Mutual Fund Rebate In Income Tax Web Investors in mutual fund trusts must report the rebates as income in the taxation year of payment Investors will receive a T3 or Releve 16 Quebec with the fee rebate included

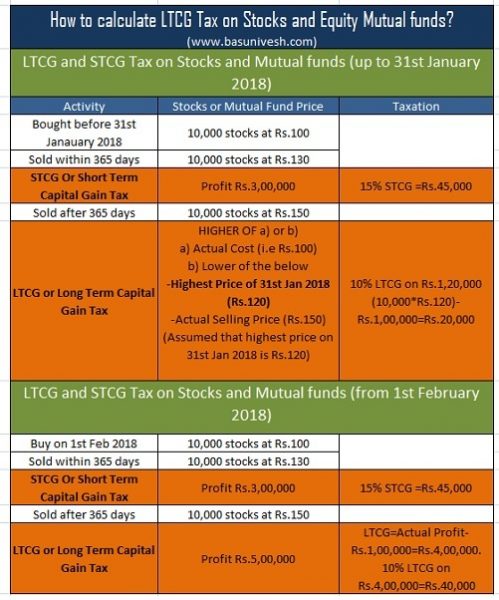

Web 10 ao 251 t 2017 nbsp 0183 32 Can mutual fund investments help me get a rebate on income tax Are wealth taxes applicable to MF investments According to the Wealth Tax Act mutual Web Long term Capital Gains Long term capital gains on equity mutual funds that surpass 1 lakh are taxed at a rate of 10 without an indexation advantage

Mutual Fund Rebate In Income Tax

Mutual Fund Rebate In Income Tax

https://assets1.cleartax-cdn.com/s/img/2017/08/02121249/EBDSP-info-1-1024x714.png

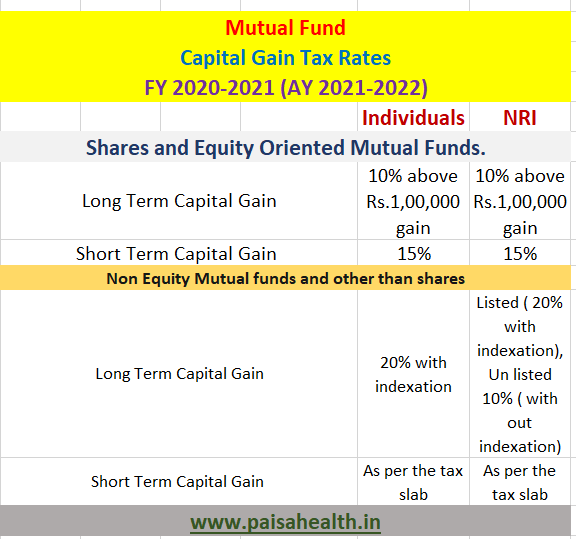

Mutual Fund Taxation AY Year 2021 2022 FY 2020 2021 Paisa Health

https://paisahealth.in/wp-content/uploads/2020/04/Capture-1.png

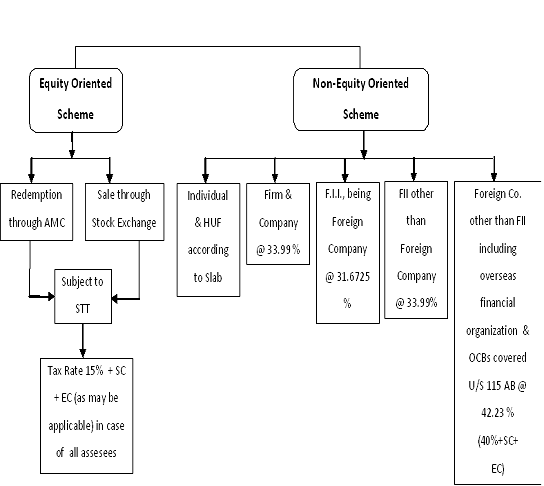

How Does Income Tax On Mutual Funds Work Quora

https://qph.fs.quoracdn.net/main-qimg-325ec703e8dd2c90553db0b8b915ddde

Web 19 sept 2022 nbsp 0183 32 1 What is Tax on Mutual Funds Tax on mutual funds refers to the tax obligations associated with investing in mutual funds Generally capital gains from the sale of mutual fund units held for less Web 11 oct 2019 nbsp 0183 32 No all mutual funds do not qualify for tax deductions under Section 80C of the income tax Act Only investments in equity linked saving schemes or ELSSs qualify

