Mlr Rebate Tax Treatment Web 27 mai 2012 nbsp 0183 32 On April 19 2012 the Internal Revenue Service IRS issued a set of Frequently Asked Questions FAQs explaining the tax treatment of premium rebates

Web 1 sept 2020 nbsp 0183 32 Tax Treatment of Benefits The Internal Revenue Service IRS issued a set of frequently asked questions addressing the tax treatment of MLR rebates In Web 1 nov 2021 nbsp 0183 32 A current year s MLR rebate is based on premiums paid to the insurer for the previous year Upon receipt of an MLR rebate the employer should calculate the

Mlr Rebate Tax Treatment

Mlr Rebate Tax Treatment

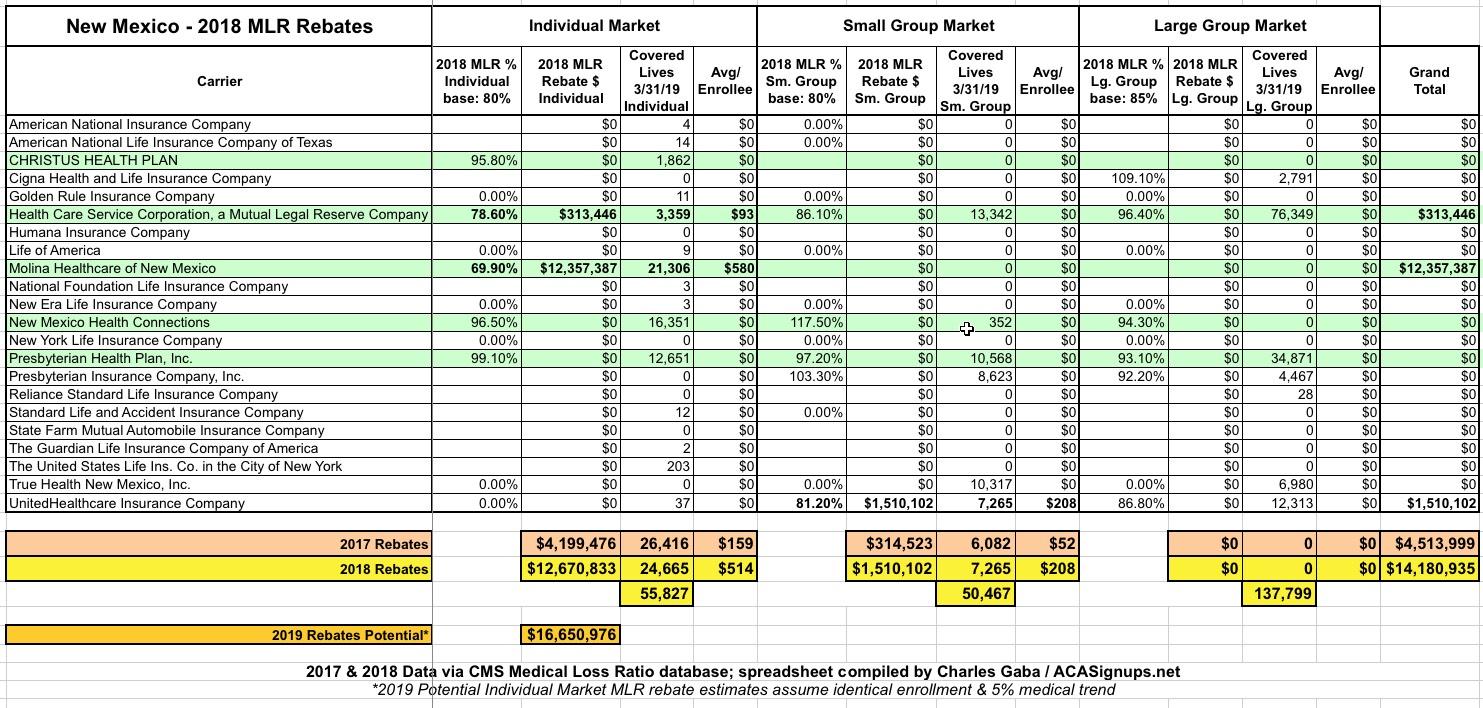

http://acasignups.net/sites/default/files/styles/inline_default/public/Microsoft ExcelScreenSnapz3173.jpg?itok=rsrVkiWE

