Mortgage Tax Return Netherlands Under certain conditions you can deduct the mortgage interest you pay on your mortgage from your taxable income in Box 1 on the tax return You will get money back from the

In the Netherlands if you have an annuity or linear mortgage then the interest on your mortgage is tax deductible and you will receive an annual or monthly tax refund from the Dutch tax office Belastingdienst You Applying for a mortgage interest deduction is quite simple and is done through your tax return In the tax return you enter the amount of mortgage interest paid which is then deducted from your taxable

Mortgage Tax Return Netherlands

Mortgage Tax Return Netherlands

https://www.pherrus.com.au/wp-content/uploads/2022/06/01_Cover_Accountant-Tax-Return-Fees-How-Much-Are-They-What-to-Know.jpg

Tax Return Form And Notebooks On The Table Free Stock Photo

https://images.pexels.com/photos/6863517/pexels-photo-6863517.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=750&w=1260

Filing Your Income Tax Return In The Netherlands In 2022 Expatica

https://admin.expatica.com/nl/wp-content/uploads/sites/3/2023/11/tax-return-netherlands.jpg

Filing a tax return as a homeowner in the Netherlands which costs of buying and financing a house are tax deductible And which costs do you have to add up to your income Read it here Taxes fees and costs for future homeowners Here is a quick overview of the taxes costs and fees involved when buying a house in the Netherlands Transfer tax Overdrachtsbelasting 2 of the purchase

The interest that you pay on your mortgage might be hypotheekrenteaftrek tax deductible from your earnings If you are on a Dutch payroll and are considered a If you are employed and have a mortgage on your home there is a good chance that you will get some money back when you file your income tax return In this