Web 21 avr 2023 nbsp 0183 32 Updated on Apr 21st 2023 7 min read CONTENTS Show When you are investing in mutual funds or plan to do so in the future it is important to know how you Web 12 f 233 vr 2020 nbsp 0183 32 Tax on mutual funds vastly depends on factors such as what kind of funds you have invested in equity debt or hybrid the duration of your investment long term

Download Mutual Fund Rebate In Income Tax

More picture related to Mutual Fund Rebate In Income Tax

ULIP Vs Mutual Fund Which Is Better Investment Insurance Funda

https://i0.wp.com/insurancefunda.in/wp-content/uploads/2016/06/Ulip-VS-Mutual-fund-income-tax.png?resize=788%2C393

Top 10 Best SIP Mutual Funds To Invest In India In 2022 Finansdirekt24 se

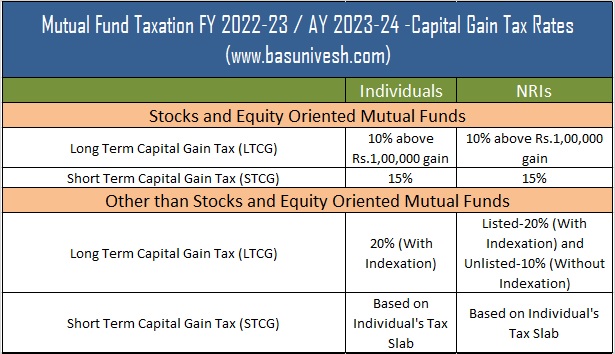

https://www.basunivesh.com/wp-content/uploads/2022/02/Mutual-Fund-Taxation-FY-2022-23.jpg

Mutual Fund Taxation FY 2021 22 AY 2022 23 Capital Gain Tax Rates

https://www.basunivesh.com/wp-content/uploads/2019/02/calculate-LTCG-Tax-on-Stocks-and-Equity-Mutual-funds.jpg

Web So on taxable income of Rs 5 lakh the income tax outgo is nil Tax calculation after claiming deductions and exemptions Total Taxable income Rs 5 lakh Income Tax A Up to Rs 2 5 lakh 0 5 on Rs Web 3 janv 2020 nbsp 0183 32 Mutual funds tax rebate is also an important way of reclaiming almost 20 of your mutual funds tax In this post I gave you 8 ways to reduce tax on Mutual funds

Web The rebate amount will be fully taxed as income when withdrawn from a retirement plan in the same way as any amounts withdrawn would be taxed Rebate amounts withdrawn Web 27 d 233 c 2022 nbsp 0183 32 27 December 2022 Mutual Funds Tax on mutual funds is paid against the profits earned through investment in equity and debt schemes In the case of equity

Which Are The Best Debt Funds In India Quora

https://qph.fs.quoracdn.net/main-qimg-f14e5bc9b459369aa45e827a14162ad3

Budget 2018 Mutual Fund Taxation FY 2018 19

https://res.cloudinary.com/djrpgm5d4/image/upload/v1/blog_images/tts9t9zxdnhftt8wxuik.jpg

https://www.mackenzieinvestments.com/content/dam/final/co…

Web Investors in mutual fund trusts must report the rebates as income in the taxation year of payment Investors will receive a T3 or Releve 16 Quebec with the fee rebate included

https://cleartax.in/s/different-mutual-funds-taxed

Web 10 ao 251 t 2017 nbsp 0183 32 Can mutual fund investments help me get a rebate on income tax Are wealth taxes applicable to MF investments According to the Wealth Tax Act mutual

Mutual Fund Taxation FY 2022 23 AY 2023 24 BasuNivesh

Which Are The Best Debt Funds In India Quora

How Does Income Tax On Mutual Funds Work Quora

Budget 2018 Mutual Fund Taxation FY 2018 19 BasuNivesh

How Mutual Funds Are Taxed In 2019 2020 In India

Mutual Funds And Shares New Rule 10 LTCG Tax On Stocks Equity Mutual

Mutual Funds And Shares New Rule 10 LTCG Tax On Stocks Equity Mutual

Mutual Funds Taxation Rules Capital Gains Tax Rates Chart FY 2017 18

Taxation Of Income And Capital Gains From Mutual Fund Units

Mutual Funds Taxation Rules FY 2020 21 Budget 2020 2022

Mutual Fund Rebate In Income Tax - Web 12 f 233 vr 2020 nbsp 0183 32 Tax on mutual funds vastly depends on factors such as what kind of funds you have invested in equity debt or hybrid the duration of your investment long term