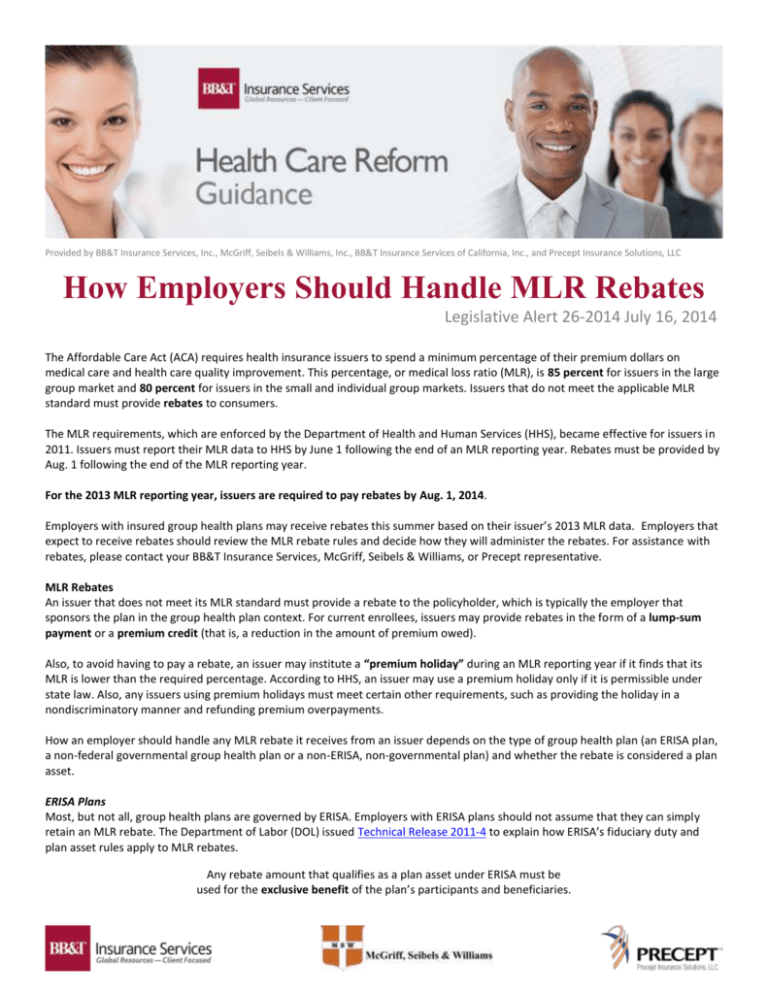

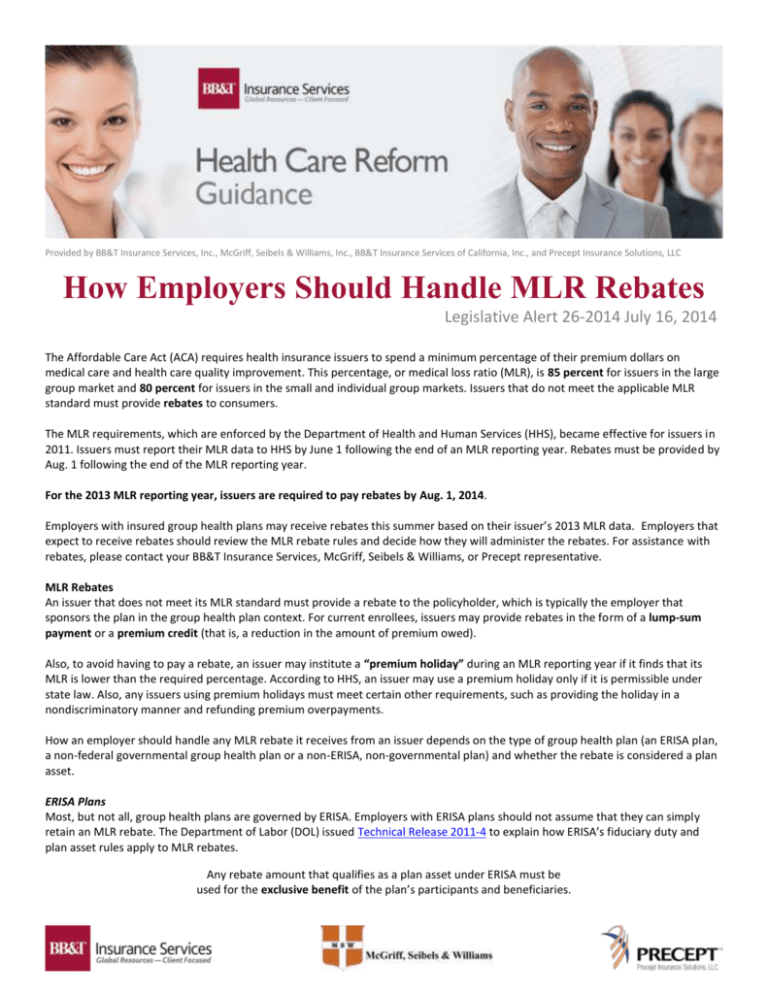

How Employers Should Handle MLR Rebates Central PA Benefit Solutions

https://www.1benefitsolutions.com/wp-content/uploads/2021/04/MLR-1200x800.jpg

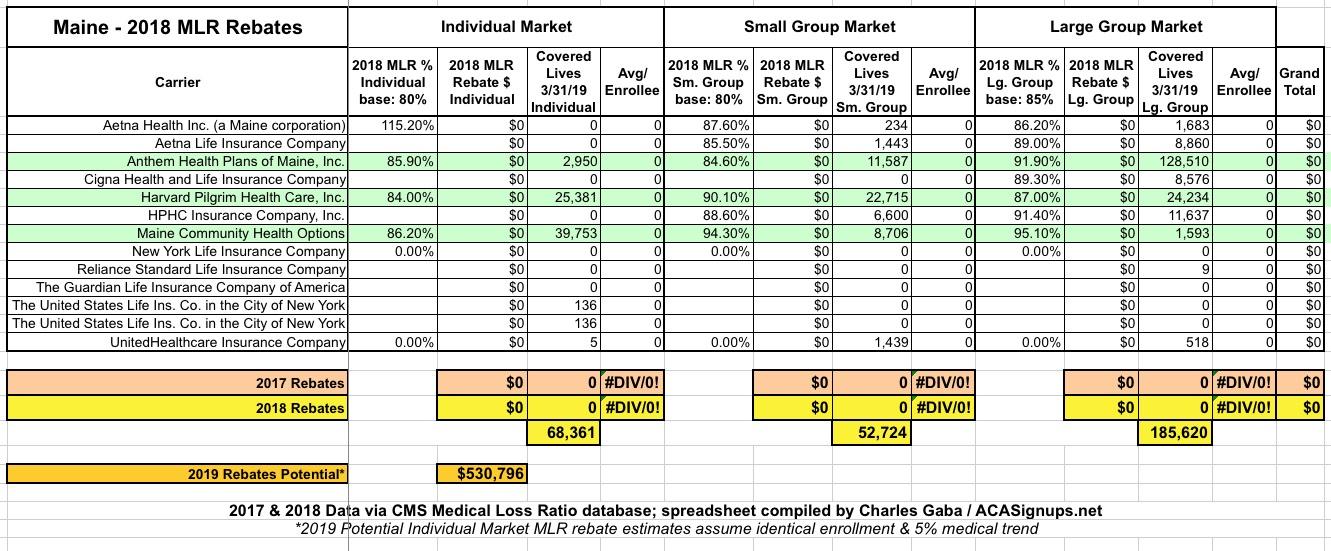

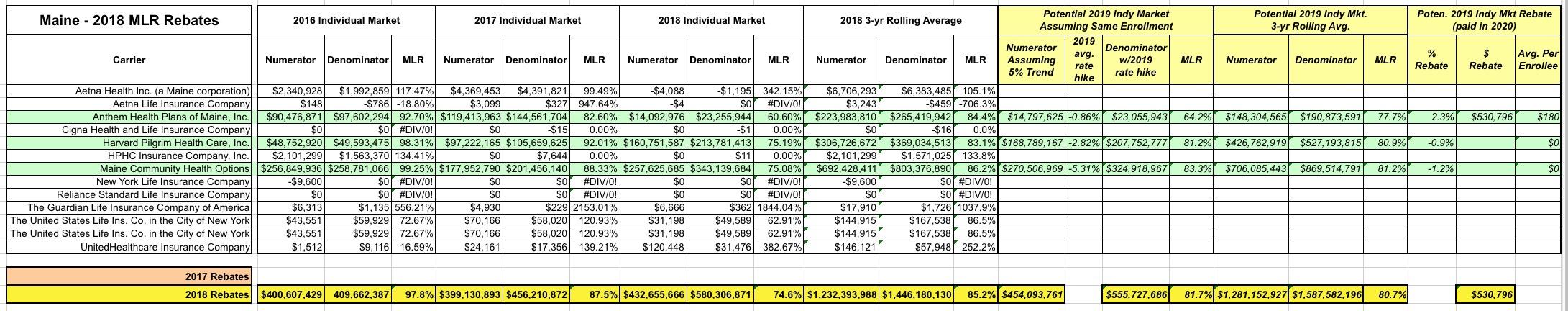

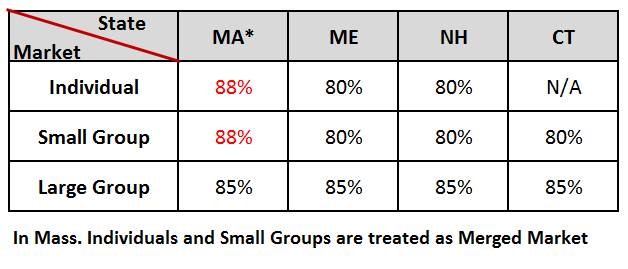

Maine The Most Boring MLR Rebate Table For At Least Two Years Running

http://acasignups.net/sites/default/files/styles/inline_default/public/Microsoft ExcelScreenSnapz3217.jpg?itok=syQO6500

Web 20 oct 2020 nbsp 0183 32 MLR REBATES An issuer that does not meet its MLR standard must provide a rebate to the policyholder typically the employer that sponsors the plan in the group Web 9 ao 251 t 2022 nbsp 0183 32 Tax Treatment of MLR Rebates The tax implications of MLR rebates for group health plans are outlined below If employees paid their plan premiums through a

Web What is the Medical Loss Ratio MLR rebate and how does it affect you Due to the Affordable Care Act enacted in May 2010 insurance companies are required to spend a Web The IRS issued a set of frequently asked questions FAQs addressing the tax treatment of MLR rebates In general the In general the rebates tax consequences depend on

