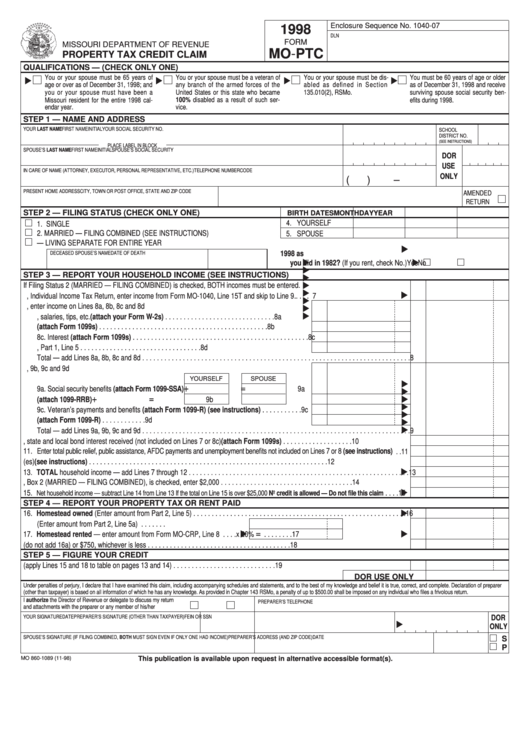

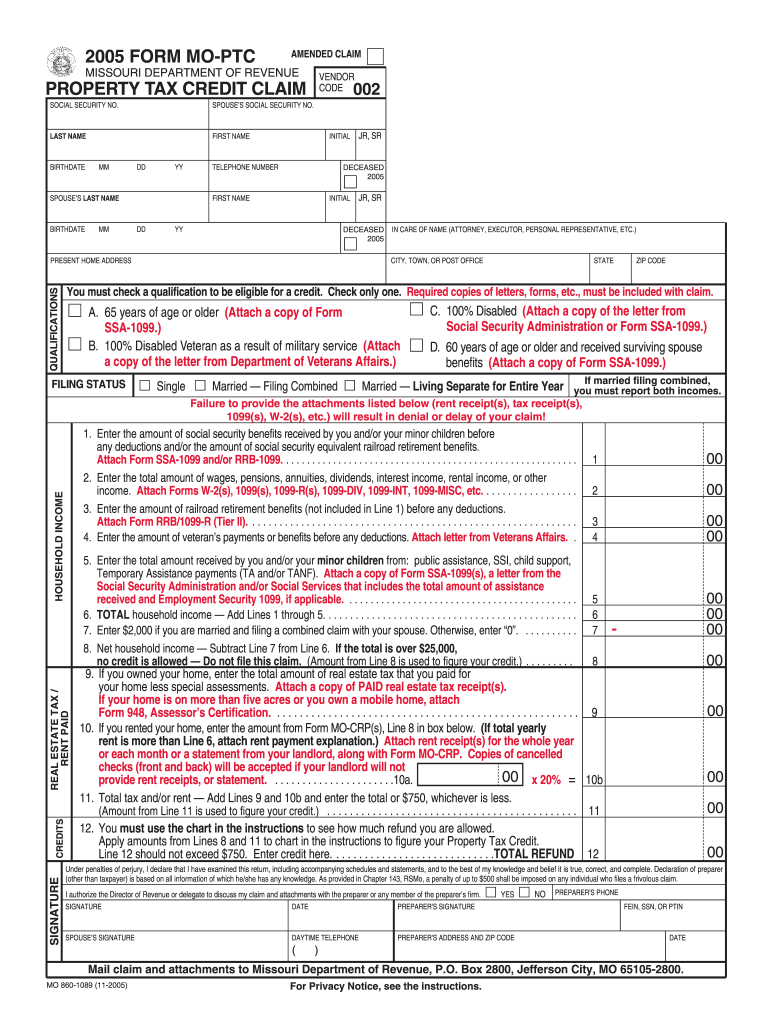

Missouri Property Tax Credit Form 2021 Web The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year The credit is for a maximum of 750 for renters and 1 100 for owners who owned and occupied their home

