Montana Tax Rebate Bill 2024 The Property Tax Rebate is a rebate of up to 675 per year of property taxes paid on a principal residence There is a rebate available for property taxes paid for Tax Year 2022 and another rebate available for property taxes paid for Tax Year 2023 Check the status of your Property Tax Rebate Rebate Resources County Property Tax Lookup

The rebates are equal to the amount of a taxpayer s 2021 taxes up to 1 250 for single married filing separately and head of household filers and 2 500 for married filing jointly filers Taxpayers can find the amount of their 2021 tax liability on line 20 of their Montana tax return How to claim your Montana tax rebates 2023 Legislature Filing period opens for homeowner property tax rebates Montana homeowners have from Aug 15 until Oct 1 to file for rebates of as much as 675 on their 2022 property taxes Learn more in our tax rebate FAQ by Eric Dietrich 08 15 2023 Credit Adobe stock

Montana Tax Rebate Bill 2024

Montana Tax Rebate Bill 2024

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA18Uiac.img?w=1920&h=1080&m=4&q=86

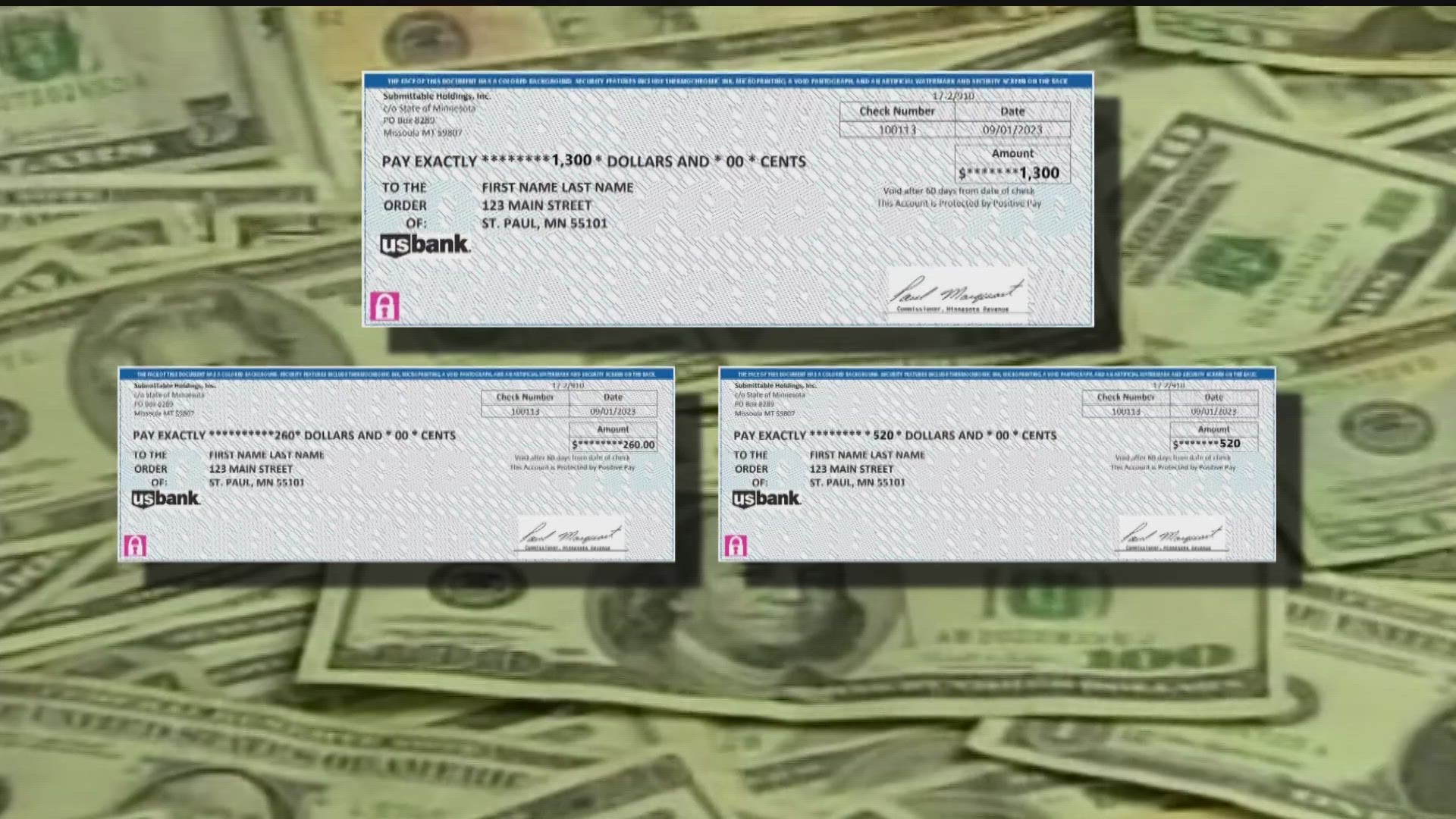

Montana Sends 260 Tax Rebate Checks To Minnesota Taxpayers Blogging Big Blue

https://www.bloggingbigblue.com/wp-content/uploads/2023/09/Tax-rebate-montana-scaled.jpg

