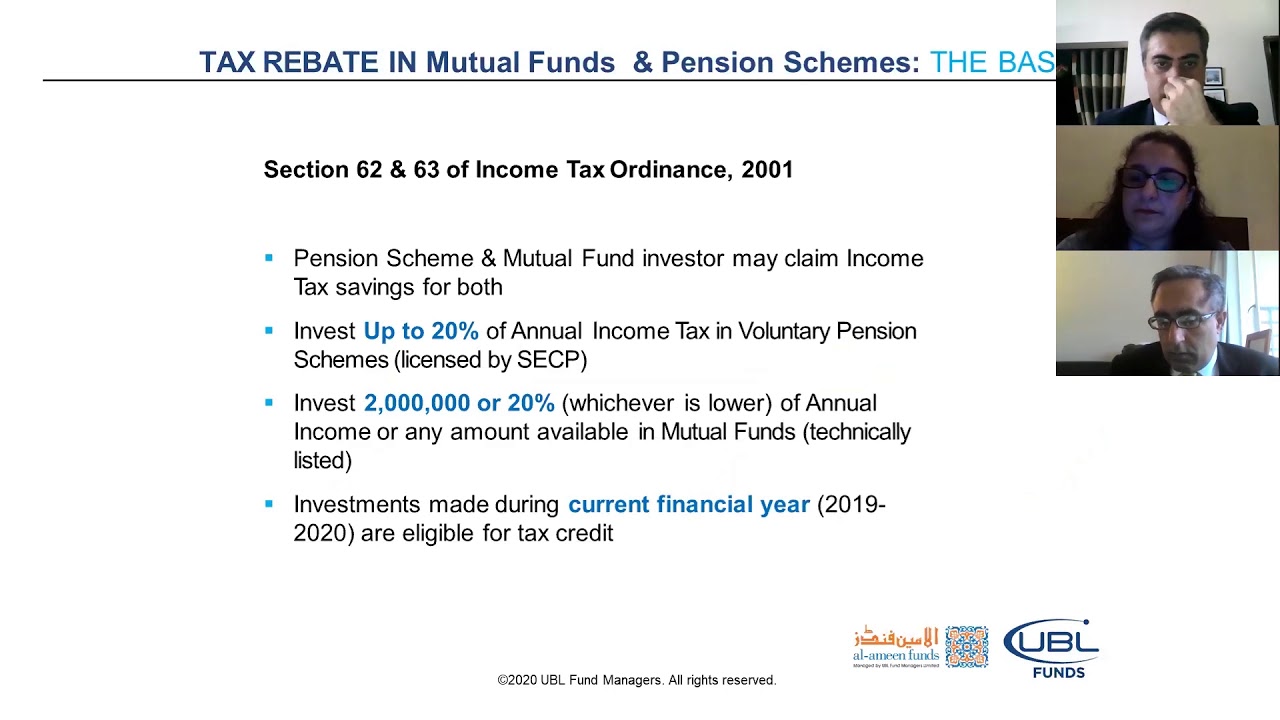

Mutual Fund Tax Rebate Section Web Step 1 Invest In Al Meezan Pension Fund upto your tax ceiling before June 30 Invest upto maximum of 20 of taxable income in Meezan Tahaffuz

Web 24 mars 2017 nbsp 0183 32 Section 80C is one of the most popular and favourite sections amongst the taxpayers as it allows to reduce taxable income by making tax saving investments or Web Mutual fund trust Mutual fund corporation Investors in registered accounts will not be taxed on the rebates they receive The rebate amount will be fully taxed as income when

Mutual Fund Tax Rebate Section

Mutual Fund Tax Rebate Section

https://i1.wp.com/insurancefunda.in/wp-content/uploads/2016/06/Ulip-VS-Mutual-fund-income-tax.png?resize=788%2C393

