Mlr Rebate Taxable Web Once you have calculated the amount you must return include that amount as Other Taxes owed on Line 60 of your 2012 Form 1040 U S Individual Income Tax Return

Web 27 mai 2012 nbsp 0183 32 MLR rebates paid by an Insurance Company either as cash payments or as premium reductions are return premiums Return premiums reduce an Insurance Web Are rebates taxable In general rebates are taxable if you pay health insurance premiums with pre tax dollars or you received tax benefits by deducting premiums

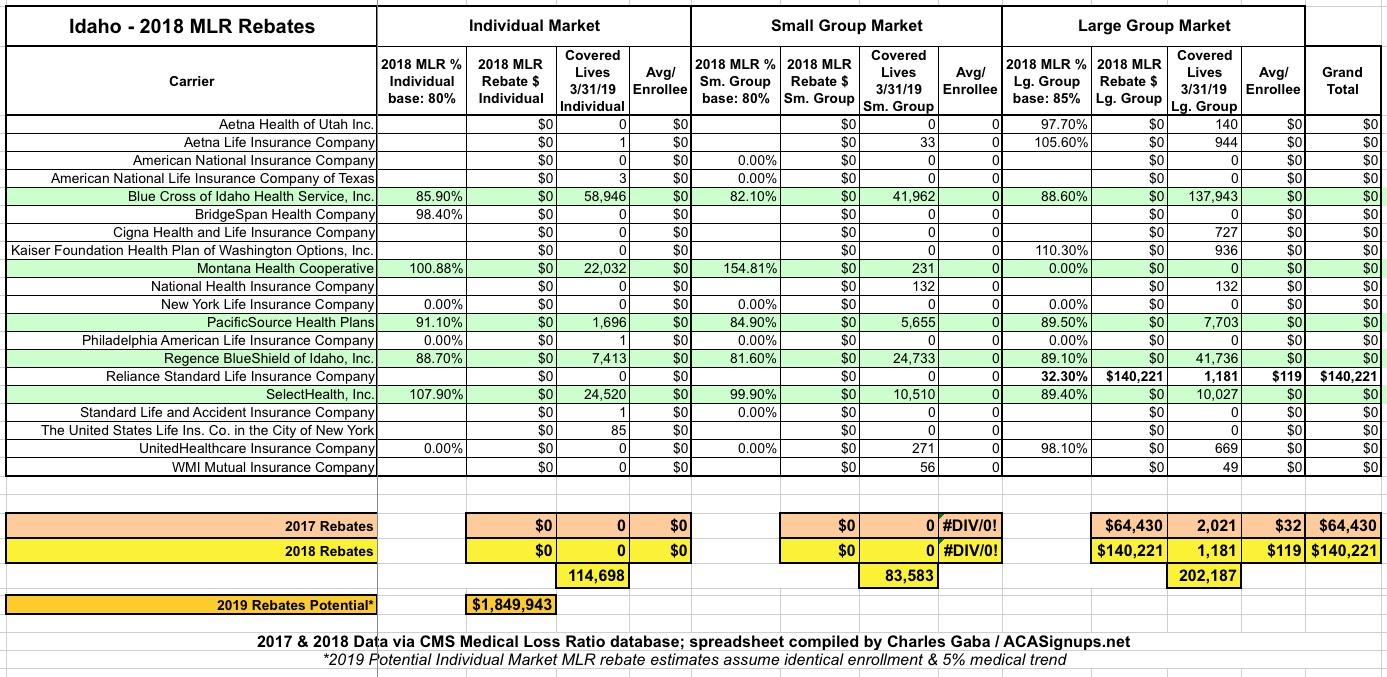

Mlr Rebate Taxable

Mlr Rebate Taxable

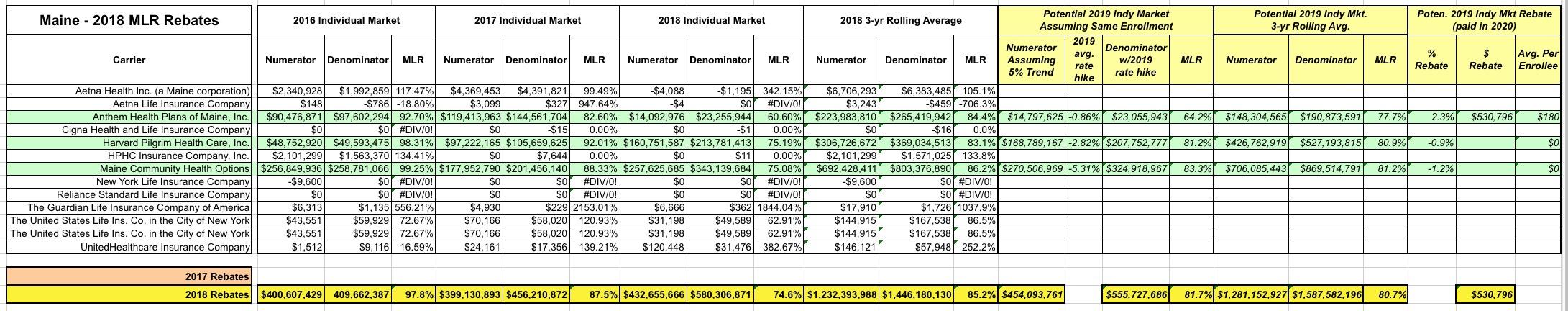

http://acasignups.net/sites/default/files/styles/inline_default/public/Microsoft ExcelScreenSnapz3218.jpg?itok=3A2yhlmo

