Mutual Funds Investment Rebate In Income Tax Web 3 janv 2020 nbsp 0183 32 Mutual funds tax rebate is also an important way of reclaiming almost 20 of your mutual funds tax In this post I gave you 8 ways to reduce tax on Mutual funds

Web 3 juin 2022 nbsp 0183 32 Individuals in the 22 24 32 35 and part of the 37 tax brackets up to 445 850 in 2022 must pay a 15 tax on capital gains Also those in the highest Web 11 oct 2019 nbsp 0183 32 No all mutual funds do not qualify for tax deductions under Section 80C of the income tax Act Only investments in equity linked saving schemes or ELSSs qualify

Mutual Funds Investment Rebate In Income Tax

Mutual Funds Investment Rebate In Income Tax

https://i1.wp.com/insurancefunda.in/wp-content/uploads/2016/06/Ulip-VS-Mutual-fund-income-tax.png?resize=788%2C393

Best ELSS Mutual Funds To Invest In 2023 80 C Rebate With Tax Saving

https://i.ytimg.com/vi/9QLU4J7ykKk/maxresdefault.jpg

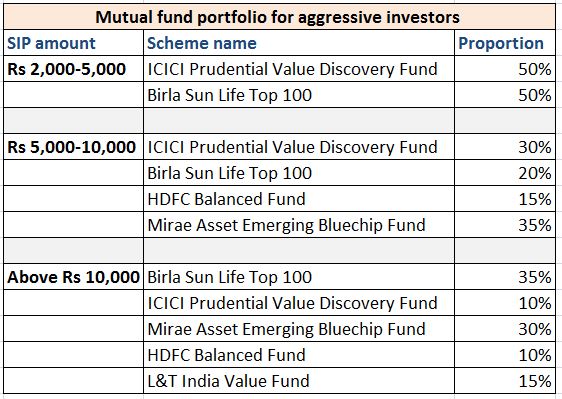

Top 10 Best SIP Mutual Funds To Invest In India In 2022 Finansdirekt24 se

https://www.basunivesh.com/wp-content/uploads/2022/02/Mutual-Fund-Taxation-FY-2022-23.jpg

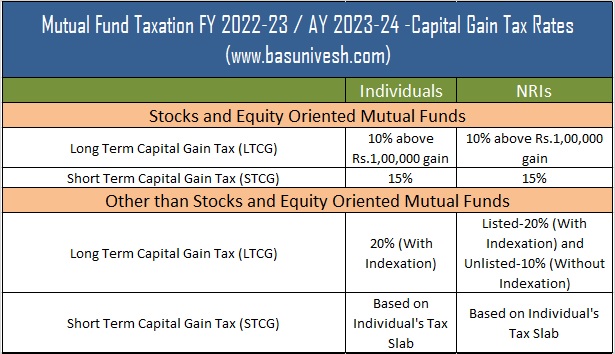

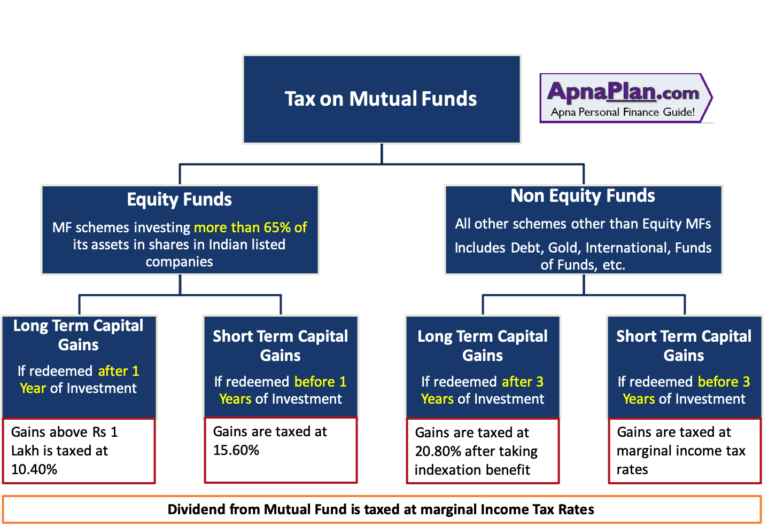

Web 12 f 233 vr 2020 nbsp 0183 32 Tax on mutual funds vastly depends on factors such as what kind of funds you have invested in equity debt or hybrid the duration of your investment long term Web Income tax rebate is like the final bargain that you can claim from your taxable income after you have claimed exemptions and deductions Tax rebate under Section 87A of the Income Tax Act is the final reduction

Web 19 sept 2022 nbsp 0183 32 1 What is Tax on Mutual Funds Tax on mutual funds refers to the tax obligations associated with investing in mutual funds Generally capital gains from the sale of mutual fund units held for less Web 11 ao 251 t 2023 nbsp 0183 32 Taxes on investments depend on the investment type See current tax rates for capital gains dividends mutual funds 401 k s and real estate investments

