Mn State Tax Deduction For 529 Contributions A taxpayer may subtract up to 1 500 3 000 for married joint filers of contributions to any state s section 529 college savings plan or prepaid tuition plan The subtraction

A generous Minnesota state income tax deduction or tax credit only available to Minnesota taxpayers Minnesota state income tax deferred earnings and tax free See your contributions go further with MNSAVES 529Plan tax benefits State Tax Deduction MN taxpayers may qualify for a state tax deduction up to 3 000 if married

Mn State Tax Deduction For 529 Contributions

Mn State Tax Deduction For 529 Contributions

https://adalawcompliance.com/wp-content/uploads/2021/08/TAX-CREDIT-AND-DEDUCTIONS.png

10 Things Parents Should Know About College Savings

https://www.upromise.com/articles/wp-content/uploads/sites/3/2021/09/10_Things_General_02.jpg

How Much Is Your State s 529 Plan Tax Deduction Really Worth

https://webresources-savingforcollege.s3.amazonaws.com/images/original-state-map-2017-12.png

Minnesota taxpayers may Deduct up to 3 000 for a married couple filing jointly or 1 500 for all other filers for contributions made to a qualified 529 account Instead Minnesota taxpayers can reduce their state taxable income up to 3 000 if married filing jointly 1 500 filing single for contributions made into a Minnesota College Savings

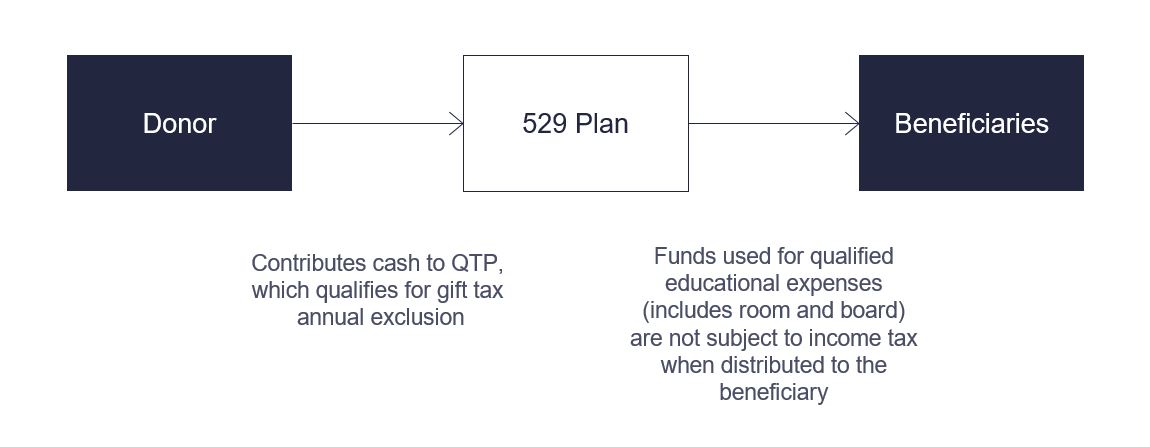

Section 529 College Savings Plan If you contribute to a section 529 college savings plan you may be eligible for a subtraction from income Who Qualifies Do I States offer a wide variety of incentives for 529 plan contributions including income tax deductions tax credits and matching grants As of 2023 33 states including

Download Mn State Tax Deduction For 529 Contributions

More picture related to Mn State Tax Deduction For 529 Contributions

Is There A Tax Deduction For 529 College Savings Plan

https://media.marketrealist.com/brand-img/g4p92tkWH/0x0/tax-deduction-for-529-college-savings-plan-1648782472634.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

5498 Esa 2018 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/416/852/416852962/big.png

Minnesota is one of the few states that allows a tax deduction or credit for contributions to ANY state s 529 plan They also offer a tax credit depending on income You can If you contribute to a section 529 college savings plan you may be eligible for a nonrefundable credit Who Qualifies Do I have to be the account owner or

If you file state income taxes in one of the nine tax parity states which are Arizona Arkansas Kansas Maine Minnesota Missouri Montana Ohio and Pennsylvania you may be able to claim a state tax Minnesota Missouri Montana Pennsylvania The most common benefit offered is a state income tax deduction for 529 plan contributions However Indiana

Tax Deduction Rules For 529 Plans What Families Need To Know College

https://i.pinimg.com/originals/de/60/7c/de607c8b7bca6d071b488e7be6b27938.jpg

How Does An NC 529 Tax Deduction Work CFNC

https://www.cfnc.org/media/gkrhpy1n/tax-deduction-money.jpg

https://www. house.mn.gov /hrd/pubs/ss/ss529cred.pdf

A taxpayer may subtract up to 1 500 3 000 for married joint filers of contributions to any state s section 529 college savings plan or prepaid tuition plan The subtraction

https://www. mnsaves.org /resources/faq

A generous Minnesota state income tax deduction or tax credit only available to Minnesota taxpayers Minnesota state income tax deferred earnings and tax free

Paying For Christian School K 12 With 529 Plans

Tax Deduction Rules For 529 Plans What Families Need To Know College

Biz Brain Tax Deductions For College Savings Nj

We Look Forward To Beginning A Conversation To Help You Achieve Your

New MA State Tax Deduction For 529 Contributions Woodside Wealth

Maximize Your Ohio Income Tax Deduction With A Contribution To Your

Maximize Your Ohio Income Tax Deduction With A Contribution To Your

What To Know About The 529 Grandparent Loophole

Maine State Tax Deduction NextGen 2022

Save For Your Kid s College And Have A Backup Plan

Mn State Tax Deduction For 529 Contributions - Log in Why MNSAVES Learn and Plan Investment Options Resources Account Center Open an Account Home How Tos Explore ways to manage your account with how to