This US States Property Tax Rebate For Residents How To Qualify

https://www.lamansiondelasideas.com/wp-content/uploads/2023/03/Montana-Tax-Refunds-and-Rebates.jpg

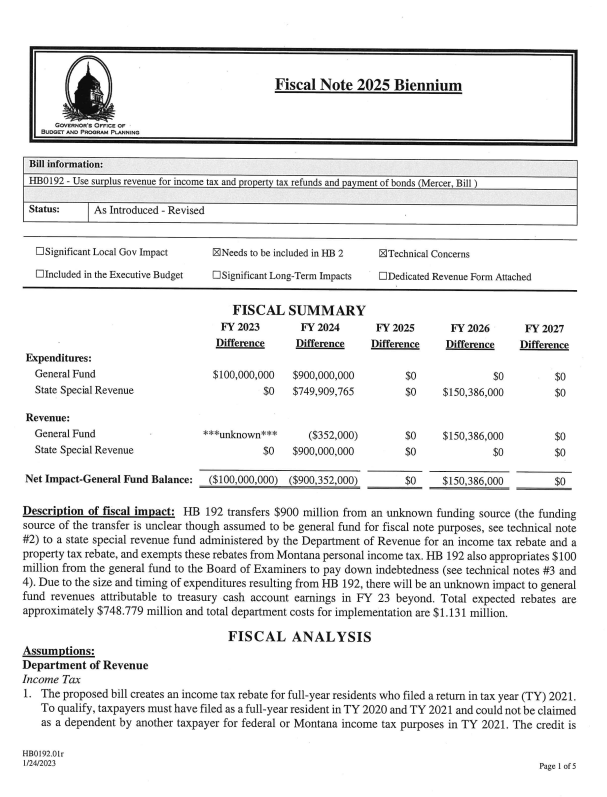

The money comes from House Bill 192 which set aside 480 million of the surplus to provide income tax rebates The income tax rebate is for taxes paid in 2021 Individuals eligible shouldn t 1 house bill no 963 2 introduced by m regier g hertz b mercer 3 4 a bill for an act entitled an act providing for the tax reduction fund providing 5 that excess revenues for the fiscal year beginning july 1 2023 be transferred into 6 the tax rebate fund distributing excess revenue to montanans based on certain

House Bill 192 as amended Friday would put 480 million into income tax rebates Individual taxpayers would qualify for up to 1 250 in rebates on their 2021 state income tax bill House Bill 212 which would raise the exemption threshold for the state s business equipment tax from 300 000 of business property to 1 million The governor s budget provides 500 million in property tax relief for Montanans for their primary residence with a 1 000 property tax rebate in both 2023 and 2024 We can make a difference for the retired couple in the Flathead who because they can t afford their rising property taxes are thinking about selling the home they raised their

Download Montana Tax Rebate Bill 2024

More picture related to Montana Tax Rebate Bill 2024

Here s How To Claim Your Montana Property Tax Rebate

https://townsquare.media/site/1107/files/2023/08/attachment-Tax-Rebate.jpg?w=980&q=75

Farmer Finishers Somber School News Montana Tax Rebate Flakes Trip 2024

https://townsquare.media/site/109/files/2023/03/attachment-Flakes-Image-33.jpg?w=980&q=75

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Senate Bill 121 will reduce the top rate of 6 5 to 5 9 effective as previously scheduled on Jan 1 2024 The bill also increases the Montana Earned Income Tax Credit from 3 of the federal credit to 10 Apportionment changes Senate Bill 124 amends the current apportionment formula from three factor with double weighted sales to single By Amy Beth Hanson Published 1 41 PM PST March 2 2023 HELENA Mont AP Montana s legislature has passed bills totaling over 1 billion in tax relief and rebates for state residents But lawmakers have tabled parts of Republican Gov Greg Gianforte s budget proposal including a child tax credit

Gov Gianforte shaking hands with Rep Tom Welch R Dillon sponsor of House Bill 222 providing Montana homeowners a 675 property tax rebate in 2023 and 2024 To qualify for the rebate taxpayers must have owned and lived in their home for at least seven months during 2022 The amount of the rebate is the property taxes paid on this principal In his Budget for Montana Families the governor proposed a 1 000 property tax rebate in 2023 and 2024 which was in the original version of HB 222 I want to thank Representative Tom Welch for leading the effort to provide Montana homeowners with meaningful property tax relief the governor said

Montana Tax Rebate Checks Up To 2 500 Coming In July

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1csa1K.img?w=1920&h=1080&m=4&q=79

