Mn Renters Rebate Form 2024 Renter s Property Tax Refund Forms and Instructions Form M1PR Homestead Credit Refund for To check your refund status go to www revenue state mn us after July 1 and enter Where s My Refund into the Search box With this system you can 2024 or you believe the rent amount or any other amounts entered on your CRP are

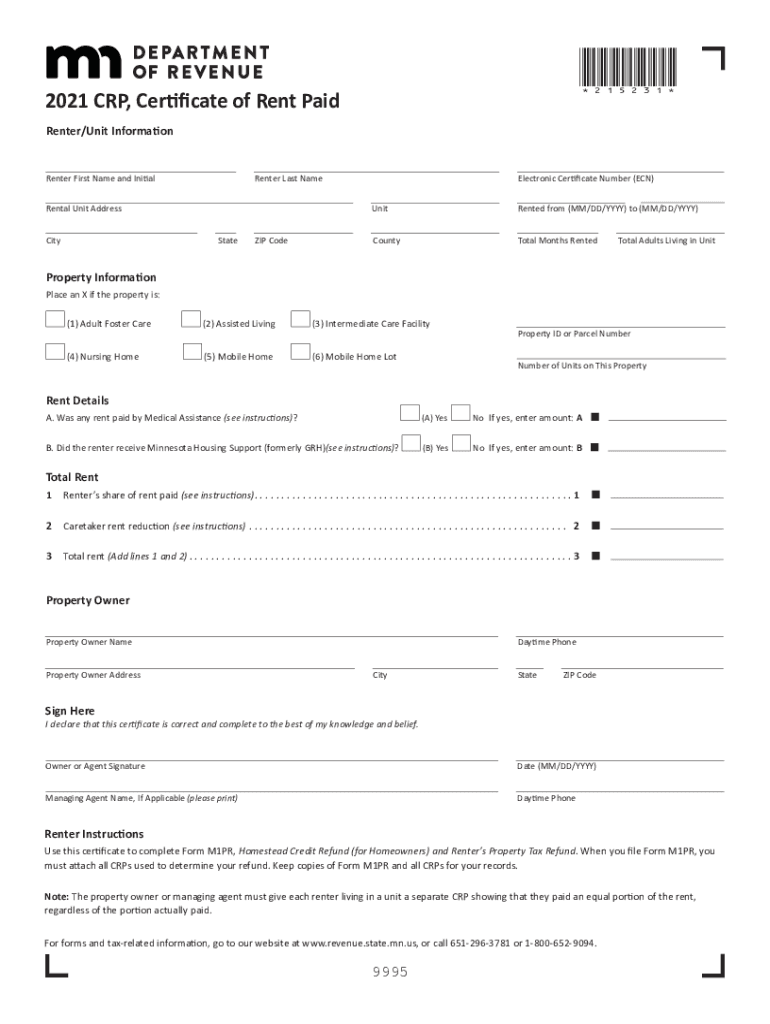

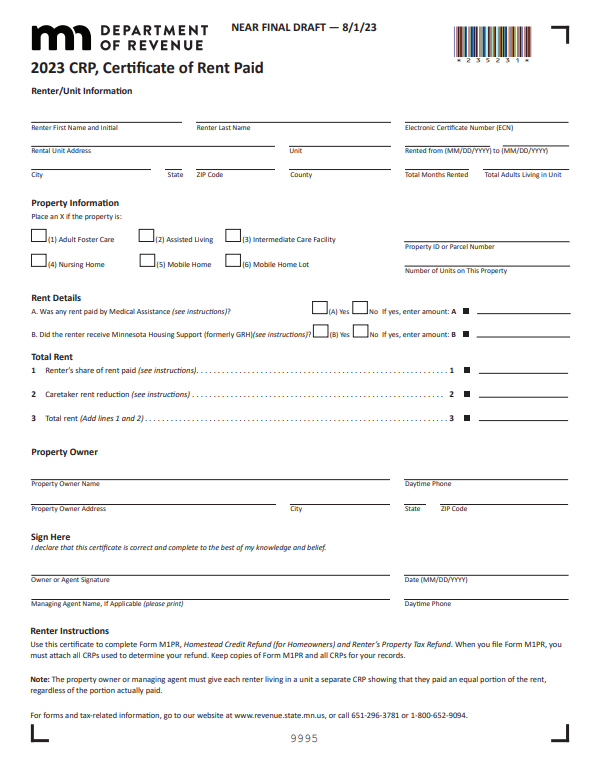

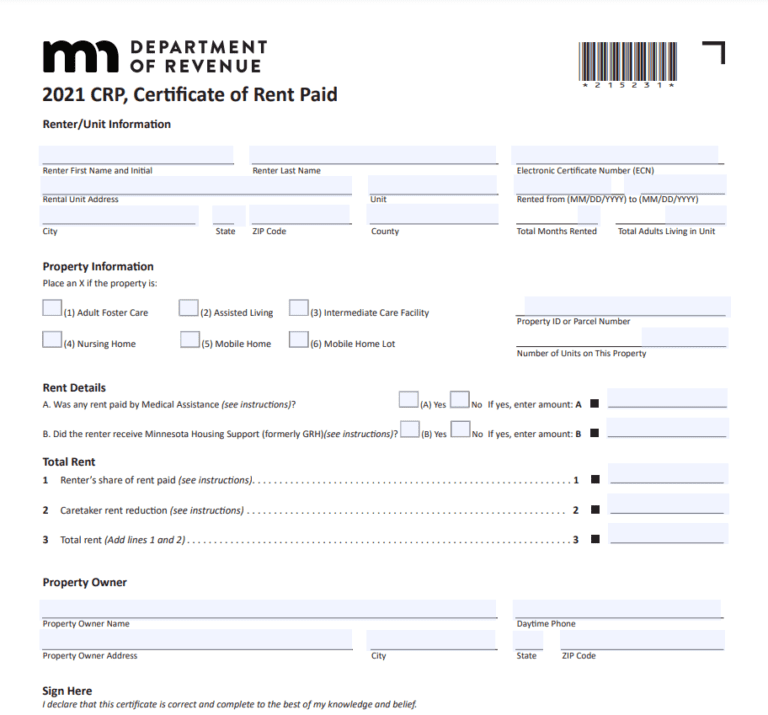

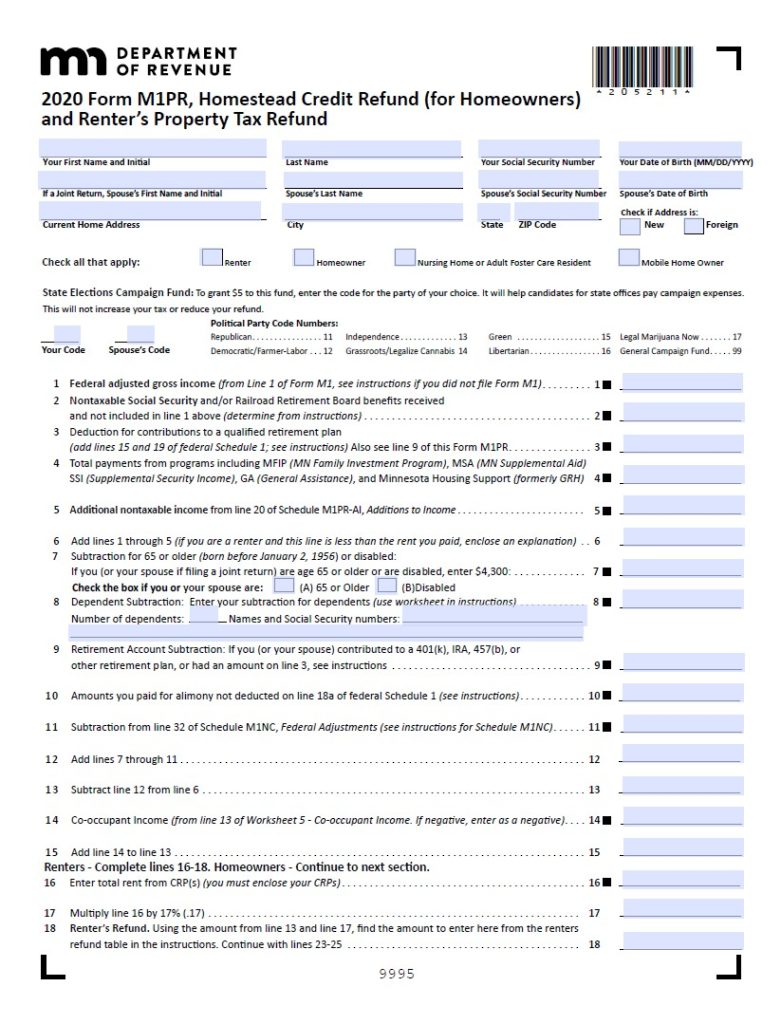

