Montana 2024 Tax Rebate Property Tax Rebate The property tax rebate claim period for tax year 2022 has closed We will begin accepting claims for the rebate for tax year 2023 on August 15 2024 and all claims must be filed by October 1 2024 The Property Tax Rebate is a rebate of up to 675 per year of property taxes paid on a principal residence

What Elective state income tax paid by a partnership or S corporation on the distributive share of an affected owner s Montana Source Income Calculation the distributive share of an affected owner s Montana Source Income times the highest marginal rate 2023 6 75 2024 5 9 The department says taxpayers can apply for the 2022 property tax rebates through its online TransAction Portal or via a paper form during an application period that runs from Aug 15 2023 to Oct 1 2023 To apply through the TransAction Portal you ll need the following information Your home address

Montana 2024 Tax Rebate

Montana 2024 Tax Rebate

https://www.wordenthane.com/wp-content/uploads/2023/06/AdobeStock_602491697-scaled.jpeg

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Montana Sends 260 Tax Rebate Checks To Minnesota Taxpayers Blogging Big Blue

https://www.bloggingbigblue.com/wp-content/uploads/2023/09/Tax-rebate-montana-scaled.jpg

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to The individual income tax rebate is 1 250 for individual filers and 2 500 for married couples filing jointly The money comes from House Bill 192 which set aside 480 million of the surplus

The governor s budget provides 500 million in property tax relief for Montanans for their primary residence with a 1 000 property tax rebate in both 2023 and 2024 We can make a difference for the retired couple in the Flathead who because they can t afford their rising property taxes are thinking about selling the home they raised their The rebate provides Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 WHAT ARE THE QUALIFICATIONS To qualify for the property tax rebate you must have 3 Owned a Montana residence for at least seven months in 2022 3 Lived in that Montana residence for at least seven months in 2022

Download Montana 2024 Tax Rebate

More picture related to Montana 2024 Tax Rebate

When Will We Get The Extra Tax Rebate Checks In Montana Details

https://townsquare.media/site/990/files/2023/03/attachment-032923-MT-Tax-Rebate-.jpg?w=980&q=75

This US States Property Tax Rebate For Residents How To Qualify

https://www.lamansiondelasideas.com/wp-content/uploads/2023/03/Montana-Tax-Refunds-and-Rebates.jpg

Montana Income Tax Information What You Need To Know On MT Taxes

https://www.taunyafagan.com/wp/wp-content/uploads/2021/10/2023-Montana-Individual-Income-Tax-Help-Form.png

During the press conference the governor highlighted elements of his Budget for Montana Families which provides Montanans with 1 billion in property and income tax relief the largest tax cut in Montana history The governor s budget provides Montanans with 2 000 in property tax rebates for their primary residence over 2023 and 2024 The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are at GetMyRebate mt gov The fastest way for taxpayers to apply for and get the rebate is by applying online Claiming a property tax rebate online should take

The Montana Property Tax Rebate is a program that provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The claim period for the 2023 tax year opens on August 15 2024 and closes on October 1 2024 However taxpayers can also have their rebate mailed to them by check The department will process claims as they are received and distribute rebates by December 31 2023 Montana homeowners will be eligible for a second property tax rebate up to 675 in 2024 for property taxes paid on a principal residence for 2023

Montana Tax Rebate Package Muscled Through Initial House Votes

https://montanafreepress.org/wp-content/uploads/2021/08/Montana-Capitol_Eliza-Wiley_1200x675.png

Montana Tax Rebate 2023 Benefits Eligibility How To Apply PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/04/Montana-Tax-Rebate-2023-768x684.png

https://mtrevenue.gov/taxes/property-tax-rebate-house-bill-222/

Property Tax Rebate The property tax rebate claim period for tax year 2022 has closed We will begin accepting claims for the rebate for tax year 2023 on August 15 2024 and all claims must be filed by October 1 2024 The Property Tax Rebate is a rebate of up to 675 per year of property taxes paid on a principal residence

https://mtrevenue.gov/download/112298/?tmstv=1701716155

What Elective state income tax paid by a partnership or S corporation on the distributive share of an affected owner s Montana Source Income Calculation the distributive share of an affected owner s Montana Source Income times the highest marginal rate 2023 6 75 2024 5 9

