Minimum Medical Expense Tax Deductible For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

Are medical expenses tax deductible Your medical expenses may be tax deductible under certain circumstances If the medical bills you pay out of pocket in a year exceed 7 5 percent of 99 Medical Expenses You Can Deduct in 2024 Written by Charlene Rhinehart CPA Published on March 25 2024 Key takeaways If you itemize

Minimum Medical Expense Tax Deductible

Minimum Medical Expense Tax Deductible

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

Medical Expense Tax Strategy Bunching Medical Expenses For

http://ramsaycpa.com/blog/wp-content/uploads/2017/10/10_03_17_80407780_ITB_560x292.jpg

Are Medical Expenses Tax Deductible Chime

https://www.chime.com/wp-content/uploads/2022/02/shutterstock_1519955696-scaled.jpg

1 You Must Itemize Deductions Itemizing is essential for taking advantage of the medical expense deduction As you file your taxes you have two options either This rule stipulates that taxpayers can only deduct the portion of their total medical expenses that surpasses 7 5 of their AGI For instance if your AGI is

Eligible medical expenses for the medical tax deduction include but are not limited to Transportation costs related to medical care such as a taxi ambulance Updated on January 12 2023 Reviewed by Eric Estevez In This Article View All Photo sturti Getty Images Individuals can claim some of the cost of medical dental and other health care related expenses on tax

Download Minimum Medical Expense Tax Deductible

More picture related to Minimum Medical Expense Tax Deductible

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

https://i.pinimg.com/originals/7b/37/05/7b37052b2fb0ea107a6dd3af15498805.jpg

Deducting Medical Dental Expenses On Your Tax Return PPL CPA

https://www.pplcpa.com/wp-content/uploads/2023/03/MEDICAL-EXPENSE-DEDUCTIBLE.png

Is Director s Medical Expense Tax deductible In Malaysia Apr 26

https://cdn1.npcdn.net/image/1650978457680e089edf19567382624e16a78f6475.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

Are medical expenses tax deductible You can deduct unreimbursed medical and dental expenses for yourself your spouse and your dependents Some of the costs Table of Contents Are medical expenses tax deductible What medical expenses tax deductions can I claim What medical expenses are not deductible Can

Key Takeaways The IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross income In total you must spend more than 7 5 of your Adjusted Gross Income AGI on medical expenses and be able to itemize your deductions in order to possibly

Sars 2022 Weekly Tax Tables Brokeasshome

https://cdn.ymaws.com/www.thesait.org.za/resource/resmgr/docs/01.jpg

Deductible Business Expenses For Independent Contractors Financial

https://www.financialdesignsinc.com/wp-content/uploads/2020/11/Expenses-1.jpg

https://www. nerdwallet.com /article/taxes/me…

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

https://www. bankrate.com /taxes/tax-deducti…

Are medical expenses tax deductible Your medical expenses may be tax deductible under certain circumstances If the medical bills you pay out of pocket in a year exceed 7 5 percent of

Medical Expense Deduction How To Claim A Tax Deduction For Medical

Sars 2022 Weekly Tax Tables Brokeasshome

How Does The Medical Expense Tax Credit Work In Canada

Director Medical Fees Tax Deductible Malaysia Edward Hudson

How To Claim The Medical Expense Deduction On Your Taxes

TaxTips ca Medical Expense Tax Credit METC

TaxTips ca Medical Expense Tax Credit METC

Tax Worksheettax Deductible Expense Logtax Deductions Etsy In 2022

Are Medical Expenses Tax Deductible The TurboTax Blog

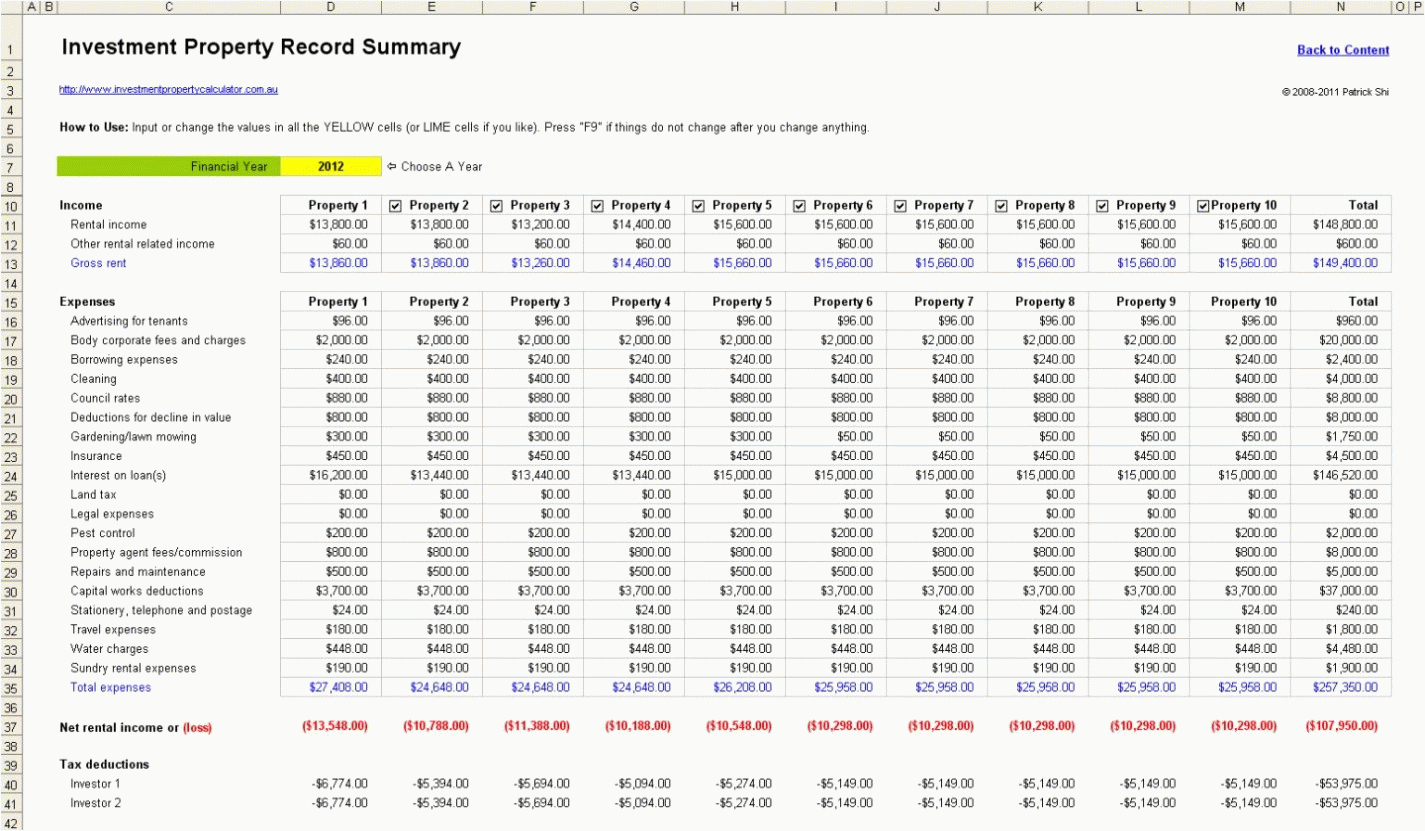

Rental Income Template

Minimum Medical Expense Tax Deductible - Eligible medical expenses for the medical tax deduction include but are not limited to Transportation costs related to medical care such as a taxi ambulance