Mlr Rebate Former Employees Web 1 nov 2021 nbsp 0183 32 A current year s MLR rebate is based on premiums paid to the insurer for the previous year Upon receipt of an MLR rebate the employer should calculate the

Web 17 ao 251 t 2020 nbsp 0183 32 Returning the rebate to individuals who participated in the plan both in the year in which the rebate is received 2020 in this case and in the year used to Web 1 sept 2020 nbsp 0183 32 The minimum required percentage called the medical loss ratio MLR is If the employer is the policyholder as is most often the case the portion of the rebate that

Mlr Rebate Former Employees

Mlr Rebate Former Employees

https://s3.studylib.net/store/data/009223871_1-094dc07274c6e2ac82fa1c72bf493e69-768x994.png

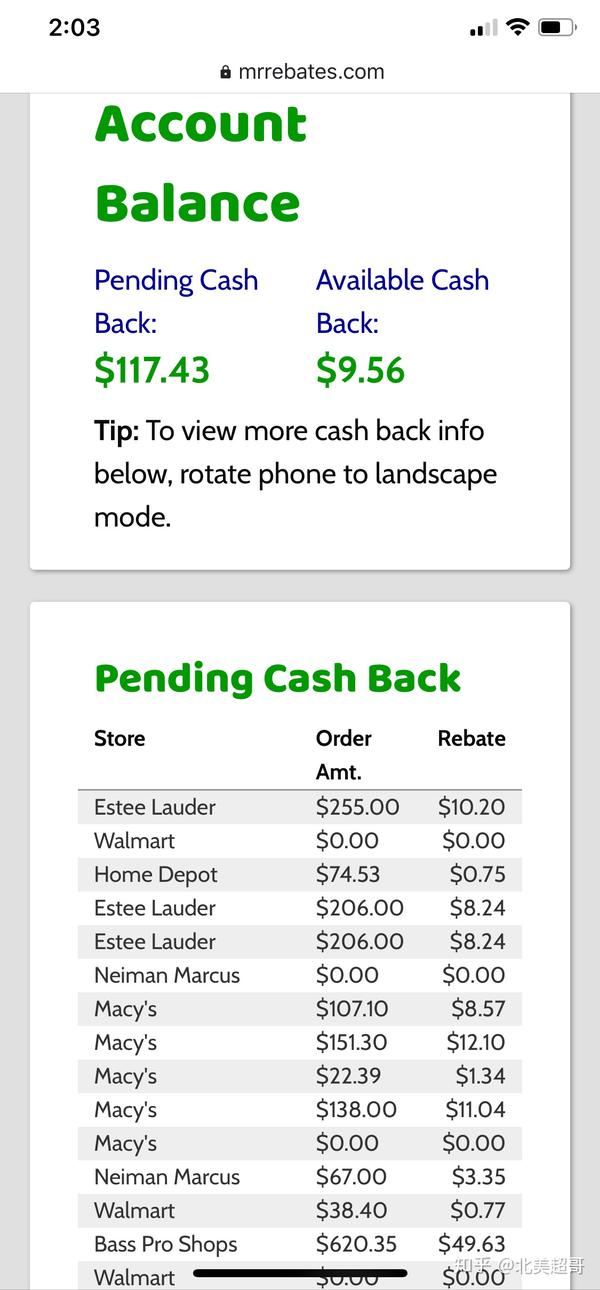

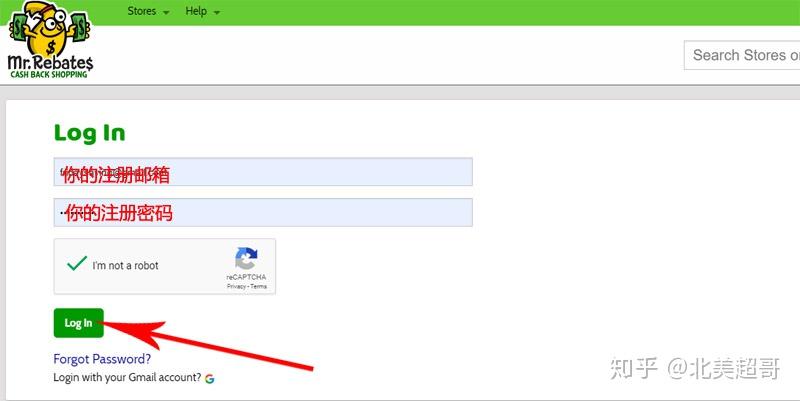

