Minnesota Property Tax Rebate 2024 Property taxes or rent paid on your primary residence in Minnesota Regular Property Tax Refund Income Requirements If you are and You may qualify for a refund of up to A renter Your total household income is less than 73 270 2024 Your property must be classified as your homestead or you must have applied for homestead

2023 Tax Law Updates The 2023 legislative session resulted in a number of changes to Minnesota s tax code including some that affect previous tax years At this time you should not amend any Minnesota returns solely to account for these changes Major changes are summarized below Minnesota allows a property tax credit to renters and homeowners who were residents or part year residents of Minnesota during the tax year 2024 The deadline for claiming the 2023 refund is August 15 2024 The refund will be deposited into the account indicated in the e file process The account cannot be a foreign account

Minnesota Property Tax Rebate 2024

Minnesota Property Tax Rebate 2024

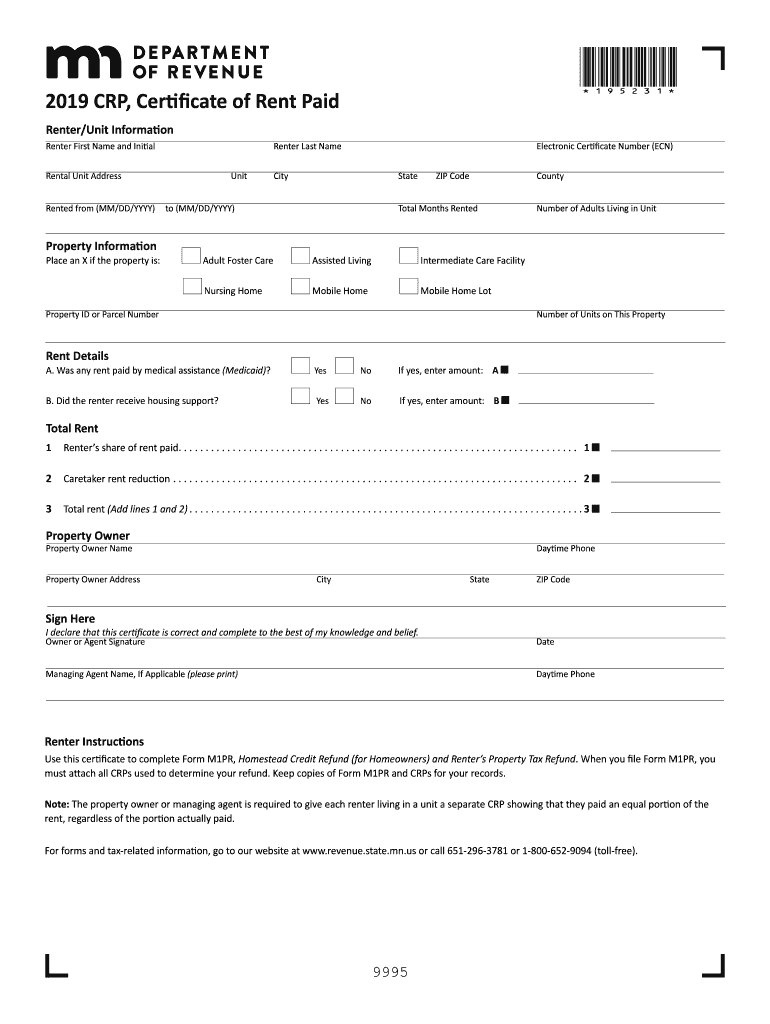

https://anokacountymn.gov/ImageRepository/Document?documentID=21308

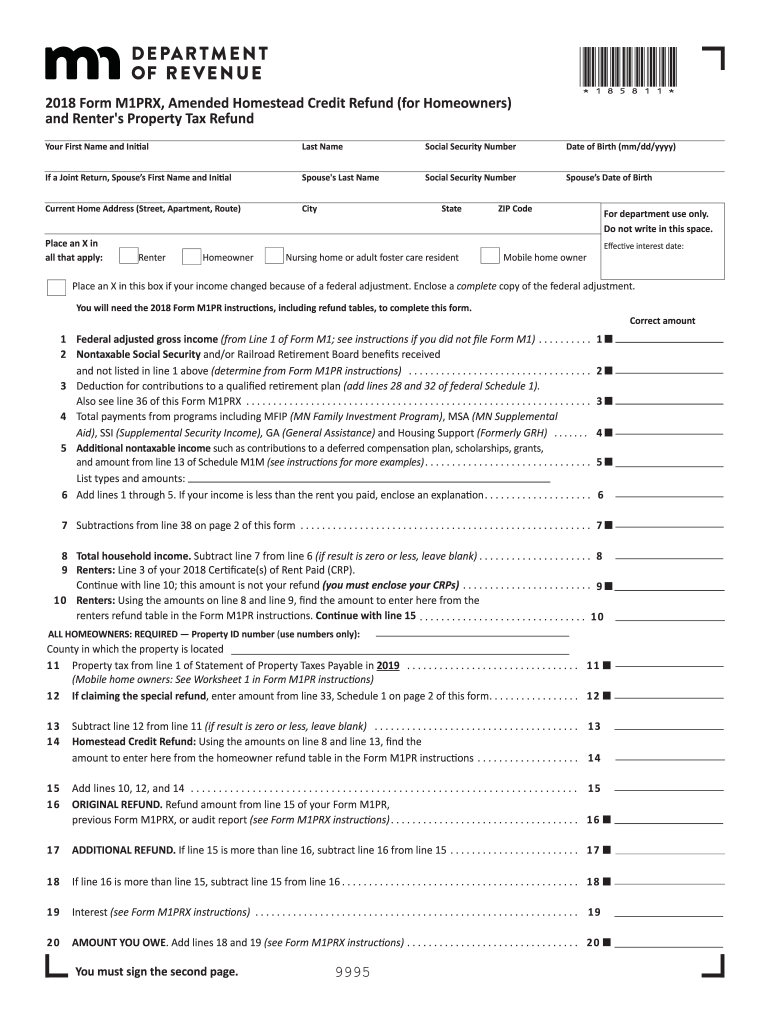

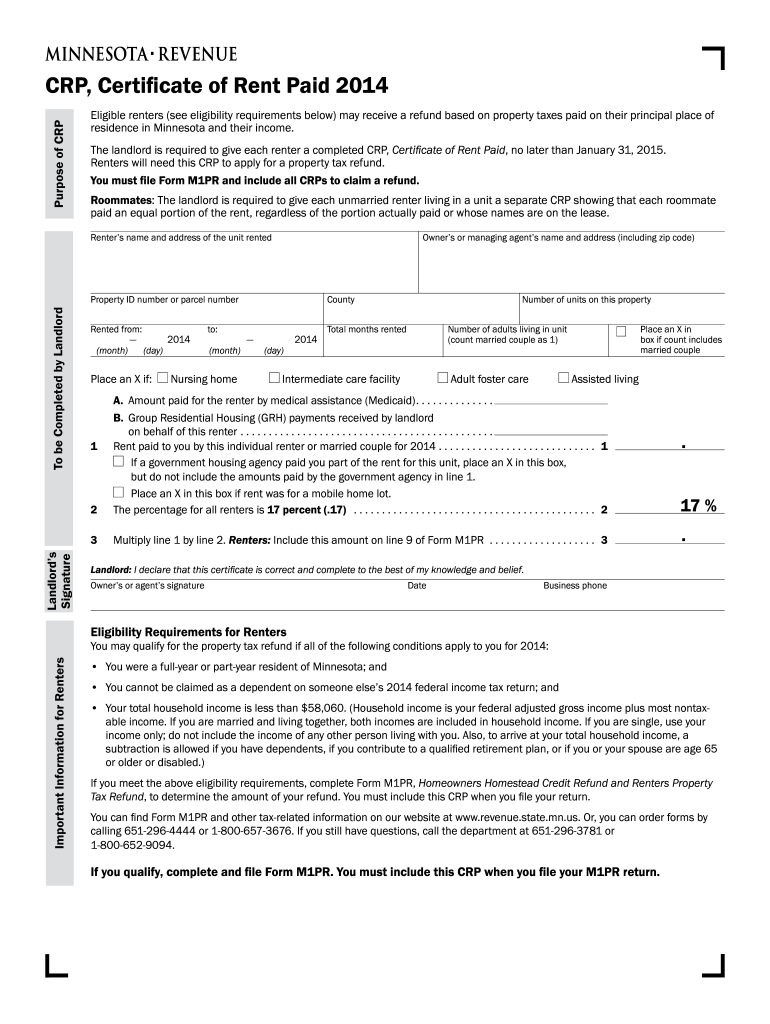

M1pr Form 2022 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/459/835/459835865/large.png

