My Tax Return Status Verkko 18 lokak 2023 nbsp 0183 32 You can check the status of your 2022 income tax refund 24 hours after e filing Please allow 3 or 4 days after e filing your 2020 and 2021 tax year returns If you filed a paper return please allow 4 weeks before checking your status Check Your Refund Information is updated once a day overnight What You Need

Verkko 30 marrask 2023 nbsp 0183 32 Individuals Payments Refunds Tax refunds individual taxpayers If you have paid too much tax in withholding or prepayments we refund the excess back to you when the tax year is over Refunds are paid to taxpayers on different dates depending on when their tax assessment process is completed Verkko 12 kes 228 k 2023 nbsp 0183 32 Log in to MyTax opens in a new window Then proceed as follows See image You can see the amount and payment date of your refund on the MyTax home page under Tax decision on income tax Please note You can see the amount of your tax refund in MyTax only after you have received a tax decision

My Tax Return Status

My Tax Return Status

https://i0.wp.com/www.elidge.com/wp-content/uploads/2022/10/what-does-it-mean-if-my-tax-return-status-says_optimized-1024x576-1.jpg

Why Is My Tax Return Status Still Pending LiveWell

https://livewell.com/wp-content/uploads/2023/10/how-to-get-my-2014-tax-return-1697720100.jpg

Why Is My Tax Return Status Still Pending LiveWell

https://livewell.com/wp-content/uploads/2023/10/why-is-my-tax-return-status-still-pending-1697822358.jpg

Verkko Financial difficulties Specific instructions for various types of taxes if you pay late You will receive 1 3 reminders before your overdue taxes are sent to the enforcement authorities for recovery If you cannot pay the tax by the date indicated you can apply for a payment arrangement Verkko E services MyTax is an e service of the Tax Administration In MyTax you can request a tax card or prepayment file a personal or corporate tax return pay taxes submit your bank account number file and pay transfer tax

Verkko 22 marrask 2021 nbsp 0183 32 You can check the status of your tax return in MyTax See the instructions How to find saved and submitted returns requests and applications in MyTax Page last updated 11 22 2021 Verkko 9 kes 228 k 2023 nbsp 0183 32 You can pay your back taxes on the current day in MyTax or copy the payment details from MyTax and pay the tax later in your online bank Log in to MyTax opens in a new window See image You can see the amount and due date of your back taxes under Payment status on the home page If your tax assessment has not

Download My Tax Return Status

More picture related to My Tax Return Status

Here Is What I Got For my Tax Return Status R IRS

https://preview.redd.it/here-is-what-i-got-for-my-tax-return-status-v0-ncm36wbx72ob1.jpg?width=1242&format=pjpg&auto=webp&s=a0da3cfdd35baf5308db0358eac8aaef4b12a790

Check Status Of Your Federal And State Tax Refund

https://pdfimages.wondershare.com/pdf-forms/tax-return-status.png

Where Is My 2011 State And Federal Refund Using Online Tool

https://myjourneytomillions.com/wp-content/uploads/2011/04/Refund-Status-Results.png

