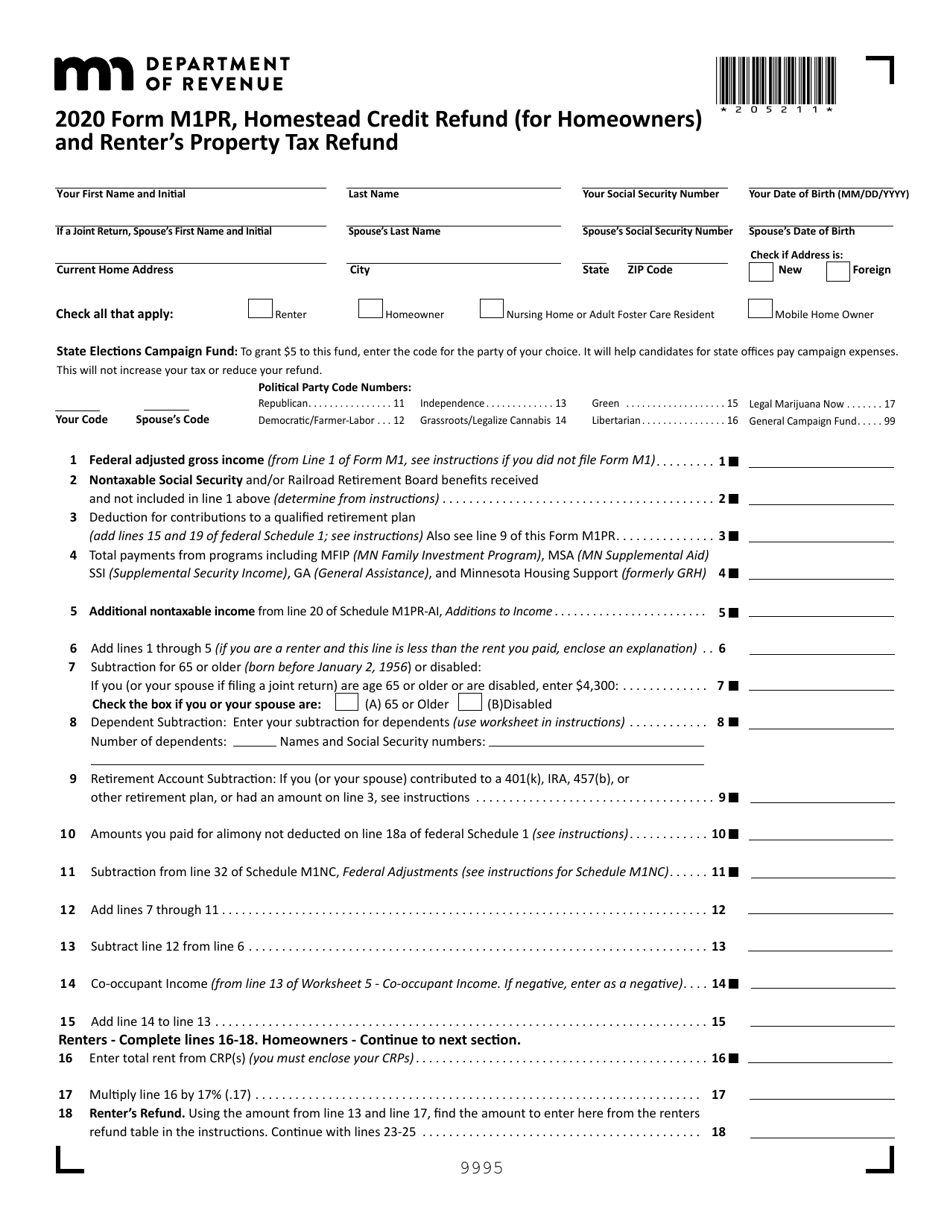

Mn Renter S Rebate Form M1pr The refund is 60 of the amount of tax paid that exceeds the 12 increase up to 1 000 You may qualify for this special refund even if you do not qualify for the 2023 Homestead Credit Refund If you are filing only for the special property tax refund complete only lines 1 15 19 20 23 25 and Schedule 1

