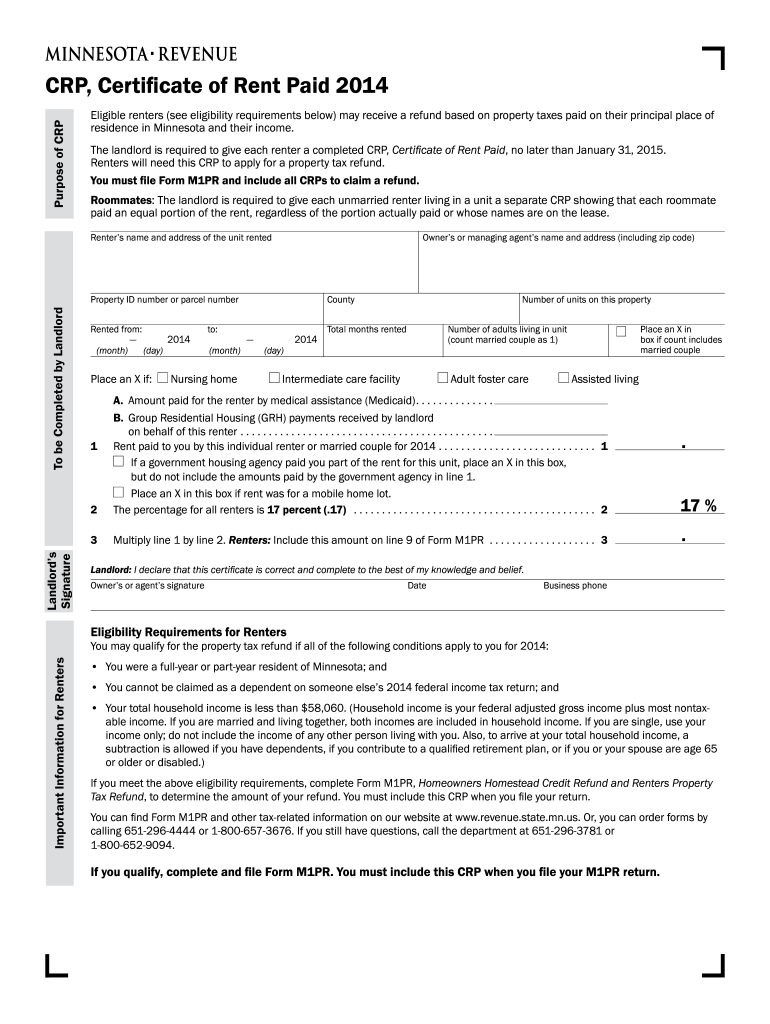

Minnesota Renters Rebate Form 2024 Renters will need the CRP to apply for the Renter s Property Tax Refund The Minnesota Department of Revenue has expanded access to their CRP system in e Services and you will be able to create CRPs using e Services by January 1 2024 all residential property owners and managing agents will be able to use e Services Minnesota Department of