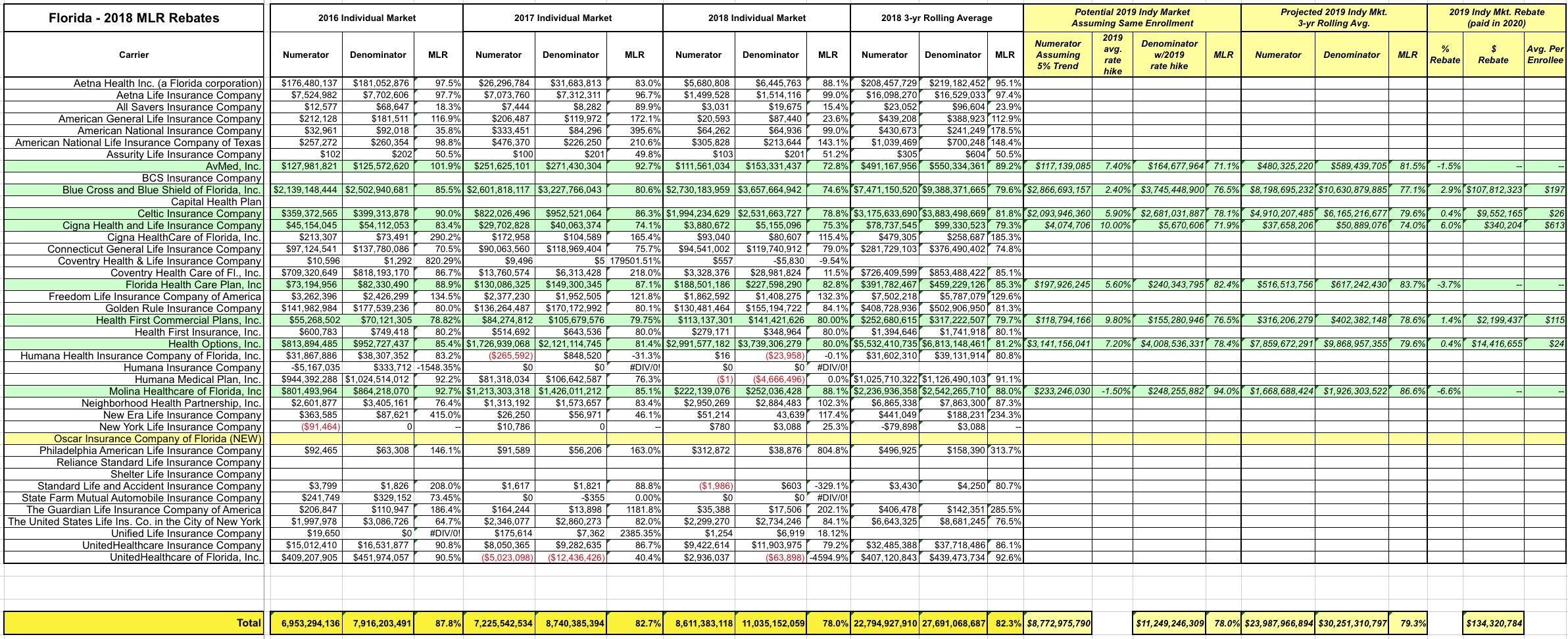

Exclusive Florida 2018 MLR Rebate Payments Potential 2019 Rebates

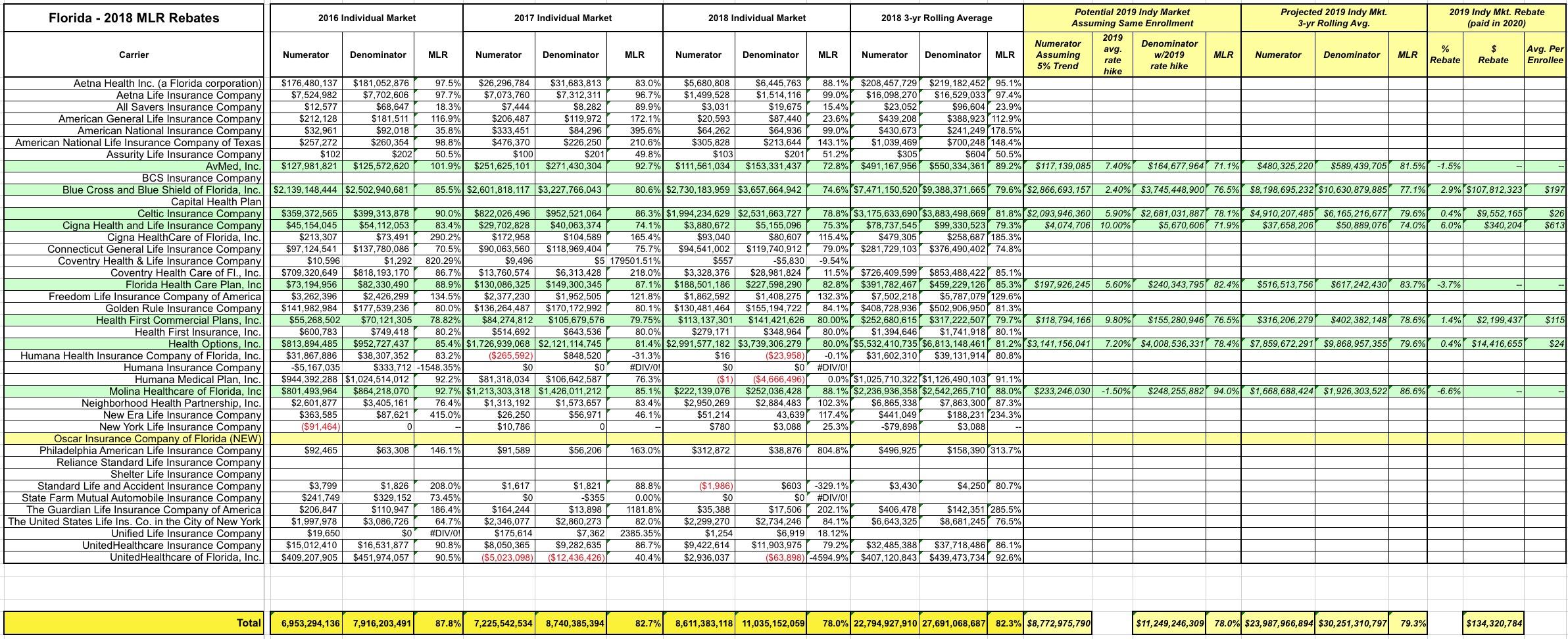

https://acasignups.net/sites/default/files/styles/inline_default/public/Microsoft ExcelScreenSnapz3101.jpg?itok=qrpLCWM5

