National Pension Scheme Income Tax Rebate Web If your rate of Income Tax in Scotland is 19 your pension provider will claim tax relief for you at a rate of 20 You do not need to pay the difference UK tax relief is also available

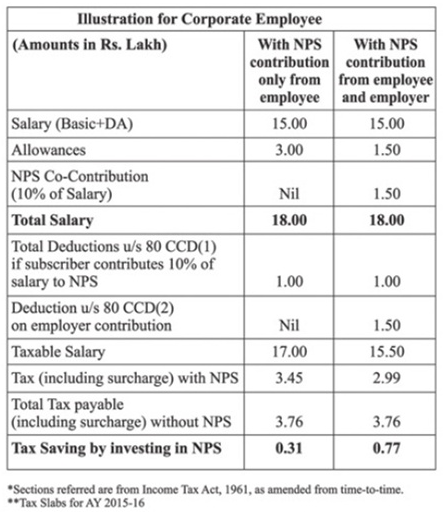

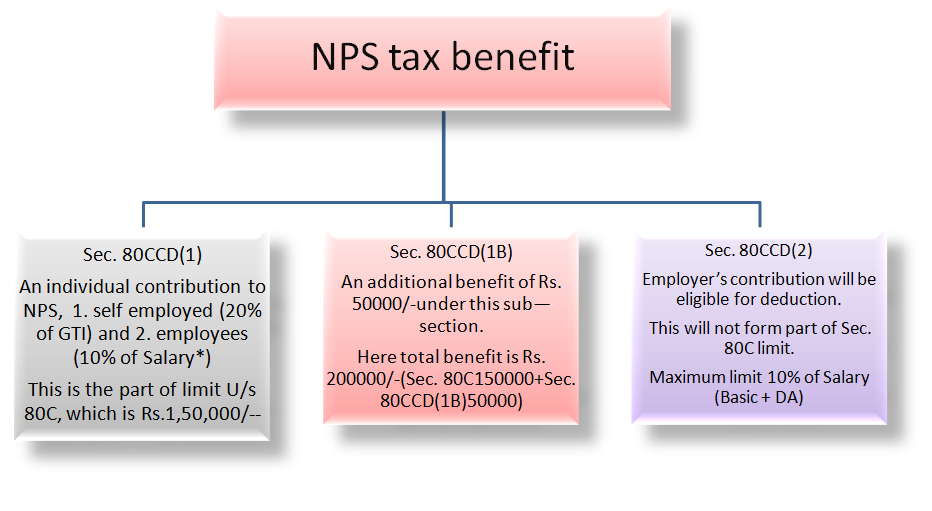

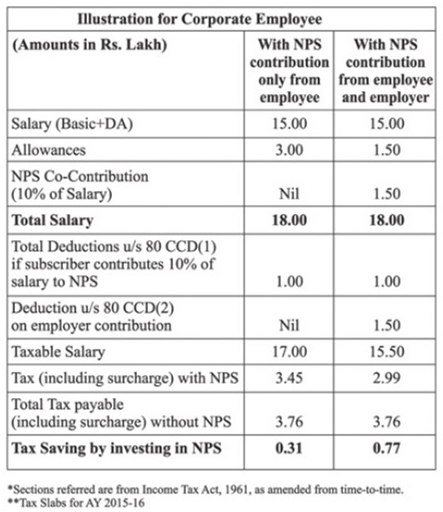

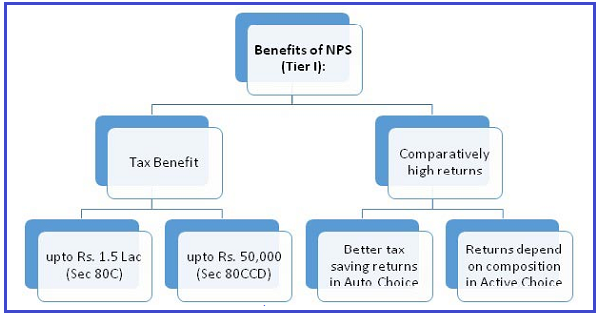

Web 1 sept 2020 nbsp 0183 32 a The maximum tax deductions allowed is Rs 1 50 000 This limit is inclusive of section 80C limit b In case of salaried individual the maximum deduction cannot exceed 14 of salary of Individual Web 30 janv 2023 nbsp 0183 32 Thus the total maximum tax rebate an individual can avail on NPS is of INR 2 lakh including INR 1 5 lakh which is a part of Section 80 C limit NPS Tier II Account