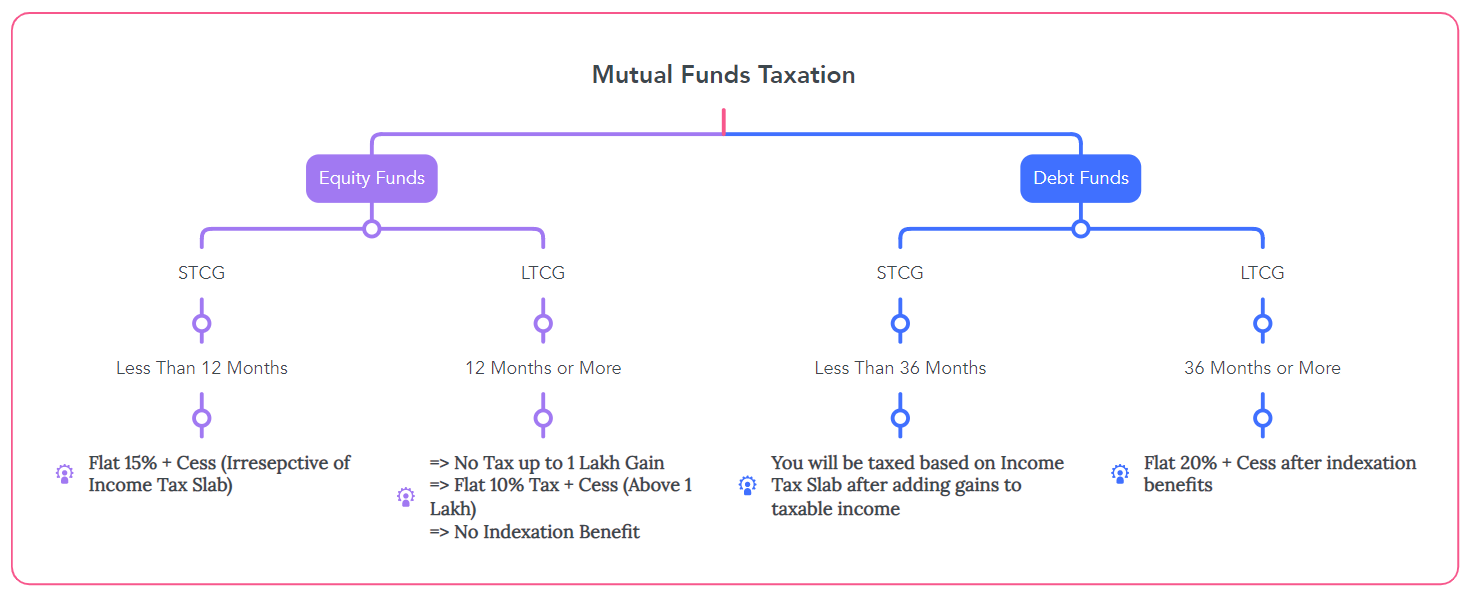

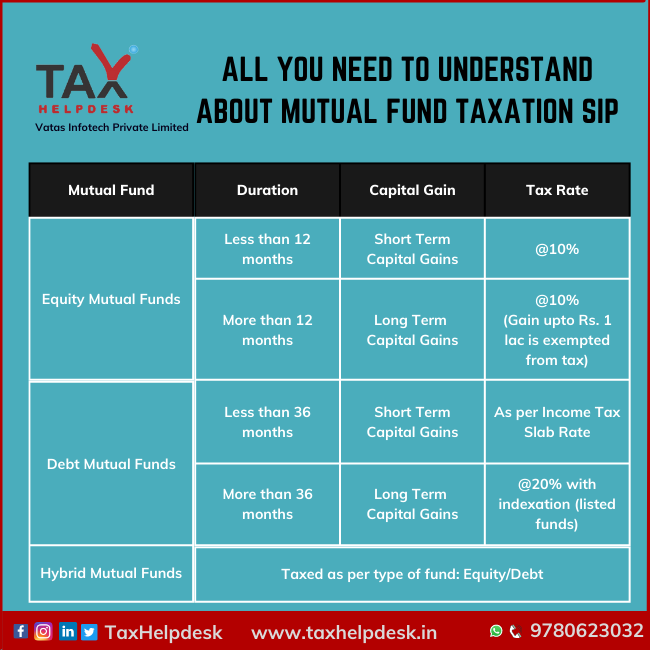

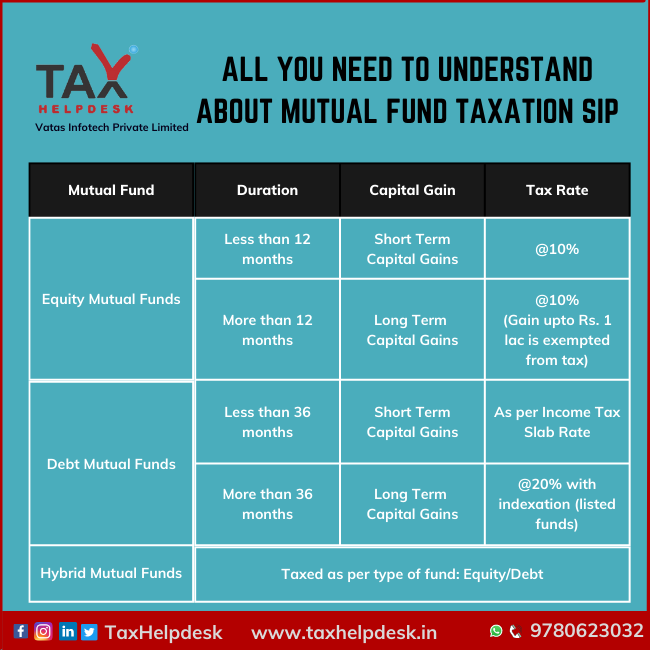

Mutual Fund Taxation FY 2022 23 AY 2023 24 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2022/02/Mutual-Fund-Tax.jpg