M1pr Fillable Form Printable Forms Free Online

https://www.pdffiller.com/preview/489/729/489729898/large.png

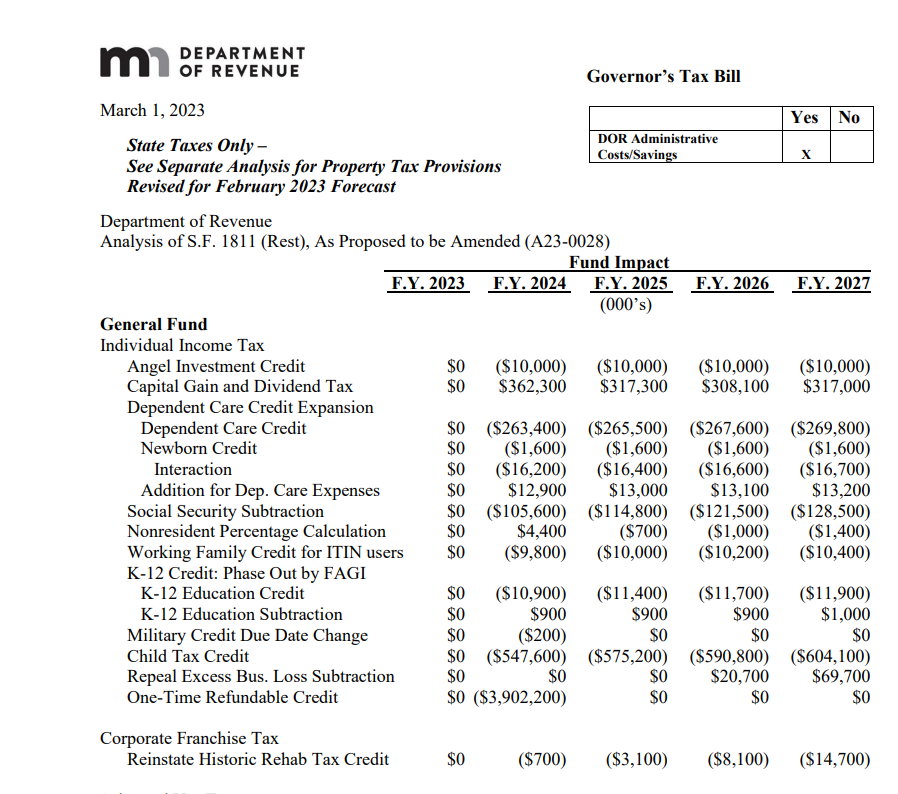

The Department of Revenue estimates the policy changes would result in property tax refunds paid out by the state increasing by 23 3 million in fiscal year 2024 and 4 1 million in fiscal year 2025 Deadline July 28 2023 at 5 p m CT Minnesotans who died before Jan 1 2023 are not eligible for the rebate check Is there anything else The rebate checks came in much smaller than originally proposed by Gov Tim Walz but lawmakers are touting other benefits like the child tax credit which people will start getting next year