Web MO PTC 2021 Property Tax Credit Claim 21344010001 21344010001 Birthdate MM DD YYYY 2021 Property Tax Credit Claim Form MO PTC Name Spouse s Birthdate MM DD YYYY Address Select Here for Amended Claim Print in BLACK ink only and DO NOT STAPLE Social Security Number in 2021 Spouse s Social Security Number Web Property Tax Credit Claim Am I Eligible Use the diagram below to determine if you or your spouse are eligible to claim the Property Tax Credit Please note direct deposit of a property tax credit refund claim is not an option with this filing method Yes Continue to File No Return home Services Contact Information Office Locations

Missouri Property Tax Credit Form 2021

Missouri Property Tax Credit Form 2021

https://printablerebateform.net/wp-content/uploads/2021/08/Rent-Rebate-Form-Missouri-2021-768x999.jpg

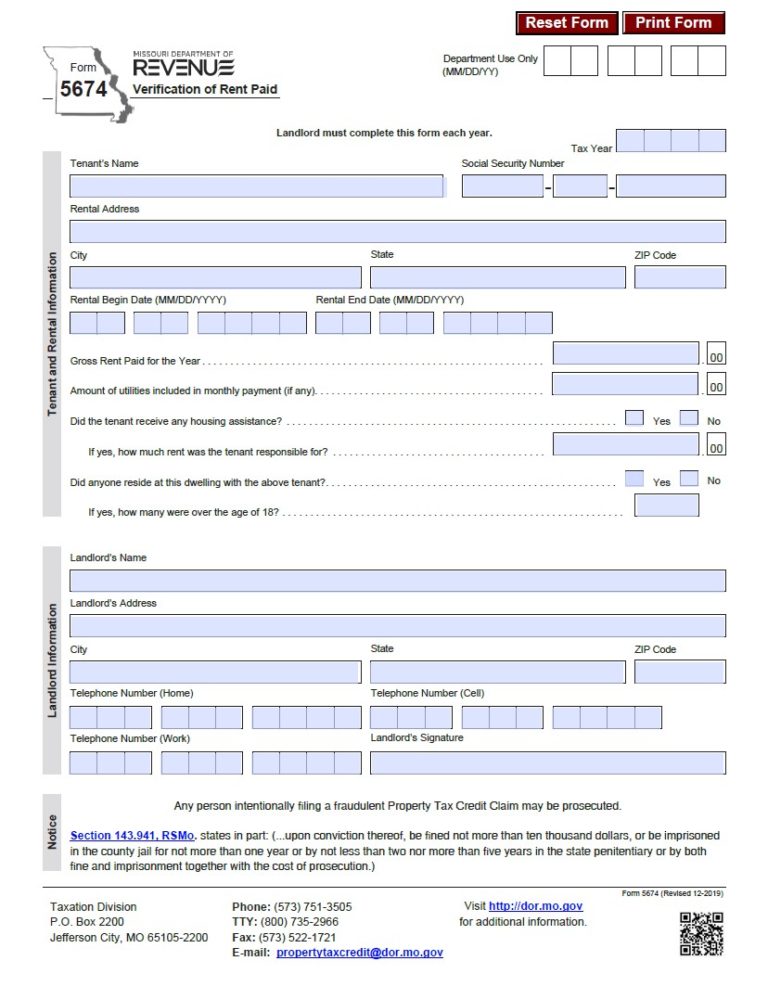

Form MO PTC Property Tax Credit Claim For Mo Fill Out And Sign

https://www.signnow.com/preview/100/455/100455914/large.png

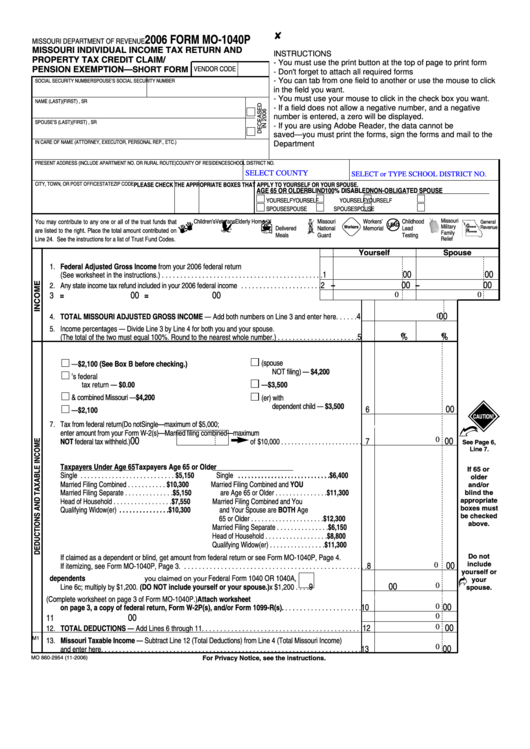

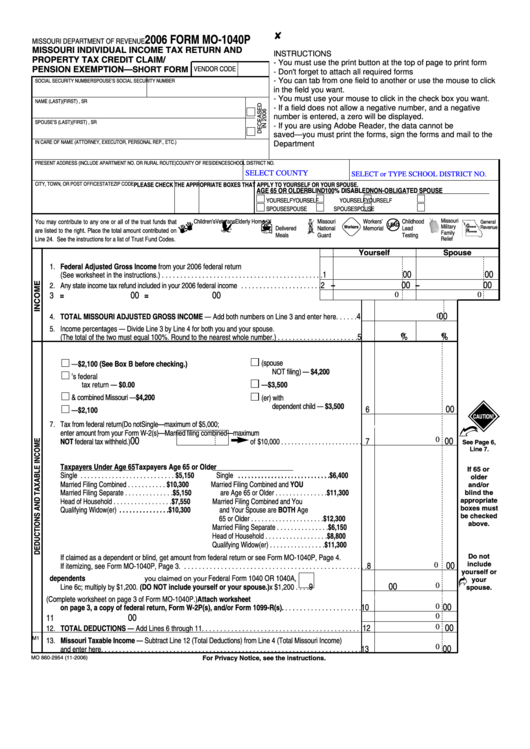

MO Form MO 1040A 2020 2022 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/548/264/548264537/large.png

Web We last updated the Property Tax Credit Claim in January 2023 so this is the latest version of Form MO PTC fully updated for tax year 2022 You can download or print current or past year PDFs of Form MO PTC directly from TaxFormFinder You can print other Missouri tax forms here Web Property Tax Credit The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disable individuals for a portion of the real estate taxes or rent they have paid for the year

