Mortgage Effective Interest Rate After Tax Rebate Web To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements You filed an IRS form 1040 and itemized your deductions The mortgage

Web Home loan tax benefit calculator is an online tool that helps you determine the exact amount to be paid after all the eligible tax deductions Check tax savings on home loans Web 5 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct

Mortgage Effective Interest Rate After Tax Rebate

Mortgage Effective Interest Rate After Tax Rebate

https://image.slidesharecdn.com/chap005-120923223533-phpapp01/95/chap005-7-728.jpg?cb=1348439910

Effective Interest Rates

https://s2.studylib.net/store/data/010079663_1-ffa00f81c348a1b1b7b82dc67e40e180-768x994.png

Reserve Bank Delivers Sharp Rise In Mortgage Defaults MacroBusiness

https://www.macrobusiness.com.au/wp-content/uploads/2022/12/Capture-44.png

Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021 Web 18 juil 2023 nbsp 0183 32 Eligible homeowners can claim the mortgage interest tax deduction on Schedule A of their annual tax returns Schedule A accompanies Form 1040 or 1040 SR

Web Effective Mortgage Payment After Income Tax Savings Amount Original monthly mortgage payment with insurance property tax amp HOA Equivalent monthly mortgage payment after income tax savings Web 28 d 233 c 2021 nbsp 0183 32 Let s say you paid 10 000 in mortgage interest and are in the 32 percent tax bracket You ll lower your tax bill by 3 200 after subtracting the 10 000 deduction

Download Mortgage Effective Interest Rate After Tax Rebate

More picture related to Mortgage Effective Interest Rate After Tax Rebate

How To Calculate An Annual Interest Rate Shop Outlets Save 60

https://www.double-entry-bookkeeping.com/wp-content/uploads/effective-interest-rate-formula-1.png

How To Calculate Effective Interest Rate 8 Steps with Pictures

https://www.wikihow.com/images/thumb/d/d8/Calculate-Effective-Interest-Rate-Step-2-Version-2.jpg/aid1594499-v4-728px-Calculate-Effective-Interest-Rate-Step-2-Version-2.jpg

Top Annual Interest Rate Formula Excel Tips Formulas

https://usercontent2.hubstatic.com/13347425.jpg

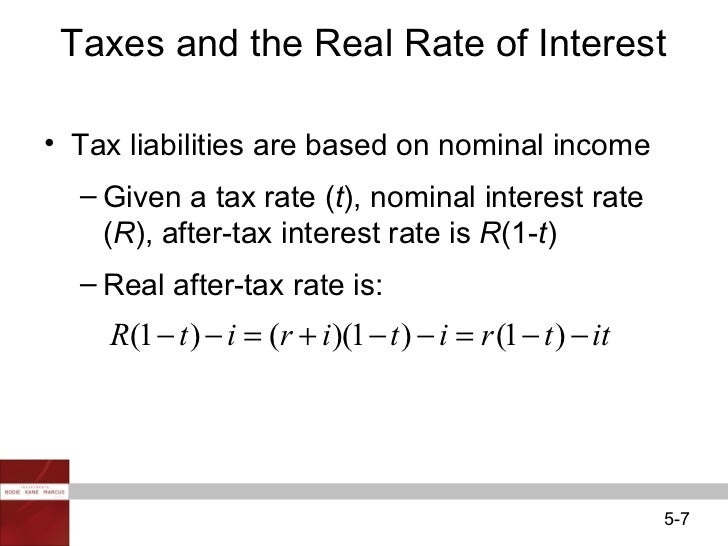

Web Mortgage Tax Savings Calculator Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes The interest paid Web 19 sept 2016 nbsp 0183 32 The after tax interest rate on the mortgage is the interest rate multiplied by 1 your marginal tax rate In other words it s the interest you pay minus the tax

