Mt Property Tax Rebate 2024 The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are available at getmyrebate mt gov

The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are at GetMyRebate mt gov The fastest way for taxpayers to apply for and get the rebate is by applying online The rebate provides Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 WHAT ARE THE QUALIFICATIONS To qualify for the property tax rebate you must have 3 Owned a Montana residence for at least seven months in 2022 3 Lived in that Montana residence for at least seven months in 2022

Mt Property Tax Rebate 2024

Mt Property Tax Rebate 2024

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate.jpg

How To Get Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

PA Property Tax Rebate What To Know Credit Karma

https://creditkarma-cms.imgix.net/wp-content/uploads/2020/07/pa-property-tax-rebate.jpg?auto=compress

The rebate provides Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 WHAT ARE THE QUALIFICATIONS To qualify for the property tax rebate you must have 3 Owned a Montana residence for at least seven months in 2022 3 Lived in that Montana residence for at least seven months in 2022 Montana homeowners will be eligible for a second property tax rebate up to 675 in 2024 for property taxes paid on a principal residence for 2023 Last November the governor proposed 2 000 in property tax rebates for Montana homeowners at their primary residence in his Budget for Montana Families

Montana homeowners will be eligible for a second property tax rebate of up to 675 in 2024 for property taxes paid on a principal residence for 2023 For additional information about the property tax rebate or to check on the status of the income or property tax rebates visit the Montana Department of Revenues Website Montana homeowners eligible for 675 rebates in both 2023 and 2024 Governor s Office July 14 2023 HELENA Mont Joining Representative Tom Welch R Dillon Governor Greg Gianforte this week celebrated a new law which provides Montana homeowners up to 1 350 in property tax rebates over the next two years

Download Mt Property Tax Rebate 2024

More picture related to Mt Property Tax Rebate 2024

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

Deadline For Tax And Rent Relief Extended

https://www.senatorhughes.com/wp-content/uploads/2022/06/property-tax-rebate-2021-booklet.jpg

Sponsored by Rep Tom Welch R Dillon House Bill 222 provides Montanans with 1 000 in property tax rebates for their primary residence in both 2023 and 2024 as proposed in the governor s Budget for Montana Families The 500 million proposal represents the largest state administered tax rebate in the country The department says taxpayers can apply for the 2022 property tax rebates through its online TransAction Portal or via a paper form during an application period that runs from Aug 15 2023 to Oct 1 2023 To apply through the TransAction Portal you ll need the following information Your home address

The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are at GetMyRebate mt gov The fastest way for taxpayers to apply for and get the rebate is by applying online GREAT FALLS Mont As Montana homeowners begin to claim their 675 property tax rebate Governor Greg Gianforte today promoted additional property tax relief he secured for Montana homeowners with low or fixed incomes