National Pension Scheme Income Tax Rebate

National Pension Scheme Income Tax Rebate

https://www.apnaplan.com/wp-content/uploads/2015/12/NPS-illustration-of-Tax-Exemption-on-NPS-by-restructing-of-Salary.png

What Is Section 80 Mean What Is NOTIFICATION Under GST 2019 02 18

https://www.mintwise.com/blog/wp-content/uploads/2014/08/New-Pension-Scheme-NPS-Section-80CCD2-_2.png

Best NPS Funds 2019 Top Performing NPS Scheme

https://www.relakhs.com/wp-content/uploads/2019/01/Latest-NPS-rules-changes-norms-2019-revised-NPS-scheme-Tier-2-tax-benefits-80c.jpg

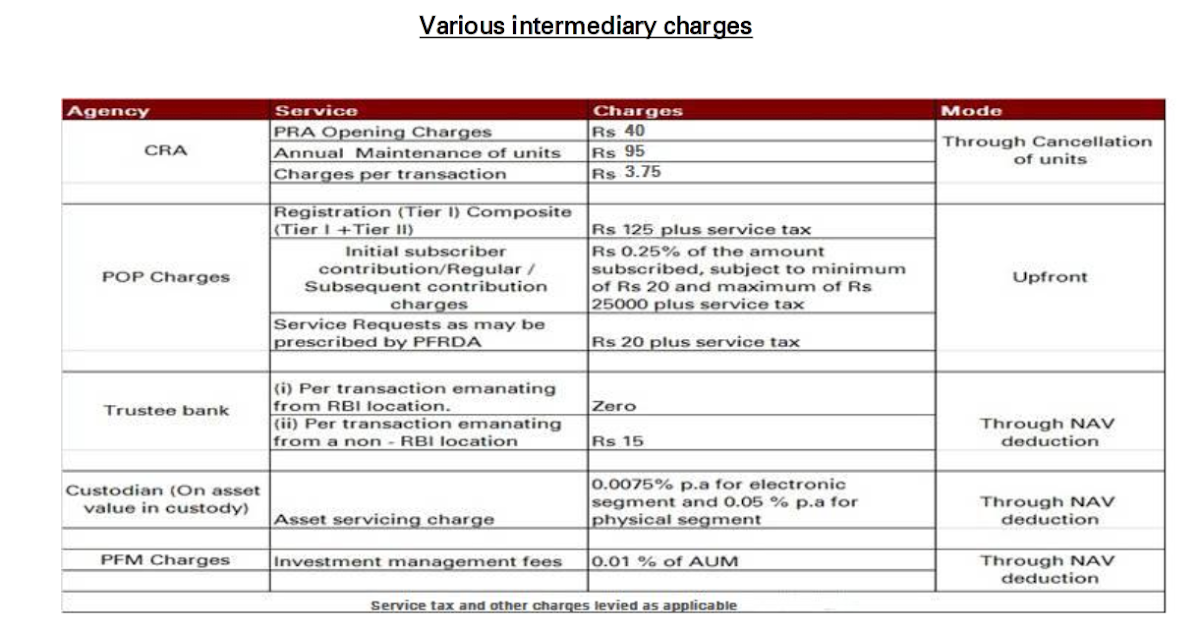

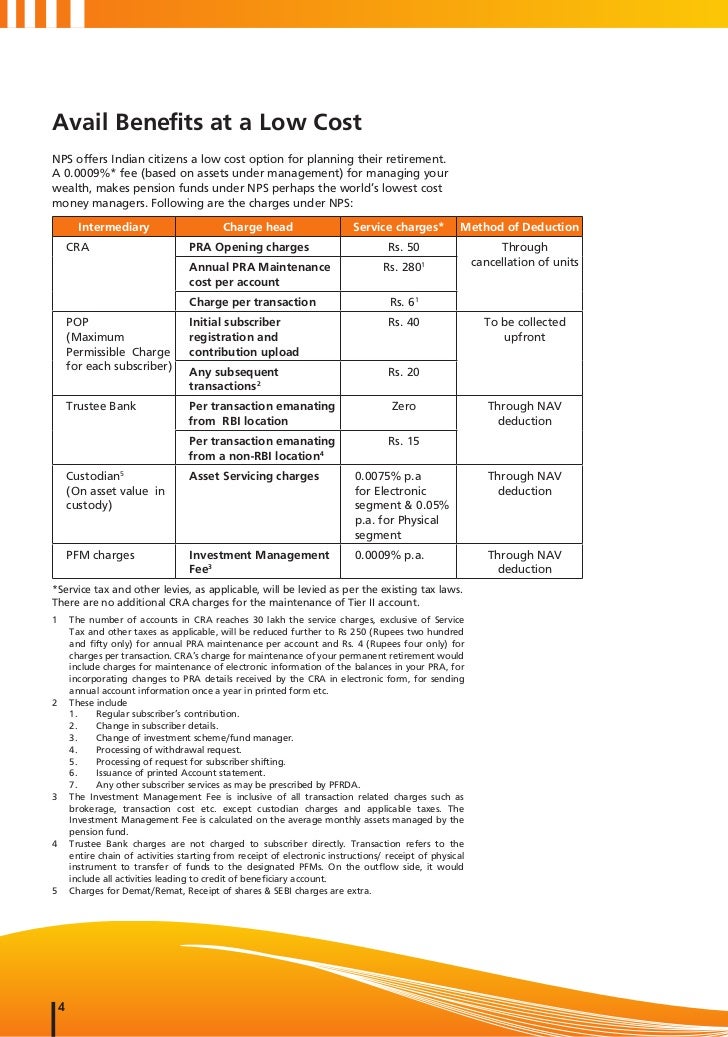

Web 28 sept 2021 nbsp 0183 32 Who should invest in the NPS The NPS is a good scheme for anyone who wants to plan for their retirement early on and has a low risk appetite A regular pension Web Under Section 80CCD 1 of the Income Tax Act NPS offers a tax exemption of up to Rs 1 5 lakh In case a company provides an NPS facility the employer s contribution to NPS

Web 5 f 233 vr 2016 nbsp 0183 32 Tax Benefits under NPS A tax exemption of Rs 1 5 lakh can be claimed on the employee s and employer s contribution towards the National Pension System NPS Web 15 juil 2023 nbsp 0183 32 Income tax deductions under Section 80CCD 1B under Income Tax Act which allows deduction upto Rs 50 000 Learn about National Pension Scheme NPS benefits types of NPS accounts amp

Download National Pension Scheme Income Tax Rebate

More picture related to National Pension Scheme Income Tax Rebate

How To Claim Section 80CCD 1B TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/02/How-to-claim-Section-80CCD1B-National-Pension-Scheme.png