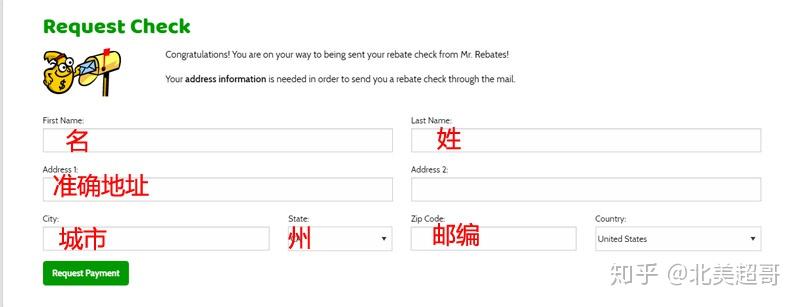

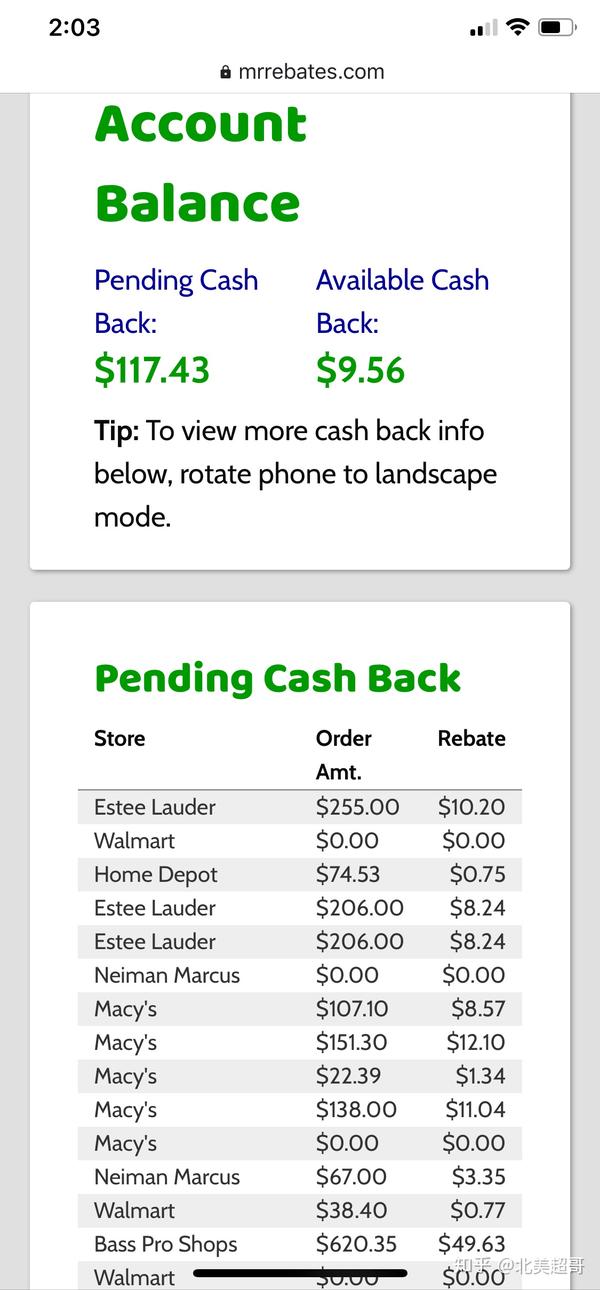

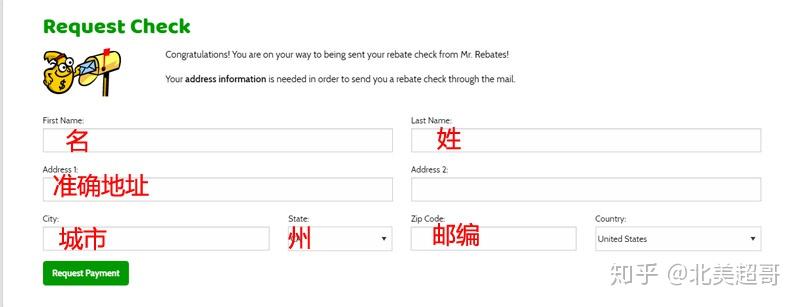

Mr Rebates Mrrebates

https://pic1.zhimg.com/v2-1885ba4befbf10c52cd40187ffe24884_b.jpg

Splitting Your MLR Rebate With Your Employees

https://media-exp1.licdn.com/dms/image/C4D12AQGkYwMd5oeoYw/article-cover_image-shrink_600_2000/0/1569277366102?e=2147483647&v=beta&t=BZfWzvRcKCDfTCe7hBtJ-FS4Y9EQmb1WPQHzL8tYrn4

Web 14 sept 2021 nbsp 0183 32 The law does not require employers to track down former employees for MLR rebates but COBRA participants must be included in any premium rebates if Web 9 ao 251 t 2022 nbsp 0183 32 ERISA and tax considerations for MLR rebates Options available to employers that receive MLR rebates Medical Loss Ratio MLR rebate season is quickly