Published August 23 2023 There are three property tax relief programs aimed at homeowners offered by the state of Minnesota Homestead Credit Refund Program Targeting Property Tax Refund Senior Citizen Property Tax Deferral Program Below is a basic description of each program its eligibility criteria and sample benefits calculations It is due August 15 2024 Send it to Minnesota Property Tax Refund Mail Station 0020 600 N Robert St St Paul MN 55145 0020 You should get your refund within 60 days after you file or after August 15 for renters and September 30 for homeowners Whichever is later

Download Minnesota Property Tax Rebate 2024

More picture related to Minnesota Property Tax Rebate 2024

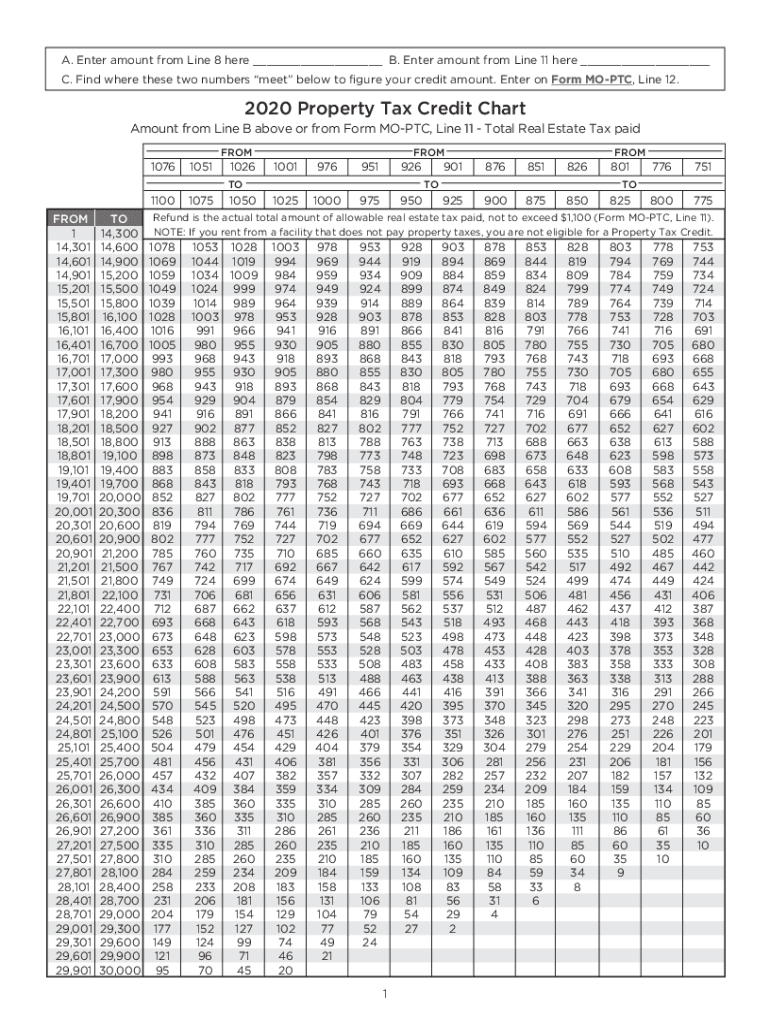

2020 Form MO MO PTC Chart Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/535/790/535790049/large.png

PA Rent property Tax Rebate Deadline Is Dec 31

https://www.gannett-cdn.com/-mm-/c7d45056378a34e0c7b84c67f874fae8f3653a44/c=0-377-1735-1357/local/-/media/2015/11/17/PAGroup/YorkDailyRecord/635833565265831604-ThinkstockPhotos-479013272.jpg?width=3200&height=1680&fit=crop

