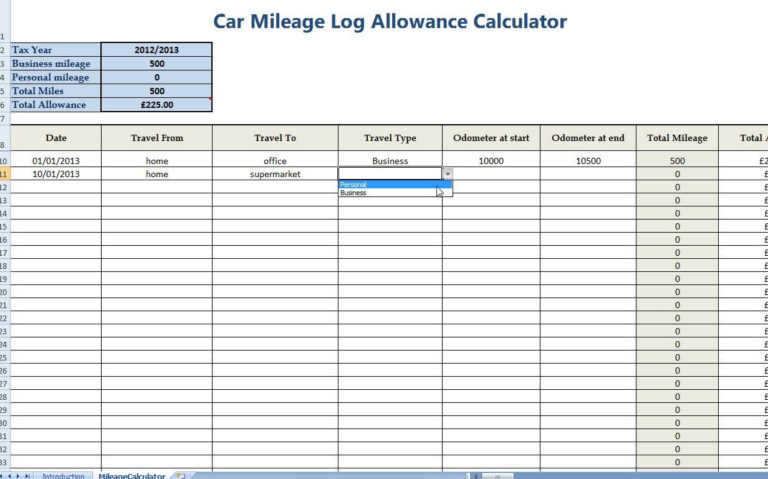

Mileage Log With Reimbursement Form MS Excel Excel Templates Excel

https://i.pinimg.com/originals/89/1b/0a/891b0ad37c9259795ebb74fa88dbb1e0.png

Web 21 juil 2020 nbsp 0183 32 From 1 September 2023 the advisory electric rate for fully electric cars will be 10 pence per mile Hybrid cars are treated as either petrol or diesel cars for advisory fuel Web Kick off your HMRC tax refund claim with RIFT s mileage claim calculator Mileage tax relief is by far the largest part of most tax rebate claims and refund claims can stretch

Web 30 d 233 c 2019 nbsp 0183 32 The approved amount the maximum that can be paid tax free is calculated as the number of miles of business travel by the employee other than as a passenger Web Rates and allowances travel mileage and fuel allowances GOV UK Home

