Montana Tax Rebate 2024 Eligibility The rebate provides Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 WHAT ARE THE QUALIFICATIONS To qualify for the property tax rebate you must have 3 Owned a Montana residence for at least seven months in 2022 3 Lived in that Montana residence for at least seven months in 2022

The Home Electrification and Appliance Rebate Program rebates are tiered based on your gross household income and eligibility is capped at 150 AMI Appliances and HVAC systems must also meet certain efficiency standards Both programs can be utilized for single family multi family and manufactured housing Montana homeowners eligible for 675 rebates in both 2023 and 2024 Governor s Office which provides a property tax rebate of up to 675 in both 2023 and 2024 for Montana homeowners at their primary residence Joining the governor for the ceremony Rep Welch added This bill is the cornerstone of change going forward the governor

Montana Tax Rebate 2024 Eligibility

Montana Tax Rebate 2024 Eligibility

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1csa1K.img?w=1920&h=1080&m=4&q=79

The Montana Income Tax Rebate Are You Eligible

https://www.wordenthane.com/wp-content/uploads/2023/06/AdobeStock_602491697-scaled.jpeg

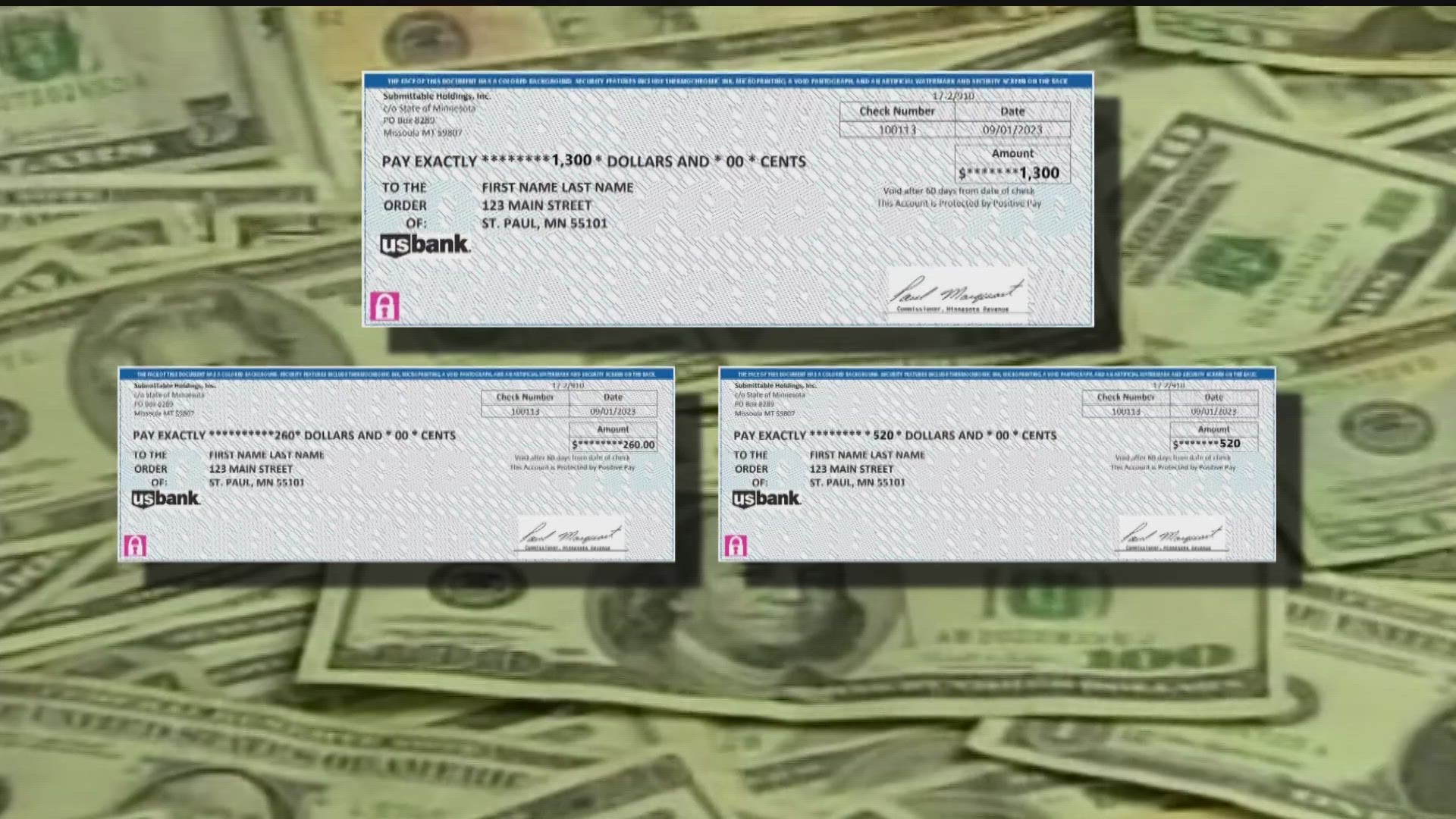

Montana Sends 260 Tax Rebate Checks To Minnesota Taxpayers Blogging Big Blue

https://www.bloggingbigblue.com/wp-content/uploads/2023/09/Tax-rebate-montana-scaled.jpg

