Mississippi Tax Rebate 2024 Mississippi Solar Tax Credits Incentives and Rebates Breakdown in 2024 Mississippi Solar Panels Cost Is It Worth Going Solar in Mississippi Frequently Asked Questions FAQs

Tax Rates Mississippi has a graduated tax rate These rates are the same for individuals and businesses There is no tax schedule for Mississippi income taxes The graduated 2023 income tax rate is 0 on the first 10 000 of taxable income 5 on the remaining taxable income in excess of 10 000 Mississippi doesn t currently offer state income tax credits for solar installations but it does have two rebate programs both are for households with low to moderate incomes Key insights

Mississippi Tax Rebate 2024

Mississippi Tax Rebate 2024

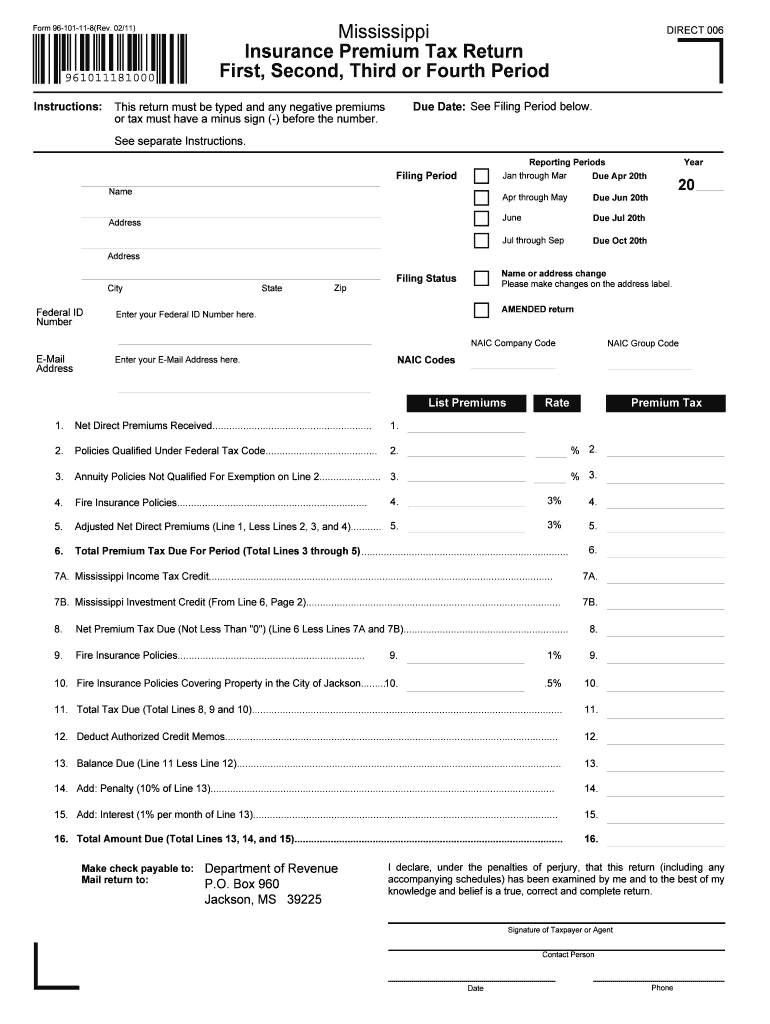

https://i2.wp.com/data.formsbank.com/pdf_docs_html/255/2552/255274/page_1_thumb_big.png

Mississippi State Income Tax Withholding Form Veche info 16

https://i2.wp.com/www.signnow.com/preview/428/783/428783020/large.png

Mississippi Plans Income Tax Elimination While Alabama Plans Temporary Rebate

https://optimise2.assets-servd.host/al-news/production/images/AP22095789007843.jpg?w=1200&h=630&q=82&auto=format&fit=crop&dm=1668628102&s=176a89ea829f58a8bc2111c2200d2323

You can quickly estimate your Mississippi State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Mississippi and for quickly estimating your tax commitments in 2024 Here in Mississippi the Legislature could provide all people currently earning a paycheck a one time rebate of 1 000 and not impact the ability moving forward to continue services at current levels

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Mississippi If you install your photovoltaic system before the end of 2032 the federal tax credit is 30 of the cost of your solar panel system This is 30 off the entire cost of the system including equipment labor and permitting Mississippi like most states is collecting an unprecedented amount of revenue thanks to a number of factors including federal COVID 19 relief money directed to the states inflation and strong consumer spending About 20 states already have opted to return some of those record revenue collections to taxpayers through direct payments

Download Mississippi Tax Rebate 2024

More picture related to Mississippi Tax Rebate 2024

/cloudfront-us-east-1.images.arcpublishing.com/gray/HGN7HWM6KVG7XKH4G6LK4HQHQY.jpg)

Mississippi Tax Revenue Jumps During 1st Half Of Budget Year

https://gray-wtok-prod.cdn.arcpublishing.com/resizer/3v4YFKi66plYb9b1z3D5wlpoHE4=/1200x600/smart/filters:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/gray/HGN7HWM6KVG7XKH4G6LK4HQHQY.jpg

Mississippi State Income Tax 2011 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/397/591/397591361/large.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Mississippi leaders chose to eschew immediate relief for a permanent tax cut that when fully enacted will take about 525 million annually out of the roughly 7 billion revenue stream At one point this year Lt Gov Delbert Hosemann and some senators proposed a combination of a tax cut and a rebate for 2022 but that proposal did not survive Taxpayers in 14 states could get some financial relief this year thanks to lower individual tax rates enacted in 2024 according to an analysis from the Tax Foundation a think tank that focuses

The Legislature did in fact approve the at least 350 million incentive package in a one day special session READ MORE Lawmakers pass 350 million deal to lure major green energy plant to north Mississippi The plant will be located a stone s throw from the Tennessee state line There are multiple reasons including the state s generous Refund Status Website Mississippi Department of Revenue Refund Status Phone Support 1 601 923 7801 24 hours refund line Hours 8 a m 5 p m General Tax Information 1 601 923 7089 1 601 923 7700 Online Contact Form Contact Mississippi Department of Revenue 2023 State Tax Filing Deadline April 15 2024

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

Mississippi s Sales Tax Holiday Is July 29 30

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1060nS.img?w=1280&h=720&m=4&q=86

https://www.forbes.com/home-improvement/solar/mississippi-solar-incentives/

Mississippi Solar Tax Credits Incentives and Rebates Breakdown in 2024 Mississippi Solar Panels Cost Is It Worth Going Solar in Mississippi Frequently Asked Questions FAQs

https://www.dor.ms.gov/individual/tax-rates

Tax Rates Mississippi has a graduated tax rate These rates are the same for individuals and businesses There is no tax schedule for Mississippi income taxes The graduated 2023 income tax rate is 0 on the first 10 000 of taxable income 5 on the remaining taxable income in excess of 10 000

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

Virginia Tax Rebate 2024

Property Tax Rebate Pennsylvania LatestRebate

Mississippi Renters Rebate 2023 PrintableRebateForm

TAX REBATE Ft The Receipts Podcast OFF THE CUFF PODCAST Listen Notes

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

Senior Tax Rebate Program Downtown KCK 701 N 7th St Trfy Kansas City KS 66101 3035 United

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Mississippi Tax Rebate 2024 - Mississippi like most states is collecting an unprecedented amount of revenue thanks to a number of factors including federal COVID 19 relief money directed to the states inflation and strong consumer spending About 20 states already have opted to return some of those record revenue collections to taxpayers through direct payments