Mortgage Tax Rebate Web 19 janv 2023 nbsp 0183 32 Updated 19 Jan 2023 Buy to let mortgage interest tax relief explained Changes to tax relief rules mean some landlords face higher bills We explain what the changes mean for you Danielle Richardson

Web 5 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct Web 14 juin 2022 nbsp 0183 32 A mortgage rebate is a type of cash back incentive home lenders may offer to entice potential homebuyers into using their lending services A mortgage rebate

Mortgage Tax Rebate

Mortgage Tax Rebate

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

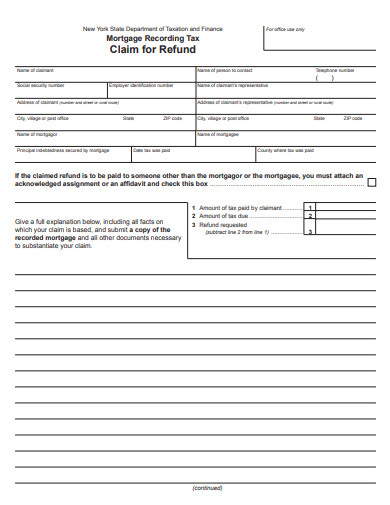

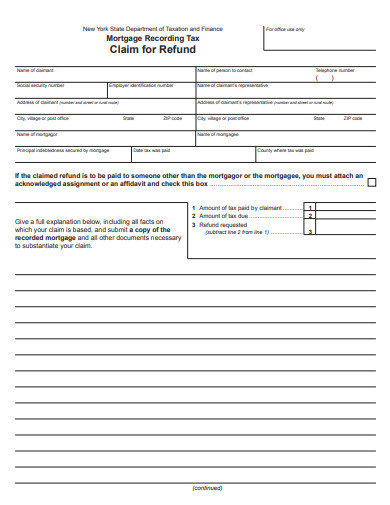

10 Mortgage Form Templates In PDF DOC

https://images.template.net/wp-content/uploads/2019/09/Mortgage-Recording-Tax-Form.jpg

