Nb Property Tax Rebate Web Property Tax relief may be available to those who own property in New Brunswick For Homeowners Residential Property Tax Credit For a principal residence Property Tax

Web less than 22 000 you are eligible for up to a 300 rebate Between 22 001 and 25 000 you are eligible for up to a 200 rebate Between 25 001 and 30 000 you are eligible Web 3 juin 2022 nbsp 0183 32 For 2022 this relief program will provide provincial and local property tax savings of about 10 million for apartment buildings of four units or more and 4 million

Nb Property Tax Rebate

Nb Property Tax Rebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/land-transfer-tax-new-brunswick-canadian-mortgage-app.png?resize=768%2C1529&ssl=1

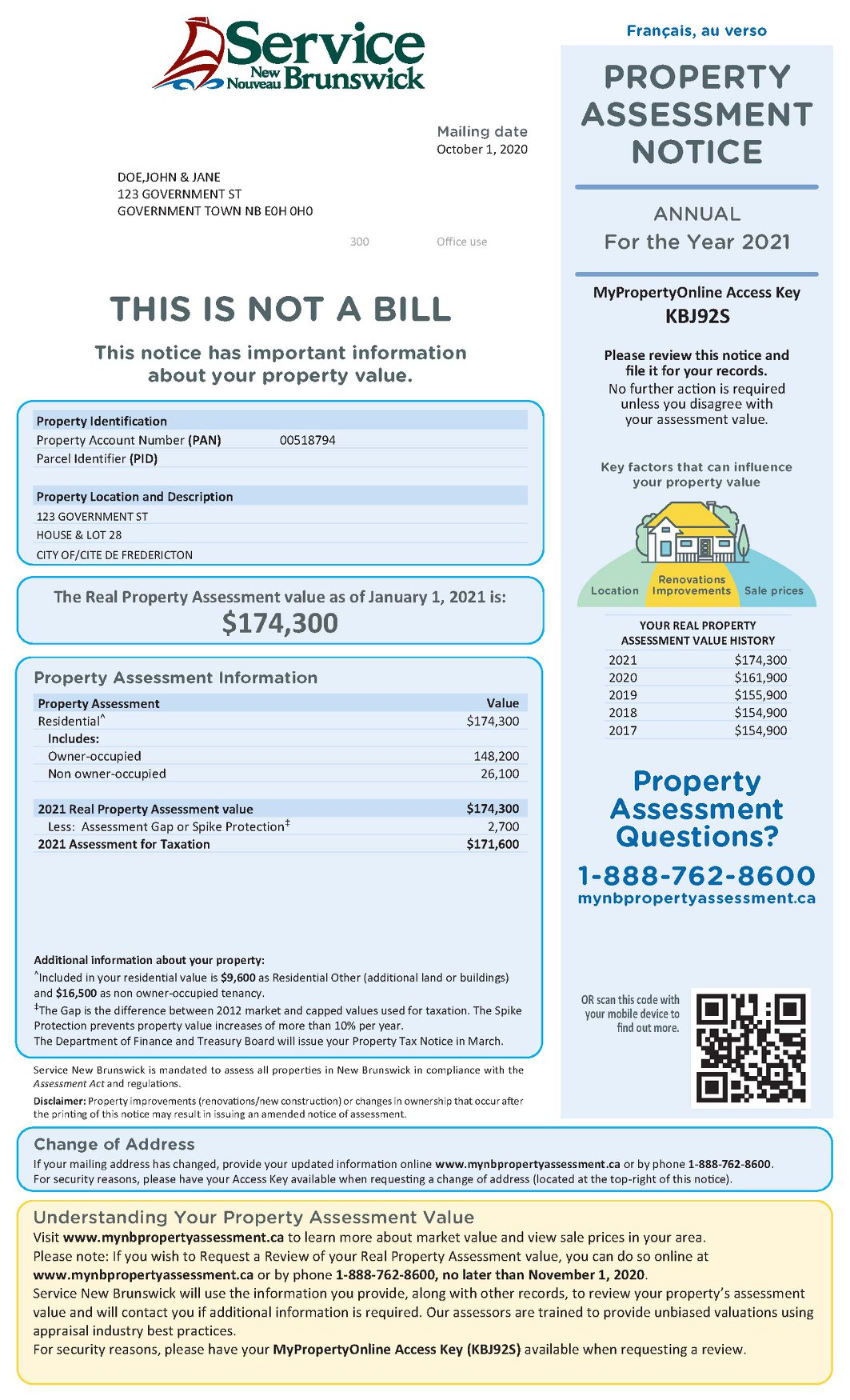

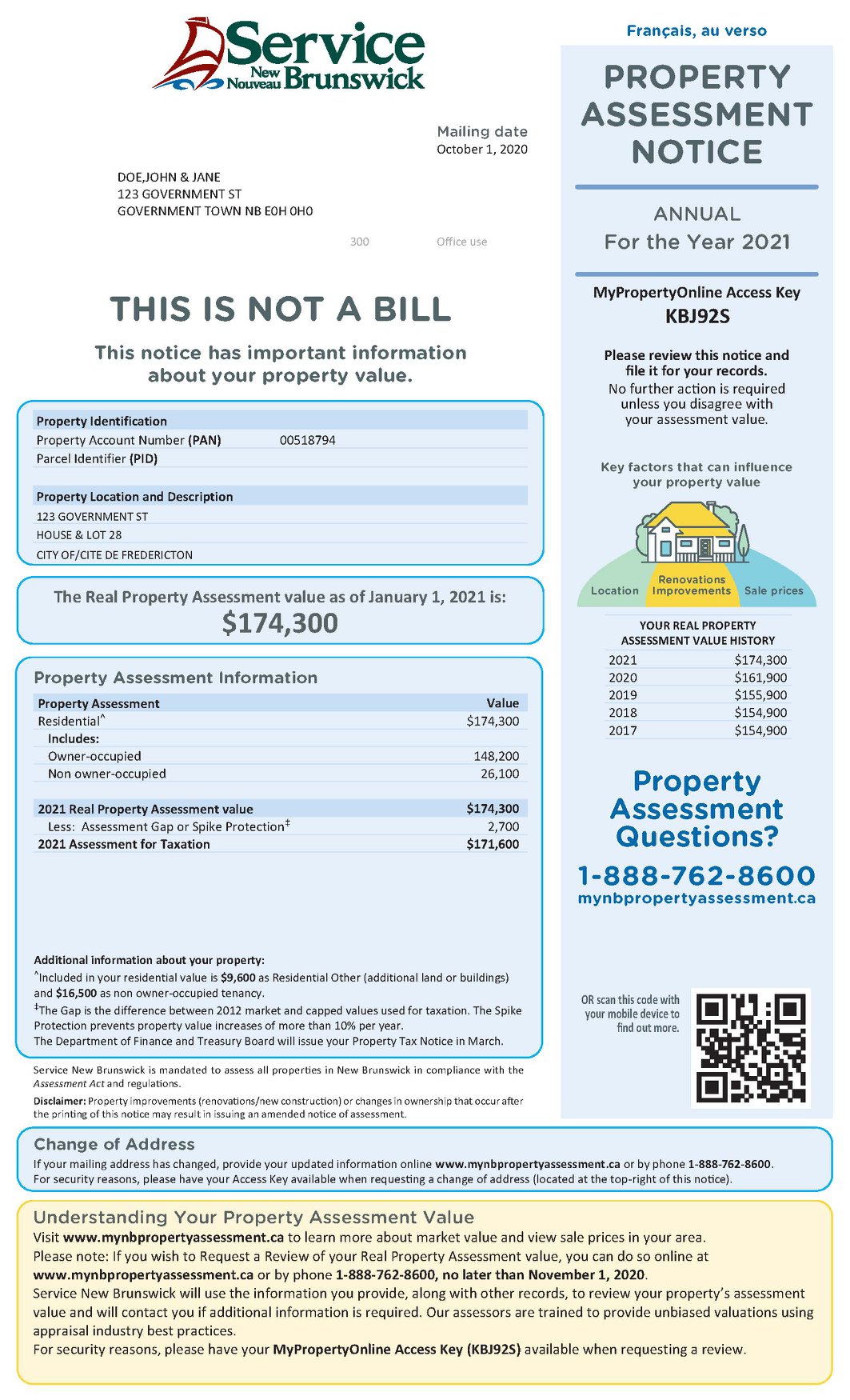

New Brunswick Property Assessments Are Here Blog 103 9 MAX FM

http://1039maxfm.com/wp-content/uploads/sites/8/2020/10/Property-Ass-1.jpg

Some New Brunswick Residents Shocked By Large Property Tax Assessment

https://i1.wp.com/media.globalnews.ca/videostatic/707/315/2017-03-10T21-21-46.133Z--1280x720.jpg?w=670&quality=70&strip=all

