Montana Income Tax Rebates 2024 Updates from the 2023 Legislature for Tax Year 2024 Simplification Reduced Tax Rate and Expanded Montana Earned Income Tax Credit Long Term Capital Gains Tax Rate Military Retirement Exemption for Certain Military Retirees Expanded Qualified Endowment Credit De Minimis Filing Requirement for Certain Nonresidents 5 5

Friday Mar 24th 2023 Photo NBC Montana p p HELENA Mont Montana s GOP controlled Legislature put 764 million into tax rebates refunding residents income and property taxes The latest entrant is Montana where lawmakers passed reforms Monday The top income tax rate will fall to 5 9 in 2024 from 6 75 now Gov Greg Gianforte called it the largest tax cut in Montana history and it builds on his 2021 cut that dropped the rate from 6 9 The state s tax code will also collapse to two brackets from seven

Montana Income Tax Rebates 2024

Montana Income Tax Rebates 2024

https://data.formsbank.com/pdf_docs_html/312/3122/312294/page_1_thumb_big.png

Montana Income Tax MT State Tax Calculator Community Tax

https://www.communitytax.com/wp-content/uploads/2020/01/image18.jpg

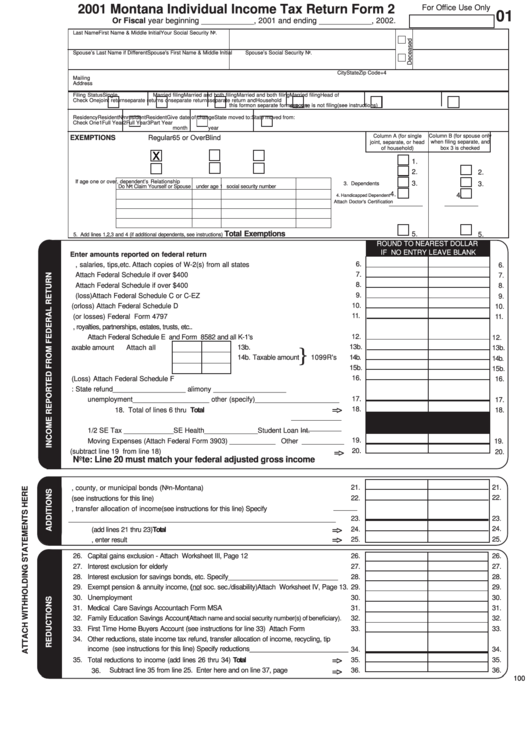

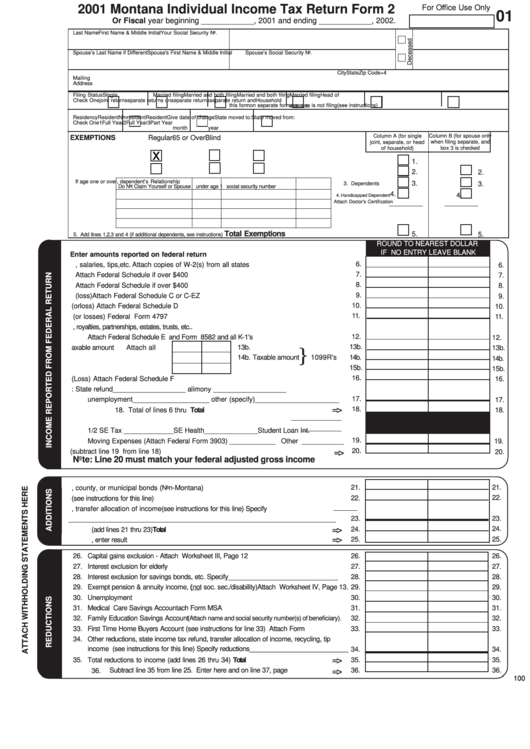

Montana Fillable Tax Forms Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/213/2130/213013/page_1_thumb_big.png

Senate Bill 121 will reduce the top rate of 6 5 to 5 9 effective as previously scheduled on Jan 1 2024 The bill also increases the Montana Earned Income Tax Credit from 3 of the federal credit to 10 Apportionment changes Senate Bill 124 amends the current apportionment formula from three factor with double weighted sales to single These you have to apply for The department says taxpayers can apply for the 2022 property tax rebates through its online TransAction Portal or via a paper form during an application period that runs from Aug 15 to Oct 1 2023 A second application period for 2023 rebates will be open across the same dates in 2024

The Property Tax Rebate is a rebate of up to 500 a year of property taxes on a principal residence paid for 2022 and 2023 Individuals should check eligibility and will have to apply for the The department says taxpayers can apply for the 2022 property tax rebates through its online TransAction Portal or via a paper form during an application period that runs from Aug 15 2023 to Oct 1 2023 To apply through the TransAction Portal you ll need the following information Your home address

