Montana Property Tax Rebate 2024 2023 The rebate provides Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 WHAT ARE THE QUALIFICATIONS To qualify for the property tax rebate you must have 3 Owned a Montana residence for at least seven months in 2022 3 Lived in that Montana residence for at least seven months in 2022

However taxpayers can also have their rebate mailed to them by check The department will process claims as they are received and distribute rebates by December 31 2023 Montana homeowners will be eligible for a second property tax rebate up to 675 in 2024 for property taxes paid on a principal residence for 2023 Last November the This spring the governor also delivered Montanans 120 million in permanent long term property tax relief and secured up to 1 350 in property tax rebates for Montana homeowners over the next two years Eligible Montana homeowners may now claim their first rebate up to 675 at getmyrebate mt gov The deadline for claims is October 1 2023

Montana Property Tax Rebate 2024

Montana Property Tax Rebate 2024

https://townsquare.media/site/1098/files/2020/02/Taxes-4.jpg?w=980&q=75

Property Tax Rebate In Montana Sandra Johnson Realtor

https://bigskyliving.com/wp-content/uploads/2023/05/Property-Tax-Rebate-in-Montana.jpg

How To Apply For Your Montana Property Tax Rebate Bozeman Real Estate Group

https://breg-2022.imgix.net/Bozeman-Drone_2023-08-16-205554_yysv.jpg?auto=format&crop=focalpoint&domain=breg-2022.imgix.net&fit=crop&fp-x=0.5&fp-y=0.5&h=787&ixlib=php-3.3.1&q=82&usm=20&w=1400

Gov Gianforte celebrating property tax relief for Montanans with Rep Tom Welch R Dillon At a local residence in Dillion the governor ceremonially signed House Bill 222 carried by Rep Welch which provides a property tax rebate of up to 675 in both 2023 and 2024 for Montana homeowners at their primary residence Montana homeowners will be eligible for a second property tax rebate of up to 675 in 2024 for property taxes paid on a principal residence for 2023 For additional information about the property tax rebate or to check on the status of the income or property tax rebates visit the Montana Department of Revenues Website

You can also call the department at 406 444 6900 Rebates on 2022 and 2023 property taxes Homeowners are eligible for up to 675 a year for their 2022 and 2023 property taxes on their principal residence defined as the place where you ve lived for at least seven months of the year If you paid less than 675 in property taxes in either year The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are at GetMyRebate mt gov The fastest way for taxpayers to apply for and get the rebate is by applying online Claiming a property tax rebate online should take

Download Montana Property Tax Rebate 2024

More picture related to Montana Property Tax Rebate 2024

Here s How To Claim Your Montana Property Tax Rebate

https://townsquare.media/site/1107/files/2023/08/attachment-Tax-Rebate.jpg?w=980&q=75

Montana Property Tax Rebate Scam Alert Stay Vigilant And Safe Here s What You Need To Know

https://www.bloggingbigblue.com/wp-content/uploads/2023/09/scammers-scaled.jpg

This US States Property Tax Rebate For Residents How To Qualify

https://www.lamansiondelasideas.com/wp-content/uploads/2023/03/Montana-Tax-Refunds-and-Rebates.jpg

Missoula MT KGVO AM News Montanans are getting their taxes in order now that 2023 has given way to 2024 KGVO News spoke to our resident CPA Walt Kero on Wednesday s Talk Back program The rebate provides Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 WHAT ARE THE QUALIFICATIONS To qualify for the property tax rebate you must have 3 Owned a Montana residence for at least seven months in 2022 3 Lived in that Montana residence for at least seven months in 2022