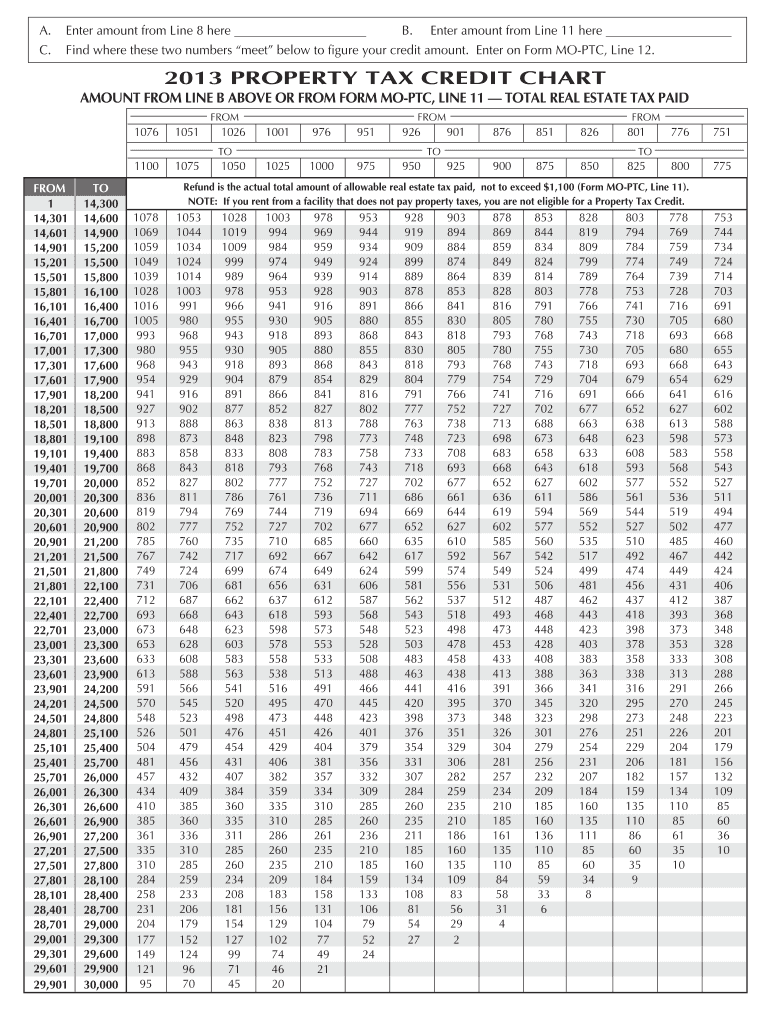

Web Property Tax Credit Claim Chart for Determining Credit for Refund 2022 12 13 2022 MO PTC Claim Chart Property Tax Credit Claim Chart for Determining Credit for Refund 2021 12 31 2021 MO PTC Claim Chart Property Tax Credit Claim Chart for Determining Credit for Refund 2020 12 29 2020 MO PTC Claim Chart Web Missouri allows for a property tax credit for certain senior citizens and 100 disabled individuals for a portion of what was paid in real estate taxes or rent that was paid throughout the tax year The maximum amount of the credit for renters is 750 and 1 100 for home owners that pay real estate taxes