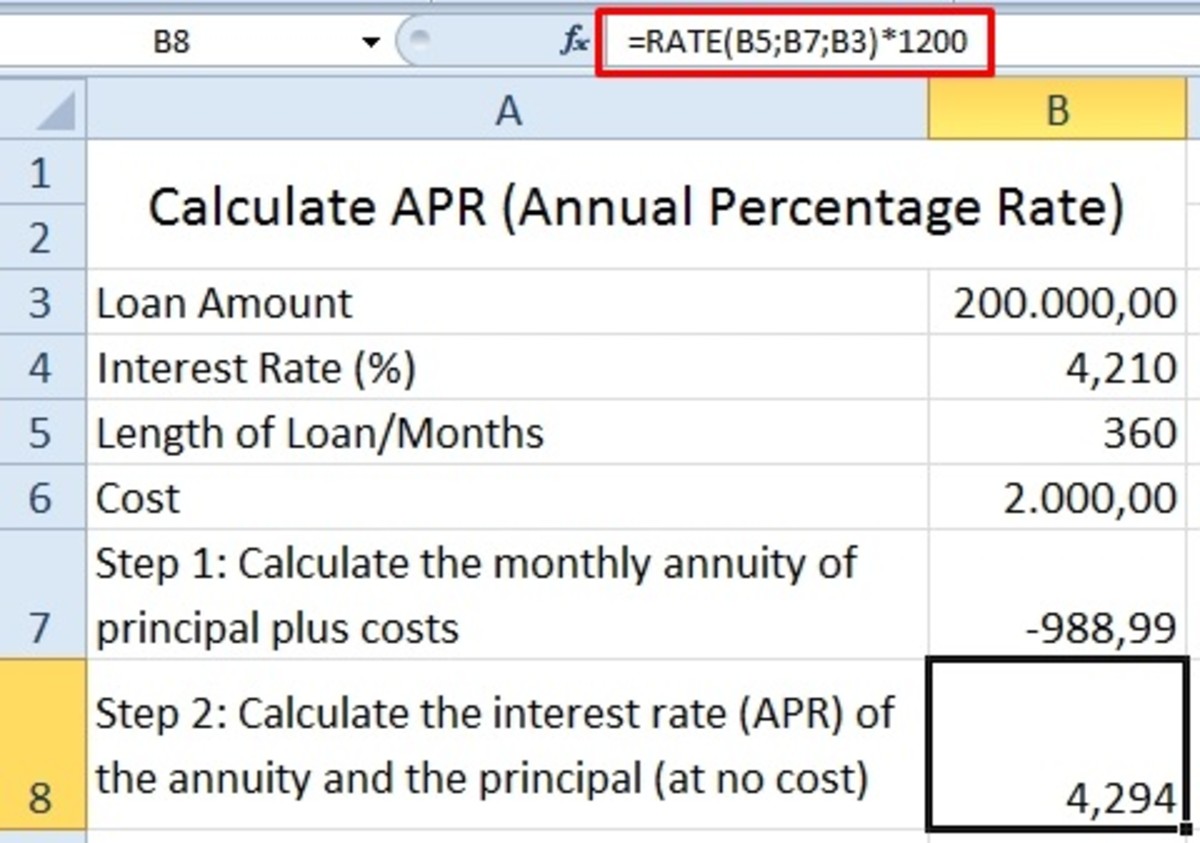

Web Just plug in the amount of the loan your current home value the interest rate the length of the loan any points or closing costs and your annual taxes insurance and PMI Then Web 23 d 233 c 2016 nbsp 0183 32 An example Let s say your lender offers you a 200 000 mortgage at 4 interest The lender charges one discount point 2 000 and an origination fee of 750

How To Calculate Effective Interest Rate 8 Steps with Pictures

https://www.wikihow.com/images/thumb/4/46/Calculate-Effective-Interest-Rate-Step-3-Version-2.jpg/aid1594499-v4-728px-Calculate-Effective-Interest-Rate-Step-3-Version-2.jpg

FIN 502 Study Guide Winter 2017 Final Second Mortgage Effective

https://new-docs-thumbs.oneclass.com/doc_thumbnails/new_mobile/1567582-study-guides-ca-ryerson-fin-502-examfinal.jpg

https://www.bankrate.com/mortgages/mortgage-tax-deduction-calculator

Web To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements You filed an IRS form 1040 and itemized your deductions The mortgage

https://www.kotak.com/.../home-loan/home-loan-tax-benefit-calculator.html

Web Home loan tax benefit calculator is an online tool that helps you determine the exact amount to be paid after all the eligible tax deductions Check tax savings on home loans

