National Pension System Nps Income Tax Benefit Verkko 30 tammik 2023 nbsp 0183 32 Eligible to claim deduction on contribution up to 10 of the salary basic dearness allowance Claim a tax deduction up to 20 of their gross income or INR 1 50 000 whichever is less INR

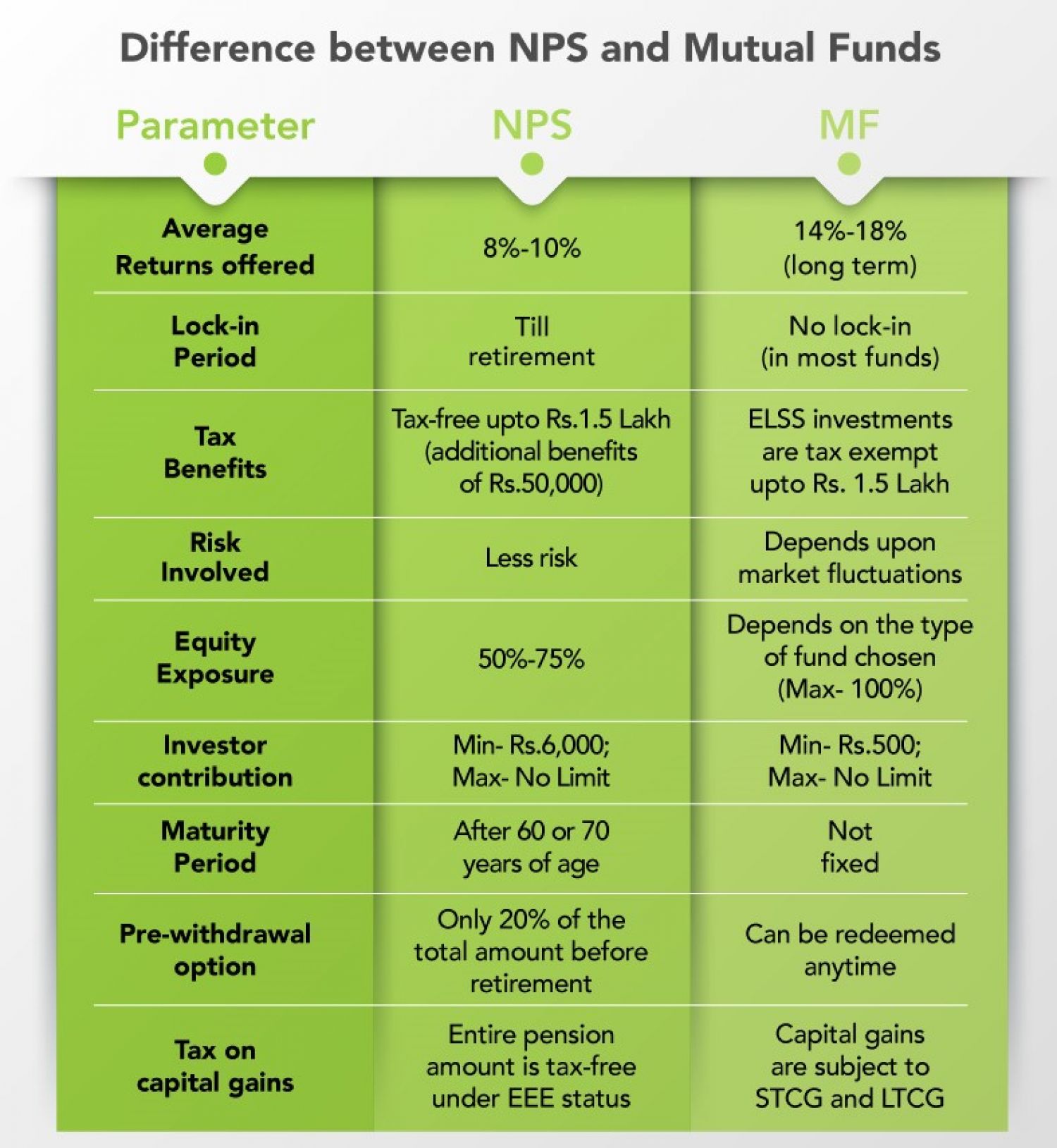

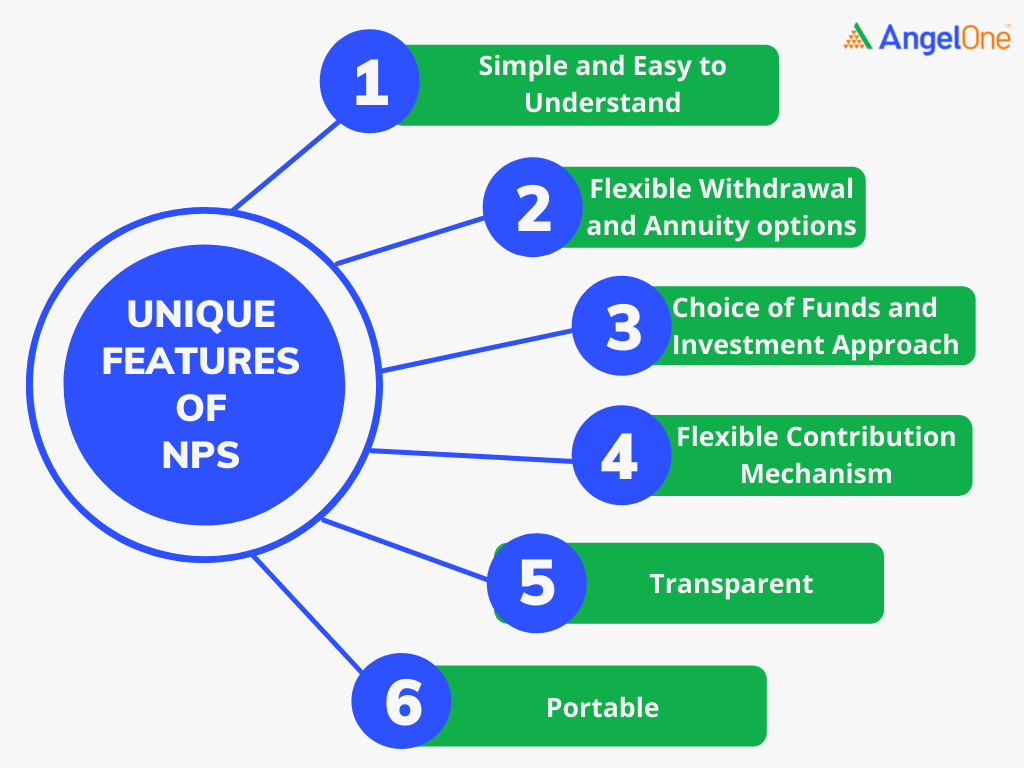

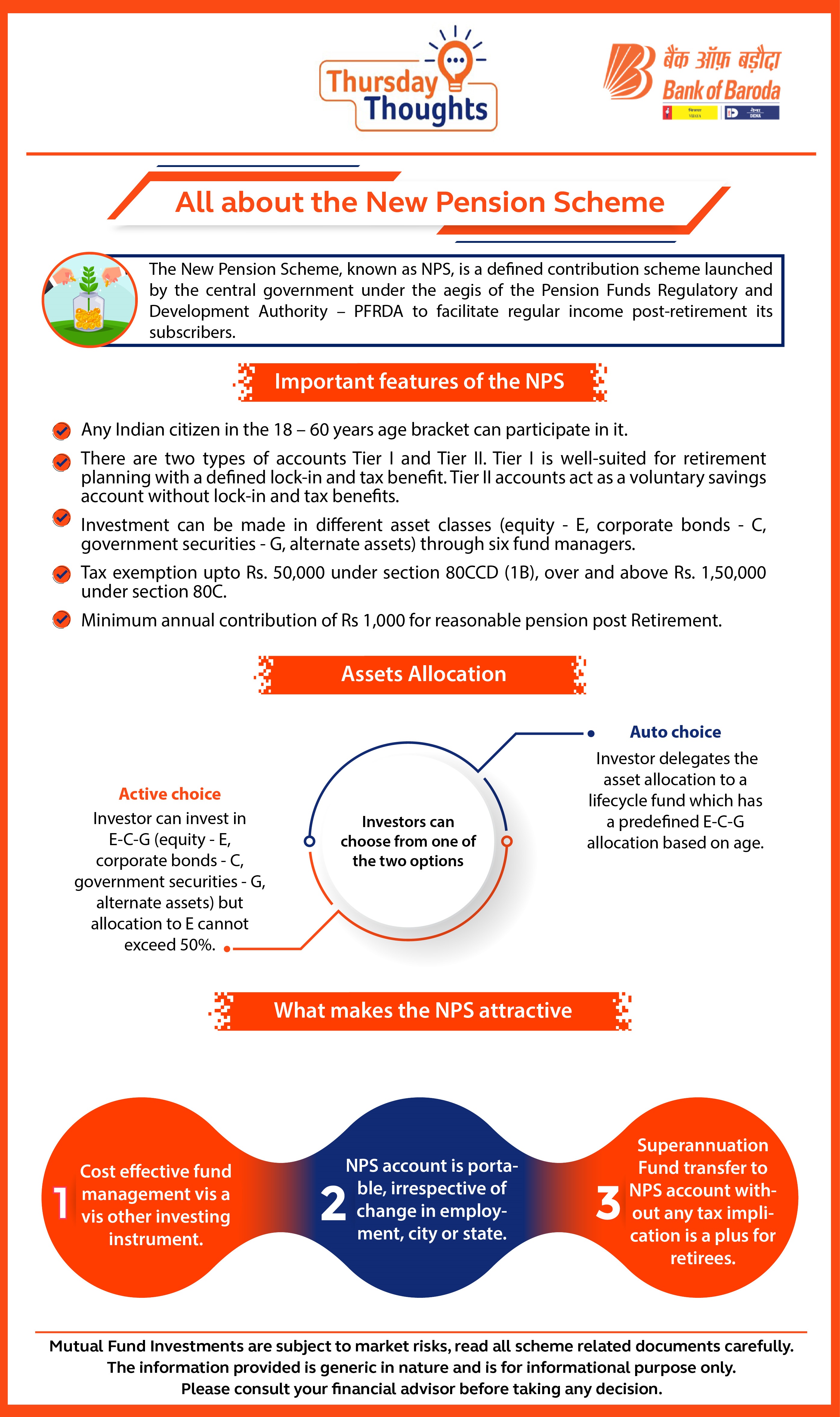

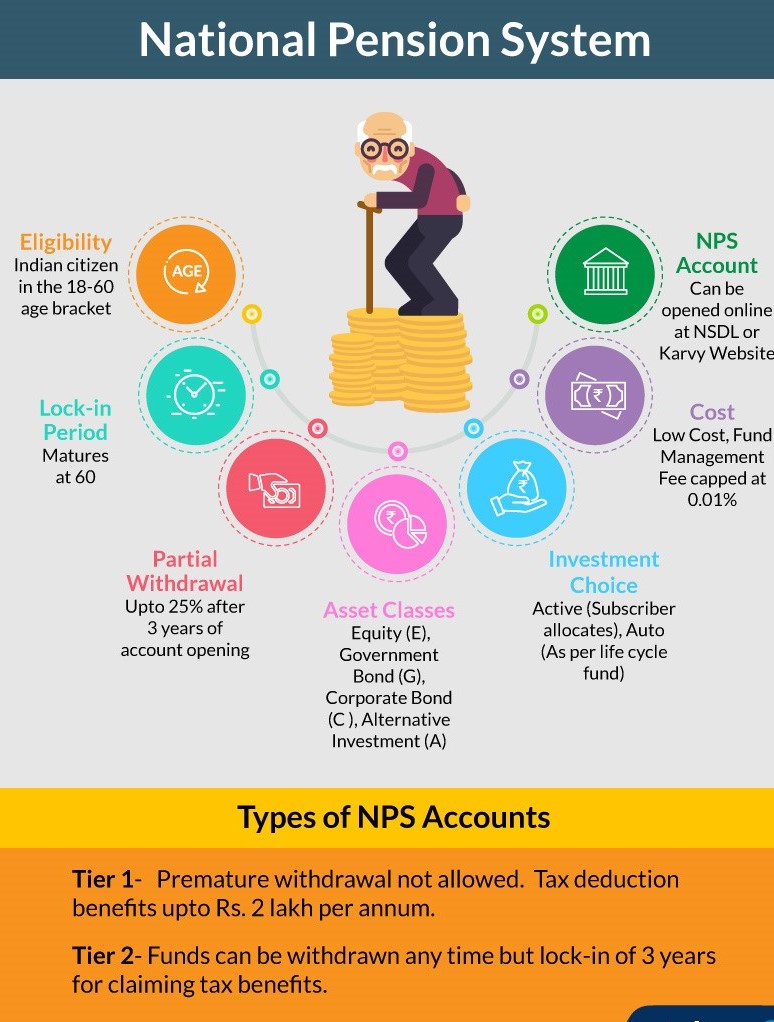

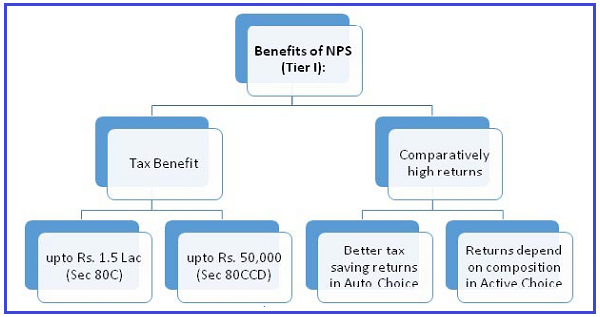

