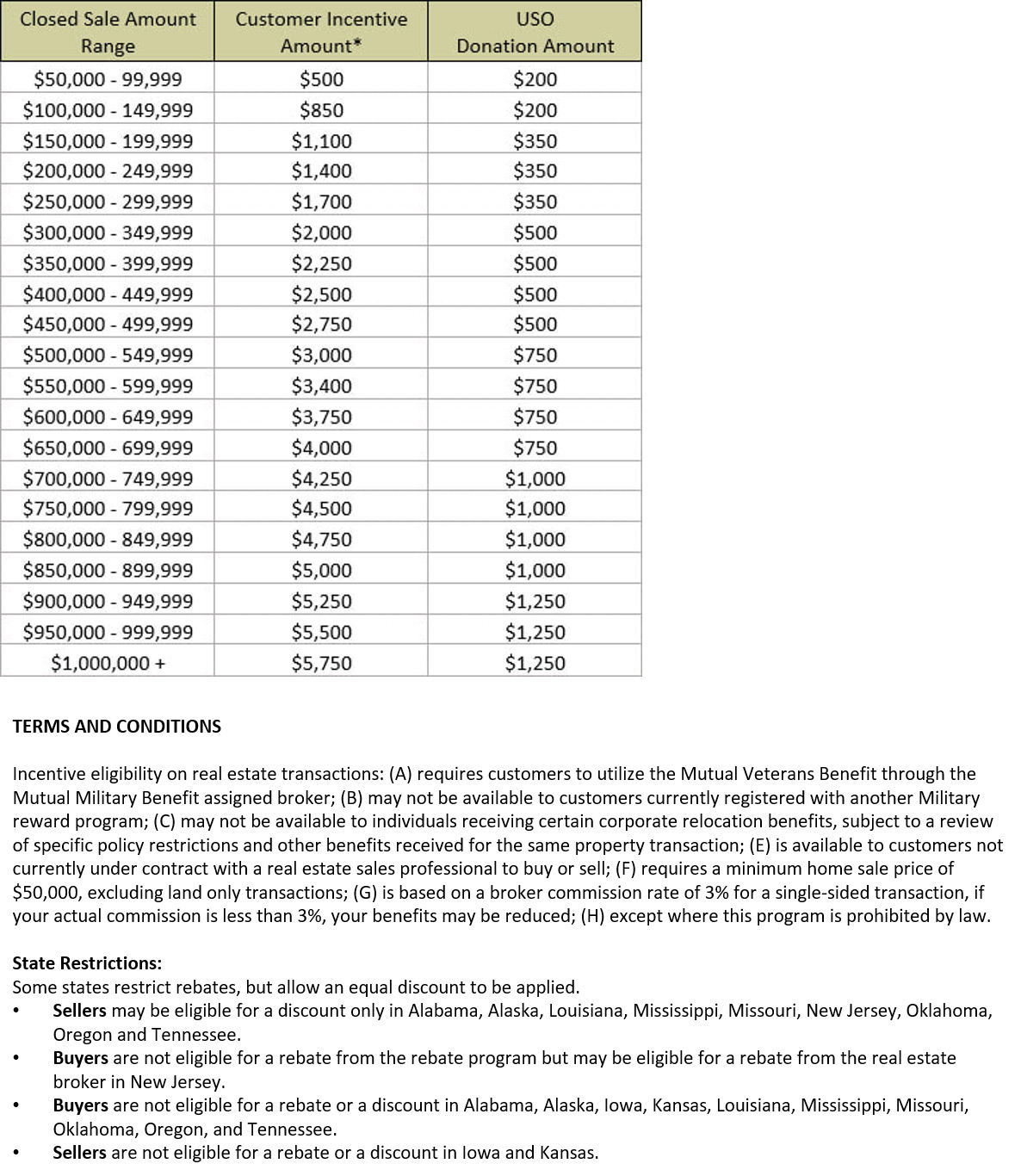

Mortgage Loan Tax Rebate Web 5 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct

Web 4 ao 251 t 2023 nbsp 0183 32 Topic What is income tax rebate on home loan quot Maximize your savings with the income tax rebate on home loans By taking advantage of this itemized deduction for mortgage interest you can lower your taxable income and keep more money in your pocket With the recent changes individuals and married couples filing jointly can deduct Web Under certain conditions you can deduct the mortgage interest you pay on your mortgage from your taxable income in Box 1 on the tax return You will get money back from the

