Monthly Child Tax Credit 2023 Schedule See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint filers 2023 2024 Child Tax Credit Schedule 8812 H R Block Life Stages Work Taxes 101 Tax Breaks and Money What s New Tax Information CenterFilingCredits Child Tax Credit How it works How to claim it 7 min read Share 7 min read Share Legislation update as of Feb 5 2024 Hearing news of an increase to the Child Tax Credit in 2024

Monthly Child Tax Credit 2023 Schedule

Monthly Child Tax Credit 2023 Schedule

https://s.hdnux.com/photos/01/35/74/61/24628288/5/rawImage.jpg

Child Tax Credit 2024 Child Tax Credit 2024 By Clear Start Tax

https://miro.medium.com/v2/resize:fit:1200/1*KsfOocLtQfEdOBFic2MiOw.png

House Passes Child Tax Credit Expansion NPR Tmg News

https://lh3.googleusercontent.com/J6_coFbogxhRI9iM864NL_liGXvsQp2AupsKei7z0cNNfDvGUmWUy20nuUhkREQyrpY4bEeIBuc=w0

How the child tax credit will look in 2023 Will Congress approve more monthly child tax credit payments How the scaled down child tax credit could impact the 2023 tax The legislation includes advanced monthly child tax credit payments from July 15 through Dec 15 It s the first time in history eligible families will receive an advance payment of the child

The IRS will issue advance CTC payments July 15 Aug 13 Sept 15 Oct 15 Nov 15 and Dec 15 Who needs to take action now If you haven t filed or registered with the IRS now is the time to take action The sooner you do the sooner you will begin receiving monthly payments How much is the 2023 child tax credit Right now unless Congress makes last minute changes the 2023 child tax credit is worth up to 2 000 per qualifying child

Download Monthly Child Tax Credit 2023 Schedule

More picture related to Monthly Child Tax Credit 2023 Schedule

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/t22-0188.gif?itok=6FfQuMuW

Child Tax Credit Payment Schedule 2022 Child Tax Credit Payment

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Key Takeaways The Child Tax Credit CTC can reduce the amount of tax you owe by up to 2 000 per qualifying child If you end up owing less tax than the amount of the CTC you may be able to get a refund using the Additional Child Tax Credit ACTC Besides the July 15 payment payment dates are Aug 13 Sept 15 Oct 15 Nov 15 and Dec 15 Here are further details on these payments Families will see the direct deposit payments in their accounts starting today July 15

How the child tax credit will look in 2023 The child tax credit isn t going away but it has returned to its previous levels There are a handful of requirements that you and your Credit The Child Tax Credit is one of the nation s strongest tools to provide tens of millions of families with some support and breathing room while raising children It has also being shown

Expanding The Child Tax Credit Budgetary Distributional And

https://images.squarespace-cdn.com/content/v1/55693d60e4b06d83cf793431/1635174298909-BVRM1BK6BUJQKSEXWQK9/AdobeStock_299187554.jpeg

Child Tax Credit Update Here s Three Reasons You Should Opt Out Of

https://www.the-sun.com/wp-content/uploads/sites/6/2021/09/kc-child-tax-credit-comp-1.jpg?w=1040

https://finance.yahoo.com/personal-finance/child...

