Mutual Fund Investment Deduction In Income Tax That s why you should check Section 80C of the Income Tax Act The law allows you to enjoy substantial tax deductions depending on where you invest One of the best investment options is ELSS mutual funds which offer a tax reduction of up to INR 1 5 lakh under Section 80C

Can mutual fund investments help me get a rebate on income tax Under Section 80C of the Income Tax Act tax benefits are applicable in the case of ELSS or Equity Linked Saving Schemes You can get up to Rs 1 5 lakh in tax deduction and save around Rs 46 800 each year on taxes To file income tax returns for capital gains earned from mutual funds taxpayers must submit ITR 2 Read to know the steps for e filing this return

Mutual Fund Investment Deduction In Income Tax

Mutual Fund Investment Deduction In Income Tax

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

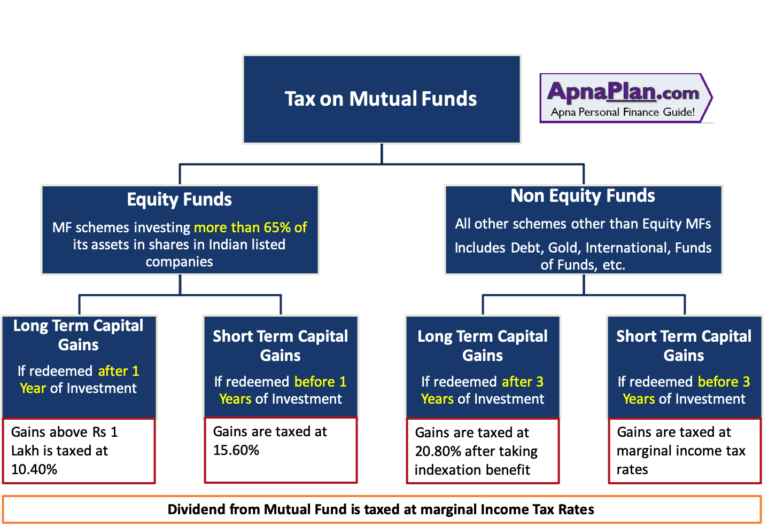

Do You Know How Tax On Mutual Funds Impact Your Returns FY 2021 22

https://www.apnaplan.com/wp-content/uploads/2021/04/Capital-Gains-Tax-on-Mutual-Funds-in-India-for-FY-2021-22-AY-2022-23-768x527.png

Section 194K Tax Deduction On Income From Mutual Fund Units

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/10/Section-194K-Tax-Deduction-On-Income-From-Mutual-Fund-Units-1024x576.png