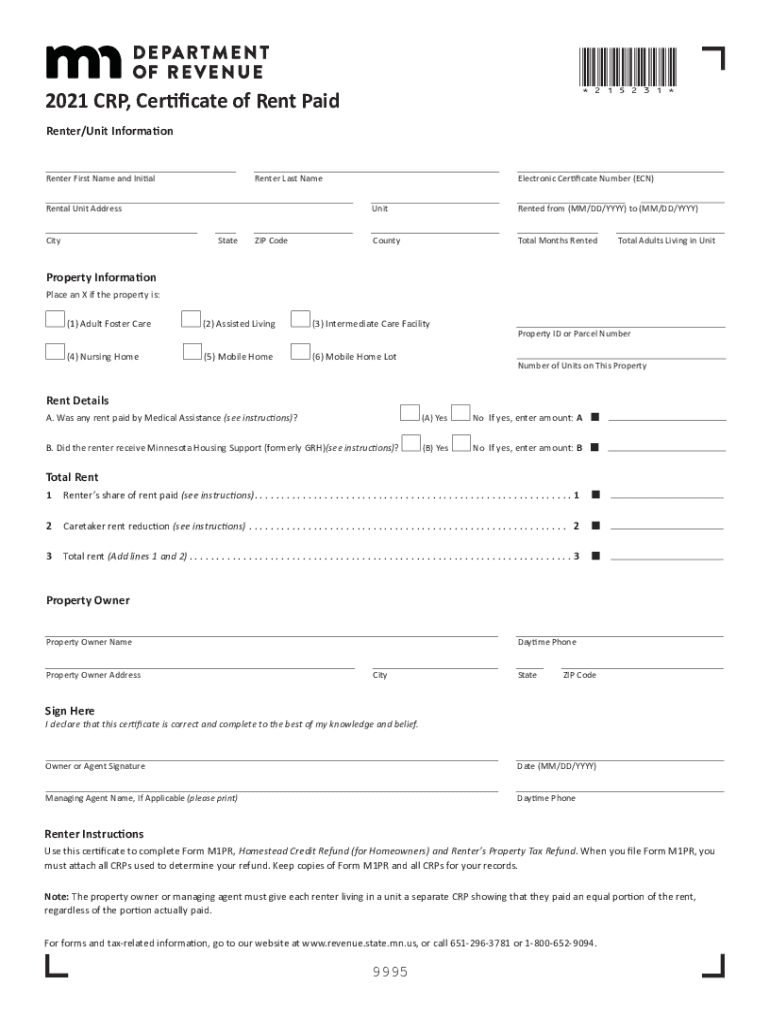

You must give each renter a CRP by January 31 2024 Renters will need the CRP to apply for the Renter s Property Tax Refund The Minnesota Department of Revenue has expanded access to their CRP system in e Services and you will be able to create CRPs using e Services by January 1 2024 all residential property owners and managing agents What are the maximums For refund claims filed in 2022 based on rent paid in 2021 and 2021 household income the maximum refund is 2 280 Renters whose income exceeds 64 920 are not eligible for refunds How are claims filed Refund claims are filed using Minnesota Department of Revenue DOR Schedule M1PR

Mn Renters Rebate Form 2024

Mn Renters Rebate Form 2024

https://www.signnow.com/preview/578/948/578948407/large.png

Mn Renters Rebate Refund Table RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/form-m1pr-download-fillable-pdf-or-fill-online-homestead-credit-refund-21.png?fit=530%2C704&ssl=1

MN Renters Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/12/MN-Renters-Rebate-Form-2023.png