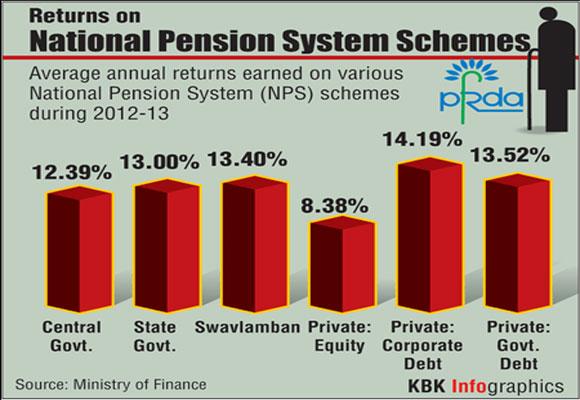

Annual Returns On National Pension Schemes Rediff Business

https://im.rediff.com/money/2013/may/16kbk.jpg

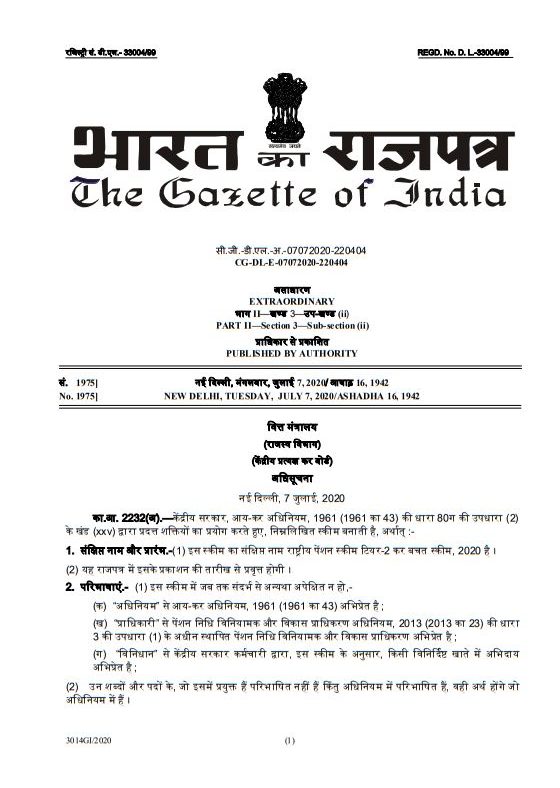

National Pension Scheme Tier II Tax Saver Scheme 2020 Under Section

https://www.staffnews.in/wp-content/uploads/2020/07/national-pension-scheme-tier-ii-tax-saver-scheme-2020-notification-page-1-hindi-e1594178999106.jpg