Mortgage Loan Tax Rebate

Mortgage Loan Tax Rebate

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Mortgage Calculator Free Home Mortgage Calculator For Excel Calculate

https://i.pinimg.com/736x/1e/bf/2e/1ebf2ead0c37812eaed478655de6de70.jpg

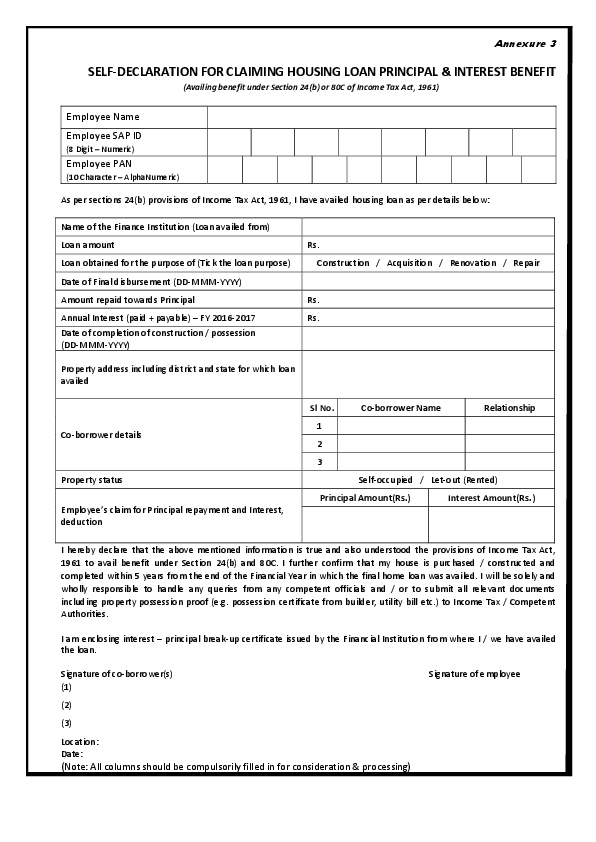

Mortgage Loans For Veterans

https://www.oriontalent.com/mutualmortgage/images/Benefit-1.jpg

Web 21 ao 251 t 2023 nbsp 0183 32 Find out whether your loan is backed by the federal government making you eligible for help Call or write your mortgage servicer Your servicer is required to tell you Web To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements You filed an IRS form 1040 and itemized your deductions The mortgage

Web 19 janv 2023 nbsp 0183 32 The tax relief landlords get on a buy to let mortgage interest has now ended as of April 2020 Instead you ll receive a tax credit based on 20 of your mortgage interest payments We help you Web 14 juin 2022 nbsp 0183 32 A mortgage rebate also known as a lender credit is an incentive that a mortgage lender may offer to entice you into getting a home loan through them versus

Download Mortgage Loan Tax Rebate

More picture related to Mortgage Loan Tax Rebate

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

What Does Rebate Lost Mean On Student Loans

https://studentloanhero.com/wp-content/uploads/f21d66bc-bb4b-4eb4-8ba2-066e3aa6040a_pasted20image200.png

Bank mortgage rebate comparison v2 Starpro Agency Limited

https://starpagency.com/wp-content/uploads/2016/05/bank-mortgage-rebate-comparison-v2.jpg

Web Mortgage Tax Benefits Calculator One of the advantages of real estate investment is that some homeowners may qualify to deduct mortgage interest payments from their income when filing their taxes This Web Form 1098 Where To Deduct Home Mortgage Interest Refund of overpaid interest More than one borrower Principal residence Amount you can exclude Ordering rule

Web 4 janv 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who Web Income tax rebate on home loan Tax deductions Tax deductions for a mortgage loan FY 2022 23 Repayment of a home loan s principal is tax deductible under Section 80C

What You Required To Learn About House Equity Loan

https://i.ytimg.com/vi/qzW5XaLnrJM/maxresdefault.jpg

How To Calculate Monthly Loan Payments In Excel

https://www.exceldemy.com/wp-content/uploads/2019/01/2.biweekly-mortgage-calculator-with-extra-payments-767x661.png

https://www.nerdwallet.com/article/taxes/mort…

Web 5 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct

https://topviews.org/what-is-income-tax-rebate-on-home-loan-a...

