Nc Hvac Tax Credit 2023 Single family households and multifamily buildings are potentially eligible for rebates to reduce the upfront cost of efficient electric technologies such as heat pumps electric cooking appliances wiring upgrades electrical panels

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 2024 Tax Incentives Credits for New HVAC in North Carolina For New HVAC Installations On January 1st 2023 new federal tax credits were announced in conjunction with the Inflation Reduction Act These tax credits cover home comfort equipment such as new air conditioners and heat pumps

Nc Hvac Tax Credit 2023

Nc Hvac Tax Credit 2023

https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white-web.png

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

North Carolina HVAC License License Lookup

https://licenselookup.org/images/2022-11/north-carolina-hvac-license-scaled-3623100866.jpg

Beginning in 2023 all North Carolina homeowners will be eligible for a tax credit of up to 30 of the cost of heat pumps or heat pump water heaters The maximum rebate for heat pumps and heat pump water heaters is 2 000 Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings

Which Tax Credits Are Potentially Available for HVAC Systems The rebates would apply for heating and cooling systems installed between Jan 1 2023 and Dec 31 2032 The following HVAC tax credits could be available if your state submits an Rebates covering 50 100 of the cost of installing new electric appliances including super efficient heat pumps water heaters clothes dryers stoves and ovens In North Carolina millions

Download Nc Hvac Tax Credit 2023

More picture related to Nc Hvac Tax Credit 2023

2022 Inflation Reduction Act News And Events For Air Inc Heating And

https://lh6.googleusercontent.com/pY5WFKSoAkseVfwuYinb6CXUg2t-04A0IgZbAvTd0EVvQJ4vOdMxYr6d5jQ90xeWZ8cZ5PLvjKE5ghBiQKl6ZV6lMa1mCge5VK2sMJmOLOOTnmGiC5bOqSq7e0eiaRUa1NsvWJwoy6jJY2AyY8iHI50YMyRB1hGNcB-kEF2Tc8NsMi-LI36xjvBcKw

Learn How The HVAC Tax Credit Can Help You This Year Make It Mowery

https://makeitmowery.com/wp-content/uploads/2021/10/HVAC-tax-credit.jpg

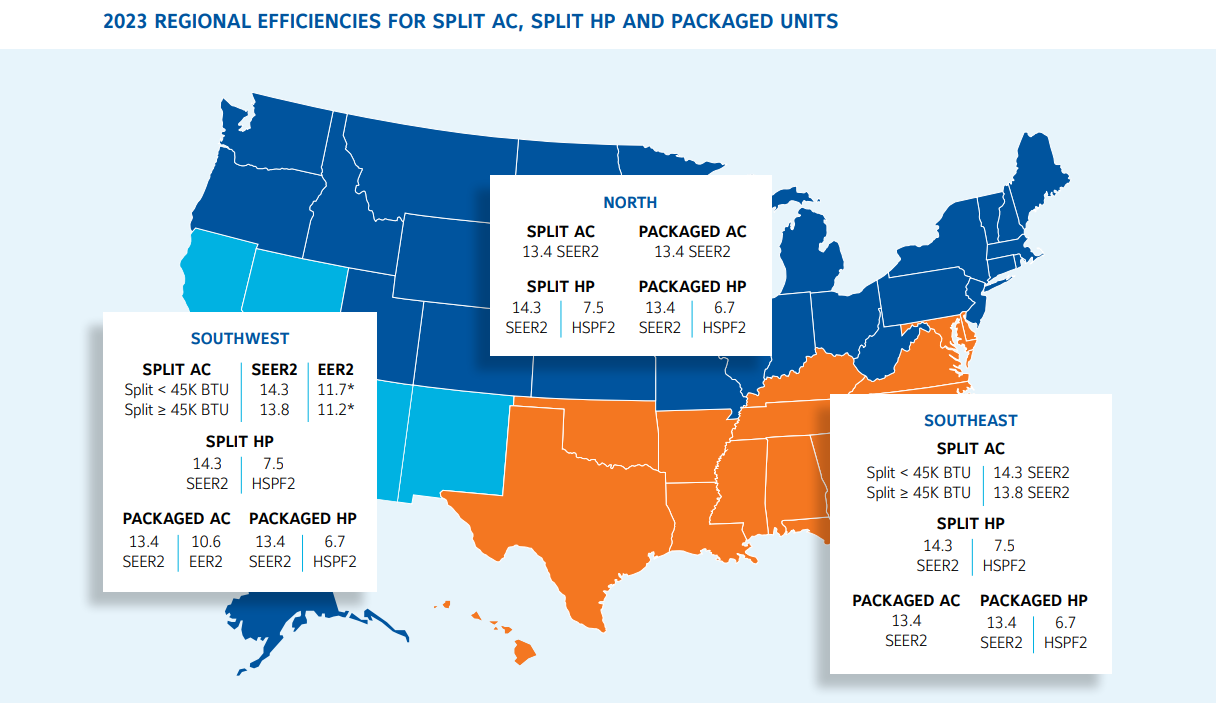

Prepare Now For 2023 Energy Efficiency Standards ACHR News

https://www.achrnews.com/ext/resources/2022/05-May/DOE-2023-Regional-Residential-Efficiencies-Map.png

Inflation Reduction Act HVAC Specific Up to 3 200 annually in tax credits to lower the cost of energy efficient upgrades by up to 30 percent Includes the purchase of heat pumps insulation efficient doors and windows electrical panel upgrades and energy audits The IRA has increased the HVAC Tax Credit from 500 to a more substantial 30 of the total project cost or a maximum of 2 000 in 2023

Together the Homeowners Managing Efficiency Rebates HOMES and Home Electrification and Appliance Rebates HEAR programs allocate over 208 million to North Carolina to provide energy efficiency rebates Follow the link above for answers to Frequently Asked Questions regarding these programs What is the 2023 federal tax credit for heat pumps The 2023 federal tax credit for heat pumps is 30 of the purchase and installation cost up to 2 000 What is the typical cost of a heat pump The typical cost of a 3 ton heat pump air handler combo is

HVAC Tax Credit For Jackson TN Residents 2023 Cagle Service Heating

https://cagleservice.com/wp-content/uploads/2023/03/HVAC-Tax-Credit-.png

Carrier HVAC Federal Tax Credits And Rebates

https://www.pineapplemoney.com/img/Carrier-Tax-Credit.jpg#header-image

https://nccleantech.ncsu.edu/2023/11/06/get...

Single family households and multifamily buildings are potentially eligible for rebates to reduce the upfront cost of efficient electric technologies such as heat pumps electric cooking appliances wiring upgrades electrical panels

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022

SAVE BIG With HVAC Tax Credits Sun Heating Cooling Inc

HVAC Tax Credit For Jackson TN Residents 2023 Cagle Service Heating

Commercial HVAC Tax Changes In Section 179 For Business Owners Energy

What HVAC Tax Credit Is Available When Filing This Year

HVAC Tax Credit Interested In Saving Money On Your HVAC Here s How

What HVAC System Qualifies For Tax Credit 2023 Makeoverarena

What HVAC System Qualifies For Tax Credit 2023 Makeoverarena

ERC Eligibility Employee Retention Credit 2023 Qualified Wages

HVAC Tax Credits Incentives For Energy Efficient HVACs

Nc Hvac Tax Credit 2023 - Beginning in 2023 all North Carolina homeowners will be eligible for a tax credit of up to 30 of the cost of heat pumps or heat pump water heaters The maximum rebate for heat pumps and heat pump water heaters is 2 000