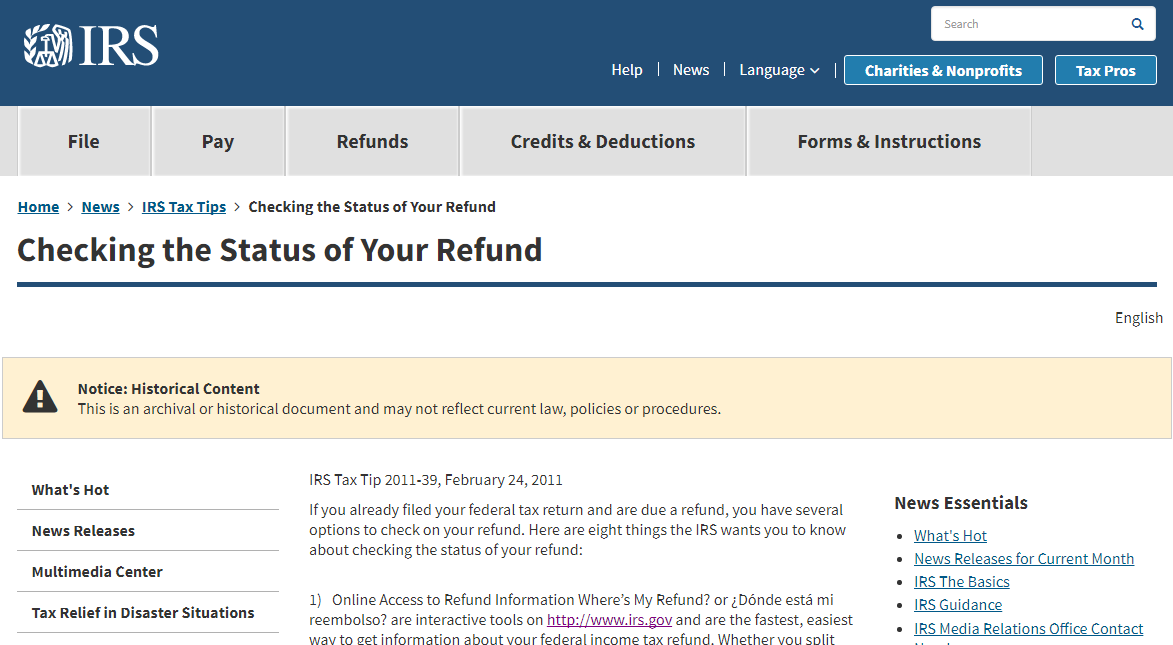

Verkko 23 helmik 2023 nbsp 0183 32 Use of tax refund for debts in enforcement If you want to check whether your tax refund has been used for debts in enforcement do as follows Click All tax years in the section Individual income tax in MyTax Click Show details on all tax years Click Tax year 2022 Click Transactions during the period Verkko 8 maalisk 2023 nbsp 0183 32 You can start checking on the status of your refund within 24 hours after e filing a tax year 2022 return 3 or 4 days after e filing a tax year 2020 or 2021 return 4 weeks after filing on paper

Verkko 8 jouluk 2023 nbsp 0183 32 Check your federal tax refund status Before checking on your refund have your Social Security number filing status and the exact whole dollar amount of your refund ready Use the IRS Where s My Refund tool or the IRS2Go mobile app to check your refund online This is the fastest and easiest way to track your refund Verkko 16 helmik 2022 nbsp 0183 32 Taxpayers can start checking on the status of their return within 24 hours after the IRS acknowledges receipt of an electronically filed return or four weeks after the taxpayer mails a paper return The tool s tracker displays progress in three phases Return received Refund approved Refund sent

How To File An Amended Tax Return 2020 Step By Step YouTube

https://i.ytimg.com/vi/MiBrvZ6DKQw/maxresdefault.jpg

3 Reasons You Shouldn t Receive A Tax Refund Next Year

https://s.yimg.com/ny/api/res/1.2/JIoLoNr_QJe3C1icuE0MAg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTM2MA--/https://media.zenfs.com/en/gobankingrates_644/b7a1d2b2c529af141deffd558b1cb65b

https://www.irs.gov/refund

Verkko 18 lokak 2023 nbsp 0183 32 You can check the status of your 2022 income tax refund 24 hours after e filing Please allow 3 or 4 days after e filing your 2020 and 2021 tax year returns If you filed a paper return please allow 4 weeks before checking your status Check Your Refund Information is updated once a day overnight What You Need

https://www.vero.fi/en/individuals/payments/refunds

Verkko 30 marrask 2023 nbsp 0183 32 Individuals Payments Refunds Tax refunds individual taxpayers If you have paid too much tax in withholding or prepayments we refund the excess back to you when the tax year is over Refunds are paid to taxpayers on different dates depending on when their tax assessment process is completed

Amended Tax Return Status R IRS

How To File An Amended Tax Return 2020 Step By Step YouTube

5 Ways To Make Your Tax Refund Bigger The Motley Fool

Check Refund Status Browserguide

Guide To Check Income Tax Return Status

Here s Why Your Tax Return May Be Smaller This Year Wnep

Here s Why Your Tax Return May Be Smaller This Year Wnep

Why Was My Tax Return Rejected Primary Causes Explained

How To Use Aadhaar Card For Electronic Tax Return Verification

How To Check The Status Of Your Tax Refund Online Mental Floss

My Tax Return Status - Verkko 22 marrask 2021 nbsp 0183 32 You can check the status of your tax return in MyTax See the instructions How to find saved and submitted returns requests and applications in MyTax Page last updated 11 22 2021