Web 4 ao 251 t 2023 nbsp 0183 32 Topic What is income tax rebate on home loan quot Maximize your savings with the income tax rebate on home loans By taking advantage of this itemized deduction for mortgage interest you can lower your taxable income and keep more money in your pocket With the recent changes individuals and married couples filing jointly can deduct

Your Mortgage What To Expect The Initial Document Review Mortgage

What You Required To Learn About House Equity Loan

How To Estimate Auto Loan Rates

Is A 30 Year Mortgage Loan A Choice BNBA Org

54 FORM FOR HOME MORTGAGE INTEREST DEDUCTION DEDUCTION HOME MORTGAGE

Excel Design Templates For Financial Management Microsoft Create

Excel Design Templates For Financial Management Microsoft Create

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

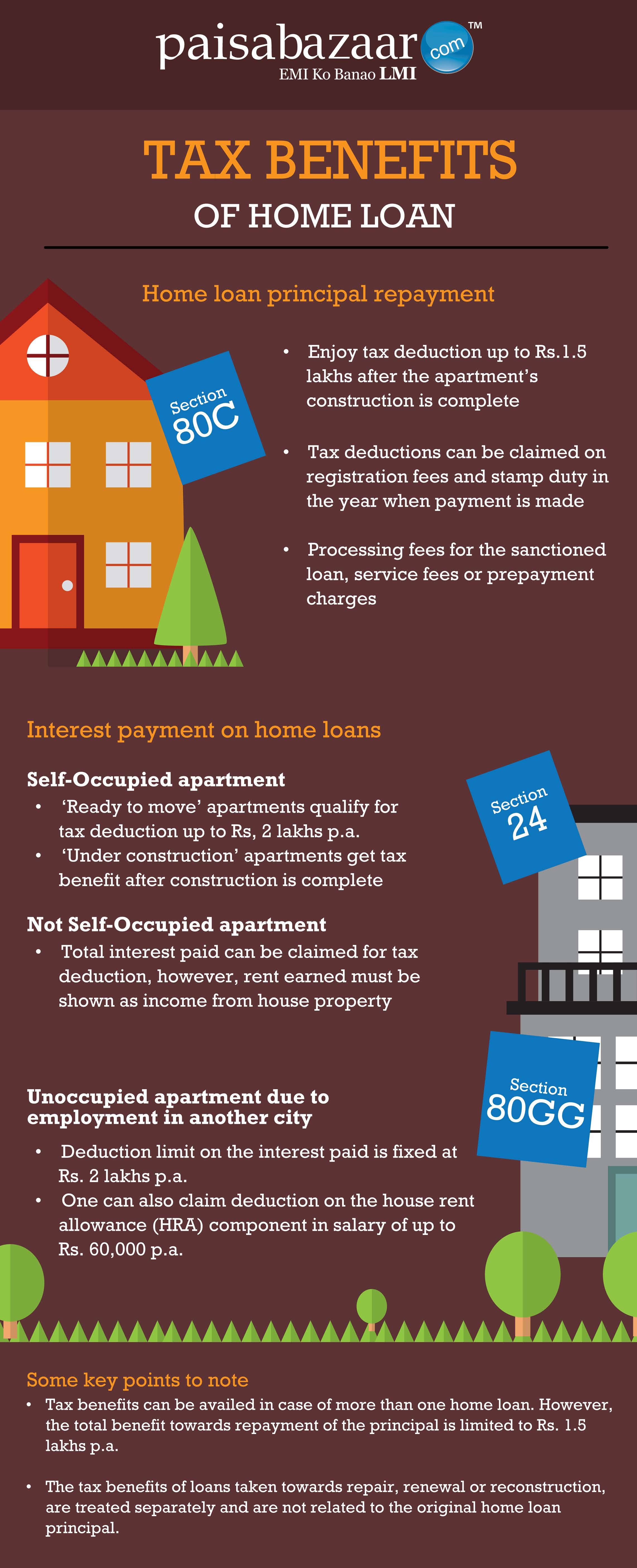

PDF SELF DECLARATION FOR CLAIMING HOUSING LOAN PRINCIPAL INTEREST

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Mortgage Loan Tax Rebate - Web 21 ao 251 t 2023 nbsp 0183 32 Find out whether your loan is backed by the federal government making you eligible for help Call or write your mortgage servicer Your servicer is required to tell you