Download Mlr Rebate Tax Treatment

More picture related to Mlr Rebate Tax Treatment

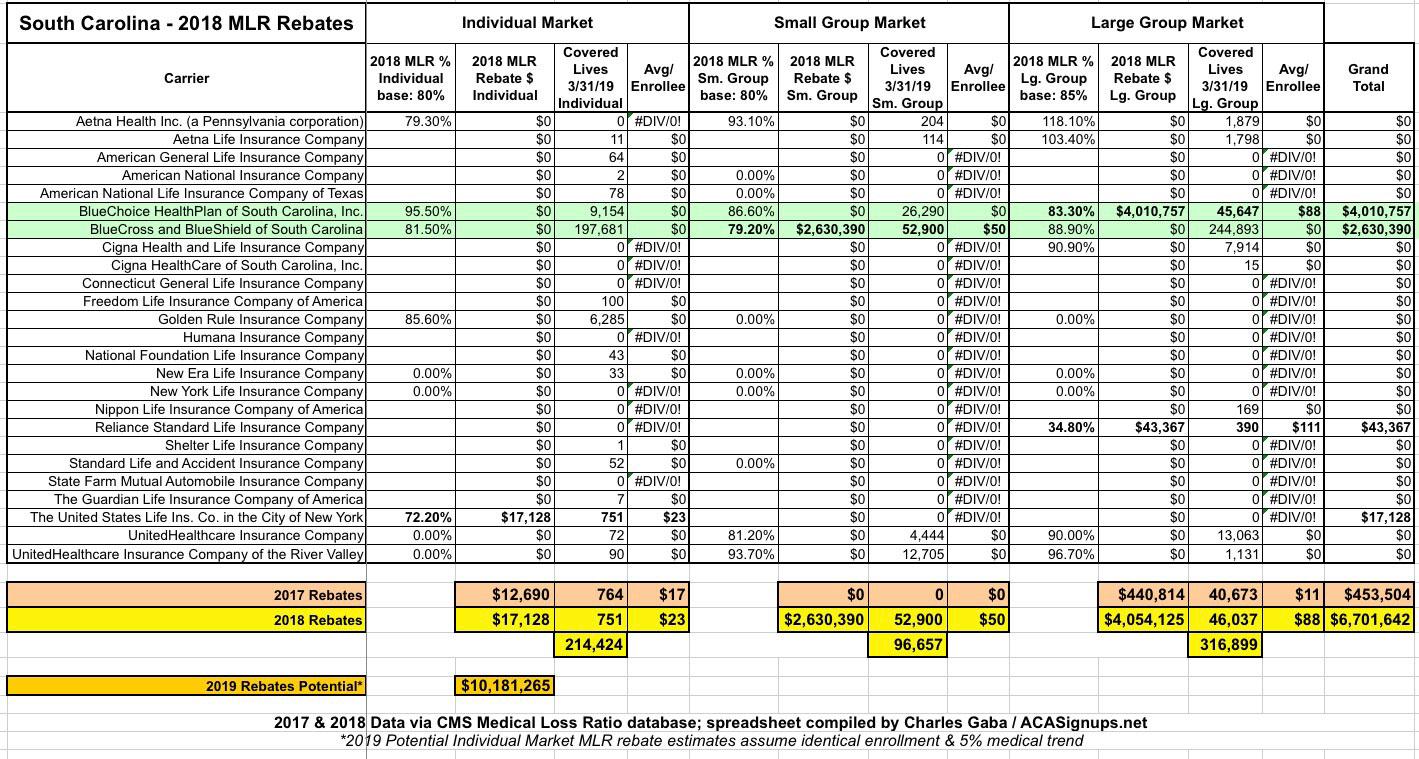

South Carolina Keep Your Eye On BCBS Next Year Re MLR Rebates ACA

https://acasignups.net/sites/default/files/styles/inline_default/public/south_carolina_summary.jpg?itok=wuIaiUlb

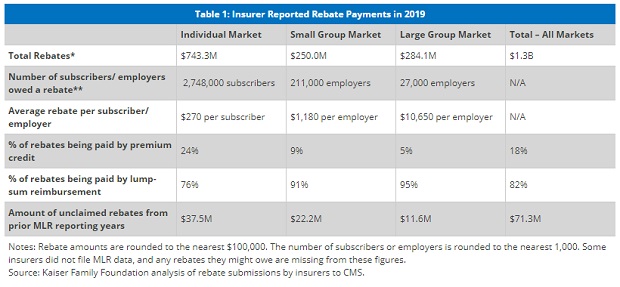

Insurers To Pay Out Record 1 3 Billion In MLR Rebates BenefitsPRO

https://images.benefitspro.com/contrib/content/uploads/sites/412/2019/09/Rebates.jpg

Index Of wp content uploads 2022 06

https://cowdenassociates.com/wp-content/uploads/2022/06/HCR-MLR-Rebates-Compliance-Steps-for-ERISA-Plan-Sponsors-pdf-791x1024.jpg

Web 25 mai 2012 nbsp 0183 32 On April 19 2012 the Internal Revenue Service IRS issued a set of Frequently Asked Questions FAQs explaining the tax treatment of premium rebates Web 27 juin 2012 nbsp 0183 32 Tax Implications of MLR Rebates Paid to Employees The tax treatment of MLR rebates paid to employees was the subject of some uncertainty until the IRS quot FAQ quot

Web 28 mai 2012 nbsp 0183 32 On April 19 2012 the Internal Revenue Service IRS issued a set of Frequently Asked Questions FAQs explaining the tax treatment of premium rebates Web 17 ao 251 t 2020 nbsp 0183 32 According to the IRS guidance if participant contributions were made on a pre tax basis the rebate portion that is returned to the participant as cash or a premium

How Employers Should Handle MLR Rebates

https://s3.studylib.net/store/data/009223871_1-094dc07274c6e2ac82fa1c72bf493e69-768x994.png