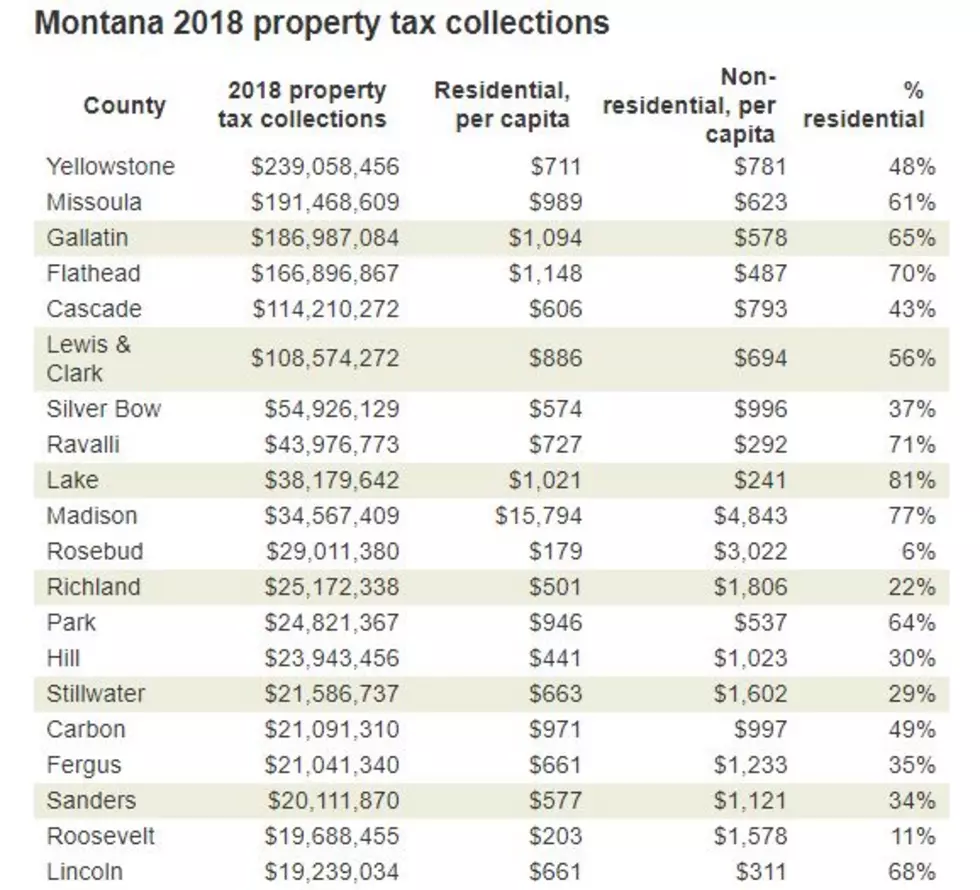

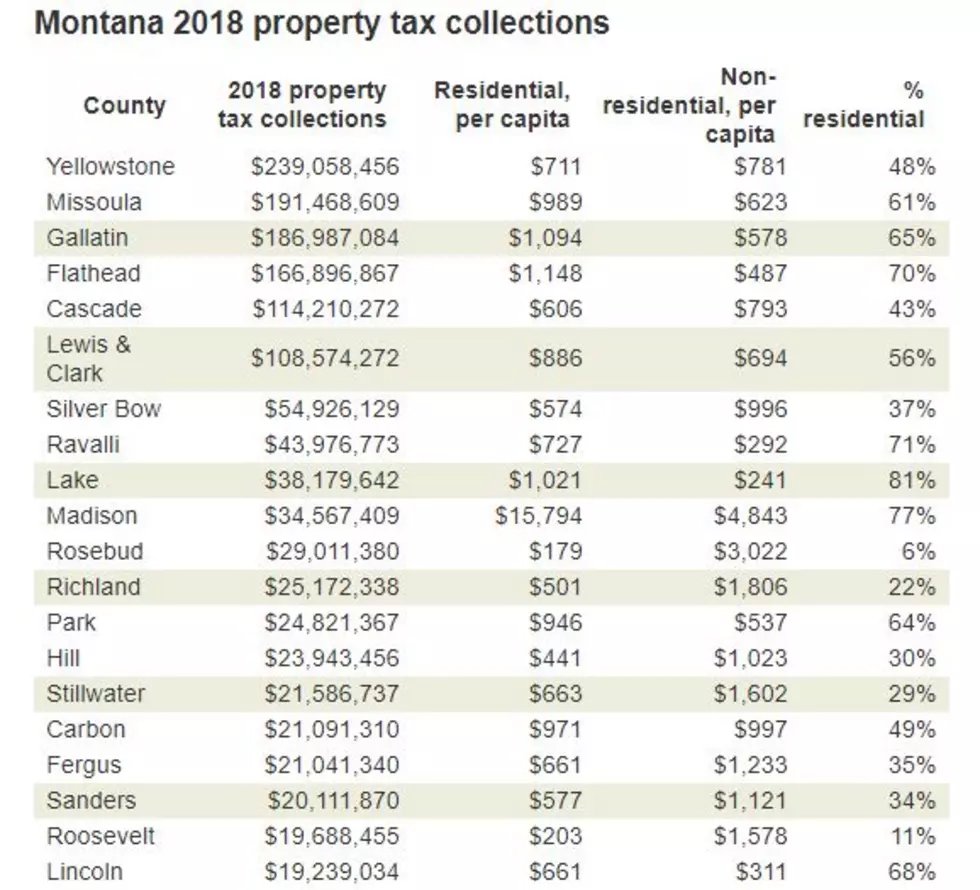

See more on Montana property tax relief 4 1 percent and 3 0 percent replacing a 30 percent net long term capital gains deduction set to take effect in 2024 Businesses in Montana will benefit from House Bill 212 which raises the business property tax exemptionA tax exemption excludes certain income revenue or even taxpayers from HELENA Mont Montana homeowners can file their claim for this year s property tax rebate starting in August The rebates are available after Governor Greg Gianforte signed House Bill 222 which provides a property tax rebate of up to 675 in both 2023 and 2024 for Montana homeowners at their primary residence

Montana Tax Rebate Checks Being Sent In July Kiplinger

https://cdn.mos.cms.futurecdn.net/HEfrCpsS8taNQzG5AbmsM6-1024-80.jpg

When Will We Get The Extra Tax Rebate Checks In Montana Details

https://townsquare.media/site/990/files/2023/03/attachment-032923-MT-Tax-Rebate-.jpg?w=980&q=75

https://leg.mt.gov/content/Committees/Interim/2023-2024/Revenue/Meetings/July-2023/property-relief-flyer.pdf

2023 The rebate provides Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 WHAT ARE THE QUALIFICATIONS To qualify for the property tax rebate you must have 3 Owned a Montana residence for at least seven months in 2022 3 Lived in that Montana residence for at least seven months in 2022