Exclusive Georgia 2018 MLR Rebate Payments Potential 2019 Rebates

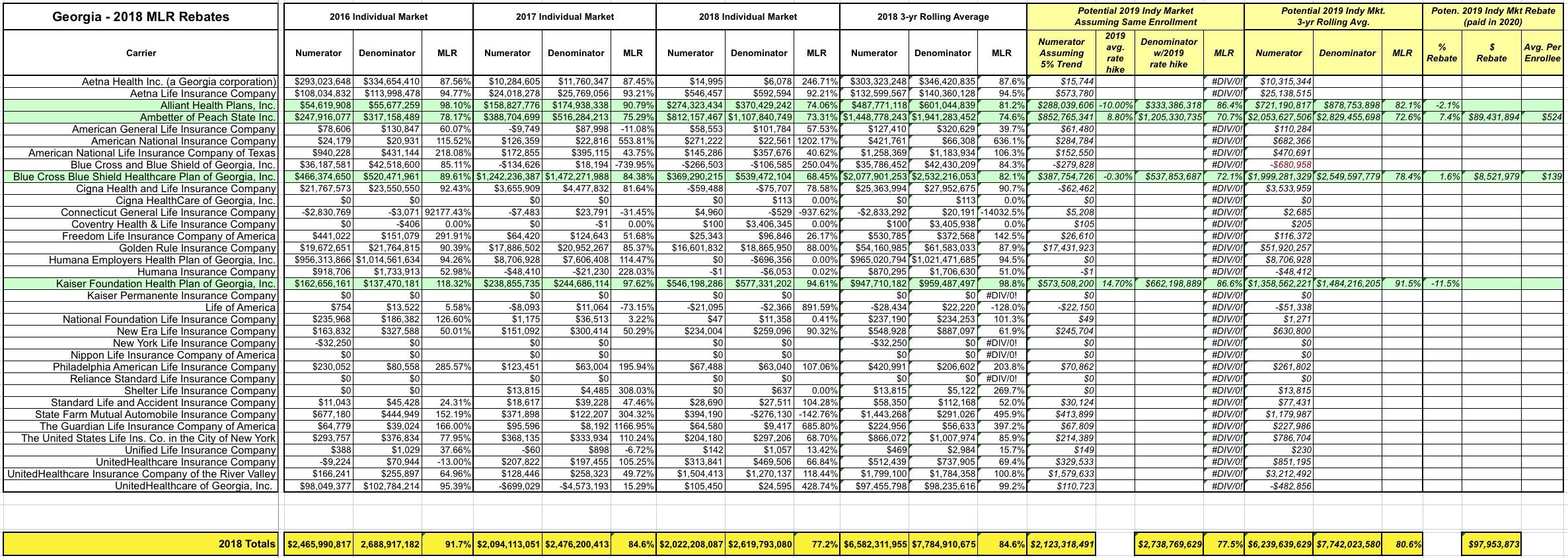

http://acasignups.net/sites/default/files/styles/inline_default/public/Microsoft ExcelScreenSnapz3099.jpg?itok=a5mbp5uC

Web 12 nov 2020 nbsp 0183 32 Discussions Taxes Get your taxes done cowdogman Level 3 Medical Loss Ratio Rebate I received in 2020 a Medical Loss Ratio Rebate check for premiums paid Web 17 mai 2023 nbsp 0183 32 MLR rebates are based on a 3 year average meaning that rebates issued in 2023 will be calculated using insurers financial data in 2020 2021 and 2022 and will go to people and businesses who

Web companies to provide a rebate related to insurance premiums in certain situations If you are interested in more information about the MLR rebate rules you should visit the HHS Web the rebate is taxable to the extent the employee received a tax benefit from the deduction Pre tax Premium Payments If premiums were paid by employees on a pre tax basis

Download Mlr Rebate Taxable

More picture related to Mlr Rebate Taxable

No Longer Exclusive Idaho 2018 MLR Rebate Payments Potential

http://acasignups.net/sites/default/files/styles/inline_default/public/Microsoft ExcelScreenSnapz3130.jpg?itok=N1Xkk9U0

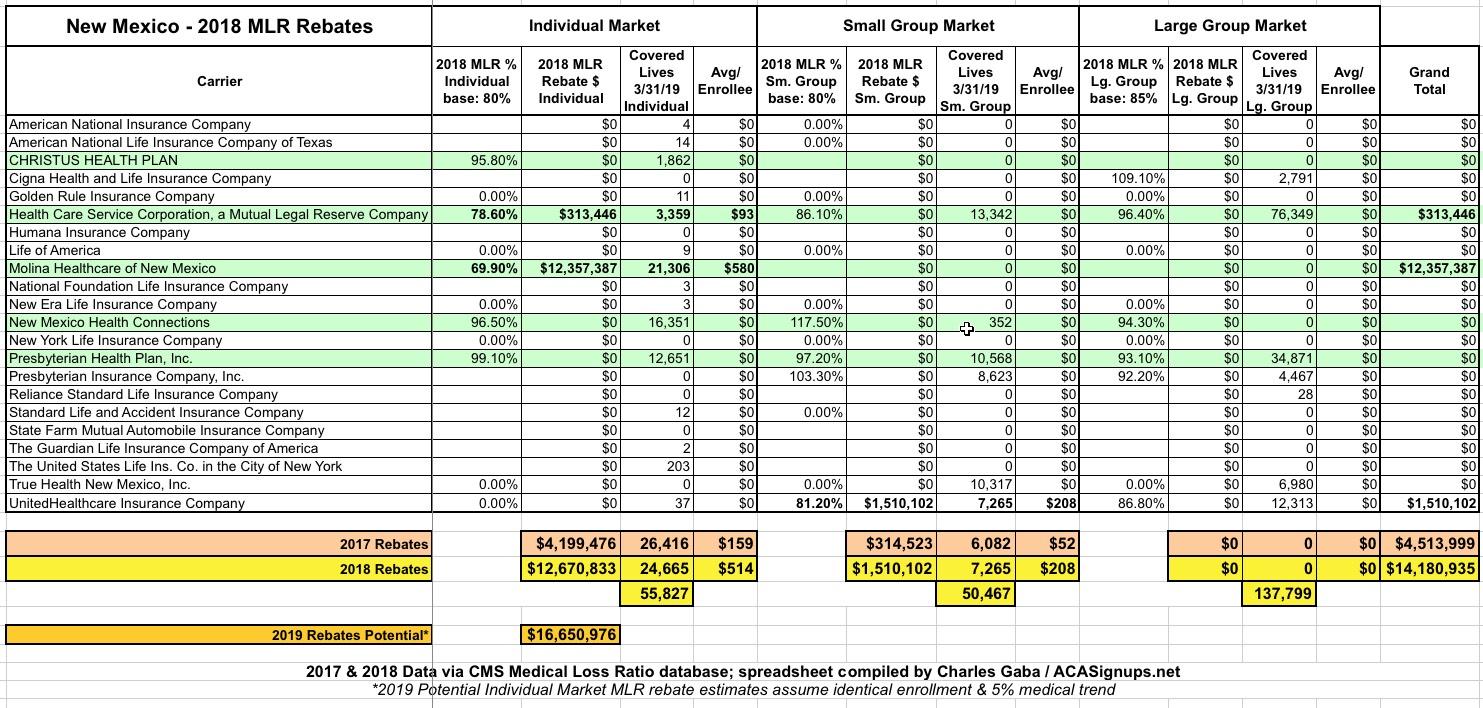

New Mexico 25 000 Enrollees To Receive 12 7 Million In MLR Rebates

http://acasignups.net/sites/default/files/styles/inline_default/public/Microsoft ExcelScreenSnapz3173.jpg?itok=rsrVkiWE