Maine The Most Boring MLR Rebate Table For At Least Two Years Running

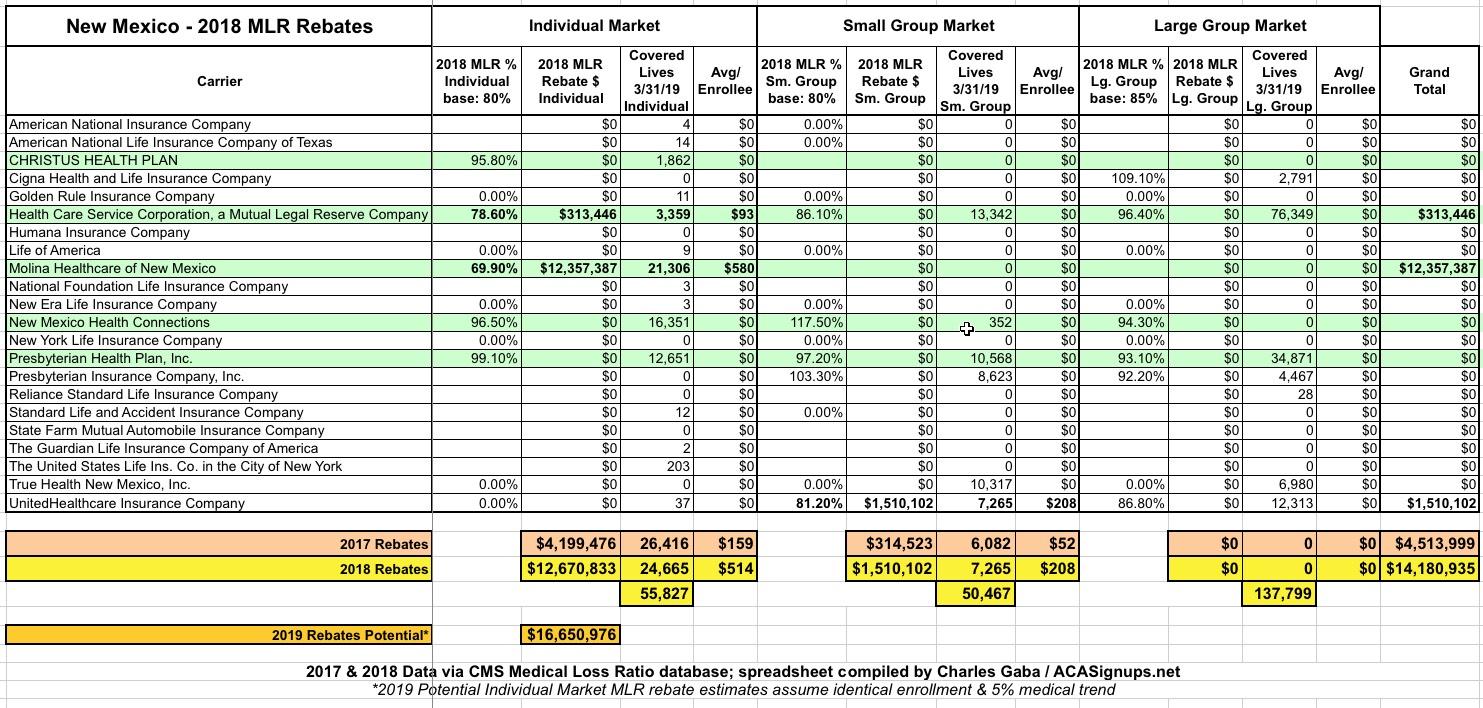

http://acasignups.net/sites/default/files/styles/inline_default/public/Microsoft ExcelScreenSnapz3218.jpg?itok=3A2yhlmo

https://www.natlawreview.com/article/irs-issues-faqs-tax-treatment...

Web 27 mai 2012 nbsp 0183 32 On April 19 2012 the Internal Revenue Service IRS issued a set of Frequently Asked Questions FAQs explaining the tax treatment of premium rebates

https://www.epicbrokers.com/insights/properly-handling-medical-loss...

Web 1 sept 2020 nbsp 0183 32 Tax Treatment of Benefits The Internal Revenue Service IRS issued a set of frequently asked questions addressing the tax treatment of MLR rebates In