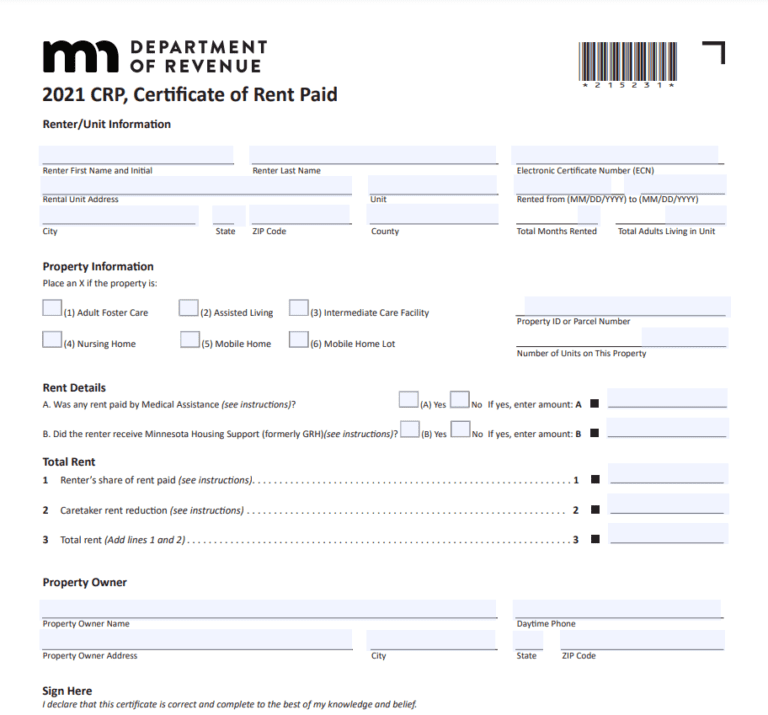

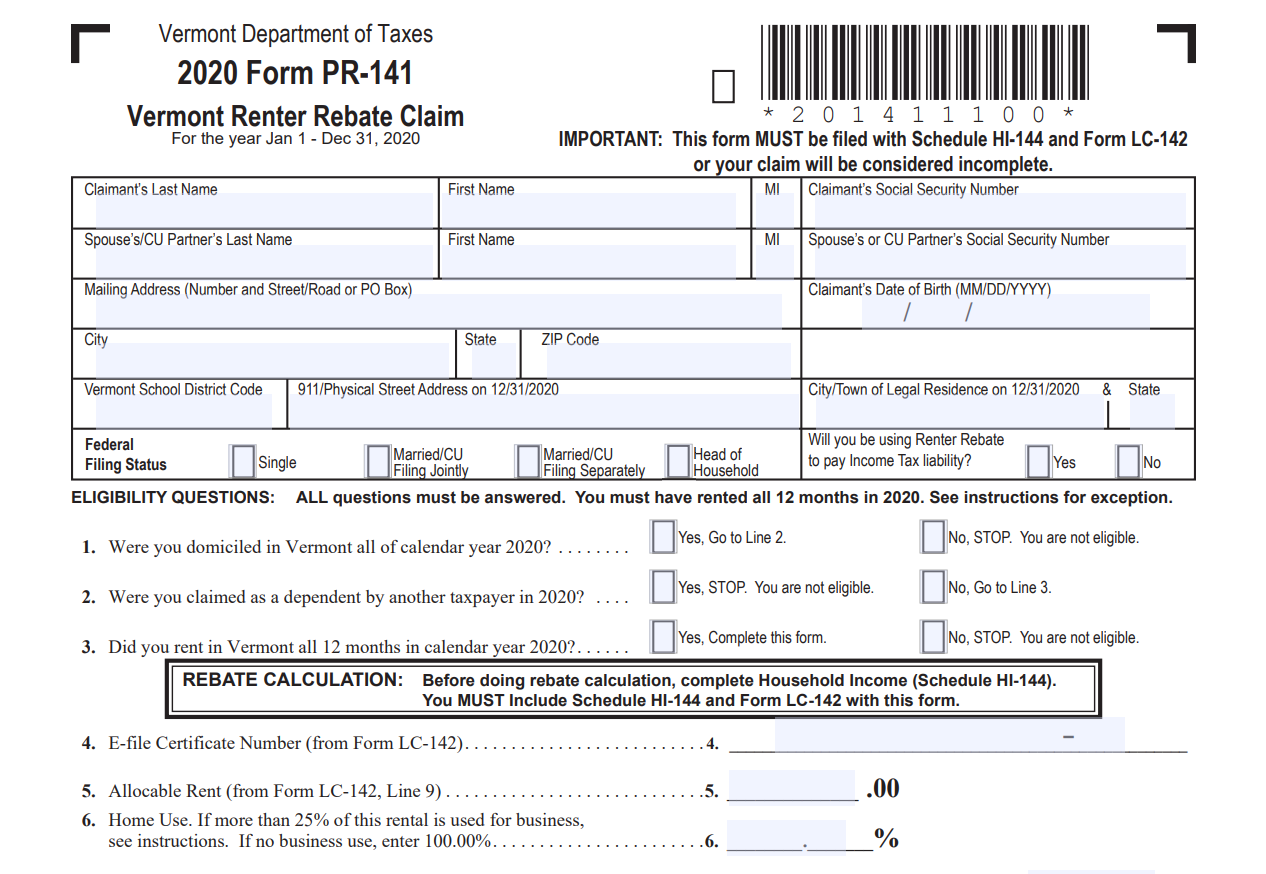

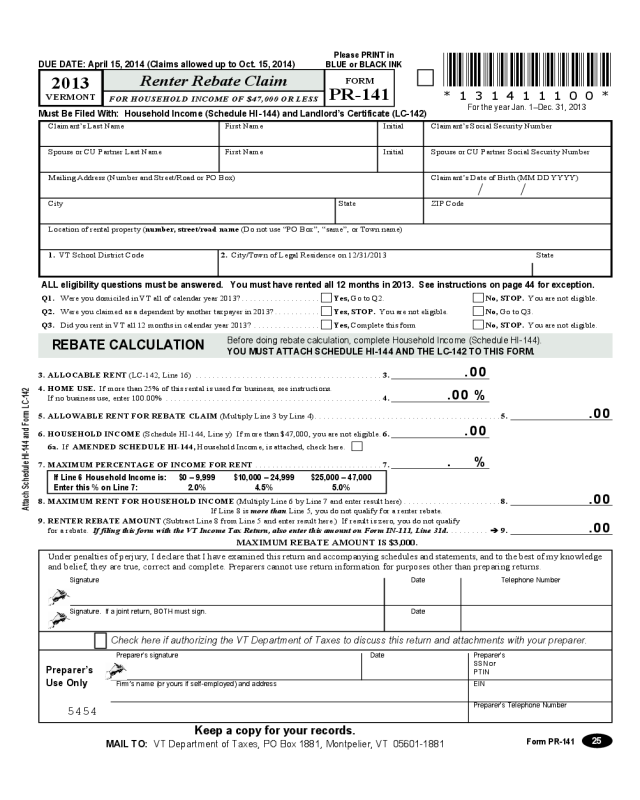

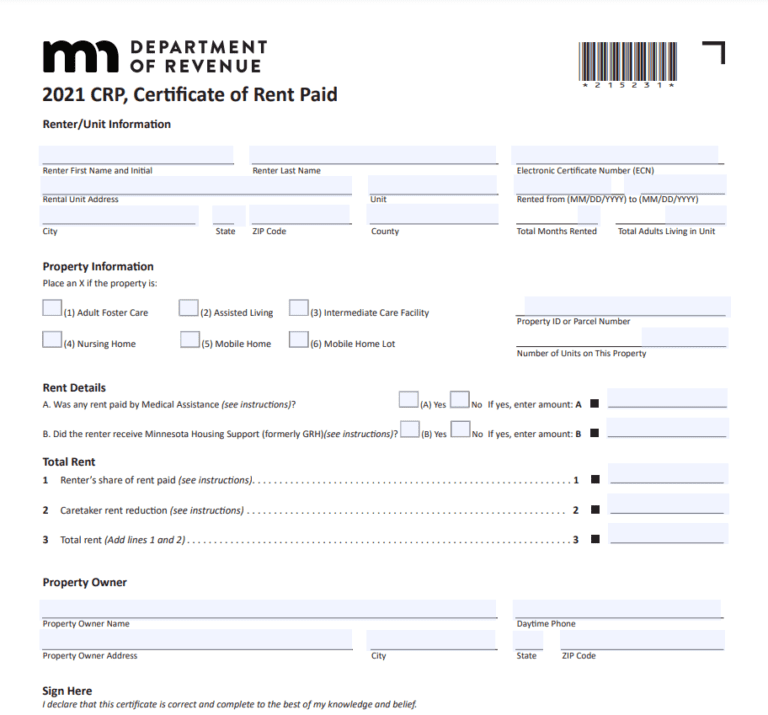

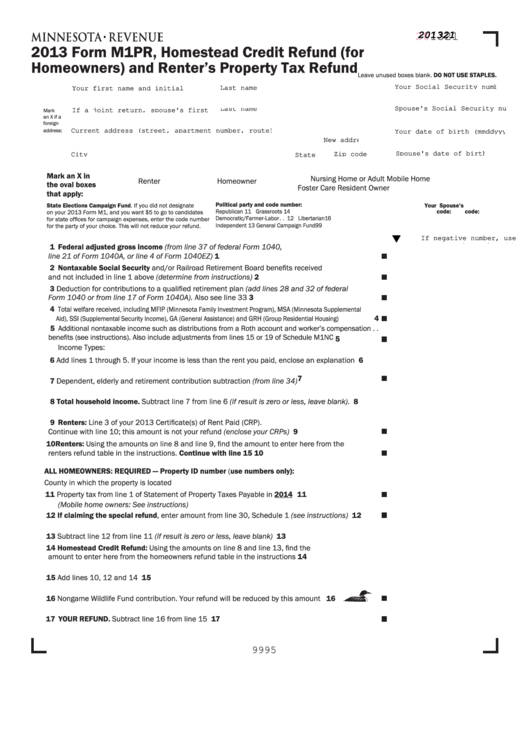

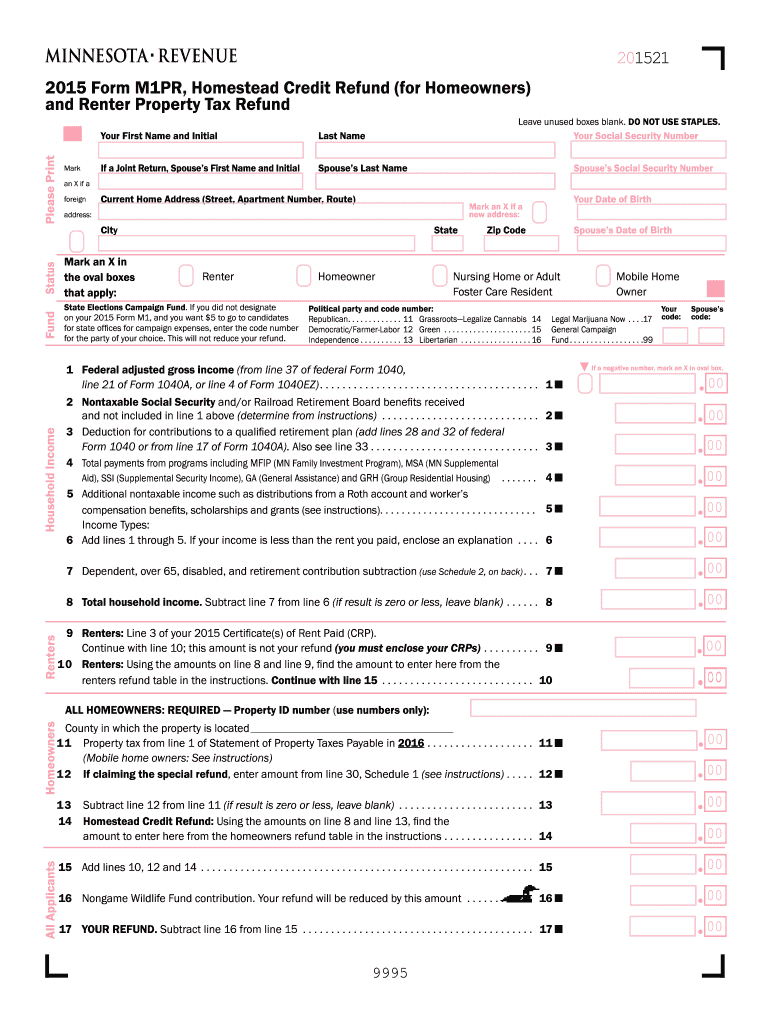

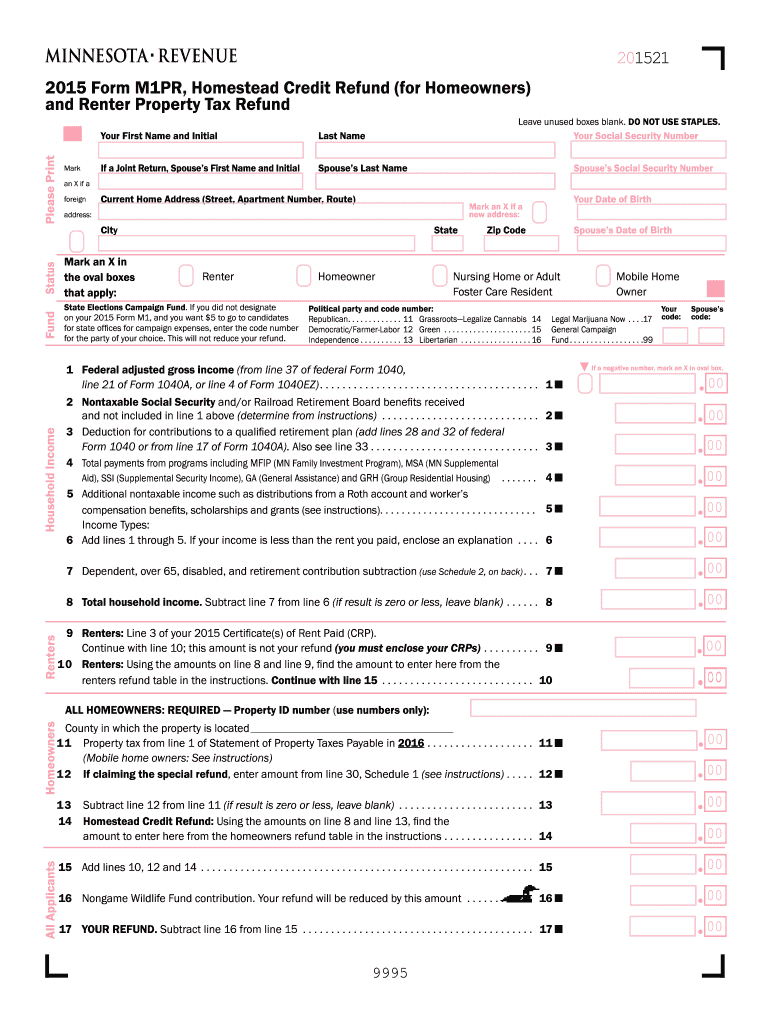