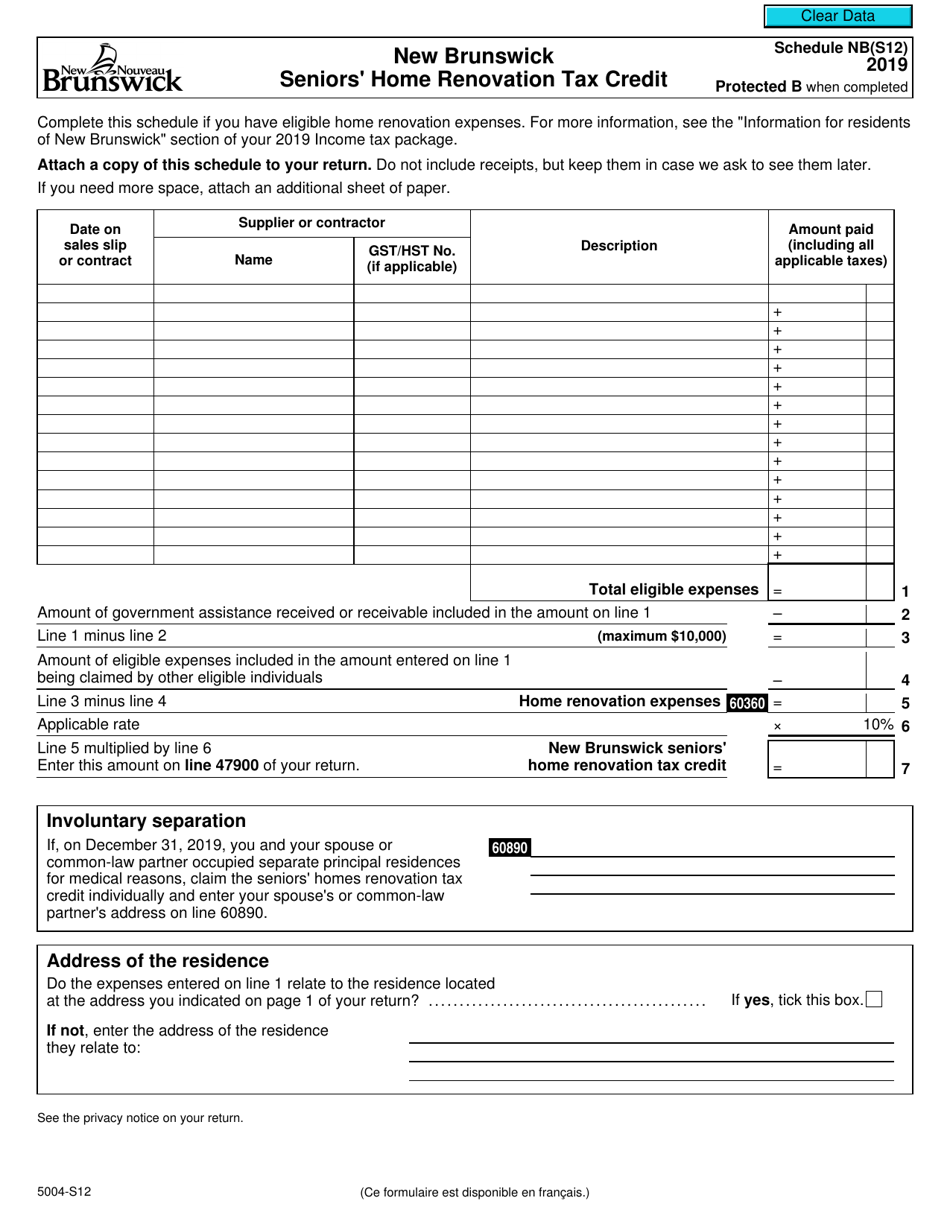

Web New Construction Tax Credit For new constructions that are not yet completed contractors or homeowners can apply for the New Construction Tax Credit and get a break on the Web Overview This program provides property tax relief to eligible seniors in New Brunswick who want to apply for a deferral of the annual increase in property taxes on their

Web 3 juin 2022 nbsp 0183 32 The New Brunswick government is spending 14 million to partially rebate 2022 property tax bills on apartment buildings and commercial properties that were hit Web New Brunswick New Brunswick Service New Brunswick Property Tax Allowance Program Description The Property Tax Allowance gives a tax break to low income property

Download Nb Property Tax Rebate

More picture related to Nb Property Tax Rebate

New York Property Owners Getting Rebate Checks Months Early

https://s.hdnux.com/photos/01/26/04/67/22564341/10/1200x0.jpg

Property Tax Expert Says Changes In Assessment Dates Make Sense But

https://i.cbc.ca/1.6604708.1683922862!/fileImage/httpImage/image.jpg_gen/derivatives/16x9_780/snb-property-info.jpg

New Brunswick Property Tax Bills Are Out Homeowners Are Hit The

https://w666.eu.org/e29d7fa2/https/02ff0b/i.cbc.ca/1.6767979.1677883239!/fileImage/httpImage/image.jpg_gen/derivatives/16x9_620/property-tax-notice.jpg