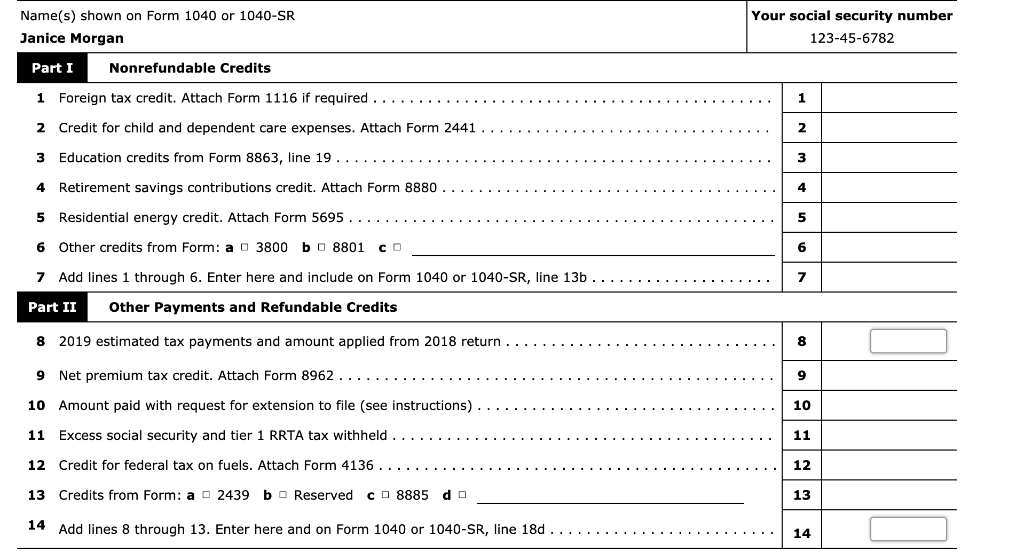

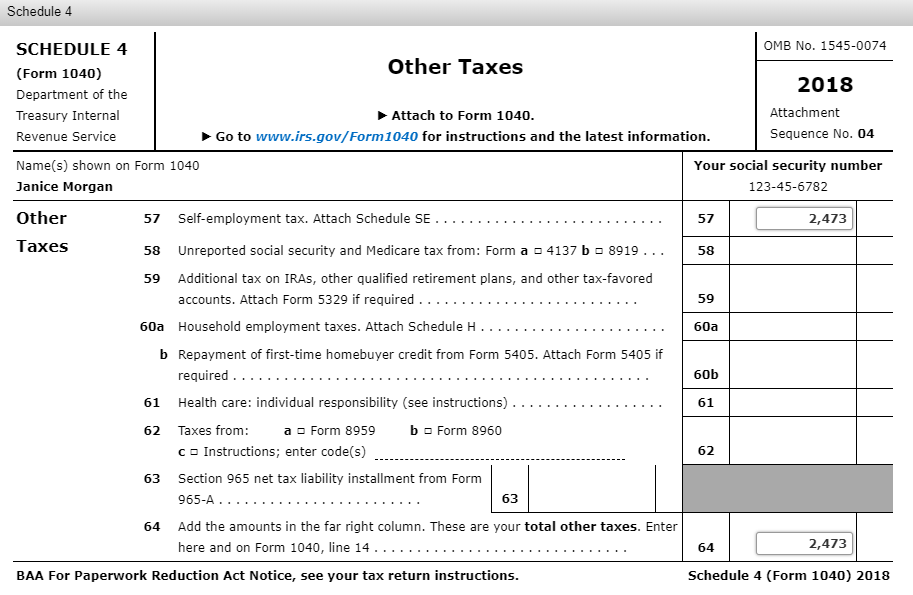

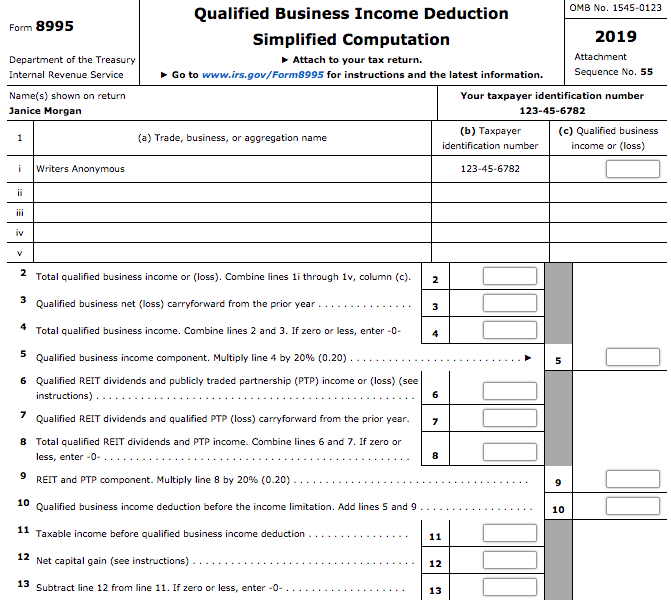

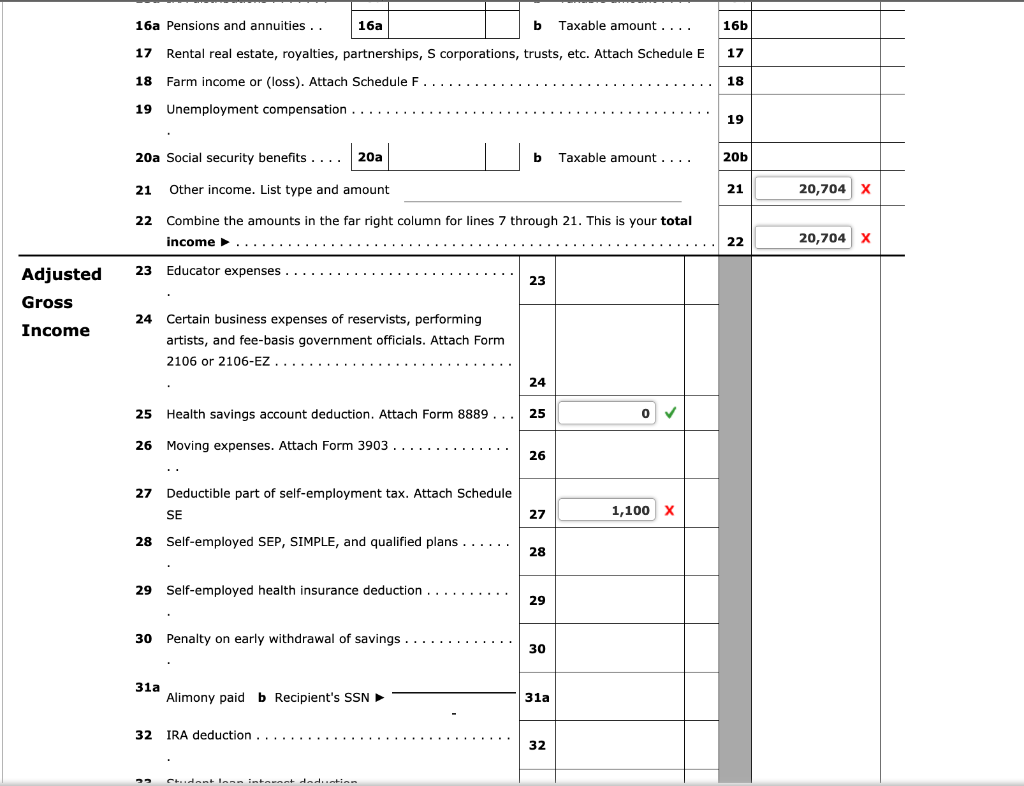

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/3b6/3b6e0b0f-5f0b-4b1a-993f-e6359e2d4ede/phpXXJUd2

Web 18 juil 2023 nbsp 0183 32 About Tax Deductions for a Mortgage Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2022 July 18 2023 03 20 PM Web 21 ao 251 t 2023 nbsp 0183 32 The maximum forbearance is 12 months otherwise You can request up to 18 months of total forbearance if your mortgage is backed by HUD FHA USDA or the VA

Web 20 juil 2016 nbsp 0183 32 How the tax reduction is worked out The reduction is the basic rate value currently 20 of the lower of finance costs costs not deducted from rental income in Web 15 f 233 vr 2022 nbsp 0183 32 The maximum rate at which you will receive a deduction for 2021 is 43 in 2022 it will be reduced to 40 And in the coming years the government plans to bring it up to approximately 37 One more

Download Mortgage Tax Rebate

More picture related to Mortgage Tax Rebate

Bank mortgage rebate comparison v2 Starpro Agency Limited

https://starpagency.com/wp-content/uploads/2016/05/bank-mortgage-rebate-comparison-v2.jpg

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Janice Morgan Age 24 Is Single And Has No Depend Chegg

https://media.cheggcdn.com/media/5f4/5f4bad1b-88b0-4fd9-a9c1-6ef870dcd48d/phpGPVdQH.png

Web To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements You filed an IRS form 1040 and itemized your deductions The mortgage Web Tax rebate on mortgage interest payments and expenses The tax rebate on mortgage interest payments will drop for home owners with an income over EUR 69 398 Right

Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021 Web Yes but not always You are subject to the same conditions as residents of the Netherlands It depends on your mortgage Select your situation You took out a mortgage or loan for

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

https://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21102/pa-1000-2014-property-tax-or-rent-rebate-claim-d1.png