Download Missouri Property Tax Credit Form 2021

More picture related to Missouri Property Tax Credit Form 2021

Missouri 2023 W4 Form Printable Printable Forms Free Online

https://www.pdffiller.com/preview/468/470/468470873/large.png

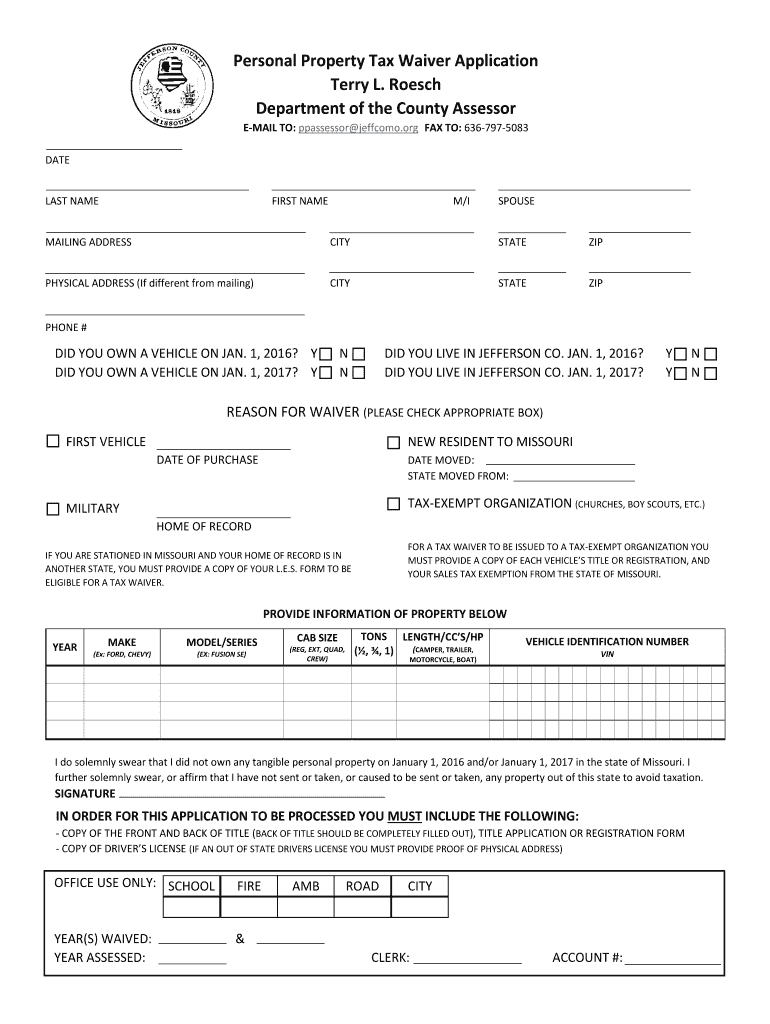

Personal Property Tax Waiver Jefferson County Mo 2019 2023 Form Fill

https://www.signnow.com/preview/101/392/101392184/large.png

Michigan Property Tax Rates By Township Eden Newsletter Bildergallerie

https://www.macomb-mi.gov/ImageRepository/Document?documentID=5881

Web 1 Dez 2022 nbsp 0183 32 Missouri DOR Releases 2022 Form MO PTC Property Tax Credit Claim With Instructions Guidance Bloomberg Connecting decision makers to a dynamic network of information people and ideas Bloomberg quickly and accurately delivers business and financial information news and insight around the world For Customers Bloomberg Web File Now with TurboTax Related Missouri Individual Income Tax Forms TaxFormFinder has an additional 61 Missouri income tax forms that you may need plus all federal income tax forms These related forms may also be needed with the Missouri Form MO PTC INS View all 62 Missouri Income Tax Forms Form Sources

Web 12 Sept 2022 nbsp 0183 32 The Missouri property tax credit is worth as much as 1 100 You can qualify for the entire amount if you owned and occupied your home for the entire year If you re a renter or live in your home for part of the year you can qualify for up to 750 Your actual credit depends on your property taxes or rent paid Web Refund is the actual total amount of allowable real estate tax paid not to exceed 1 100 or rent credit equivalent not to exceed 750 Form MO PTS Line 13 Note If you rent from a facility that does not pay property taxes you are not eligible for a Property Tax Credit Example If Line 10 is 23 980 and Line 13 of Form MO PTS is 525

Fillable Form Mo 1040p Missouri Individual Income Tax Return And

https://data.formsbank.com/pdf_docs_html/189/1897/189755/page_1_thumb_big.png

2022 Form MO DoR MO PTS Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/623/237/623237583/large.png

https://dor.mo.gov/taxation/individual/tax-types/property-tax-credit

Web The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year The credit is for a maximum of 750 for renters and 1 100 for owners who owned and occupied their home

https://dor.mo.gov/forms/MO-PTC Print Only_2021.pdf

Web MO PTC 2021 Property Tax Credit Claim 21344010001 21344010001 Birthdate MM DD YYYY 2021 Property Tax Credit Claim Form MO PTC Name Spouse s Birthdate MM DD YYYY Address Select Here for Amended Claim Print in BLACK ink only and DO NOT STAPLE Social Security Number in 2021 Spouse s Social Security Number