The governor s budget provides 500 million in property tax relief for Montanans for their primary residence with a 1 000 property tax rebate in both 2023 and 2024 We can make a difference for the retired couple in the Flathead who because they can t afford their rising property taxes are thinking about selling the home they raised their This spring the governor also delivered Montanans 120 million in permanent long term property tax relief and secured up to 1 350 in property tax rebates for Montana homeowners over the next two years Eligible Montana homeowners may now claim their first rebate up to 675 at getmyrebate mt gov The deadline for claims is October 1 2023

If you were a full year Montana resident who paid your state taxes on 2020 and 2021 income on time you should receive a rebate of up to 1 250 for your 2021 taxes If you meet those requirements but paid less than 1 250 in 2021 you should have your entire payment refunded 1 Rebates on 2021 Montana income taxes If you were a full year Montana resident who paid your state taxes on 2020 and 2021 income on time you should receive a rebate of up to 1 250 for your 2021 taxes If you meet those requirements but paid less than 1 250 in 2021 you should have your entire payment refunded

Download Montana Tax Rebate 2024 Eligibility

More picture related to Montana Tax Rebate 2024 Eligibility

When Will We Get The Extra Tax Rebate Checks In Montana Details

https://townsquare.media/site/990/files/2023/03/attachment-032923-MT-Tax-Rebate-.jpg?w=980&q=75

Here s How To Claim Your Montana Property Tax Rebate

https://townsquare.media/site/1107/files/2023/08/attachment-Tax-Rebate.jpg?w=980&q=75

Farmer Finishers Somber School News Montana Tax Rebate Flakes Trip 2024

https://townsquare.media/site/109/files/2023/03/attachment-Flakes-Image-33.jpg?w=980&q=75

The Property Tax Rebate is a rebate of up to 500 a year of property taxes on a principal residence paid for 2022 and 2023 Individuals should check eligibility and will have to apply for the How to claim your Montana tax rebates Montana s GOP controlled Legislature put 764 million into tax rebates refunding residents income and property taxes Here s what you need to do to

The Montana Property Tax Rebate is a program that provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The claim period for the 2023 tax year opens on August 15 2024 and closes on October 1 2024 The Montana 1 250 up to 2 500 for joint filers rebate is separate from the property tax rebate and is available to eligible homeowners and non homeowners The 1 250 Montana tax rebate is

How To Claim Your 2022 Montana Tax Rebates Montana Senior News

https://www.montanaseniornews.com/wp-content/uploads/2023/04/394-191-WEB_montana-tax-rebate_1200x630-1024x538.jpg

Montana Income Tax Rebate Of Up To 2 500 Coming To Eligible Taxpayers This July Check

https://www.pelhamplus.com/wp-content/uploads/2023/07/Montana-Free-Press_11zon.jpg

https://leg.mt.gov/content/Committees/Interim/2023-2024/Revenue/Meetings/July-2023/property-relief-flyer.pdf

The rebate provides Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 WHAT ARE THE QUALIFICATIONS To qualify for the property tax rebate you must have 3 Owned a Montana residence for at least seven months in 2022 3 Lived in that Montana residence for at least seven months in 2022

https://deq.mt.gov/energy/Programs/efficiency

The Home Electrification and Appliance Rebate Program rebates are tiered based on your gross household income and eligibility is capped at 150 AMI Appliances and HVAC systems must also meet certain efficiency standards Both programs can be utilized for single family multi family and manufactured housing

Individual Income Tax Rebate

How To Claim Your 2022 Montana Tax Rebates Montana Senior News

Montana Tax Rebate Package Muscled Through Initial House Votes

Unlocking Your 2022 Montana Tax Rebate A Step by Step Guide To Finding Your Property Geocode

Unraveling The Montana Tax Rebate 2023 Your Comprehensive Guide USRebate

Montana Income Tax Information What You Need To Know On MT Taxes

Montana Income Tax Information What You Need To Know On MT Taxes

This US States Property Tax Rebate For Residents How To Qualify

Income And Property Tax Relief Montana s 675 Rebate For 2023 Explained

Minnesota Tax Rebate Checks From Montana Company Are Legitimate Kare11

Montana Tax Rebate 2024 Eligibility - IIT Rebate Qualifications Tax Filings and Residency Montana resident for all of 2021 Jan 1 Dec 31 Filed 2020 and 2021 MT Form 2 by 10 17 2022 2020 either part year or full year resident 2021 full year resident 2021 Form 2 Line 20 must be greater than 0 Can t be claimed as a dependent on another person s 1040 or Form 2