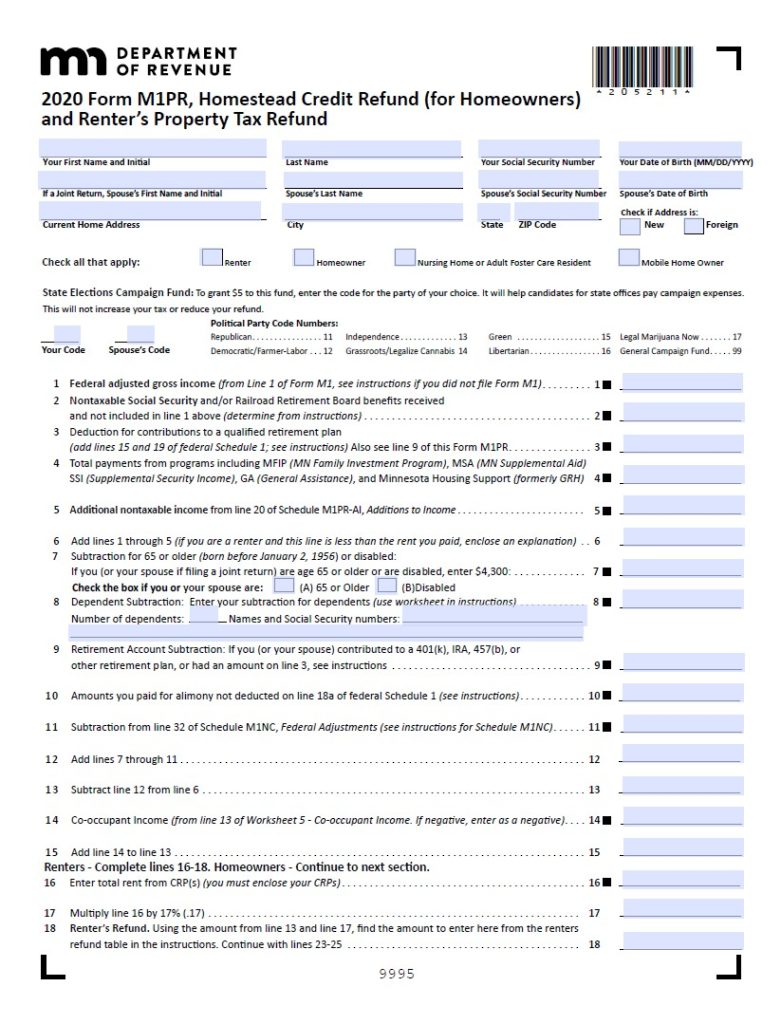

Renter s Property Tax Refund Forms and Instructions Form M1PR Homestead Credit Refund for property taxes or rent paid on your primary residence in Minnesota Regular Property Tax Refund Income Requirements If you are and You may qualify for a refund of up to A renter Your total household income is less than 73 270 2 570 If you rent your landlord must give you a Certificate of Rent Paid CRP by January 31 2024 If you own use your Property Tax Statement Get the tax form called the 2023 Form M 1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund

Minnesota Renters Rebate Form 2024

Minnesota Renters Rebate Form 2024

https://handypdf.com/resources/formfile/images/10000/renters-rebate-sample-form-page1.png

Oral B Rebate Form 2024 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/02/Oral-B-Rebate-Form-2023.jpg

Renter s Property Tax Refund Minnesota Department Of Revenue Fill Out And Sign Printable PDF

https://www.signnow.com/preview/100/442/100442201/large.png

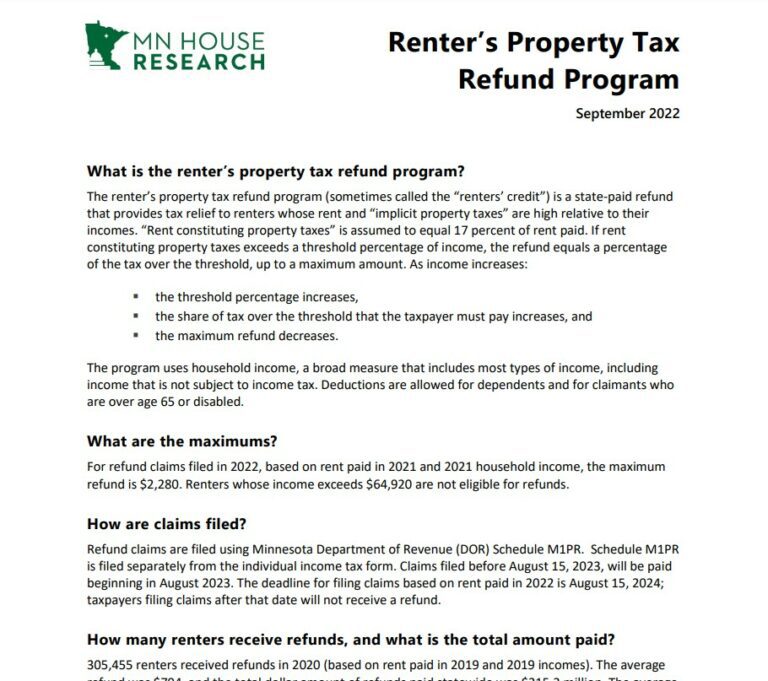

The renter s property tax refund program sometimes called the renters credit is a state paid refund that provides tax relief to renters whose rent and implicit property taxes are high relative to their incomes Rent constituting property taxes is assumed to equal 17 percent of rent paid 1 Can I get a property tax refund if I own my own house Do I have to file my renter s refund with my regular taxes on April 15 Can I file my renter s refund after August 15 LawHelpMN does not collect any personal information when you take this quiz For more information see our privacy policy