Download Mutual Funds Investment Rebate In Income Tax

More picture related to Mutual Funds Investment Rebate In Income Tax

5 Best Income Mutual Funds To Invest In 2016

https://myinvestmentideas.com/wp-content/uploads/2015/11/Best-Income-Mutual-Funds-to-invest-in-2016.jpg

Best Growth And Income Mutual Funds IncomeProTalk

https://www.incomeprotalk.com/wp-content/uploads/top-growth-and-income-mutual-funds-10-years-oncomie.png

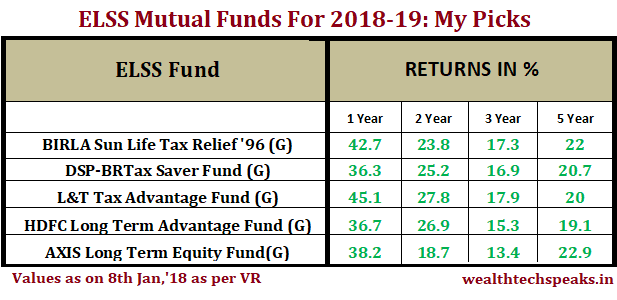

Best Performing ELSS Mutual Funds For Investment In 2018 19

http://wealthtechspeaks.in/wp-content/uploads/2018/01/Top-ELSS-Fund-2018.png

Web 22 janv 2022 nbsp 0183 32 A rebate is a credit paid to a buyer of a portion of the amount paid for a product or service In a short sale a rebate is a fee that the borrower of stock pays to the investor who loaned the Web 31 ao 251 t 2023 nbsp 0183 32 You may owe tax on mutual funds even if you haven t sold your shares See how and when you pay tax on mutual funds plus what you can do to pay less

Web 10 juil 2016 nbsp 0183 32 Currently the tax on long term capital gain is zero But if you sell or redeem your equity mutual fund investments before 12 months you will have to pay short term Web 15 juin 2020 nbsp 0183 32 Investors must pay tax on mutual fund investments once they redeem units and realise profits Further a switch transaction is considered the equivalent of a

Best Mutual Funds To Invest In 2019 List Of Top Mutual Funds 2019

https://bank.caknowledge.com/wp-content/uploads/2017/03/Best-Mutual-Funds-img-3.jpg

New To Equity Mutual Funds Start With ELSS Funds

http://www.spews.org/wp-content/uploads/2020/01/mfp27e47de4-90e0-4f07-a351-f1b739fabf63.jpg

https://financialslot.com/mutual-funds-tax-rebate

Web 3 janv 2020 nbsp 0183 32 Mutual funds tax rebate is also an important way of reclaiming almost 20 of your mutual funds tax In this post I gave you 8 ways to reduce tax on Mutual funds

https://www.investopedia.com/.../091715/basics-income-tax-mutual-fund…

Web 3 juin 2022 nbsp 0183 32 Individuals in the 22 24 32 35 and part of the 37 tax brackets up to 445 850 in 2022 must pay a 15 tax on capital gains Also those in the highest

Mutual Funds Artofit

Best Mutual Funds To Invest In 2019 List Of Top Mutual Funds 2019

Best Mutual Funds To Invest In For 2018 Invest Walls

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Basic Understanding Of Mutual Fund

Mutual Funds For Monthly Income Invest With Einvestment Fund

Mutual Funds For Monthly Income Invest With Einvestment Fund

5 Best ELSS Mutual Funds 2020 Top TAX Saving Equity MF Schemes

Do You Know How Tax On Mutual Funds Impact Your Returns FY 2021 22

Top Monthly Income Plan Scheme MIP MF s To Invest For 2014

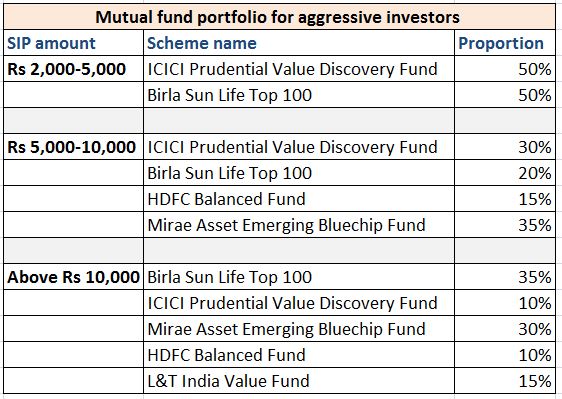

Mutual Funds Investment Rebate In Income Tax - Web Deductibles You are allowed to invest up to Rs 1 5 lakh in tax saving funds You will get a tax deduction of up to Rs 1 5 lakh under Section 80C of the Income Tax Act Advantage