Mo Ptc Fillable Form Printable Forms Free Online

Fillable Form Mo 1040p Missouri Individual Income Tax Return And

Missouri Hotel Tax Exempt 2014 2024 Form Fill Out And Sign Printable

Mississippi Individual Income Tax Extension Influencedesignz

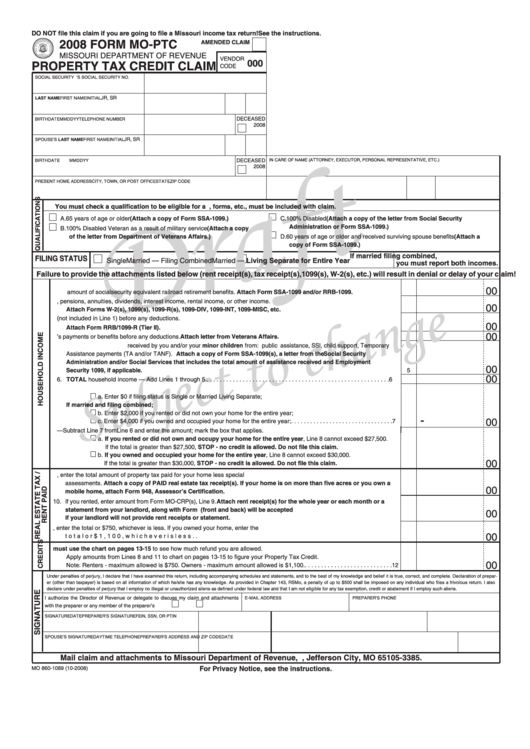

Form Mo Ptc Draft Property Tax Credit Claim 2008 Printable Pdf Download

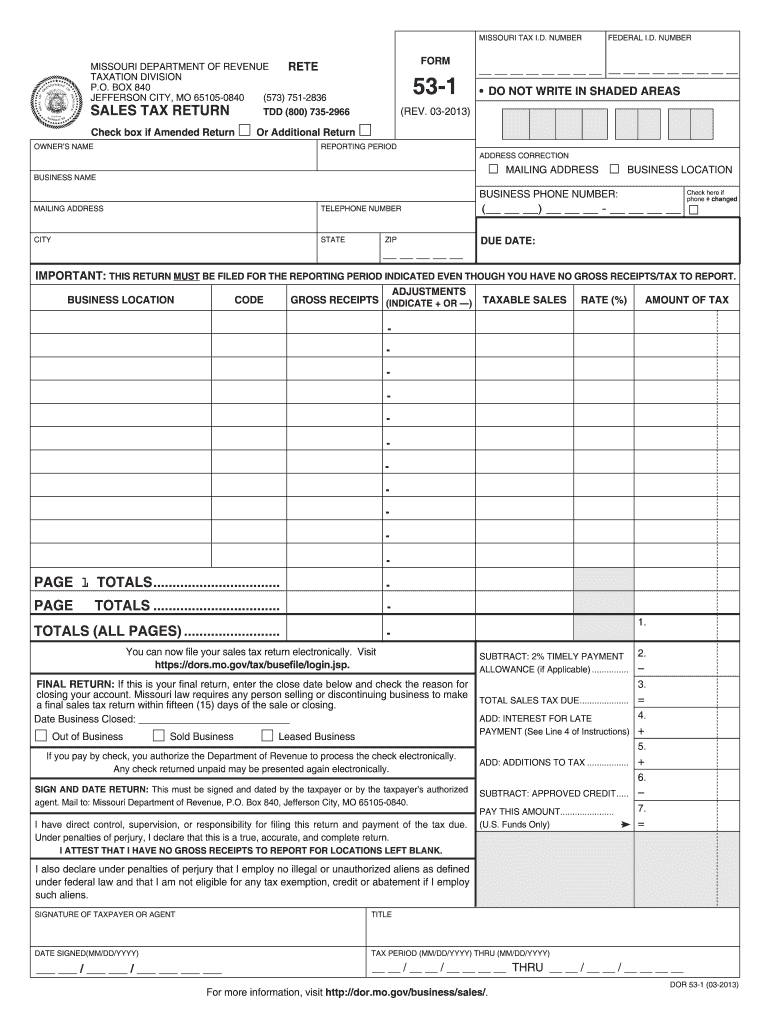

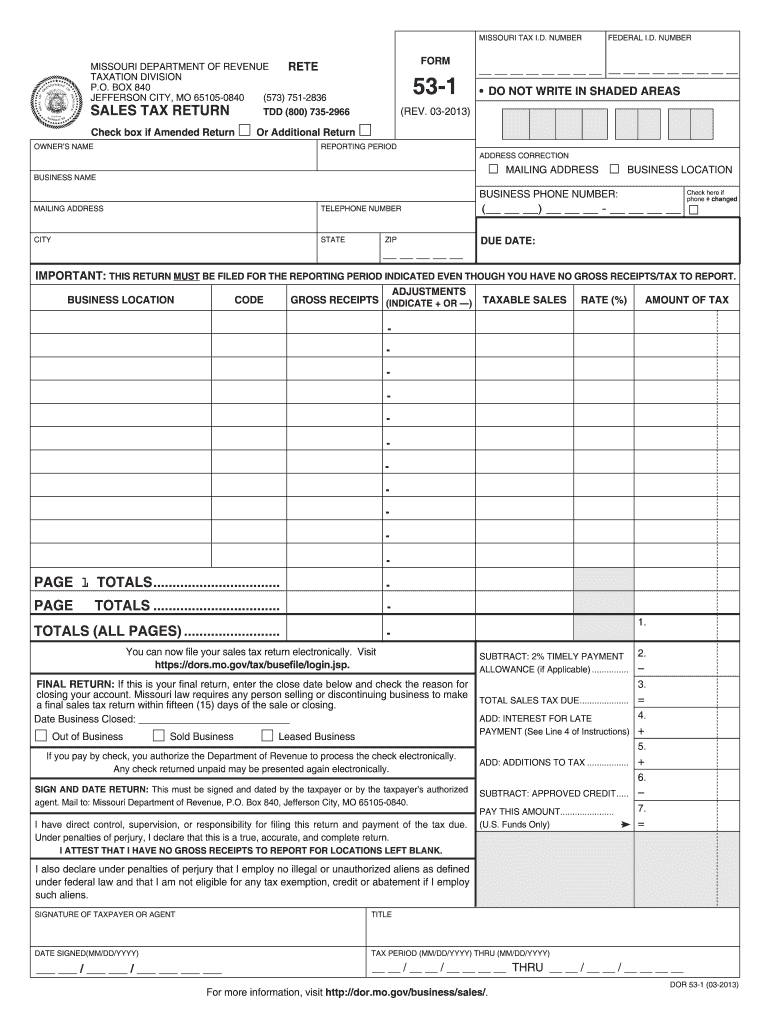

Missouri Sales Tax Form 53 1 Instruction Fill Out And Sign Printable