Fillable Online 2020 MLR Rebate Template Fax Email Print PdfFiller

https://www.pdffiller.com/preview/551/749/551749767/large.png

Web 14 sept 2021 nbsp 0183 32 In the Small Group market the law requires an MLR of 80 That is at least 80 of premium dollars must be spent on health care related expenses and no more Web 12 sept 2012 nbsp 0183 32 The basic rule of thumb in determining whether your MLR rebate is taxable is fairly straightforward if a tax benefit was previously gained on the premiums now

Web 9 ao 251 t 2022 nbsp 0183 32 Tax Treatment of MLR Rebates The tax implications of MLR rebates for group health plans are outlined below If employees paid their plan premiums through a Web 9 juin 2022 nbsp 0183 32 According to the IRS for participants who made pre tax contributions to a plan and received a rebate portion in the form of a premium holiday or cash payment the

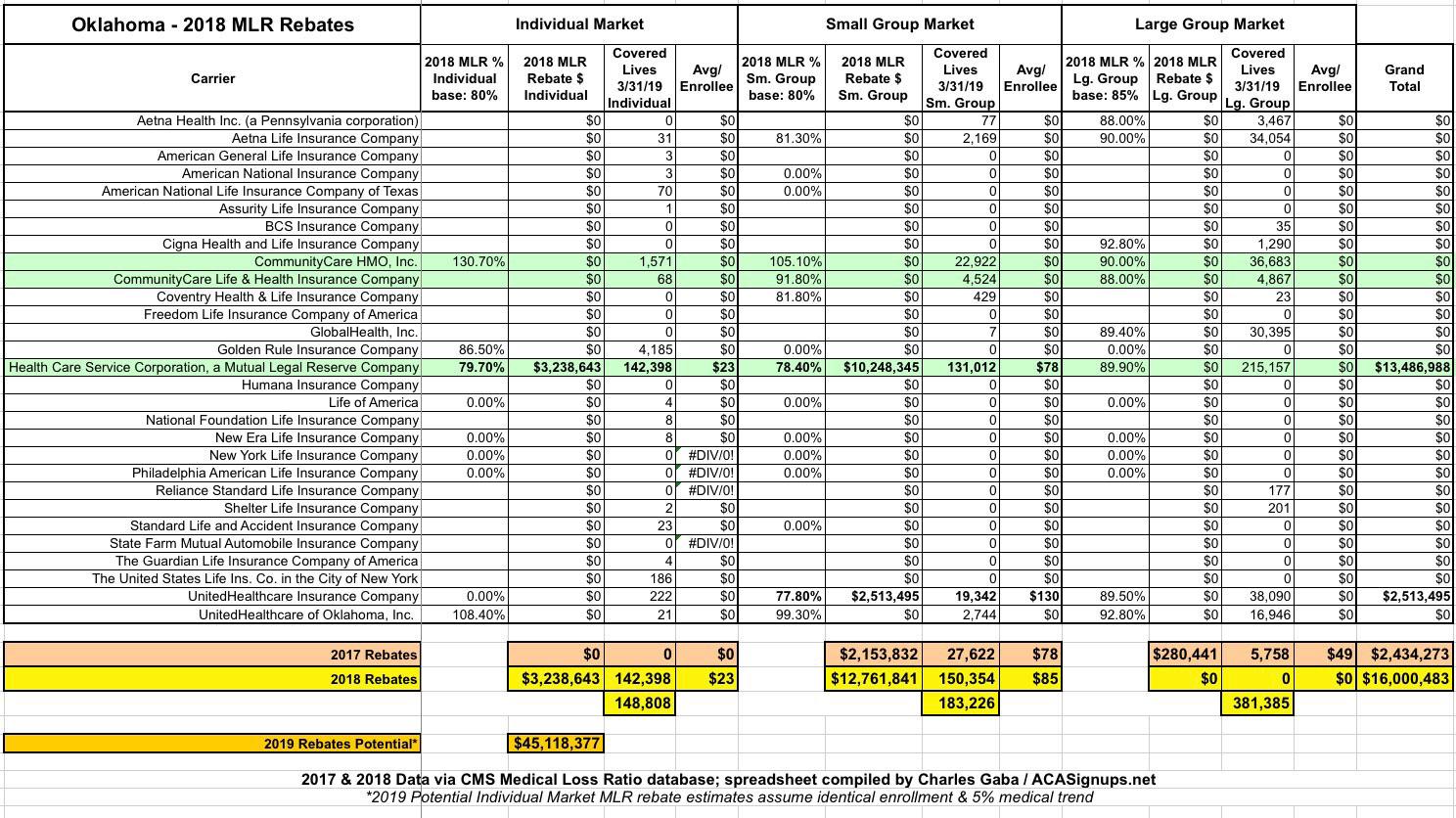