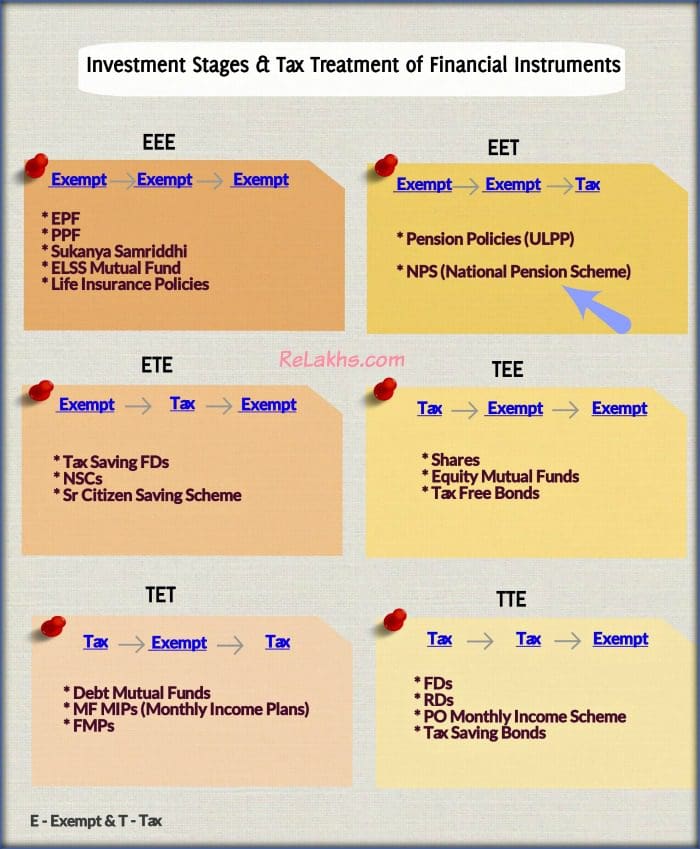

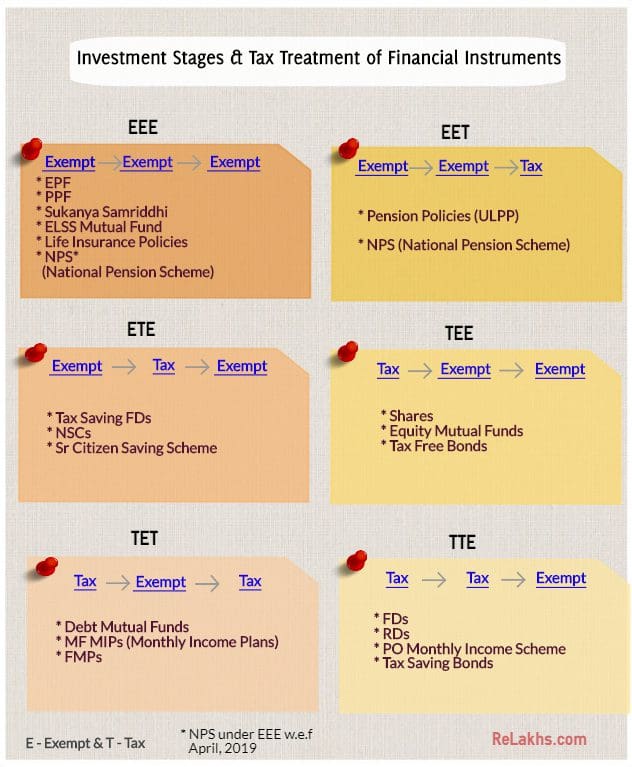

Web 11 mai 2020 nbsp 0183 32 NPS tax rebate Investing in the NPS offers tax benefits under sections 80 CCD 1 80CCD 2 and 80CCD 1B Under section 80 CCD 1 investments up to Rs Web This rebate is over and above the limit prescribed under Section 80C c Interim Partial withdrawal up to 25 of the contributions made by the subscriber from NPS Tier I is tax

Web 26 juin 2020 nbsp 0183 32 Is NPS deduction allowed under New Tax Regime In the new tax regime taxpayers will have to forgo most of the income tax exemptions and deductions to avail Web 11 nov 2022 nbsp 0183 32 NPS Tax Benefits NPS Rebate in New Tax Regime Nov 11 2022 Alankit Would you like a relaxed life post retirement without income stress Then a retirement

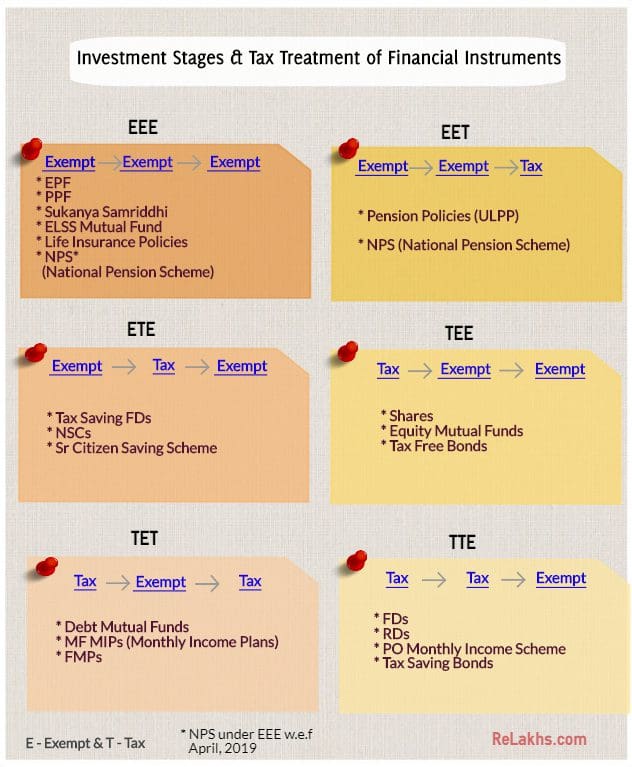

National Pension Scheme NPS Why Not To Invest In NPS Drawbacks

https://www.relakhs.com/wp-content/uploads/2018/12/National-Pension-Scheme-NPS-EET-Tax-category-latest-NPS-is-now-EEE.jpg