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/e40/e40704e5-b559-4cc6-9813-0237a8a5e3d1/phpzsNBgK

https://www.which.co.uk/money/tax/income-ta…

Web 19 janv 2023 nbsp 0183 32 Updated 19 Jan 2023 Buy to let mortgage interest tax relief explained Changes to tax relief rules mean some landlords face higher bills We explain what the changes mean for you Danielle Richardson

https://www.nerdwallet.com/article/taxes/mort…

Web 5 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct

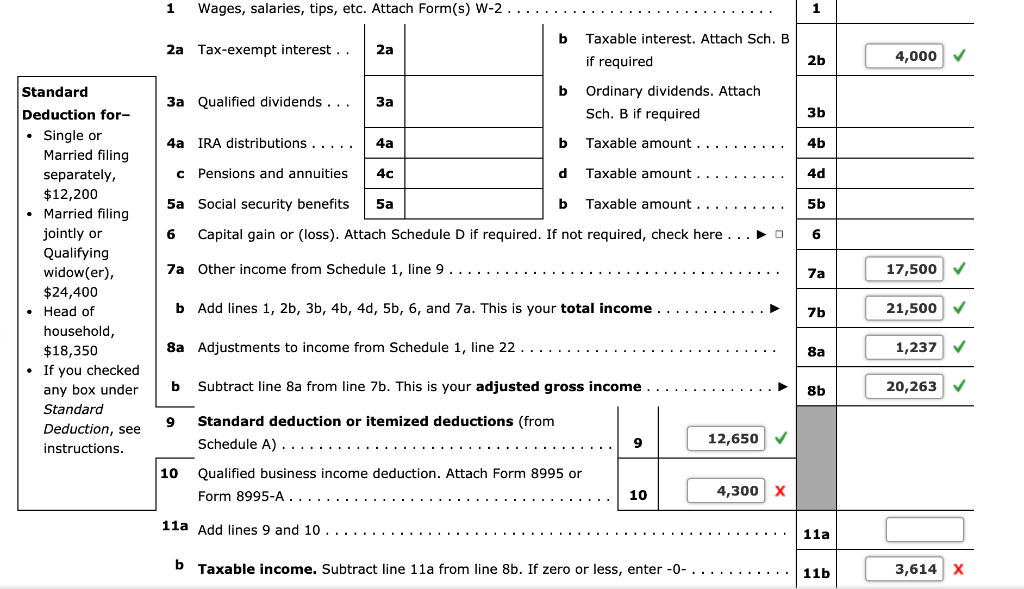

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

Ptr Tax Rebate Libracha

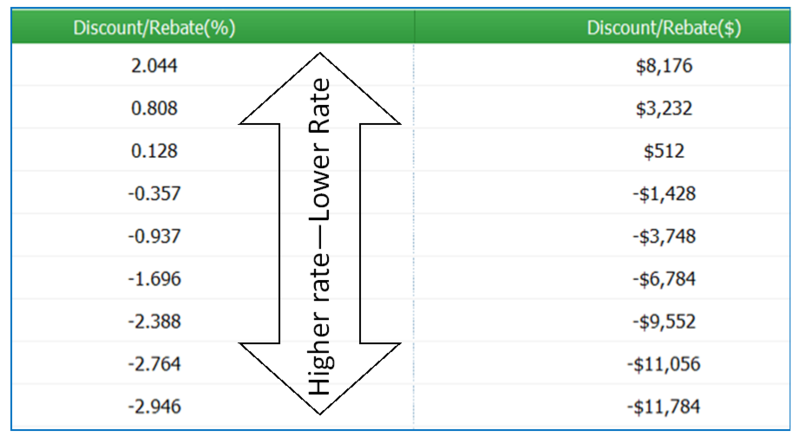

Using Rebate Pricing To Reduce Closing Cost On Your Refi Or Home Purchase

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Tax Rebate For Individual It Is The Refund Which An Individual Can

Tax Rebate For Individual It Is The Refund Which An Individual Can

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Janice Morgan Age 24 Is Single And Has No Chegg

Note This Problem Is For The 2017 Tax Year Janic Chegg

Mortgage Tax Rebate - Web Mortgage tax relief hypotheekrenteaftrek In the Netherlands if you have an annuity or linear mortgage then the interest on your mortgage is tax deductible and you will