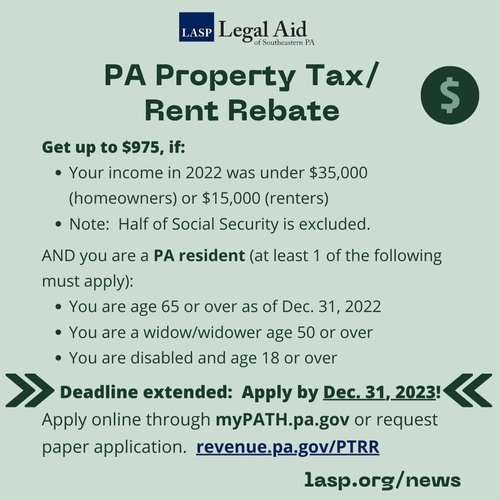

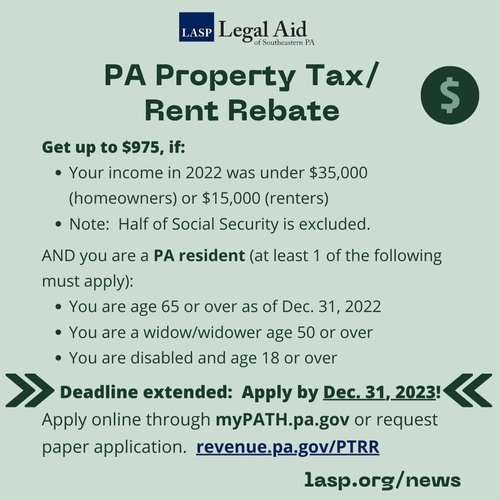

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg?format=500w

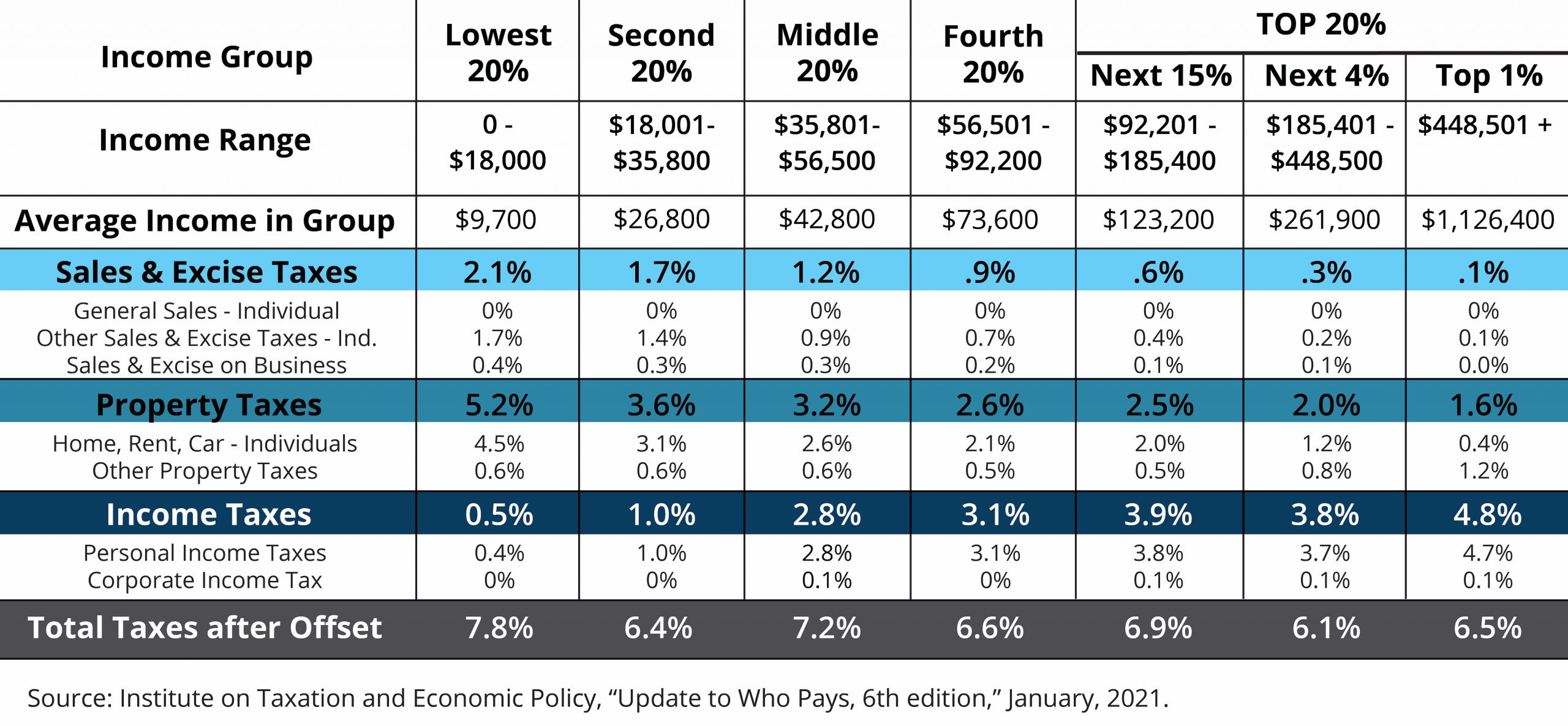

Policy Basics Who Pays Taxes In Montana Montana Budget Policy Center

https://mbadmin.jaunt.cloud/wp-content/uploads/2021/03/tax-tables--scaled.jpg

https://mtrevenue.gov/last-call-to-claim-property-tax-relief/

The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are available at getmyrebate mt gov

https://mtrevenue.gov/all-montana-property-tax-rebates-will-be-sent-by-paper-check-tax-news-you-can-use/

The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are at GetMyRebate mt gov The fastest way for taxpayers to apply for and get the rebate is by applying online

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Tax Rebate For Individual It Is The Refund Which An Individual Can Claim From The Income Tax

Be Aware Of Montana Property Tax Rebate Scams Tax News You Can Use Montana Department Of Revenue

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Provincial Property Tax Rebate Victoria County

Provincial Property Tax Rebate Victoria County

2016 Property Tax Rebate Instructional Video YouTube

Illinois Ev Tax Rebate 2023 Tax Rebate

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

Mt Property Tax Rebate 2024 - Updates from the 2023 Legislature for Tax Year 2024 Simplification Reduced Tax Rate and Expanded Montana Earned Income Tax Credit Long Term Capital Gains Tax Rate Military Retirement Exemption for Certain Military Retirees Expanded Qualified Endowment Credit De Minimis Filing Requirement for Certain Nonresidents 5 5