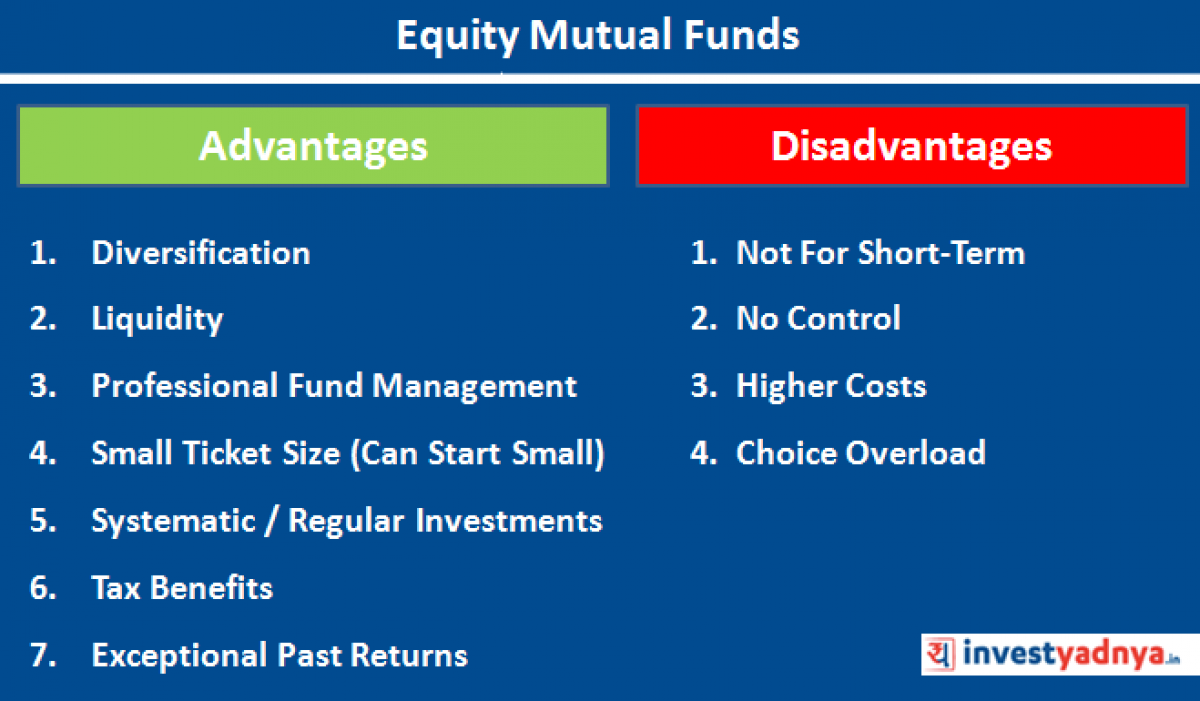

Mutual funds are not tax free except for ELSS equity linked savings schemes or tax saving funds and some retirement funds As per the Income Tax Act under Section 80C you can claim a deduction of up to Rs 1 5 lakh for investments made in ELSS and can save taxes up to Rs 46 800 Learn the procedure for declaring mutual fund investments and disclosing capital gains in your Income Tax Return ITR Understand the specific forms and sections related to reporting mutual funds for accurate tax compliance

In general most distributions you receive from a mutual fund must be declared as investment income on your yearly taxes That means you may owe tax on mutual funds you ve invested in even if you haven t sold any of the shares or received any cash from your investments Here s an overview of how and when you pay tax

Download Mutual Fund Investment Deduction In Income Tax

More picture related to Mutual Fund Investment Deduction In Income Tax

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

Mutual Funds Direct Vs Regular MF 7 Things That Investors Should Know

https://www.tickertape.in/blog/wp-content/uploads/2020/12/Mutual-Funds.png

Tax Deductions For Financial Year 2018 19 WealthTech Speaks

https://wealthtechspeaks.in/wp-content/uploads/2017/04/Tax-Deduction-Under-Section-80C.png

Eligible Investments Under Section 80CCG Individuals who invest in these following instruments are deemed eligible for tax deductions under Section 80CCG of Income Tax Act Units of ETFs Equity based mutual fund schemes Shares of Navratna Maharatna or Miniratna Securities of BSE 100 CNX100 These funds help investors Individual and HUF save taxes under Section 80C of the Income Tax Act 1961 Investing in ELSS qualifies for a tax deduction of up to Rs 1 5 lakh Tax saving mutual fund typically invest in the growth oriented equity market

If you have invested in tax saving ELSS schemes you may claim a tax deduction when you declare your investment in your Income Tax Returns ITR Moreover any gains or losses incurred on redeeming an existing mutual fund investment should also be declared in the ITR The Income Tax Act 1961 offers one major deductions on investment in certain kinds of Mutual Funds Equity Linked Savings Scheme Under Section 80C of the Act an amount equal to the investment in Equity Linked Savings Scheme is deductible from the taxable income of an assessee subject to a maximum limit of Rs 1 50 000 such

Standard Deduction 2020 Self Employed Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/standard-deduction-budget-announcements-budget-2018-gives.jpg