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023.png

The State of Minnesota has limited funds for the EV rebate When the program launches on February 1 2024 completed applications will be reviewed on a first come first served basis For new electric vehicles owners lessees may receive a rebate up to 2 500 For used electric vehicles owners may receive a rebate up to 600 Click Property Tax Refund in the Minnesota Quick Q A Topics menu to expand This refund does not transfer to your Minnesota Form M1 File by August 15 2024 Your 2023 Form M1PR should be mailed delivered or electronically filed with the department by August 15 2024 The final deadline to claim the 2023 refund is Aug 15 2024

MPR News Politics and Government The Department of Revenue finished processing the rebate checks here s what you need to know Lisa Ryan and MPR News Staff October 2 2023 5 16 PM In the application of the Minnesota EV Tax Rebate Program an Electric Vehicle is defined as a motor vehicle that is able to be powered by an electric motor drawing current from rechargeable storage batteries fuel cells or other portable sources of electrical current and meets or exceeds applicable regulations in Code of Federal Regulations title 49 part 571 and successor requirements

Mn Renters Rebate Refund Table RentersRebate

https://www.rentersrebate.net/wp-content/uploads/2022/10/form-m1pr-minnesota-property-tax-refund-return-instructions-2005-5.png

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

https://www.revenue.state.mn.us/sites/default/files/2023-12/m1pr-inst-23.pdf

Property taxes or rent paid on your primary residence in Minnesota Regular Property Tax Refund Income Requirements If you are and You may qualify for a refund of up to A renter Your total household income is less than 73 270 2024 Your property must be classified as your homestead or you must have applied for homestead

https://www.revenue.state.mn.us/tax-law-changes

2023 Tax Law Updates The 2023 legislative session resulted in a number of changes to Minnesota s tax code including some that affect previous tax years At this time you should not amend any Minnesota returns solely to account for these changes Major changes are summarized below

2022 Vehicle Tax Refund Form Fillable Printable Pdf Forms Handypdf Gambaran

Mn Renters Rebate Refund Table RentersRebate

City Of Chicago Proper ty Tax Rebate Program CLARETIAN ASSOCIATES BUILDING COMMUNITY IN