The Minnesota Renter s Property Tax Refund can provide relief to renters if a portion of their rent goes toward property taxes postmarked or dropped off by August 15 2023 The final deadline to claim the 2022 refund is August 15 2024 Required Documentation Renters Form M1PR Homestead Credit Refund for Homeowners and Renter s Your net property tax increased by more than 12 from 2023 to 2024 AND The increase was at least 100 Renters with household income of less than 73 270 can claim a refund up to 2 570 You must have lived in a building where the owner of the building Was accessed the property tax Paid a portion of the rent receipts instead of the property tax

Download Minnesota Renters Rebate Form 2024

More picture related to Minnesota Renters Rebate Form 2024

Renters Rebate Form MN 2022 Class Profile Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Renters-Rebate-Form-MN-2022.png

NDP Playing Games With Renters Landlords BC Liberal Caucus RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/12/ndp-playing-games-with-renters-landlords-bc-liberal-caucus.jpg

Connecticut Renters Rebate 2023 Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/01/Connecticut-Renters-Rebate-2023.png

We last updated the Homestead Credit Refund for Homeowners and Renters Property Tax Refund in January 2024 so this is the latest version of Form M1PR fully updated for tax year 2023 We last updated Minnesota Form M1PR from the Department of Revenue in January 2024 Refund is 2 210 Renters whose income exceeds 62 960 are not eligible for refunds Refund claims are filed using Minnesota Department of Revenue DOR Schedule M1PR Schedule M1PR is filed separately from the individual income tax form Claims filed before August 15 2021 will be paid beginning in August 2021 The deadline for filing

Minnesota Housing Support and 5 000 was paid by the renter enter 2 000 on Line A 3 000 on Line B and 10 000 on Line 1 Nursing homes or intermediate care facilities Multiply the number of months the resident lived in the care facility by 600 Download or print the 2023 Minnesota Form M1PR Instructions Homestead Credit Refund and Renter s Property Tax Refund Instruction Booklet for FREE from the Minnesota Department of Revenue should be electronically filed postmarked or dropped off by August 15 2023 The final deadline to claim the 2022 refund is August 15 2024 Where

2022 Rent Certificate Form Fillable Printable PDF Forms Handypdf RentersRebate

https://www.rentersrebate.net/wp-content/uploads/2022/12/2022-rent-certificate-form-fillable-printable-pdf-forms-handypdf-3.png

Renters Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021-781x1024.jpg

https://www.careproviders.org/CPM/ACTION/Vol39/Ed03/ZP05.aspx

Renters will need the CRP to apply for the Renter s Property Tax Refund The Minnesota Department of Revenue has expanded access to their CRP system in e Services and you will be able to create CRPs using e Services by January 1 2024 all residential property owners and managing agents will be able to use e Services Minnesota Department of

https://www.revenue.state.mn.us/sites/default/files/2023-12/m1pr-inst-23.pdf

Renter s Property Tax Refund Forms and Instructions Form M1PR Homestead Credit Refund for property taxes or rent paid on your primary residence in Minnesota Regular Property Tax Refund Income Requirements If you are and You may qualify for a refund of up to A renter Your total household income is less than 73 270 2 570