How Does Income Tax On Mutual Funds Work Quora

https://qph.fs.quoracdn.net/main-qimg-10beff6e705468d9c1409c3f6cf30904

Web 27 d 233 c 2022 nbsp 0183 32 27 December 2022 Mutual Funds Tax on mutual funds is paid against the profits earned through investment in equity and debt schemes In the case of equity Web 19 sept 2022 nbsp 0183 32 How much tax do I pay on mutual funds The total tax that you have to pay depends on the type of mutual fund you hold For instance gains from equity funds and hybrid equity oriented funds are taxed at

Web 30 ao 251 t 2023 nbsp 0183 32 As per Section 62 of Income Tax Ordinance 2001 an individual investor of open end mutual fund unit trust schemes can claim tax credit on investment up to Rs Web 3 juin 2022 nbsp 0183 32 This is why it is important to keep track of which income is subject to the lower rate For 2022 those in the 10 and 12 income tax brackets are not required to pay

Download Mutual Fund Tax Rebate Section

More picture related to Mutual Fund Tax Rebate Section

Real Estate Or Mutual Funds Find Your Answer In This Ultimate Guide

https://assets1.cleartax-cdn.com/s/img/2017/08/02121249/EBDSP-info-1-1024x714.png

Mutual Fund Taxation A Y 2022 23 STCG LTCG And Dividends

https://alerttax.in/wp-content/uploads/2022/07/mutual-fund-taxation-2022-23.png

Capital Gains Tax Indexation Table India Elcho Table

https://www.basunivesh.com/wp-content/uploads/2021/02/Mutual-Fund-Taxation-FY-2021-22-AY2022-23-1280x720.jpg

Web 31 ao 251 t 2023 nbsp 0183 32 Mutual fund taxes typically include taxes on dividends and earnings while the investor owns the mutual fund shares as well as capital gains taxes when the investor sells the mutual Web 12 f 233 vr 2020 nbsp 0183 32 Can mutual fund investments help me get a rebate on income tax Only investments in tax saving mutual funds qualify for tax deduction under Section 80C of the

Web 3 janv 2020 nbsp 0183 32 Updated 2022 06 02 at 10 59 PM Share Mutual funds tax rebate is an idea you will like when it comes to reducing or reclaiming your tax on mutual funds Most Web 11 juin 2020 nbsp 0183 32 As per this section the taxpayers can avail of a tax benefit of up to Rs 1 50 lakhs from their total income by making certain eligible investments and payments