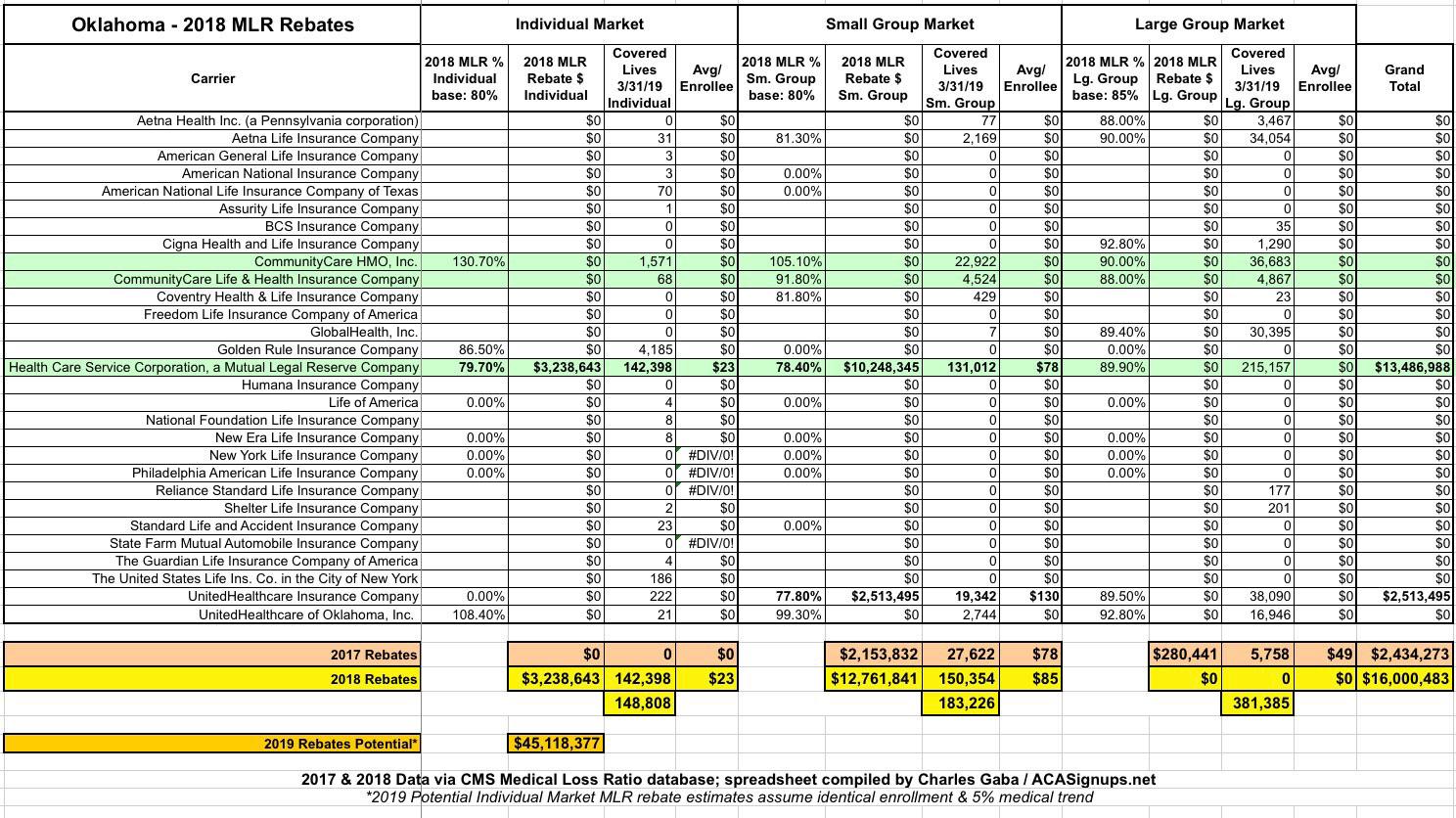

Oklahoma 16 Million In MLR Rebates To Be Paid To 273 000 Blue Cross

http://acasignups.net/sites/default/files/styles/inline_default/public/oklahoma_summary.jpg?itok=ox6D9wdY

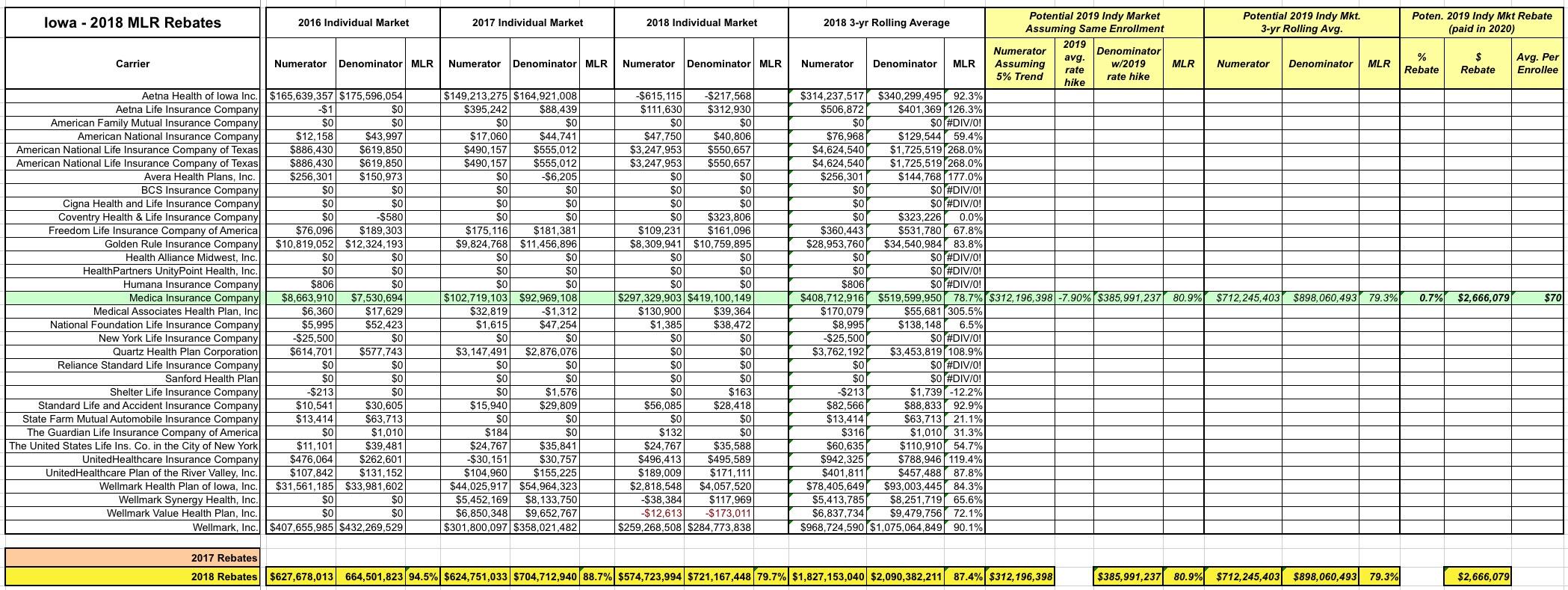

Iowa 2 4 Million In MLR Rebate Payments Going To 49 000 Enrollees

http://acasignups.net/sites/default/files/styles/inline_default/public/Microsoft ExcelScreenSnapz3139.jpg?itok=PdDSpV9W

https://www.irs.gov/pub/irs-utl/Medical Loss Ratio (MLR) Re…

Web Once you have calculated the amount you must return include that amount as Other Taxes owed on Line 60 of your 2012 Form 1040 U S Individual Income Tax Return

https://www.natlawreview.com/article/irs-issues-faqs-tax-treatment...

Web 27 mai 2012 nbsp 0183 32 MLR rebates paid by an Insurance Company either as cash payments or as premium reductions are return premiums Return premiums reduce an Insurance