Minnesota Renters Rebate Date RentersRebate

2022 Rent Certificate Form Fillable Printable PDF Forms Handypdf RentersRebate

Mn Renters Rebate Refund Table RentersRebate

New Jersey Renters Rebate 2023 Printable Rebate Form

Minn Kota Rebate Form PrintableRebateForm

PA Rent Rebate Form Printable Rebate Form

PA Rent Rebate Form Printable Rebate Form

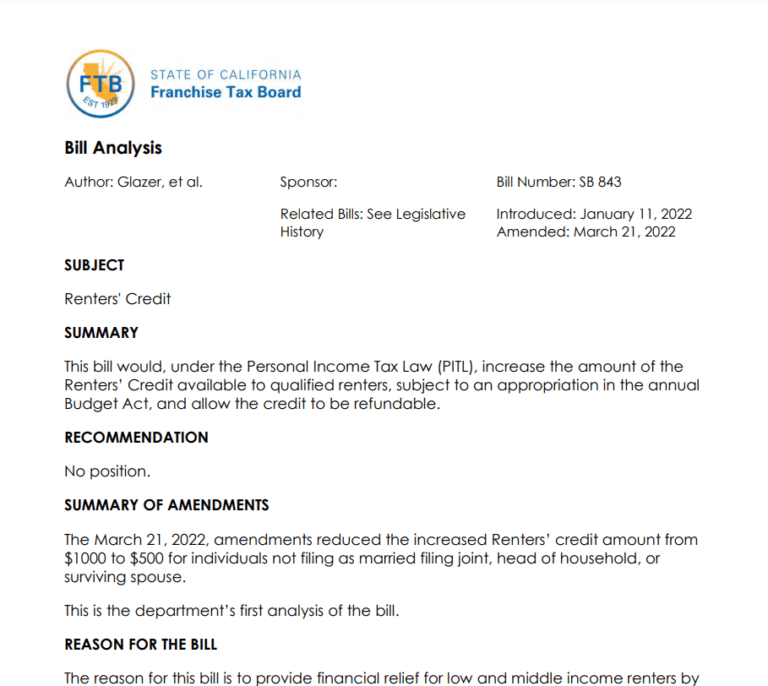

California Renters Rebate 2023 Printable Rebate Form

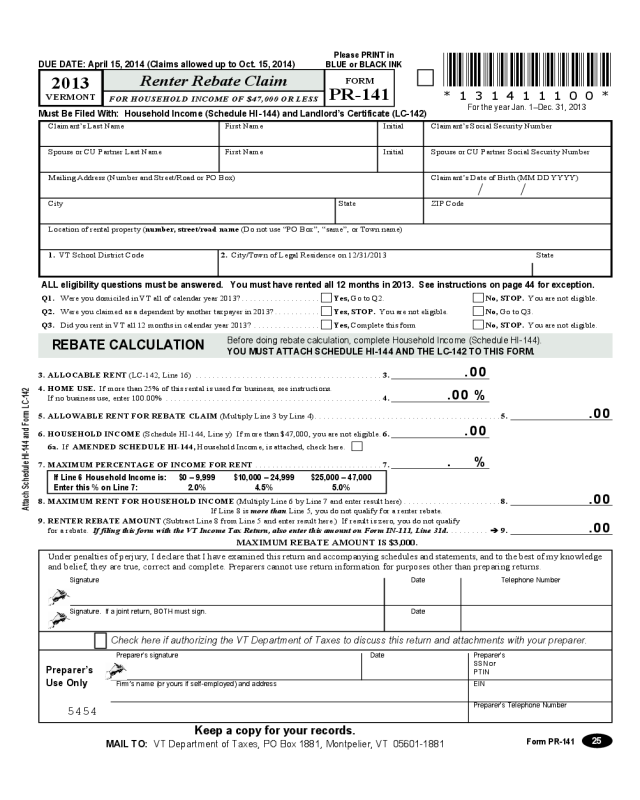

PR 141 Renter Rebate Claim

Minnesota Renters Rebate 2023 Printable Rebate Form

Minnesota Renters Rebate Form 2024 - That permanent change would be effective for property taxes payable in 2024 but the bill would beef up the refund program even more on a onetime basis For refunds on taxes payable in 2023 the increase in property taxes would only need to be 6 and the maximum refund would be 2 500 Minnesota House of Representatives 100 Rev Dr