Montana Rebates 2024 For those whose filing status was single head of household or married filing separately the rebate will be either 1 250 or the line 20 amount whichever is less Married filing jointly taxpayers rebates will be 2 500 or the line 20 amount whichever is less Check on your rebate in TAP

We will begin accepting claims for the rebate for tax year 2023 on August 15 2024 and all claims must be filed by October 1 2024 The Property Tax Rebate is a rebate of up to 675 per year of property taxes paid on a principal residence The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are at GetMyRebate mt gov The fastest way for taxpayers to apply for and get the rebate is by applying online

Montana Rebates 2024

Montana Rebates 2024

https://www.montanaseniornews.com/wp-content/uploads/2023/04/394-191-WEB_montana-tax-rebate_1200x630-1024x538.jpg

Details On How To Claim Montana Tax Rebates KECI

https://nbcmontana.com/resources/media2/16x9/full/1024/center/80/26f3fd27-fde7-412e-8ffd-c2288942b919-large16x9_MontanaCapitol.jpg

![]()

Montana Tax Rebates Montana Department Of Revenue

https://mtrevenue.gov/wp-content/uploads/2023/06/IIT-Rebate-Icon.png

Last updated December 02 2023 Stimulus checks from the federal government ended a couple of years ago but some states have provided financial relief through tax rebate checks or inflation At a local residence in Dillion the governor ceremonially signed House Bill 222 carried by Rep Welch which provides a property tax rebate of up to 675 in both 2023 and 2024 for Montana homeowners at their primary residence Joining the governor for the ceremony Rep Welch added This bill is the cornerstone of change going forward

The Montana Department of Revenue has created a website to update Montanans on recently passed income tax and property tax rebates 2024 Money for the property tax rebates comes from House 2023 The rebate provides Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 WHAT ARE THE QUALIFICATIONS To qualify for the property tax rebate you must have 3 Owned a Montana residence for at least seven months in 2022 3 Lived in that Montana residence for at least seven months in 2022

Download Montana Rebates 2024

More picture related to Montana Rebates 2024

Montana Tax Rebate 2023 Benefits Eligibility How To Apply PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/04/Montana-Tax-Rebate-2023-768x684.png

Rebates For Seniors Mark Coure MP

https://markcoure.com.au/images/news/seniors-rebates-photo.png

DEC Savage Rascal Rebate Gun Rebates

https://gun-rebates.com/wp-content/uploads/2022/12/DEC-Savage-Rascal-Rebate.jpg

Home Energy Financial and Incentive Programs Program Overview DEQ currently offers grants and loan programs for alternative energy systems alternative fuel transportation and electric vehicle infrastructure Additional tax credits and rebates recently passed by congress will roll out soon The department says taxpayers can apply for the 2022 property tax rebates through its online TransAction Portal or via a paper form during an application period that runs from Aug 15 to Oct 1

Montana homeowners will be eligible for a second property tax rebate of up to 675 in 2024 for property taxes paid on a principal residence for 2023 For additional information about the property tax rebate or to check on the status of the income or property tax rebates visit the Montana Department of Revenues Website 2023 Legislature Filing period opens for homeowner property tax rebates Montana homeowners have from Aug 15 until Oct 1 to file for rebates of as much as 675 on their 2022 property taxes Learn more in our tax rebate FAQ by Eric Dietrich 08 15 2023 Credit Adobe stock May not be republished without license