Verkko The NPS scheme holds immense value for anyone who works in the private sector and requires a regular pension after retirement The scheme is portable across jobs and locations with tax benefits under Section 80C and Section 80CCD Verkko 1 syysk 2020 nbsp 0183 32 The contribution made in the National Pension System NPS qualifies for tax benefits under the Income Tax Act 1961 On the amount invested in NPS one can avail tax breaks under Section 80CCD 1

National Pension System Nps Income Tax Benefit

National Pension System Nps Income Tax Benefit

https://www.alankit.com/blog/blogimage/different-types-of-nps-accounts-and-tax-benefits.jpg

NPS Tax Benefits How To Avail NPS Income Tax Benefits

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

Should Invest In NPS Just For The Tax Benefits NPS

https://carajput.com/art_imgs/why-we-should-invest-in-nps-just-for-the-tax-benefits.jpg

Verkko 20 syysk 2022 nbsp 0183 32 To claim maximum tax benefit he she can now invest an additional Rs 90 000 rupees in the NPS Tier 1 account which will allow him her to claim another Rs 40 000 under Section CCD 1 and Rs 50 000 under Section 80CCD 1B The third Section 80CCD 2 of the NPS is for corporate subscribers or employees enrolled in Verkko Also you can withdraw up to 50 of the corpus if you have completed 25 years of service You can claim tax benefits under Section 80 CCD 1 Section 80CCD 1B and Section 80CCD 2 as mentioned above When you open an NPS account Tier I account is mandatory and is automatically functional