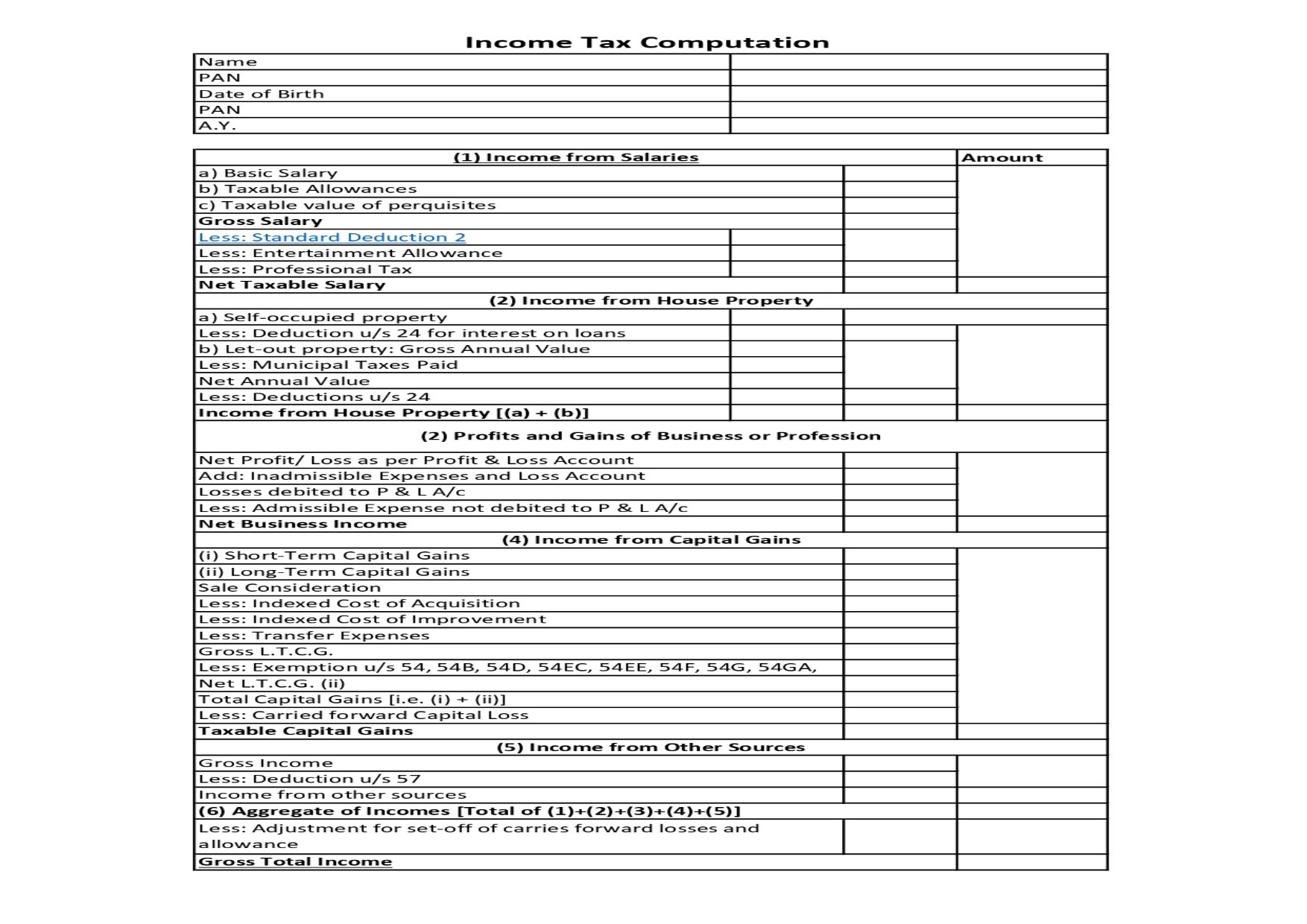

Income Tax Computation Format PDF A Comprehensive Guide

https://www.thetaxheaven.com/public/uploads/news-39.jpeg

https://choiceindia.com/blog/list-of-mutual-funds...

That s why you should check Section 80C of the Income Tax Act The law allows you to enjoy substantial tax deductions depending on where you invest One of the best investment options is ELSS mutual funds which offer a tax reduction of up to INR 1 5 lakh under Section 80C

https://cleartax.in/s/different-mutual-funds-taxed

Can mutual fund investments help me get a rebate on income tax Under Section 80C of the Income Tax Act tax benefits are applicable in the case of ELSS or Equity Linked Saving Schemes You can get up to Rs 1 5 lakh in tax deduction and save around Rs 46 800 each year on taxes