Download Mortgage Tax Return Netherlands

More picture related to Mortgage Tax Return Netherlands

Tax Return Free Creative Commons Handwriting Image

http://www.picpedia.org/handwriting/images/tax-return.jpg

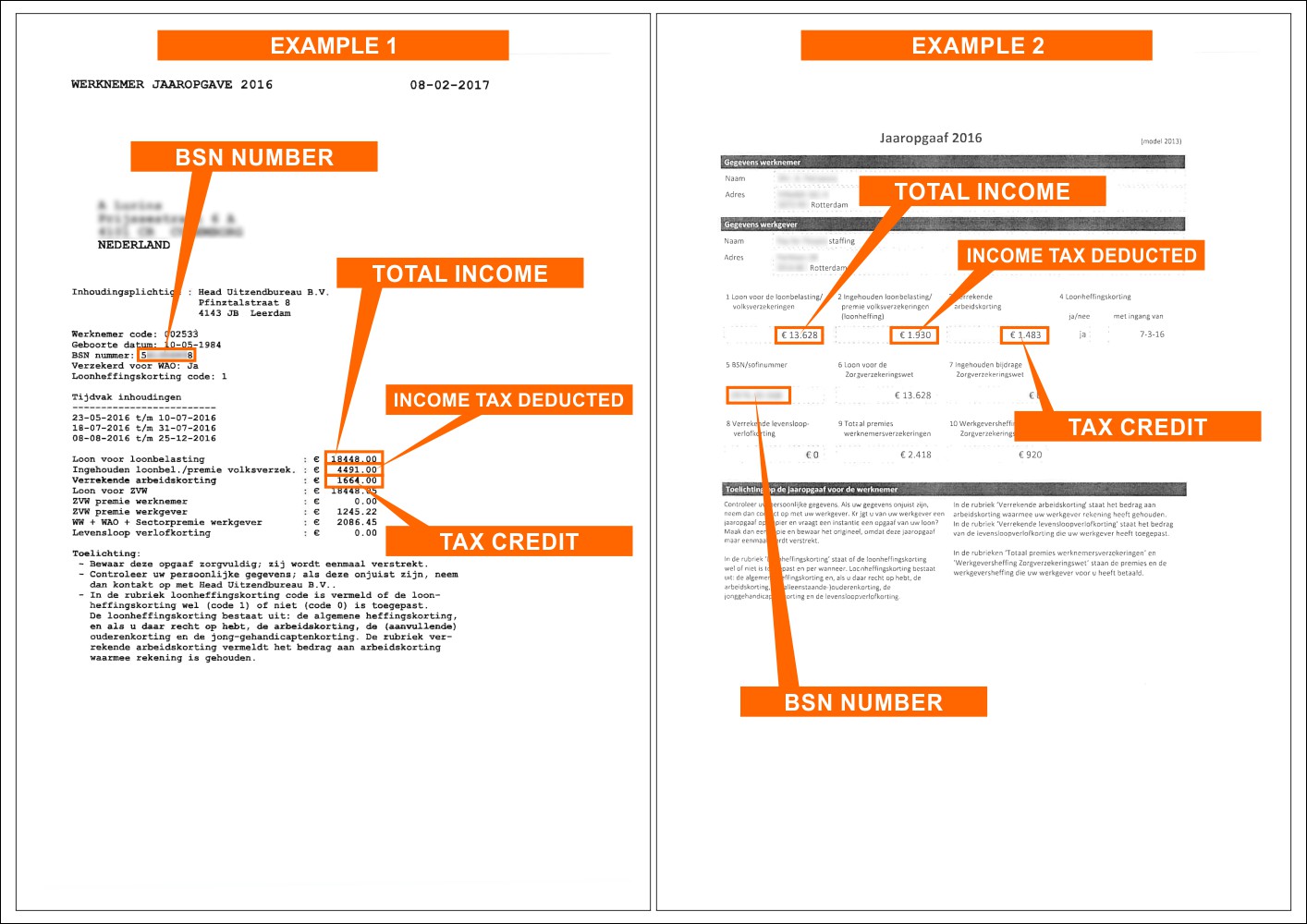

Quick Tax Refund If You Worked In Netherlands RTTAX

https://rttax.com/data/upl_ill/Jaaropgave_HOL_EN.jpg

4 Smart Investments Using Your Tax Return

https://blog.usccreditunion.org/hubfs/tax-return-money.jpg

Belastingaftrek or tax deduction is an important factor to consider when taking out a mortgage in the Netherlands One of the key tax deductions that borrowers can benefit A house that you own and use as your main residence is considered a Box 1 asset If the Box 1 house is financed with a mortgage which meets the mortgage requirements see below the owner can

Filing an online tax return in 4 steps Do I have to file a tax return as a non resident taxpayer What do I need to file my tax return Can I still apply for a postponement You can receive a tax refund on the mortgage interest deduction every month by requesting a preliminary negative tax bill from the tax authorities This is done by means of a

Income Tax Return Netherlands Help Expat Tax Advisor

https://taxsavers.nl/wp-content/uploads/2019/11/tax-house-mortgage.jpeg

Tax Return Deadline Extension

https://i0.wp.com/www.bachesamuels.com/wp-content/uploads/2022/01/Tax-return-red-1.png?fit=6912%2C3456&ssl=1

https://www.abnamro.nl/en/personal/mortgages/buying...

Under certain conditions you can deduct the mortgage interest you pay on your mortgage from your taxable income in Box 1 on the tax return You will get money back from the

https://www.iamexpat.nl/housing/dutch-…

In the Netherlands if you have an annuity or linear mortgage then the interest on your mortgage is tax deductible and you will receive an annual or monthly tax refund from the Dutch tax office Belastingdienst You

WHAT HAPPENS IF YOU DON T FILE AN INCOME TAX RETURN The Global Hues

Income Tax Return Netherlands Help Expat Tax Advisor

I Have Not Lived Or Worked In The Netherlands The Whole Year Can I

Tax Return Employment Self Employment Dividend Rental Property

Requirements To Getting A Mortgage In The Netherlands FVB De Boer R

How To Read And Understand A Tax Return C2P Central

How To Read And Understand A Tax Return C2P Central

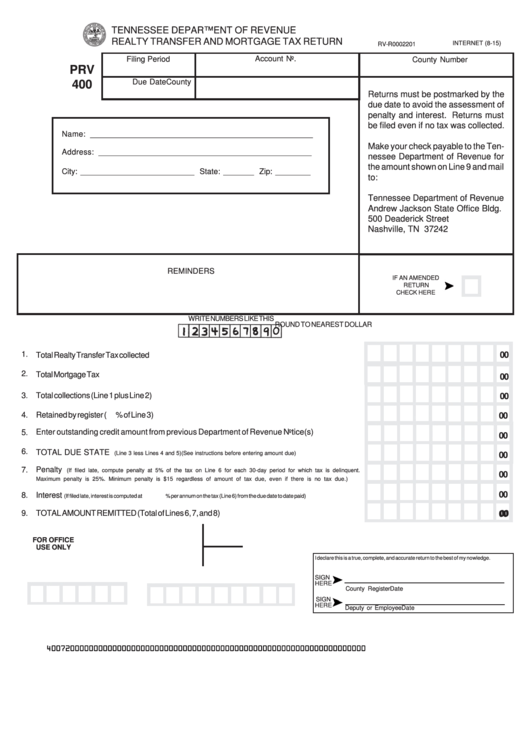

Realty Transfer And Mortgage Tax Return Printable Pdf Download

2023 Business Tax Return Subscription CPAs For Hire St Louis CPA

Commercial Loans Coast2Coast Mortgage

Mortgage Tax Return Netherlands - If you are employed and have a mortgage on your home there is a good chance that you will get some money back when you file your income tax return In this