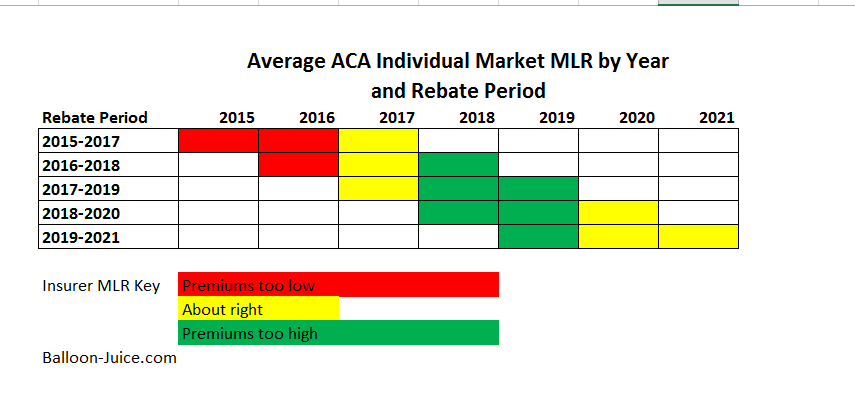

Balloon Juice Risk Corridors And Buying Future Medical Loss Ratio

Oklahoma 16 Million In MLR Rebates To Be Paid To 273 000 Blue Cross

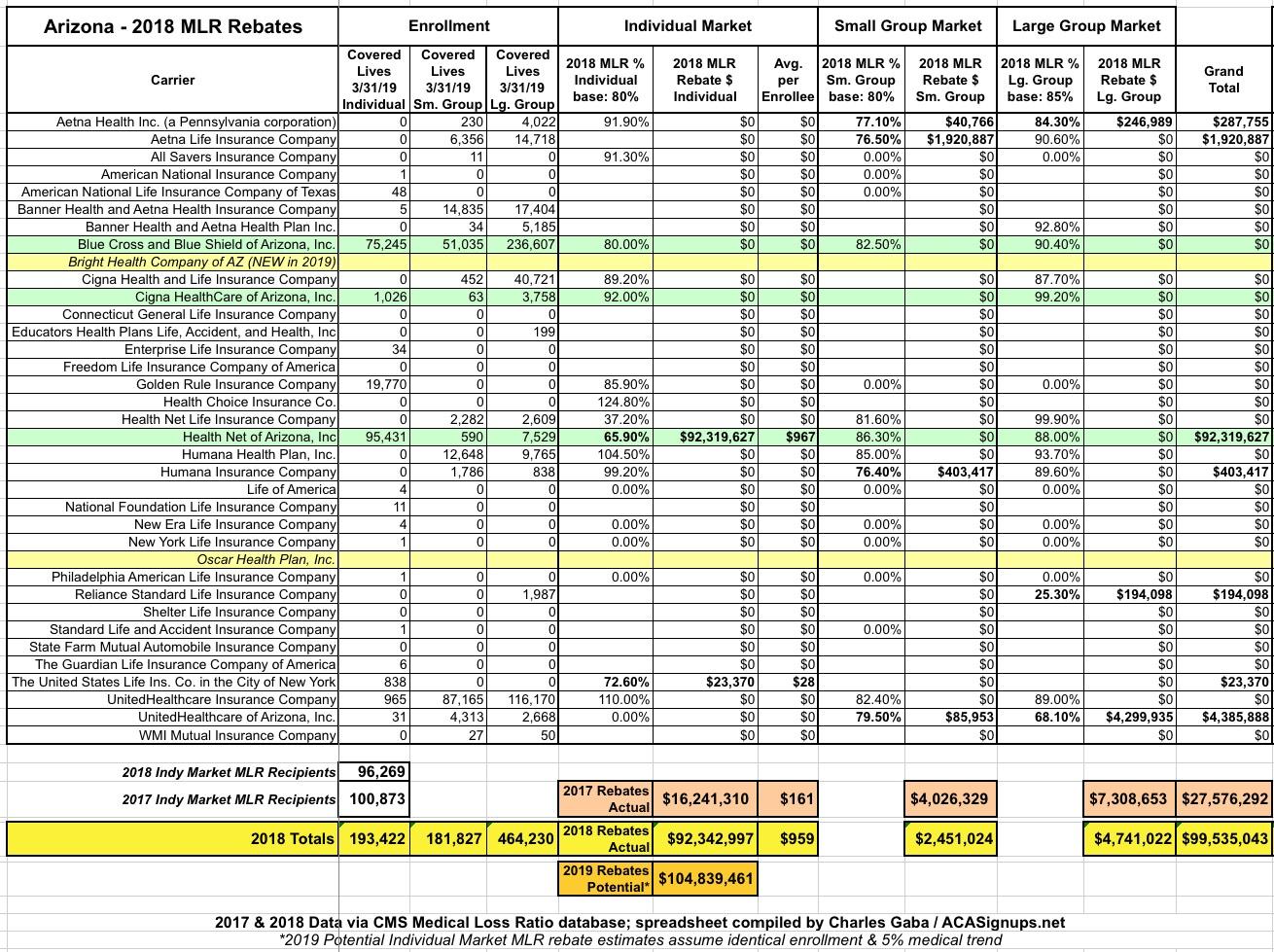

Exclusive Arizona 2018 MLR Rebate Payments Potential 2019 Rebates

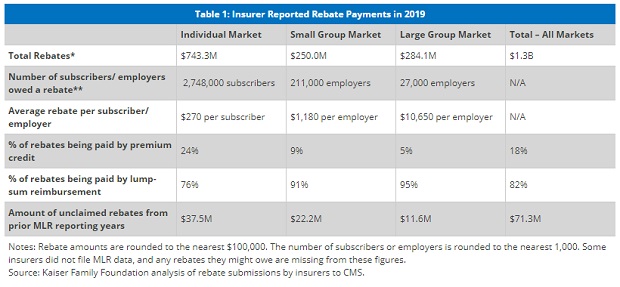

Insurers To Pay Out Record 1 3 Billion In MLR Rebates BenefitsPRO