Web Employer groups may choose whether to distribute MLR rebate checks to former employees They are not required to track down former employees If it is determined Web If my rebate is paid to my employer how will that benefit me In general employers can use rebates to reduce future health insurance premiums enhance benefits or issue rebate

Download Mlr Rebate Former Employees

More picture related to Mlr Rebate Former Employees

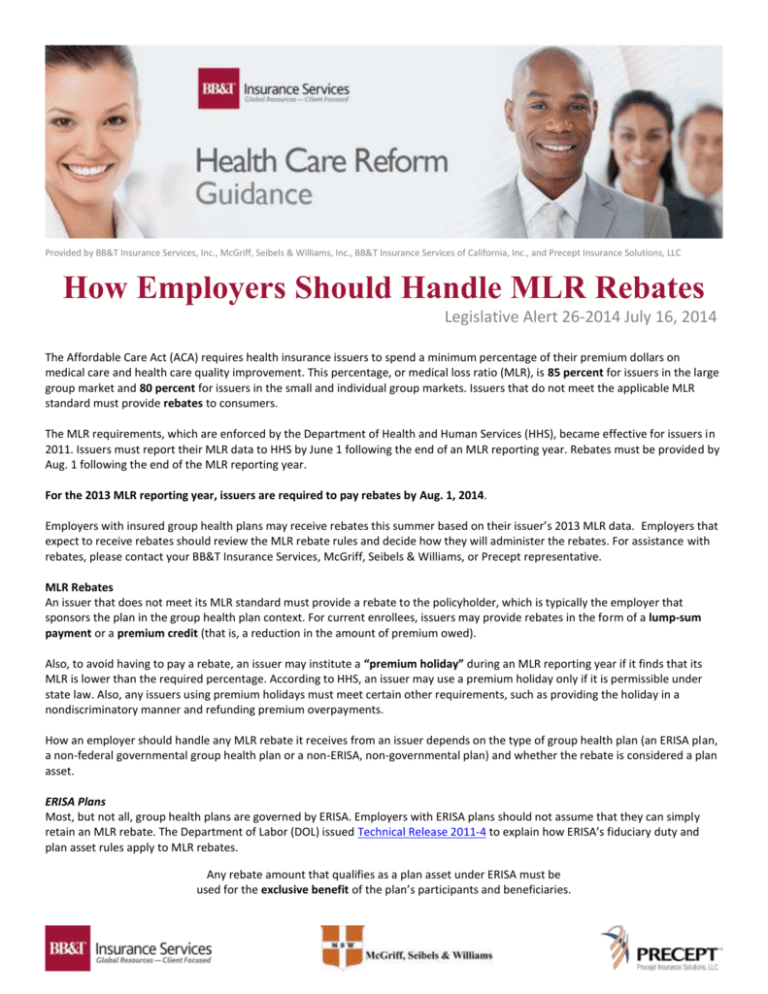

How Employers Should Handle MLR Rebates Central PA Benefit Solutions

https://www.1benefitsolutions.com/wp-content/uploads/2021/04/MLR-1200x800.jpg

Ask The Experts Medical Loss Ratio MLR Rebates ThinkHR

https://www.thinkhr.com/wp-content/uploads/2019/05/iStock_000045581430_Small-1.jpg

Mr Rebates Mrrebates

https://pic1.zhimg.com/v2-d6446bff8694363dc44ab624f1fb6058_r.jpg

Web Frequently asked questions on the federal tax consequences to an insurance company that pays a MLR rebate and an individual policyholder who receives a MLR rebate as well Web 9 juin 2022 nbsp 0183 32 If a plan offers multiple benefit options under separate policies the participants and beneficiaries covered under the specific policy the rebate applies to should receive

Web 4 sept 2012 nbsp 0183 32 In early August 2012 some U S employers with fully insured employee health benefit plans received a medical loss ratio MLR rebate These rebates were Web 20 oct 2020 nbsp 0183 32 HHS interim final regulations on the MLR rules provide that employers must use the portion of the rebate attributable to the amount of premium paid by employees

Mr Rebates Mrrebates

https://pic3.zhimg.com/v2-802820faa472ff6527c956bbfe65cce6_r.jpg

Handling MLR Rebates

https://apexbg.com/wp-content/uploads/2022/09/Apex-Compliance-_How-Employers-Should-Handle-MLR-Rebates.Thumbnail-880x495.png

https://www.epicbrokers.com/insights/medical-loss-ratio-rebates-what...

