Mutual Fund Income Tax Rebate Web Investors in mutual fund trusts must report the rebates as income in the taxation year of payment Investors will receive a T3 or Releve 16 Quebec with the fee rebate included

Web 3 janv 2020 nbsp 0183 32 Mutual funds tax rebate is an idea you will like when it comes to reducing or reclaiming your tax on mutual funds Most income you earn from investments is Web 11 oct 2019 nbsp 0183 32 No all mutual funds do not qualify for tax deductions under Section 80C of the income tax Act Only investments in equity linked saving schemes or ELSSs qualify

Mutual Fund Income Tax Rebate

Mutual Fund Income Tax Rebate

https://www.basunivesh.com/wp-content/uploads/2017/02/Mutual-Fund-Taxation-2017-18-Capital-Gain-Tax-Rates.jpg

Which Are The Best Debt Funds In India Quora

https://qph.fs.quoracdn.net/main-qimg-f14e5bc9b459369aa45e827a14162ad3

Basics Of Mutual Fund Investment Beginners Guide 2020

https://getmoneyrich.com/wp-content/uploads/2009/11/Mutual-Fund-Investment-Income-Tax-Benefits2.png

Web 3 juin 2022 nbsp 0183 32 Individuals in the 22 24 32 35 and part of the 37 tax brackets up to 445 850 in 2022 must pay a 15 tax on capital gains Also those in the highest Web So on taxable income of Rs 5 lakh the income tax outgo is nil Tax calculation after claiming deductions and exemptions Total Taxable income Rs 5 lakh Income Tax A Up to Rs 2 5 lakh 0 5 on Rs

Web 9 avr 2023 nbsp 0183 32 Avail Tax Rebate by investing in HBL Pension Funds Maximize your income tax rebate by investing in HBL Pension Funds Not only will you save on taxes Web 12 f 233 vr 2020 nbsp 0183 32 Tax on mutual funds vastly depends on factors such as what kind of funds you have invested in equity debt or hybrid the duration of your investment long term

Download Mutual Fund Income Tax Rebate

More picture related to Mutual Fund Income Tax Rebate

How Does Income Tax On Mutual Funds Work Quora

https://qph.fs.quoracdn.net/main-qimg-10beff6e705468d9c1409c3f6cf30904

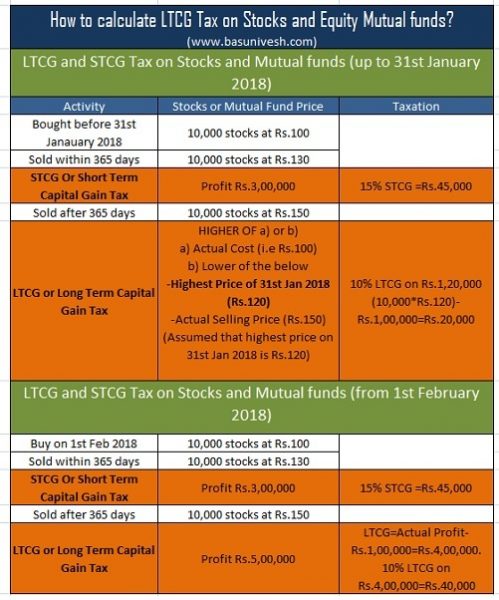

Mutual Fund Taxation FY 2021 22 AY 2022 23 Capital Gain Tax Rates

https://www.basunivesh.com/wp-content/uploads/2019/02/calculate-LTCG-Tax-on-Stocks-and-Equity-Mutual-funds.jpg

Mutual Funds Taxation Rules Capital Gains Tax Rates Chart FY 2017 18

http://www.relakhs.com/wp-content/uploads/2015/04/MF-Taxation-factors-Capital-gains.jpg

Web 19 sept 2022 nbsp 0183 32 1 What is Tax on Mutual Funds Tax on mutual funds refers to the tax obligations associated with investing in mutual funds Generally capital gains from the sale of mutual fund units held for less Web 14 mars 2022 nbsp 0183 32 Mutual Fund Dividends If your mutual fund pays out dividends then you ll have to pay taxes on that income Generally dividends paid out will be qualified dividends At the end of the year

Web Monthly Taxable Income PKR Monthly Tax PKR A Effective Tax Rate Investment in VPS PKR Monthly Tax Saving PKR B Net Monthly Tax Payable PKR A B 100 000 6 250 6 25 20 000 1 250 5 000 Web 30 ao 251 t 2023 nbsp 0183 32 As per Section 62 of Income Tax Ordinance 2001 an individual investor of open end mutual fund unit trust schemes can claim tax credit on investment up to Rs

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

https://www.mackenzieinvestments.com/content/dam/final/co…

Web Investors in mutual fund trusts must report the rebates as income in the taxation year of payment Investors will receive a T3 or Releve 16 Quebec with the fee rebate included

https://financialslot.com/mutual-funds-tax-rebate

Web 3 janv 2020 nbsp 0183 32 Mutual funds tax rebate is an idea you will like when it comes to reducing or reclaiming your tax on mutual funds Most income you earn from investments is

Mutual Fund Taxation YouTube

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Budget 2018 Mutual Fund Taxation FY 2018 19 BasuNivesh

Decoding Section 87A Rebate Provision Under Income Tax Act

Mutual Funds Taxation Rules FY 2020 21 Capital Gains Dividends

2007 Tax Rebate Tax Deduction Rebates

2007 Tax Rebate Tax Deduction Rebates

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Comparison Of New Income Tax Regime With Old Tax Regime The Economic

Features Of Debt Mutual Funds Mutuals Funds Investing Fund

Mutual Fund Income Tax Rebate - Web 27 d 233 c 2022 nbsp 0183 32 27 December 2022 Mutual Funds Tax on mutual funds is paid against the profits earned through investment in equity and debt schemes In the case of equity