Income Tax Information NPS Tax Benefit Sec 80CCD 1 80CCD 1B And

https://2.bp.blogspot.com/-M2x6C7-6FRs/Wv7FH91f_QI/AAAAAAAAAYA/a3qFywzgcPwMcFze1jMvhr6r0hgmni_hQCLcBGAs/s1600/NPS%2Bdeduction.png

https://www.gov.uk/tax-on-your-private-pension/pension-tax-relief

Web If your rate of Income Tax in Scotland is 19 your pension provider will claim tax relief for you at a rate of 20 You do not need to pay the difference UK tax relief is also available

https://taxguru.in/income-tax/income-tax-be…

Web 1 sept 2020 nbsp 0183 32 a The maximum tax deductions allowed is Rs 1 50 000 This limit is inclusive of section 80C limit b In case of salaried individual the maximum deduction cannot exceed 14 of salary of Individual

National Pension Scheme NPS Why Not To Invest In NPS Drawbacks

National Pension Scheme NPS Why Not To Invest In NPS Drawbacks

Taxation Of NPS Return From The Scheme

6 Reasons To Invest In National Pension Scheme For Retirement Savings

National Pension Scheme

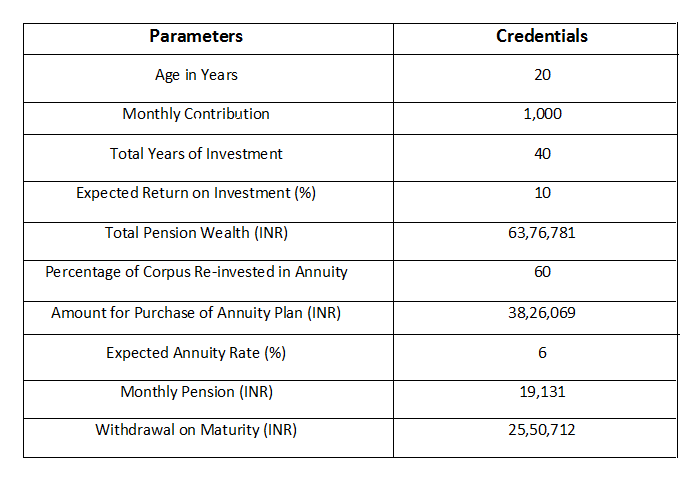

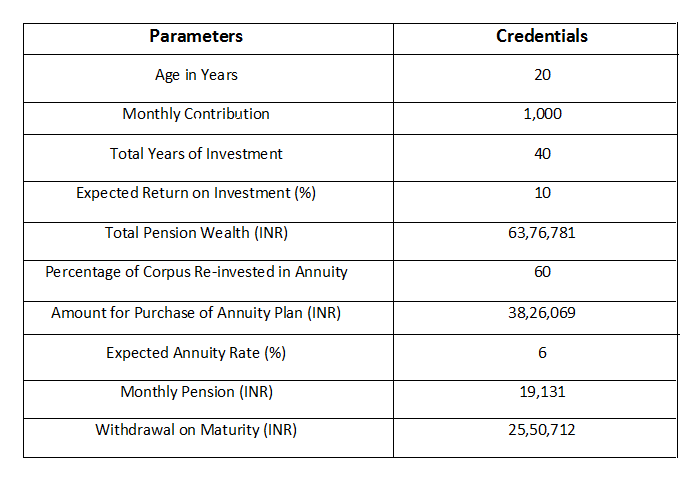

National Pension Scheme Or NPS NPS Scheme Details NPS Calculator

National Pension Scheme Or NPS NPS Scheme Details NPS Calculator

NPS National Pension Scheme Complete Details Pt1 TheWealthWisher TW2

Steps To Voluntary Contribution In NPS News 1

ALL ABOUT NPS NATIONAL PENSION SCHEME ADDITIONAL DEDUCTION Rs 50000

National Pension Scheme Income Tax Rebate - Web Under Section 80CCD 1 of the Income Tax Act NPS offers a tax exemption of up to Rs 1 5 lakh In case a company provides an NPS facility the employer s contribution to NPS