How Do You Calculate Interest Rate On A Mortgage 17 You Can Discover

How To Calculate Effective Interest Rate 8 Steps with Pictures

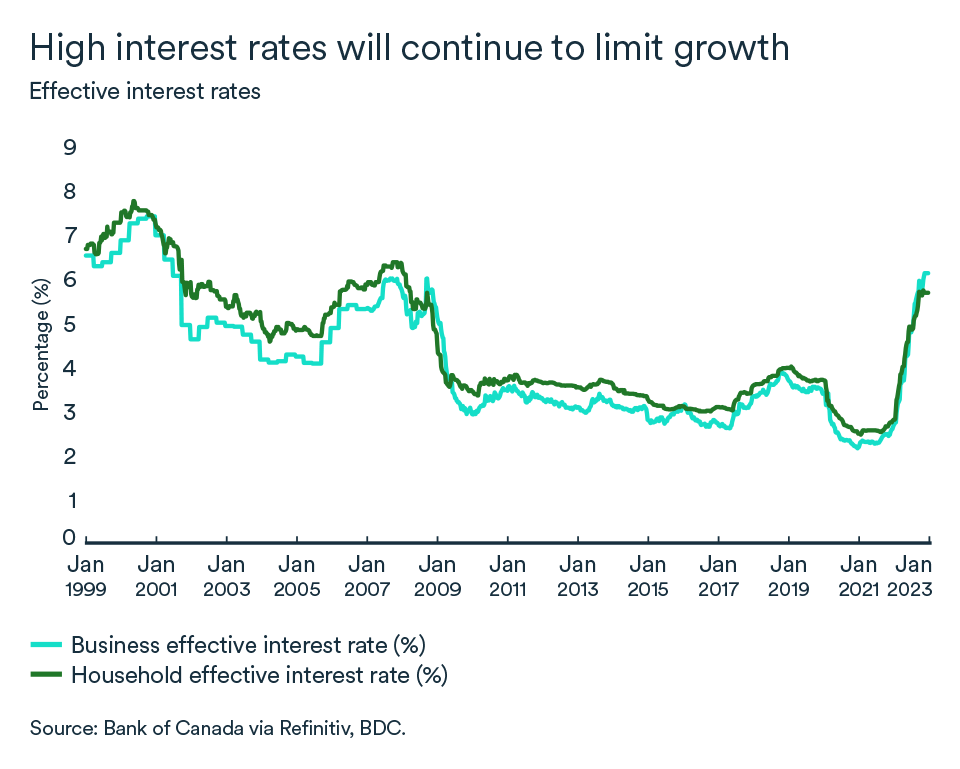

Monthly Economic Letter February 2023 BDC ca

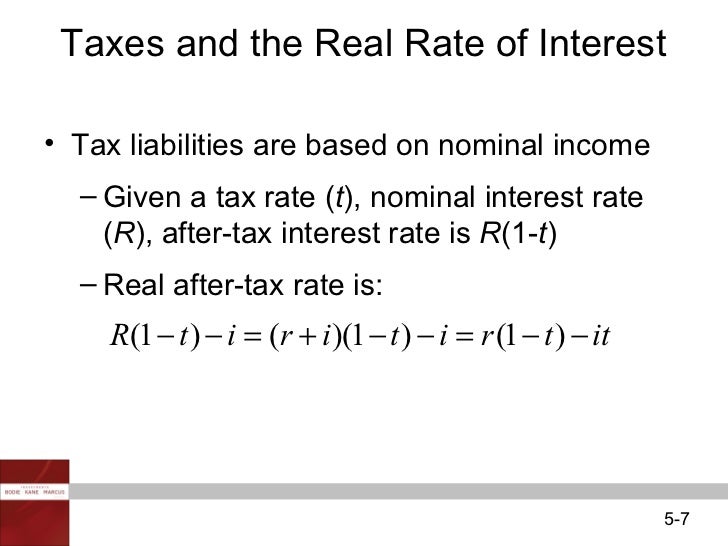

The Nominal Interest Rate Could Best Be Described As The