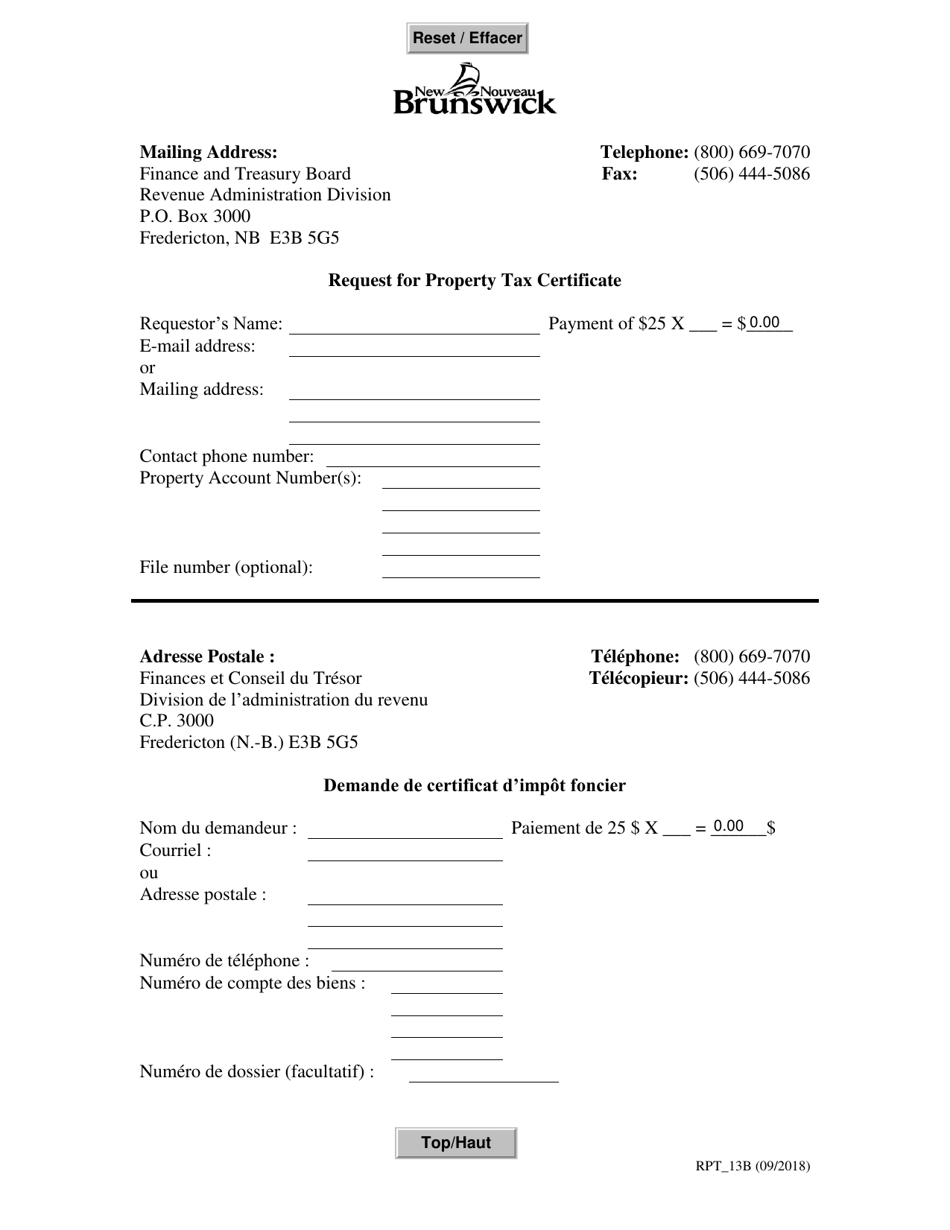

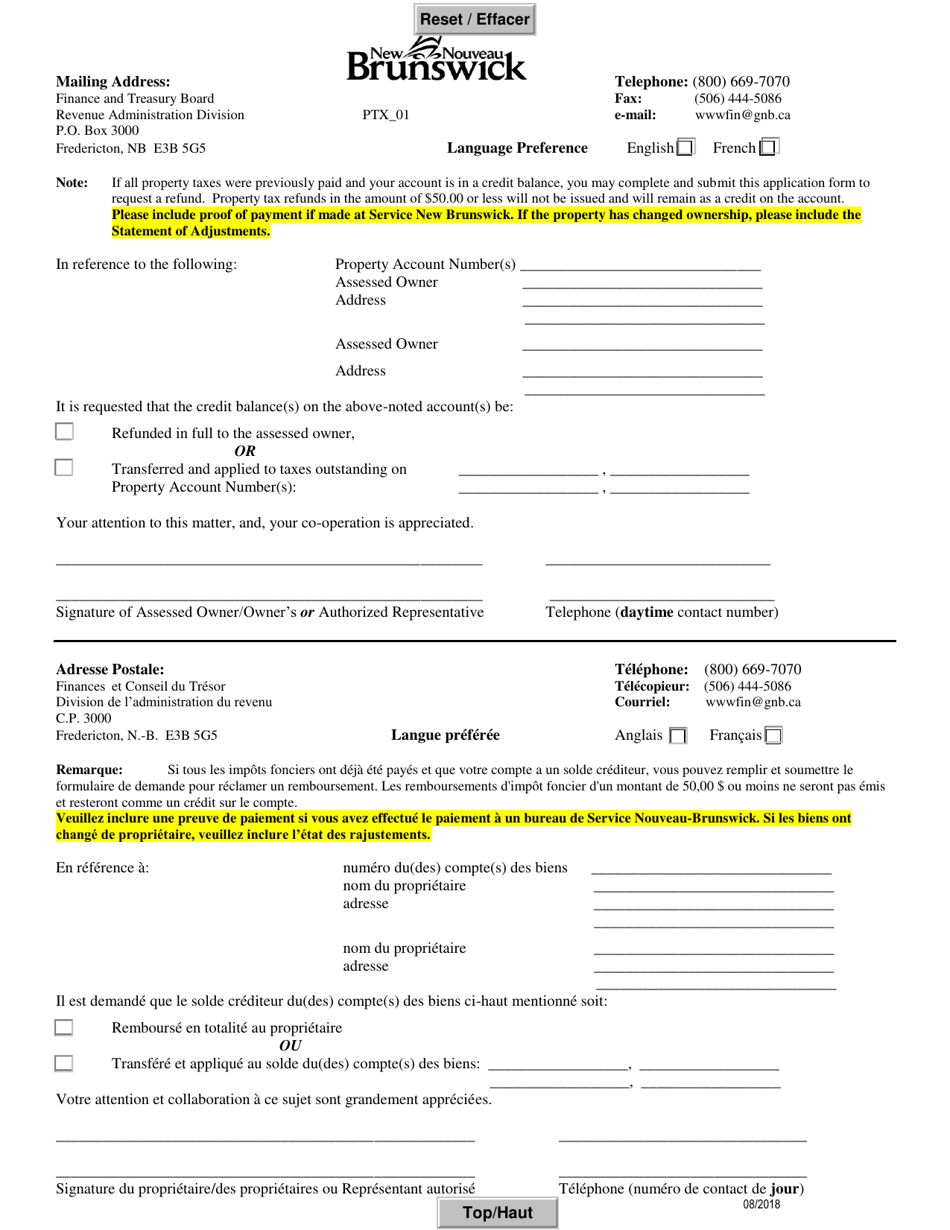

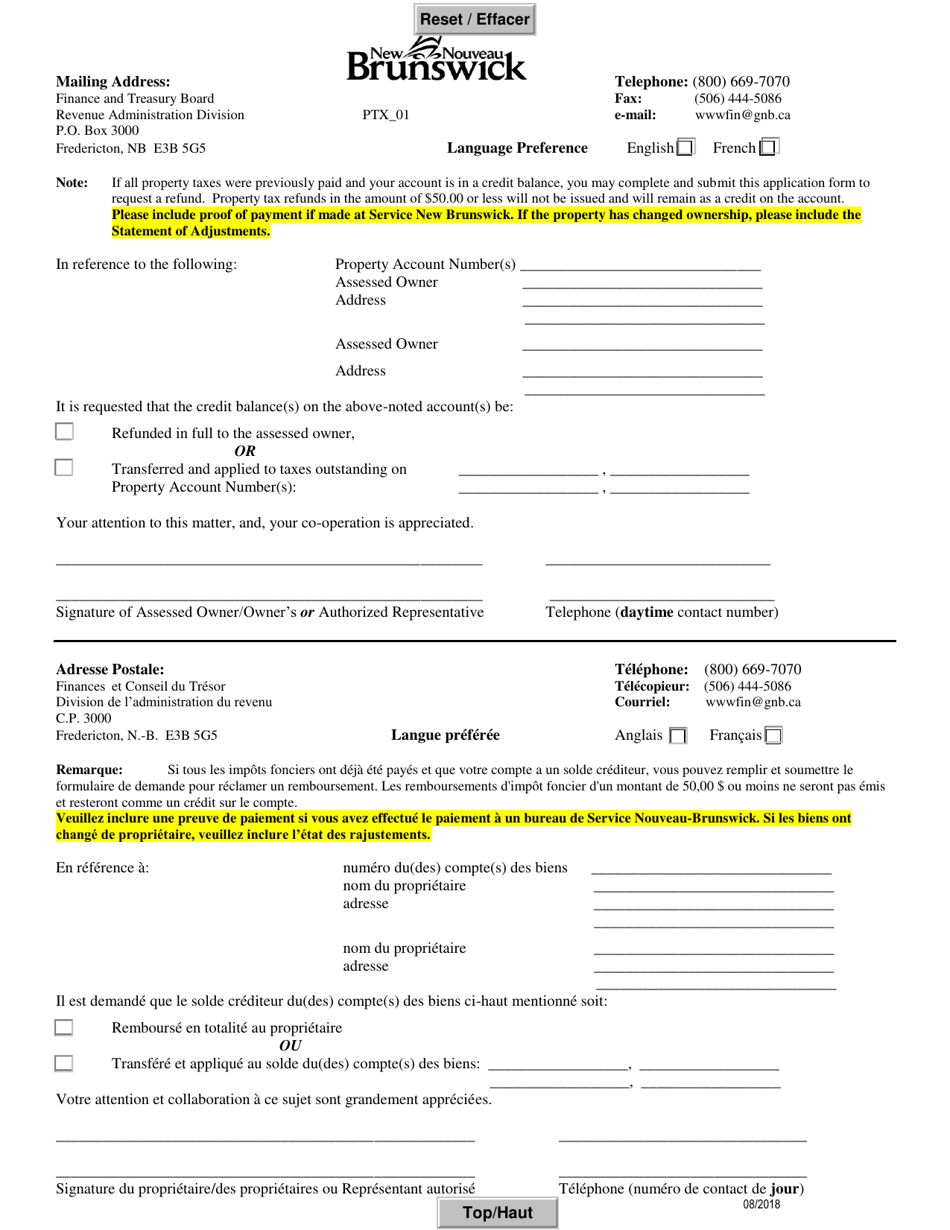

Web This program provides property tax relief to eligible seniors in New Brunswick who want to apply for a deferral of the annual increase in property taxes on their principal residence Web PO Box 3000 Fredericton NB E3B 5G5 You may leave the credit in your tax account where it will accrue interest as a prepayment towards next year s taxes Property tax refunds

Web Apply for property tax relief Property owners who disagree with their assessment have 30 days from the date their notice was mailed to submit a Request for Review RfR File a Web 12 mars 2010 nbsp 0183 32 Homeowners will be able to apply for a rebate of between 100 and 300 depending on their income said Greg Byrne The province is also broadening the