Download Mileage Tax Rebate Uk

More picture related to Mileage Tax Rebate Uk

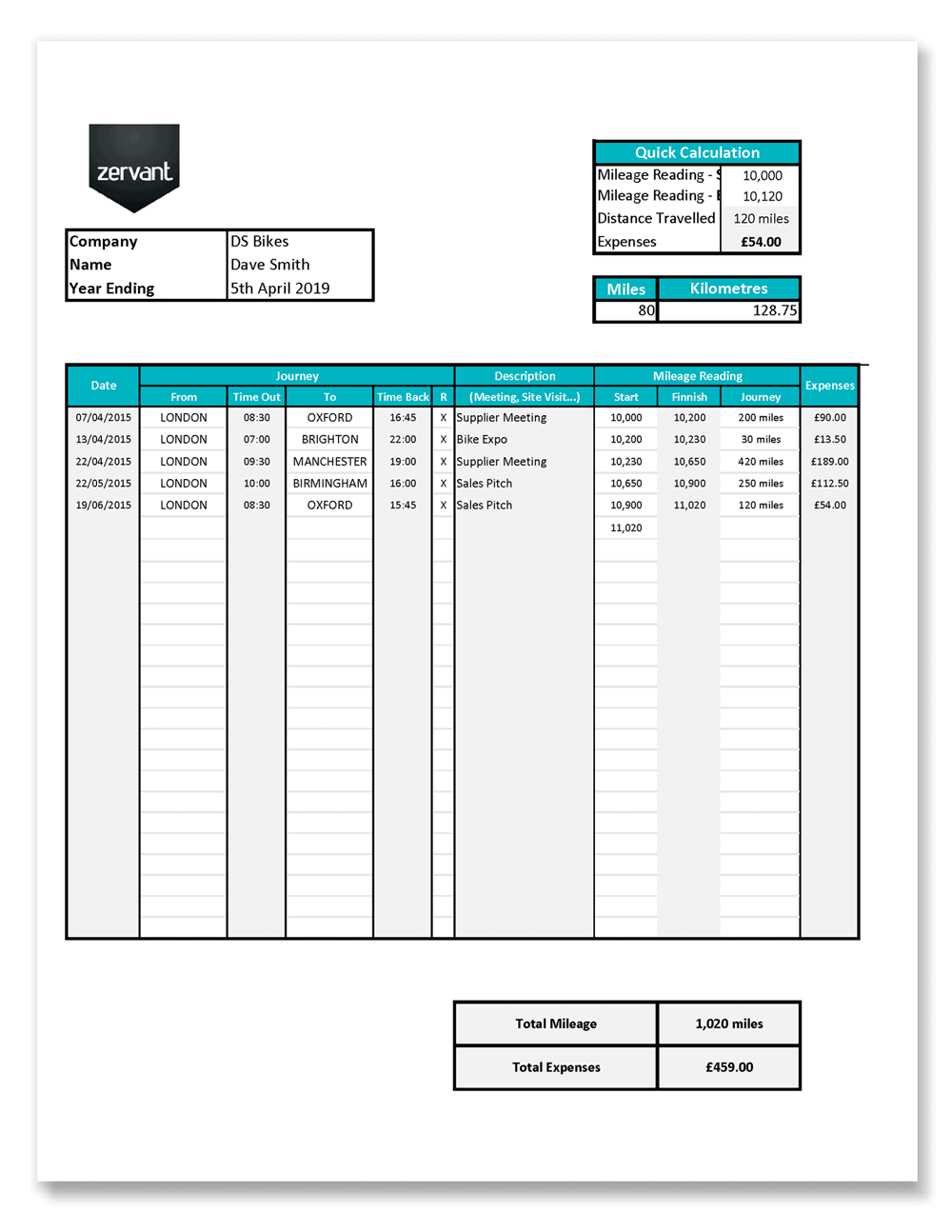

Free UK Mileage Log Zervant Blog

https://www.zervant.com/wp-content/uploads/2015/08/mileage-log-41.png

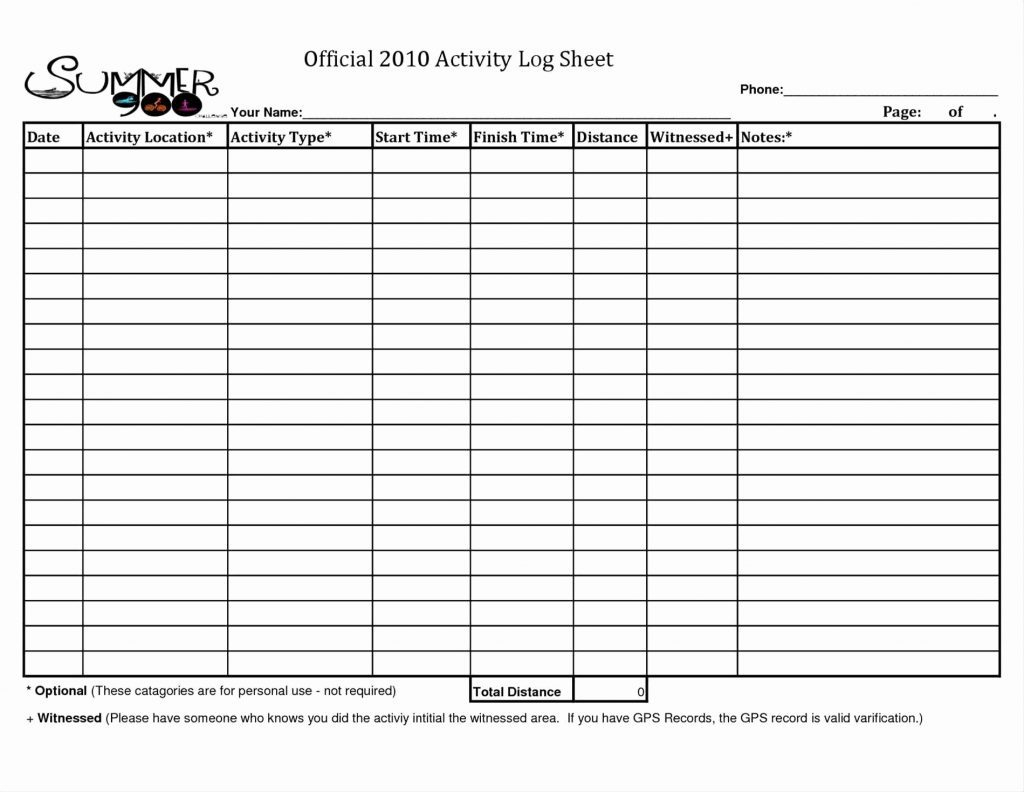

Mileage Log Form For Taxes Awesome 2019 Mileage Log Fillable Printable

https://i.pinimg.com/originals/6f/6b/27/6f6b275a4b34f6b54f6b92e27be13337.jpg

50 Mileage Log Form For Taxes Ufreeonline Template

https://ufreeonline.net/wp-content/uploads/2019/04/mileage-log-form-for-taxes-luxury-2019-mileage-log-fillable-printable-pdf-amp-forms-of-mileage-log-form-for-taxes.png

Web You claim back tax relief for expenses of employment such as business mileage as part of a tax rebate claim It means keeping track of your mileage expenses and how far you Web HMRC won t automatically give you a mileage tax rebate for your travel so you have to claim it back which can be worth 163 3 000 on average when you claim with RIFT Here s a

Web The mileage tax relief calculator uses the current approved mileage rates of 45p per mile for the first 10 000 business miles and 25p per mile for every business mile after that Web Mileage allowance rebate works by reducing your taxable pay based the total number of business miles travelled in the year multiplied by specific Approved Mileage Rates by

Mileage Log Template For Taxes New Mileage Spreadsheet For Taxes

https://i.pinimg.com/originals/74/27/72/74277222a9d4830d0a5d5265e743fb9c.jpg

Work Mileage Allowance Relief Greater Manchester

https://yourtaxrebates.co.uk/wp-content/uploads/2020/12/Pics-2048x1024.png

https://www.taxrebateservices.co.uk/tax-guides/mileage-allowance...

Web Government approved mileage allowance relief rates for the 2023 2024 tax year are Car van 163 0 45 per mile up to 10 000 miles 163 0 25 over 10 000 miles If you carry a

https://www.gov.uk/guidance/claim-income-tax-relief-for-your...

Web 3 mars 2016 nbsp 0183 32 the total amount of mileage allowance payments you ve had Using a company vehicle for work You can only claim for your actual fuel costs If any amount is