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

How To Get Property Tax Rebate PropertyRebate

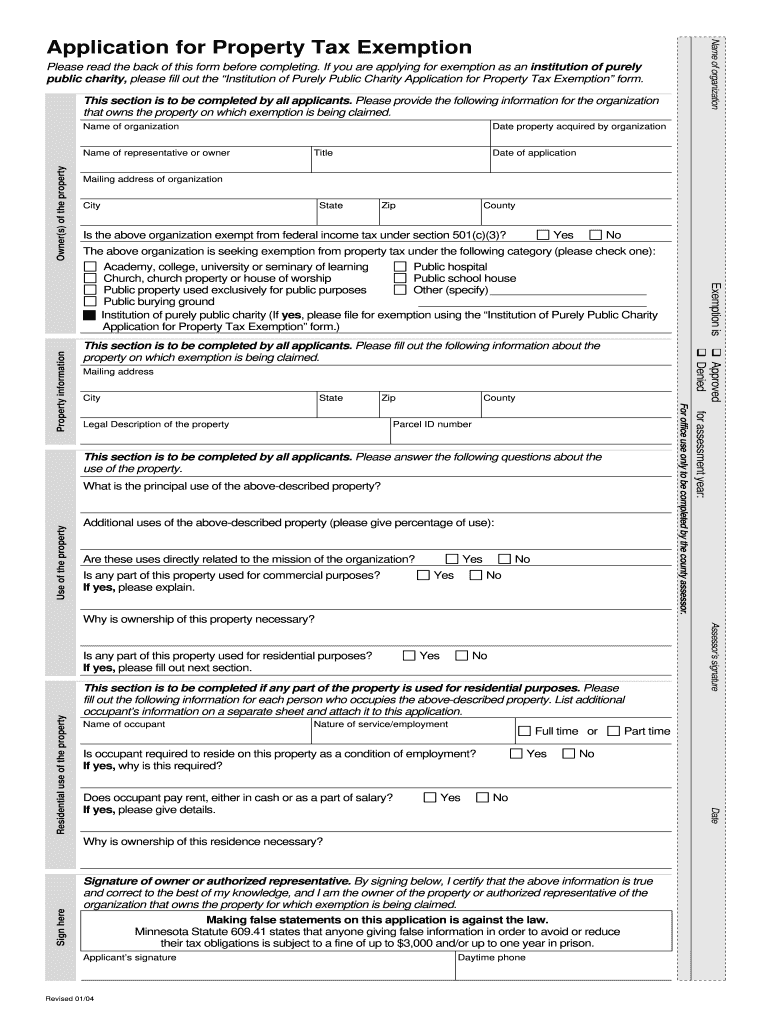

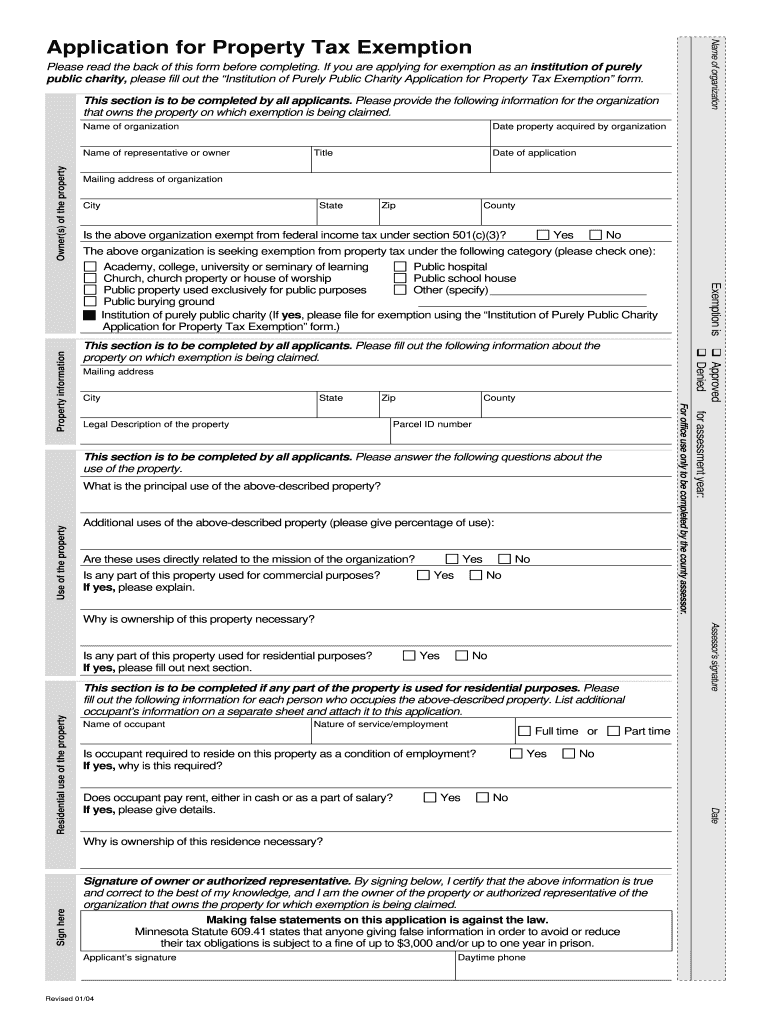

Minnesota Property Tax Exemptions Fill Online Printable Fillable Blank PdfFiller

Minnesota Property Tax Exemptions Fill Online Printable Fillable Blank PdfFiller

Minnesota Tax Rebate Deadline Extended How To Get Your Money

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Request A Paper Application

Minnesota Property Tax Rebate 2024 - Deadline July 28 2023 at 5 p m CT Minnesotans who died before Jan 1 2023 are not eligible for the rebate check Is there anything else The rebate checks came in much smaller than originally proposed by Gov Tim Walz but lawmakers are touting other benefits like the child tax credit which people will start getting next year