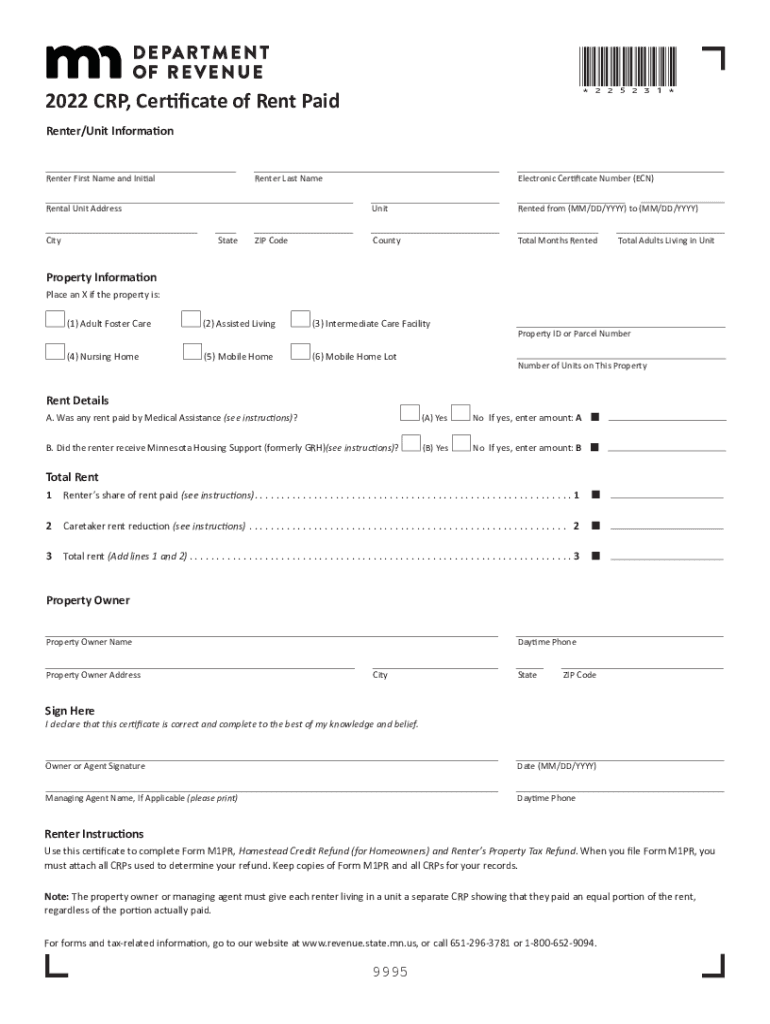

You may qualify for a tax refund if your household income is less than 73 270 What do I need to claim the refund A completed Form M1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund A copy of your Certificate of Rent Paid CRP 2023 Property Tax Refund Return M1PR Instructions pdf To apply for a refund complete lines 1 15 to determine your total household income If you are applying with your spouse you must include both of your incomes If a line does not apply to you or if the amount is zero leave the line blank Homeowners Above line 19 provide the property

Mn Renter S Rebate Form M1pr

Mn Renter S Rebate Form M1pr

https://www.pdffiller.com/preview/102/13/102013958/large.png

Printable Renters Auto Pay Form Printable Forms Free Online

https://handypdf.com/resources/formfile/images/10000/renters-rebate-sample-form-page1.png