Mileage Allowance Relief Calculator CALCULATORUK CVG

Mileage Log Template For Taxes New Mileage Spreadsheet For Taxes

Mileage Spreadsheet Template Record Sheet Uk Gas For Taxes Pertaining

Free Mileage Tracking Log And Mileage Reimbursement Form

8 Printable Mileage Log Templates For Personal Or Commercial Use

Mileage Log Free Printable Printable World Holiday

Mileage Log Free Printable Printable World Holiday

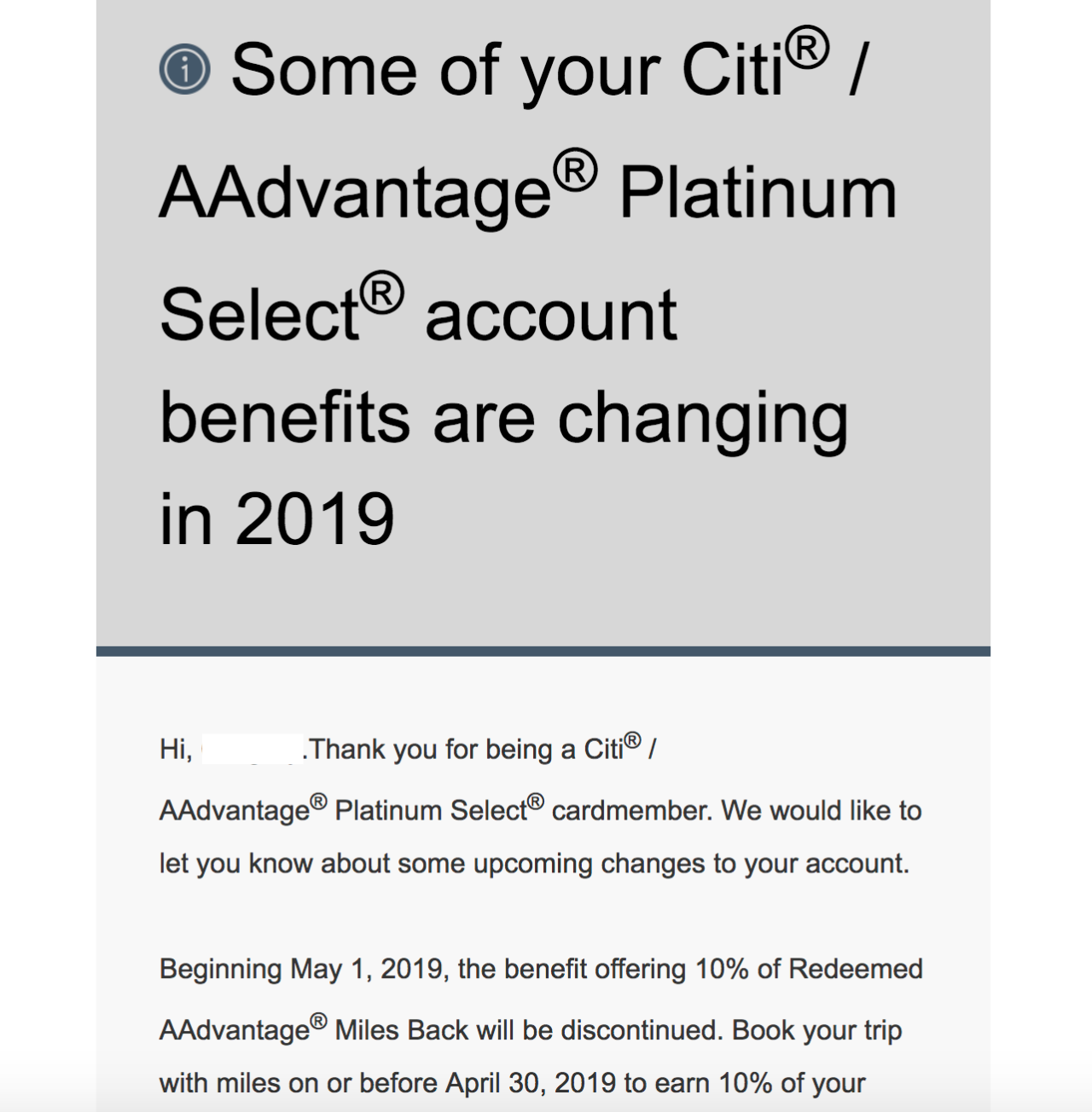

Citi AAdvantage Cards Cutting 10 Mileage Rebate For Awards LaptrinhX

Mileage Spreadsheet Uk Google Spreadshee Mileage Log Spreadsheet Uk

Online Mileage Log Spreadsheet Db excel

Mileage Tax Rebate Uk - Web 30 d 233 c 2019 nbsp 0183 32 The approved amount the maximum that can be paid tax free is calculated as the number of miles of business travel by the employee other than as a passenger