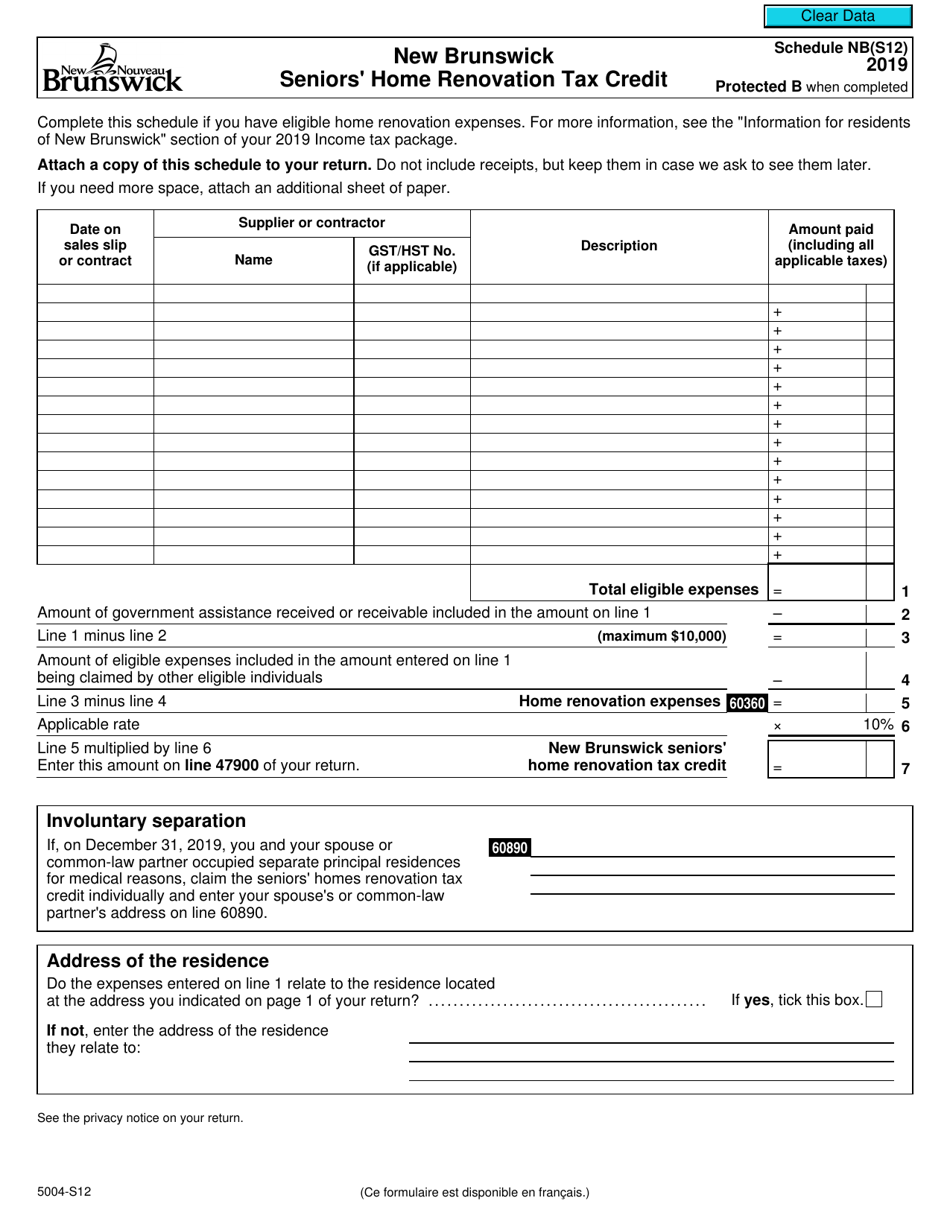

Form 5004 S12 Schedule NB S12 Download Fillable PDF Or Fill Online New

https://data.templateroller.com/pdf_docs_html/2066/20665/2066591/form-5004-s12-schedule-nb-s12-new-brunswick-seniors-home-renovation-tax-credit-canada_print_big.png

How To Pay Your New Brunswick Property Taxes Online TINB

https://thisisnewbrunswick.ca/wp-content/uploads/2022/12/5616whx5ndq.jpg

https://www2.gnb.ca/content/snb/en/sites/property-assessment/apply.html

Web Property Tax relief may be available to those who own property in New Brunswick For Homeowners Residential Property Tax Credit For a principal residence Property Tax

https://www2.gnb.ca/content/gnb/en/departments/finance/taxes/other.html

Web less than 22 000 you are eligible for up to a 300 rebate Between 22 001 and 25 000 you are eligible for up to a 200 rebate Between 25 001 and 30 000 you are eligible

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

Form 5004 S12 Schedule NB S12 Download Fillable PDF Or Fill Online New

Property Tax Rebate New York State Printable Rebate Form

South Brunswick Property Tax Propertyvc

New Brunswick Getting Out Of Property Assessment Business Following

South Brunswick Property Tax Propertyvc

South Brunswick Property Tax Propertyvc

Older Disabled Residents Can File For Property Tax Rent Rebate Program

New Brunswick Property Tax System Inflated Home Values By Combined 52M

South Brunswick Property Tax Propertyvc

Nb Property Tax Rebate - Web Property Assessment Services is mandated to produce the Assessment List each year Service New Brunswick prepares and issues available assessment information online for