https://news.mt.gov/Governors-Office/Governor_Gianforte_Encourages_Montana_Homeowners_to_Apply_for_Property_Tax_Rebate_by_October_1

However taxpayers can also have their rebate mailed to them by check The department will process claims as they are received and distribute rebates by December 31 2023 Montana homeowners will be eligible for a second property tax rebate up to 675 in 2024 for property taxes paid on a principal residence for 2023 Last November the

Individual Income Tax Rebate

Montana Tax Rebate Checks Being Sent In July Kiplinger

Income And Property Tax Relief Montana s 675 Rebate For 2023 Explained

Montana Tax Rebate 2023 Benefits Eligibility How To Apply PrintableRebateForm

Montana Personal Property Tax PROPERTY BSI

Unlocking Your 2022 Montana Tax Rebate A Step by Step Guide To Finding Your Property Geocode

Unlocking Your 2022 Montana Tax Rebate A Step by Step Guide To Finding Your Property Geocode

PA Property Tax Rebate What To Know Credit Karma

Unraveling The Montana Tax Rebate 2023 Your Comprehensive Guide USRebate

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Beaver County

Montana Property Tax Rebate 2024 - Gov Gianforte celebrating property tax relief for Montanans with Rep Tom Welch R Dillon At a local residence in Dillion the governor ceremonially signed House Bill 222 carried by Rep Welch which provides a property tax rebate of up to 675 in both 2023 and 2024 for Montana homeowners at their primary residence