It is due August 15 2024 Send it to Minnesota Property Tax Refund Mail Station 0020 600 N Robert St St Paul MN 55145 0020 You should get your refund within 60 days after you file or after August 15 for renters and September 30 for homeowners Whichever is later Who can get a refund How do I get my refund What if my landlord doesn t give me the CRP Where can I get help with tax forms Quiz The Renter s Refund Property Tax Refund Are you ready Try to answer the questions below 1 Can I get a property tax refund if I own my own house

The Minnesota Renter s Property Tax Refund can provide relief to renters if a portion of their rent goes toward property taxes postmarked or dropped off by August 15 2023 The final deadline to claim the 2022 refund is August 15 2024 Required Documentation Renters Form M1PR Homestead Credit Refund for Homeowners and Renter s The increase was at least 100 Renters with household income of less than 73 270 can claim a refund up to 2 570 You must have lived in a building where the owner of the building Made property tax payments to a local government in place of property taxes Renters who are residents of another state but present in Minnesota for more than 183

Download Mn Renters Rebate Form 2024

More picture related to Mn Renters Rebate Form 2024

MN Renters Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/12/MN-Renters-Rebate-Form-768x715.png

2022 Renters Rebate Mn Instructions RentersRebate

https://www.rentersrebate.net/wp-content/uploads/2023/05/pa-renters-rebate-form-2022-rentersrebate-72.jpg

Renters Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021-781x1024.jpg

Minnesota Legislature signed tax law changes for the tax year 2022 into effect on May 24th 2023 These tax law changes effect the calculation of the Minnesota Property Tax Refund M1PR and provides a one time increase of the 2022 Homestead Credit Refund or Renter s Property Tax Refund claimed on Form M1PR The state released the updated forms in June E File your 2023 and your 2022 Minnesota Homestead Credit and Renter s Property Tax Refund return Form M1PR using eFile Express Most calculations are automatically performed for you Eliminate errors before submitting your return Receive confirmation that your return was accepted

For refund claims filed in 2021 based on rent paid in 2020 and 2020 household income the maximum refund is 2 210 Renters whose income exceeds 62 960 are not eligible for refunds How are claims filed Refund claims are filed using Minnesota Department of Revenue DOR Schedule M1PR Published December 10 2023 According to Minnesota Gov Tim Walz the IRS will tax state rebates sent to many Minnesota residents last year These rebates commonly known as Walz checks were

Mn Renters Rebate Mailing Address Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Minnesota-Renters-Rebate-2023-768x681.jpg

Mn Renters Rebate Form RentersRebate

https://www.rentersrebate.net/wp-content/uploads/2022/10/2019-form-mn-dor-crp-fill-online-printable-fillable-blank-pdffiller-48.png

https://www.revenue.state.mn.us/sites/default/files/2023-12/m1pr-inst-23.pdf

Renter s Property Tax Refund Forms and Instructions Form M1PR Homestead Credit Refund for To check your refund status go to www revenue state mn us after July 1 and enter Where s My Refund into the Search box With this system you can 2024 or you believe the rent amount or any other amounts entered on your CRP are

https://www.careproviders.org/CPM/ACTION/Vol39/Ed03/ZP05.aspx

You must give each renter a CRP by January 31 2024 Renters will need the CRP to apply for the Renter s Property Tax Refund The Minnesota Department of Revenue has expanded access to their CRP system in e Services and you will be able to create CRPs using e Services by January 1 2024 all residential property owners and managing agents

Unlocking The Benefits Mn Renter s Rebate Form 2023 Rent Rebates

Mn Renters Rebate Mailing Address Printable Rebate Form

Mn Renters Rebate Refund Table RentersRebate

Renters Rebate Form MN 2022 Class Profile Printable Rebate Form

Renters Rebate Mn Instructions RentersRebate

2021 Rent Certificate Form Fillable Printable PDF Forms Handypdf RentersRebate

2021 Rent Certificate Form Fillable Printable PDF Forms Handypdf RentersRebate

2022 Rent Certificate Form Fillable Printable PDF Forms Handypdf RentersRebate

Central Oregon Rental Association Printable Rebate Form RentersRebate

Minnesota Renters Rebate Efile RentersRebate

Mn Renters Rebate Form 2024 - Rep Nathan Coulter The bill s provisions would be effective for tax year 2023 or for refunds based on rent paid in 2023 meaning the first credits calculated as part of the income tax return would be claimed during the 2024 filing period