Download Montana Income Tax Rebates 2024

More picture related to Montana Income Tax Rebates 2024

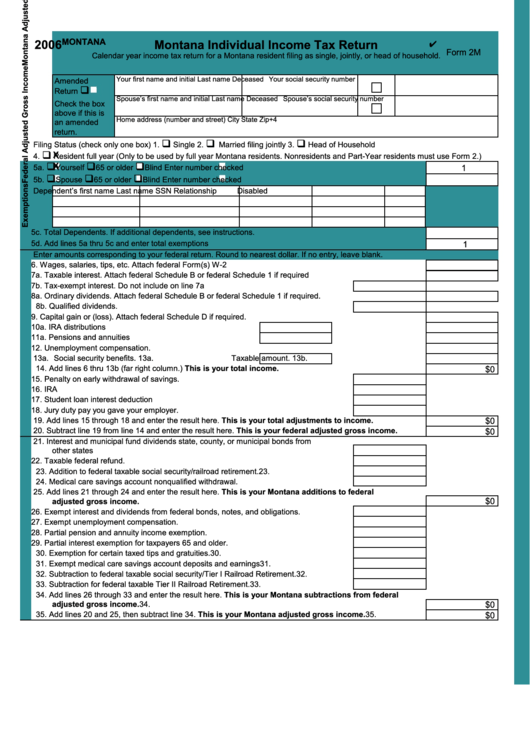

Montana Income Tax MT State Tax Calculator Community Tax

https://www.communitytax.com/wp-content/uploads/2020/01/image17.jpg

Montana Income Tax Calculator 2023 2024

https://www.taxuni.com/wp-content/uploads/2022/11/Montana-Income-Tax-Calculator-TaxUni-1.jpg

Montana Income Tax Information What You Need To Know On MT Taxes

https://www.taunyafagan.com/wp/wp-content/uploads/2021/10/2023-Montana-Individual-Income-Tax-Help-Form.png

KPAX Published March 23 2023 HELENA KPAX The Montana Department of Revenue has created a website to update Montanans on recently passed income and property tax rebates The two tax rebates were signed into law by Governor Greg Gianforte last week The individual income tax rebate is 1 250 for individual filers and 2 500 for married One bill that lawmakers have passed provides a one time tax rebate of up to 1 250 to individual income taxpayers but no more than what they paid in state taxes in 2021 for an estimated total of

Montana currently has seven tax brackets based on levels of income with a different tax rate for each ranging from 1 on the lowest bracket to 6 75 on the highest Under the new law that Credit Eric Dietrich MTFP Flanked by dozens of Republican lawmakers on the steps of the state Capitol Gov Greg Gianforte signed a tax cut rebate and spending package totalling more than 1 billion Monday The eight bill package which provides short term property and income tax rebates and also cuts state income taxes on an ongoing basis

Montana Income Tax Calculator 2023 2024

https://www.taxuni.com/wp-content/uploads/2022/11/Montana-Paycheck-Calculator-TaxUni-Cover-1.jpg

The Montana Income Tax Rebate Are You Eligible

https://www.wordenthane.com/wp-content/uploads/2023/06/AdobeStock_602491697-scaled.jpeg

https://mtrevenue.gov/download/112298/?tmstv=1701716155

Updates from the 2023 Legislature for Tax Year 2024 Simplification Reduced Tax Rate and Expanded Montana Earned Income Tax Credit Long Term Capital Gains Tax Rate Military Retirement Exemption for Certain Military Retirees Expanded Qualified Endowment Credit De Minimis Filing Requirement for Certain Nonresidents 5 5

https://nbcmontana.com/amp/news/local/how-to-claim-your-montana-tax-rebates

Friday Mar 24th 2023 Photo NBC Montana p p HELENA Mont Montana s GOP controlled Legislature put 764 million into tax rebates refunding residents income and property taxes

Facts About Montana s Individual Income Tax AgEconMT

Montana Income Tax Calculator 2023 2024

Montana Income Tax MT State Tax Calculator Community Tax

Montana State Tax Form 2023 Printable Forms Free Online

This US States Property Tax Rebate For Residents How To Qualify

Montana Income Tax MT State Tax Calculator Community Tax

Montana Income Tax MT State Tax Calculator Community Tax

Montana Tax Rebates To Be Issued July 3 KECI

How To Claim Your Montana Tax Rebates KECI

Download Instructions For Form CIT Montana Corporate Income Tax Return PDF 2018 Templateroller

Montana Income Tax Rebates 2024 - The Property Tax Rebate is a rebate of up to 500 a year of property taxes on a principal residence paid for 2022 and 2023 Individuals should check eligibility and will have to apply for the