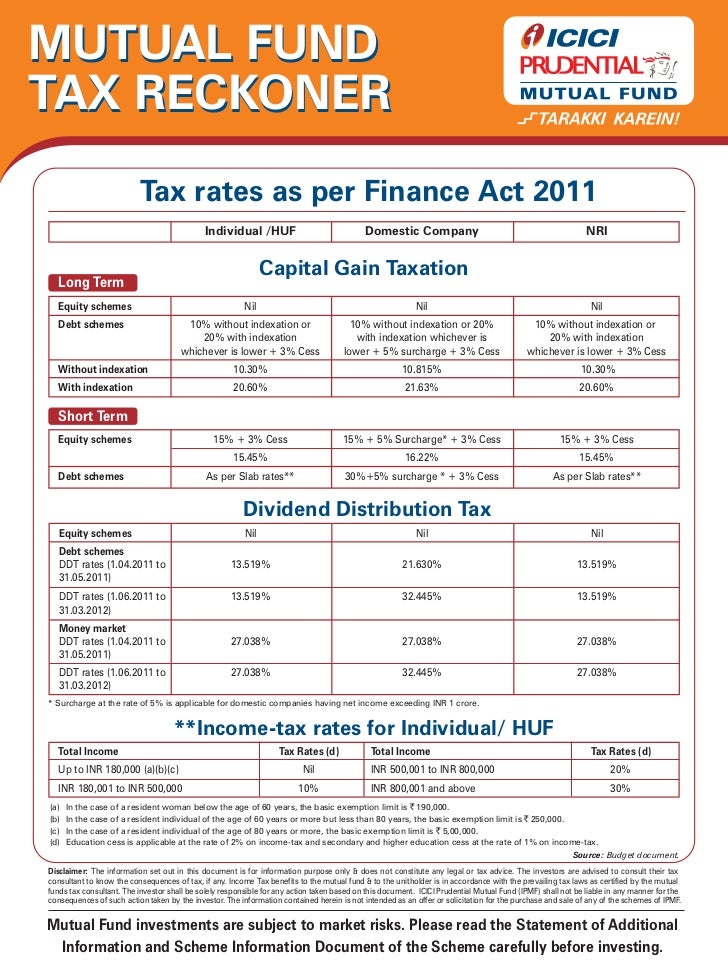

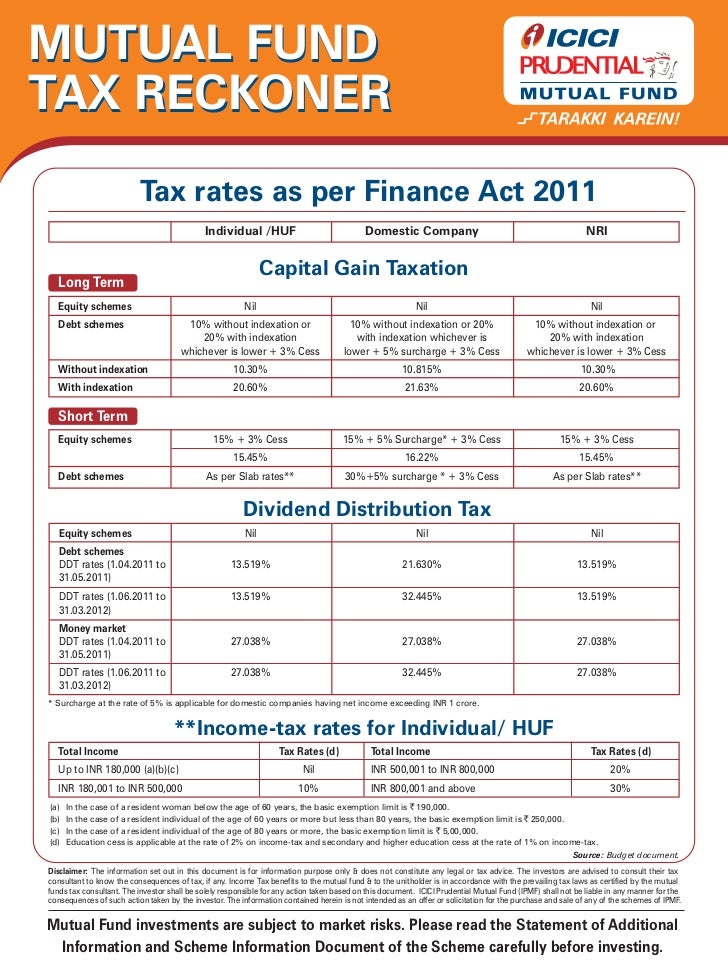

Mutual Fund Tax Reckoner 2011 2012

https://image.slidesharecdn.com/mutualfundtaxreckoner2011-2012-111220032539-phpapp02/95/mutual-fund-tax-reckoner-2011-2012-1-728.jpg?cb=1324352115

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

https://www.almeezangroup.com/investor-edu…

Web Step 1 Invest In Al Meezan Pension Fund upto your tax ceiling before June 30 Invest upto maximum of 20 of taxable income in Meezan Tahaffuz

https://cleartax.in/s/80c-80-deductions

Web 24 mars 2017 nbsp 0183 32 Section 80C is one of the most popular and favourite sections amongst the taxpayers as it allows to reduce taxable income by making tax saving investments or

Investing Can Be Interesting Financial Awareness Mutual Fund Tax

Mutual Fund Tax Reckoner 2011 2012

Mutual Fund Taxation FY 2019 20 BasuNivesh

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Get Up To 40 Of Tax Rebate By Investing In Mutual And Pension Funds

Financial Archives TaxHelpdesk

Financial Archives TaxHelpdesk

How ELSS Mutual Funds Can Grow Your Money Save Tax Too Investor

Which Section Offers Tax Rebate To Investors In Mutual Fund MoneyInsight

Mutual Funds Taxation How Is It Different For NRIs

Mutual Fund Tax Rebate Section - Web 21 ao 251 t 2023 nbsp 0183 32 Under Section 87A of the Income Tax Act 1961 resident individuals with a taxable income of up to 5 lakhs can claim a tax rebate of 12 500 or the payable tax