MLR Rebate FAQs Harvard Pilgrim Health Care Employer

How Employers Should Handle MLR Rebates

Anthem Releases Medical Loss Ratio Rebate Information Hometown

Handling MLR Rebates

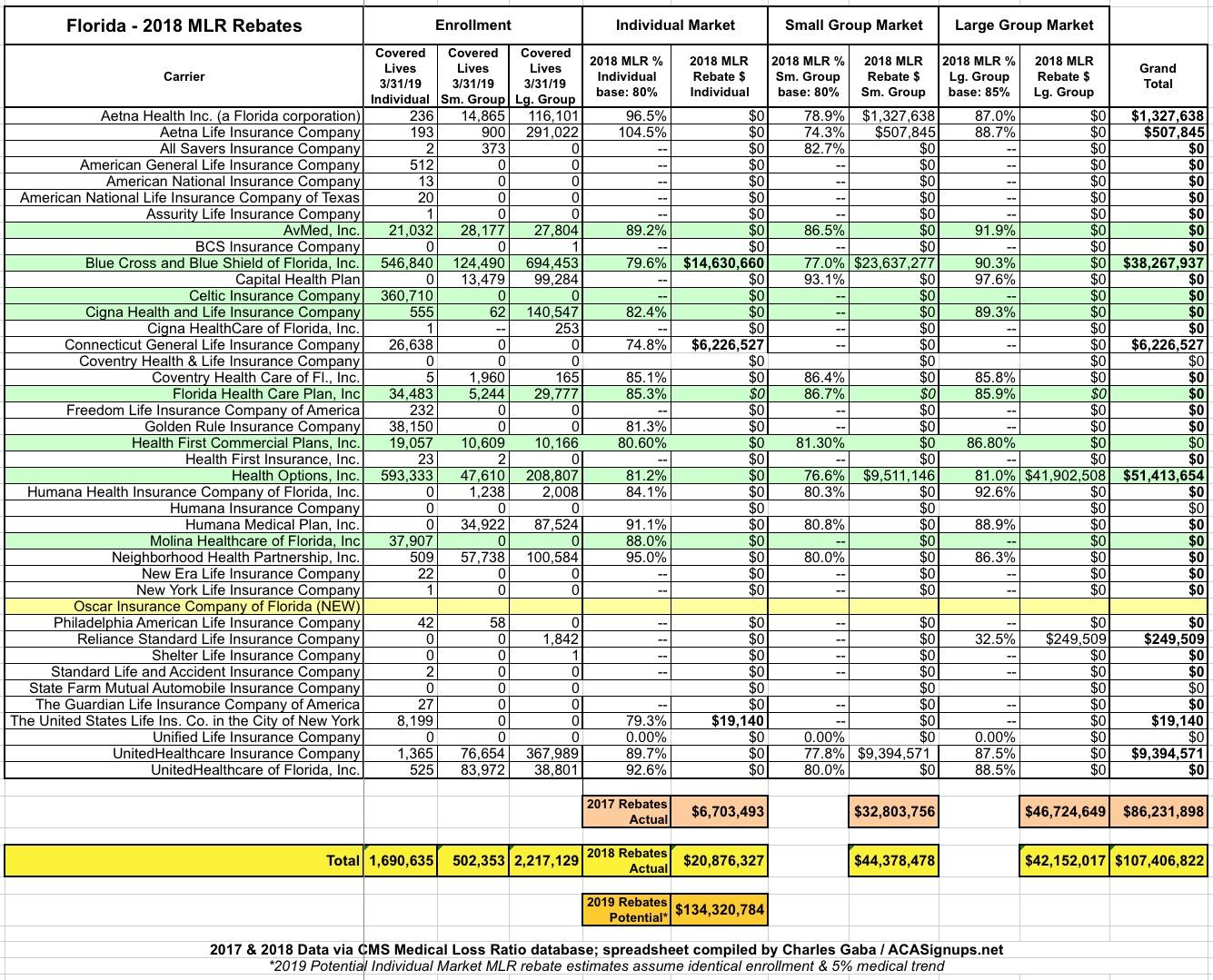

Exclusive Florida 2018 MLR Rebate Payments Potential 2019 Rebates

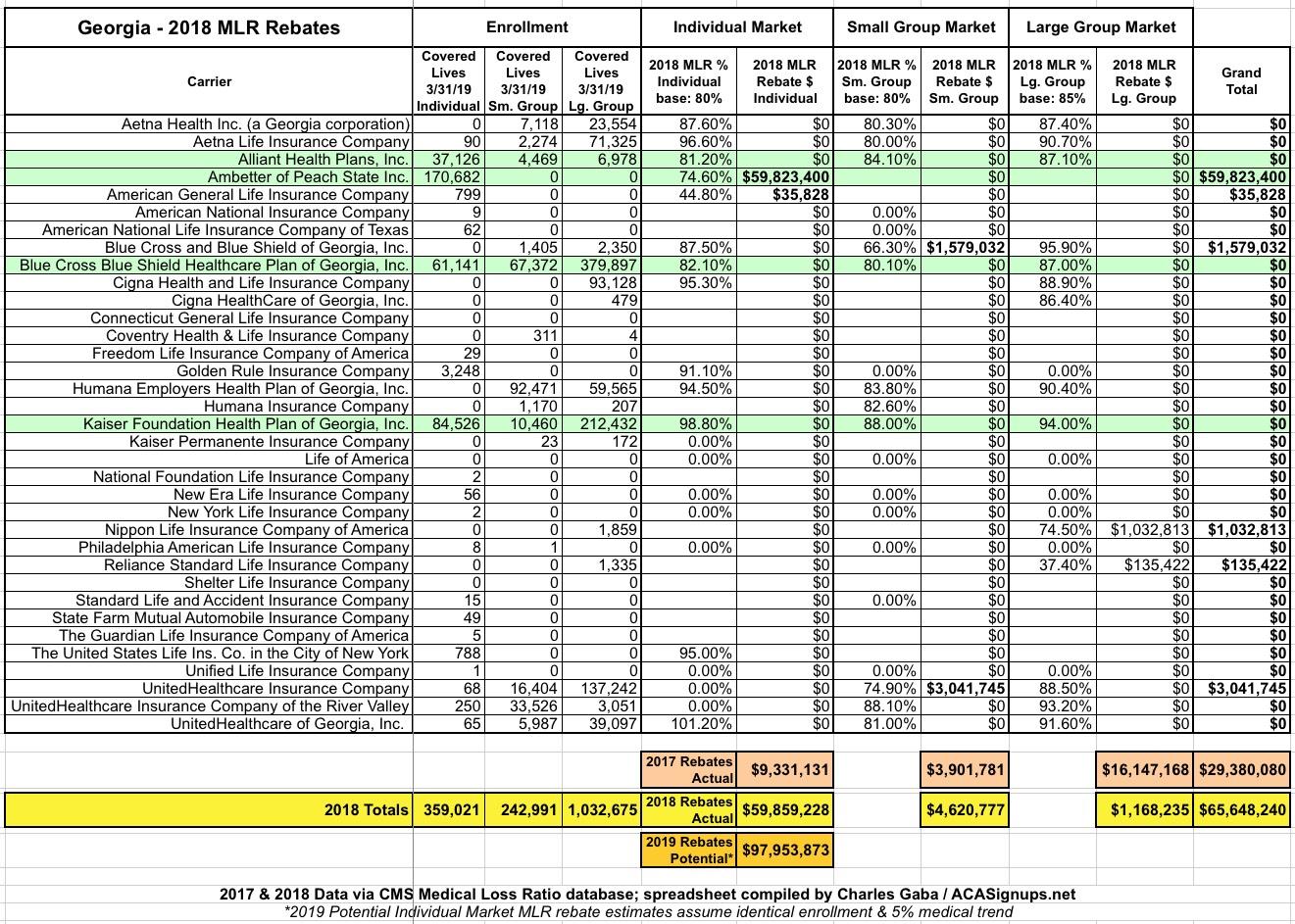