How To Claim Your 2022 Montana Tax Rebates Montana Senior News

Montana Tax Rebate Package Muscled Through Initial House Votes

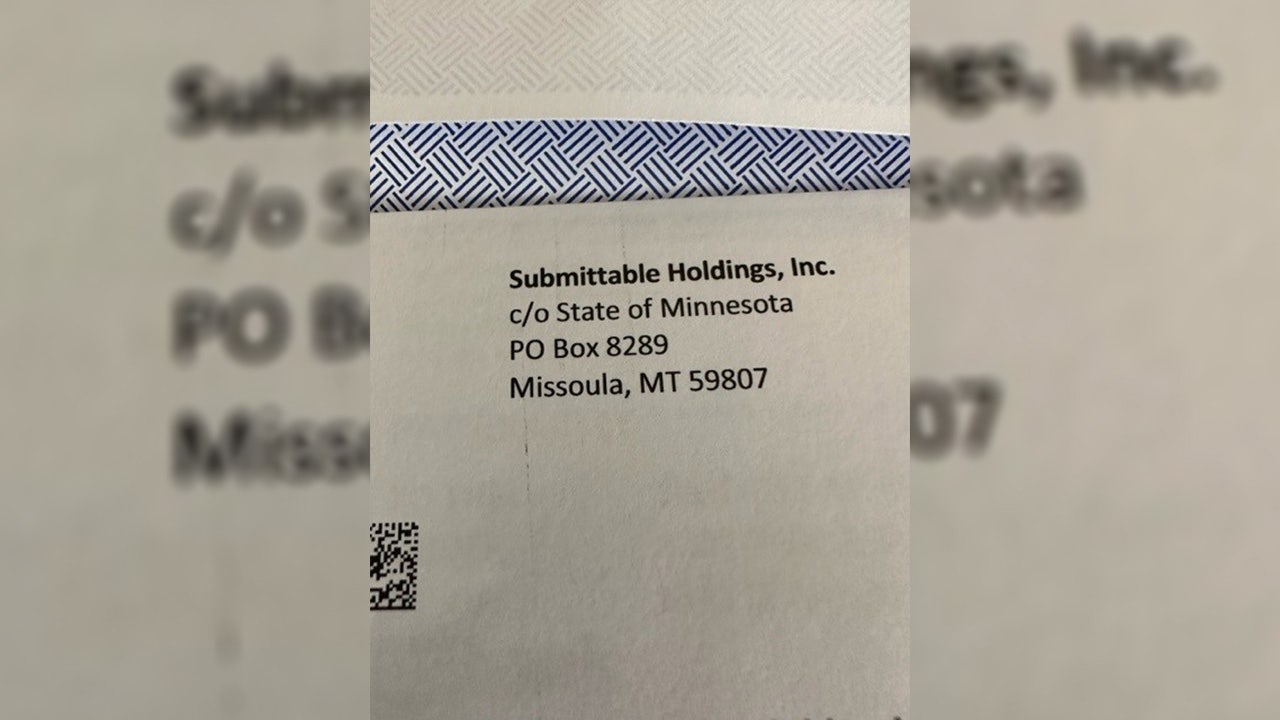

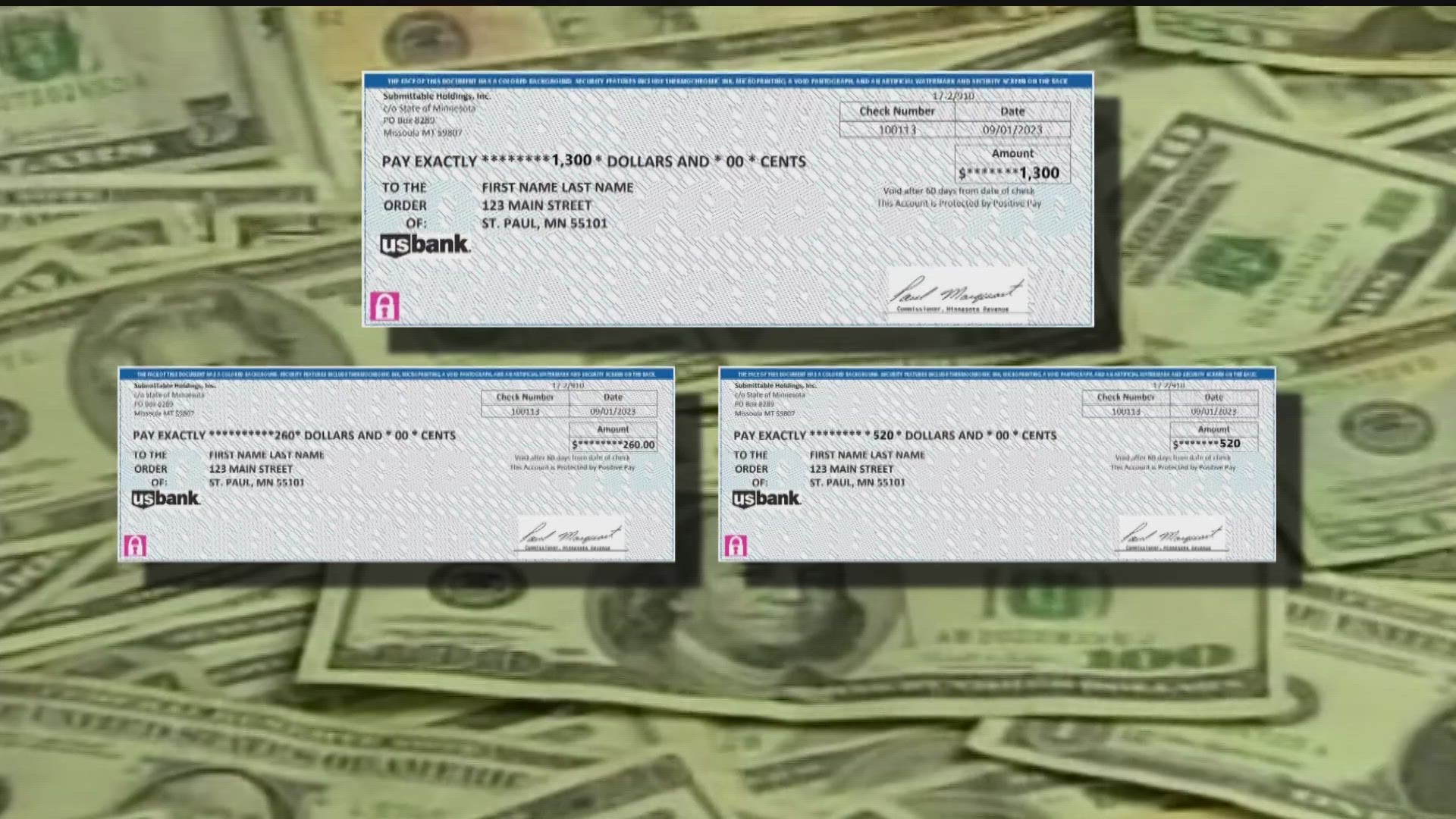

Minnesota Tax Rebate Checks May Look Like Junk Mail

Property Tax Rebate In Montana Sandra Johnson Realtor

Montana Income Tax Rebate Of Up To 2 500 Coming To Eligible Taxpayers This July Check

Unraveling The Montana Tax Rebate 2023 Your Comprehensive Guide USRebate

Unraveling The Montana Tax Rebate 2023 Your Comprehensive Guide USRebate

Unlocking Your 2022 Montana Tax Rebate A Step by Step Guide To Finding Your Property Geocode

Minnesota Tax Rebate Checks From Montana Company Are Legitimate Kare11

What To Do If You Didn t Get The Montana Tax Rebate Of Up To 2 500 24 7 Wall St

Montana 2024 Tax Rebate - January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to