Web 1 nov 2021 nbsp 0183 32 A current year s MLR rebate is based on premiums paid to the insurer for the previous year Upon receipt of an MLR rebate the employer should calculate the

https://www.amwinsconnect.com/news/how-employers-should-handle-…

Web 17 ao 251 t 2020 nbsp 0183 32 Returning the rebate to individuals who participated in the plan both in the year in which the rebate is received 2020 in this case and in the year used to

2022 MLR Rebate Checks To Be Issued Soon To Fully Insured Plans

Mr Rebates Mrrebates

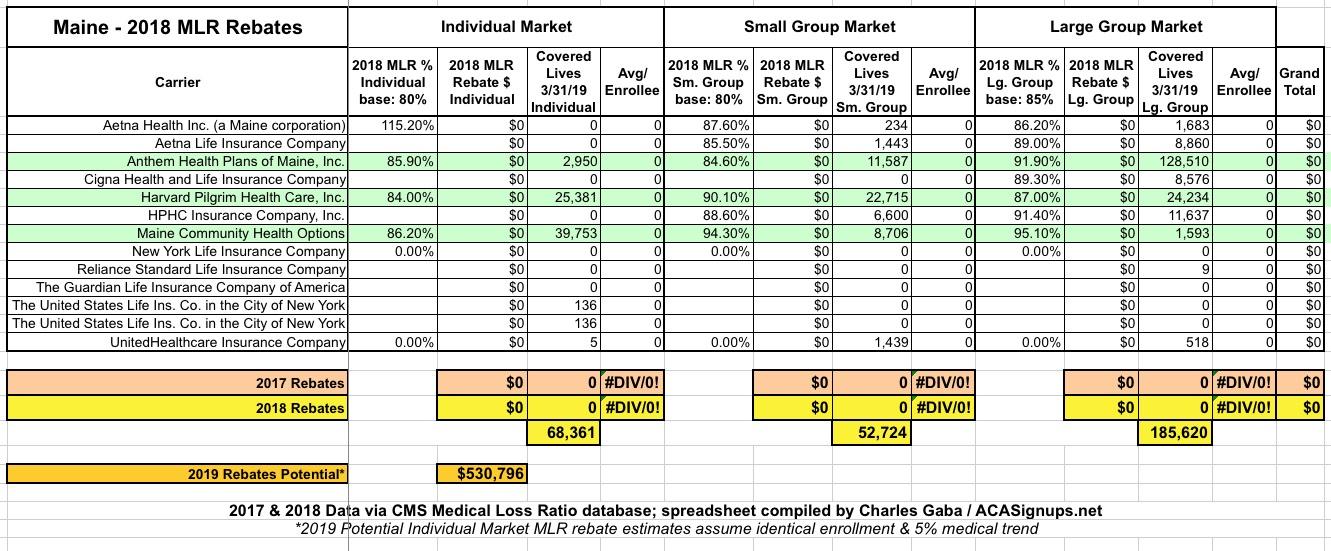

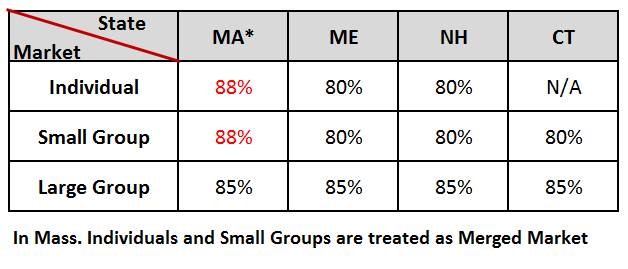

Maine The Most Boring MLR Rebate Table For At Least Two Years Running

2020 Medical Loss Ratio MLR Rebate FAQ

Mr Rebates Mrrebates

Mr Rebates Mrrebates

Mr Rebates Mrrebates

Mr Rebates Quick Cash Button Chrome

MLR Rebate FAQs Harvard Pilgrim Health Care Employer

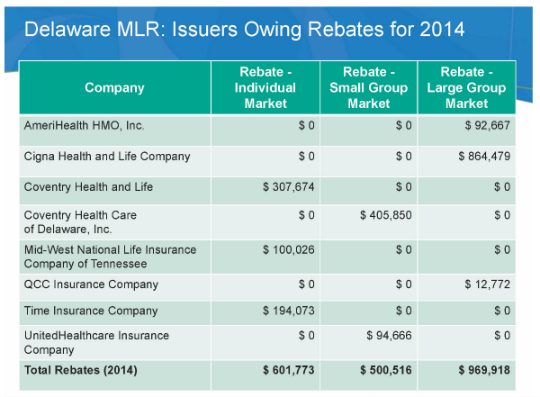

Health Insurers To Rebate More Than 2M To Delaware Consumers

Mlr Rebate Former Employees - Web If my rebate is paid to my employer how will that benefit me In general employers can use rebates to reduce future health insurance premiums enhance benefits or issue rebate