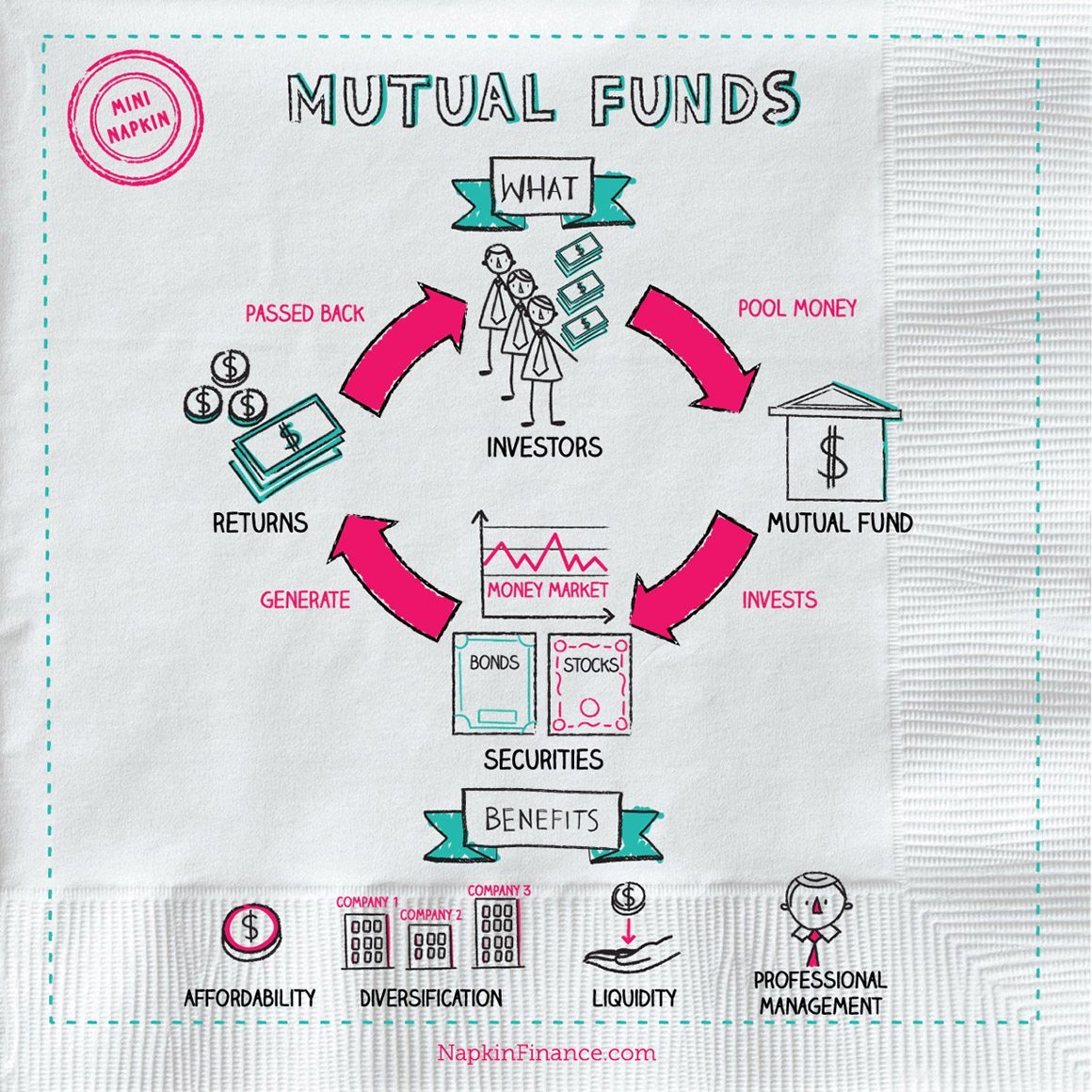

Guide To Mutual Fund Fundamentals How MF Investments Work Finschool

Standard Deduction 2020 Self Employed Standard Deduction 2021

The Provisions Of Section 50C Of The Income Tax Act Do Not Apply To

Mutual Fund Definition Investing Stock Hedge Fund Napkin Finance

What Is Mutual Fund And How Does It Works

Basic Understanding Of Mutual Fund

Basic Understanding Of Mutual Fund