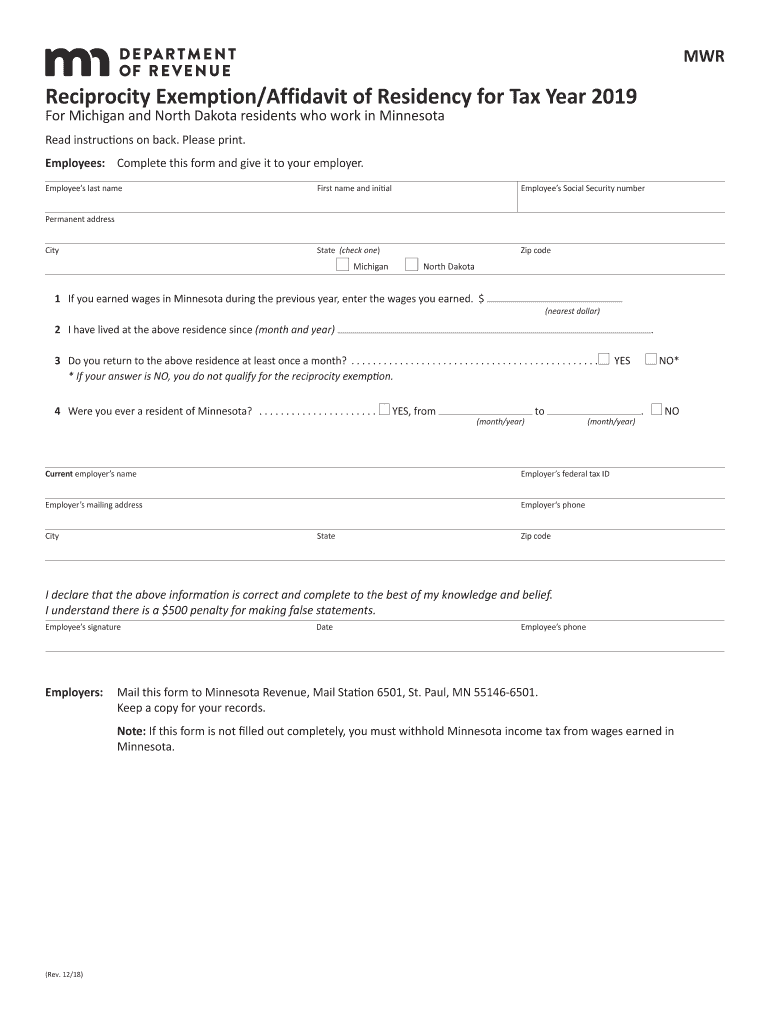

Mn M1pr Table 2019 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/463/100/463100184/large.png