Property Tax Rebate In Montana Sandra Johnson Realtor

https://bigskyliving.com/wp-content/uploads/2023/05/Property-Tax-Rebate-in-Montana.jpg

https://mtrevenue.gov/taxes/property-tax-rebate-house-bill-222/

The Property Tax Rebate is a rebate of up to 675 per year of property taxes paid on a principal residence There is a rebate available for property taxes paid for Tax Year 2022 and another rebate available for property taxes paid for Tax Year 2023 Check the status of your Property Tax Rebate Rebate Resources County Property Tax Lookup

https://mtrevenue.gov/montana-department-of-revenue-to-start-issuing-individual-income-tax-rebates-in-july/

The rebates are equal to the amount of a taxpayer s 2021 taxes up to 1 250 for single married filing separately and head of household filers and 2 500 for married filing jointly filers Taxpayers can find the amount of their 2021 tax liability on line 20 of their Montana tax return

Unlocking Your 2022 Montana Tax Rebate A Step by Step Guide To Finding Your Property Geocode

Montana Tax Rebate Checks Up To 2 500 Coming In July

Montana Income Tax Information What You Need To Know On MT Taxes

Montana Tax Rebate 2023 The Concept Of Tax Rebates PrintableRebateForm

What To Do If You Didn t Get The Montana Tax Rebate Of Up To 2 500 24 7 Wall St

Income And Property Tax Relief Montana s 675 Rebate For 2023 Explained

Income And Property Tax Relief Montana s 675 Rebate For 2023 Explained

Montana Tax Rebate Package Muscled Through Initial House Votes

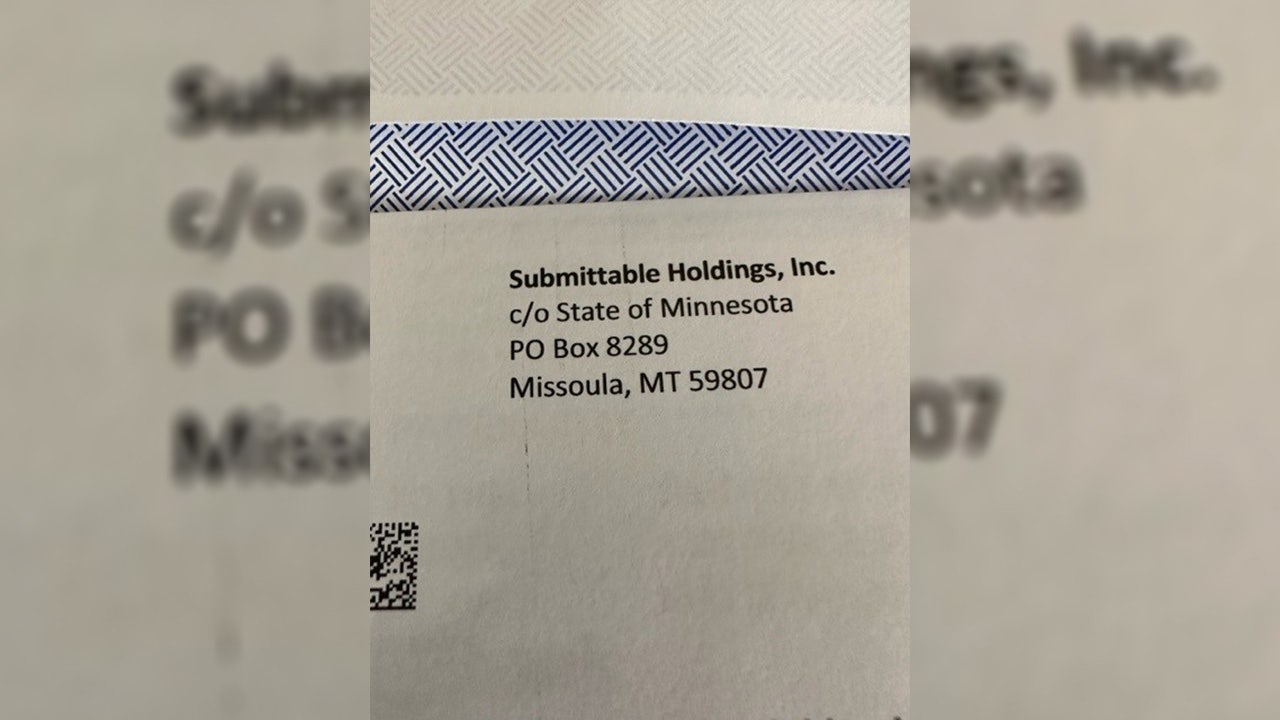

Minnesota Tax Rebate Checks May Look Like Junk Mail

Minnesota Tax Rebate Checks From Montana Company Are Legitimate Kare11

Montana Tax Rebate Bill 2024 - The governor s budget provides 500 million in property tax relief for Montanans for their primary residence with a 1 000 property tax rebate in both 2023 and 2024 We can make a difference for the retired couple in the Flathead who because they can t afford their rising property taxes are thinking about selling the home they raised their