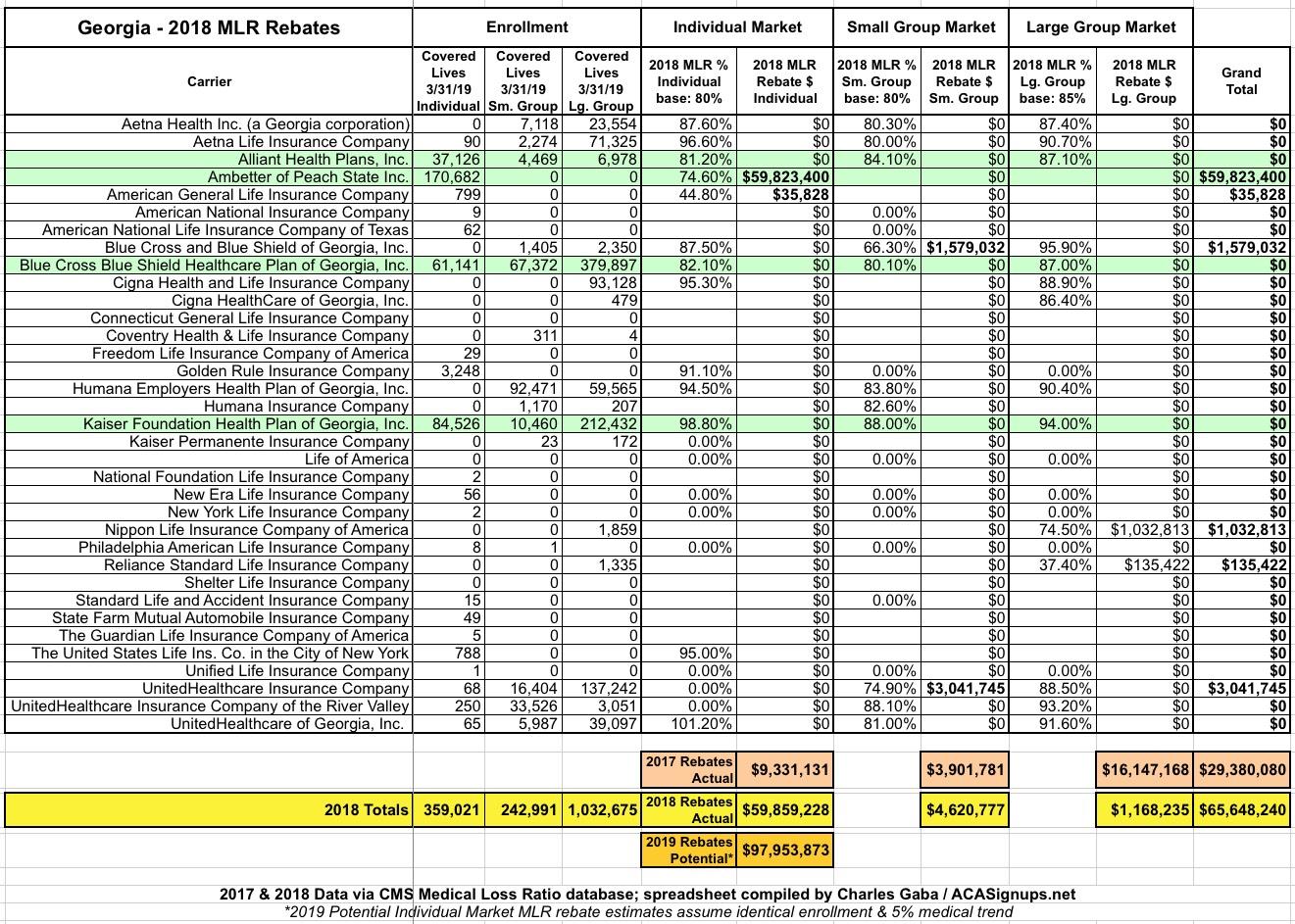

Exclusive Georgia 2018 MLR Rebate Payments Potential 2019 Rebates

Exclusive Georgia 2018 MLR Rebate Payments Potential 2019 Rebates

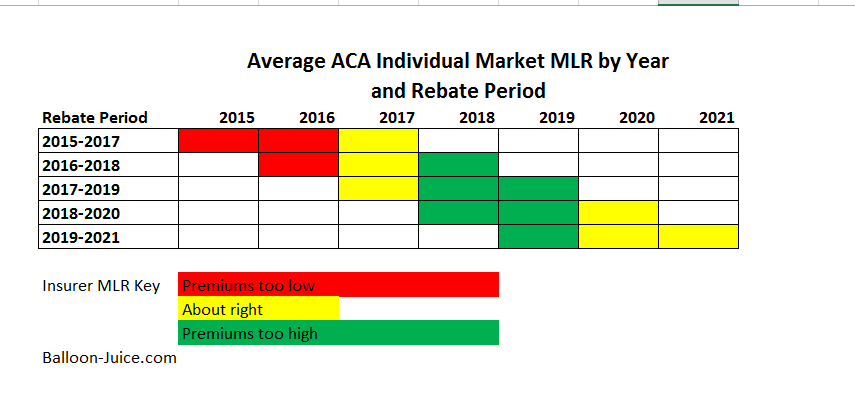

Balloon Juice Summer 2021 MLR Rebates Are Big

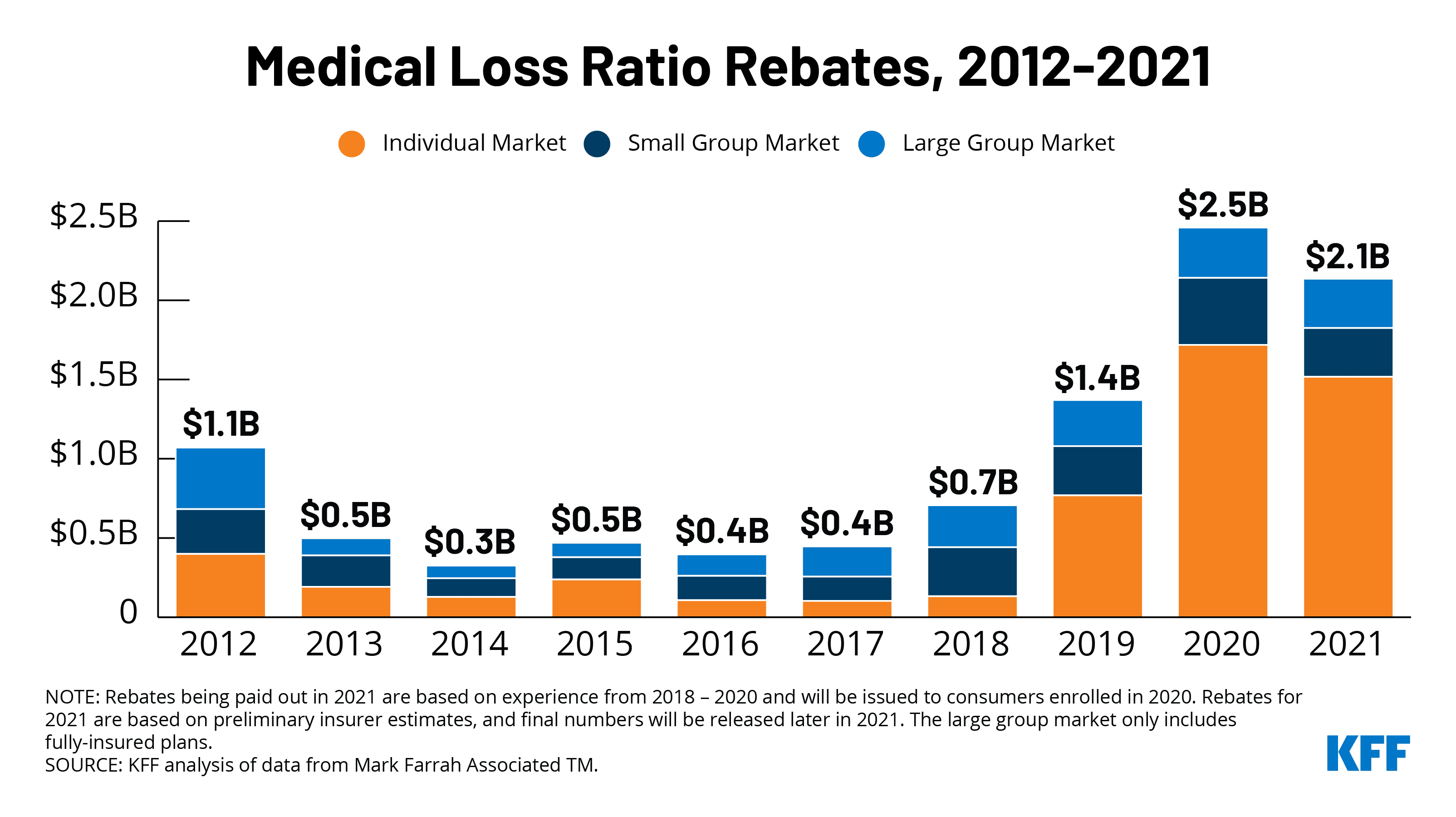

MLR Rebates Under ACA Expected To Top 2 Billion This Fall BenefitsPRO