See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

https://smartasset.com/taxes/all-about-child-tax-credits

The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint filers

IRS Releases Website To Manage Child Tax Credit Deposits Payne

Expanding The Child Tax Credit Budgetary Distributional And

Planilla Child Tax Credit Desarrolladora Empresarial

How People Are Using The Monthly Child Tax Credit Payments SaverLife

Child Tax Credit Payments Schedule 2024

One Republican Eyes More Direct Payments Amid Rising Childcare Costs

One Republican Eyes More Direct Payments Amid Rising Childcare Costs

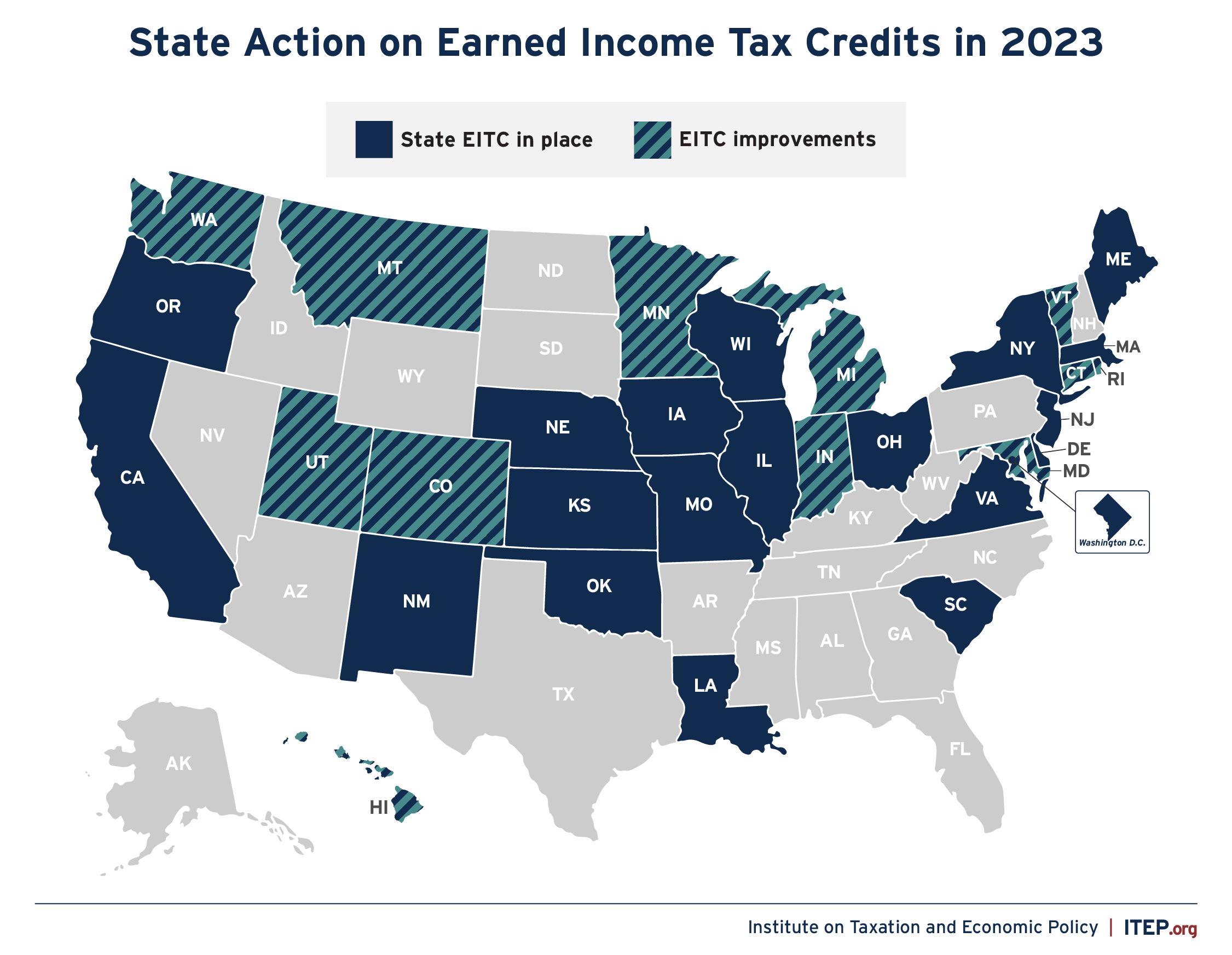

Refundable Credits A Winning Policy Choice Again In 2023 ITEP

Child Tax Credit How Much Is It For 2024

Thousands Of Americans Eligible For 5 000 Stimulus Check And Child Tax

Monthly Child Tax Credit 2023 Schedule - The IRS will issue advance CTC payments July 15 Aug 13 Sept 15 Oct 15 Nov 15 and Dec 15 Who needs to take action now If you haven t filed or registered with the IRS now is the time to take action The sooner you do the sooner you will begin receiving monthly payments