Missouri Sales Tax Form 53 1 Instruction Fill Out And Sign Printable

2022 Mo Ptc Tax Credit Fillable Form Fillable Form 2024

2021 Declaration Of Homestead Form Fillable Printable Pdf And Forms

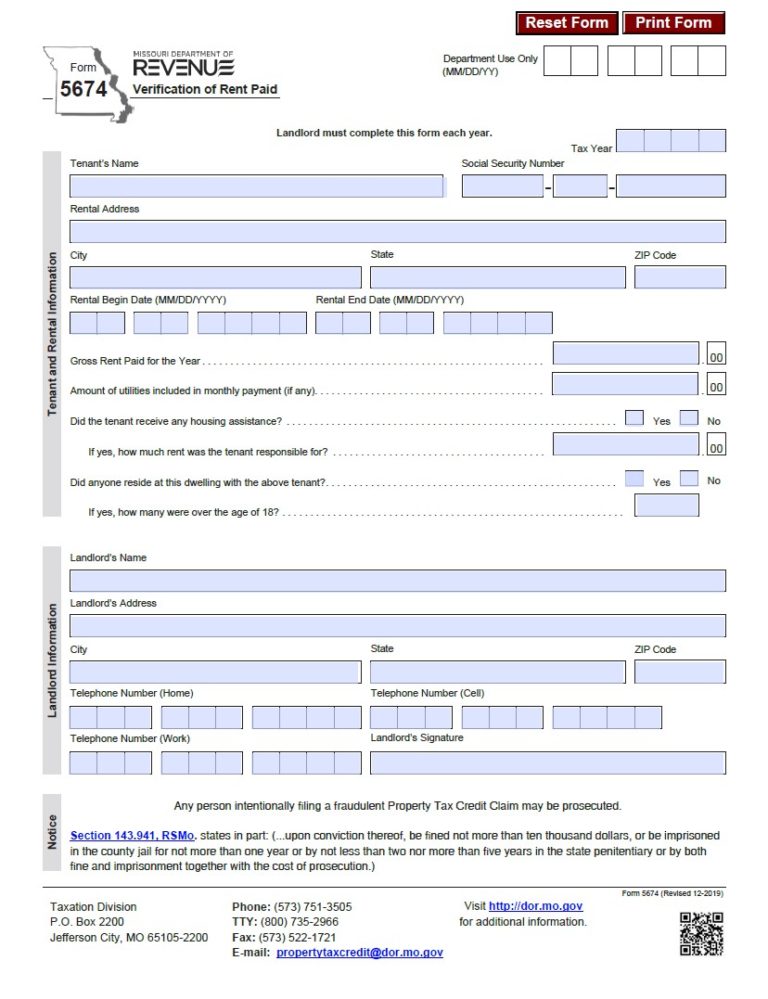

MO MO CRP 2020 Fill Out Tax Template Online US Legal Forms

Missouri Property Tax Credit Form 2021 - Web Property Tax Credit The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disable individuals for a portion of the real estate taxes or rent they have paid for the year