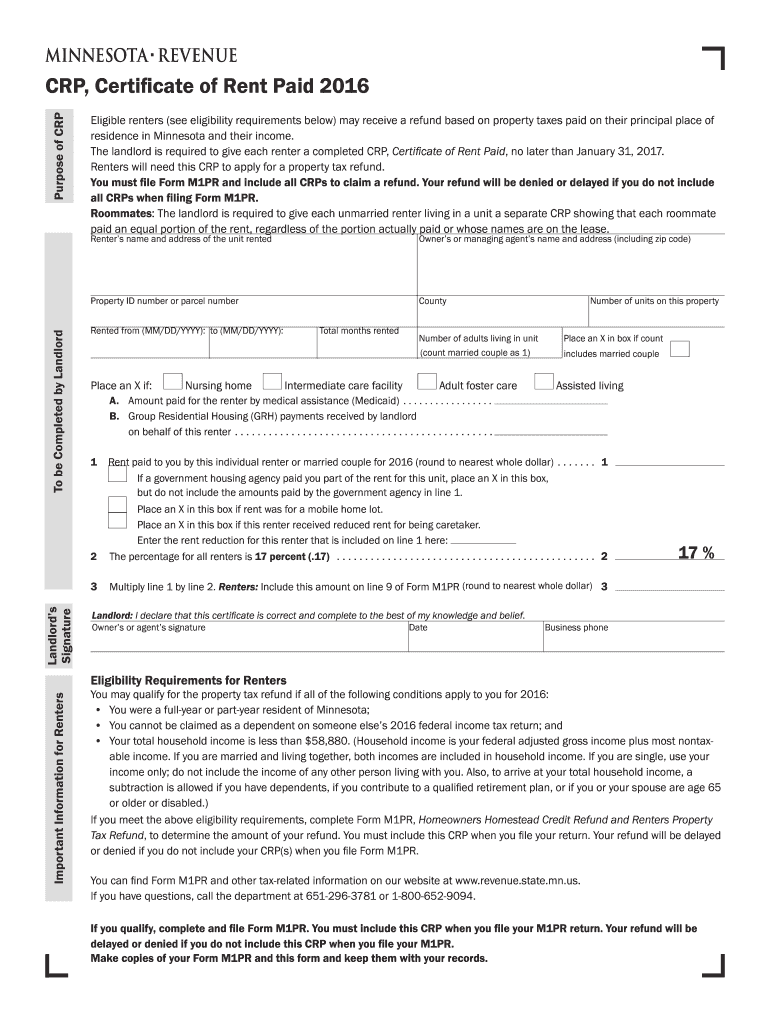

You must have a CRP Certificate of Rent Paid for each rental unit you lived in during 2022 You need this to calculate your refund Your property owner or managing agent must give you a completed 2022 CRP no later than January 31 2023 Include it with your completed return 2022 Form M1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund Your Date of Birth MM DD YYYY City State ZIP Code Check all that apply Renter Homeowner Nursing Home or Adult Foster Care Resident State Elections Campaign Fund Mobile Home Owner

For more information see the instructions for Form M1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund Claim the Refund You can claim your refund through a software provider or by paper Refund claims are filed using Minnesota Department of Revenue DOR Schedule M1PR Schedule M1PR is filed separately from the individual income tax form Claims filed before August 15 2021 will be paid beginning in August 2021

Download Mn Renter S Rebate Form M1pr

More picture related to Mn Renter S Rebate Form M1pr

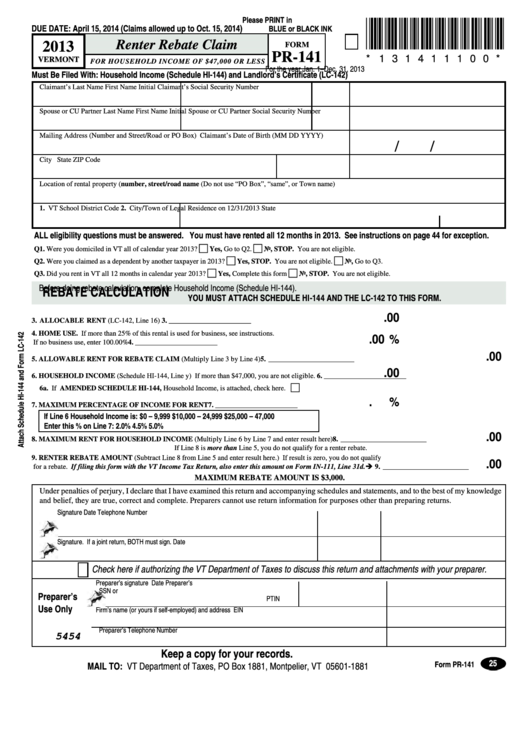

Fillable Form Pr 141 Vermont Renter Rebate Claim 2013 Printable Pdf

https://data.formsbank.com/pdf_docs_html/337/3372/337279/page_1_thumb_big.png

Elderly Disabled Renter Rebate Westbrook CT

https://westbrookct.us/ImageRepository/Document?documentId=3015

2016 Form MN DoR CRP Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/393/455/393455515/large.png

Renters with household income of less than 73 270 can claim a refund up to 2 570 You must have lived in a building where the owner of the building Was accessed the property tax Paid a portion of the rent receipts instead of the property tax Beginning with refunds payable in 2025 for tax year 2024 taxpayers will file and claim the credit as part of their income tax returns The Minnesota Department of Revenue DOR will pay taxpayers refunds at the same time as any income tax refunds owed to a taxpayer

You may claim both the property tax refund on Form M1PR and the renter s rebate on Schedule M1RENT of your 2024 Minnesota Income Tax Return Owned a mobile Minnesota Tax Forms Mail Station 1421 600 N Robert St St Paul MN 55146 1421 This information is available in alternate formats PRST STD U S POSTAGE PAID Yes you can file your M1PR when you prepare your Minnesota taxes in TurboTax We ll make sure you qualify calculate your Minnesota property tax refund and fill out an M1PR form The M1PR can be mailed or e filed if qualified

MN Renters Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/12/MN-Renters-Rebate-Form-768x715.png

Renters Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/06/Renters-Rebate-Vt.png

https://www.revenue.state.mn.us/.../m1pr-inst-23.pdf

The refund is 60 of the amount of tax paid that exceeds the 12 increase up to 1 000 You may qualify for this special refund even if you do not qualify for the 2023 Homestead Credit Refund If you are filing only for the special property tax refund complete only lines 1 15 19 20 23 25 and Schedule 1

https://dev.revenue.state.mn.us/sites/default/...