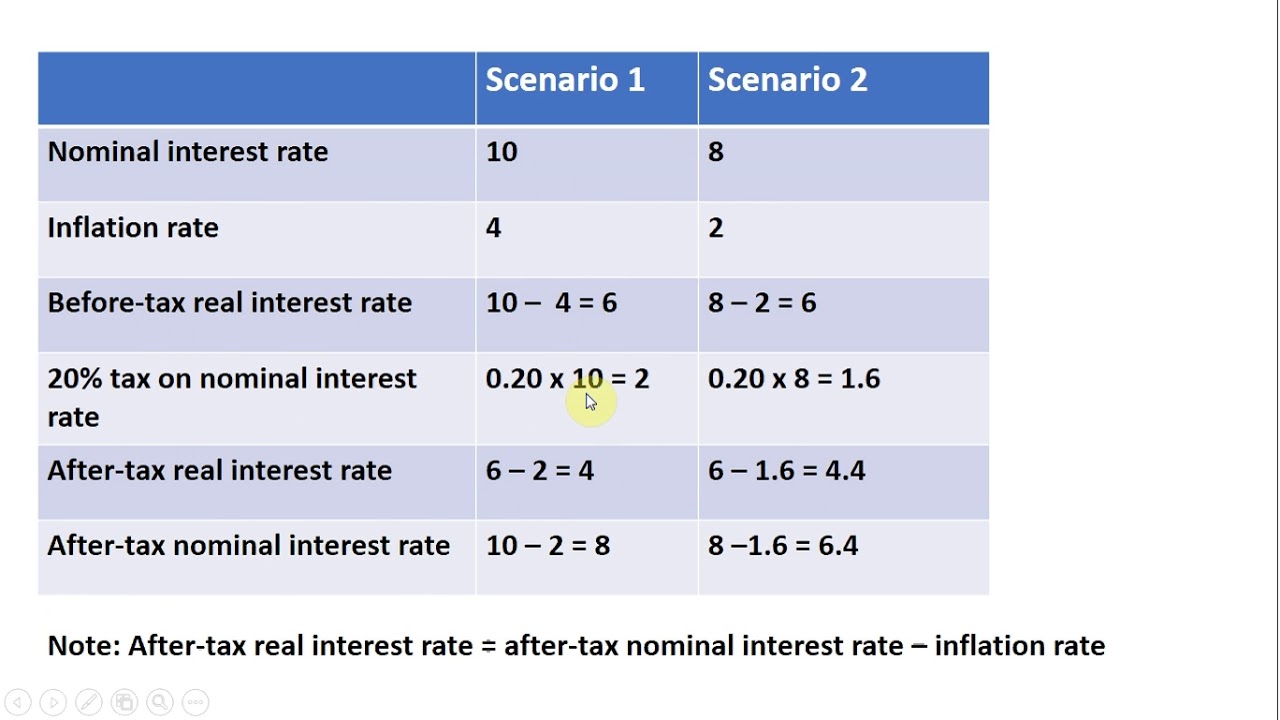

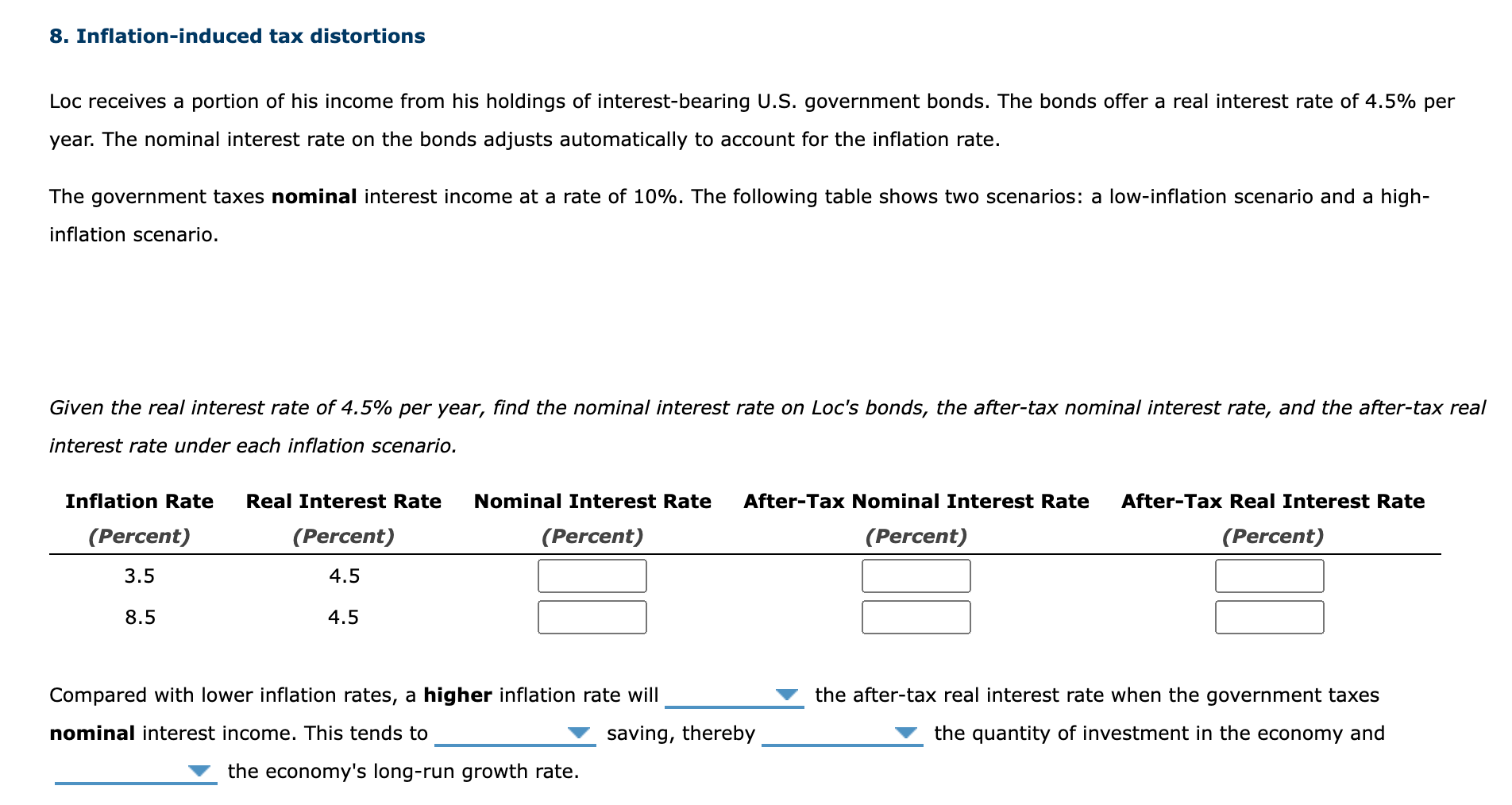

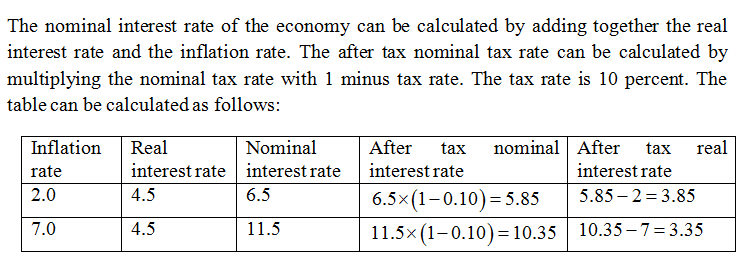

Solved 8 Inflation induced Tax Distortions Loc Receives A Chegg

Effective Interest Rate Formula Converting Nominal Interest Rate To

Effective Interest Rate Formula Converting Nominal Interest Rate To

TLRY Tilray Short Interest And Earnings Date Annual Report Aug 2021

PUBM PubMatic Short Interest And Earnings Date Annual Report Jun

Answered 8 Inflation induced Tax Distortions Bartleby

Mortgage Effective Interest Rate After Tax Rebate - Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021