6 Tips For Managing Mutual Fund Investment Risk HALAL PURSUIT

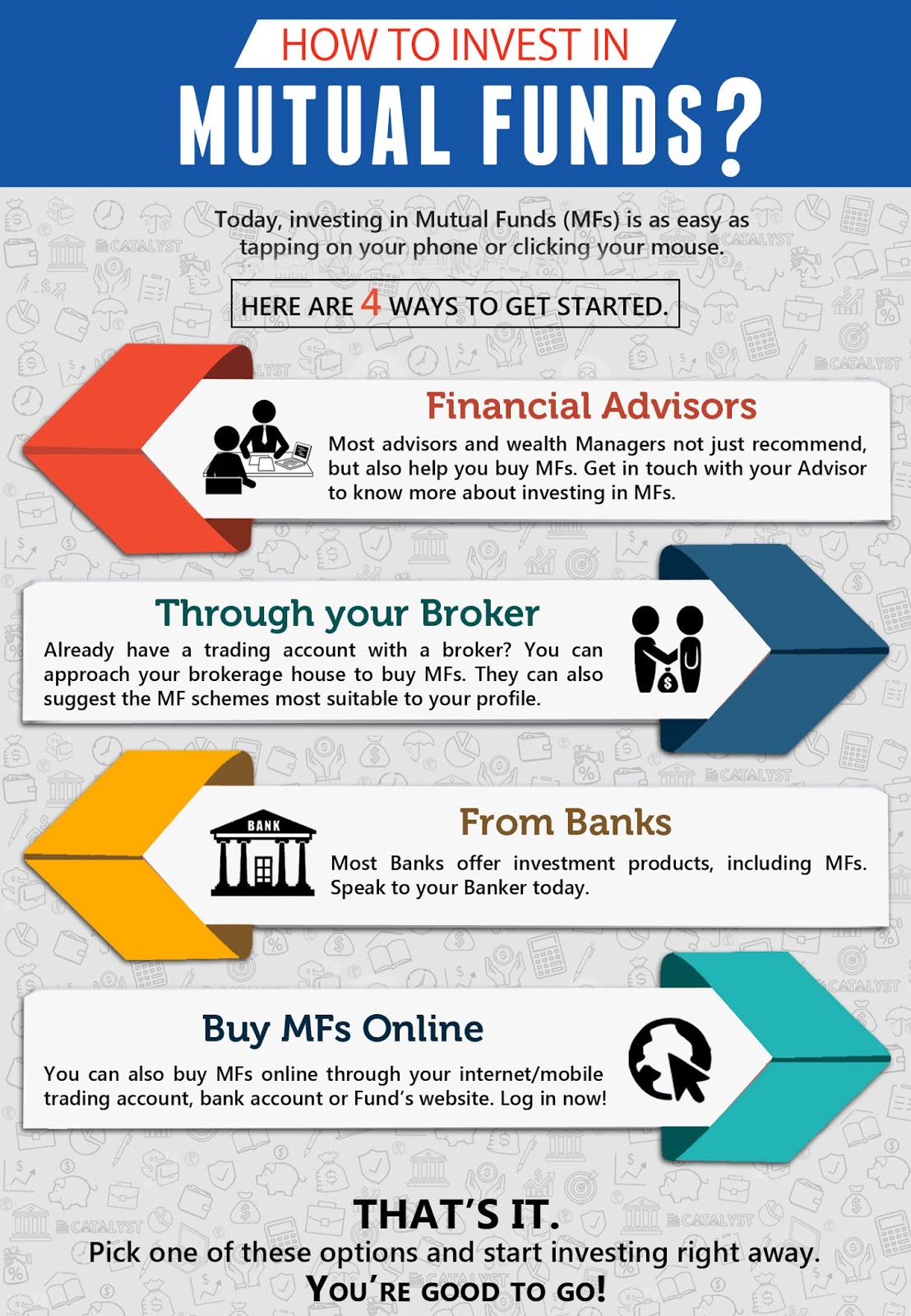

How To Invest In Mutual Funds by FinVise India

Section 80C Deduction Under Section 80C In India Paisabazaar

Mutual Fund Investment Deduction In Income Tax - Learn the procedure for declaring mutual fund investments and disclosing capital gains in your Income Tax Return ITR Understand the specific forms and sections related to reporting mutual funds for accurate tax compliance