You may qualify for a tax refund if your household income is less than 73 270 What do I need to claim the refund A completed Form M1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund A copy of your Certificate of Rent Paid CRP

2019 2024 Form VT LC 142 Fill Online Printable Fillable Blank

MN Renters Printable Rebate Form

Form M1PR Download Fillable PDF Or Fill Online Homestead Credit Refund

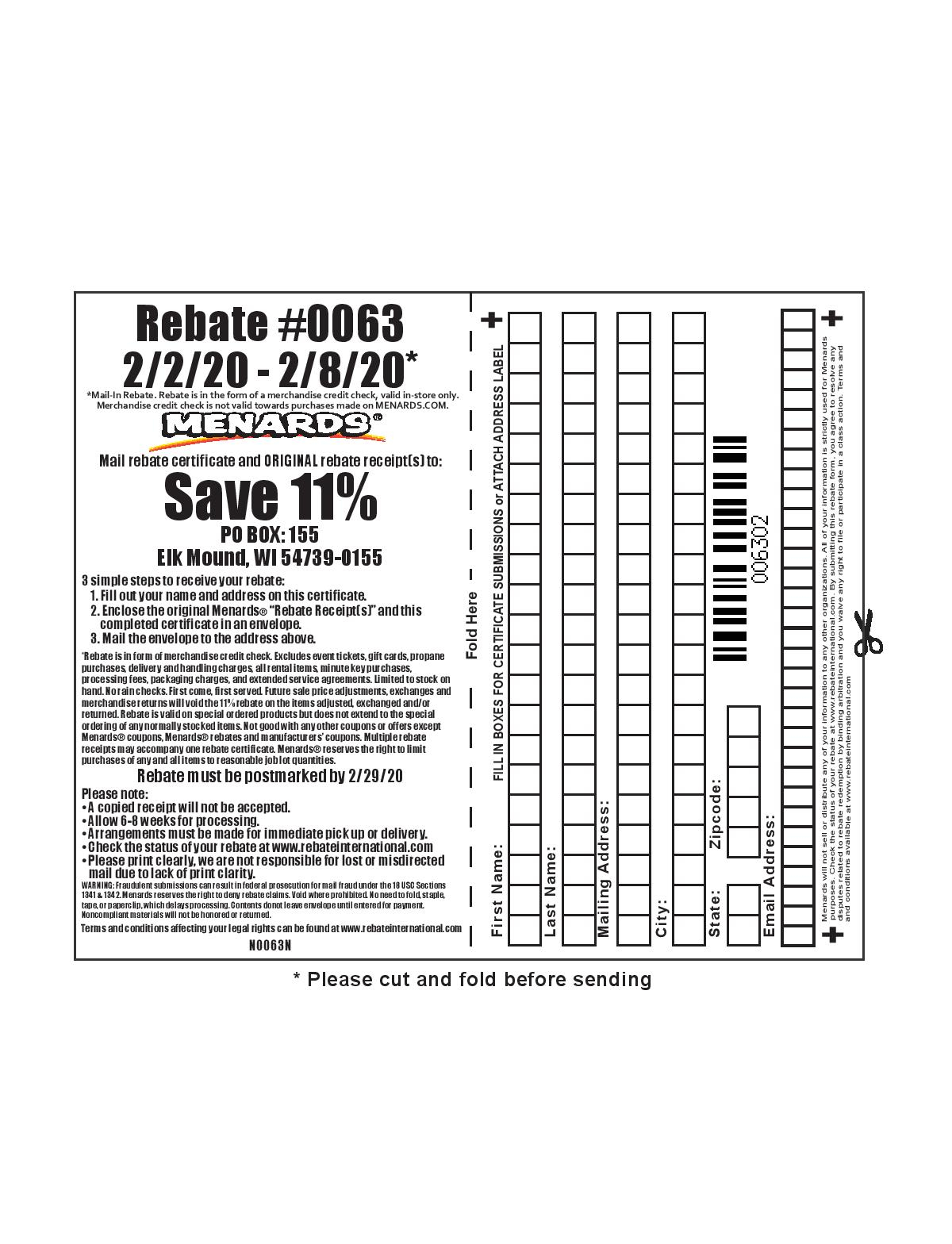

Menards 11 Rebate 0063 Purchases 2 2 20 2 8 20 Printable Form 2021

Fillable Form M1pr Homestead Credit Refund For Homeowners And

M1pr Form Fill Out And Sign Printable PDF Template SignNow

M1pr Form Fill Out And Sign Printable PDF Template SignNow

Mn Renters Rebate Fill Out Sign Online DocHub

Minnesota Property Tax Refund 2019 2023 Form Fill Out And Sign

Fillable Form M1pr Homestead Credit Refund For Homeowners And

Mn Renter S Rebate Form M1pr - You must have a CRP Certificate of Rent Paid for each rental unit you lived in during 2021 You need this to calculate your refund Your property owner or managing agent must give you a completed 2021 CRP no later than January 31 2022 Include it with your completed return