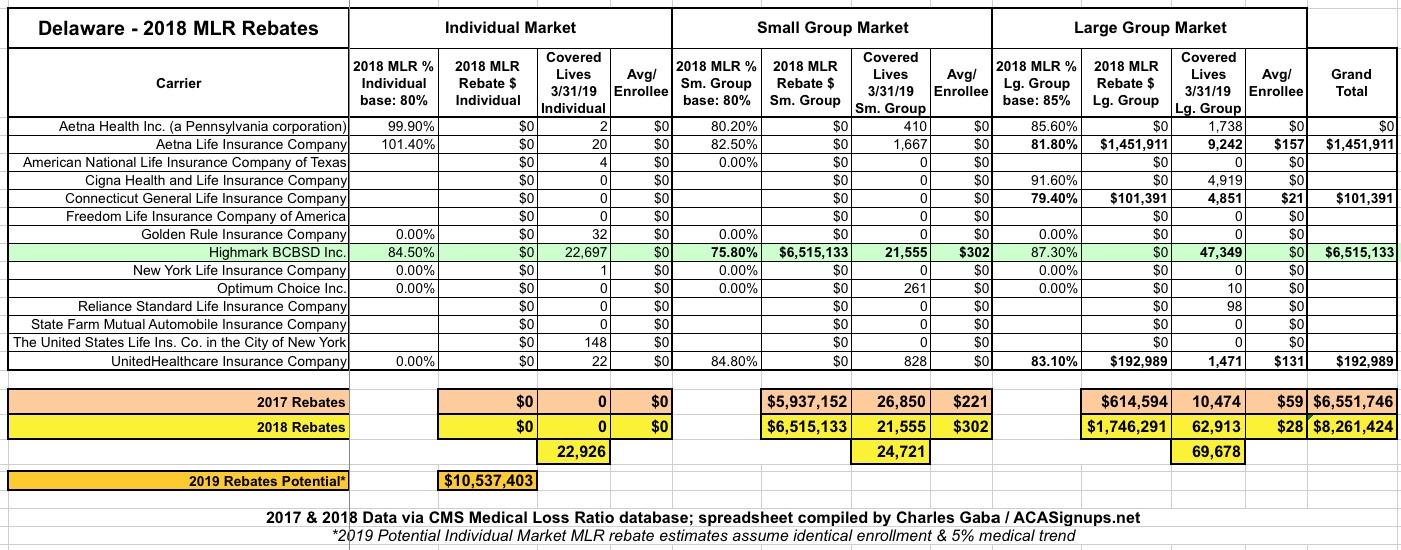

Exclusive Delaware 2018 MLR Rebate Payments Potential 2019 Rebates

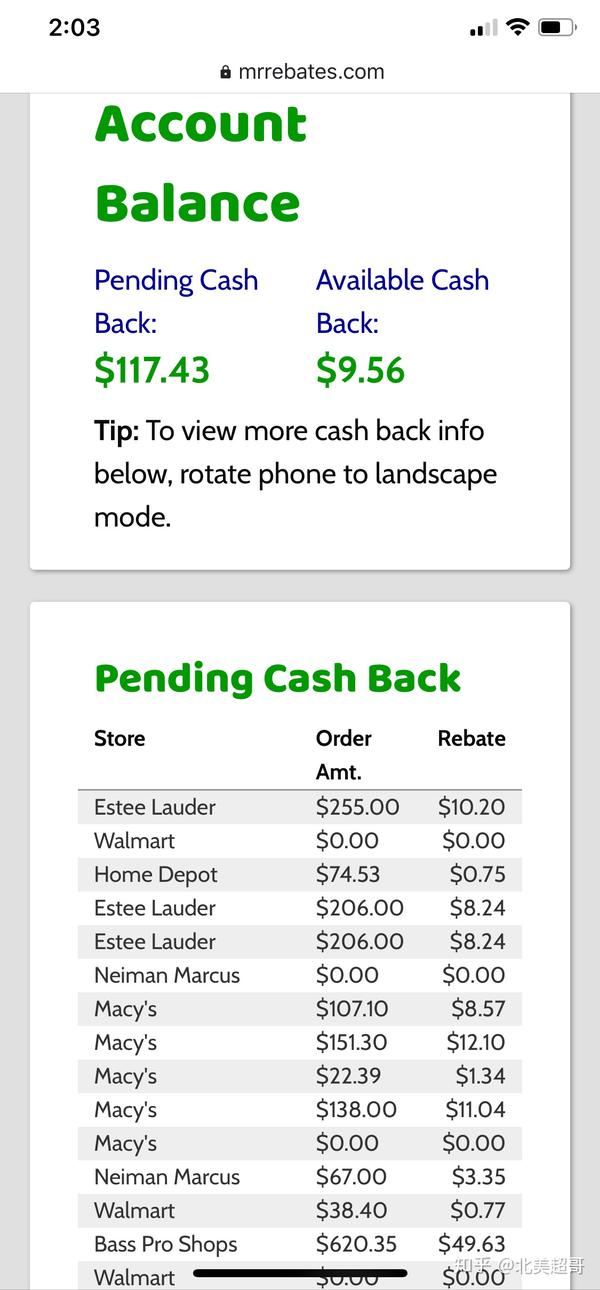

Mr Rebates Mrrebates

Mr Rebates Mrrebates

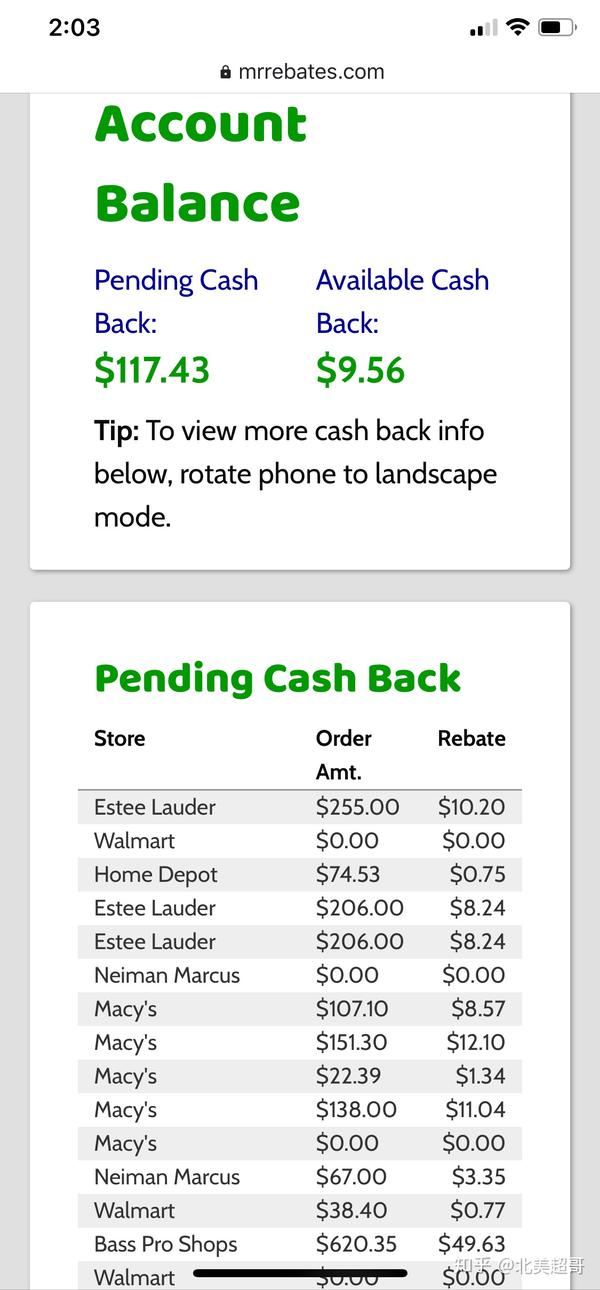

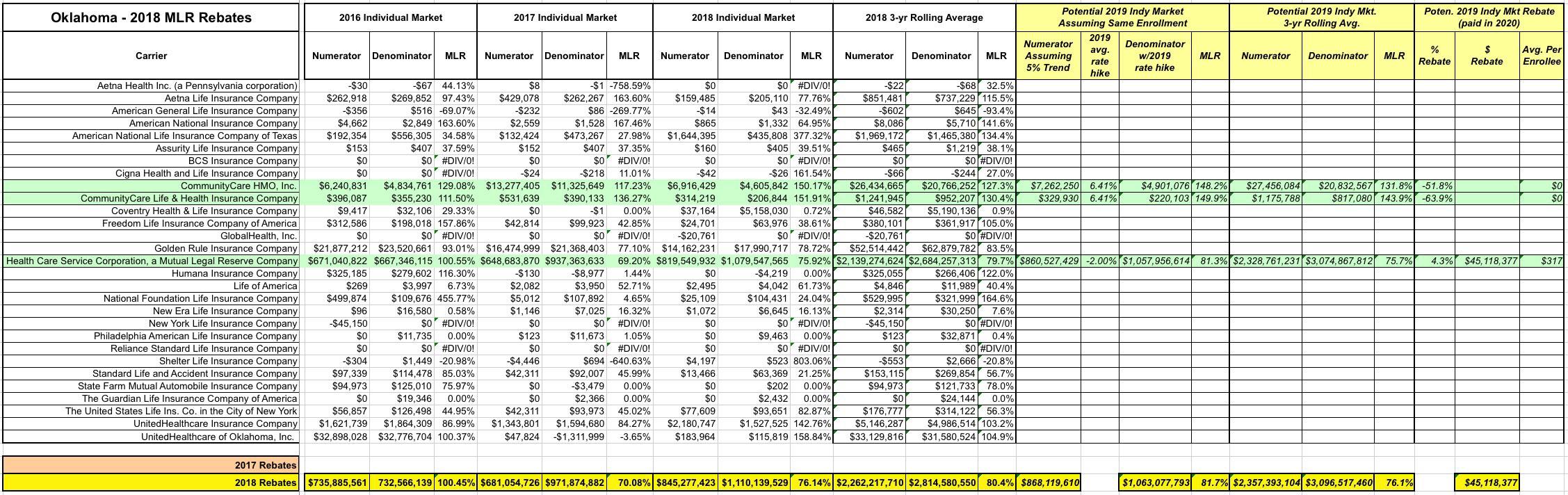

Oklahoma 16 Million In MLR Rebates To Be Paid To 273 000 Blue Cross

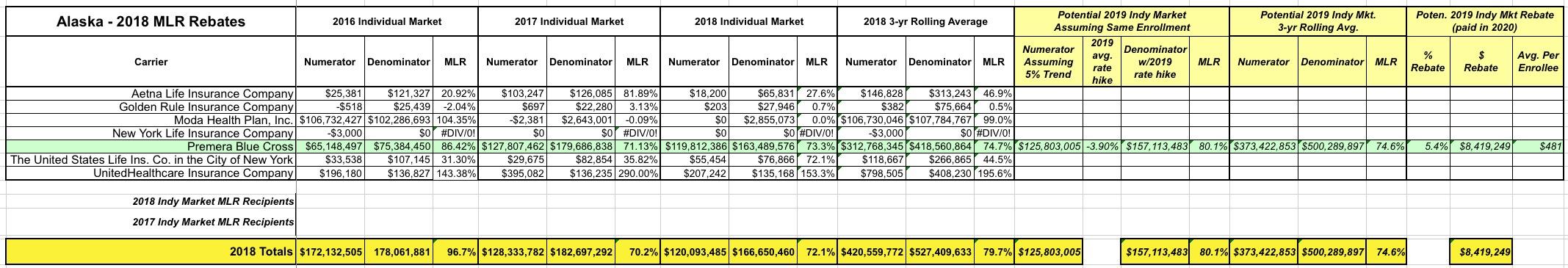