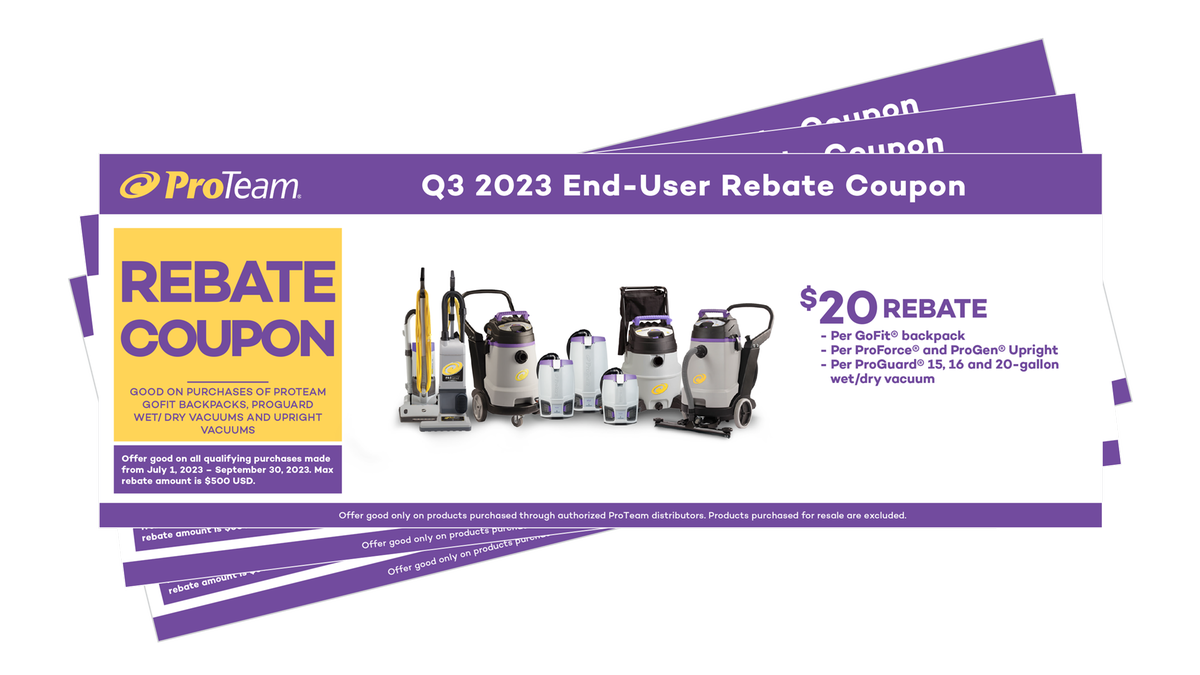

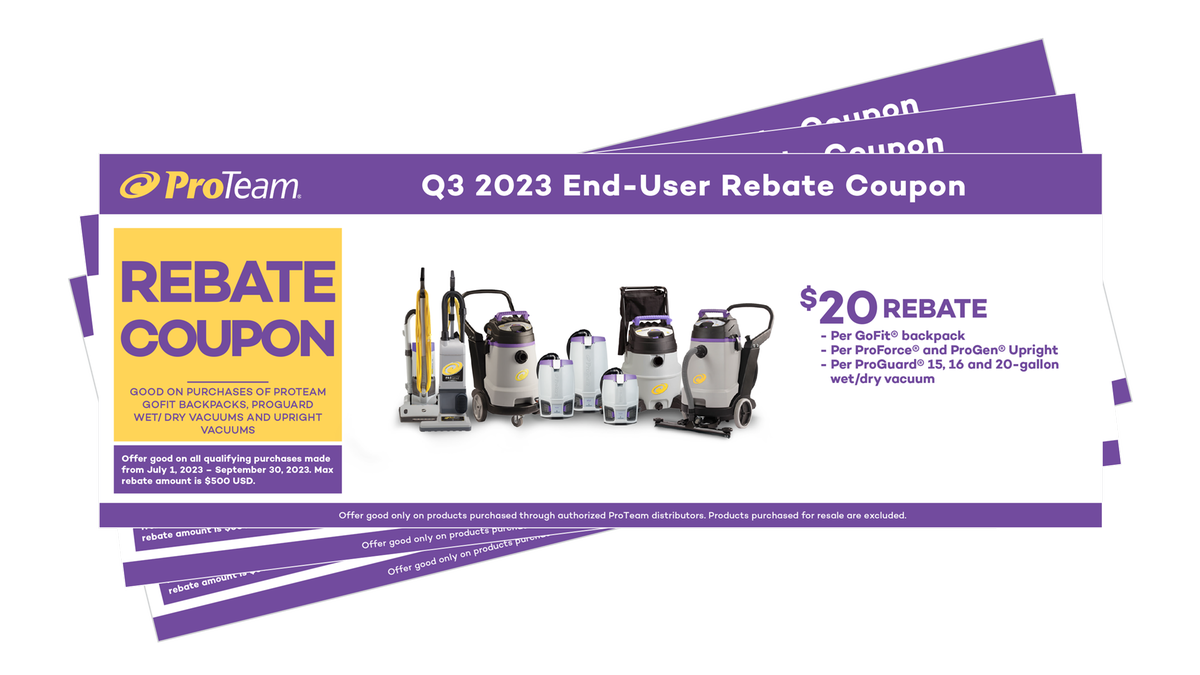

Manufacturer Rebates CleanFreak

https://cdn.shopify.com/s/files/1/0624/3270/6740/files/rebates-q3-full-line.png?v=1686831920

Smith Wesson Shield EZ Holiday Rebate H H Shooting Sports Oklahoma City

https://www.hhshootingsports.com/wp-content/uploads/2022/11/SmithWessonRebates-HalfPage-scaled.jpg

https://mtrevenue.gov/taxes/montana-tax-rebates/individual-income-tax-rebate-house-bill-192/

For those whose filing status was single head of household or married filing separately the rebate will be either 1 250 or the line 20 amount whichever is less Married filing jointly taxpayers rebates will be 2 500 or the line 20 amount whichever is less Check on your rebate in TAP

https://mtrevenue.gov/taxes/property-tax-rebate-house-bill-222/

We will begin accepting claims for the rebate for tax year 2023 on August 15 2024 and all claims must be filed by October 1 2024 The Property Tax Rebate is a rebate of up to 675 per year of property taxes paid on a principal residence

CAT Rebates W L Inc

Manufacturer Rebates CleanFreak

How Do Home Rebates Work DC MD VA Home Rebates

NWC Tryouts 2023 2024 NWC Alliance

Milwaukee Tool Rebates Printable Rebate Form

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

Energy Rebates Don t Leave Money On The Table Schmidt Associates

Primary Rebate South Africa Printable Rebate Form

.png)

Why Are Rebates And Rebate Management Important For Manufacturers And Distributors Enable

Montana Rebates 2024 - The Montana Department of Revenue has created a website to update Montanans on recently passed income tax and property tax rebates 2024 Money for the property tax rebates comes from House