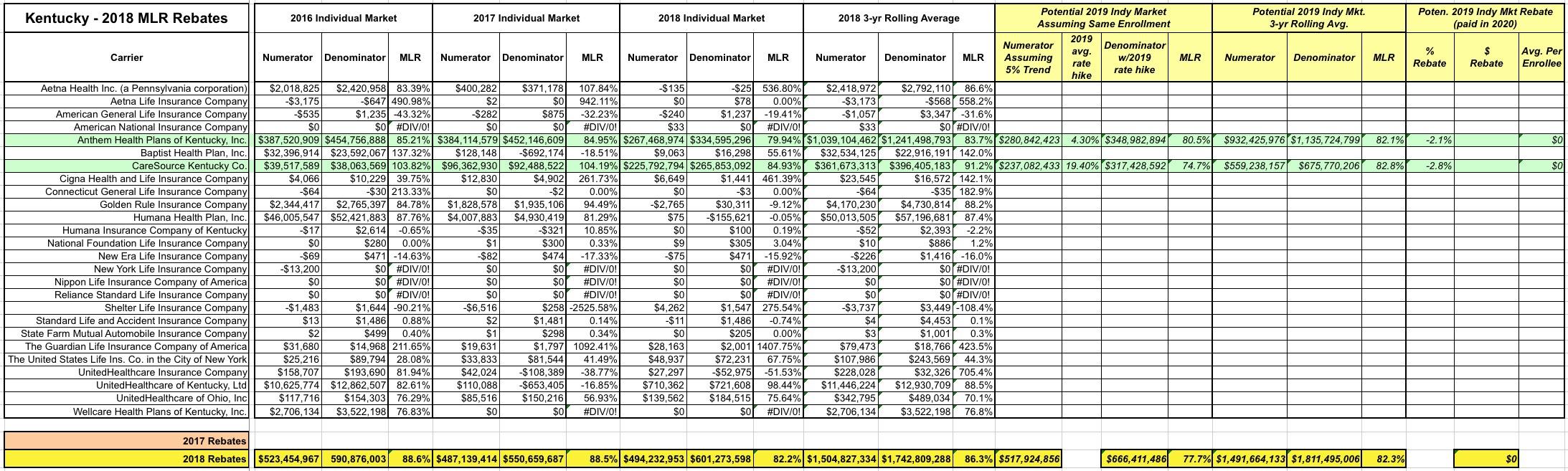

Kentucky 363 Large Group Enrollees To Split 44 000 In MLR Rebates

Mlr Rebate Tax Treatment - Web The IRS issued a set of frequently asked questions FAQs addressing the tax treatment of MLR rebates In general the In general the rebates tax consequences depend on