Exclusive Alaska 2018 MLR Rebate Payments Potential 2019 Rebates

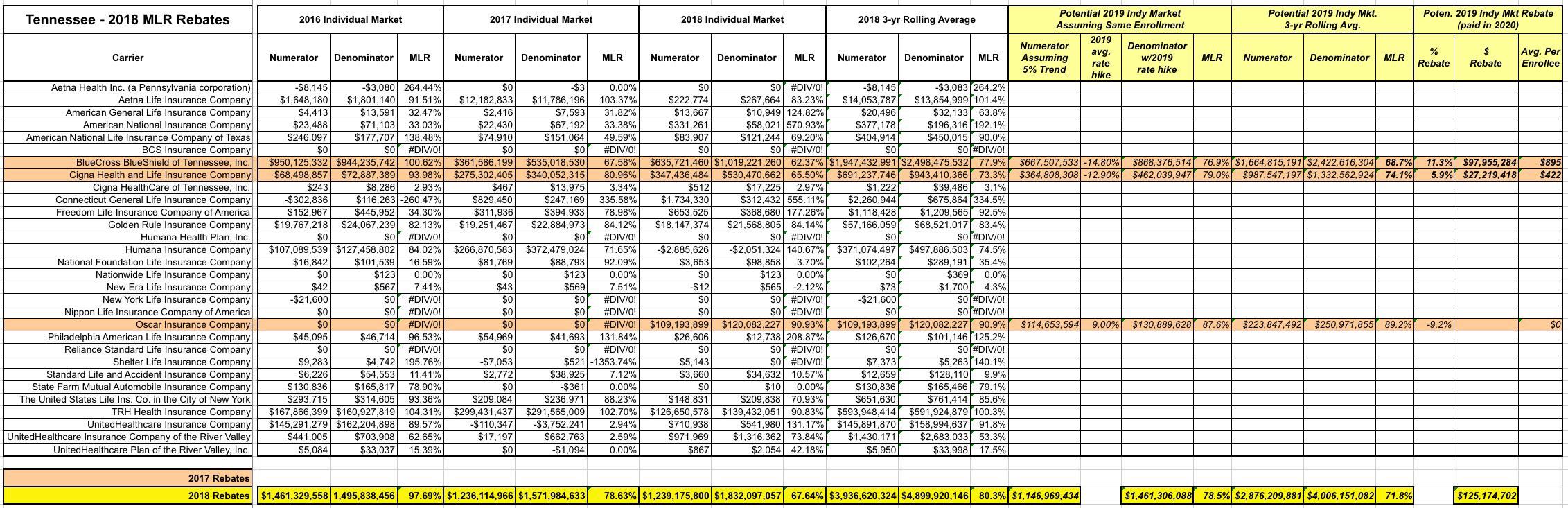

Tennessee 57 Million In MLR Rebates To Be Paid Out To 174 000

Mlr Rebate Taxable - Web companies to provide a rebate related to insurance premiums in certain situations If you are interested in more information about the MLR rebate rules you should visit the HHS