Verkko 30 tammik 2023 nbsp 0183 32 Any individual who is a subscriber of NPS Tier 1 account can claim tax benefit under Sec 80 CCD 1 within the overall ceiling of Rs 1 5 lac under Sec 80 CCE Additionally NPS Tier 1 account is eligible for an additional tax deduction of Rs 50 000 under IT Sec 80 CCD 1 B which is over and above the Rs 1 5 Lac ceiling prescribed Verkko Tax Benefits of NPS The NPS has its share of income tax benefits both at the time of making contributions and at the time of withdrawal on maturity Individual taxpayers can claim deduction on contributions under Tier I NPS up to Rs 1 5 lakh in a financial year under Section 80C

Download National Pension System Nps Income Tax Benefit

More picture related to National Pension System Nps Income Tax Benefit

NPS All You Need To Know Angel One

https://w3assets.angelone.in/wp-content/uploads/2022/06/NPS.png

All About The New Pension Scheme Bank Of Baroda

https://www.bankofbaroda.in/-/media/project/bob/countrywebsites/india/blogs/thursday-thoughts/images/new-pension-scheme-10-11.jpg

National Pension Scheme NPS Income Tax Benefits

https://thetaxtalk.com/wp-content/uploads/2023/08/Slide2.jpg

Verkko 6 What are the tax benefits of NPS The various Tax benefit as under A Employee Contribution Deduction upto 10 of salary basic DA within overall ceiling Rs 1 50 Lakh u s 80C B Voluntary Contribution Deduction upto Rs 50 000 u s 80 CCD 1B from taxable income for additional contribution to NPS C Employer Contribution Verkko NPS National Pension System is a government sponsored pension scheme You should also seek the NPS benefit under Section 80CCD 2 wherein up to 10 of the basic salary put in the NPS on behalf of the employee is tax free NPS cut income tax by Rs 86 000 know how

Verkko 28 jouluk 2023 nbsp 0183 32 Discover the tax advantages and benefits of the National Pension System NPS for different age groups From tax deductions and investment flexibility for young adults to tax planning and Verkko 11 jouluk 2023 nbsp 0183 32 NPS or National Pension System is a government sponsored pension scheme available to both salaried and self employed individuals It offers dual benefit Tax savings during your working years A regular income stream after retirement

How To Update Details In NPS Account Nominee Address DOB Other Changes

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nominee-in-nps.jpg

Income Tax Benefits Under National Pension Scheme NPS

https://taxguru.in/wp-content/uploads/2020/09/National-Pension-Scheme.jpg

https://www.forbes.com/advisor/in/retirement/nps-tax-benefit

Verkko 30 tammik 2023 nbsp 0183 32 Eligible to claim deduction on contribution up to 10 of the salary basic dearness allowance Claim a tax deduction up to 20 of their gross income or INR 1 50 000 whichever is less INR

https://cleartax.in/s/nps-national-pension-scheme

Verkko The NPS scheme holds immense value for anyone who works in the private sector and requires a regular pension after retirement The scheme is portable across jobs and locations with tax benefits under Section 80C and Section 80CCD

National Pension Scheme NPS Features Advantages Tax Benefits

How To Update Details In NPS Account Nominee Address DOB Other Changes

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

All About Of National Pension Scheme NPS CA Rajput Jain

National Pension System NPS Clarification On The Provisions Under

National Pension Scheme NPS Account Returns And Benefits In 2023

National Pension Scheme NPS Account Returns And Benefits In 2023

Wealth Maker

TAX BENEFIT OF NPS SIMPLE TAX INDIA

National Pension System NPS Dev Investments

National Pension System Nps Income Tax Benefit - Verkko Also you can withdraw up to 50 of the corpus if you have completed 25 years of service You can claim tax benefits under Section 80 CCD 1 Section 80CCD 1B and Section 80CCD 2 as mentioned above When you open an NPS account Tier I account is mandatory and is automatically functional